Tax material

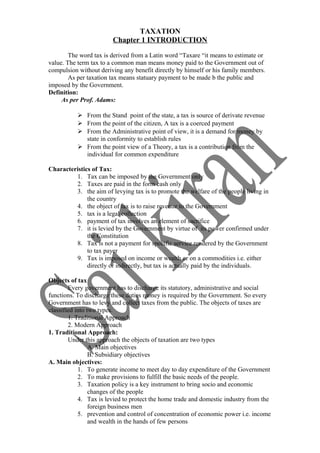

- 1. TAXATION Chapter 1 INTRODUCTION The word tax is derived from a Latin word “Taxare “it means to estimate or value. The term tax to a common man means money paid to the Government out of compulsion without deriving any benefit directly by himself or his family members. As per taxation tax means statuary payment to be made b the public and imposed by the Government. Definition: As per Prof. Adams: From the Stand point of the state, a tax is source of derivate revenue From the point of the citizen, A tax is a coerced payment From the Administrative point of view, it is a demand for money by state in conformity to establish rules From the point view of a Theory, a tax is a contribution from the individual for common expenditure Characteristics of Tax: 1. Tax can be imposed by the Government only 2. Taxes are paid in the form cash only 3. the aim of levying tax is to promote the welfare of the people living in the country 4. the object of tax is to raise revenue to the Government 5. tax is a legal collection 6. payment of tax involves an element of sacrifice 7. it is levied by the Government by virtue of its power confirmed under the Constitution 8. Tax is not a payment for specific service rendered by the Government to tax payer 9. Tax is imposed on income or wealth or on a commodities i.e. either directly or indirectly, but tax is actually paid by the individuals. Objects of tax Every government has to discharge its statutory, administrative and social functions. To discharge these duties money is required by the Government. So every Government has to levy and collect taxes from the public. The objects of taxes are classified into two types. 1. Traditional Approach 2. Modern Approach 1. Traditional Approach: Under this approach the objects of taxation are two types A. Main objectives B. Subsidiary objectives A. Main objectives: 1. To generate income to meet day to day expenditure of the Government 2. To make provisions to fulfill the basic needs of the people. 3. Taxation policy is a key instrument to bring socio and economic changes of the people 4. Tax is levied to protect the home trade and domestic industry from the foreign business men 5. prevention and control of concentration of economic power i.e. income and wealth in the hands of few persons

- 2. 6. A good taxation system provides redistribution of income and wealth i.e. making the lower income people to become rich and the rich not to grow at a faster rate Subsidiary objectives 1. One of the economic objective of imposing taxes is for formation of public capital for the rapid development of the economy 2. In times scarcity of a commodity heavy taxation or high tax rate reduces the domestic consumption 3. To encourage savings and channelise such savings into instruments in the form of shares of limited companies. Modern Approach The basic objective of taxation in the olden days is to raise the revenue by the government to meet its costs like administration cost, maintenance of law and order to provide defense against external threats. But in the modern days the taxation policy is an important tool to reduce inequalities of income and wealth and to promote economic development. The objects of modern approach 1. Increasing employment opportunities 2. Reducing regional imbalance 3. Production of domestic industries from the competition of foreign industries 4. Promoting capital formation 5. Promoting exports and restricting imports. 6. Rapid economic development 7. Regulating production from the national point of view 8. Regulating consumption of particular commodity DIRECT TAXES A direct tax is one in which the immediate and ultimate burden will be on the same person. Direct tax are those which are imposed on a person income or wealth and the tax liability cannot transfer to other persons i.e if tax is levied directly on a same person’s income or wealth then it is known as direct tax. A direct tax is paid to the Government by the person on whom it is imposed. Example: Income tax, Wealth tax and professional tax. Merits of direct taxes: 1. Economy: The cost of collecting direct taxes is low as compares to indirect taxes. The payment of these taxes is made directly to the Government no mediators involve. 2. Certainty: The Government declares tax rates and rules and regulations related to direct taxes in every financial year. So as for the tax rates tax payer know how much and when he has to pay tax and the Government also knows equally about the tax revenue likely to be received. 3. Elasticity: Direct taxes are elasticity in nature. Government can increase its revenue by increasing tax rate and by withdrawing the deductions and exemptions. 4. Equity: Direct taxes are equitable because rich has to more pay tax and poor man pay low tax or no tax.

