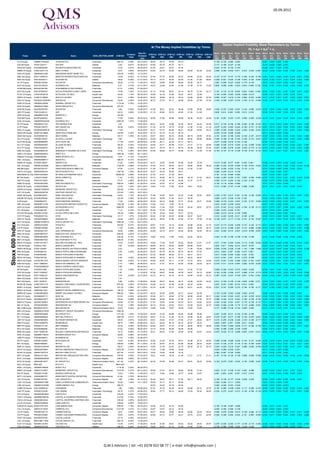

Stoxx 600 Index - Dividends and Implied Volatility Surfaces Parameters

- 1. 16.10.2012 Option Implied Volatility Skew Parameters by Terms: At The Money Implied Volatilities by Terms 2 IVt = atx + btx + ct Next Ex- Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Dividend ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - Ticker Name GICS_SECTOR_NAME ATM Ref Dividend (a) - (a) - (a) - (a) - (a) - (a) - (a) - (b) - (b) - (b) - (b) - (b) - (b) - (b) - Yield 30D 60D 90D 6M 12M 18M 24M Date 30D 60D 90D 6M 12M 18M 24M 30D 60D 90D 6M 12M 18M 24M NESN VX Equity NESTLE SA-REG Consumer Staples 62.00 3.39% 24.04.2013 12.09 11.44 11.60 12.41 14.70 14.31 14.55 -0.153 -0.198 -0.203 -0.168 -0.125 -0.090 -0.077 0.035 0.021 0.016 0.008 0.003 0.002 0.002 HSBA LN Equity HSBC HOLDINGS PLC Financials 610.00 4.58% 20.03.2013 17.99 18.35 18.92 20.48 21.56 23.26 23.64 -0.229 -0.304 -0.302 -0.241 -0.131 -0.111 -0.101 0.019 0.013 0.009 0.005 0.004 0.001 0.000 NOVN VX Equity NOVARTIS AG-REG Health Care 58.65 4.26% 26.02.2013 12.05 11.79 11.06 10.17 13.14 12.92 12.43 -0.289 -0.214 -0.163 -0.085 -0.078 -0.037 0.001 0.042 0.022 0.016 0.008 0.003 0.002 0.001 ROG VX Equity ROCHE HOLDING AG-GENUSSCHEIN Health Care 184.50 4.07% 07.03.2013 14.17 13.61 13.54 14.39 16.77 17.44 17.25 -0.244 -0.233 -0.197 -0.096 -0.066 -0.018 0.006 0.029 0.016 0.012 0.006 0.003 0.003 0.004 VOD LN Equity VODAFONE GROUP PLC Telecommunication Services 173.05 5.89% 21.11.2012 16.20 17.06 17.33 17.67 18.67 19.27 18.88 -0.146 -0.276 -0.281 -0.204 -0.077 -0.086 -0.090 0.006 0.008 0.007 0.004 0.000 0.000 0.002 BP/ LN Equity BP PLC Energy 433.95 5.00% 07.11.2012 21.24 22.08 22.34 22.96 24.11 25.25 24.79 -0.199 -0.217 -0.205 -0.154 -0.074 -0.109 -0.110 0.005 0.005 0.005 0.002 0.000 0.001 0.001 RDSA NA Equity ROYAL DUTCH SHELL PLC-A SHS Energy 26.72 5.05% 14.11.2012 13.27 14.11 14.57 15.33 16.18 17.12 17.16 0.074 -0.139 -0.172 -0.129 -0.112 -0.104 -0.077 0.030 0.020 0.016 0.006 0.003 0.002 0.002 GSK LN Equity GLAXOSMITHKLINE PLC Health Care 1439.00 5.35% 14.11.2012 13.93 14.55 14.87 15.78 17.12 17.59 17.25 -0.210 -0.265 -0.242 -0.154 -0.125 -0.124 -0.117 0.004 0.009 0.009 0.005 0.002 0.002 0.001 FP FP Equity TOTAL SA Energy 39.07 6.07% 18.03.2013 19.80 19.24 19.67 20.52 20.96 19.39 18.83 -0.124 -0.212 -0.239 -0.219 -0.142 -0.038 -0.119 0.021 0.013 0.011 0.004 0.003 0.000 0.002 SAN FP Equity SANOFI Health Care 68.83 4.04% 10.05.2013 21.38 20.90 20.77 20.48 21.57 19.65 19.62 -0.185 -0.263 -0.267 -0.201 -0.140 -0.118 -0.108 0.022 0.009 0.007 0.004 0.002 0.002 0.002 BATS LN Equity BRITISH AMERICAN TOBACCO PLC Consumer Staples 3233.00 4.32% 06.03.2013 16.59 16.71 16.68 17.56 -0.179 -0.206 -0.190 -0.132 0.004 0.005 0.004 0.001 SIE GY Equity SIEMENS AG-REG Industrials 77.30 3.95% 24.01.2013 20.62 20.08 19.57 19.57 20.54 21.02 20.78 -0.251 -0.249 -0.228 -0.171 -0.158 -0.123 -0.085 0.024 0.012 0.009 0.005 0.002 0.002 0.002 BAS GY Equity BASF SE Materials 65.72 3.96% 29.04.2013 23.81 23.20 23.39 23.80 24.39 24.34 25.22 -0.400 -0.338 -0.301 -0.216 -0.130 -0.071 -0.059 0.022 0.010 0.007 0.003 0.001 0.000 0.000 SAN SQ Equity BANCO SANTANDER SA Financials 6.04 12.39% 17.10.2012 38.86 38.94 38.02 36.90 33.37 31.65 27.22 -0.335 -0.328 -0.296 -0.209 -0.062 0.160 0.353 0.002 -0.001 -0.001 0.001 0.001 -0.001 -0.002 BAYN GY Equity BAYER AG-REG Health Care 70.00 2.57% 29.04.2013 25.06 24.26 24.21 24.41 25.19 24.70 24.72 -0.365 -0.328 -0.301 -0.225 -0.164 -0.140 -0.115 0.024 0.011 0.008 0.003 0.002 0.002 0.002 DGE LN Equity DIAGEO PLC Consumer Staples 1792.00 2.68% 27.02.2013 16.40 16.33 16.65 17.99 19.27 20.07 19.97 -0.353 -0.343 -0.312 -0.227 -0.154 -0.121 -0.115 0.012 0.011 0.009 0.005 0.003 0.003 0.003 BG/ LN Equity BG GROUP PLC Energy 1326.00 1.28% 10.04.2013 24.65 24.36 24.58 25.74 25.90 26.02 -0.207 -0.188 -0.179 -0.155 -0.128 -0.128 0.013 0.009 0.006 0.003 0.002 0.002 NOVOB DC Equity NOVO NORDISK A/S-B Health Care 956.50 1.67% 21.03.2013 33.46 29.09 26.96 24.26 -0.154 -0.091 -0.058 -0.002 0.000 0.000 0.000 0.000 SAP GY Equity SAP AG Information Technology 55.56 1.51% 24.05.2013 22.60 20.94 20.63 20.92 22.43 23.00 23.41 -0.295 -0.279 -0.269 -0.231 -0.199 -0.173 -0.136 0.021 0.011 0.009 0.004 0.003 0.002 0.001 BLT LN Equity BHP BILLITON PLC Materials 1942.50 3.90% 04.03.2013 26.86 27.11 27.38 28.59 29.78 32.67 33.38 -0.308 -0.276 -0.248 -0.186 -0.124 -0.117 -0.115 0.007 0.006 0.004 0.002 0.001 0.000 0.000 ABI BB Equity ANHEUSER-BUSCH INBEV NV Consumer Staples 67.71 2.70% 24.04.2013 20.82 20.44 20.58 21.14 21.93 21.93 -0.248 -0.266 -0.254 -0.198 -0.121 -0.121 0.020 0.009 0.006 0.003 0.001 0.001 ENI IM Equity ENI SPA Energy 17.77 6.13% 20.05.2013 23.96 24.27 24.25 23.49 24.05 22.88 23.15 -0.383 -0.363 -0.332 -0.237 -0.181 -0.143 -0.128 0.019 0.006 0.003 0.002 0.001 0.002 0.002 RIO LN Equity RIO TINTO PLC Materials 3033.50 3.54% 27.02.2013 32.41 31.60 31.79 33.14 34.20 35.08 34.87 -0.319 -0.253 -0.224 -0.171 -0.129 -0.100 -0.086 0.007 0.006 0.004 0.001 0.002 0.001 0.001 AZN LN Equity ASTRAZENECA PLC Health Care 2909.50 6.29% 13.02.2013 15.87 15.66 15.62 16.72 17.97 20.16 20.63 -0.396 -0.348 -0.291 -0.186 -0.120 -0.132 -0.140 0.013 0.012 0.010 0.005 0.002 0.001 0.001 UNA NA Equity UNILEVER NV-CVA Consumer Staples 28.45 3.50% 07.11.2012 17.03 16.41 16.13 16.08 16.41 16.14 15.85 -0.282 -0.260 -0.232 -0.173 -0.108 -0.097 -0.063 0.025 0.013 0.010 0.005 0.002 0.004 0.003 ALV GY Equity ALLIANZ SE-REG Financials 94.92 4.85% 10.05.2013 20.08 20.85 21.38 21.89 23.70 22.12 22.16 -0.195 -0.225 -0.228 -0.184 -0.090 -0.098 -0.025 0.020 0.008 0.006 0.003 0.001 0.003 0.003 BNP FP Equity BNP PARIBAS Financials 40.42 3.46% 