NNN Property Research report

•

1 like•475 views

NNN Property research report

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Two Ways the Auto Industry Can Beat Possible Slowdown in 2018

Two Ways the Auto Industry Can Beat Possible Slowdown in 2018

Cox Automotive Market Insight Overview August 2019

Cox Automotive Market Insight Overview August 2019

2016 q3 net lease research report | The Boulder Group

2016 q3 net lease research report | The Boulder Group

JLL Detroit Industrial Insight & Statistics - Q2 2016

JLL Detroit Industrial Insight & Statistics - Q2 2016

JLL Pittsburgh Industrial Insight & Statistics - Q1 2018

JLL Pittsburgh Industrial Insight & Statistics - Q1 2018

Similar to NNN Property Research report

Similar to NNN Property Research report (20)

3rd Quarter Net Lease Market Research Report | The Boulder Group

3rd Quarter Net Lease Market Research Report | The Boulder Group

Net Lease Research Report Q4 2015 | The Boulder Group

Net Lease Research Report Q4 2015 | The Boulder Group

The Boulder Group | Q3 2014 Net Lease Research Report2014 q3-net-lease-resear...

The Boulder Group | Q3 2014 Net Lease Research Report2014 q3-net-lease-resear...

net lease research report q1 2018 | The Boulder Group

net lease research report q1 2018 | The Boulder Group

Net Lease Market Research Report Published by The Boulder Group

Net Lease Market Research Report Published by The Boulder Group

More from The Boulder Group

More from The Boulder Group (20)

The Boulder Group Net Lease Tenant Profile Report 2020

The Boulder Group Net Lease Tenant Profile Report 2020

Net Lease Tenant Profile Report 2019 | The Boulder Group

Net Lease Tenant Profile Report 2019 | The Boulder Group

Net Lease Casual Dining Report 2018 | The Boulder Group

Net Lease Casual Dining Report 2018 | The Boulder Group

Net Lease Big Box Research Report | The Boulder Group

Net Lease Big Box Research Report | The Boulder Group

Sale Leaseback Property For Sale - The Boulder Group

Sale Leaseback Property For Sale - The Boulder Group

Recently uploaded

Recently uploaded (20)

BPTP THE AMAARIO For The Royals Of Tomorrow in Sector 37D Gurgaon Dwarka Expr...

BPTP THE AMAARIO For The Royals Of Tomorrow in Sector 37D Gurgaon Dwarka Expr...

9990771857 Call Girls in Dwarka Sector 1 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 1 Delhi (Call Girls) Delhi

Call Girls in Karkardooma Delhi +91 84487779280}Woman Seeking Man in Delhi NCR

Call Girls in Karkardooma Delhi +91 84487779280}Woman Seeking Man in Delhi NCR

9990771857 Call Girls in Dwarka Sector 2 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 2 Delhi (Call Girls) Delhi

M3M 129 E Brochure Noida Expressway, Sector 129, Noida

M3M 129 E Brochure Noida Expressway, Sector 129, Noida

BPTP THE AMAARIO Luxury Project Invest Like Royalty in Sector 37D Gurgaon Dwa...

BPTP THE AMAARIO Luxury Project Invest Like Royalty in Sector 37D Gurgaon Dwa...