- 3. 5. Convenience: Most of the direct taxes are collected at the source of income itself as such it is convenient to the tax payer and also for Government. 6. Civics Responsibility: The direct taxes are create civic responsibility among the tax payers about their contribution to the revenue of the Government for welfare of country. 7. Less possibility of shortage: The possibility of shortage in the amount collected as direct taxes are very rare. The person who are payable tax they remit the amount tax department with in the time stipulated. Because there is any delay or default in payment then he person has to pay interest, penalty etc. and also subject to other punishment under law. 8. Reducing the inequalities: The main aim of direct tax is to reduce the inequalities in the country. These taxes ultimately affect the rich persons and if the Government spends the amount on increase the income of the poor people. Demerits of direct taxes: 1. Unpopular: Direct taxes are not popular when compared to indirect taxes. No person is willing to pay part of income or wealth towards taxes i.e people will appose imposition of taxes. 2. Inconvenience: Indirect taxes are convenient because these taxes are included in price of goods. Under direct tax laws, tax payer are required to maintain the accounts of the income, savings and capital expenditure etc. and the same is to be submitted to the tax department at the time of filing returns.. If he fails to file the returns in time it becomes offense which causes inconvenience to the tax payers. 3. Complex laws: Generally the provisions of direct taxes contain deduction, exemptions and chargeability of income etc. To a common man it becomes a problem to understand the provisions of the Act. So the must be depends on tax consultants. 4. Possibility of evasion: In case of direct taxes there is maximum chance of tax evasion compared with indirect taxes by hiding incomes of tax payers. 5. Arbitrary tax rates: Tax rates are fixed by the minister in charge with the help of tax department officials who may not possess the knowledge to assess the tax payment capacity of the people. INDIRECT TAXES Tax is levied on the price of goods and services then it is known as indirect tax. Indirect tax is collected by middle men in the channels of distributions of goods and it is remitted to the Government. Indirect taxes are the taxes charged to a business man, first pays the tax and later on he shifts the tax burden to ultimate consumer by charging high price. The price charged to a consumer includes cost of goods, profit margin of the seller and indirect taxes paid by him at the time of purchases or productions of the goods. Merits of indirect taxes: 1. Convenience: Indirect taxes are included in the price of the goods and services and as such tax payer is not aware of tax payment while purchasing the goods and services. Since

- 4. the tax is paid, tax payer is aware of the payment of tax but he does not feel it as a burden. 2. Productivity: Indirect taxes are highly productivity. By imposing few taxes government can get huge revenue. Government can impose tax on selected goods and services whose demand is inelastic. 3. Minimum evasion: Generally indirect taxes are levied and collected at the time of production or purchases of goods by the business man and the scope for evasion is minimum. 4. Wide coverage: Indirect tax covers most of the people irrespective of rich or poor will make the contribution to the Government.i.e. indirectly it is helping one and all to participate for the development of the nation. Demerits of indirect taxes: 1. Uncertainty: Revenue to be collected through indirect taxes contains uncertainty because it is not easy to estimate the demand for goods, which are influenced by the number of factors. 2. Violation of ability to pay principle: Both reach and poor have to pay the same price for the goods i.e. both have to pay same amount of tax, and this is against to the principal of the taxation. 3. Inflationary in nature: Indirect taxes lead to a rise in prices. The increase in the prices of the raw material, finished goods etc. create inflationary trends in the economy. 4. High cost of collection: Administration cost of collecting indirect taxes may be high because they have to be collected from large number of persons that to in small amount. 5. Absence of civic responsibility: Indirect taxes are collected through middle man like traders. The tax pays does not feel the payment of tax while purchasing goods i.e. indirect taxes may not create the civic responsibility in the minds of people. Difference between Direct taxes and Indirect taxes Direct Taxes Indirect Taxes 1. Direct taxes are levied on income or wealth of a person Indirect taxes are levied on prices of goods and services 2. The tax payer knows the tax liability, time and amount of tax to be paid The consumer has no idea about tax paid by him because the tax is included in the price of goods charged by the business men 3. Increase in tax rate may reduce savings and investment by the public. Increase in the rate will help to control the inflation Increase in the tax rate is reduce consumption and increase the prices of goods 4. There is a scope of tax evasion is maximum, either by not paying tax or tax payer may understate the income or wealth by suppressing the actual facts. The scope for tax evasion by the consumer is not there, but right from the manufacture to the retailer, the scope for tax evasion is possible by showing less production or sales