30.05.2013 36.04 35.85 35.76 35.18 36.12 36.27 35.79 -0.305 -0.288 -0.279 -0.229 -0.142 -0.147 -0.140 0.012 0.004 0.003 0.002 0.001 0.001 0.001 TEF SQ Equity TELEFONICA SA Telecommunication Services 10.49 07.11.2013 29.48 29.84 29.80 29.77 30.09 29.26 27.65 -0.191 -0.202 -0.203 -0.243 -0.229 -0.089 0.096 0.007 0.002 0.001 0.002 0.002 0.001 0.000 ULVR LN Equity UNILEVER PLC Consumer Staples 2345.00 3.44% 07.11.2012 14.88 14.88 15.12 16.05 16.56 16.56 -0.248 -0.248 -0.237 -0.194 -0.159 -0.159 0.010 0.010 0.009 0.005 0.004 0.004 DAI GY Equity DAIMLER AG-REGISTERED SHARES Consumer Discretionary 38.11 5.77% 11.04.2013 31.23 30.34 30.15 31.20 30.03 31.65 30.42 -0.186 -0.164 -0.161 -0.149 -0.078 -0.038 0.005 0.013 0.005 0.004 0.002 0.001 0.001 0.001 EOAN GY Equity E.ON AG Utilities 18.38 5.99% 03.05.2013 18.03 18.18 18.95 20.60 21.20 20.23 21.30 -0.257 -0.282 -0.283 -0.233 -0.135 -0.060 -0.051 0.036 0.016 0.011 0.004 0.002 0.003 0.003 UBSN VX Equity UBS AG-REG Financials 12.30 1.63% 22.04.2013 28.74 28.15 28.08 27.98 29.09 28.47 29.07 -0.383 -0.275 -0.239 -0.191 -0.120 -0.092 -0.067 0.028 0.014 0.010 0.004 0.002 0.003 0.004 STAN LN Equity STANDARD CHARTERED PLC Financials 1472.50 3.62% 06.03.2013 26.31 26.50 26.39 26.72 27.09 27.09 -0.170 -0.227 -0.220 -0.154 -0.120 -0.120 0.007 0.007 0.006 0.002 0.001 0.001 ABBN VX Equity ABB LTD-REG Industrials 17.81 4.49% 29.04.2013 22.83 21.94 21.84 22.04 23.79 23.82 25.13 -0.329 -0.278 -0.253 -0.178 -0.084 -0.049 -0.011 0.020 0.010 0.008 0.004 0.001 0.000 -0.001 BBVA SQ Equity BANCO BILBAO VIZCAYA ARGENTA Financials 6.24 6.72% 10.01.2013 41.25 40.54 40.54 38.95 40.01 40.38 41.78 -0.330 -0.241 -0.220 -0.199 -0.062 0.088 0.202 0.002 -0.001 -0.002 -0.002 -0.004 -0.007 -0.009 SAB LN Equity SABMILLER PLC Consumer Staples 2682.00 2.35% 05.12.2012 18.34 18.34 18.62 19.61 -0.214 -0.214 -0.206 -0.174 0.007 0.007 0.007 0.004 MC FP Equity LVMH MOET HENNESSY LOUIS VUI Consumer Discretionary 124.10 2.42% 22.04.2013 28.36 26.32 25.91 25.81 26.35 23.42 22.60 -0.272 -0.226 -0.205 -0.165 -0.117 -0.109 -0.125 0.013 0.006 0.005 0.002 0.001 0.002 0.002 NG/ LN Equity NATIONAL GRID PLC Utilities 703.00 5.81% 28.11.2012 15.01 14.82 14.98 15.66 16.21 -0.137 -0.163 -0.143 -0.074 -0.045 0.007 0.011 0.009 0.002 0.002 BARC LN Equity BARCLAYS PLC Financials 244.85 2.65% 07.11.2012 38.05 37.74 37.50 37.28 38.33 38.14 37.44 -0.352 -0.299 -0.273 -0.221 -0.145 -0.106 -0.094 0.006 0.008 0.007 0.002 0.001 0.003 0.004 DBK GY Equity DEUTSCHE BANK AG-REGISTERED Financials 34.15 2.20% 03.06.2013 41.05 39.08 37.97 35.65 35.26 34.19 34.38 -0.368 -0.327 -0.304 -0.240 -0.151 -0.103 -0.042 0.016 0.006 0.004 0.003 0.001 0.001 0.000 AAL LN Equity ANGLO AMERICAN PLC Materials 1804.50 2.68% 27.03.2013 37.67 36.79 36.62 37.15 37.60 39.09 39.73 -0.278 -0.259 -0.241 -0.196 -0.120 -0.095 -0.073 0.006 0.005 0.004 0.002 -0.001 -0.001 -0.002 AI FP Equity AIR LIQUIDE SA Materials 95.47 2.62% 13.05.2013 21.57 21.38 21.35 21.18 21.90 21.73 21.41 -0.154 -0.222 -0.237 -0.211 -0.151 -0.157 -0.132 0.018 0.011 0.009 0.004 0.002 0.002 0.002 RB/ LN Equity RECKITT BENCKISER GROUP PLC Consumer Staples 3673.00 3.59% 20.02.2013 15.83 15.83 15.90 16.72 17.40 17.40 -0.281 -0.281 -0.250 -0.146 -0.086 -0.086 0.009 0.009 0.008 0.004 0.002 0.002 ZURN VX Equity ZURICH INSURANCE GROUP AG Financials 244.50 7.16% 04.04.2013 17.80 17.23 17.36 18.65 18.02 18.72 18.69 -0.285 -0.297 -0.290 -0.239 -0.124 -0.089 -0.056 0.032 0.015 0.010 0.005 0.004 0.003 0.004 BN FP Equity DANONE Consumer Staples 48.46 3.10% 07.05.2013 23.98 21.76 21.23 20.23 20.50 19.93 19.78 -0.167 -0.228 -0.227 -0.175 -0.127 -0.188 -0.193 0.016 0.008 0.006 0.003 0.002 0.003 0.003 TSCO LN Equity TESCO PLC Consumer Staples 307.45 4.84% 24.04.2013 17.99 18.07 18.45 19.33 20.64 20.58 20.69 -0.062 -0.182 -0.200 -0.160 -0.077 -0.075 -0.059 0.001 0.005 0.006 0.004 0.000 0.000 0.000 IMT LN Equity IMPERIAL TOBACCO GROUP PLC Consumer Staples 2295.00 4.72% 16.01.2013 20.05 20.05 20.00 20.76 -0.140 -0.140 -0.115 -0.047 0.003 0.003 0.003 0.002 PRU LN Equity PRUDENTIAL PLC Financials 866.50 3.12% 27.03.2013 23.60 23.81 24.06 25.13 26.41 27.00 26.52 -0.244 -0.352 -0.343 -0.235 -0.151 -0.160 -0.123 0.008 0.008 0.007 0.004 0.002 0.003 0.002 DTE GY Equity DEUTSCHE TELEKOM AG-REG Telecommunication Services 9.03 7.75% 24.05.2013 26.30 24.33 23.85 22.29 21.88 21.59 21.76 -0.459 -0.357 -0.297 -0.165 -0.057 -0.036 0.039 0.040 0.016 0.009 0.003 0.002 0.001 0.001 SYNN VX Equity SYNGENTA AG-REG Materials 346.50 2.48% 22.04.2013 19.60 19.26 19.39 19.76 20.61 20.73 20.97 -0.461 -0.369 -0.320 -0.221 -0.140 -0.116 -0.099 0.020 0.011 0.008 0.004 0.002 0.001 0.001 INGA NA Equity ING GROEP NV-CVA Financials 6.88 25.04.2013 38.16 38.02 37.85 37.73 38.78 38.57 38.93 -0.339 -0.303 -0.297 -0.285 -0.234 -0.214 -0.161 0.021 0.007 0.005 0.003 0.001 0.002 0.002 SU FP Equity SCHNEIDER ELECTRIC SA Industrials 48.11 3.74% 13.05.2013 37.18 36.66 36.34 35.54 36.21 35.96 36.59 -0.242 -0.249 -0.243 -0.191 -0.137 -0.124 -0.105 0.013 0.005 0.004 0.001 0.001 -0.001 -0.001 CFR VX Equity CIE FINANCIERE RICHEMON-BR A Consumer Discretionary 59.95 1.03% 09.09.2013 29.87 28.82 28.55 28.41 28.66 28.79 -0.217 -0.207 -0.199 -0.164 -0.115 -0.100 0.010 0.004 0.003 0.002 0.001 0.002 HMB SS Equity HENNES & MAURITZ AB-B SHS Consumer Discretionary 234.60 4.05% 03.05.2013 16.77 17.90 18.23 19.16 19.44 -0.280 -0.135 -0.116 -0.131 -0.086 0.069 0.030 0.016 0.005 0.003 LIN GY Equity LINDE AG Materials 134.65 2.01% 30.05.2013 20.17 19.85 20.00 20.50 21.08 21.15 21.79 -0.286 -0.283 -0.272 -0.222 -0.147 -0.109 -0.098 0.021 0.011 0.008 0.004 0.003 0.002 0.001 Stoxx 600 Index GSZ FP Equity GDF SUEZ Utilities 17.62 3.80% 01.05.2013 21.15 