M3M The Line Brochure - Premium Investment Opportunity for Commercial Ventures

M3M The Line Brochure - Premium Investment Opportunity for Commercial Ventures

MEQ Mainstreet Equity Corp Q2 2024 Investor Presentation

MEQ Mainstreet Equity Corp Q2 2024 Investor Presentation

9990771857 Call Girls Dwarka Sector 8 Delhi (Call Girls ) Delhi

9990771857 Call Girls Dwarka Sector 8 Delhi (Call Girls ) Delhi

Retail Center For Sale - 1019 River St., Belleville, WI

Retail Center For Sale - 1019 River St., Belleville, WI

Kohinoor Teiko Hinjewadi Phase 2 Pune E-Brochure.pdf

Kohinoor Teiko Hinjewadi Phase 2 Pune E-Brochure.pdf

TENANT SCREENING REPORT SERVICES How Tenant Screening Reports Work

TENANT SCREENING REPORT SERVICES How Tenant Screening Reports Work

Greater Vancouver Realtors Statistics Package April 2024

Greater Vancouver Realtors Statistics Package April 2024

NNN Property Research report

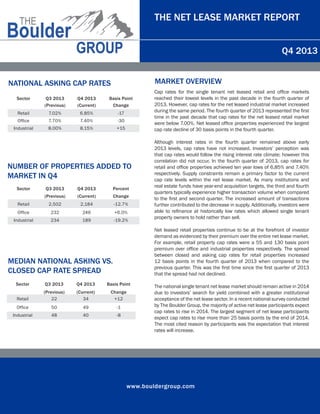

- 1. THE NET LEASE MARKET REPORT Q4 2013 NATIONAL ASKING CAP RATES MARKET OVERVIEW Cap rates for the single tenant net leased retail and office markets reached their lowest levels in the past decade in the fourth quarter of 2013. However, cap rates for the net leased industrial market increased during the same period. The fourth quarter of 2013 represented the first time in the past decade that cap rates for the net leased retail market were below 7.00%. Net leased office properties experienced the largest cap rate decline of 30 basis points in the fourth quarter. Sector Q3 2013 (Previous) Q4 2013 (Current) Basis Point Change Retail 7.02% 6.85% -17 Office 7.70% 7.40% -30 Industrial 8.00% 8.15% +15 NUMBER OF PROPERTIES ADDED TO MARKET IN Q4 Sector Q3 2013 Q4 2013 Percent (Previous) (Current) Change Retail 2,502 2,184 -12.7% Office 232 246 +6.0% Industrial 234 189 -19.2% Net leased retail properties continue to be at the forefront of investor demand as evidenced by their premium over the entire net lease market. For example, retail property cap rates were a 55 and 130 basis point premium over office and industrial properties respectively. The spread between closed and asking cap rates for retail properties increased 12 basis points in the fourth quarter of 2013 when compared to the previous quarter. This was the first time since the first quarter of 2013 that the spread had not declined. MEDIAN NATIONAL ASKING VS. CLOSED CAP RATE SPREAD Although interest rates in the fourth quarter remained above early 2013 levels, cap rates have not increased. Investors’ perception was that cap rates would follow the rising interest rate climate; however this correlation did not occur. In the fourth quarter of 2013, cap rates for retail and office properties achieved ten year lows of 6.85% and 7.40% respectively. Supply constraints remain a primary factor to the current cap rate levels within the net lease market. As many institutions and real estate funds have year-end acquisition targets, the third and fourth quarters typically experience higher transaction volume when compared to the first and second quarter. The increased amount of transactions further contributed to the decrease in supply. Additionally, investors were able to refinance at historically low rates which allowed single tenant property owners to hold rather than sell. Sector Q3 2013 Q4 2013 Basis Point Retail (Previous) 22 (Current) 34 Change +12 Office 50 49 -1 Industrial 48 40 -8 The national single tenant net lease market should remain active in 2014 due to investors’ search for yield combined with a greater institutional acceptance of the net lease sector. In a recent national survey conducted by The Boulder Group, the majority of active net lease participants expect cap rates to rise in 2014. The largest segment of net lease participants expect cap rates to rise more than 25 basis points by the end of 2014. The most cited reason by participants was the expectation that interest rates will increase. www.bouldergroup.com

