This document contains a summary of a consumer confidence index report for Vietnam in 2024. It includes the following key points:

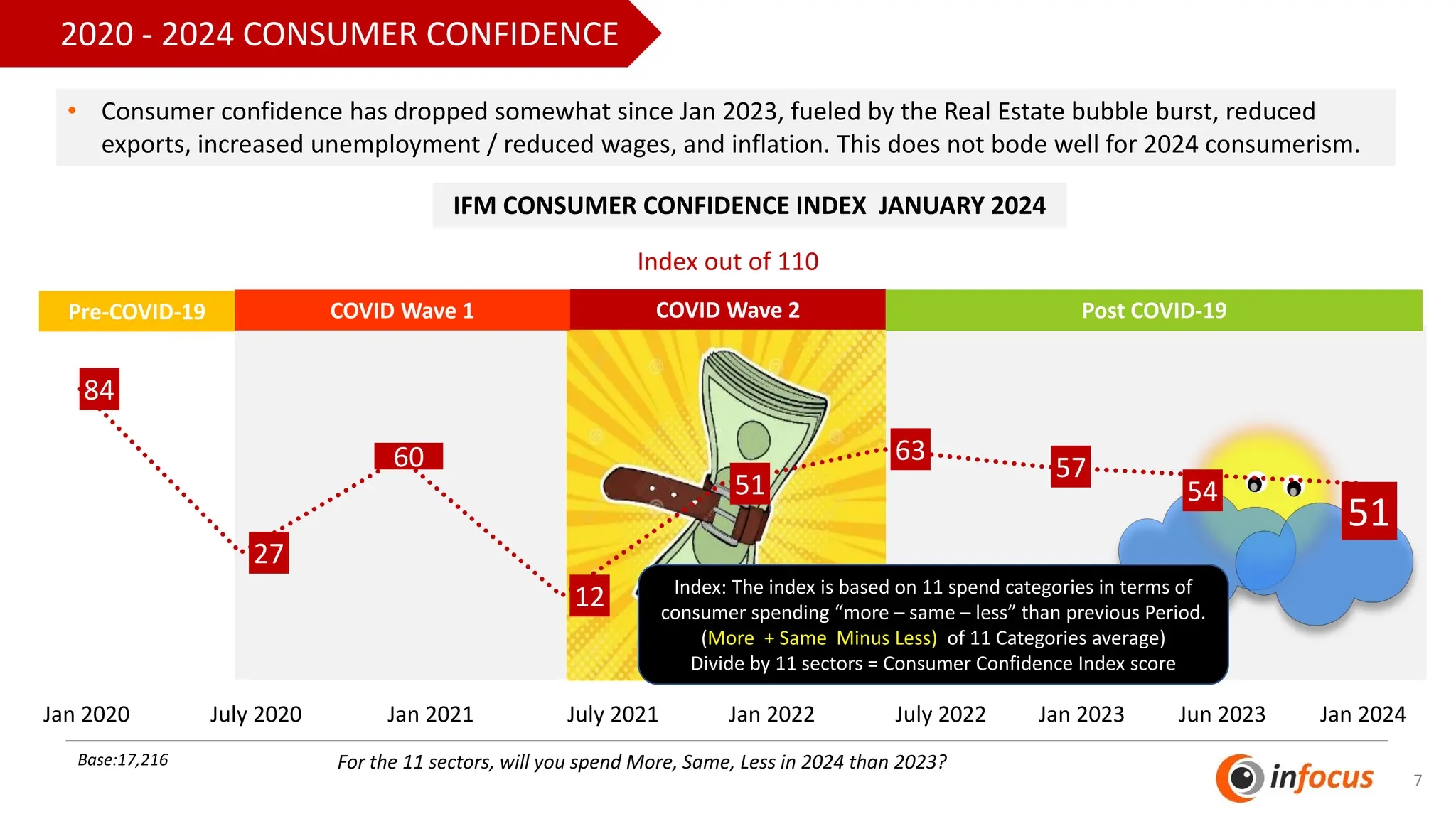

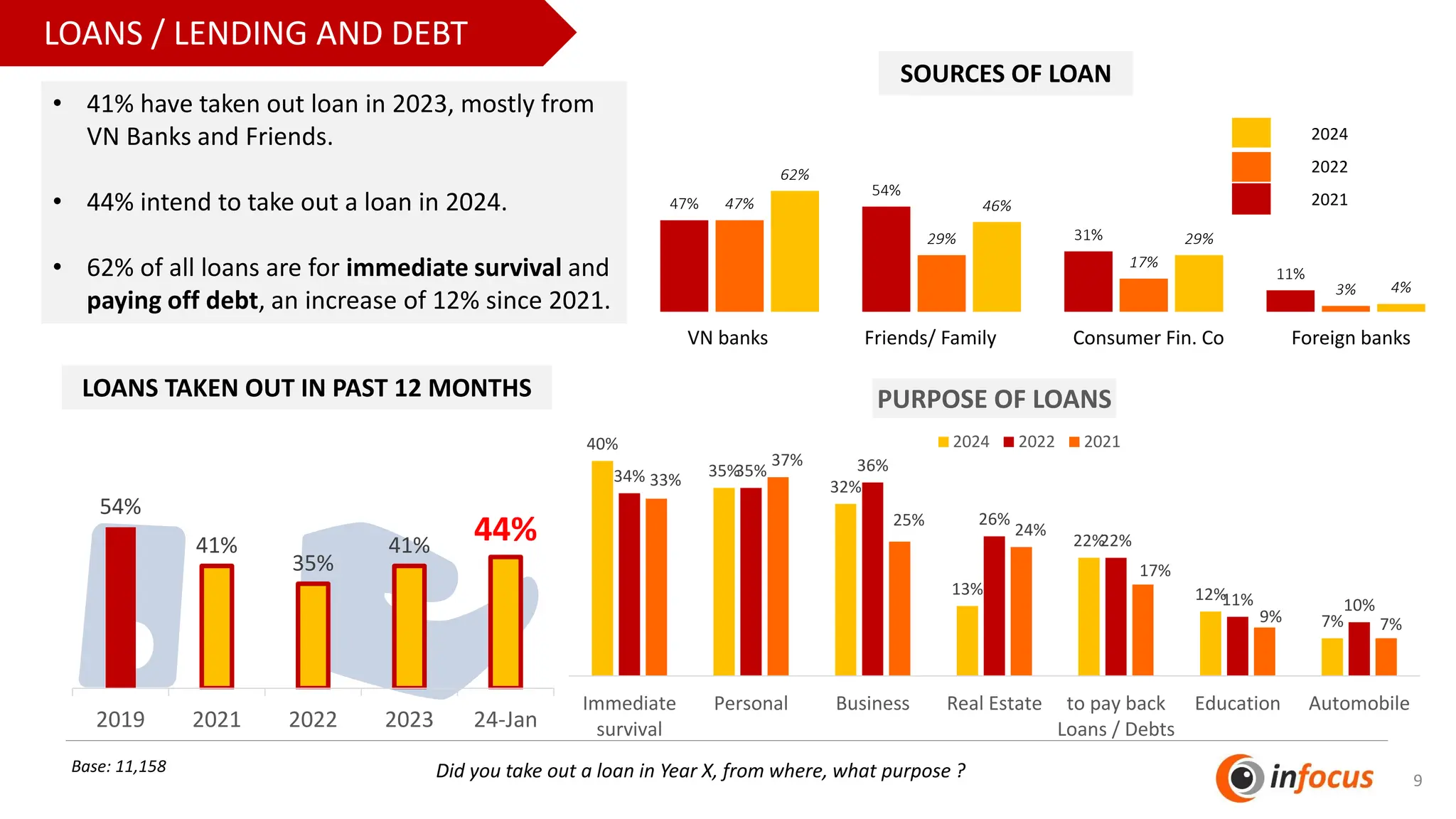

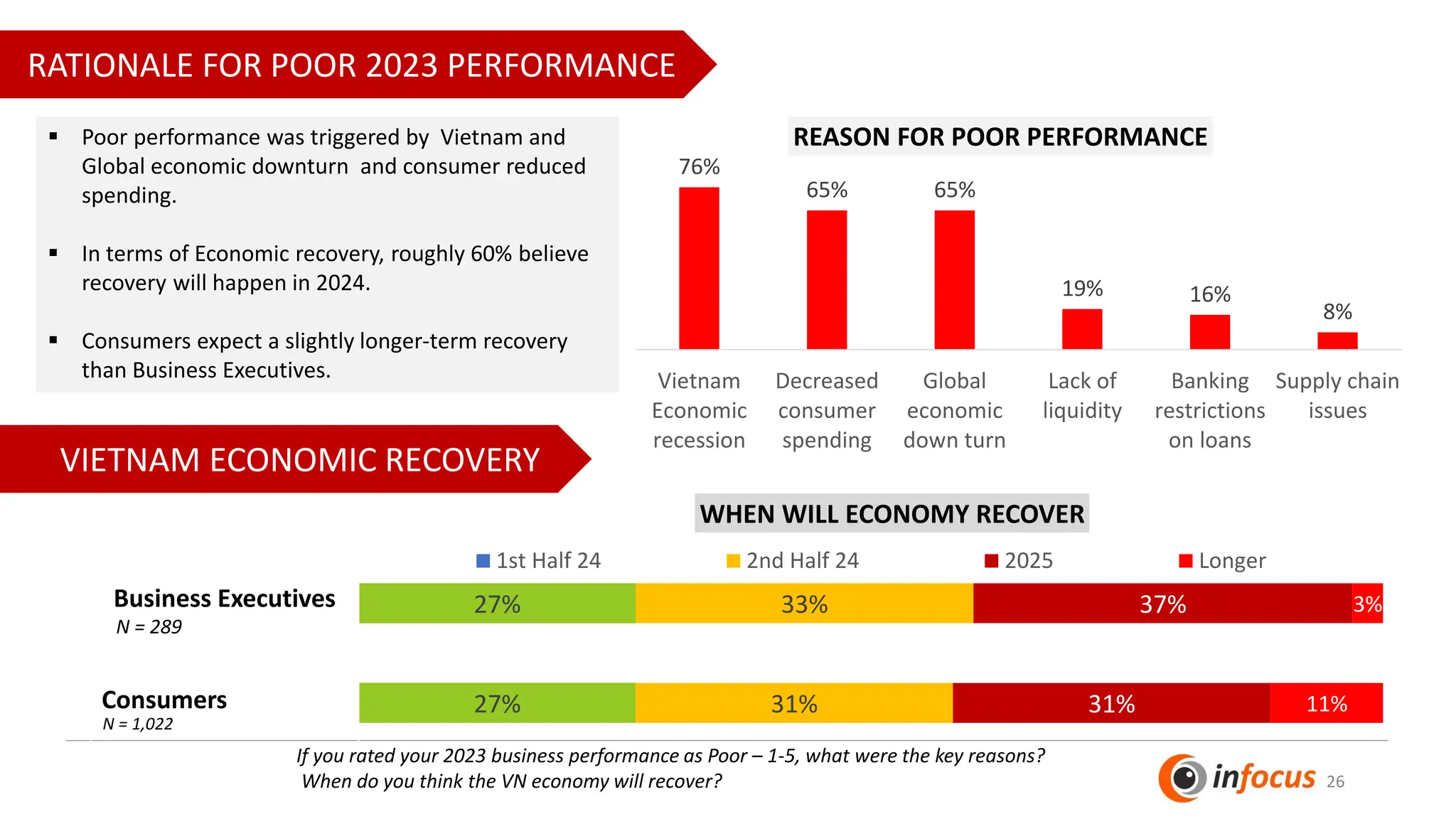

1. The consumer confidence index dropped slightly from January 2023, driven by factors like the real estate market decline, reduced exports, inflation, and unemployment.

