Growth strategies

•

1 j'aime•204 vues

For more, please visit http://bit.ly/1LIdBT8 Asia's size and diversity: opportunity and obstacle An infographic from The Economist Intelligence Unit

Signaler

Partager

Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

In 2021, the Economic Research Institute for ASEAN and East Asia (ERIA) – together with Curated Connectors, a Singapore based start-up – hosted a webinar series to discuss how innovation, start-up creation, and entrepreneurship at large are contributing to shape the post-pandemic recovery. The discussions in each episode of the webinar series brought in innovators, ‘start-uppers’, and entrepreneurs from the Association of Southeast Asian Nations (ASEAN) and its Dialogue Partners as well as experts from international organisations, non-governmental organisations (NGOs), foundations, and policymakers. This report summarises the key messages and trends that arose from the first half of the webinar series.Entrepreneurship, Startups, and Innovation (E-S-I) in ASEAN and East Asia: Sh...

Entrepreneurship, Startups, and Innovation (E-S-I) in ASEAN and East Asia: Sh...Economic Research Institute for ASEAN and East Asia

ERIA's Chief Economist Prof Fukunari Kimura gave a presentation on inter-regional trade integration during the second session of the High-level Symposium on Intra-ASEAN Trade and Investment: Enhancing Intra-ASEAN Trade and Investment for a Cohesive and Responsive ASEAN held in Hanoi on 10 January 2020. Prof Kimura showed how intra-ASEAN trade flows are at good and stable level but nevertheless there is room for expanding these flows. He also explained how trade is changing in ASEAN and at global level: from more traditional forms of trade to trade linkages enabled by international economic networks and driven by digital technologies.

Promotion of Intra-Trade and Investment for a Cohesive and Responsive ASEAN C...

Promotion of Intra-Trade and Investment for a Cohesive and Responsive ASEAN C...Economic Research Institute for ASEAN and East Asia

This report summarises the key messages that emerged during the first five episodes of the ERIA MSME Talks, a series of webinars designed to discuss key issues, challenges, and opportunities for ASEAN MSMEs in the COVID-19 world, with a diverse group of stakeholders including entrepreneurs, policymakers, academics, and experts from the region. This report details some of the building blocks for the development of more sustainable and inclusive entrepreneurship ecosystems during the post-pandemic economic recovery in ASEAN.Event Report: ASEAN MSMEs in a COVID-19 World (revised)

Event Report: ASEAN MSMEs in a COVID-19 World (revised)Economic Research Institute for ASEAN and East Asia

Presentation file on "Thailand: An ASEAN Hub, A World of Opportunities" by Ms. Ajarin Pattanapanchai, Senior Executive Investment Advisor, Thailand Board of Investment, June 15, 2015 at Courtyard Philadelphia Downtown (BIO 2015)Thailand: An Asian Hub, A World of Opportunities (BIO 2015)

Thailand: An Asian Hub, A World of Opportunities (BIO 2015)Thailand Board of Investment North America

Recommandé

In 2021, the Economic Research Institute for ASEAN and East Asia (ERIA) – together with Curated Connectors, a Singapore based start-up – hosted a webinar series to discuss how innovation, start-up creation, and entrepreneurship at large are contributing to shape the post-pandemic recovery. The discussions in each episode of the webinar series brought in innovators, ‘start-uppers’, and entrepreneurs from the Association of Southeast Asian Nations (ASEAN) and its Dialogue Partners as well as experts from international organisations, non-governmental organisations (NGOs), foundations, and policymakers. This report summarises the key messages and trends that arose from the first half of the webinar series.Entrepreneurship, Startups, and Innovation (E-S-I) in ASEAN and East Asia: Sh...

Entrepreneurship, Startups, and Innovation (E-S-I) in ASEAN and East Asia: Sh...Economic Research Institute for ASEAN and East Asia

ERIA's Chief Economist Prof Fukunari Kimura gave a presentation on inter-regional trade integration during the second session of the High-level Symposium on Intra-ASEAN Trade and Investment: Enhancing Intra-ASEAN Trade and Investment for a Cohesive and Responsive ASEAN held in Hanoi on 10 January 2020. Prof Kimura showed how intra-ASEAN trade flows are at good and stable level but nevertheless there is room for expanding these flows. He also explained how trade is changing in ASEAN and at global level: from more traditional forms of trade to trade linkages enabled by international economic networks and driven by digital technologies.

