Io And Poa Disclosure Booklet2

- 2. More Mortgage Info Interest-Only Mortgage Payments and Payment-Option ARMs

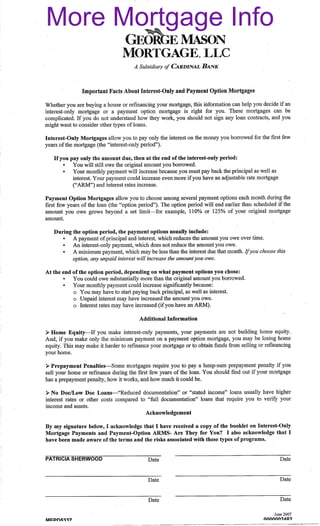

- 3. OMore Mortgage Info wning a home is part of the American dream. But high home prices may make the What is an I-O mortgage payment? dream seem out of reach. To make monthly Traditional mortgages require that each mortgage payments more affordable, many month you pay back some of the money you lenders offer home loans that allow you to () borrowed (the principal) plus the interest on pay only the interest on the loan during the that money. The principal you owe on your first few years of the loan term or () make mortgage decreases over the term of the loan. only a specified minimum payment that could In contrast, an I-O payment plan allows you to be less than the monthly interest on the loan. pay only the interest for a specified number of years. After that, you must repay both the Whether you are buying a house or principal and the interest. refinancing your mortgage, this information can help you decide if an interest-only Most mortgages that offer an I-O payment mortgage payment (an I-O mortgage)—or plan have adjustable interest rates, which an adjustable-rate mortgage (ARM) with means that the interest rate and monthly the option to make a minimum payment (a payment will change over the term of the loan. payment-option ARM)—is right for you. Lenders The changes may be as often as once a month have a variety of names for these loans, but or as seldom as every to 5 years, depending keep in mind that with I-O mortgages and on the terms of your loan. For example, a 5/ payment-option ARMs, you could face ARM has a fixed interest rate for the first 5 years; after that, the rate can change once a payment shock. Your payments may go year (the “” in 5/) during the rest of the loan. up a lot—as much as double or triple— More information on ARMs is available in the after the interest-only period or when the Federal Reserve Board’s Consumer Handbook payments adjust. on Adjustable Rate Mortgages. In addition, with payment-option ARMs you The I-O payment period is typically between could face and 0 years. After that, your monthly negative amortization. Your payments may payment will increase—even if interest rates not cover all of the interest owed. The stay the same—because you must pay back the unpaid interest is added to your mortgage principal as well as the interest. For example, balance so that you owe more on your if you take out a 0-year mortgage loan with a mortgage than you originally borrowed. 5-year I-O payment period, you can pay only interest for 5 years and then both principal and Be sure you understand the loan terms and the interest over the next 5 years. Because you risks you face. And be realistic about whether begin to pay back the principal, your payments you can handle future payment increases. If increase after year 5. you’re not comfortable with these risks, ask about another loan product. Interest-Only Mortgage Payments and Payment-Option ARMs Interest-Only Mortgage Payments and Payment-Option ARMs

