Contenu connexe

Similaire à 人口统计学定向方法低效 (20)

Plus de 中文互联网数据研究资讯中心--199it

Plus de 中文互联网数据研究资讯中心--199it (20)

人口统计学定向方法低效

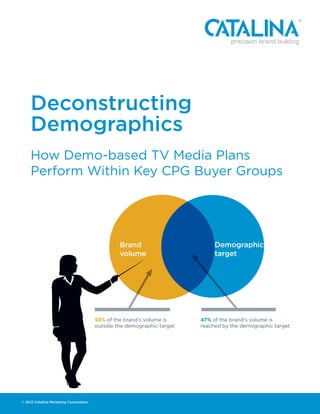

- 1. Deconstructing

Demographics

How Demo-based TV Media Plans

Perform Within Key CPG Buyer Groups

Brand Demographic

volume target

53% of the brand's volume is 47% of the brand's volume is

outside the demographic target reached by the demographic target

© 2012 Catalina Marketing Corporation

- 2. 2

PG / 1

about the study

Deconstructing Demographics is a new study by Catalina We believe the results will surprise many of you. We also

that looks at the effectiveness of demographic targeting believe they compel our industry to consider making

in finding consumers who are truly valuable to brands. significant changes in the way advertisers plan and deliver

For years our industry has relied on demographics to media. There is a clear need to transition from demographic

define target audiences. Today, however, new data sources targeting to purchase-based audience buying.

and media types give us the opportunity to look beyond

demographics for the first time. We hope this report sparks

further reflection among brand advertisers, media planners,

media buyers, and media owners.

The findings show that demo-based media plans are

inefficient in reaching consumers who buy more. In fact, study highlights

they reach all buyer segments at virtually the same rate.

As a result, demo-based media plans waste a large portion • Demo-based media plans treat all buyer groups

of ad exposures on buyer audiences that have little or equally, no matter what their value to a brand is.

no value to brands. In our study, just 15 percent of ad Across every brand and category in our study, ad

exposures were delivered to households that accounted exposures were delivered to buyer groups almost

for 80 percent of sales for the average brand. Meanwhile, exactly in proportion to their population size. No

brand advertisers delivered 64 percent of ad exposures to deviation was greater than 4 percent.

households that accounted for just 2 percent of sales. • Demo-based media plans deliver a large portion

of ad exposures to low-value households.

Demographics are, in fact, a poor surrogate for purchasing The average brand in this study delivered 64

behavior. More than half of all sales for the average brand percent of television media exposures to households

fell outside of the largest demographic groups typically that accounted for 2 percent of sales.

used by advertisers for targeting.

• Higher-value households are undervalued.

The findings show that demo-based Only 36 percent of exposures reached households

that accounted for 98 percent of brand sales.

media plans are inefficient in reaching

the consumers who buy more. • Common demographic targets miss a majority

of sales volume.

Our new research is based on a single-source data Households headed by women ages 25-54

view of the demographics, media exposure, and in- represented 41 percent of all households,

store purchasing behavior of American households. This but provided just 47 percent of sales for the

aggregated and anonymized view, powered by Nielsen average brand.

Catalina Solutions, combines Catalina’s shopper database— • Brand advertisers now have delivery alternatives

the world’s largest data warehouse of consumer purchasing that reach households based on purchasing

behavior—and data generated by Nielsen’s U.S. National behavior, not demographics.

People Meter (NPM) television panel. The study tracks

3,800 NPM households. It looks at 10 leading CPG food • Shopper ID-driven media networks can

brands which, together, spent more than $415 million on reach exactly the right buyers based on their

measured TV media in 2011. For each brand, we reviewed purchase behavior to address any brand strategy.

TV advertising exposures and brand and category • Purchase-based targeting is now dramatically

spend across groups of households, segmented by their improving the efficiency of online and television

demographic make-up, level of category engagement, and advertising.

level of brand loyalty. The result is a new, in-depth look at

the way demographic-based media plans perform against

various buyer segments.

© 2012 Catalina Marketing Corporation

- 3. 3

PG / 2

MISSING THE OPPORTUNITY The result is significant media inefficiency. On average,

brands wasted 30 percent of their exposures on

If a media plan were truly efficient, one would expect advertising

households that did not participate in their categories,

to reach higher-volume category buyers with greater frequency

meaning they had either never bought or bought just

than those who contributed little or nothing to a category.

once during the 12-month study period. By comparison,

Advertisers would weight media exposures toward the greatest

households that accounted for 80 percent of the average

selling opportunities—those households that could sustain and

brand's sales volume received just 15 percent of media

grow the brand. Heavy spenders would be exposed more often

exposures. Only 36 percent of exposures reached

than households not actively shopping in the category.

households that accounted for 98 percent of sales.

Demo-based media plans reach all Just 15 percent of media exposures

buyer groups only as much as they were delivered to households that

occur in the general population. accounted for 80 percent of sales.