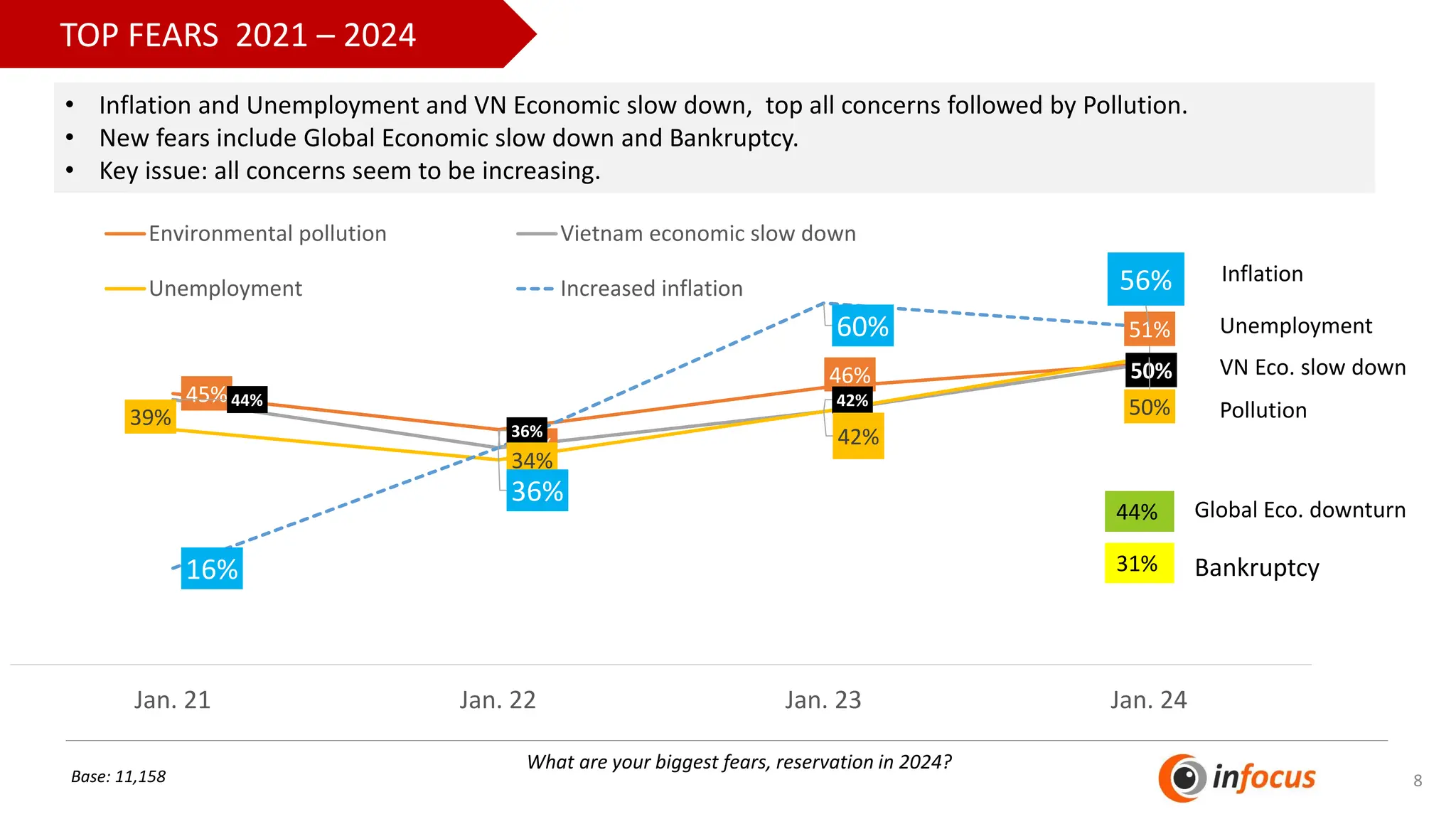

2. Top consumer fears for 2024 include inflation, unemployment, economic slowdown in Vietnam and globally, and pollution.

