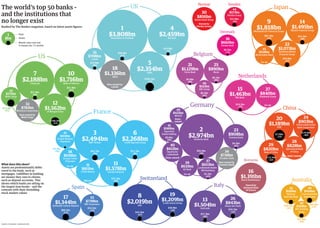

Biggest Banks

- 1. Norway Sweden The world's top 50 banks - UK 44 Japan 30 and the institutions that $816bn $573bn Nordea Group no longer exist Nordea Bank Norge Owned by $22.9bn -36% 9 14 Ranked by The Banker magazine, based on latest assets figures 1 4 Nordea Group $1,818bn $1,495bn Mizuho Financial Group Denmark Mitsubishi UFJ Financial Group 1 Rank $3,808bn $2,459bn $61.3bn $25.3bn $bn Assets Royal Bank of Scotland Barclays 36 -43% -46% Market value now and $660bn % change over 12 months Danske Bank 22 $14.8bn -71% $6.2bn 45 $1,073bn 35 -71% $528bn Sumitomo Mitsui US $708bn $20.4bn -91% Belgium Norinchukin Bank Financial Group Lloyds $30.8bn $14.6bn -86% 5 21 25 Co-op -47% 18 $2,354bn $1,129bn $890bn 7 10 $1,336bn HBOS HSBC Fortis Bank Dexia Netherlands $2,188bn $1,716bn $6.1bn $104.2bn $4.9bn -86% -41% -90% Citigroup Bank of America Now owned by 46 Lloyds $523bn 43 $21.4bn $51.4bn -81% KBC Group 15 27 $575bn -86% $6.3bn -84% $1,463bn $840bn Wells Fargo ING Bank Rabobank Group 32 12 Germany $14.2bn Co-op $73.4bn $783bn $1,562bn -77% China -47% Wachovia Corporation Now owned by JP Morgan Chase France 49 $422bn WestLB Wells Fargo State- 20 24 $108.5bn owned $903bn -37% 41 $1,189bn China Construction ICBC 2 Bank Corporation $589bn 23 47 $514bn 3 6 Hypo Real Estate Holding $2,974bn $908bn $178bn $134.6bn -40% $2,494bn $2,268bn $0.6bn Commerzbank -33% Groupe Banques -93% Deutsche Bank Populaires BNP Paribas Crédit Agricole Group $4.5bn 28 40 -82% 29 $828bn $5.4bn $612bn $820bn Agricultural Bank -78% 38 $42.7bn -44% $27.7bn -48% Bayerische $26.4bn -56% 34 Bank of China of China $638bn Landesbank $736bn State-owned Groupe Caisse State-owned Dresdner Bank $112.4bn d'Epargne 37 Romania -32% What does this show? Co-op 31 11 39 $635bn $653bn Now owned by Commerzbank Assets are predominantly debts $815bn $1,578bn DZ Bank Landesbank Baden- owed to the bank, such as mortgages. Liabilities in banking Crédit Mutuel Société Générale Co-op Württemberg $3.1bn 16 are money they owe to clients, Switzerland -62% $1,391bn such as deposit accounts. This Mutual $25.1bn -48% Banca Româneasca Australia shows which banks are sitting on the largest loan books – and the Spain Italy Owned by National Bank 42 48 contrast with their dwindling of Greece $585bn $444bn stock market values 8 19 National Commonwealth 17 33 $1,209bn 13 26 Australia Bank Bank Group $1,344bn Santander Central Hispano $739bn BBV Argentaria $2,019bn UBS Credit Suisse Group $1,504bn $843bn $26.5bn $419bn 50 $36.1bn Intesa San Paolo -11% $32.1bn $36.9bn UniCredit -32% $60.2bn -24% $34.7bn ANZ Banking -53% -51% $34.1bn -53% Group -47% $27.3bn -66% $24.4bn -34% SOURCES: THE BANKER, THOMSON REUTERS