- 4. More Mortgage Info What is a payment-option ARM? A payment-option ARM is an adjustable-rate mortgage that allows you to choose among even if interest rates rise more than 7.5%. Any interest you don’t pay because of the payment cap will be added to the balance of your loan. several payment options each month. The Payment-option ARMs have a built-in options typically include recalculation period, usually every 5 years. At this point, your payment will be recalculated a traditional payment of principal and (lenders use the term recast) based on the interest (which reduces the amount you remaining term of the loan. If you have a owe on your mortgage). These payments 0-year loan and you are at the end of year may be based on a set loan term, such as 5, your payment will be recalculated for the a 5-, 0-, or 0-year payment schedule. remaining 5 years. The payment cap does an interest-only payment (which does not not apply to this adjustment. If your loan change the amount you owe on your balance has increased, or if interest rates have mortgage). risen faster than your payments, your payments could go up a lot. a minimum (or limited) payment (which may be less than the amount of interest Ending the option payments. Lenders end the due that month and may not pay down option payments if the amount of principal any principal). If you choose this option, you owe grows beyond a set limit, say 0% the amount of any interest you do not or 5% of your original mortgage amount. pay will be added to the principal of the For example, suppose you made minimum loan, increasing the amount you owe and payments on your $80,000 mortgage and increasing the interest you will pay. had negative amortization. If the balance grew to $5,000 (5% of $80,000), the option Interest rates. The interest rate on a payment- payments would end. Your loan would be option ARM is typically very low for the recalculated and you would pay back principal first to months (%, for example). After and interest based on the remaining term of that, the rate usually rises to a rate closer to your loan. It is likely that your payments would that of other mortgage loans. Your monthly go up significantly. payments during the first year are based on the initial low rate, meaning that if you only make the minimum payment, it may not cover What do you need to ask when the interest due. The unpaid interest is added shopping for an I-O mortgage or to the amount you owe on the mortgage, a payment-option ARM? resulting in a higher balance. This is known as Use the Mortgage Shopping Worksheet to negative amortization. Also, as interest rates go compare different loan products. Ask lenders up, your payments are likely to go up. or brokers about the details of their loans and Payment changes. Many payment-option about the different loan options they offer. ARMs limit, or cap, the amount the monthly And don’t be afraid to make lenders and minimum payment may increase from year to brokers compete with each other by letting year. For example, if your loan has a payment them know you are shopping for the best deal. cap of 7.5%, your monthly payment won’t Look for a mortgage that allows you to buy the increase more than 7.5% from one year to the house and continue to afford the payments, next (for example, from $,000 to $,075), even if payments go up over time. Interest-Only Mortgage Payments and Payment-Option ARMs Interest-Only Mortgage Payments and Payment-Option ARMs 5

- 5. More Mortgage Info Mortgage Shopping Worksheet See the Consumer Handbook on Adjustable Rate Mortgages to help you compare other ARM Mortgage Shopping Worksheet - continued Example features and Looking for the Best Mortgage to What is the payment cap? 7.5% per year; does not apply to help you compare other loan features. recalculation every 5th year Can this loan have negative Yes Example amortization? Name of lender or broker ABC Mortgage Co. Is there a limit to how much Up to 125% of original contact information 800-123-4567 the balance can grow before amount borrowed (loan will be Mortgage amount $180,000 the loan will be recalculated? recalculated if balance grows to $225,000) Loan description Payment-option ARM; 1-month Is there a prepayment Yes introductory rate; 30-year term penalty if I end this mortgage Is this an I-O payment or a Payment-option ARM early by refinancing or selling payment-option ARM? my home? If different payment options 1. First year’s minimum payment How much is the penalty? 3% of amount borrowed in are available, what are the based on initial interest rate 1st year ($5,400), down to options? 1% of amount borrowed in 3rd 2. Interest-only payment based year ($1,800); no prepayment on rate after adjustment penalty after year 3 3. Fully amortizing payment $630 What will my monthly based on 30-year term payments be for the first year What is the full term of the 30 years of the loan? mortgage? Does this include taxes and No How long is the option The loan will be recalculated insurance? Homeowner’s period? (recast) every 5 years. Payment association fees? options are available every month except (1) when loan is What is the most my $677 (based on 7.5% cap) recast every 5 years, (2) when minimum monthly payment balance is 125% of original loan, could be after 12 months? or (3) if you fall more than 60 $728 (based on 7.5% cap) What is the most my days behind in your payments. minimum monthly payment What is the initial interest 1.6% could be after 24 months? rate? $738 (based on 7.5% cap) What is the most my For a payment-option ARM, 1 month minimum monthly payment how long does the initial could be after 36 months? interest rate apply? $2,491 (based on recalculation What is the most my What will the interest rate be 6.4% minimum monthly payment of the loan when balance is after the initial rate? could be after 48 months? $225,000) How often can the interest Monthly What is the most my $2,491 (based on recalculation rate adjust? minimum monthly payment of the loan after 4 years) could be after 60 months What is the periodic interest 2% per year (5 years)? rate cap? What would my minimum $1,308 (based on recalculation What is the overall interest 6% lifetime cap (maximum of the loan after 5 years) monthly payment be after rate cap? interest rate is 12.4%) 60 months (5 years) if the How often will the monthly Annually interest rate stays the same? payments adjust? What are the fees and See good faith estimate charges due at closing on this loan? Interest-Only Mortgage Payments and Payment-Option ARMs Interest-Only Mortgage Payments and Payment-Option ARMs 7

