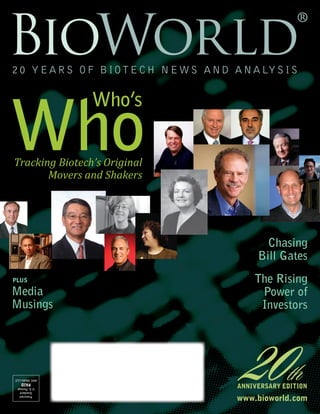

Tracking Biotech's Original Movers and Shakers Over 20 Years

- 1. 1|BioWorld® 20thAnniversaryEdition www.bioworld.com Tracking Biotech’s Original Movers and Shakers Chasing Bill Gates The Rising Power of Investors Presorted Standard U.S.Postage PAID AHCMediaLLC

- 3. 1|BioWorld® 20thAnniversaryEdition My company, now AHC Media LLC, acquired BioWorld shortly thereafter, and I have been its publisher ever since. For those of us working on these products, we have enjoyed a truly terrific ride. We’ve reached, in 2010, the 20th anniversary of thebusiness.OneoftheearliestBioWorldpublicationswehave in our archives is a magazine product, BioWorld, the “Premier Issue” as it was dubbed, dated November/December 1990. Preceded by both online and fax variations, the magazine edition would expire after just one further issue. We have since evolved into an almost entirely online enterprise, leaving both the glossy pages and the faxes behind. Returning to our roots, however, we are celebrating our 20th with the magazine publicationyouseehere–alookbackatbiotechnologythrough the prism of BioWorld’s two decades and a look ahead at developments to come. I can think of no more appropriate use of this space than to thank a host of people who have contributed to that ride. The thank yous begin with our customers. Our circulation data does not stretch all the way back to 1990, but certainly we have readers who have been with us since the February 1994 acquisition. Thank you for subscribing. Thank you for making us better every day with your insights and comments. Every move we make, every headline we write is with you in mind. Keep your suggestions coming. I want to thank David Bunnell, whose Io Publishing Inc. nurtured BioWorld through its founding three years, and from whom we purchased the BioWorld assets. Cynthia Robbins- Roth, founding editor in chief, invited me to lunch during that first San Mateo visit, although by then she had moved on and her BioVenture View was an indirect competitor. We became great friends and have been so ever since. BioWorld has benefited from the energy and professionalism of a wonderful staff over the 16 years of our management. I can’t name everyone here but I’ll thank the six managing editors who have directed BioWorld’s daily coverage from our Atlanta newsroom with vision, hard work and sound journalistic judgment — Lynn Yoffee, Charles Craig, Jim Shrine, Randy Osborne, Brady Huggett and Glen Harris. Jim Stommen served for a period as executive editor of both BioWorld and our med-tech unit, with its flagship, Medical Device Daily. Plus, we’ve had three remarkable marketing managers getting the word out: Paige Stanfield, Chris Walker and Jane Cazzorla. Amongourreporters,Imustsingleoutthelate,greatDavidLeff, who wrote colorfully and astutely for us for 12 years about the sciencethatformsthefoundationofthebiotechnologyindustry. He certainly elevated our esteem in the sector in the process. I know the reporters themselves would find me remiss if I did not mention their sources over the years — the thousands of company executives, analysts, scientists, attorneys and other industry insiders who have (usually) returned their calls and answered their questions. Many of you are also subscribers, so we double our thanks. We’ve had excellent business relationships with a number of industry partners and players. Special thanks go to Mark Dibner of BioAbility; Robert Kilpatrick and the Technology Vision Group; Alexandra Scott and the International Business Forum; Matthew Chervenak of General Biologics; and Carola Schropp of the EBD Group. BIO, the Biotechnology Industry Organization, has been both a subject of our stories, as well as a source. We’ve been each other’s customer. We’ve exhibited at BIO every year since 1995. We’ve enjoyed, particularly, a relationshipofmutualrespectwithitstwolongtimepresidents, Carl Feldbaum and Jim Greenwood. And thank you, finally, to the biotechnology industry as a whole. Whether sporting a lab coat or a business suit, you are a smart, upbeat, innovative group. Your optimism has been infectious.Ican’timagineabetterindustryforustobecovering. Keep the news flowing. We’ll continue to cover it as no one else in the industry has: every business day for the last 20 years. I first visited BioWorld’s offices on the second floor of a commercial building on South B Street in San Mateo, Calif., in January 1994. The business, then about three years old, consisted mainly of a daily, faxed newspaper, BioWorld Today; a weekly look at financial trends in the sector, BioWorld Financial Watch (since renamed BioWorld Insight); and a nascent online news and data service.

- 4. BioWorld® 20thAnniversaryEdition|2 BIOWORLD 2010 ART DIRECTOR Rachna Batra BRAND MANAGER Nicole Cathcart ILLUSTRATOR Lauren Tokarski BIOWORLD NEWSROOM MANAGING EDITOR Glen Harris ASSISTANT MANAGING EDITOR Jennifer Boggs SENIOR STAFF WRITER Karen Pihl-Carey WASHINGTON EDITOR Donna Young STAFF WRITERS Randy Osborne, Trista Morrison, Catherine Hollingsworth, Michael Harris SCIENCE EDITOR Anette Breindl SENIOR PRODUCTION EDITOR Ann Duncan BUSINESS OFFICE SENIOR VICE PRESIDENT/ GROUP PUBLISHER Donald R. Johnston DIRECTOR OF PRODUCT MANAGEMENT Jane Cazzorla MARKETING COORDINATOR Sonia Blanco ACCOUNT REPRESENTATIVES Bob Sobel, Chris Wiley, Scott Robinson DISPLAY ADVERTISING For ad rates and information, please call Stephen Vance at (404) 262-5511 or e-mail him at stephen.vance@ahcmedia.com TO SUBSCRIBE For information on BioWorld® Today and all other products, please call Customer Service at (800) 888-3912 or (404) 262-5476 or visit us at www.bioworld.com. BIOWORLD 2010 is published by AHC Media LLC, 3525 Piedmont Road, Building Six, Suite 400, Atlanta, GA 30305 U.S.A. Opinions expressed are not necessarily those of this publication. Mention of products or services does not constitute endorsement. BioWorld® is a trademark of AHC Media LLC, a Thompson Publishing Group company. Copyright © 2010 AHC Media LLC. All Rights Reserved. No part of this publication may be reproduced without the written consent of AHC Media LLC. CONTENTSThe Hope and Promise of Biotechnology By James C. Greenwood Gates Closed: Microsoft’s ‘Boy Wonder’ Grows Up – and Up Who’s Who: Tracking Biotech’s Movers and Shakers The Future Is Here: Who Will Shape Biotech Over the Next 20 Years? BioWorld Says… The Biotech Revolution: 20 Years of Battling Disease Two Decades Later, Still-‘Broken’ Model Striving to Fix Itself, Keep the Cash Flowing Activist Shareholders Up the Ante, But Is Innovation at Stake? The Blog Fog, Social-Media ‘Journalism,’ Twitter Litter: What’s Next? The New Patient Activism: Taking It to the Streets – and Beyond From Orphan Drug Act to ARRA: Government’s Impact on Biotech Here There Still Be Dragons: 20 Years Later, Looking for Heritability in the Details Breaking News: There’ll Be No Break in News! Bio-Developments: 1990-2010 As the Biotech Industry Matures, Enter the Hollywood Era By Karl Thiel Oh, Magic 8-Ball, Will Biotech Prosper? Predictions for the Future 4 6 10 24 29 32 34 36 38 40 42 44 45 46 48

- 6. BioWorld® 20thAnniversaryEdition|4 On behalf of the Biotechnology Industry Organization (BIO), I want to recognize and applaud BioWorld on its 20th Anniversary as one of the most highly regarded and well-recognized trade publications providing insights and vital coverage of our industry. Shortly after BioWorld opened its doors, BIO was formed through the merger of the Association of Biotechnology Companies and the Industrial Biotechnology Association. The goal of our organization was for the entire industry, from young start-ups to established companies, to speak with one voice on important public policy issues at the state and national levels. That continues to be our primary focus at BIO – to bring together the industry and advocate for large and small companies alike with one voice. Similar to BioWorld, one of our association’s goals is to communicate the contributions and promise of biotechnology to address many of the world’s problems. At the 2010 BIO International Convention, we will release a report on the value of biotechnology titled, “Healing, Fueling, Feeding: How Biotechnology Is Enriching Your Life.” The report tells the promising story of biotechnology through data and anecdotes capturing some of the many contributions of our industry, which I’ve highlighted below. We believe this report and this year’s convention are occurring at a defining moment for our industry. We arrive in Chicago during a period of great uncertainty and great hope for our industry.Theglobaleconomicdownturn has hit our industry hard but the fundamentals — the brilliant promise of our science — remain strong. This event gives us the opportu- nity to celebrate our accomplishments, discuss our common challenges, learn about new technologies and trends, and seek new opportunities for invest- ment and collaboration. It also gives us the opportunity to assess the great achievements of the overall industry, and look to the future for what we hope to accomplish to move innovation for- ward and help better our world. The past 20 years have propelled the biotech industry to contribute to a better and more sustainable way of life. Thanks to modern biotechnology, we live longer and healthier lives, enjoy a more abundant food supply and higher nutritional value, use less and cleaner energy and have safer, more efficient industrial manufacturing. Today, there are more than 250 biotechnologyhealthcareproductsand vaccines available to patients, many for previously untreatable diseases. Our companies continue to innovate at a breathtaking pace, developing medicines that are providing hope where there once was none and new tools to allow for more personalized and effective care. More than 13.3 million farmers around the world use By James C. Greenwood President and CEO, Biotechnology Industry Organization Biotechnology THE HOPE AND PROMISE OF

- 7. 5|BioWorld® 20thAnniversaryEdition agricultural biotechnology to increase yields, prevent damage from insects and pests and reduce farming’s impact on the environment. And more than 50 biorefineries are being built across North America to test and refine technologies to produce biofuels and chemicals from renewable biomass, which can help reduce greenhouse gas emissions. We have high hopes for the next 20 years. We have a lofty goal — as an industry, we must continue to leverage cutting-edge innovations to address looming challenges and help create a brighter future. Already, we have made significant progress in meeting this goal and have only tapped a small fragment of the many potential uses — and benefits — of biotechnology. Biotechnology helps us answer the world’s most pressing challenges: resource sustainability, environmental stewardship, water scarcity, an aging population and cancer, to name just a few. The biotech industry is an eco- nomic growth engine, providing high- quality jobs for researchers and scien- tists, and generating employment for millions of workers in other industries. Every day, research scientists explore new ways to improve our quality of life using biotechnology applications. In health care, more than 600 new biotechnology medicines are currently being developed and tested for more than 100 diseases that could yield promising results in the near future. Researchers are capitalizing on genetic information to develop promising new cures for cancer, including therapeutic vaccines, and — through personalized medicine — working to help the right patients get the right treatment at the right time. Fulfilling the promise of personalized medicine truly could transform the delivery of health care within the next 20 years. And promising new work on malaria, tuberculosis, and dengue fever may prove the key to developing vaccines for deathly diseases that plague the world. While great progress has already been made to improve crop yields and the nutritional value of our food sup- ply, we can expect further positive im- pacts in the near future. Through new biotechnological innovations, scien- tists are in the process of developing salt-tolerant, drought-resistant crops and opportunities for leveraging cur- rently non-productive land. Continued advances in the area of genetically en- gineered animals will enable research- ers to enhance food production and expand scientific knowledge. Also promising are applications that would reduce the environmental footprint of our farms. Biotechnology may pave the way for a 21st century industrial revolution that moves our economy away from a petrochemical-based economy to a more green and cleantech focused, bioprocessing-based economy. This could lead to the emergence of a new “home grown” value chain, giving every state the opportunity to sustainably leverage biological resources. And industry scientists are deploying new tools, such as synthetic biology and genetically enhanced microbes that require only sunlight and carbon dioxide, to enable bioprocesses for biofuels and chemicals. As an industry, we must continue our proud tradition of researching and developing breakthrough new products and technologies that address some of the greatest challenges facing our global population and our planet. It is the passionate, committed people in our industry who conduct the vital research and development work that will help treat previously untreatable diseases, grow more crops on available land, prevent pollution and environmental degradation at the source and develop advanced, renewable sources of energy. Year round, we remain committed to advocating on behalf of the industry to create a policy and regulatory environment to support the important work that is being done every day. The value of biotechnology is often either overlooked or misunderstood by policymakers and the public. They must be made aware of the value that biotechnology brings to society and everyday life in order to make informed decisions that will affect future biotechnological innovation. BIO has the privilege and honor of telling the biotechnology story to the world. We hope that you will take a moment to read the value of biotech report, which you can access at valueofbiotech.com. And feel free to use the information and stories within the report to tell others about the enormous promise and potential of the biotech industry. Again, we applaud the long- standingcommitmentofBioWorldover the past 20 years to provide accurate and fair reporting of our industry. We stand ready to advocate and support the industry as it continues to deliver on the promise of biotechnology to help heal, fuel and feed the world for years to come. THE BIOTECH INDUSTRY IS AN ECONOMIC GROWTH ENGINE, PROVIDING HIGH-QUALITY JOBS FOR RESEARCHERS AND SCIENTISTS, AND GENERATING EMPLOYMENT FOR MILLIONS OF WORKERS IN OTHER INDUSTRIES. James C. Greenwood is President and CEO of BIO in Washington, D.C., which represents more than 1,200 biotechnology companies, academic institutions, state biotechnology centers and related organizations across the United States and in more than 30 other nations. BIO members are involved in the research and development of innovative healthcare, agricultural, industrial and environmental biotechnology products. BIO also produces the annual BIO International Convention, the world’s largest gathering of the biotechnology industry, along with industry-leading investor and partnering meetings held around the world.

- 8. BioWorld® 20thAnniversaryEdition|6 20 years ago, he sat for a BioWorld Q&A. Today, computer genius and biotech investor Bill Gates is busier than ever. CLOSED Microsoft’s ‘Boy Wonder’ Grows Up — and Up By Randy Osborne Staff Writer W riting in a BioWorld magazine feature story two decades ago, David Bunnell described hearing news from the editor that his friend, the famous entrepreneur Bill Gates, was entering biotech. “‘He is?’ I exclaimed somewhat incredulously. ‘How so?’” That year, 1990, Gates become the single largest investor in fledgling ICOS Corp., of Seattle. “BioWorld visits the software boy wonder,” trumpeted the headline in our premier magazine issue. ICOS, to become best known as Eli Lilly and Co.’s partner for the erectile-dysfunction drug Cialis (tadalafil), was bought in 2007 by Indianapolis-based Lilly for $2.1 billion — seemingly major bucks, but hardly enough to make golden Gates exclaim incredulously, even then. The Microsoft chairman’s presence in the biotech industry has only grown with his riches. In 1994, Gates founded the Bill & Melinda Gates Foundation (then known as the William H. Gates Foundation) to give back by enhancing health care in poverty-stricken areas of the world. Phone calls and email from BioWorld to the foundation requesting an interview with Gates for our 20th anniversary issue drew an encouraging response at first. Then came a follow-up contact from one of Gates’ staffers, who said he would “have to decline the opportunity” because of other commitments. The chase was on. Trying to reach him through the foundation’s bureaucratic strata was probably futile to begin with, we reasoned. So we tried email to www. thegatesnotes.com, the website where Bill shares with fans under categories such as “what I’m thinking,” “what I’m learning about,” and “my travels.” Maybe Bill would take a few minutes from his schedule to tell our readers what he’d been thinking and learning about since the BioWorld magazine article in days of yore. We could ask him a lot of questions about the

- 10. BioWorld® 20thAnniversaryEdition|8 Maybe it was for the best, since Bill has his own, mostly non-biotech projects going, and he needs to put his efforts there. Maybe he wouldn’t have had much to say about the industry overall anyhow. The chat might have been full of awkward silences. biotech industry, where it’s been and where it’s going. We could ask him what he meant, in that original interview, when he said: “In my industry, we’ve built up a few companies like Microsoft that are going to be there for a long time. Biotech still doesn’t really have that. You can say Genentech sort of surrendered.” Hmm… 1990 was the year Basel, Switzerland-based Roche AG acquired a majority stake in Genentech Inc. Was Bill talking about that? Could we ask him? Nope. Nothing. Next we considered firing off 150 characters on Twitter, where Bill tweets on occasion. Isn’t this how everybody talks to each other now – by way of Twitter and Facebook? Bill listed 685,227 Twitter followers at last count. Cutting through the noise and persuading him to get on the horn for a real-time chitchat ought to be easy, right? Sure. We gave that one up before starting. Continued effort seemed worthwhile. Bill’s original BioWorld interview contained keen- minded insights, including his comparison of biotech with the burgeoning field of computers. Bill reeled off the commonalities: “Smart people; a new industry where nobody really knows the rules and a lot of surprising things can happen; different ways you can look at partnerships and distributing products; situations where you’re friends on one deal and you’re enemies on the next; a small community where you’re always running into each other; an arena in which the courts are totally crazed with the level of ambiguity — is this thing protected or is it not? — are you going to be put out of business with this lawsuit that’s been running for years, where you basically have to assume that you’re going to win?” We assumed we were going to win. We tracked down David Bunnell, the writer of the original Bill article and founder of BioWorld, as well as other important media outlets. It was Bunnell’s friendship with Bill, after all, that won him the first interview; possibly hecouldpullsomestringsandgetusasecondone. We wrote to Bunnell at www.eldr.com, where he is co-founder and editor in chief. It’s an online publication that offers “an enlightened, entertaining and sometimes edgy approach to aging through its reviews, articles and interviews, dynamic photography and artwork,” according to the website’s self-description. “Bringing back BioWorld memories for you.” This was the cheery, inviting — or so we thought — subject line of an email to Bunnell. “The reason I’m contacting you is that I’m trying to reach Mr. Gates for 15 minutes, and cannot penetrate the wall of his people; I’m hoping you can help,” we wrote. “Can you? Would you? Thank you for anything you might do.” Bunnell declined the opportunity too, apparently. No reply. Could be that he had just as much going on as his longtime friend Bill. We were aging, and getting edgy about it, but no Bill. Other avenues were explored — many other avenues. We contacted friends of friends of Bill. We tried to find people who knew people who had once stood in line somewhere in proximity to Bill. We cajoled public relations people who seemed like they had important connections. One warned about the “tall order,” but vowed: “I will do everything in my power to make it happen.” Didn’t happen. Not through her power, or ever at all. Maybe it was for the best, since Bill has his own, mostly non-biotech projects going, and he needs to put his efforts there. Maybe he wouldn’t have had much to say about the industry overall anyhow. The chat might have been full of awkward silences. Yet we prefer the past, when the world seemed more manageable and people easier to reach, just by picking up the phone and waiting on hold for a few minutes. Bill was talking about computers when he said the following, but it seems to fit: “The industry is now dominated by large companies that are very different from the ones who started it up, and you get people who are still very nostalgic for those old days.” Amen, Bill. Amen. ABOVE: Bill Gates

- 12. BioWorld® 20thAnniversaryEdition|10 n 1990, a new group of biotech leaders started to emerge. Some held positions within the industry, leaving big pharma to run young biotechcompaniesorrisingthroughthenewlyestablishedbiotechrankstoadvance cutting-edge technologies. Others hailed from the financial community, from Washington or from academia. Together, they were poised to take the helm from the biotech industry’s original founders and navigate through uncharted waters, nurturing innovation, building infrastructure and overcoming early challenges along the way. Twenty years ago, the BioWorld staff compiled a list of those people – the ones most likely to shape the future of the biotech industry. Based on a combination of research, interviews and personal opinions, the list served as an early “who’s who” for the industry. What happened to those petri dish pioneers, those leaders of the lab and brainiacs of the boardroom? Let’s take a look at how the members of our original list have fared over the past 20 years… In the original issue 20 years ago, BioWorld picked the up-and-coming stars expected to shape the future of the biotech industry. Where are they now? By Trista Morrison Staff Writer Tracking Biotech’s Original Movers and Shakers

- 14. BioWorld® 20thAnniversaryEdition|12 Dennis Longstreet EXECUTIVES Hollings Renton THEN: President and chief operating officer of Cetus Corp., a biotech reeling from the FDA’s rejection of cancer drug Proleukin (interleukin-2). NOW: Founded in 1971, Cetus was one of the original biotech start-ups. Its first claim to fame was scientist Kary Mullis’ work on the polymerase chain reaction (PCR), a DNA amplification technique that earned Mullis a Nobel Prize and provided the nascent biotech industry with a foundation on which to build. But by 1990, Cetus had turned its focus to drugs, namely cancer drug Proleukin and multiple sclerosis drug Betaseron (interferon beta-1b). When the FDA rejected Proleukin, Renton was brought in to get things back on track. He did just that. Within a year, he had engineered Cetus’ acquisition by Chiron Corp., where he took over as president and chief operating officer. He oversaw Chiron’s approval of Proleukin and Betaseron. Chiron itself later would be acquired by Novartis AG, but Renton didn’t stick around to see that – he was lured to a little cancer start-up called Onyx Pharmaceuticals Inc. Onyx was the brainchild of Frank McCormick, now director of the UCSF Helen Diller Family Comprehensive Cancer Center. Back then, McCormick was vice president of research at Cetus and then at Chiron. Shortly after the merger, he got funding from venture investors Brook Byers and Sam Colella to spin out a biotech focused on cancer. Renton joined Onyx as president and CEO in 1993. He quickly inked deals with Warner-Lambert Co. (now Pfizer Inc.) for Onyx’s lead oncolytic virus program and with Bayer AG for an early stage kinase inhibitor program. After going public in 1996, Onyx fell victim to the harsh markets of 2001 and was forced to restructure. Then Pfizer backed away from its partnership, forcing Renton to make what he called a “key strategic decision.” Onyx abandoned its Phase III oncolytic virus program to focus on Nexavar (sorafenib), then in Phase I/II with partner Bayer. “We were probably one of the earlier companies to make a strategic decision to abandon a platform and focus on a single drug,” Renton said. The bet paid off. Nexavar gained approval for kidney and liver cancers, posting global sales of $843.5 million last year and helping thousands of patients. Renton retired in 2008 and now serves as chairman of the board at Affymax Inc., co-chairman of the board at Portola Pharmaceuticals Inc., and board member for Rigel Pharmaceuticals Inc. and Cepheid Inc. THEN: President of Johnson & Johnson’s Ortho Biotech group, the first standalone biotech subsidiarytocomeoutofbigpharmaandthe only company at the time with a monoclonal antibody on the market (transplant rejection treatment OKT3). NOW: Ortho laid the groundwork for a string of successful J&J biotech subsidiaries, including Centocor Inc. Longstreet’s influence was critical to building the big pharma’s biotech presence, as was that of James Utaski, who oversaw J&J’s business development and venture capital efforts during the same time period. Over the years, Longstreet moved up the big pharma’s ranks, eventually serving as group chairman and managing four medical device divisions with $4 billion in sales. After retiring in 2005, he joined private equity firm RoundTable Healthcare Partners in 2006, where he still serves as a senior advisor and sits on multiple company boards. “We were probably one of the earlier companies to make a strategic decision to abandon a platform and focus on a single drug.”

- 15. 13|BioWorld® 20thAnniversaryEdition Michael Riordan THEN: Founder, president and CEO of antisense start-up Gilead Sciences Inc. NOW: Drawing on experience from both the medical and venture capital fields, Riordan (left) founded Gilead when he was just 29 years old. In addition to making BioWorld’s original movers-and-shakers list in 1990, he was also named one of BioPeople Magazine’s most eligible bio-bachelors. In 1990, Riordan had been pushing Gilead’s scientists to figure out a way to make antisense work, but to no avail. The programs were sold to Isis Pharmaceuticals Inc., which continues to advance antisense today. Gilead then turned its focus to aptamers, which were later sold to Eyetech Pharmaceuticals Inc., Archemix Inc. and others. But the seeds that would one day grow Gilead into a $7 billion HIV and liver disease powerhouse were already being planted: Riordan recruited John Martin, now chairman and CEO; John Milligan, now president and chief operating officer; and Norbert Bischofberger, now chief scientific officer. That early dream team picked up rights to some antiviral technologies that had fallen through the cracks during the merger of Bristol-Myers Co. and the Squibb Corp. Although only in preclinical, they would one day become HIV drug Viread (tenofovir disoproxil fumarate) and HBV drug Hepsera (adefovir dipivoxil). Riordan left Gilead in 1997 and spent several years traveling in Europe and Asia. He’s working on a nonprofit at the intersection of human rights and digital media, but prefers to keep the project under the radar for the time being. And – attention, ladies – he hasn’t settled down to marriage yet, so you’ve still got a chance to capture this bio-bachelor’s heart. James Sherblom THEN: Chairman and CEO of Transgenic Sciences Inc., a pioneer of manufacturing recombinant products in transgenic animals. NOW: Sherblom hailed from Genzyme Corp., which back then was no stranger to supporting its early stage enzyme research with diverse acquisitions. He employed a similar strategy at TSI, acquiring lab-testing service firms to helpfundthetransgenicmanufacturing programs. TSI was sold to Genzyme, and Sherblom founded Seaflower Ventures to seed new life science and medical technology start-ups. The firm was involved in funding Geltex Pharmaceuticals Inc., which developed Renagel (sevelamer hydrochloride) and was later bought by partner Genzyme for $1 billion. Seaflower is well- respected in the early stage venture industry, and Sherblom still serves as managing general partner. He also co-founded the Massachusetts Biotechnology Council, which has grown into a powerful regional biotech industry organization representing more than 600 member organizations. Ron Unterman THEN: A pioneer in environmental biotechnology, Unterman left General Electric to co-found Envirogen Inc., a start-up focused on bioremediation of hazardous wastes. NOW: UntermanservedaschiefscientificofficerasEnvirogen went public and was sold to engineering and technology firm Shaw Environmental. He later joined the Slater Center for Marine and Environmental Technologies, a Rhode Island venture firm. Roger Salquist THEN: Chairman and CEO of Calgene Inc., which held the future of agricultural biotechnology in its hands as the first biotech to pursue approval of a genetically engineered food. NOW: Salquist got his FDA approval of the Flavr Savr tomato, although it proved too expensive for commercial success. Nevertheless, he negotiated Calgene’s acquisition by Monsanto Co. in 1996 and then founded venture firm Bay City Capital in 2007. Bay City has helped fund dozens of biotechs and still invests actively in the space today. Salquist, however, retired in 2003 to serve as chairman of the Connect entrepreneurship program at the University of California, Davis. He later moved on to a position as chairman of lipid profiling company Lipomics Inc.

- 16. BioWorld® 20thAnniversaryEdition|14 Virginia Walker THEN: Vice president of finance at California Biotechnology Inc. and a champion of creative biotechnology financing. NOW: Walker organized the first conference of the association of biotechnology financial officers. She also helped turn around CalBio, which later became Scios Inc., nowaJohnson&JohnsonsubsidiaryfocusedonmarketingheartfailuredrugNatrecor (nesiritide). But the biotech industry lost her talents as she took senior finance positions with General Electric, semiconductor company Intersil Corp., software developer OSE Systems/Enea and high-tech consulting firm Jamison Group. Art Benvenuto THEN: A former Eli Lilly and Co. executive who took the helm of Marrow-Tech Inc., serving as chairman, president and CEO of the regenerative medicine firm. NOW: Marrow-Tech changed its name to Advanced Tissue Sciences Inc. and won FDA-approval of Dermagraft, a bioen- gineered, cryopreserved tissue used to treat diabetic foot ulcers. But the firm went bankrupt trying to fund its portion of a joint venture with Smith & Nephew. Dermagraft, however, lived on: the tech- nology was sold to Advanced BioHealing Inc., which successfully markets it today. Benvenuto (right) went on to serve as chairman of the life science group at RA Capital Management LLC, and he served on several biotech boards. Today he is chairman and CEO of Micell Technolo- gies Inc., an early stage firm developing bio-coatings for drug-device combina- tion products. And Benvenuto wasn’t the only ATS alum to impact the indus- try: ATS Chief Medical Officer Ron Cohen became founder, president and CEO of Acorda Therapeutics Inc., which recent- ly won FDA approval of Ampyra (dal- fampridine) to improve walking ability in patients with multiple sclerosis. John Groom THEN: A Smith Kline & French Laboratories alum who left big pharma to serve as founding president and CEO of Athena Neurosciences Inc. NOW: Groom engineered Athena’s $600 million takeover by Elan Corp. plc. in 1996, which gave the big pharma access to soon-to-be- approved muscle spasticity drug Zanaflex (tizanidine hydrochloride) and seizure drug Diastat (diazepam). Elan also took over development of a little multiple sclerosis antibody in Athena’s pipeline: back then it was known as Antegren, but it would one day become a blockbuster under the brand name Tysabri (natalizumab). Groom joined the Elan ranks, eventually serving as president and chief operating officer. Known as a charismatic leader, he retired in 2001 and now serves on several biotech boards. Alan Timms THEN: Traded a high-level position with G.D. Searle & Co. (now part of Pfizer Inc.) to serve as president and CEO of Glycomed Inc. NOW: Timms had decades of big pharma experience gained first at Sandoz (now part of Novartis AG) and later at Searle, where he served as president of research and development. He left to run his own consulting company, but after just two years he was recruited to the top spot at Glycomed, a biotech founded by Brian Atwood, who later went on to found venture firm Versant Ventures. Glycomed’s carbohydrate chemistry platform proved difficult to advance, however, and Timms left the struggling company during a 1994 restructuring, just prior to its acquisition by Ligand Pharmaceuticals Inc. Timms returned to his consulting firm until he retired in 2001; he also served on several biotech boards. Glenn French THEN: President of Applied Immune Sciences Inc. NOW: Applied ImmuneSciences Inc., an innovator in cell and gene therapies, soldone-thirdofitselftoRhone-Poulenc Rorer Inc. in 1993. The big pharma (which would eventually form part of Sanofi-Aventis Group) bought the rest in 1995, at which point French moved on. Like so many other early biotechs, Applied ImmuneSciences produced more than one future biotech leader: scientific founder Thomas Okarma went on to become president and CEO of stem cell pioneer Geron Corp.

- 17. 15|BioWorld® 20thAnniversaryEdition David Blech FINANCIAL COMMUNITY THEN: Founder of at least a dozen biotechs including Genetic Systems Corp., Celgene Corp., Icos Corp. and Neurogen Corp., as well as the head of biotech investment firm Blech & Co., which was seeking to “rescue” struggling companies. NOW: Blech kept founding biotechs – among them Alexion Pharmaceuticals Inc. and Neurocrine Biosciences Inc. He shook up many traditional venture capitalists with his unorthodox funding approaches and decision-making based on what he referred to as an intuitive sense about people. But Blech’s empire came crashing down when his investment firm got into trouble for buying and selling stocks to and from brokerage accounts that he controlled, which created the illusion of liquidity. His firm failed to open its doors on Sept. 22, 1994 – known on Wall Street as “Blech Thursday” – sending ripples through the entire biotech sector and stranding several biotechs that had depended on his support. Blech later pleaded guilty to criminal securities fraud. But that wasn’t the end for Blech – like so many of the biotech companies he invested in, he would rise again from the ashes. The Seattle Times reported a few years ago that he was consulting for Intellect Neurosciences Inc., an antibody firm working on disease-modifying Alzheimer’s drugs. And the Times also noted that his family owns about $25 million worth of biotech penny-stocks. Denise Gilbert THEN: An analyst with County Na- tional Westminster Bank (a.k.a. County NatWest) known for insight- ful, substantive commentary that got beyond the hype. NOW: As investment banks began to sense biotech’s potential, Gilbert was one of the original financial analysts hired to cover the industry. After advancing through analyst positions with Smith Barney Harris & Upham and Montgomery Securities, she moved to the corporate side as chief financial officer and executive vice president first at Affymax Inc. and later at Incyte Corp. In 2000, she left Incyte to bicycle around the world. She later served as CEO of privately held bioinformatics firm Entigen Corp. before branching off on her own as an independent consultant. Gilbert serves on the boards of Dynavax Technologies Corp., Cytokinetics Inc. and KaloBios Pharmaceuticals Inc. Yasunori Kaneko THEN: Head of corporate finance for Paribas Capital Markets Ltd.’s investment banking division, where he was known for pioneering strategic alliances between U.S. and Japanese biotech companies. NOW: Kaneko (right) left Paribas to serve as chief financial officer and senior vice president at antisense pioneer Isis Pharmaceuticals Inc., which he took public in 1991. He then headed finance and business development at Tularik Inc., a company started by fellow Genentech Inc. alum David Goeddel, now a managing partner with venture firm The Column Group. At Tularik, Kaneko oversaw several big pharma partnerships and took the biotech public in 1999, five years before it would be acquired by Amgen Inc. He left Tularik to join Skyline Ventures, an active health care investment group. According to Skyline’s website, Kaneko “committed to golf several years ago after an unfortunate heading incident at a team reunion for his junior All-Star soccer team.”

- 18. BioWorld® 20thAnniversaryEdition|16 Nancy Olson THEN: A former general partner at venture firm Sequoia Capital who was independently backing young biotechs. NOW: In 1993, Olson was recruited to run health care investments for St. Paul Venture Capital. She backed companies like Biopsys Medical Inc. (bought by Johnson and Johnson), Santarus Inc. (now public) and Pro- metheus Laboratories Inc. (profitable and soon to be public). When St. Paul launched its health care-focused Fog City Fund in 2000, Olson was appoint- ed as the fund’s sole managing partner and continued to provide seed funding for firms like BioLucent Inc. (acquired by Hologic Inc.) and Somaxon Pharma- ceuticals Inc. (now public). She consid- ers herself extremely fortunate to have been investing on behalf of a single limited partner for 17 years, and as Fog City Fund winds down, she has taken an active role in nonprofits including the University of California, Berkeley, the Girl Scouts of the San Francisco Bay Area and the San Francisco Opera. Joe Lacob THEN: Partner at venture firm Kleiner, Perkins, Caufield & Byers. NOW: Lacob is one of the few on this list who, 20 years later, is still with the same company. But don’t let that fool you into thinking he’s been complacent. Lacob has managed investments in more than 50 life science companies, not to mention several internet companies and green-tech/alternative energy companies. He serves on the boards of several biotech and medical device firms as well as nonprofits, and is known within the industry as a prominent venture capitalist. THEN: As managing director at investment banking firm PaineWebber, Papadopoulos was known for taking risks to finance young biotechs. NOW: As he rose through the PaineWebber ranks, eventually becoming chairman of the bank’s biotech-focusedsubsidiary,Papadopoulosbecame known as the industry’s consummate deal maker and financier. He managed complex acquisitions like Warner-Lambert Co.’s $2.1 billion buyout of Agouron Pharmaceuticals Inc., and he developed innovative mechanisms to help fund research. Among the funding models he popularized were Special Purpose Accelerated Research Corporations, or SPARCs, which were similar to R&D limited partnerships but involved spinning off a product to be funded as a separate publicly traded company rather than a private investment opportunity. He also conceived the tracking stock concept, which helped Genzyme Corp. reorganize its business units. One of Papadopoulos’ most innovative inventions was the use of Regulation D filing exemptions to allow sophisticated private investors to invest in biotech start-ups. The approach, used for both ICOS Corp. and Athena Neurosciences Inc., “brought venture capital to the masses,” Papadopoulos said. Few of Papado- poulos’ creative financ- ing mechanisms have survived to the pres- ent day. Symphony Capital’s funding model contains echoes of the old R&D limited partnerships, but for the most part, as tax benefit loopholes were closed, simpler financing approaches like registered direct offerings and PIPEs took precedence. Still, many say the industry couldn’t have matured without Papadopoulos’ help. AfterPaineWebber,Papadopoulosservedasvicechairmanofinvestment bank Cowen & Co. until his retirement in 2006. But his influence extended beyond banking. He doubled as a venture capitalist, pouring his own money into biotechs like Anadys Pharmaceuticals Inc., Cellzome Inc., and Exelixis Inc., which he co-founded and still oversees as chairman. He remains an active investor and board member of several other biotechs, including BG Medicine, Regulus Therapeutics Inc., Joule Biotechnologies Inc. and Biogen Idec Inc. Papadopoulos also gets credit for raising the bar on biotech conferenc- es: The banking conferences he sponsored during the industry’s early years were known for bringing together the top minds in the business and chang- ing the intellectual level at which business was discussed. He still hosts an exclusive biotech conference each year in Greece, which serves as the main funding source for a nonprofit he co-founded with Harvard Medical School’s Spyros Artavanis to provide support and guidance to Greek scientists. Stelios Papadopoulos “[Regulation D filing exemptions] brought venture capital to the masses.”

- 19. 17|BioWorld® 20thAnniversaryEdition Larry Bock THEN: General partner with Avalon Ventures, a then-young life science and high-tech investment firm that is still active in biotech company formation. NOW: Bock had biotech in his blood: his father, Richard Bock, was one of the original biotech brokers. With that kind of pedigree, it was no surprise when Larry Bock ditched a job at Genentech Inc. to return to business school and try his hand at venture capital. In the 1980s, Bock was trying to recruit Harvard neurologist Dennis Selkoe to start a biotech company. Kevin Kinsella, founder of Avalon Ventures, was pursuing Selkoe as well. The two “decided to collaborate rather than compete,” Bock said, and the result was Athena Neurosciences Inc., which would later be bought by Elan Corp. plc. Bock and Kinsella worked so well together that they collaborated again on Vertex Pharmaceuticals Inc. and Genpharm International Inc. (now part of Bristol-Myers Squibb Co.) – and then Bock finally joined Avalon full-time. Over the years, Avalon sowed the seeds that would grow into much of the biotech industry as we know it today. It founded Sequana Therapeutics Inc. (now part of Celera Corp.), Pharming Group NV, Neurocrine Biosciences Inc., Ariad Pharmaceuticals Inc., Pharmacopeia Inc. (bought by Ligand Pharmaceuticals Inc.), Onyx Pharmaceuticals Inc., Caliper Life Sciences Inc., Idun Pharmaceuticals Inc. (acquired by Pfizer Inc.), Aurora Biosciences Corp. (acquired by Vertex), Conforma Therapeutics Corp. (bought by Biogen Idec Inc.) and many others. Yet some have noted that Kinsella’s investment in the hugely successful Broadway musical “Jersey Boys” made him more money than his biotech ventures. Around 2003, Bock felt the biotech venture capital business was starting to get crowded, so he moved to the still nascent nanotech field. He joined CW Group, where he founded Illumina Inc., and later moved to Lux Capital Management, where he founded Nanosys Inc. and Genocea Biosciences Inc. But while building nanotech start-ups, Bock noted that it was difficult to recruit American scientists because the next generation was placing its bets on other career paths. Inspired by the science festivals he saw on a family trip to Europe, he started a nonprofit “to get people excited about science again.” His San Diego Science Festival attracted about 250,000 attendees last year and is now gearing up to go nationwide. Bock and his wife also founded Community Cousins, a nonprofit aimed at matching families of different ethnicities to create friendships and destroy racism. [Bock started a nonprofit] “to get people excited about science again” Chris Gabrieli THEN: Launched the healthcare practice at Bessemer Venture Partners. NOW: Gabrieli led Bessemer’s investments in bio- techs like Affymax Inc., Isis Pharmaceuticals Inc., Sirtris Pharmaceuticals Inc. (now part of GlaxoS- mithKline plc) and others. He shifted his focus to politics and education about a decade ago, running for various offices in Massachusetts and found- ing Massachusetts 2020, an initiative focused on expanding public school hours. He also serves as chairman of the National Center on Time & Learn- ing, and he co-authored a book called Time to Learn: How a New School Schedule is Making Smarter Kids, Happier Parents, and Safer Neighborhoods. Ken Kelley THEN: Partner with Institutional Venture Partners. NOW: Kelley oversaw the funding of 20 biotech and medical device firms during his tenure at IVP. In the mid-1990s he founded IntraBiotics Pharmaceuticals Inc. (now Ardea Biosciences Inc.), taking the company public in 2000. He went on to fund more start-ups as general partner at Latterell Ventures, and he later formed his own consulting firm, K2 Bioventures. Kelley now serves on several boards and holds the CEO spot at PaxVax Inc., a biotech he founded in early 2007.

- 20. BioWorld® 20thAnniversaryEdition|18 Rep. Robert Kastenmeier, D-Wis. THEN: As chairman of the House Sub- committee on Courts, Intellectual Prop- erty and the Administration of Justice, Kastenmeier was pegged to “make or break” the Boucher bill, an initiative de- signed to protect biotech process pat- ents against foreign competitors. NOW: The Boucher bill, formally known asthe“BiotechnologyPatentProtection Act,” made the rounds in Congress for several years before passing as a set of amendments to the patent law. It addressed the fact that while host cells used to produce genetically engineered proteins were patentable, the process of producing the protein within the cell was not. The Boucher bill influenced later legislation such as the 1995 “Biotechnology Patent Process Protection Act.” Back in 1990, the Boucher bill was a controversial topic within the industry, with the Association of Biotechnology Companies speaking out against it while the Industrial Biotechnology Association supported it. The situation was just one of many in which the two industry trade groups found themselves at loggerheads, making it difficult for biotech interests to gain any political traction. That changed in 1993, when the two merged to form the Biotechnology Industry Organization (BIO), which has served as biotech’s political voice ever since. Kastenmeier, meanwhile, lost his 1990 re-election bid to Republican Scott Klug. Margaret Mellon THEN: Director of the National Wildlife Federation’s biotechnology policy center. NOW: As a scientist, Mellon had more credibility than the average gadfly, and her push to get politics out of science at federal agencies was aligned with the biotech industry. But she was no fan of agricultural biotech, having co-authored books like Ecological Risks of Engineered Crops and Hogging It!: Estimates of Antimicrobial Abuse in Livestock. She drew attention to the potential risks of releasing untested genetically modified organisms, and her reasoned voice of opposition was critical in positioning agricultural and environmental biotechnology as real issues that deserved real legislative consideration. Mellon left the NWF to serve as senior scientist and director of the food & environment program at the Union of Concerned Scientists, a science-based nonprofit. She also serves on the U.S. Department of Agriculture's Advisory Committee on Biotechnology and 21st Century Agriculture. Jeremy Rifkin THEN: President of the Foundation on Economic Trends and a biotech naysayer who fought access to genetic information, argued about side effects associated with Genentech Inc.’s growth hormone and sued the FDA over quality issues. NOW: When you see protestors dressed like tomatoes outside of BIO’s annual conference, you have Rifkin to thank for it. He was one of the first anti-biotech activists, making frequent television appearances in which he condemned agricultural biotechnology and genetic engineering. One of his 17 books, The Biotech Century: Harnessing the Gene and Remaking the World, poses such questions as “Will artificial creation…mean the end of nature?” and “What will it mean to live in a world where babies are genetically engineered and customized in the womb?” When it became clear that the U.S. was going to embrace agricultural biotechnology, Rifkin shifted his focus on that front to Europe, and he has had an impact in shaping the anti-biotech sentiment overseas. He still runs the Foundation on Economic Trends, but he’s become somewhat more mainstream over the years, turning his attention to topics like green energy, sustainable development and employment in an automated world. REGULATORY

- 21. 19|BioWorld® 20thAnniversaryEdition Insoluble Drug? We Have a Solution for You! A DREAM TEAM comprising some of the leading specialists worldwide in the field. All our scientists have a track record of success in enhancing the solubility of challenging drugs. A STRONG FOCUS on our core competency of enhancing the solubility of drugs to form liquid formulations for parenteral, oral and ophthalmic administration. THE MOST ADVANCED TECHNOLOGIES: • Nanocrystals • Microemulsions • Co-solvents • Cyclodextrin complexation • Polymeric micelles A SHORT TIME-TO-MARKET: by using off-patent technologies and GRAS (Generally recognised As Safe) ingredients, we ensure your development pathway is fast and easy, facilitating quick access to the market. A FLEXIBLE PACKAGE tailored to your needs and adapted to the unique characteristics of your molecule. Visit us at www.solvatek.com SOLVATEKSOLVATEK

- 22. BioWorld® 20thAnniversaryEdition|20 Greg Simon THEN: As staff director of the investigations and oversight subcommittee of the House Committee on Science, Space and Technology, Simon was trying to strike a compromise between biotech and environmental groups regarding field tests of GMOs. NOW: Simon was open-minded, listening to the arguments of the agricultural biotech industry and its opponents, such as Jeremy Rifkin and Margaret Mellon. He made sure that key Democrats remained open-minded as well instead of yielding to environmental extremists, and his push for conservative, regulated progress propelled the U.S. to become one of the only countries that supported ag-bio. Simon served as Vice President Al Gore’s chief domestic policy advisor on economic, science and technology issues from 1991 to 1997, overseeing the NIH and the FDA. He and a group of other biotech regulatory experts, known as the “Clone Heads,” influenced the development of the regulatory framework for biotechnology products. He also played a significant role in the creation of the international space station and revamping the telecommunications industry. Simon made a quick sojourn into the private sector, starting his own consulting firm, before teaming up with Michael Milken in 2003 to fund a nonprofit called FasterCures. The group works to boost funding for disease research organizations; increase patient participation in research; build networks between nonprofits, philanthropists and the industry; and otherwise speed new drugs to market. Simon also served as part of the Obama administration's transition team reviewing the Department of Health and Human Services. Last year, he left FasterCures to serve as senior vice president of public policy for Pfizer Inc. David Beier THEN: Vice president of government affairs at Genentech Inc. NOW: Beier was one of the first lobbyists to work Capitol Hill for the biotech in- dustry, and as such he was instrumental in shaping early legislation, including successfully lobbying to keep orphan drug exclusivity provisions in the Or- phan Drug Act. In 1998, he became Vice President Al Gore’s chief domes- tic policy advisor. He then served as a partner with the Washington law firm of Hogan and Hartson until 2003, when he accepted the role of senior vice presi- dent, global government affairs for Am- gen Inc. He continues in that role today, serving as a member of Amgen’s CEO staff and overseeing health care policy, corporate affairs, domestic and inter- national government relations, health economics initiatives, pricing, payor planning, philanthropy and corporate communications. He also serves on the board at Aryx Therapeutics Inc. Lisa Raines THEN: Director of government relations for the Industrial Biotechnology Association. NOW: Like David Beier, Raines (left) was oneofthefirstbiotechlobbyistsandwas instrumental in keeping orphan drug exclusivity provisions in the Orphan Drug Act. She joined Genzyme Corp. as senior vice president for government relations in 1993 and had a hand in just about every piece of biotech legislation to emerge during the 1990s, including the Prescription Drug User Fee Act of 1992, the Biotechnology Patent Protection Act of 1995, the FDA Export Reform and Enhancement Act of 1996 and the FDA Modernization Act of 1997. Raines developed a reputation as an intelligent, hard-working, passionate and loyal figure on Capitol Hill. She alwaysspokehermindandwasn’tafraid to go head-to-head against big pharma’s deep-pocketed trade associations when necessary. She also took on the biotech industry, convincing cash-strapped CEOs that FDA user fees were the only way to help an underfunded agency keep up with its workload. On Sept. 11, 2001, Raines was aboard American Airlines flight 77 from Washington D.C. to Los Angeles, on her way to a Genzyme sales meeting in Palm Springs, Calif. All 64 people on board the plane – including Raines, then 42 years old – were killed when terrorists hijacked the aircraft and crashed it into the Pentagon, killing another 125 people on the ground.

- 23. 21|BioWorld® 20thAnniversaryEdition Alfred Gilman THEN: Professor of pharmacology at the University of Texas Southwestern Medical Center and discoverer of G proteins. NOW: Gilman (right) and other researchers defined the G protein-coupled receptor pathway, one of the most common mechanisms for getting information from the outside of a cell to the inside to regulate the cell’s function. It is estimated that between one-third and one-half of all drugs work in this pathway. Gilman’s discovery earned him the nickname “G- Man” and a Lasker Award in 1989. A few years later he was awarded the Nobel Prize in Physiology or Medicine, which he shared with fellow G-Man Martin Rodbell, now deceased. Gilman was elected as dean of UTSW Medical School in 2005. But for the last few years, he’s left the research world to serve as chief scientific officer of the Cancer Prevention Research Institute of Texas (CPRIT). Modeled on the California Institute for Regenerative Medicine, CPRIT is a state agency empowered to spend $3 billion over 10 years on cancer research in Texas. Gilman also serves on the boards of Regeneron Pharmaceuticals Inc. and Eli Lilly and Co. SCIENTISTS Philip Leder THEN: Founding chairman of Harvard Medical School’s department of genet- ics and one of the first researchers to use transgenic mice to study cancer. NOW: Leder, like many of the scientists on this list, remains at his post 20 years later. Perhaps this reflects that while investors and entrepreneurs expect rapid returns, scientists understand that making important discoveries and proving them out takes a lifetime. Leder’s genetically engineered “oncomouse”wentontobroadlyimpact the study of cancer, and the concept of mimicking human diseases in mice has become a standard in biotech research. His work was recognized with a Lasker Award and the National Medal of Science. Earlier in his career, he also contributed to the deciphering of the genetic code, figuring out which letters corresponded to which amino acids. He is now the John Emory Andrus Professor of Genetics at Harvard. Robert Langer THEN: Professor of chemical and biochemical engineering at the Massachusetts Institute of Technology and a pioneer of controlled-release drugs and biodegradable polymers. NOW: Langer’s discoveries sin- gle-handedly shaped the drug delivery industry. Over the years his combination of science and business acumen has helped found about two dozen com- panies, including Enzytech Inc. (now part of Alkermes Inc.), Momenta Pharmaceuticals Inc., Pervasis Therapeutics Inc., Bind Bioscienes Inc. and Selecta Bio- sciences Inc. His work has been recognized with the National Medal of Science, the Millennium Technology Prize and numerous other awards. Langer is known for his creativity and his solutions-based approach to melding material science and pharmaceuticals. In addition to drug delivery, he contributed to early work in angiogenesis and tissue engineering. He now serves in the top post of “Institute Professor” at MIT, where he runs the world’s largest biomedical engineering lab. His research focuses on polymers for the delivery of genetically engineered proteins and nucleic acids, including siRNA, and nanotechnology.

- 24. BioWorld® 20thAnniversaryEdition|22 Catherine Mackey THEN: Director of plant genetics at DeKalb Genetics Corp. and the first scientist to report solid data on genetically engineered corn. NOW: Originally a Pfizer Inc. scientist, Mackey moved to DeKalb as part of Pfizer’s divestiture of its genetically modified seed business. After advancing through the DeKalb ranks and launching three products, she played a role in the firm’s $2.5 billion sale to Monsanto Co. Mackey then came full circle by returning to Pfizer to lead its genomics and proteomics programs. By 2001, Mackey had risen to the position of senior vice president of global research and development at Pfizer. She now runs Pfizer’s oncology- focused facility in La Jolla, Calif., and manages the big pharma’s external research networks in the Western U.S. She also serves on the boards of several San Diego nonprofits. R. Michael Blaese THEN: Chief of the cellular immunol- ogy section of the NIH’s National Cancer Institute. NOW: Another gene therapy pioneer, Blaese worked with W. French Anderson on early clinical trials for ADA-SCID. He went on to serve as president and chief scientific officer of the Molecular Pharmaceuticals Division of Kimeragen Inc., a genetic surgery company that merged with ValiGene SA. Blaese has dedicated his life to studying and treating children with rare genetic disorders, and he is currently chief of the Clinical Gene Therapy Branch at the National Human Genome Research Institute. He also is working on gene therapies for cancer and HIV. Scott Putney THEN: Vice president of molecular biology and AIDS vaccine specialist at Repligen Corp. NOW: The development of an AIDS vac- cine has proven more difficult than anyone could have imagined. Encour- aging data emerged from the recent combination of Sanofi-Aventis Group SA's ALVAC HIV vaccine with the AIDS- Vax product from VaxGen Inc., Genen- tech Inc./Roche AG and Global Solu- tions for Infectious Diseases, but much work remains to be done. Repligen eventually dropped its AIDS vaccine program, and Putney went on to run protein and molecular biology for Al- kermes Inc. He led efforts to develop an inhaled human growth hormone, then went to work for Alkermes’ part- ner on the product, Eli Lilly and Co. W. French Anderson THEN: Chief of the molecular hema- tology branch at the NIH’s National Heart, Lung and Blood Institute and a pioneer of gene therapy. NOW: After conducting the first safety test of a gene therapy in humans, An- derson used the approach to replace a defective gene in a young girl with ad- enosine deaminase deficiency-related severe combined immunodeficiency (ADA-SCID), an immune deficiency disorder also known as “bubble boy disease.” ADA-SCID has become one of the more successful endeavors within the troubled gene therapy field. He joined the University of Southern California faculty and later served as director of the Keck School of Medicine’s gene therapy labs. In 2007 he was convicted of sexual abuse of a minor and is currently serving a 14-year sentence. He main- tains his innocence. Steven Rosenberg THEN: Chief of surgery at the NIH’s National Cancer Institute. NOW: He is chief of surgery at the NIH’s National Cancer Institute, and a professor at the Uniformed Services UniversityofHealthSciencesandatthe George Washington University School of Medicine and Health Sciences. Rosenbergisknownforadvancingboth immunotherapies and gene therapies forcancer.Hepioneeredtheearlywork on interleukin-2 as a cancer therapy, providing data that were instrumental to Cetus Corp.’s and Chiron Corp.’s development and eventual approval of Proleukin. He was also the first to conduct gene therapy trials in cancer, the indication which has subsequently become among the most advanced and generated the most industry interest in the gene therapy field. He currently is working on a melanoma vaccine. Special thanks for helping us locate and profile these leaders goes to: Jill Anderson, Brian Atwood, Gil Bashe, David Beier, Art Benvenuto, Jeff Bird, Larry Bock, Lou Bock, Ray Briscuso, Carl Feldbaum, Stephanie Fischer, Alfred Gilman, Robert Langer, Robert More, Nancy Olson, Stelios Papadopoulos, Richard Pops, Hollings Renton, Michael Riordan, Cynthia Robbins-Roth, Greg Simon, Alan Timms, Troy Wilson

- 26. BioWorld® 20thAnniversaryEdition|24 Trying to guess who will emerge as the movers and shakers of the biotech industry over the next 20 years is akin to trying to find a needle in a giant stack of … needles. The sector has grown and expanded since its early days thanks to the tireless and inspiring work of so many. And even more executives, investors and scientists are stepping up every day, leaving the BioWorld staff with the unenviable task of narrowing down to a handful the people we think will influence biotech over the next 20 years. We considered the current trends in deal-making, the changing financing models and the latest scientific breakthroughs, and we sought some outside nominations to help us get a sense of the big players in biotech today whose influences could easily stretch across the next two decades and beyond. Some on this list will seem no-brainers. Others will raise some eyebrows. Regardless, this opinionated list is a personal one to BioWorld and is certainly not intended to be all-inclusive. If you think we’ve left out someone, let us know. In the meantime, here are, in no particular order, our predictions for the future. Join us in 2030, and we can see how well we’ve done. Who Will Shape Biotech Over the Next 20 Years? BioWorld Says… Severin Schwan He’s among a new genera- tion of young big pharma CEOs, having risen rapidly through the ranks to take the helm at Roche AG in 2008, just in time to lead the charge on the largest- ever biotech acquisition with the $46 billion buyout of Genentech Inc. Since taking over, Schwan has garnered a reputation for rattling some of the staid big pharma traditions – even going so far as to cast his lot with BIO instead of the pharma lobbying group – and has demanded continuing innovation even as other pharmas move into the less risky generic space. He’s also known for his collegiate-style management, a sign that he could make good on his pledge to preserve Genentech’s culture of innovation, which bodes well for the industry overall. John Maraganore The CEO of pioneering RNAi firm Alnylam Phar- maceuticals Inc., Mara- ganore is well known for his science-driven management approach, and he’s been a strong proponent of innovation over repur- posing or generic drug development. Under his leadership, Alnylam has become a go-to firm for RNAi-based intellectual property and has devel- oped ALN-RSV01, the first RNAi drug to hit clinical proof of concept. And, in an industry currently facing some tough decisions as the R&D failure rate increases, with more money spent and less to show for it, Mara- ganore has been particularly forceful in his belief that solid science must trump marketing-based decisions and such nebulous calculations as net present value. Peter Hecht Hecht has been CEO of Ironwood Phar- maceuticals Inc. since its founding in 1998. He gets credit for recognizing the potential of bowel drug linaclotide early on and prioritizing it ahead of more advanced programs – similar to how Amgen Inc. peered through a haze of competing products and saw the early potential in Epogen (epoetin alfa). Linaclotide went on to generate good Phase III data, attract a trio of lucrative partnerships and pave the way for Ironwood’s $216 million IPO – which some would say opened the cur- rent IPO window. Public investors are learning to love Hecht for his focus on long-term value and his often uncon- ventional, Warren Buffett-esque tech- niques, such as investing his own mon- ey into every financing, incentivizing his board with stock, and hand-picking his IPO investors. Whether Ironwood becomes the next Amgen or Hecht goes on to something else, there’s little doubt he’ll have an impact. Sol J. Barer The chairman and CEO of Celgene Corp., Barer has been a driving force behind the firm, which has become one of the top biotech market caps since it merged with partner Pharmion Corp., in a $2.9 billion deal disclosed in late 2007. Bearded, scholarly Barer, with multiple degrees from Rutgers University, continues to lead Celgene to strong earnings, thanks to sales of such products as Revlimid (lenalidomide), Vidaza (azacitidine) and Thalomid (thalidomide), while pushing ever-forward with new programs in inflammation and solid EXECUTIVES

- 27. 25|BioWorld® 20thAnniversaryEdition tumors. And, throughout Celgene’s considerable growth, he’s been known for maintaining the same culture of entrepreneurship that the company boasted 20 years ago. David Goeddel He’s the self-effacing scientist who was among those powering Genen- tech Inc. in its first years. Now he’s a managing partner with The Column Group, a venture capital firm focused on investing in the neglected area of early stage drug development. Known for gene cloning expertise, Goeddel laid the groundwork for a handful of strong-selling Genentech products. He co-founded Tularik and was president and CEO until Amgen Inc. bought the firm in 2004 for $1.3 billion. Now he’s heading up NGM, a start-up focusing on diabetes and skeletal muscle health. Richard Pops He’s the high-profile CEO of Alkermes Inc., who retook that position in late 2009, more than two years after he departed. Back in the saddle, his first move was to launch a strong push for growth and innovation in the face of economic hard times, when others were hunkering down. Congenial and widely respected, Pops serves on several biotech boards as well as the Biotechnology Industry Organization and the Pharmaceutical Research and Manufacturers of America. He’s not just a thinker; he’s a doer. And we can’t wait to see what he does next. Carol Gallagher Hired as CEO of privately held Calistoga Pharmaceuticals Inc., Gallagher is charged with building a business development strategy for the small Seattle-based firm working on isoform-selective PI3 kinase inhibitors. After serving in key roles in a handful of big pharma and biotech companies, she perhaps is best known for leading the Rituxan (rituximab) commercialization team at Biogen Idec Inc., getting that product to the $1 billion mark. As biotech moves away from one-pill-fits-all to a more personalized medicine approach, executives like Gallagher, who have a knack for finding the right patient populations, talking to the right doctors and bringing on board the right partners will be even more crucial to success. Edwin Moses Moses heads up Ablynx NV, a firm that develops domain antibody-derived therapeutics and has managed to buck the tough financing trends in Europe. He took over as CEO in 2004, got the firm through an IPO in 2007 and, at the start of 2010, the Ghent, Belgium-based firm had more than two years of cash in its coffers. And his business savvy likely will con- tinue giving a boost to the European biotech industry. To date, Moses has been involved in financing rounds totaling more than €300 million and has led a number of deals, including the £316 million cross-border merger between UK-based Oxford Asymmetry International and Evotec Biosystems, of Germany. Ron Cohen When BioWorld’s first biotech all-stars list came out in 1990, it included Art Benvenuto, then Co- hen’s boss at Advanced Tissue Sci- ences Inc. But Cohen wasn’t destined play second fiddle for long: In 1995, he founded Acorda Therapeutics Inc. His physician’s background gave him the patient-focused outlook he used to tap into advocacy group networks, raise venture money, advance his lead product into Phase III trials for spinal cord injury and multiple sclerosis, take Acorda public, build a niche sales force, bag an ex-U.S. partnership and gain FDA approval of Ampyra (dal- fampridine) for the improvement of walking ability in multiple sclerosis patients. Moving forward, Cohen’s job will be to silence the skeptics and prove Ampyra’s commercial viability, all while advancing Acorda’s next gen- eration of neuroregenerators. Chris LeMasters He’s a company builder who hails from the business development rather than the finance side. He spent six years with Eli Lilly and Co. before jumping to the biotech world to run business de- velopment at Conforma Therapeutics Corp. He oversaw Conforma’s eventual acquisition by Biogen Idec Inc., then co- founded spinout Cabrellis Pharmaceu- ticals Corp. and oversaw its takeover by Pharmion Corp. He and the former Cabrellis team then started Tragara Pharmaceuticals Inc. and in-licensed a cancer and inflammation drug, and LeMasters simultaneously started up Aarden Pharmaceuticals Inc. to de- velop drugs targeting protein tyrosine phosphatases. We have no doubt that this is just the tip of LeMasters’ compa- ny-founding iceberg. Personalized Medicine Many insiders agree the personalized treatment approach will be the wave of the future. As executive director of the Personalized Medicine Coalition, Edward Abrahams is poised to play a key role. The coalition already has grown from its original 18 founding members in 2004 to more than 160 today. Abrahams previously served as executive director of the Pennsylvania Biotechnology Association, where he spearheaded the successful effort that led to the Commonwealth of Pennsylvania’s investment of $200 million in the state’s biotech industry. Then there’s Mara Aspinall, former president of Genzyme Genetics, who’s hailed as being at the forefront of personalized medicine, and serves on the board of the Personalized Medicine Coalition. She’s now

- 28. BioWorld® 20thAnniversaryEdition|26 president and CEO of diagnostics firm On-Q-ity Inc., which is working on DNA repair biomarkers for predicting treatment response and microfluidic chip technology for monitoring circulating tumor cells, and is an active member of the federal Secretary of Health and Human Services’ Advisory Commission on Genetics. And Randy Scott, executive chairman of Genomic Health, and Kim Popovits, president and CEO of Genomic Health, are working to improve the quality of cancer treatments through genomic-based treatment decisions. Scott founded Genomic Health after watching a close friend struggle with cancer and wondering why the molecular make-up of specific tumors had not become the basis for cancer care. The personalized approach could set a new standard for health care if these and other supporters have their way. Daphne Zohar Her name is synonymous with innovation. Her venture firm, Puretech, bridges the so-called “valley of death,” meeting with aca- demics to identify promising early stage technologies and funding them to the point of licensing or company creation. She started Solace Pharma- ceuticals Inc., Follica Inc., Satori Phar- maceuticals Inc. and many others, but one of her most ambitious and creative projects to date is Enlight Biosciences LLC. Enlight arose from Puretech’s realization that big phar- ma was intensely interested in new academic technologies that could aid drug discovery, even if venture inves- tors had little appetite for funding such endeavors. Zohar brought to- gether Pfizer Inc., Merck & Co. Inc., Eli Lilly and Co., Johnson and Johnson, Abbott and Novartis AG in a precom- petitive partnership that funds those technologies. Such precompetitive deals are said to be the wave of the future, and Zohar is riding the crest of that wave. Clarke Futch He’s the co-founder and managing director at Cowen Healthcare Royalty Partners. He previously served as a partner at Paul Capital Partners, where he led royalty-related investments for the Paul Royalty Funds. He helped pioneer the use of securitization with pharmaceutical royalties as a means of alternative — and flexible — biotech financing and, over the past two years, has helped raise nearly $2 billion dedicated to the royalty finance market. He joined CHRP along with co-founder Todd Davis and Gregory Brown, all of whom were lured to Cowen from Paul Capital and had worked as a team on royalty- based investments. Francesco De Rubertis He’s a partner at Index Ventures, a UK- and European-based VC firm that has been breaking the mold for biotech investing and dealmaking for the past several years. De Rubertis helped secure the impressive $190 million Phase I-stage deal between private Dutch biotech PanGenetics BV and Abbott, and is a fan of asset- centric investment models, which are designed to get new compounds into the industry without having to fund whole companies. He’s also focused on funding much-needed early stage investments and public equities, and his name is sure to be a staple in the European venture community for years to come. Robert (Bob) More Though you’d never know it from his humble persona, More is one of the venture guys every biotech wants to have on its board. Prior to joining Frazier Healthcare Ventures two years ago, More spent 12 years with Domain Associates. He was involved with investments in ESP Pharma Inc. (acquired by PDL BioPharma Inc.), Esprit Pharma Inc. (acquired by Allergan Inc.), Novalar Pharmaceuticals Inc. (gained FDA approval) and many others. But plenty of VCs offer experience — what More adds is an uncommon dose of common sense. Biotechs report that he’s one of the few investors who starts a company by asking why it deserves to exist rather than just whether or not he can make money off of it. And while More doesn’t shy away from giving portfolio companies a reality check, he’s a true believer in biotech’s potential. We can’t wait to see what he funds next. Activist Shareholders They are already leaving an imprint on biotech. Billionaire investor Carl Icahn has pushed through some of the biggest acquisition deals of the past few years, such as ImClone Systems Inc.’s $6.5 billion buyout by Eli Lilly and Co. and MedImmune Inc.’s $15.2 billion takeout by AstraZeneca plc, and he continues to push companies via not- so-subtle approaches (i.e., proxy fights and aggressive grabs for board seats) to do what’s best for shareholders. Whether that pushing is good or bad for the industry is debatable; but, if there’s money to be made in biotech, Icahn’s not going away any time soon. Also raising the profile of activist investors is Biotechnology Value Fund. Partners Mark Lampert, Oleg Nodelman and Matthew Perry have been putting the pressure on portfolio firms that fail to act quickly after clinical failures and waste cash reserves rather than returning money FINANCIERS