21.21 21.55 22.12 23.23 25.46 25.35 -0.163 -0.192 -0.201 -0.170 -0.109 -0.136 -0.107 0.028 0.012 0.008 0.004 0.001 0.000 -0.002 OR FP Equity L'OREAL Consumer Staples 99.59 2.21% 29.04.2013 20.73 20.14 20.06 20.18 20.83 20.75 20.80 -0.113 -0.218 -0.235 -0.193 -0.149 -0.152 -0.134 0.019 0.009 0.007 0.003 0.002 0.003 0.003 CS FP Equity AXA SA Financials 12.17 6.00% 06.05.2013 32.94 32.72 32.55 31.48 32.48 30.61 29.28 -0.243 -0.292 -0.306 -0.264 -0.172 -0.131 -0.142 0.017 0.006 0.005 0.003 0.001 0.003 0.004 CSGN VX Equity CREDIT SUISSE GROUP AG-REG Financials 21.76 3.45% 09.05.2013 32.73 31.59 31.03 30.19 31.57 30.25 30.98 -0.179 -0.209 -0.219 -0.194 -0.111 -0.084 -0.064 0.020 0.008 0.005 0.003 0.001 0.002 0.002 LLOY LN Equity LLOYDS BANKING GROUP PLC Financials 42.43 06.03.2013 35.18 35.13 35.35 36.21 37.41 39.14 39.12 -0.155 -0.240 -0.259 -0.256 -0.135 -0.138 -0.156 0.010 0.001 0.000 0.004 0.003 0.002 0.001 BT/A LN Equity BT GROUP PLC Telecommunication Services 218.90 4.34% 19.12.2012 25.64 22.58 22.55 24.04 24.44 25.84 25.74 -0.321 -0.266 -0.229 -0.179 -0.077 -0.092 -0.095 0.005 0.009 0.008 0.002 -0.001 0.000 -0.001 CNA LN Equity CENTRICA PLC Utilities 335.90 5.03% 24.04.2013 15.11 15.11 15.36 15.99 16.49 16.51 -0.055 -0.055 -0.077 -0.126 -0.112 -0.122 0.013 0.013 0.011 0.005 0.001 0.001 STL NO Equity STATOIL ASA Energy 146.70 4.64% 16.05.2013 24.51 23.05 22.46 22.67 22.67 22.67 -0.010 -0.142 -0.165 -0.185 -0.185 -0.185 0.030 0.025 0.004 0.001 0.001 0.001 VOW3 GY Equity VOLKSWAGEN AG-PREF Consumer Discretionary 146.35 2.56% 19.04.2013 30.71 29.94 29.76 29.40 30.81 30.57 30.97 -0.266 -0.228 -0.219 -0.190 -0.138 -0.104 -0.084 0.014 0.006 0.005 0.003 0.001 0.001 0.001 ITX SQ Equity INDITEX Consumer Discretionary 98.26 1.83% 02.05.2013 28.68 28.16 27.55 25.93 25.25 24.71 24.41 -0.153 -0.156 -0.163 -0.183 -0.191 -0.182 -0.170 0.002 0.002 0.001 0.001 0.001 0.001 0.000 ERICB SS Equity ERICSSON LM-B SHS Information Technology 58.75 4.60% 10.04.2013 34.78 30.55 27.88 29.89 30.46 30.46 30.46 -0.091 -0.346 -0.225 -0.128 0.073 0.073 0.073 0.016 0.016 0.008 0.003 -0.001 -0.001 -0.001 VIV FP Equity VIVENDI Telecommunication Services 15.87 6.30% 06.05.2013 31.36 29.56 28.86 27.17 26.98 26.63 26.23 -0.251 -0.200 -0.187 -0.133 -0.014 -0.010 0.003 0.021 0.004 0.002 0.003 0.001 0.003 0.003 RR/ LN Equity ROLLS-ROYCE HOLDINGS PLC Industrials 884.00 2.23% 24.04.2013 19.12 19.12 19.68 21.40 -0.321 -0.321 -0.273 -0.132 0.010 0.010 0.008 0.003 MUV2 GY Equity MUENCHENER RUECKVER AG-REG Financials 126.90 5.12% 26.04.2013 16.56 17.01 17.76 19.23 20.47 19.58 20.22 -0.256 -0.255 -0.251 -0.211 -0.150 -0.116 -0.092 0.025 0.013 0.010 0.004 0.002 0.003 0.003 XTA LN Equity XSTRATA PLC Materials 959.60 2.78% 01.05.2013 33.07 33.27 33.74 34.49 35.61 34.89 34.91 -0.165 -0.207 -0.220 -0.214 -0.070 -0.090 -0.076 0.012 0.007 0.004 0.001 -0.001 0.000 0.000 GLE FP Equity SOCIETE GENERALE Financials 25.16 1.99% 31.05.2013 44.74 43.92 43.37 41.67 41.46 40.66 41.07 -0.344 -0.299 -0.279 -0.231 -0.185 -0.153 -0.151 0.012 0.005 0.004 0.002 0.002 0.003 0.003 BMW GY Equity BAYERISCHE MOTOREN WERKE AG Consumer Discretionary 60.64 4.29% 15.05.2013 30.16 29.55 29.54 29.16 29.88 29.15 29.65 -0.271 -0.255 -0.240 -0.189 -0.141 -0.120 -0.095 0.016 0.007 0.005 0.002 0.001 0.001 0.002 UCG IM Equity UNICREDIT SPA Financials 3.60 2.09% 20.05.2013 43.89 44.53 44.33 43.30 43.46 43.60 44.66 -0.381 -0.358 -0.330 -0.287 -0.263 -0.389 -0.439 0.012 0.003 0.002 0.002 0.002 0.001 0.001 NDA SS Equity NORDEA BANK AB Financials 63.50 3.94% 25.03.2013 27.10 25.58 24.41 30.99 27.53 27.53 -0.460 -0.354 -0.380 -0.300 -0.073 -0.073 0.052 0.025 0.017 0.003 -0.001 -0.001 SREN VX Equity SWISS RE AG Financials 65.85 5.16% 17.04.2013 20.02 19.84 19.96 20.02 21.08 21.64 23.27 -0.335 -0.286 -0.262 -0.201 -0.131 -0.095 -0.067 0.028 0.015 0.012 0.005 0.003 0.002 0.001 ENEL IM Equity ENEL SPA Utilities 2.92 4.97% 24.06.2013 26.99 26.93 26.93 26.91 27.11 27.32 27.19 -0.319 -0.321 -0.298 -0.239 -0.158 -0.155 -0.147 0.028 0.008 0.005 0.002 0.001 0.001 0.001 ISP IM Equity INTESA SANPAOLO Financials 1.32 4.56% 24.06.2013 43.33 43.22 43.11 43.49 42.03 42.95 45.51 -0.348 -0.331 -0.300 -0.294 -0.144 -0.185 -0.118 0.012 0.002 0.001 0.001 0.001 0.001 0.002 RI FP Equity PERNOD-RICARD SA Consumer Staples 88.54 1.86% 02.07.2013 20.79 20.64 20.75 21.29 21.97 23.13 22.82 -0.194 -0.265 -0.275 -0.238 -0.165 -0.111 -0.088 0.018 0.011 0.009 0.003 0.003 0.002 0.002 FTE FP Equity FRANCE TELECOM SA Telecommunication Services 9.40 12.23% 10.06.2013 28.83 27.25 26.47 24.14 18.58 29.24 29.16 -0.114 -0.188 -0.204 -0.157 0.070 0.177 0.309 0.023 0.011 0.008 0.005 0.005 -0.010 -0.013 PHIA NA Equity KONINKLIJKE PHILIPS ELECTRON Industrials 18.83 3.98% 02.05.2013 27.53 25.79 25.42 25.25 25.91 24.90 25.47 -0.235 -0.282 -0.281 -0.206 -0.122 -0.116 -0.087 0.018 0.008 0.006 0.003 0.001 0.002 0.002 DG FP Equity VINCI SA Industrials 34.39 5.23% 21.05.2013 28.56 28.43 28.52 28.27 29.97 29.13 29.65 -0.251 -0.242 -0.229 -0.178 -0.096 -0.157 -0.162 0.019 0.006 0.004 0.002 0.000 0.000 0.000 ASML NA Equity ASML HOLDING NV Information Technology 41.22 23.49% 26.04.2013 33.89 28.63 35.53 47.00 46.98 34.67 31.09 -0.175 1.003 0.875 0.344 0.178 1.025 1.000 0.007 -0.006 -0.009 -0.009 -0.003 -0.017 -0.010 RWE GY Equity RWE AG Utilities 35.31 5.66% 19.04.2013 18.46 19.84 20.40 20.76 22.66 22.27 23.32 -0.231 -0.279 -0.283 -0.222 -0.140 -0.110 -0.080 0.028 0.011 0.007 0.003 0.002 0.001 0.001 SSE LN Equity SSE PLC Utilities 1447.00 5.82% 23.01.2013 14.60 14.60 14.54 14.97 -0.117 -0.117 -0.118 -0.131 0.003 0.003 0.003 0.003 G IM Equity ASSICURAZIONI GENERALI Financials 12.29 2.85% 20.05.2013 31.94 32.98 33.13 32.59 