One might argue that these brands had strategies for

Demographic targeting, however, typically reaches all buyer

winning new customers rather than growing volume among

groups for brands only as much as they occur in the general

existing buyers. However, the obvious place to look for

population. The result is significant waste and inefficiency in

new buyers would be among active category consumers.

delivering to a brand’s most valuable consumers.

On average, active category buyers equaled 70 percent of

households for brands and received only 70.5 percent of

Our study segments households across a variety of buyer

exposures. They received exposures at virtually the same

groups based on category spend and brand loyalty. These

rate as inactive category buyers (see Fig. 2, p. 3).

buyer groups range from non-category buyers and heavy

category spenders who are brand loyals to heavy category

Across all 10 brands, only one, a soft drink brand, managed

spenders who are switchers and the pivotal consumers

to reach heavy category buyers with a significantly greater

who together make up 80 percent of brand sales. Across

frequency than those households existed in the population.

every brand and category in our study, ad exposures

Several brands in the study from the yogurt, frozen dinner,

were delivered to different buyer groups almost exactly in

packaged cheese, and canned soup categories reached

proportion to their population size. No deviation was greater

heavy category buyers with less frequency than those

than 4 percent (see Fig. 1, p. 2).

Treating Every Household As Equal

households occurred in the population.

Treating Every Percent

FIG. 1

Household EqualLY 100%

A

Demo-targeted advertising reaches

all buyer groups equally, no matter 80% A

what their value is to a brand. For

the average brand in our study, ad

exposures reached every buyer 60%

group in nearly direct proportion

to their size of population. Despite

40%

demo-based planning, no group

experienced a deviation of more

than 4 percent. 20%

0%

rs

s

e

s

y

d

y

d

d

d

al

er

iv

or

or

an

an

he

an

n

oy

t

m

ra

eg

g

Ac

Br

Br

itc

Br

te

su

tL

B

at

Sw

n-

al

Ca

m

y

y

on

Ca

C

or

av

t

No

iu

n-

To

lC

1x

ry

g

He

ed

y

No

te

av

go

ta

M

Ca

vo

Avg. % of HHs Avg. % of Exposures

He

te

Pi

Ca

y

av

He

© 2012 Catalina Marketing Corporation

- 4. 4

PG / 3

All Women 25–54 Are Not households headed by men and older women are major

buyers in these and other CPG categories. Some 60 percent

Created Equal

of all sales came from outside of the W25-54 target for the

Demographics do provide some level of targeting. Across

frozen dinner brand, 58 percent for the cereal brand, and 50

the 10 brands we studied, households headed by women

percent for the yogurt brand (see Fig. 4, p. 4).

between the ages of 25 and 54, on average, accounted for

47 percent of sales. While this is a significant opportunity,

These findings demonstrate that demographics are, in fact,

this demographic group is far too large and diverse to be

an insufficient surrogate for purchasing behavior, creating

considered an efficient target.

inefficiencies for media planners who have been forced to

rely on them for lack of better tools or metrics.

When is a group just too big to be called a target group?

There are approximately 64 million women in the United

States between the ages of 25 and 54, representing 21

More Precision in the Buying

percent of the population. Decision

Historically, marketers have had little choice but to rely

More than half of all volume fell on demographics as the best means of determining when

outside of this huge target of and where advertising should be placed to achieve better

households headed by women 25-54. results. It was really the only data available, and the only

way media were measured, scored, and guaranteed.

Yet more than half (53 percent) of all volume fell outside this

huge target (see Fig. 3, p. 4). On average across the brands The world, however, is changing rapidly. In the era of

studied, 29 percent of households headed by women ages big data, marketers now have new tools and new media

25–54 were inactive in the category. Only 22 percent of types that can improve targeting techniques and drive

households headed by this group were heavy buyers. far greater efficiency of delivery. For example, new

technologies are enabling more precise ad targeting based

Consider a low-calorie frozen dinner brand, a low-fat cereal on purchasing profiles, not demographics. To be effective

brand, and a popular yogurt brand. Among the three, none for brands, these new approaches must have the scale to

had more than half of sales coming from within the reach millions of buyer-relevant consumers. Importantly,

demographic target of households headed by women while these solutions may appear expensive from a CPM

between ages 25 and 54. The findings show that perspective, they can be far more efficient in ROI.

heavy buyers are underserved

FIG. 2 by demo-based targeting

Heavy category buyers are worth almost five times more,

but they receive TV ad exposures at virtually the same rate 483

as the average household.

Brand Value

to HH Index 8

(% of Average)

Brand Exposures

to HH Index

95 103

(% of Average)

Non/One-time Heavy Buyers

Category Buyers

© 2012 Catalina Marketing Corporation

- 5. PG / 5

4

Targeting a buyer audience using actual purchasing

behavior data ensures delivery to households with higher Is Your Target Hitting

FIG. 3

value to specific brands and their categories. It also the Target?

allows advertisers to target the buyer segments that are

For the average brand in our

most relevant to their brand objectives. For example, a

penetration/trial strategy might index toward households

study, more than half of all

that are heavy category buyers, but have not yet tried your sales volume fell outside of

brand. A share of requirements strategy might target heavy the demographic target of

category buyers who are switchers. households headed by women

ages 25–54. This demographic

Targeting based on purchasing behavior represents 41 percent of all

ensures delivery to households with households.

higher value to brands.

