Report

Share

Download to read offline

Recommended

Deductions from gross total income under section 80 C to 80 U of income tax act 1961 (Chapter VI A) Useful for undergraduate taxation students Deductions from gross total income under section 80C to 80 U of income tax ac...

Deductions from gross total income under section 80C to 80 U of income tax ac...Dr. Sanjay Sawant Dessai

Recommended

Deductions from gross total income under section 80 C to 80 U of income tax act 1961 (Chapter VI A) Useful for undergraduate taxation students Deductions from gross total income under section 80C to 80 U of income tax ac...

Deductions from gross total income under section 80C to 80 U of income tax ac...Dr. Sanjay Sawant Dessai

Import and Export Financing-Forms and Methods with Alternative financing technique (EDF, International Factoring, Bonded Warehouse Faculty, Duty Draw back facility, UPAS LC) business case solution, in relation with Rupali Bank Ltd. International Business.Import and Export Financing-Forms and Methods with Alternative financing tech...

Import and Export Financing-Forms and Methods with Alternative financing tech...Md. Mostahidur Rahman, CDCS

More Related Content

What's hot

Import and Export Financing-Forms and Methods with Alternative financing technique (EDF, International Factoring, Bonded Warehouse Faculty, Duty Draw back facility, UPAS LC) business case solution, in relation with Rupali Bank Ltd. International Business.Import and Export Financing-Forms and Methods with Alternative financing tech...

Import and Export Financing-Forms and Methods with Alternative financing tech...Md. Mostahidur Rahman, CDCS

What's hot (20)

Import and Export Financing-Forms and Methods with Alternative financing tech...

Import and Export Financing-Forms and Methods with Alternative financing tech...

TIME OF SUPPLY AND TAX INVOICE UNDER CGST ACT & RULES

TIME OF SUPPLY AND TAX INVOICE UNDER CGST ACT & RULES

Similar to Gst flowchart icai gst returns

Similar to Gst flowchart icai gst returns (20)

Issues in Export & Import of Goods & Services vis-a-vis Foreign Trade Policy

Issues in Export & Import of Goods & Services vis-a-vis Foreign Trade Policy

Normal Service tax rate with effect from 1st June 2015 is 14

Normal Service tax rate with effect from 1st June 2015 is 14

More from Rajula Gurva Reddy

More from Rajula Gurva Reddy (20)

Simplified approach to export of services rules dear friends

Simplified approach to export of services rules dear friends

Cbec notification-40-2017-cgst-rate-dt-23-oct-2017-nominal-gst-rate-for-suppl...

Cbec notification-40-2017-cgst-rate-dt-23-oct-2017-nominal-gst-rate-for-suppl...

Simplified approach to export of services rules dear friends

Simplified approach to export of services rules dear friends

2017 draft alertlist of superintendent of hyderabad zone agt, 2017

2017 draft alertlist of superintendent of hyderabad zone agt, 2017

Recently uploaded

$ Love Spells^ 💎 (310) 882-6330 in Utah, UT | Psychic Reading Best Black Magic Removal Specialist Near Me Spiritual Healer Powerful Love Spells Astrologer Spell to Get Ex-Lover Back | Lost Love Spell Caster$ Love Spells^ 💎 (310) 882-6330 in Utah, UT | Psychic Reading Best Black Magi...

$ Love Spells^ 💎 (310) 882-6330 in Utah, UT | Psychic Reading Best Black Magi...PsychicRuben LoveSpells

Recently uploaded (20)

CAFC Chronicles: Costly Tales of Claim Construction Fails

CAFC Chronicles: Costly Tales of Claim Construction Fails

$ Love Spells^ 💎 (310) 882-6330 in Utah, UT | Psychic Reading Best Black Magi...

$ Love Spells^ 💎 (310) 882-6330 in Utah, UT | Psychic Reading Best Black Magi...

Smarp Snapshot 210 -- Google's Social Media Ad Fraud & Disinformation Strategy

Smarp Snapshot 210 -- Google's Social Media Ad Fraud & Disinformation Strategy

How do cyber crime lawyers in Mumbai collaborate with law enforcement agencie...

