More Related Content

Viewers also liked

Viewers also liked (20)

Introduction to investing power point presentation 1.12.1.g1

Introduction to investing power point presentation 1.12.1.g1

More from nadinesullivan

More from nadinesullivan (20)

Les 24 2

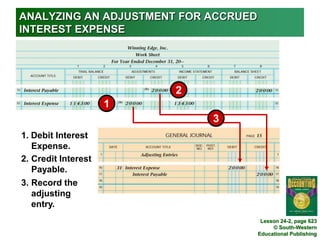

- 1. 3 ANALYZING AN ADJUSTMENT FOR ACCRUED INTEREST EXPENSE 2 1 1. Debit Interest Expense. 2. Credit Interest Payable. 3. Record the adjusting entry. Lesson 24-2, page 623

- 2. 1 2 POSTING AN ADJUSTING ENTRY FOR ACCRUED INTEREST EXPENSE 1. Post the debit. 2. Post the credit. Lesson 24-2, page 624

- 3. REVERSING ENTRY FOR ACCRUED INTEREST EXPENSE 1 2 1. Debit Interest Payable. 2. Credit Interest Expense. Lesson 24-2, page 625

- 4. 4 PAYING A NOTE PAYABLE SIGNED IN A PREVIOUS FISCAL PERIOD 1 3 2 1. Debit for Principal 2. Debit for Total Interest 3. Credit for Maturity Value 4. Post amounts in General columns. Lesson 24-2, page 626

- 5. TERMS REVIEW accrued expenses accrued interest expense Lesson 24-2, page 628