Furthermore, in online media, this heightened level of

targeting allows advertisers to segment their creative to

ensure the delivery of personalized messaging. Rather than

the old demographic method of creating a single piece of

copy for all women between the ages of 25 and 54, a brand Brand Demographic

can now tailor messages and offers toward specific buying volume target

behaviors. For example, non-buyers would receive a very

different message from consumers who have bought the

brand. Environmentally-conscious consumers would receive

a different message relevant to that purchasing behavior

than savers. This kind of relevance enhances your ability to

engage consumers with your messaging.

53% of the brand's volume is 47% of the brand's volume is

Catalina has long led our industry in purchase-based outside the demographic target reached by demographic target

targeting. Catalina's capacity to see the evolving purchase

history of some 75 percent of American shoppers and

deliver relevant advertising and offers to those consumers at

the point of sale has set the standard for precise targeting missing the Target?

via a shopper ID-driven network. Catalina is now expanding FIG. 4

For the 10 brands tracked in this

its ability to precisely reach high-value consumers via a

study, as much as 60 percent of

variety of new communication channels, including online

and mobile. sales volume fell outside of the

demographic target of households

As part of that effort, the company has just launched headed by women 25–54.

Catalina BuyerVision™ to help brands and media planners

leverage purchase-based segmentation to engage the

right buyer audiences with digital advertising anywhere Category Group Volume Outside of the Volume Reached by

on the web. Powered by Nielsen Catalina Solutions and Demographic Target the Demographic

Target

by Catalina’s unique insights into in-store purchasing

Frozen dinner 60% 40%

behavior, BuyerVision allows brands and retailers to target

the right buyer audiences as defined by purchasing, not Cereal 58% 42%

demographics. Rather than targeting websites and web

Yogurt 50% 50%

content, BuyerVision identifies the buyers who are most

important to a brand strategy, finds them online, and serves Cookies 49% 51%

them advertising wherever they are on the web. It allows

Soft drinks 49% 51%

campaign results (i.e., sales lift among your targeted buyer

audience) to then be measured precisely at the point of Mayonnaise 60% 40%

sale.

Italian sauces 49% 51%

Purchase-based targeting on the web has delivered Salty snacks 44% 56%

impressive results that can be measured at the point

Packaged cheese 53% 47%

of sale. Nielsen Catalina Solutions' 600 case study

compilation, "From Clicks to Cashiers," documents an Canned soup 58% 42%

average in-store sales lift of 22 percent.

© 2012 Catalina Marketing Corporation

- 6. 6

PG / 5

Conclusion did you know?

By default, demographic targeting has been an accepted Deconstructing Demographics uncovered some

best practice among brand advertisers, media planners, surprising facts about how demographic-based

and media channels themselves for many years. Yet, as targeting performs against different buyer groups for

this study shows, demographic profiling falls far short of actual brands:

efficiently finding a brand’s most valuable consumers.

• More than half of all ad exposures for a leading

Media plans based on demographic targeting tend to

mayonnaise brand were delivered to a group that

treat every buyer audience, from non-category buyers

made up less than 10 percent of brand dollars.

to heavy category and brand buyers, as equals. They

deliver exposures to all buying segments almost exactly • Half of exposures to an Italian sauce brand were

in proportion to their share of the general population. delivered to a group that made up just 5 percent

Demographic groups themselves tend to be too large of brand dollars.

and too diverse to serve as effective targets. Indeed, the • Two low-calorie brands in frozen foods and cereal

majority of brand sales tends to fall outside of even the are marketed primarily to women, but 20 percent

largest demographic groups, such as households headed and 18 percent of sales, respectively, came from

by women ages 25–54. households with no women reported.

Demographic profiling falls far short • A common sex-age demographic target for CPG

of efficiently finding a brand’s most brands is female ages 25–54. There are roughly

valuable consumers. 64 million people in the United States who fit that

demographic—almost three times more people

Today, in an era of big data and more actionable than the entire population of Australia.

insights into consumer purchasing, there are major new • Women ages 25–54 are the primary demographic

opportunities to more efficiently target higher-value target for most CPG brands, but more than half of

consumers. From shopper ID-driven media networks to all sales for the average brand fell outside of this

purchase-based audience targeting, new, more precise, and demographic group.

relevant targeting is available and should be integrated into

• Among the 10 brands in our study, only four

most brand advertising and promotional campaigns.

had ad exposures hitting heavy buyers in their

category with greater frequency than the general

population, and only one—in the soft drink

If you’re interested in learning more about purchase-based

category— had exposures more than 1.2 times

targeting and how you can put Catalina BuyerVision to

greater.

work in your next campaign, please call 1-877-210-1917.

• For four other brands, ad exposures reached

heavy category buyers less frequently than they

did the general population.

© 2012 Catalina Marketing Corporation