33.21 33.31 35.85 -0.427 -0.335 -0.310 -0.245 -0.131 -0.118 -0.081 0.018 0.004 0.002 0.001 0.001 0.000 -0.001 CPG LN Equity COMPASS GROUP PLC Consumer Discretionary 695.50 3.15% 23.01.2013 16.10 16.10 16.08 16.73 17.62 17.62 -0.164 -0.164 -0.168 -0.177 -0.169 -0.169 0.012 0.012 0.010 0.004 0.004 0.004 TLW LN Equity TULLOW OIL PLC Energy 1422.00 0.91% 17.04.2013 25.68 25.68 26.26 27.82 -0.154 -0.154 -0.143 -0.097 0.003 0.003 0.003 0.002 UL FP Equity UNIBAIL-RODAMCO SE Financials 171.55 4.84% 07.05.2013 17.66 17.55 17.75 18.07 19.64 19.64 19.64 -0.403 -0.326 -0.296 -0.220 -0.129 -0.129 -0.129 0.019 0.011 0.009 0.005 0.002 0.002 0.002 IBE SQ Equity IBERDROLA SA Utilities 3.92 8.57% 02.01.2013 36.85 35.47 35.80 33.42 31.80 34.20 34.92 -0.125 -0.123 -0.108 -0.079 0.015 0.206 0.417 0.007 0.004 0.003 0.002 0.000 0.001 0.000 EI FP Equity ESSILOR INTERNATIONAL Health Care 71.36 1.37% 24.05.2013 20.87 20.27 20.24 20.53 21.53 20.76 20.11 -0.309 -0.302 -0.280 -0.202 -0.138 -0.147 -0.135 0.024 0.011 0.008 0.004 0.002 0.002 0.003 VOLVB SS Equity VOLVO AB-B SHS Industrials 91.95 3.81% 05.04.2013 31.32 29.94 28.98 30.54 29.78 -0.320 -0.284 -0.259 -0.186 -0.078 0.027 0.011 0.006 0.003 0.003 ADS GY Equity ADIDAS AG Consumer Discretionary 67.32 1.86% 10.05.2013 24.00 23.12 22.93 23.23 24.54 24.88 25.62 -0.318 -0.306 -0.289 -0.229 -0.156 -0.113 -0.084 0.020 0.010 0.008 0.004 0.002 0.001 0.000 DPW GY Equity DEUTSCHE POST AG-REG Industrials 15.57 4.63% 10.05.2013 20.42 20.29 20.46 21.07 22.35 22.15 22.91 -0.223 -0.274 -0.270 -0.189 -0.127 -0.094 -0.080 0.033 0.014 0.010 0.004 0.002 0.001 0.001 EXPN LN Equity EXPERIAN PLC Industrials 1086.00 2.00% 19.12.2012 16.16 16.16 16.67 18.07 -0.221 -0.221 -0.209 -0.151 0.006 0.006 0.005 0.003 GLEN LN Equity GLENCORE INTERNATIONAL PLC Materials 339.30 2.91% 15.05.2013 30.82 31.13 31.44 33.31 31.59 30.98 32.31 -0.215 -0.194 -0.179 -0.088 -0.074 0.199 -0.009 0.005 0.006 0.005 -0.001 0.002 -0.001 0.000 SHBA SS Equity SVENSKA HANDELSBANKEN-A SHS Financials 242.50 4.23% 27.03.2013 20.30 19.16 18.63 20.98 21.73 -0.163 -0.281 -0.285 -0.233 0.045 0.039 0.017 0.012 0.005 -0.001 WPP LN Equity WPP PLC Consumer Discretionary 855.00 3.42% 05.06.2013 20.30 20.30 20.67 21.59 -0.281 -0.281 -0.253 -0.165 0.013 0.013 0.011 0.002 BA/ LN Equity BAE SYSTEMS PLC Industrials 329.90 5.94% 17.04.2013 25.62 24.51 24.02 23.16 23.37 23.37 0.062 0.019 -0.004 -0.034 -0.023 -0.023 0.007 0.007 0.006 0.002 0.001 0.001 SHP LN Equity SHIRE PLC Health Care 1829.00 0.59% 06.03.2013 28.94 28.32 27.80 27.21 0.064 0.043 0.031 0.014 0.007 0.009 0.008 0.004 FRE GY Equity FRESENIUS SE & CO KGAA Health Care 96.60 1.11% 14.05.2013 17.06 16.91 17.27 18.59 20.70 22.29 22.49 -0.424 -0.285 -0.234 -0.150 -0.106 -0.110 -0.105 0.017 0.009 0.007 0.004 0.002 0.001 0.001 SWEDA SS Equity SWEDBANK AB - A SHARES Financials 120.80 4.88% 28.03.2013 25.95 24.34 23.50 25.56 23.94 -0.332 -0.318 -0.327 -0.253 0.080 0.046 0.021 0.012 0.006 0.001 PSON LN Equity PEARSON PLC Consumer Discretionary 1239.00 3.68% 03.04.2013 17.59 17.59 17.70 18.41 -0.219 -0.219 -0.203 -0.147 0.004 0.004 0.004 0.003 AV/ LN Equity AVIVA PLC Financials 336.90 7.72% 20.03.2013 27.30 27.95 28.27 30.27 28.49 32.47 33.59 -0.329 -0.296 -0.278 -0.252 -0.054 -0.168 -0.204 0.005 0.007 0.006 0.002 0.001 0.000 0.000 FME GY Equity FRESENIUS MEDICAL CARE AG & Health Care 58.72 1.28% 13.05.2013 18.96 17.99 17.86 18.13 19.21 20.21 21.42 -0.204 -0.189 -0.187 -0.173 -0.125 -0.109 -0.095 0.027 0.012 0.009 0.004 0.002 0.001 0.001 REP SQ Equity REPSOL SA Energy 15.47 5.43% 03.01.2013 37.79 38.69 39.60 37.63 38.13 39.15 39.12 -0.226 -0.314 -0.306 -0.176 -0.170 -0.008 0.007 -0.002 0.000 0.001 0.001 0.001 -0.003 -0.003 SAMAS FH Equity SAMPO OYJ-A SHS Financials 24.93 5.01% 15.04.2013 22.42 20.75 20.33 19.74 -0.247 -0.248 -0.247 -0.205 0.022 0.010 0.008 0.004 HOLN VX Equity HOLCIM LTD-REG Materials 64.20 1.95% 09.05.2013 22.68 22.20 22.33 22.90 24.63 24.46 24.91 -0.443 -0.307 -0.267 -0.218 -0.139 -0.123 -0.122 0.016 0.009 0.007 0.003 0.002 0.002 0.002 SGO FP Equity COMPAGNIE DE SAINT-GOBAIN Industrials 26.59 4.89% 10.06.2013 37.04 36.01 35.67 34.50 34.72 35.44 36.73 -0.199 -0.217 -0.216 -0.157 -0.081 -0.094 -0.012 0.015 0.007 0.005 0.002 0.001 -0.001 -0.002 TLSN SS Equity TELIASONERA AB Telecommunication Services 45.98 7.07% 04.04.2013 20.66 18.49 17.07 20.88 21.56 21.56 21.56 -0.246 -0.187 -0.175 -0.159 0.140 0.140 0.140 0.068 0.038 0.021 0.007 -0.005 -0.005 -0.005 ATCOA SS Equity ATLAS COPCO AB-A SHS Industrials 153.80 3.41% 22.04.2013 31.02 29.81 28.67 28.94 27.89 -0.599 -0.364 -0.284 -0.201 -0.120 0.034 0.011 0.005 0.003 0.005 SAND SS Equity SANDVIK AB Industrials 89.00 4.27% 03.05.2013 30.35 29.66 29.28 31.61 34.14 -0.246 -0.261 -0.248 -0.137 0.069 0.033 0.012 0.006 0.001 -0.002 ML FP Equity MICHELIN (CGDE) Consumer Discretionary 62.38 3.69% 24.05.2013 29.17 29.10 29.35 29.78 30.69 31.21 -0.284 -0.276 -0.262 -0.202 -0.144 -0.116 0.016 0.007 0.006 0.003 0.002 0.001 HEN3 GY Equity HENKEL AG & CO KGAA VORZUG Consumer Staples 63.73 1.43% 16.04.2013 20.19 19.97 20.09 20.73 22.12 22.06 22.17 -0.249 -0.248 -0.249 -0.228 -0.157 -0.130 -0.120 0.022 0.011 0.009 0.004 0.002 0.002 0.001 KNEBV FH Equity KONE OYJ-B Industrials 57.75 2.51% 05.03.2013 SDRL NO Equity SEADRILL LTD Energy 227.40 8.68% 10.12.2012 20.11 20.11 22.06 -0.021 -0.021 0.022 0.005 0.005 0.004 MT NA Equity ARCELORMITTAL Materials 11.58 4.97% 15.02.2013 38.96 39.18 38.85 38.37 38.44 42.19 43.26 -0.181 -0.211 -0.192 -0.116 0.007 -0.005 -0.023 0.010 0.004 0.004 0.002 0.000 -0.003 -0.003 TEL NO Equity TELENOR ASA Telecommunication Services 108.90 5.33% 17.05.2013 22.65 22.69 23.48 28.40 -0.491 -0.401 -0.179 -0.141 