- 2. THE NET LEASE MARKET REPORT Q4 2013 SELECTED SINGLE TENANT SALES COMPARABLES Sale Date Sector Price Per SF Cap Rate Oct-13 Retail LA Fitness Houston TX $12,000,000 $267 7.50% 15 Oct-13 Retail Dick’s Sporting Goods Durham NC $11,800,000 $204 7.50% 9 Oct-13 Retail Trader Joe’s Evanston IL $11,000,000 $733 5.08% 15 Dec-13 Retail Kohl’s Avondale AZ $10,600,000 $120 6.55% 10 Nov-13 Retail Walgreens Greenwood IN $9,200,000 $695 5.92% 25 Nov-13 Retail Besy Buy Mishawaka IN $7,000,000 $140 10.83% 10 Oct-13 Retail Bank of America Chicago IL $6,940,000 $733 5.62% 12 Oct-13 Retail Walgreens Memphis TN $6,410,000 $440 5.90% 22 Oct-13 Office GSA - DEA Tallahassee FL $6,150,000 $322 7.64% 6 Dec-13 Retail Aldi Addison IL $5,475,000 $198 5.81% 15 Oct-13 Retail CVS Opelika AL $5,250,000 $482 6.66% 19 Tenant City State Price Lease Term Remaining NET LEASED CAP RATE TRENDS 8.75% 8.25% 7.75% 7.25% 6.75% Q2 Q3 Q4 Q1 Q2 2006 2006 2006 2007 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q3 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2010 2010 2010 2011 2011 2011 2011 2012 2012 2012 Retail www.bouldergroup.com Q4 2012 Q1 2013 Office Q2 Q3 Q4 2013 2013 2013 Industrial

- 3. THE NET LEASE MARKET REPORT Q4 2013 MEDIAN ASKING CAP RATES BY YEAR BUILT THE BOULDER GROUP CAP RATE POLL 20102013 20052009 20002004 Pre 2000 Walgreens 5.58% 5.75% 6.20% 7.50% CVS 5.50% 5.75% 6.50% 7.75% N/A 7.25% 7.89% 8.96% Advance Auto Parts 6.40% 6.97% 7.65% 8.25% AutoZone 5.69% 5.95% 7.15% N/A O’Reilly Auto Parts 6.00% 6.40% 7.00% 8.00% Dollar General 6.50% 7.45% 8.50% 9.00% Family Dollar 7.25% 8.45% 8.69% 9.00% McDonald’s 4.05% 4.50% 4.70% 5.00% FedEx 6.50% 6.70% 7.77% 8.81% GSA 6.75% 7.25% 7.52% 8.00% Chase 4.60% 5.00% N/A N/A Bank of America 4.75% 5.00% 5.88% N/A Wells Fargo 4.70% 4.88% 5.02% 6.10% 7-Eleven 5.50% 5.88% 6.05% 6.28% DaVita 6.57% 6.75% 7.50% 8.00% Fresenius 6.39% 7.00% 7.10% 8.90% Tenant Rite Aid WHERE DO YOU EXPECT NET LEASE CAP RATES TO MOVE BY THE END OF 2014? Cap rates will move up 25 bps or more (39%) Cap rates will move up 1 bps to 24 bps (21%) Cap rates will remain unchanged (24%) Cap rates will move down 1 bps to 24 bps (16%) Cap rates will move down 25 bps or more (0%) FOR MORE INFORMATION AUTHOR John Feeney | Research Director john@bouldergroup.com CONTRIBUTORS Randy Blankstein | President rblank@bouldergroup.com Jimmy Goodman | Partner jimmy@bouldergroup.com Zach Wright | Research Analyst zach@bouldergroup.com © 2014. The Boulder Group. Information herein has been obtained from databases owned and maintained by The Boulder Group as well as third party sources. We have not verified the information and we make no guarantee, warranty or representation about it. This information is provided for general illustrative purposes and not for any specific recommendation or purpose nor under any circumstances shall any of the above information be deemed legal advice or counsel. Reliance on this information is at the risk of the reader and The Boulder Group expressly disclaims any liability arising from the use of such information. This information is designed exclusively for use by The Boulder Group clients and cannot be reproduced, retransmitted or distributed without the express written consent of The Boulder Group. www.bouldergroup.com