- 5. 5. The Government has to establish link with every tax payer as such the cost of collecting tax is high. The cost of collecting taxes to the government is low when compared to direct taxes, because these taxes are collets directly from the manufacturer and business men. 6. Ability of the tax payer is taken into account i.e. collect more tax from rich and less or no tax from poor people and thus it is satisfies the principle of equity Ability of the payer is ignored both rich and poor have pay the same amount of tax it is against the principle of tax 7. The tax payer having civic responsibility The tax payer may not posses civic responsibility Types of taxes 1. DUTY: Imposition of tax to regulating industrial production, and control export and imports of the goods is known as Duty. Example: Central Government levied Excise duty on goods manufacture in India and custom duty on export and import. 2. CESS: If any tax is levied for a specific purpose then it is known as “Cess”. For example Education cess, it is levied for promoting education in the country. 3. SURCHARGE: Tax on tax is known as “Surcharge”. It is levied by the central Government with object of collecting higher tax in short period of time. The surcharge levied and collected by the Central Government is not made available to the State Government as their share. Surcharge can be levied on Income tax and Customs or other duties which are in the list of Central Government. Example: Income tax assessees whose status is Company, if their total income is more than Rs. 1 crore then surcharge is levied 7.5% on their income tax. 4. OCTROI: If tax is levied by Local bodies or Municipalities on the goods brought from the other parts of the country by traders for sale onto their jurisdiction limits then it is known as Octroi. This tax is also known as Entry tax. 5. TERMINAL TAX: It is the tax levied by Local bodies or Municipalities on the goods leaving for sale from their boundaries into other parts of the country. 6. TOLL TAX: This tax is paid by vehicular travelers. The persons who are traveling in car, bus, jeep etc. for using the road or bridge to reach their destination have to pay the tax. Toll tax is collected not only from passengers travel vehicles but it is also collected from truck, lorries carrying the goods for transportation.

- 6. Chapter 2 - BASIC CONCEPTS 1. ASSESSEE (Sec 2(7)): Assessee is a person by whom any tax or any other sum of money such as interest and penalty etc. due under the Income tax Act. or in respect of whom any proceedings under the Act has been taken for the assessment if his income or the income of the other persons for which he assessable or any refund due to him or to such persons. The term ‘Assessee’ includes following persons. 1. Every person in respect of whom any proceeding under this Act has been taken for the assessment of his income. For the current assessment year 2012-2013 if an individual’s total income is exceeds limit i.e. Rs.1,80,000 for men Rs.1,90,000 for women Rs.2,50,000 for senior citizen and Rs.5,00,000 for super senior citizen he has to fill returns otherwise I.T.O will issue the notice and proceedings initiated. Such person is known as an assesee. 2. A person whom a refund is due. 3. Every person who is deemed to be an assessee e.g. Guardian or trustee in case of minor or trust’s income exceeds limit as per this Act. 4. Every person who is deemed to be an assessee in default under provisions of this Act. e.g. Employer in case of tax deducted at source of employees PERSON (Sec.2 (3)): According to sec.2 (31) every person having a taxable income i.e. more than exempted limit is liable to pay tax. Hence the term person is a very important it is includes following types of assesses. 1. Individual: It refers to a natural living human being whether male or female o minor or major 2. Hindu undivided family:

- 7. A HUF means a group of persons lineally descended from a common ancestor. The head of the HUF is known as “KARTHA” and its members are called “co- parceners”. Karhta is assessed for the income derived from the Joint Hindu family. 3. Company: A company which is incorporated under the Companies Act. of 1956. 4. Firm: A partnership of two or more persons carrying on a business or profession under the Indian Partnership Act.1932. 5. An Association of Persons or Body of Individuals: A group of persons formed for promoting a joint venture, business or trustee of a trust etc. 6. Every other Artificial Judicial person: A public corporation established under a Special Act. of legislature like University, Hindu deity ASSESSMENT YEAR (Sec 2(a)): Assessment year means the period of 12 months commencing from 1st April of every year and ending on 31st March of next. This is also known as financial year. The current assessment year is 2012-2013. It is starts on 1st April. 2012 and ends on 31st March, 2013. It is the year during which income of a person relating to the relevant previous year is assessed to tax. Every person who is liable to pay tax field return during assessment year on prescribed date. It is year which whole of the process of assessment is done. PREVIOUS YEAR (Sec.3) Previous year is the preceding 12 months period in the relevant assessment year. It is starts on 1st April and ends on 31st March of next. The income earned during the above period is considered for tax purpose; therefore it is also known as Income year or Accounting year Previous year is financial year immediately proceeding to the assessment year. Present previous year is 2011-2012 i.e. 1st April, 2011 to 31st March, 2012. 1. Previous year for continuing business: It is the financial year proceeding to the relevant assessment year. 2. Previous year in case of newly started business: The previous year for newly started business shall be the period between commencement of business and 31st March next following. 3. Previous year in case of a newly crated source of income: In such case the previous year shall be the period between the day which such source comes into existence and 31st March next following. PREVIOUS YEAR FOR DEEMED INCOMES:

- 8. Incomes which are belongs to assessee found by the assessing officer in the books of accounts, if the explanation given by the assesee about these incomes is not satisfactory to the assessing officer then these incomes treated as deemed incomes. The following are the deemed incomes: 1. Unexplained Cash credit (Sec.68): It is a credit in the of accounts books of assessee for which the assessee is not in a position to give satisfactory explanation to the assessing officer then the same will be treated as deemed as income of the previous year. 2. Unexplained Investments (Sec.69): The investment possessed by the assessee which are not record in the books of accounts they are found by the assessing officer, then assessee is unable to give satisfactory explanation to the officer then it is treated as deemed as income for the previous year in which they are made. 3. Unexplained money or jewelry or any other assets (Sec.69A): When the assessee is found with the excess money then the balance shown by the cash book or holding jeweler or valuable articles which are not record in the books and the assessee is not in position to explain how he has acquired these, in such a case they will be treated deemed as income of the financial year in which they have found in the possession. 4. Investments not fully disclosed (Sec.69B): If the assessee has understated the amount of investments in the books the understated amount of investment shall be deemed to be income of the assessee for the year in which such investments have been made. 5. Un-explained expenditure (Sec.69C): If assesee spend money on marriage, party or on other items but he is unable to satisfy the authorities on the source of income from where such amount was spent it called unexplained expenditure and it is treated deemed as income of the previous year in which such expenditure is incurred. 6. Payment of Hundi Money in cash (Sec.69D): Every payment against hundi must be made through account payee cheque. In case such payment made in cash, it shall be deemed as income of the year in which such payment is made. EXCEPTIONS FOR GENARAL RULE OF PREVIOUS YEAR: The general rule is that the incomes earned during the year is put t tax in the relevant assessment year. But there are certain exceptions to the general rule. In these cases income is taxed in the year in which it is earned. These exceptions are: 1. Shipping business income of non resident person having no agent in India (Sec.172) 2. In case of person leaving India with no intention to return back during current previous Year (Sec.174) 3. In case of persons who are likely to transfer the asset to avoid tax (Sec.175) 4. In case of discontinue business (Sec.176) 5. Income of bodies formed for short duration. RESIDENTIAL STATUSE Income tax is chargeable in respect of total income of a person earned during the year. The scope of the total income depends upon the residential status of the

- 9. person. What incomes are to be included and excluded in computing total taxable income. i.e. the income earned and received in India only is to be taxed or the income earned and received in outside India is also taxed depends upon the residential status of the assessee in the relevant previous year. If the residential status of a person is “Resident “then he has to pay tax on global income i.e. income received in India and also on the income received outside India. If the residential status of a person is “Non- Resident “then he has to pay tax on the income received in India only Determination of Residential Status Sec.6 Income tax Act 1961 Sec.6 contains the provisions for determining the residential status of different types of persons. For determining of residential statue the PERSONS are classified as follows. 1. Individual 2. Hindu Undivided Family 3. Firm and Association of Persons (AOP) 4. Companies 5. Every other persons Residential Status of Individual The residential status of an Individual is determining in three types. They are 1) Resident and Ordinary Resident 2) Resident and but not Ordinary Resident 3) Non-Resident Conditions for Determination of Residential Status For determination of residential status of Individual two sets of conditions are considered I. Basic conditions II. Additional conditions I. Basic conditions These basic conditions are considered for determine weather the person is Resident or Non-Resident. The basic conditions are two types 1. He is in India for a minimum period of 182 days in relevant previous year. 2. He is in India for a period of 60 days or more during the relevant previous year and 365 days or more during the Four years preceding to the relevant previous year. Exception to the General Rule in Special Situation For the following person, the first basic condition only has to be applied to determine the residential status i.e. no need to apply second basic condition. a) An Indian citizen leaving the country during the previous year for employment outside India. b) An Indian citizen or a person of an Indian origin visiting India during the previous year. c) An Indian citizen who is a member of crew in the ship If a person satisfies one or both of the two basic conditions then he will be considered as “ Resident “ If a person fails to satisfies any one of the two basic conditions then he will be treated as “ Non-Resident “ If the status of person is “Resident “then only apply the tests of additional conditions. If an assessee is a “Non-Resident” the tests of additional conditions are not to be applied.

- 10. Additional conditions: Additional conditions are to be applied if the residential status of an individual is “Resident”. Additional conditions are two. They are 1. He has been resident in India for 2 out of 10 previous years preceding to the relevant previous year 2. He has been resident in India for a period of 730 days or more during 7 years preceding to the relevant previous year. If an individual satisfies both the additional conditions then he will be treated as “ Resident and Ordinary Resident “ IF an individual satisfies any one of the two or none of the additional conditions then he will be considered as “Resident and not Ordinary Resident Residential Status of Hindu Undivided Family The joint Indian family is known as Hindu Undivided Family. The head of the H.U.F is known as KARTHA. Kartha is assessed for the family income and as such he is liable to pay tax on it. The other members of the family are known as coparceners are not liable to pay tax on family income. If the Katha for any reason relinquishes his responsibility, one of the coparcener has to manage the affairs, and then the member will be designated as the manager. The residential status of H.U.F is determining in three types. They are 1) Resident and Ordinary Resident 2) Resident and but not Ordinary Resident 3) Non-Resident Conditions for Determination of Residential Status For determination of residential status of Individual two sets of conditions are considered I. Basic conditions II. Additional conditions I. Basic conditions These basic conditions are considered for determine weather the H.U.F is Resident or Non-Resident. To determine the residential status of H.U.F first control and management of affairs is to be considered. 1. If the place of control and management of affairs of the H.U.F is wholly or partly situated in India then it is treated as “ Resident “ 2. If the place of control and management of affairs of the H.U.F is wholly situated in outside India then it is treated as “ Non-Resident “ Additional conditions: Additional conditions are to be applied if the residential status H.U.F is “Resident” i.e. If H.U.F status is Non-Resident then tests of additional conditions are not to be applied. Additional conditions are two. They are 1. The Kartha or the Manager of the H.U.F has been resident in India for 2 out of 10 previous years preceding to the relevant previous year 2. The Kartha or the Manager of the H.U.F has been resident in India for a period of 730 days or more during 7 years preceding to the relevant previous year. If the H.U.F satisfies both the additional conditions then it will be treated as “ Resident and Ordinary Resident “