0.047 0.023 0.005 0.002 OML LN Equity OLD MUTUAL PLC Financials 175.10 3.60% 17.04.2013 21.97 21.97 22.22 22.71 -0.228 -0.228 -0.216 -0.172 0.009 0.009 0.008 0.003 HEIA NA Equity HEINEKEN NV Consumer Staples 48.76 1.91% 23.04.2013 21.27 20.15 19.83 19.57 19.68 19.58 19.64 -0.417 -0.308 -0.269 -0.205 -0.135 -0.126 -0.110 0.023 0.013 0.010 0.005 0.003 0.002 0.003 AKZA NA Equity AKZO NOBEL Materials 43.22 3.47% 22.10.2012 31.30 28.26 27.46 26.11 25.83 25.34 25.52 -0.015 -0.146 -0.171 -0.161 -0.115 -0.102 -0.076 0.009 0.005 0.004 0.003 0.001 0.001 0.001 ARM LN Equity ARM HOLDINGS PLC Information Technology 592.50 0.76% 01.05.2013 28.48 28.48 29.12 31.15 -0.113 -0.113 -0.104 -0.072 0.006 0.006 0.005 0.001 CRH ID Equity CRH PLC Materials 13.83 4.54% 06.03.2013 36.19 34.22 33.88 34.86 33.47 33.84 -0.271 -0.318 -0.252 -0.084 -0.193 -0.213 0.010 0.002 0.001 -0.001 0.001 0.001 SEBA SS Equity SKANDINAVISKA ENSKILDA BAN-A Financials 55.70 3.32% 01.04.2013 29.25 26.78 25.39 26.86 26.43 -0.177 -0.231 -0.310 -0.212 -0.030 0.031 0.019 0.012 0.005 0.000 PP FP Equity PPR Consumer Discretionary 132.20 3.03% 02.05.2013 23.03 22.29 22.30 22.43 23.41 24.16 24.37 -0.169 -0.234 -0.226 -0.149 -0.108 -0.091 -0.060 0.017 0.006 0.004 0.003 0.001 0.001 0.001 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 2. 16.10.2012 Option Implied Volatility Skew Parameters by Terms: At The Money Implied Volatilities by Terms IVt = atx + btx2 + ct Next Ex- Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Dividend ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - ATM Vol - Ticker Name GICS_SECTOR_NAME ATM Ref Dividend (a) - (a) - (a) - (a) - (a) - (a) - (a) - (b) - (b) - (b) - (b) - (b) - (b) - (b) - Yield 30D 60D 90D 6M 12M 18M 24M Date 30D 60D 90D 6M 12M 18M 24M 30D 60D 90D 6M 12M 18M 24M LGEN LN Equity LEGAL & GENERAL GROUP PLC Financials 136.20 5.54% 17.04.2013 20.56 20.37 21.03 22.62 23.53 23.53 -0.366 -0.326 -0.284 -0.210 -0.205 -0.205 0.011 0.011 0.009 0.003 0.002 0.002 CA FP Equity CARREFOUR SA Consumer Staples 16.38 4.03% 04.07.2013 34.20 32.74 32.45 32.50 31.88 31.92 32.28 -0.176 -0.213 -0.211 -0.170 -0.069 -0.063 -0.091 0.020 0.007 0.004 0.002 0.002 0.002 0.003 UHR VX Equity SWATCH GROUP AG/THE-BR Consumer Discretionary 381.90 1.75% 21.05.2013 23.52 22.80 23.15 24.13 25.52 26.07 26.38 -0.099 -0.200 -0.219 -0.183 -0.119 -0.098 -0.092 0.011 0.006 0.005 0.003 0.001 0.001 0.001 EAD FP Equity EADS NV Industrials 26.55 2.26% 04.06.2013 29.18 27.86 27.50 27.04 27.80 27.33 28.15 -0.129 -0.163 -0.165 -0.122 -0.075 -0.065 -0.053 0.013 0.005 0.004 0.002 0.001 0.001 0.001 REL LN Equity REED ELSEVIER PLC Consumer Discretionary 617.00 3.74% 24.04.2013 16.69 16.69 17.00 17.56 -0.211 -0.211 -0.209 -0.185 0.005 0.005 0.005 0.004 WOS LN Equity WOLSELEY PLC Industrials 2682.00 2.57% 03.04.2013 24.66 24.66 25.02 25.86 -0.114 -0.114 -0.105 -0.080 0.002 0.002 0.002 0.001 TEC FP Equity TECHNIP SA Energy 87.70 1.92% 09.05.2013 28.26 28.26 28.77 30.00 30.53 29.11 -0.259 -0.259 -0.237 -0.168 -0.131 -0.100 0.003 0.003 0.003 0.002 0.002 0.002 BSY LN Equity BRITISH SKY BROADCASTING GRO Consumer Discretionary 754.50 3.48% 27.03.2013 16.12 16.47 16.98 18.73 19.59 19.59 19.59 -0.188 -0.194 -0.175 -0.101 -0.029 -0.029 -0.029 0.003 0.007 0.006 0.003 0.004 0.004 0.004 AH NA Equity KONINKLIJKE AHOLD NV Consumer Staples 9.56 4.60% 26.04.2013 17.22 16.94 16.98 17.05 17.84 16.94 17.33 0.064 -0.161 -0.188 -0.113 -0.025 -0.044 -0.004 0.029 0.020 0.015 0.004 0.001 0.003 0.003 SGSN VX Equity SGS SA-REG Industrials 2012.00 1.49% 18.03.2013 17.10 17.19 17.55 18.88 20.25 21.22 -0.286 -0.292 -0.286 -0.234 -0.140 -0.138 0.007 0.010 0.010 0.005 0.002 0.001 DNB NO Equity DNB ASA Financials 73.60 2.72% 26.04.2013 29.28 28.03 30.33 32.44 -0.257 -0.135 -0.205 -0.274 0.060 0.022 0.007 0.000 SPM IM Equity SAIPEM SPA Energy 35.25 2.18% 20.05.2013 26.53 26.99 27.32 28.08 29.58 29.58 -0.367 -0.343 -0.293 -0.211 -0.098 -0.098 0.005 0.004 0.004 0.001 0.000 0.000 RRS LN Equity RANDGOLD RESOURCES LTD Materials 7685.00 0.52% 08.05.2013 37.36 37.36 37.27 36.99 0.003 0.003 -0.010 -0.045 0.001 0.001 0.000 -0.001 SAF FP Equity SAFRAN SA Industrials 30.18 2.58% 18.12.2012 24.49 24.49 25.40 27.90 29.50 29.50 -0.142 -0.142 -0.145 -0.149 -0.128 -0.128 0.006 0.006 0.005 0.003 0.001 0.001 SL/ LN Equity STANDARD LIFE PLC Financials 291.50 5.09% 20.03.2013 16.24 16.24 18.01 22.23 -0.279 -0.279 -0.292 -0.278 0.008 0.008 0.007 0.002 SCAB SS Equity SVENSKA CELLULOSA AB-B SHS Consumer Staples 119.50 3.85% 08.04.2013 24.56 21.83 21.06 23.31 23.91 -0.157 -0.104 -0.171 -0.099 0.065 0.032 0.017 0.012 0.004 -0.001 ASSAB SS Equity ASSA ABLOY AB-B Industrials 217.30 2.49% 02.05.2013 28.06 27.23 26.05 26.52 26.19 -0.252 -0.250 -0.229 -0.154 -0.084 0.030 0.011 0.006 0.002 0.002 LG FP Equity LAFARGE SA Materials 44.48 1.35% 03.07.2013 32.92 31.91 31.58 31.44 33.03 32.76 33.60 -0.319 -0.275 -0.253 -0.209 -0.130 -0.078 -0.023 0.017 0.007 0.005 0.003 0.001 0.000 -0.002 DANSKE DC EquityDANSKE BANK A/S Financials 105.70 1.42% 19.03.2013 24.29 24.70 25.62 28.32 -0.293 -0.240 -0.201 -0.122 0.046 0.012 0.004 0.002 KGF LN Equity KINGFISHER PLC Consumer Discretionary 279.70 3.48% 01.05.2013 19.40 20.48 20.99 21.83 -0.084 -0.196 -0.204 -0.139 -0.002 0.002 0.003 0.003 MRW LN Equity WM MORRISON SUPERMARKETS Consumer Staples 267.10 4.58% 15.05.2013 16.25 15.72 15.97 16.96 -0.178 -0.146 -0.134 -0.107 0.003 0.002 0.002 0.002 DB1 GY Equity DEUTSCHE BOERSE AG Financials 41.35 5.80% 16.05.2013 25.13 24.70 24.67 24.06 25.32 24.04 24.70 -0.300 -0.314 -0.300 -0.218 -0.130 -0.102 -0.088 0.020 0.009 0.006 0.003 0.001 0.002 0.002 TIT IM Equity TELECOM ITALIA SPA Telecommunication Services 0.76 5.63% 