- 6. More Mortgage Info When might an I-O mortgage payment or a payment-option ARM be right for you? payment could jump to $,0 or more. If you cannot reasonably expect to make this larger payment when the time comes, you might want to think about a different type of loan. Despite the risks of these loans, an I-O mortgage payment or a payment-option ARM might be right for you if the following apply: Mortgage Shopping Worksheet you have modest current income but are Use this worksheet to compare mortgages. reasonably certain that your income will go up in the future (for example, if you’re Mortgage Mortgage finishing your degree or training program), Name of lender or broker contact information you have sizable equity in your home and Mortgage amount will use the money that would go toward principal payments for other investments, Loan description or Is this an I-O payment or a you have irregular income (such as payment-option ARM? commissions or seasonal earnings) and If different payment options are want the flexibility of making I-O or available, what are the options? option-ARM minimum payments during What is the full term of the low-income periods and larger payments mortgage? during higher-income periods. How long is the option period? What is the initial interest rate? When might an I-O mortgage payment or a payment-option For a payment-option ARM, how long does the initial ARM not make sense? interest rate apply? Interest-only or option-ARM minimum What will the interest rate be after the initial rate? payments may be risky if you won’t be able How often can the interest rate to afford the higher monthly payments in the adjust? future. For example, suppose you are in the What is the periodic interest market for a home and can afford a monthly rate cap? payment of about $,00. Depending on What is the overall interest rate the interest rate, with a traditional 0-year, cap? fixed-rate mortgage, you might expect to get How often will the monthly a $80,000 mortgage. A lender or broker payments adjust? could offer you an I-O mortgage payment of What is the payment cap? $,00 monthly that might enable you to get a $5,000 mortgage—and, therefore, a more Can this loan have negative amortization? expensive house. But keep in mind that your payments could go up because of interest rate Is there a limit to how much the balance can grow before increases when the I-O period ends, or when the loan will be recalculated? the loan is recalculated. Your $,00 monthly 8 Interest-Only Mortgage Payments and Payment-Option ARMs Interest-Only Mortgage Payments and Payment-Option ARMs

- 7. More Mortgage Info Mortgage Shopping Worksheet - continued What are the alternatives to I-O mortgage payments and payment- option ARMs? Mortgage Mortgage If you are not sure that an I-O mortgage Is there a prepayment penalty if I end this mortgage early payment or a payment-option ARM makes by refinancing or selling my sense for you, there are several other home? alternatives you could consider. How much is the penalty? Find out if you qualify for a community What will my monthly housing program that offers lower payments be for the first year interest rates or reduced fees for first-time of the loan? homebuyers, making homeownership Does this include taxes and more affordable. insurance? Homeowner’s association fees? Consider a fixed-rate mortgage or a fully What is the most my minimum amortizing ARM. Shop around for terms monthly payment could be and features that fit your needs and your after 12 months? budget. What is the most my minimum monthly payment could be Take more time to save for a larger down after 24 months? payment, reducing the amount you need What is the most my minimum to borrow and making your mortgage monthly payment could be payments more affordable. after 36 months? What is the most my minimum Look for a less expensive home. Once you monthly payment could be build up equity, you could buy a more after 48 months? expensive home. What is the most my minimum monthly payment could be after 60 months (5 years)? What should I keep in mind when it What would my minimum comes to an I-O mortgage payment monthly payment be after 60 or a payment-option ARM? months (5 years) if the interest rate stays the same? Both types of loans can be flexible What are the fees and charges and allow you to make lower monthly due at closing on this loan? payments during the first few years of the loan. You can repay some of the principal at any time to help keep future payments lower. Neither loan may be the right choice if the attraction of an initial smaller monthly payment leads you to take out a larger mortgage than you will be able to afford when the interest-only period ends or when the option payments are recalculated. 0 Interest-Only Mortgage Payments and Payment-Option ARMs Interest-Only Mortgage Payments and Payment-Option ARMs