How do cyber crime lawyers in Mumbai collaborate with law enforcement agencie...

Navigating the Legal and Ethical Landscape of Blockchain Investigation.pdf

Navigating the Legal and Ethical Landscape of Blockchain Investigation.pdf

Relationship Between International Law and Municipal Law MIR.pdf

Relationship Between International Law and Municipal Law MIR.pdf

PPT- Voluntary Liquidation (Under section 59).pptx

PPT- Voluntary Liquidation (Under section 59).pptx

Cyber Laws : National and International Perspective.

Cyber Laws : National and International Perspective.

Corporate Sustainability Due Diligence Directive (CSDDD or the EU Supply Chai...

Corporate Sustainability Due Diligence Directive (CSDDD or the EU Supply Chai...

Gst flowchart icai gst returns

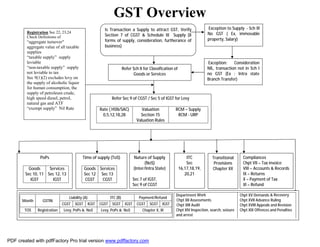

- 1. GST Overview Is Transaction a Supply to attract GST, Verify Section 7 of CGST & Schedule III Supply (8 forms of supply, consideration, furtherance of business) Exception to Supply - Sch III No GST ( Ex, immovable property, Salary) Refer Sch II for Classification of Goods or Services Exception: Consideration NIL, transaction not in Sch I no GST (Ex : Intra state Branch Transfer) Refer Sec 9 of CGST / Sec 5 of IGST for Levy Rate ( HSN/SAC) 0,5,12,18,28 Valuation Section 15 Valuation Rules RCM – Supply RCM - URP Registration Sec 22, 23,24 Check Definitions of “aggregate turnover" aggregate value of all taxable supplies “taxable supply” supply leviable “non-taxable supply” supply not leviable to tax Sec 9(1)(2) excludes levy on the supply of alcoholic liquor for human consumption, the supply of petroleum crude, high speed diesel, petrol, natural gas and ATF “exempt supply” Nil Rate PoPs Goods Sec 10, 11 IGST Services Sec 12, 13 IGST Time of supply (ToS) Goods Sec 12 CGST Services Sec 13 CGST Nature of Supply (NoS) (Inter/Intra State) Sec 7 of IGST, Sec 9 of CGST ITC Sec 16,17,18,19, 20,21 Transitional Provisions Chapter XX Compliances Chpt VII – Tax invoice VIII – Accounts & Records IX – Returns X – Payment of Tax XI – Refund Department Work Chpt XII Assessments Chpt XIII Audit Chpt XIV Inspection, search, seizure and arrest Chpt XV Demands & Recovery Chpt XVII Advance Ruling Chpt XVIII Appeals and Revision Chpt XIX Offences and Penalties Month GSTIN Liability (A) ITC (B) Payment/Refund CGST SGST IGST CGST SGST IGST CGST SGST IGST TOS Registration Levy, PoPs & NoS Levy, PoPs & NoS Chapter X, XI PDF created with pdfFactory Pro trial version www.pdffactory.com

- 2. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 3. “aggregate turnover" means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis, “taxable supply” means a supply of goods or services or both which is leviable to tax under this Act; “non-taxable supply” means a supply of goods or services or both which is not leviable to tax under this Act or under the Integrated Goods and Services Tax Act; Sec 9(1)(2) excludes levy on the supply of alcoholic liquor for human consumption, the supply of petroleum crude, high speed diesel, petrol, natural gas and ATF “exempt supply” means supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax under section 11, or under section 6 of the Integrated Goods and Services Tax Act, and includes non-taxable supply; PDF created with pdfFactory Pro trial version www.pdffactory.com

- 4. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 5. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 6. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 7. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 8. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 9. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 10. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 11. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 12. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 13. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 14. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 15. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 16. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 17. PDF created with pdfFactory Pro trial version www.pdffactory.com