20.05.2013 36.45 36.13 35.92 34.90 37.36 34.11 33.77 -0.250 -0.275 -0.226 -0.122 0.070 -0.021 -0.077 0.026 0.008 0.005 0.002 -0.001 0.000 0.001 NOK1V FH Equity NOKIA OYJ Information Technology 2.10 03.05.2013 73.02 68.74 68.86 69.16 68.29 66.70 69.40 -0.055 -0.056 -0.081 -0.160 -0.211 -0.144 -0.070 0.007 0.003 0.002 0.002 0.003 0.002 0.001 LAND LN Equity LAND SECURITIES GROUP PLC Financials 805.50 3.77% 28.11.2012 13.46 14.21 14.71 16.07 -0.144 -0.199 -0.195 -0.153 0.003 0.005 0.005 0.003 MKS LN Equity MARKS & SPENCER GROUP PLC Consumer Discretionary 390.30 4.41% 14.11.2012 24.57 23.10 22.82 23.06 23.91 24.32 24.71 -0.015 -0.083 -0.100 -0.108 -0.070 -0.077 -0.083 0.005 0.009 0.008 0.003 0.002 0.002 0.002 INVEB SS Equity INVESTOR AB-B SHS Financials 145.80 4.12% 15.04.2013 18.48 17.55 17.37 19.45 21.21 -0.289 -0.257 -0.245 -0.166 0.075 0.049 0.026 0.016 0.003 0.000 PUB FP Equity PUBLICIS GROUPE Consumer Discretionary 43.05 1.97% 27.06.2013 22.81 21.73 21.75 22.38 23.04 23.52 23.77 -0.158 -0.209 -0.222 -0.198 -0.127 -0.102 -0.090 0.019 0.008 0.006 0.002 0.002 0.002 0.002 REN NA Equity REED ELSEVIER NV Consumer Discretionary 10.51 4.79% 25.04.2013 21.25 19.01 18.64 18.63 18.25 18.27 18.61 0.072 -0.152 -0.206 -0.154 -0.087 -0.054 -0.029 0.028 0.018 0.014 0.004 0.002 0.002 0.003 AGN NA Equity AEGON NV Financials 4.27 5.15% 16.05.2013 35.91 34.59 34.28 33.61 33.88 32.65 33.53 -0.189 -0.210 -0.226 -0.222 -0.096 -0.063 -0.024 0.025 0.010 0.007 0.002 0.001 0.002 0.001 AGK LN Equity AGGREKO PLC Industrials 2278.00 1.07% 17.04.2013 MAERSKB DC Equity MOELLER-MAERSK A/S-B AP Industrials 40680.00 2.46% 15.04.2013 29.23 27.37 27.16 27.27 -0.057 -0.080 -0.073 -0.044 0.006 0.002 0.001 0.000 PAH3 GY Equity PORSCHE AUTOMOBIL HLDG-PRF Consumer Discretionary 48.07 2.18% 24.06.2013 30.90 31.08 31.09 31.63 31.06 32.08 32.04 -0.257 -0.208 -0.173 -0.130 -0.073 -0.105 -0.079 0.013 0.005 0.004 0.001 0.002 0.001 0.001 NXT LN Equity NEXT PLC Consumer Discretionary 3610.00 2.77% 26.06.2013 18.03 18.03 18.53 20.08 -0.236 -0.236 -0.202 -0.102 0.009 0.009 0.007 0.002 SN/ LN Equity SMITH & NEPHEW PLC Health Care 668.00 2.48% 17.04.2013 16.96 16.96 17.23 18.09 -0.270 -0.270 -0.244 -0.153 0.007 0.007 0.006 0.004 RNO FP Equity RENAULT SA Consumer Discretionary 35.15 4.89% 10.05.2013 42.40 39.94 39.20 38.06 40.04 38.08 39.94 -0.252 -0.226 -0.216 -0.165 -0.064 -0.060 0.032 0.012 0.005 0.003 0.001 -0.001 -0.001 -0.006 CARLB DC Equity CARLSBERG AS-B Consumer Staples 520.00 1.15% 25.03.2013 24.62 23.07 23.18 24.80 -0.159 -0.118 -0.094 -0.055 0.004 0.001 0.000 0.000 LR FP Equity LEGRAND SA Industrials 29.15 3.29% 31.05.2013 26.64 26.64 26.96 27.45 27.21 27.21 -0.112 -0.112 -0.113 -0.101 -0.117 -0.117 0.003 0.003 0.002 0.001 0.002 0.002 YAR NO Equity YARA INTERNATIONAL ASA Materials 286.60 2.62% 10.05.2013 31.32 31.58 31.91 35.47 -0.179 -0.166 -0.118 -0.172 0.006 0.001 0.000 0.002 SCMN VX Equity SWISSCOM AG-REG Telecommunication Services 384.90 5.72% 12.04.2013 13.55 13.07 13.06 13.33 12.83 13.27 14.11 0.027 -0.143 -0.179 -0.147 -0.078 -0.072 -0.077 0.016 0.013 0.011 0.006 0.004 0.003 0.003 TEN IM Equity TENARIS SA Energy 15.17 2.48% 19.11.2012 27.83 27.34 27.43 28.00 -0.219 -0.243 -0.224 -0.143 0.010 0.003 0.003 0.002 ACA FP Equity CREDIT AGRICOLE SA Financials 6.30 0.79% 27.05.2013 47.33 45.39 44.63 43.31 41.95 39.95 40.17 -0.255 -0.273 -0.263 -0.214 -0.216 -0.168 -0.086 0.016 0.005 0.003 0.003 0.002 0.002 0.003 TKA GY Equity THYSSENKRUPP AG Materials 17.97 2.23% 21.01.2013 35.14 35.73 35.49 35.00 35.39 36.16 36.01 -0.272 -0.210 -0.173 -0.102 -0.083 -0.056 -0.036 0.019 0.006 0.004 0.002 0.001 0.000 -0.001 RBS LN Equity ROYAL BANK OF SCOTLAND GROUP Financials 276.90 27.02.2013 38.56 38.09 37.95 38.09 39.54 40.19 41.38 -0.229 -0.277 -0.254 -0.200 -0.141 -0.112 -0.014 0.014 0.007 0.005 0.003 0.002 0.000 -0.001 CBK GY Equity COMMERZBANK AG Financials 1.55 24.05.2013 39.52 42.64 43.64 44.67 44.18 43.56 43.33 -0.288 -0.124 -0.104 -0.132 -0.131 -0.095 -0.092 0.042 0.011 0.006 0.002 0.001 0.001 0.001 SESG FP Equity SES Consumer Discretionary 21.17 4.56% 19.04.2013 RYA ID Equity RYANAIR HOLDINGS PLC Industrials 4.55 21.86 22.58 22.37 21.46 22.01 21.91 -0.084 -0.145 -0.159 -0.167 -0.174 -0.161 0.038 0.016 0.009 0.001 0.002 0.001 GEBN VX Equity GEBERIT AG-REG Industrials 205.70 3.06% 22.04.2013 18.58 17.79 17.86 18.00 18.62 19.14 -0.213 -0.328 -0.333 -0.246 -0.162 -0.131 0.018 0.011 0.009 0.006 0.003 0.003 DSM NA Equity KONINKLIJKE DSM NV Materials 39.14 3.88% 15.05.2013 23.05 22.30 22.23 22.52 23.19 23.55 24.45 -0.277 -0.260 -0.237 -0.183 -0.129 -0.094 -0.063 0.020 0.011 0.008 0.003 0.002 0.001 0.000 MRK GY Equity MERCK KGAA Health Care 100.35 1.74% 29.04.2013 21.44 20.49 20.19 20.15 21.21 21.30 21.56 -0.265 -0.284 -0.270 -0.200 -0.120 -0.110 -0.110 0.019 0.010 0.008 0.004 0.001 0.001 0.001 FI IM Equity FIAT INDUSTRIAL Industrials 7.87 2.80% 22.04.2013 34.48 34.38 34.45 33.84 33.59 33.59 -0.236 -0.235 -0.233 -0.174 -0.043 -0.043 0.010 0.003 0.003 0.002 0.001 0.001 SDF GY Equity K+S AG-REG Materials 36.79 3.81% 10.05.2013 23.01 22.40 22.82 24.16 25.26 25.20 25.98 -0.180 -0.247 -0.253 -0.203 -0.138 -0.148 -0.153 0.013 0.008 0.007 0.003 0.001 0.001 0.001 SWMA SS Equity SWEDISH MATCH AB Consumer Staples 263.90 2.84% 03.05.2013 23.88 21.83 21.44 21.22 -0.193 -0.106 -0.067 0.005 0.015 0.005 0.003 0.001 SKFB SS Equity SKF AB-B SHARES Industrials 144.60 3.80% 24.04.2013 32.45 28.85 27.91 28.75 29.19 -0.198 -0.278 -0.262 -0.157 0.056 0.022 0.011 0.004 0.000 -0.001 BRBY LN Equity BURBERRY GROUP PLC Consumer Discretionary 1145.00 2.40% 19.12.2012 27.40 26.78 27.12 28.18 28.96 29.45 -0.174 -0.124 -0.107 -0.078 -0.079 -0.064 0.013 0.005 0.004 