Fund Focus: Tata Ethical Fund

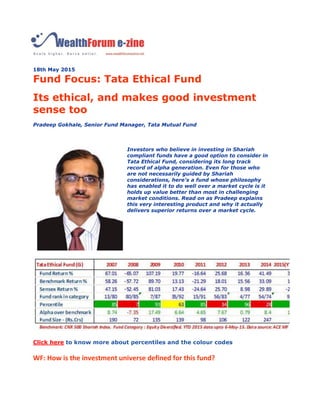

- 1. 18th May 2015 Fund Focus: Tata Ethical Fund Its ethical, and makes good investment sense too Pradeep Gokhale, Senior Fund Manager, Tata Mutual Fund Investors who believe in investing in Shariah compliant funds have a good option to consider in Tata Ethical Fund, considering its long track record of alpha generation. Even for those who are not necessarily guided by Shariah considerations, here's a fund whose philosophy has enabled it to do well over a market cycle is it holds up value better than most in challenging market conditions. Read on as Pradeep explains this very interesting product and why it actually delivers superior returns over a market cycle. Click here to know more about percentiles and the colour codes WF: How is the investment universe defined for this fund?

- 2. Pradeep: The fund is Sharia compliant fund and thus the investment universe consists of only those stocks which are in compliance with Sharia principal. Dar-al-Sharia, a Dubai based institution specialising in Islamic finance selects the universe of such stocks for the fund and the fund invests only in stocks that fall within this universe. The key selection criteria are: The fund does not invest in banking and financial sector. The fund does not invest in tobacco or alcohol sectors. The fund cannot take position in the futures and options segment. The fund cannot invest in companies who have funded more than 30% of their assets from interest bearing debt. The fund cannot invest in companies that have more than 5% of their total income coming from interest earned. WF: Which are the sectors that you would typically avoid in a Shariah compliant product? If you were to compare the CNX 500 vs the CNX 500 Shariah Index, what is the proportion of the base index that does not find its way into the Shariah Index? Pradeep: As is clear from the selection criteria above, the fund does not invest in financial, tobacco and alcohol sectors. The fund cannot invest in companies who have high debt levels or companies which generate a lot of interest income. The CNX 500 Sharia Index which is the benchmark of this fund has 153 stocks against 500 stocks in CNX 500 index. WF: Your fund has consistently delivered positive alpha over the last 6 consecutive years and in 7 of the last 8 years. What are the factors that have enabled consistent alpha generation? Pradeep: The fund has focussed on companies with strong compounding characteristics i.e. companies that can grow their earnings over a long period of time. Also, we have stuck to these companies for a long period as can be seen from the very low portfolio turnover. Additional positive for these companies was that they had low debt levels (being part of Sharia universe), thereby ensuring that the full benefits of operating profit growth went primarily to equity holders and not to lenders. Thus, we invested in quality companies with low debt and stayed with them for a long time. WF: When compared with the pool of diversified equity funds, your fund seems to do much better than the pool in more challenging market conditions (top quartile in 2011, 2013 and YTD 2015) and relatively poorly compared to peers in healthier markets (2012 and 2014). What do you attribute this to? Pradeep: Typically diversified funds have a large exposure to banking sector and also tend to have exposure to companies with higher debt levels. Such portfolio typically does well in

- 3. more bullish phases but also losses are higher when markets turn weak. Thus if you look at returns only for a bullish period you would see ethical fund returns to be lower. However, if one looks at the cumulative returns, they would turn out to be much better in the ethical fund as it does not lose much in a bear phase and retains most of the returns generated in bull phase. Thus over a longer period the investor compounds his investment in a better way in an Ethical fund. E.g. an investment of Rs 100 in Ethical fund as on January 2009, would be worth Rs 428 by Dec 14. However, the same investment in BSE Sensex would have been only Rs 292.60 whereas it would be only Rs 374.61 if invested in Bank Nifty. This is because the broader market and the banking sector fell much more in CY11 and CY13, thereby giving up a large part of the gain made in previous bull periods of CY09, CY10 and CY12. WF: How are you positioning the fund now in terms of sector and thematic preferences, in these volatile times? Pradeep: The fund is overweight on auto and auto ancillaries, cement and capital goods and industrials which we feel will benefit from the expected domestic growth recovery. Also we are overweight on IT and pharma sector as they are secular growth sectors. We are equal weight on FMCG sector due to high valuations. The fund is also underweight on oil and gas sector. The focus is again on finding companies who can compound earnings over a long period in an improving economic growth scenario. WF: Is this fund positioned largely as a Shariah compliant opportunity or is there a broader appeal that you are seeking to build for the product? Pradeep: The fund is positioned as a fund which invests in growth companies that have high capital efficiency and cash generation. Such portfolios tend to perform very well across business cycles as such companies do not lose much value in a business downturn unlike companies with large leverage. Thus the fund is ideal for long term investors who want to get the full benefit of compounding and low volatility irrespective of his / her religious preferences. As can be seen from the past record, the fund has outperformed BSE Sensex even in bull phases even though the fund cannot invest in banking sector. Disclaimer: The views expressed in this article are personal in nature and in is no way trying to predict the markets or to time them. The views expressed are for information purpose only and do not construe to be any investment, legal or taxation advice. Any action taken by you on the basis of the information contained herein is your responsibility alone and Tata Asset Management will not be liable in any manner for the consequences of such action taken by you. Please consult your Financial/Investment Adviser before investing. The views expressed in this article may not reflect in the scheme portfolios of Tata Mutual Fund. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. http://wealthforumezine.net/FundFocusTATAMF180515.html#.VV1kONKqpHw