Promotion of Intra-Trade and Investment for a Cohesive and Responsive ASEAN C...

Promotion of Intra-Trade and Investment for a Cohesive and Responsive ASEAN C...Economic Research Institute for ASEAN and East Asia

This report summarises the key messages that emerged during the first five episodes of the ERIA MSME Talks, a series of webinars designed to discuss key issues, challenges, and opportunities for ASEAN MSMEs in the COVID-19 world, with a diverse group of stakeholders including entrepreneurs, policymakers, academics, and experts from the region. This report details some of the building blocks for the development of more sustainable and inclusive entrepreneurship ecosystems during the post-pandemic economic recovery in ASEAN.Event Report: ASEAN MSMEs in a COVID-19 World (revised)

Event Report: ASEAN MSMEs in a COVID-19 World (revised)Economic Research Institute for ASEAN and East Asia

Presentation file on "Thailand: An ASEAN Hub, A World of Opportunities" by Ms. Ajarin Pattanapanchai, Senior Executive Investment Advisor, Thailand Board of Investment, June 15, 2015 at Courtyard Philadelphia Downtown (BIO 2015)Thailand: An Asian Hub, A World of Opportunities (BIO 2015)

Thailand: An Asian Hub, A World of Opportunities (BIO 2015)Thailand Board of Investment North America

Asia is becoming the preeminent global market and global source of competition. Multinational companies have a 5-year window in which to devise new corporate strategies in order to achieve sustainable growth and profitability in the Asian market. Report presents 10 trends for future and ongoing corporate strategies to meet the Asian challenge.Asia Corporate Strategy Assessment – 10 Trends in Corporate Strategic Plannin...

Asia Corporate Strategy Assessment – 10 Trends in Corporate Strategic Plannin...Team Finland Future Watch

Contenu connexe

Similaire à Growth strategies

Asia is becoming the preeminent global market and global source of competition. Multinational companies have a 5-year window in which to devise new corporate strategies in order to achieve sustainable growth and profitability in the Asian market. Report presents 10 trends for future and ongoing corporate strategies to meet the Asian challenge.Asia Corporate Strategy Assessment – 10 Trends in Corporate Strategic Plannin...

Asia Corporate Strategy Assessment – 10 Trends in Corporate Strategic Plannin...Team Finland Future Watch

Similaire à Growth strategies (20)

ASN Index-Singapore: Sponsorship Market Snapshot 2015 (Exec Summary)

ASN Index-Singapore: Sponsorship Market Snapshot 2015 (Exec Summary)

Additive Manufacturing (AM) Adding up Growth Opportunities for ASEAN

Additive Manufacturing (AM) Adding up Growth Opportunities for ASEAN

Growing together? Free trade and Asia’s technology sector

Growing together? Free trade and Asia’s technology sector

Asia Corporate Strategy Assessment – 10 Trends in Corporate Strategic Plannin...

Asia Corporate Strategy Assessment – 10 Trends in Corporate Strategic Plannin...

Plus de The Economist Media Businesses

The world’s top 100 asset owners (AOs) represent about US$19trn in assets under management. The largest, and potentially most influential, proportion is in Asia—more than a third of the total. Out of the top 20 largest funds, three out of the first five and nearly half of the total are in Asia.

For more insights, please visit: https://eiuperspectives.economist.com/sustainability/sustainable-and-actionable-study-asset-owner-priorities-esg-investing-asia?utm_source=OrganicSocial&utm_medium=Slideshare&utm_campaign=Amundi&utm_content=Slideshare_whitepaperSustainable and actionable: A study of asset-owner priorities for ESG investi...