- 8. More Mortgage Info Eventually you will have to pay back the principal you borrowed, plus any amounts added to the principal as negative amortization. Glossary Adjustable-rate mortgage (ARM) A mortgage that does not have a fixed interest rate. The rate changes during the life of the You will have lower monthly payments loan in line with movements in an index rate, only during the first few years. You will such as the rate for Treasury securities or the have larger payments later—and you will Cost of Funds for SAIF-insured institutions. need to have the income to cover those larger payments. Amortizing loan Monthly payments are large enough to pay Also, note that the interest and reduce the principal on with an adjustable-rate mortgage, interest- your mortgage. only and option-ARM monthly payments Cap, interest rate can increase, even during the I-O payment or option period. A limit on the amount your interest rate can increase. Interest caps come in two versions: by making I-O or minimum payments, you will not be building equity in your home periodic caps, which limit the interest-rate by paying down the principal on the loan, increase from one adjustment period to even though you are making monthly the next, and payments. The equity in your home may overall caps, which limit the interest- increase if the market value of your home rate increase over the life of the loan. increases, but the equity could also go By law, virtually all ARMs must have an down if the market value of your home overall cap. goes down. Cap, payment with payment-option ARMs, you may be A limit on how much the monthly payment adding to the amount you owe on your may change, either each time the payment mortgage if you pay less than the full changes or during the life of the mortgage. interest owed each month. Payment caps do not limit the amount of interest the lender is earning, so they may lead to negative amortization. Equity The difference between the fair market value of the home and the outstanding mortgage balance. Good faith estimate The Real Estate Settlement Procedures Act (RESPA) requires your mortgage lender to give you a good faith estimate of all your closing costs within business days of submitting your application for a loan, whether you are purchasing or refinancing a home. The actual Interest-Only Mortgage Payments and Payment-Option ARMs Interest-Only Mortgage Payments and Payment-Option ARMs

- 9. More Mortgage Info expenses at closing may be somewhat different from the good faith estimate. Index For More Information Additional information about interest-only mortgages and payment-option ARMs is The index is the measure of interest-rate available on the Federal Reserve Board’s changes that the lender uses to decide how web site at www.federalreserve.gov/pubs/ much the interest rate on an ARM will change mortgage_interestonly/default.htm. over time. No one can be sure when an index rate will go up or down. Some index rates tend See also these sites: to be higher than others, and some change Looking for the Best Mortgage – Shop, Compare, more often. You should ask your lender how Negotiate (at www.federalreserve.gov/pubs/ the index for any ARM you are considering has mortgage/mortb_.htm) changed in recent years, and where the index is reported. Consumer Handbook on Adjustable Rate Mortgages (at www.federalreserve.gov/pubs/ Interest arms/arms_english.htm) The price paid for borrowing money, usually A Consumer’s Guide to Mortgage Settlement given in percentages and as an annual rate. Costs (at www.federalreserve.gov/pubs/ settlement/default.htm) Margin Partners Online Mortgage Calculator The number of percentage points the lender (at www.frbatlanta.org/partnerssoftwareonline/ adds to the index rate to calculate the ARM dsp_main.cfm) interest rate at each adjustment. Negative amortization This information was prepared in Occurs when the monthly payments do not consultation with the following cover all the interest owed. The interest that is agencies and organizations: not paid in the monthly payment is added to the loan balance. This means that even after Center for Responsible Lending making many payments, you could owe more Consumer Federation of America than you did at the beginning of the loan. Consumer Mortgage Coalition Prepayment penalty Consumers Union Extra fees that may be due if you pay off the Credit Union National Association loan early by refinancing your home. These Federal Deposit Insurance Corporation fees may make it too expensive to get out of Federal Reserve Bank of New York the loan. If your loan includes a prepayment Federal Trade Commission penalty, be aware of the penalty you would Financial Services Roundtable have to pay. Ask the lender if you can get a Freddie Mac loan without a prepayment penalty, and what that loan would cost. National Consumers League Office of the Comptroller of the Currency Principal Office of Thrift Supervision The amount of money borrowed or the amount Rutgers Cooperative Extension still owed on a loan. University of Illinois Cooperative Extension Interest-Only Mortgage Payments and Payment-Option ARMs Interest-Only Mortgage Payments and Payment-Option ARMs 5

- 10. More Mortgage Info Document authored by: Board of Governors of the Federal Reserve System, Washington, DC 055. October 00 Item 4394 (1006) Greatland Corporation • To Order Call 800.530.9393 • www.greatland.com