- 11. If the H.U.F satisfies any one of the two or none of the additional conditions then it will be treated as “Resident and not Ordinary Resident “. Residential Status of the Firm and Association Of Persons (AOP) The residential status of Firm and AOP determine in two types 1. Resident 2. Non-Resident To determine the residential status of Firm and AOP place of control and management of affairs is to be considered. 1. If the place of control and management of affairs of the Firm and AOP is wholly or partly situated in India then it is treated as “ Resident “ 2. If the place of control and management of affairs of the Firm and AOP is wholly situated in outside India then it is treated as “ Non-Resident “ Residential Status of Company The residential status of Company determine in two types 1. Resident 2. Non-Resident To determine the residential status of Company place of control and management of affairs is to be considered. 1. If the place of control and management of affairs of the Company is wholly situated in India then it is treated as “ Resident “ 2. If the place of control and management of affairs of the Company is wholly or partly situated in outside India then it is treated as “ Non- Resident “ Special Note: Control and management means the place of where the meeting of board of directors is held and not the place of where employers, managers will carry on their jobs. INCIDENCE OF TAX Sec. 5 of the Income Tax Act 1961 deals with scope of the total income. The total taxable income of the person is depends upon the residential status of the person in the relevant previous year. i.e. including of income earning in India and income earning in out side India in total taxable income is depends on the residential status of the person in the relevant previous year. Types of Incomes Incomes are classified into two types 1. Indian Income 2. Foreign Income 1. Indian Income:

- 12. The following incomes are considered as Indian Incomes i). Income earned or accrued in India and received in India is India Indian Income E.g. Salary received by the employee from the employer for services rendered in India. ii). Income Earned or accrued in India but received outside is India Indian Income E.g. A foreign company wholly controlled managed from India declared dividends and the dividends received by the shareholders out of India iii). Income earned or outside India but such income received in India is Indian Income E.g. Income from business outside India received in India. 2. Foreign Income: Income earned outside India and received outside India is Foreign Income E.g. Profit from business outside India received in outside India Tax liability of the assesse based on the Residential status: 1) Resident and Ordinary Resident: An assesee’s residential status is “Ordinary Resident” during the relevant previous year then he has to pay tax on both incomes i.e. Indian Income and Foreign Income. 2) Resident and but not Ordinary Resident: An assesee’s residential status is “Not Ordinary Resident” during the relevant previous year then he has to pay tax on Indian Income and Income from business outside India and controlled from India 3) Non-Resident: An assesee’s residential status is “Non-Resident” during the relevant previous year then he has to pay tax on Indian Income only. Summarized Table Type of Incomes Resident & Ordinary Resident Resident & Not Ordinary Resident Non- Resident 1.Income earning and received in India 2.Income earning in India and received in outside India 3. Income earning in outside India and received in India 4. Income from business outside India Taxable Taxable Taxable Taxable Taxable Taxable Taxable Taxable Taxable Taxable Taxable Not Taxable

- 13. which is controlled from India 5. Income earning in Outside India and received in outside India. Taxable Not Taxable Not Taxable