Sustainable and actionable: A study of asset-owner priorities for ESG investi...The Economist Media Businesses

As businesses generate and manage vast amounts of data, companies have more opportunities to gather data, incorporate insights into business strategy and continuously expand access to data across the organisation. Doing so effectively—leveraging data for strategic objectives—is often easier said

than done, however. This report, Transforming data into action: the business outlook for data governance, explores the business contributions of data governance at organisations globally and across industries, the challenges faced in creating useful data governance policies and the opportunities to improve such programmes.Eiu collibra transforming data into action-the business outlook for data gove...

Eiu collibra transforming data into action-the business outlook for data gove...The Economist Media Businesses

Successful young entrepreneurial innovators have achieved something akin to rockstar status. They grace magazine covers and keynote global conferences, inspiring burgeoning

start-ups and Fortune 50 companies alike.

Collectively, young entrepreneurs are innovative by nature and their thinking is an important source of growth and job creation across the world. Today, with digital tools in hand, leaders are better positioned to expand their businesses across borders, seize niche opportunities and shape the global economic future.

Yet, most of today’s young entrepreneurs want more than status and a global corporate footprint. Their ideas of success arise from powerful social, political and economic convictions.

To find out what really makes young innovators tick, The Economist Intelligence Unit, sponsored by FedEx, surveyed more than 500 of these young entrepreneurs around the globe about their motivations, ideals and priorities. Our survey respondents were between 25 and 50 years of age and all founders, owners or partners of firms with fewer than 500 employees. They are living in North America, Europe, Middle

East, India and Africa, Asia-Pacific, and Latin America. We surveyed them on matters of globalization, technology and social values.

We then compared their views with a similar survey of the general public in the same regions. Side by side, these surveys enabled us to differentiate the outlooks of today’s young and innovative entrepreneurs.

Our surveys identified four key mindsets that guide young entrepreneurs: leading with passion; thinking globally; embracing social responsibility; and banking on connectivity. This report explores the similarities and divergences of today’s young entrepreneurs and the general public. It seeks insights into the elements of the business environment that matter most to entrepreneurs, as well as their views on a variety of issues including free trade and social responsibility. An entrepreneur’s perspective: Today’s world through the eyes of the young in...

An entrepreneur’s perspective: Today’s world through the eyes of the young in...The Economist Media Businesses

Gone are the days when marketing chiefs focused solely on the classic 4Ps: Product, Price, Promotions and Place - they now must take an integrated approach to drive company goals.Accountability in Marketing - Linking Tactics to Strategy, Customer Focus and...

Accountability in Marketing - Linking Tactics to Strategy, Customer Focus and...The Economist Media Businesses

In today’s low-yield and regulated environment, many Asia-Pacific investors are more actively monitoring their portfolios with a willingness to increase turnover and shift asset allocations for higher returns.In Asia-Pacific, low-yields and regulations drive new asset allocations

In Asia-Pacific, low-yields and regulations drive new asset allocationsThe Economist Media Businesses

Plus de The Economist Media Businesses (20)

Digital platforms and services: A development opportunity for ASEAN

Digital platforms and services: A development opportunity for ASEAN

Sustainable and actionable: A study of asset-owner priorities for ESG investi...

Sustainable and actionable: A study of asset-owner priorities for ESG investi...

Lung cancer in Latin America: Time to stop looking away

Lung cancer in Latin America: Time to stop looking away

How boards can lead the cyber-resilient organisation

How boards can lead the cyber-resilient organisation

Intelligent Economies: AI's transformation of industries and society

Intelligent Economies: AI's transformation of industries and society

Eiu collibra transforming data into action-the business outlook for data gove...

Eiu collibra transforming data into action-the business outlook for data gove...

An entrepreneur’s perspective: Today’s world through the eyes of the young in...

An entrepreneur’s perspective: Today’s world through the eyes of the young in...

EIU - Fostering exploration and excellence in 21st century schools

EIU - Fostering exploration and excellence in 21st century schools

Accountability in Marketing - Linking Tactics to Strategy, Customer Focus and...

Accountability in Marketing - Linking Tactics to Strategy, Customer Focus and...