0.001 0.001 0.001 Stoxx 600 Index FUM1V FH Equity FORTUM OYJ Utilities 14.18 7.05% 01.04.2013 24.20 23.02 22.93 24.63 -0.088 -0.210 -0.241 -0.190 0.016 0.006 0.004 0.002 KPN NA Equity KONINKLIJKE KPN NV Telecommunication Services 5.95 5.89% 11.04.2013 33.82 30.16 28.90 28.80 27.99 27.72 29.62 -0.097 -0.061 -0.066 -0.066 0.002 0.045 0.092 0.024 0.012 0.009 0.003 0.001 0.000 -0.001 UU/ LN Equity UNITED UTILITIES GROUP PLC Utilities 730.50 4.70% 12.12.2012 26.57 26.57 25.81 23.37 0.230 0.230 0.196 0.087 -0.001 -0.001 -0.001 -0.001 SBRY LN Equity SAINSBURY (J) PLC Consumer Staples 356.70 4.65% 21.11.2012 17.64 17.54 17.68 18.31 18.99 18.99 0.049 0.024 -0.010 -0.083 -0.065 -0.065 0.011 0.005 0.003 0.005 0.003 0.003 ANTO LN Equity ANTOFAGASTA PLC Materials 1282.00 1.16% 08.05.2013 33.34 33.34 33.44 33.84 -0.261 -0.261 -0.242 -0.176 0.004 0.004 0.003 0.002 AMS SQ Equity AMADEUS IT HOLDING SA-A SHS Information Technology 19.02 2.21% 30.01.2013 27.28 26.16 25.30 23.71 22.16 21.49 21.52 -0.136 -0.155 -0.151 -0.132 -0.104 -0.107 -0.108 0.003 0.002 0.001 0.001 0.001 0.001 0.001 CPI LN Equity CAPITA PLC Industrials 735.00 3.29% 17.04.2013 ABF LN Equity ASSOCIATED BRITISH FOODS PLC Consumer Staples 1361.00 2.13% 05.12.2012 11.73 11.73 11.81 12.07 -0.176 -0.176 -0.133 -0.006 0.007 0.007 0.007 0.007 CON GY Equity CONTINENTAL AG Consumer Discretionary 75.56 2.65% 16.05.2013 29.63 29.81 29.86 30.10 32.29 32.18 32.71 -0.355 -0.318 -0.296 -0.227 -0.139 -0.116 -0.097 0.010 0.004 0.005 0.003 0.001 0.001 0.001 SW FP Equity SODEXO Consumer Discretionary 61.12 2.68% 01.02.2013 19.62 19.62 19.28 18.88 19.09 18.63 18.53 -0.231 -0.231 -0.213 -0.162 -0.117 -0.016 -0.007 0.006 0.006 0.005 0.003 0.002 0.003 0.003 BLND LN Equity BRITISH LAND CO PLC Financials 538.50 4.94% 09.01.2013 16.87 16.87 17.17 17.56 -0.208 -0.208 -0.166 -0.027 0.013 0.013 0.010 0.002 JMAT LN Equity JOHNSON MATTHEY PLC Materials 2285.00 2.65% 28.11.2012 SAB SQ Equity BANCO DE SABADELL SA Financials 2.00 2.00% 18.12.2012 34.50 36.57 36.50 34.83 34.02 34.13 33.76 0.091 -0.009 -0.026 -0.043 -0.133 -0.139 -0.039 -0.001 -0.002 -0.001 0.001 0.002 0.001 0.001 SRG IM Equity SNAM SPA Utilities 3.53 7.08% 20.05.2013 17.08 17.16 17.33 17.36 17.60 17.60 -0.191 -0.246 -0.245 -0.209 -0.270 -0.270 0.015 0.009 0.008 0.006 0.004 0.004 BEI GY Equity BEIERSDORF AG Consumer Staples 58.97 1.36% 29.04.2013 19.18 19.07 18.98 18.74 19.27 19.65 20.21 -0.249 -0.183 -0.166 -0.130 -0.087 -0.100 -0.098 0.012 0.010 0.009 0.004 0.002 0.001 0.001 BAER VX Equity JULIUS BAER GROUP LTD Financials 32.73 2.26% 12.04.2013 21.78 22.00 22.73 24.99 26.28 26.34 26.76 -0.251 -0.248 -0.233 -0.176 -0.103 -0.068 -0.048 0.015 0.007 0.005 0.003 0.002 0.002 0.003 KYG ID Equity KERRY GROUP PLC-A Consumer Staples 40.44 0.89% 10.04.2013 23.71 22.20 22.01 23.01 24.72 24.67 -0.086 -0.122 -0.131 -0.134 -0.111 -0.106 0.012 0.004 0.003 0.002 0.003 0.003 GIVN VX Equity GIVAUDAN-REG Materials 944.50 2.65% 26.03.2013 14.18 14.63 15.24 16.80 17.53 18.47 -0.424 -0.322 -0.282 -0.211 -0.117 -0.095 0.015 0.011 0.009 0.005 0.003 0.002 HEI GY Equity HEIDELBERGCEMENT AG Materials 40.24 1.37% 03.05.2013 32.31 32.14 32.36 32.92 34.08 33.75 33.95 -0.377 -0.365 -0.348 -0.269 -0.167 -0.159 -0.141 0.009 0.006 0.006 0.003 0.001 0.001 0.002 DE NA Equity DE MASTER BLENDERS1753 NV Consumer Staples 9.53 19.17 19.80 20.30 21.39 -0.050 -0.038 -0.036 -0.043 0.026 0.009 0.006 0.002 CDI FP Equity CHRISTIAN DIOR Consumer Discretionary 109.55 2.61% 22.04.2013 23.11 23.11 23.54 24.68 25.61 25.61 -0.317 -0.317 -0.287 -0.194 -0.213 -0.213 0.005 0.005 0.004 0.003 0.004 0.004 ALO FP Equity ALSTOM Industrials 27.33 3.48% 27.06.2013 35.07 33.97 33.82 34.31 35.56 36.17 36.74 -0.264 -0.264 -0.248 -0.194 -0.110 -0.095 -0.069 0.017 0.007 0.005 0.002 0.001 0.000 -0.001 SOLB BB Equity SOLVAY SA Materials 94.51 3.24% 17.01.2013 30.54 29.30 28.85 28.68 29.28 29.28 -0.297 -0.260 -0.231 -0.158 -0.071 -0.071 0.012 0.004 0.003 0.003 0.002 0.002 ITRK LN Equity INTERTEK GROUP PLC Industrials 2826.00 1.42% 05.06.2013 IFX GY Equity INFINEON TECHNOLOGIES AG Information Technology 5.13 2.34% 08.03.2013 44.81 42.35 40.40 37.77 38.51 39.80 39.83 -0.365 -0.333 -0.300 -0.227 -0.159 -0.156 -0.134 0.010 0.005 0.005 0.002 0.001 0.000 0.001 CCL LN Equity CARNIVAL PLC Consumer Discretionary 2410.00 2.57% 20.02.2013 18.55 18.55 19.07 21.17 -0.211 -0.211 -0.199 -0.153 0.008 0.008 0.007 0.002 IHG LN Equity INTERCONTINENTAL HOTELS GROU Consumer Discretionary 1594.00 2.53% 20.03.2013 21.34 21.34 21.89 23.80 -0.213 -0.213 -0.208 -0.165 0.003 0.003 0.003 0.002 NZYMB DC Equity NOVOZYMES A/S-B SHARES Materials 163.20 1.29% 28.02.2013 25.54 25.34 25.30 25.60 -0.094 -0.050 -0.028 0.001 0.010 0.001 0.000 0.000 DSY FP Equity DASSAULT SYSTEMES SA Information Technology 82.94 0.94% 14.06.2013 20.90 20.90 21.13 21.80 22.75 22.75 -0.260 -0.260 -0.242 -0.177 -0.126 -0.126 0.006 0.006 0.005 0.003 0.002 0.002 BNR GY Equity BRENNTAG AG Industrials 100.65 2.38% 20.06.2013 20.09 21.32 21.95 22.98 24.20 23.91 24.50 -0.080 -0.214 -0.238 -0.183 -0.150 -0.099 -0.097 0.013 0.005 0.004 0.002 0.001 0.000 0.000 GTO FP Equity GEMALTO Information Technology 68.07 0.50% 24.05.2013 25.25 25.15 25.10 25.01 25.13 25.11 -0.085 -0.009 0.007 0.006 0.003 0.001 0.009 0.001 0.000 0.000 0.000 0.000 WTB LN Equity WHITBREAD PLC Consumer Discretionary 2375.00 2.32% 31.10.2012 19.43 19.43 19.89 20.70 -0.182 -0.182 -0.142 -0.041 0.012 0.012 0.010 0.003 SMIN LN Equity SMITHS GROUP PLC Industrials 1056.00 3.66% 20.03.2013 ADEN VX Equity ADECCO SA-REG Industrials 47.74 3.98% 03.05.2013 40.76 38.17 36.72 33.36 32.19 31.89 33.08 -0.306 -0.252 -0.235 -0.181 -0.093 -0.087 -0.085 0.007 0.002 0.002 0.001 