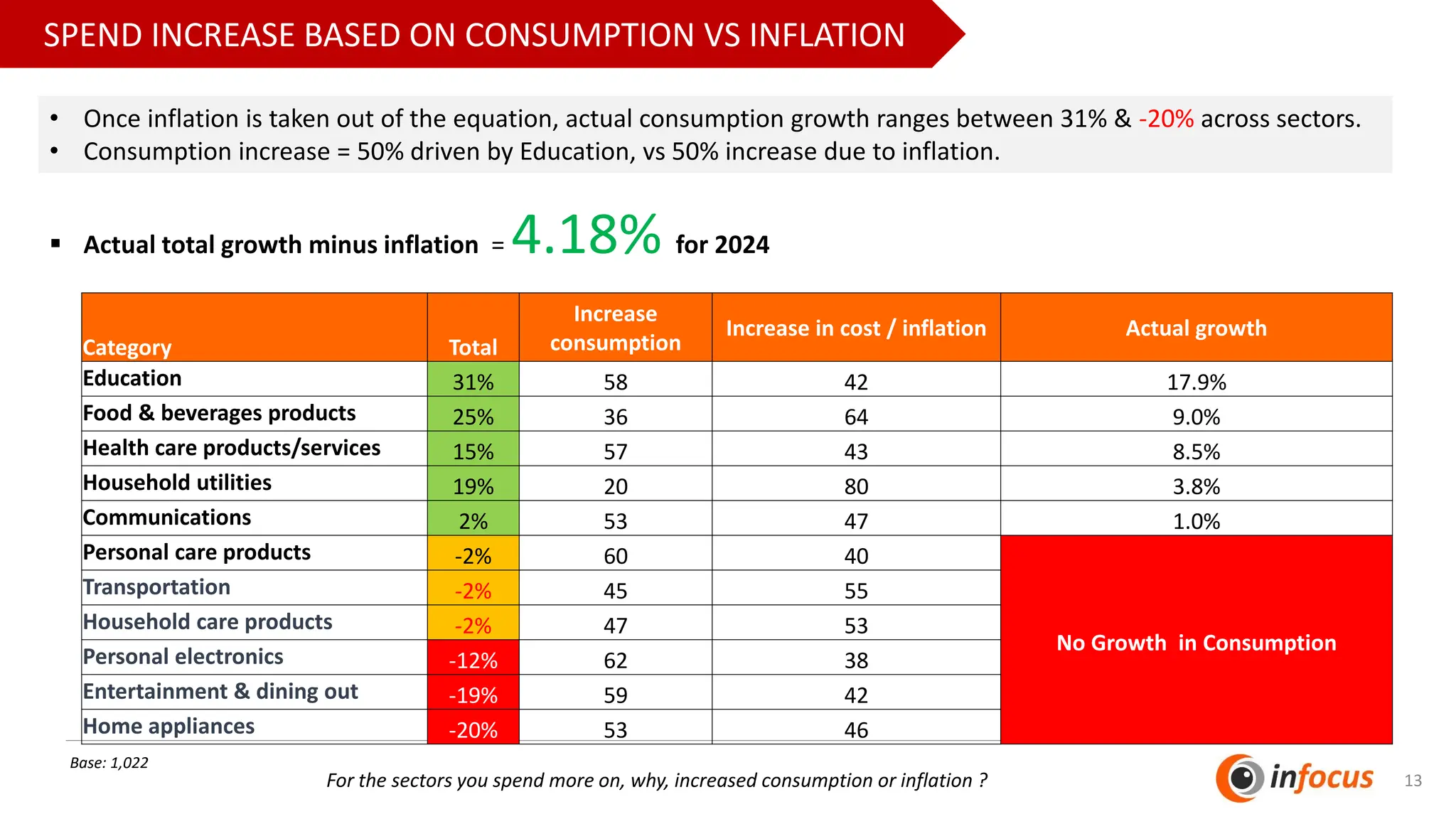

3. Spending intentions vary by category in 2024, with expected growth in education and food/beverages, but declines in entertainment, appliances, and electronics.

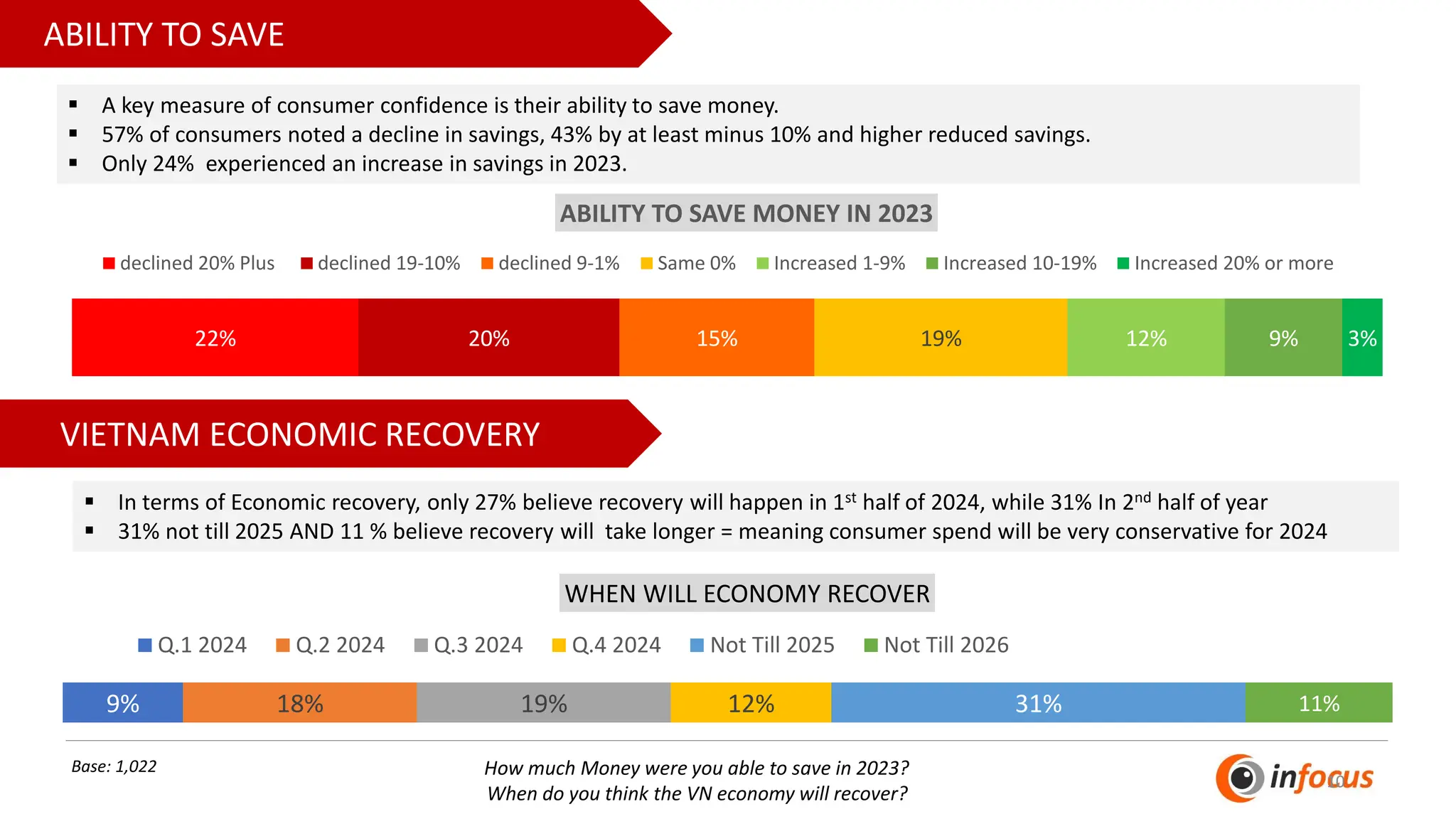

4. Many consumers report decreased savings in 2023 and expect the economic recovery to extend into 2025 or beyond.