M&A in a changing world: Opportunities amidst disruption

M&A in a changing world: Opportunities amidst disruption

Infographic: Third-Party Risks: The cyber dimension

Infographic: Third-Party Risks: The cyber dimension

Briefing paper: Third-Party Risks: The cyber dimension

Briefing paper: Third-Party Risks: The cyber dimension

In Asia-Pacific, low-yields and regulations drive new asset allocations

In Asia-Pacific, low-yields and regulations drive new asset allocations

Asia-pacific Investors Seek Balance Between Risk and Responsibility

Asia-pacific Investors Seek Balance Between Risk and Responsibility

Risks Drive Noth American Investors to Equities, For Now

Risks Drive Noth American Investors to Equities, For Now

In North America, Risks Drive Reallocation to Equities

In North America, Risks Drive Reallocation to Equities

Balancing Long-term Liabilities with Market Opportunities in EMEA

Balancing Long-term Liabilities with Market Opportunities in EMEA

Dernier

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...Falcon Invoice Discounting

Dernier (20)

Berhampur Call Girl Just Call 8084732287 Top Class Call Girl Service Available

Berhampur Call Girl Just Call 8084732287 Top Class Call Girl Service Available

Escorts in Nungambakkam Phone 8250092165 Enjoy 24/7 Escort Service Enjoy Your...

Escorts in Nungambakkam Phone 8250092165 Enjoy 24/7 Escort Service Enjoy Your...

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investors

GUWAHATI 💋 Call Girl 9827461493 Call Girls in Escort service book now

GUWAHATI 💋 Call Girl 9827461493 Call Girls in Escort service book now

Call 7737669865 Vadodara Call Girls Service at your Door Step Available All Time

Call 7737669865 Vadodara Call Girls Service at your Door Step Available All Time

Lucknow Housewife Escorts by Sexy Bhabhi Service 8250092165

Lucknow Housewife Escorts by Sexy Bhabhi Service 8250092165

joint cost.pptx COST ACCOUNTING Sixteenth Edition ...

joint cost.pptx COST ACCOUNTING Sixteenth Edition ...

Berhampur CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Pre Engineered Building Manufacturers Hyderabad.pptx

Pre Engineered Building Manufacturers Hyderabad.pptx

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Horngren’s Cost Accounting A Managerial Emphasis, Canadian 9th edition soluti...

Horngren’s Cost Accounting A Managerial Emphasis, Canadian 9th edition soluti...

Nashik Call Girl Just Call 7091819311 Top Class Call Girl Service Available

Nashik Call Girl Just Call 7091819311 Top Class Call Girl Service Available

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: Empowering Your Business Growth

Growth strategies

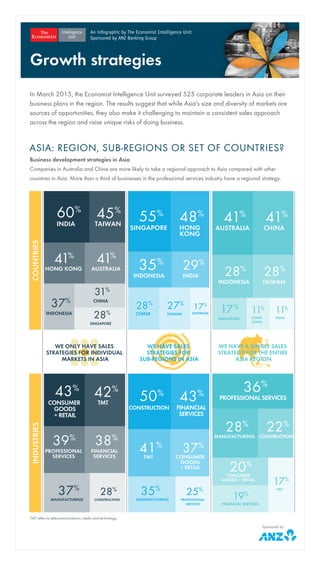

- 1. INDONESIA SINGAPORE HONG KONG INDIA 60% 45% 41% AUSTRALIA 41% 37% 31% 28% CHINA TAIWAN AUSTRALIA INDONESIA SINGAPORE HONG KONG INDIA CHINA TAIWAN 55% 48% 35% 29% 28% 27% 17% CHINA INDONESIA SINGAPORE HONG KONG 41% AUSTRALIA 41% 28% TAIWAN 28% 17% 11% 11% INDIA MANUFACTURING PROFESSIONAL SERVICES CONSUMER GOODS + RETAIL 43% 42% 39% FINANCIAL SERVICES 38% 37% 28% CONSTRUCTION TMT TMT CONSTRUCTION FINANCIAL SERVICES CONSUMER GOODS + RETAIL MANUFACTURING PROFESSIONAL SERVICES 50% 43% 41% 37% 35% 25% MANUFACTURING CONSTRUCTION FINANCIAL SERVICES 36% PROFESSIONAL SERVICES 28% 22% CONSUMER GOODS + RETAIL 20% 19% TMT 17% In March 2015, the Economist Intelligence Unit surveyed 525 corporate leaders in Asia on their business plans in the region. The results suggest that while Asia's size and diversity of markets are sources of opportunities, they also make it challenging to maintain a consistent sales approach across the region and raise unique risks of doing business. ASIA: REGION, SUB-REGIONS OR SET OF COUNTRIES? Business development strategies in Asia Companies in Australia and China are more likely to take a regional approach to Asia compared with other countries in Asia. More than a third of businesses in the professional services industry have a regional strategy. TMT refers to telecommunications, media and technology. COUNTRIESINDUSTRIES DRIVERS AND BARRIERS What are the most important drivers producing cross-border business and barriers preventing it? An infographic by The Economist Intelligence Unit Sponsored by ANZ Banking Group Growth strategies WE HAVE A SINGLE SALES STRATEGY FOR THE ENTIRE ASIA REGION WE HAVE SALES STRATEGIES FOR SUB-REGIONS IN ASIA WE ONLY HAVE SALES STRATEGIES FOR INDIVIDUAL MARKETS IN ASIA INDONESIA SINGAPORE HONG KONG INDIA 60% 45% 41% AUSTRALIA 41% 37% 31% 28% CHINA TAIWAN AUSTRALIA INDONESIA SINGAPORE HONG KONG INDIA CHINA TAIWAN 55% 48% 35% 29% 28% 27% 17% CHINA INDONESIA SINGAPORE HONG KONG 41% AUSTRALIA 41% 28% TAIWAN 28% 17% 11% 11% INDIA MANUFACTURING PROFESSIONAL SERVICES CONSUMER GOODS + RETAIL 43% 42% 39% FINANCIAL SERVICES 38% 37% 28% CONSTRUCTION TMT TMT CONSTRUCTION FINANCIAL SERVICES CONSUMER GOODS + RETAIL MANUFACTURING PROFESSIONAL SERVICES 50% 43% 41% 37% 35% 25% MANUFACTURING CONSTRUCTION FINANCIAL SERVICES 36% PROFESSIONAL SERVICES 28% 22% CONSUMER GOODS + RETAIL 20% 19% TMT 17% In March 2015, the Economist Intelligence Unit surveyed 525 corporate leaders in Asia on their business plans in the region. The results suggest that while Asia's size and diversity of markets are sources of opportunities, they also make it challenging to maintain a consistent sales approach across the region and raise unique risks of doing business. ASIA: REGION, SUB-REGIONS OR SET OF COUNTRIES? Business development strategies in Asia Companies in Australia and China are more likely to take a regional approach to Asia compared with other countries in Asia. More than a third of businesses in the professional services industry have a regional strategy. TMT refers to telecommunications, media and technology. COUNTRIESINDUSTRIES DRIVERS AND BARRIERS What are the most important drivers producing cross-border business and barriers preventing it? An infographic by The Economist Intelligence Unit Sponsored by ANZ Banking Group Growth strategies WE HAVE A SINGLE SALES STRATEGY FOR THE ENTIRE ASIA REGION WE HAVE SALES STRATEGIES FOR SUB-REGIONS IN ASIA WE ONLY HAVE SALES STRATEGIES FOR INDIVIDUAL MARKETS IN ASIA BUILDING, GROWING, HIRING What are your company's specific investment plans in the next five years? (%) Sponsored by CHINA 71% 23% INDIA 43% 36% SOUTH KOREA South-east Asia. Malaysia will see a drop in investment from other Asian countries. Myanmar, Vietnam and Thailand will become top intra-Asian investment destinations. 34% 31% TAIWAN 38% 31% INDONESIA 37% 35% MALAYSIA 41% 31% MYANMAR 42%22% VIETNAM 38%30% THAILAND 36%31% RESPONDENTS IN: AUSTRALIA CHINA HONG KONG INDIA INDONESIA SINGAPORE TAIWAN 10% 20% 30% 40% 50% 60% Open new offices Invest in new infrastructure Add to labour force Improve existing infrastructure Hire local agent or distributor Form local business partnership Market-entry research and due diligence 19% 56% 33% 52% 67% 39% 47% 20% 60% 43% 56% 63% 35% 32% 25% 51% 49% 51% 56% 34% 32% 27% 49% 43% 45% 60% 39% 29% 39% 53% 45% 44% 39% 26% 44% 17% 57% 24% 32% 49% 39% 60% 41% 37% 19% 21% 51% 27% 35% Indonesian companies are particularly focused on investing in their infrastructure Companies in Asia's largest emerging markets will be hiring more than other countries Firms in China and Taiwan will be looking for joint ventures and alliances

- 2. INDONESIA SINGAPORE HONG KONG INDIA 60% 45% 41% AUSTRALIA 41% 37% 31% 28% CHINA TAIWAN AUSTRALIA INDONESIA SINGAPORE HONG KONG INDIA CHINA TAIWAN 55% 48% 35% 29% 28% 27% 17% CHINA INDONESIA SINGAPORE HONG KONG 41% AUSTRALIA 41% 28% TAIWAN 28% 17% 11% 11% INDIA MANUFACTURING PROFESSIONAL SERVICES CONSUMER GOODS + RETAIL 43% 42% 39% FINANCIAL SERVICES 38% 37% 28% CONSTRUCTION TMT TMT CONSTRUCTION FINANCIAL SERVICES CONSUMER GOODS + RETAIL MANUFACTURING PROFESSIONAL SERVICES 50% 43% 41% 37% 35% 25% MANUFACTURING CONSTRUCTION FINANCIAL SERVICES 36% PROFESSIONAL SERVICES 28% 22% CONSUMER GOODS + RETAIL 20% 19% TMT 17% In March 2015, the Economist Intelligence Unit surveyed 525 corporate leaders in Asia on their business plans in the region. The results suggest that while Asia's size and diversity of markets are sources of opportunities, they also make it challenging to maintain a consistent sales approach across the region and raise unique risks of doing business. ASIA: REGION, SUB-REGIONS OR SET OF COUNTRIES? Business development strategies in Asia Companies in Australia and China are more likely to take a regional approach to Asia compared with other countries in Asia. More than a third of businesses in the professional services industry have a regional strategy. TMT refers to telecommunications, media and technology. COUNTRIESINDUSTRIES DRIVERS AND BARRIERS What are the most important drivers producing cross-border business and barriers preventing it? An infographic by The Economist Intelligence Unit Sponsored by ANZ Banking Group Growth strategies WE HAVE A SINGLE SALES STRATEGY FOR THE ENTIRE ASIA REGION WE HAVE SALES STRATEGIES FOR SUB-REGIONS IN ASIA WE ONLY HAVE SALES STRATEGIES FOR INDIVIDUAL MARKETS IN ASIA MANUFACTURING PROFESSIONAL SERVICES FINANCIAL SERVICES 37% 28% CONSTRUCTION TMT CONSUMER GOODS + RETAIL MANUFACTURING PROFESSIONAL SERVICES 41% 37% 35% 25% FINANCIAL SERVICES CONSUMER GOODS + RETAIL 20% 19% TMT 17% TMT refers to telecommunications, media and technology. IND DRIVERS AND BARRIERS What are the most important drivers producing cross-border business and barriers preventing it? Among the issues that help drive international business for companies in Asia, cyclical factors are the most important. Regulations and free-trade agreements are also key. Meanwhile, Asia's diverse consumer preferences and different levels of development are challenges. Sponsored by DRIVERS Significant SignificantNot Significant BARRIERS Improving economic conditions (ie, higher growth rates, rising employment) Harmonisation of regulations and/or product standards Easing of regulations that hamper cross- border investment Infrastructure improvements New free trade or investment agreements Reduced capital controls Differing stages of development among Asian economies Different consumer preferences Political corruption and instability in Asian economies Different legal standards or regulations Poor physical infrastructure in some Asian economies Difficulty sourcing talent in some Asian economies 90% 85% 82% 79% 77% 76% 10% 15% 18% 21% 23% 24% 14% 16% 20% 20% 22% 24% 86% 84% 80% 80% 78% 76%