0.001 0.000 0.001 ORK NO Equity ORKLA ASA Industrials 46.74 5.88% 19.04.2013 28.07 24.36 24.45 21.83 -0.448 -0.302 -0.237 -0.213 0.069 0.040 0.018 0.014 PFC LN Equity PETROFAC LTD Energy 1619.00 2.55% 17.04.2013 23.07 23.07 23.80 26.12 -0.080 -0.080 -0.097 -0.127 0.006 0.006 0.005 0.002 CAP FP Equity CAP GEMINI Information Technology 32.34 3.09% 04.06.2013 36.67 35.16 34.58 33.93 34.48 35.35 35.48 -0.256 -0.224 -0.210 -0.169 -0.116 -0.120 -0.113 0.017 0.007 0.005 0.002 0.000 0.000 0.000 RSA LN Equity RSA INSURANCE GROUP PLC Financials 115.00 8.22% 27.03.2013 18.37 17.79 17.99 19.54 18.69 18.69 -0.090 -0.161 -0.174 -0.153 -0.096 -0.096 0.001 0.006 0.006 0.004 0.003 0.003 SUBC NO Equity SUBSEA 7 SA Energy 131.20 2.16% 25.06.2013 33.76 33.76 33.42 32.93 -0.286 -0.286 -0.274 -0.220 0.006 0.006 0.005 0.000 LXS GY Equity LANXESS AG Materials 59.90 1.59% 16.05.2013 34.44 33.25 32.96 32.89 33.91 34.32 34.57 -0.242 -0.189 -0.181 -0.163 -0.122 -0.117 -0.106 0.010 0.003 0.003 0.002 0.001 0.002 0.002 SVT LN Equity SEVERN TRENT PLC Utilities 1693.00 4.48% 05.12.2012 17.42 17.42 17.54 18.10 -0.050 -0.050 -0.056 -0.057 0.003 0.003 0.003 0.002 REX LN Equity REXAM PLC Materials 458.50 3.51% 08.05.2013 KNIN VX Equity KUEHNE & NAGEL INTL AG-REG Industrials 106.00 4.06% 10.05.2013 24.81 23.89 24.02 24.37 26.00 23.23 -0.176 -0.234 -0.239 -0.173 -0.079 -0.006 0.011 0.007 0.006 0.002 0.000 0.004 EDP PL Equity EDP-ENERGIAS DE PORTUGAL SA Utilities 2.10 8.80% 13.05.2013 EN FP Equity BOUYGUES SA Industrials 19.55 8.19% 30.04.2013 31.61 30.92 30.60 29.06 30.54 30.58 32.03 -0.191 -0.232 -0.226 -0.148 -0.059 -0.148 -0.104 0.016 0.007 0.006 0.002 0.000 0.000 -0.002 SKAB SS Equity SKANSKA AB-B SHS Industrials 103.40 6.04% 08.04.2013 22.00 20.84 20.26 22.73 22.14 -0.255 -0.213 -0.266 -0.178 0.072 0.056 0.028 0.012 0.004 0.000 EBS AV Equity ERSTE GROUP BANK AG Financials 19.09 2.10% 17.05.2013 34.41 34.49 34.50 34.54 35.03 41.74 -0.472 -0.193 -0.141 -0.109 0.442 0.558 0.043 0.013 0.007 0.003 -0.002 -0.006 ADN LN Equity ABERDEEN ASSET MGMT PLC Financials 334.90 3.40% 05.12.2012 SGE LN Equity SAGE GROUP PLC/THE Information Technology 309.30 3.46% 06.02.2013 21.48 21.48 21.45 22.15 -0.244 -0.244 -0.213 -0.136 0.008 0.008 0.007 0.004 EDF FP Equity EDF Utilities 16.79 7.15% 13.12.2012 21.85 21.45 21.63 22.62 24.34 27.49 27.03 -0.252 -0.219 -0.199 -0.154 -0.120 -0.118 -0.095 0.032 0.013 0.009 0.005 0.002 0.002 0.002 KD8 GY Equity KABEL DEUTSCHLAND HOLDING AG Consumer Discretionary 56.39 2.66% 14.10.2013 23.98 24.32 24.67 25.97 27.24 27.87 27.22 -0.140 -0.065 -0.085 -0.162 -0.082 -0.091 -0.087 0.007 0.000 0.001 0.002 0.001 0.001 0.001 SCHP VX Equity SCHINDLER HOLDING-PART CERT Industrials 120.40 2.08% 18.03.2013 16.94 16.91 16.97 16.53 14.68 14.60 -0.186 -0.083 -0.053 0.001 0.069 0.062 0.018 0.004 0.002 0.002 0.003 0.006 GBLB BB Equity GROUPE BRUXELLES LAMBERT SA Financials 57.66 4.74% 26.04.2013 15.65 15.70 15.99 16.23 16.14 16.14 -0.209 -0.283 -0.296 -0.239 -0.118 -0.118 0.031 0.019 0.014 0.005 0.002 0.002 GFS LN Equity G4S PLC Industrials 267.10 3.43% 08.05.2013 UPM1V FH Equity UPM-KYMMENE OYJ Materials 8.73 6.87% 08.04.2013 30.39 29.45 29.43 31.80 -0.093 -0.144 -0.155 -0.141 0.015 0.002 0.001 0.002 ATLN VX Equity ACTELION LTD-REG Health Care 47.63 1.68% 06.05.2013 33.62 33.19 32.98 32.39 32.37 32.08 -0.198 -0.115 -0.095 -0.053 -0.037 -0.033 0.009 0.006 0.005 0.001 0.001 0.001 WEIR LN Equity WEIR GROUP PLC/THE Industrials 1741.00 2.19% 01.05.2013 AGS BB Equity AGEAS Financials 19.83 4.79% 29.04.2013 33.09 33.36 33.41 32.69 34.33 34.07 34.95 -0.240 -0.226 -0.216 -0.131 -0.025 -0.024 -0.015 0.015 0.004 0.003 0.003 0.001 0.000 0.000 WRT1V FH Equity WARTSILA OYJ ABP Industrials 26.53 3.49% 04.03.2013 BNZL LN Equity BUNZL PLC Industrials 1110.00 2.53% 08.05.2013 WKL NA Equity WOLTERS KLUWER Consumer Discretionary 15.00 4.80% 29.04.2013 17.53 17.47 17.92 19.18 21.04 20.62 21.33 -0.350 -0.233 -0.223 -0.221 -0.128 -0.090 -0.067 0.028 0.015 0.011 0.005 0.002 0.002 0.003 ABE SQ Equity ABERTIS INFRAESTRUCTURAS SA Industrials 11.93 5.53% 31.10.2012 25.61 25.20 24.71 24.00 23.74 23.37 23.32 -0.213 -0.214 -0.204 -0.179 -0.132 -0.120 -0.132 0.006 0.001 0.000 0.002 0.002 0.002 0.002 GETIB SS Equity GETINGE AB-B SHS Health Care 196.20 2.04% 29.04.2013 22.09 20.43 20.89 22.36 -0.250 -0.281 -0.271 -0.195 0.036 0.018 0.012 0.002 ELUXB SS Equity ELECTROLUX AB-SER B Consumer Discretionary 162.70 4.00% 03.04.2013 32.80 30.10 28.56 31.03 31.42 -0.211 -0.262 -0.230 -0.166 0.059 0.018 0.008 0.004 0.001 0.000 LUX IM Equity LUXOTTICA GROUP SPA Consumer Discretionary 28.31 1.91% 20.05.2013 17.58 18.80 19.40 20.39 21.68 21.68 -0.314 -0.312 -0.279 -0.185 -0.099 -0.099 0.017 0.006 0.004 0.003 0.001 0.001 UMI BB Equity UMICORE Materials 39.29 2.93% 26.04.2013 26.81 27.15 27.16 26.81 27.07 27.07 -0.299 -0.274 -0.248 -0.164 -0.034 -0.034 0.017 0.007 0.005 0.002 -0.001 -0.001 UCB BB Equity UCB SA Health Care 44.88 2.30% 02.05.2013 21.58 21.60 22.16 23.76 25.16 25.16 -0.306 -0.212 -0.176 -0.112 -0.060 -0.060 0.020 0.009 0.007 0.004 0.002 0.002 AMEC LN Equity AMEC PLC Energy 1102.00 3.04% 28.11.2012 AKE FP Equity ARKEMA Materials 74.23 2.16% 29.05.2013 33.93 33.93 33.51 32.68 34.96 34.96 -0.147 -0.147 -0.143 -0.126 -0.089 -0.089 0.004 0.004 0.004 0.002 0.002 0.002 ALFA SS Equity ALFA LAVAL AB Industrials 120.80 3.31% 29.04.2013 30.75 28.80 26.99 28.31 30.57 -0.247 -0.209 -0.190 -0.147 -0.059 0.040 0.015 0.011 0.003 0.000 BVI FP Equity BUREAU VERITAS SA Industrials 81.95 1.77% 11.06.2013 14.62 14.55 14.51 14.38 14.57 14.30 -0.180 -0.122 -0.076 0.008 0.012 0.014 0.012 0.007 0.005 0.000 0.000 0.000 Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |