JLL Dayton Office Report Summer 2020

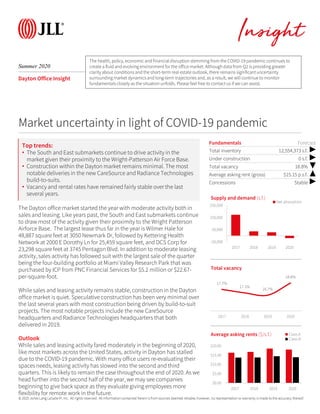

- 1. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Market uncertainty in light of COVID-19 pandemic Insight Summer 2020 Dayton Office Insight The Dayton office market started the year with moderate activity both in sales and leasing. Like years past, the South and East submarkets continue to draw most of the activity given their proximity to the Wright Patterson Airforce Base. The largest lease thus far in the year is Wilmer Hale for 48,887 square feet at 3050 Newmark Dr, followed by Kettering Health Network at 2000 E Dorothy Ln for 25,459 square feet, and DCS Corp for 23,298 square feet at 3745 Pentagon Blvd. In addition to moderate leasing activity, sales activity has followed suit with the largest sale of the quarter being the four-building portfolio at Miami Valley Research Park that was purchased by ICP from PNC Financial Services for $5.2 million or $22.67- per-square-foot. While sales and leasing activity remains stable, construction in the Dayton office market is quiet. Speculative construction has been very minimal over the last several years with most construction being driven by build-to-suit projects. The most notable projects include the new CareSource headquarters and Radiance Technologies headquarters that both delivered in 2019. Outlook While sales and leasing activity fared moderately in the beginning of 2020, like most markets across the United States, activity in Dayton has stalled due to the COVID-19 pandemic. With many office users re-evaluating their spaces needs, leasing activity has slowed into the second and third quarters. This is likely to remain the case throughout the end of 2020. As we head further into the second half of the year, we may see companies beginning to give back space as they evaluate giving employees more flexibility for remote work in the future. Top trends: • The South and East submarkets continue to drive activity in the market given their proximity to the Wright-Patterson Air Force Base. • Construction within the Dayton market remains minimal. The most notable deliveries in the new CareSource and Radiance Technologies build-to-suits. • Vacancy and rental rates have remained fairly stable over the last several years. Fundamentals Forecast Total inventory 12,554,373 s.f. ▶ Under construction 0 s.f. ▶ Total vacancy 18.8% ▼ Average asking rent (gross) $15.15 p.s.f. ▲ Concessions Stable ▶ -50,000 50,000 150,000 250,000 2017 2018 2019 2020 Supply and demand (s.f.) Net absorption 17.7% 17.1% 16.7% 18.8% 2017 2018 2019 2020 Total vacancy $0.00 $5.00 $10.00 $15.00 $20.00 2017 2018 2019 2020 Average asking rents ($/s.f.) Class A Class B The health, policy, economic and financialdisruption stemming from the COVID-19 pandemic continues to create a fluid and evolving environment for the office market. Although data from Q2 is providing greater clarity about conditions and the short-term real estate outlook, there remains significant uncertainty surrounding market dynamics and long-term trajectories and, as a result, we will continue to monitor fundamentalsclosely as the situation unfolds. Please feel free to contact us if we can assist. © 2020 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof.

- 2. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Summer 2020 Dayton Office Market Statistics Methodology: JLL tracks office buildings ≥20,000 square feet. Government, medical and owner-occupied buildings are excluded. Class Inventory (s.f.) Total Availability (s.f.) Total Availability (%) Average direct asking rent ($ p.s.f.) CBD Totals 5,209,080 529,254 24.0% $14.41 East Totals 2,376,014 251,887 10.6% $18.89 North Totals 801,769 169,350 21.1% $14.31 South Totals 4,051,360 691,883 17.1% $15.70 Upper Valley Totals 74,138 13,403 18.1% $18.00 West Totals 116,150 - 0.0% $0.00 Suburbs Totals 7,345,293 1,113,120 15.2% $16.15 Dayton Totals 12,554,373 2,363,467 18.8% $15.15 CBD A 1,877,943 529,254 28.2% $16.84 East A 1,226,952 136,584 11.1% $23.94 North A 141,150 22,957 16.3% $17.50 Suburbs A 2,869,170 293,178 10.2% $20.76 Dayton A 4,747,113 822,432 17.3% $18.02 CBD B 3,331,137 721,093 21.6% $12.99 East B 1,149,062 115,303 10.0% $16.44 North B 660,619 146,393 22.2% $13.64 South B 2,550,292 558,246 21.9% $14.86 Upper Valley B 74,138 13,403 18.1% $18.00 West B 116,150 - 0.0% $0.00 Suburbs B 4,476,123 819,942 18.3% $14.88 Dayton B 7,807,260 1,541,035 19.7% $13.89 © 2020 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof.

- 3. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Summer 2020 Dayton Office Market Market activity 3 Sale Lease 1 2 6 4 Address: 2661 Commons Blvd Lease Size: 14,900 Move Date: Q2 2020 Tenant: DeciBel Research 4 5 Address: 424 E First St Lease Size: 5,500 Move Date: Q2 2020 Tenant: Brackett Builders Inc 1 Address: 1 S Main St Square Feet: 343,236 Price: $7,444,947 Price/SF: $21.69 Buyer: R.L.R Investments, LLC Seller: CWCapital Asset Management, LLC This dashboard analyzes a partial list of office market activity in the Dayton market YTD 5 2 Address: 3050 Newmark Dr Lease Size: 48,887 Move Date: Q1 2020 Tenant: Wilmer Hale 3 Address: 3745 Pentagon Blvd Lease Size: 23,298 Move Date: Q1 2020 Tenant: DCS Corp 6 Building Park: Miami Valley Research Park Square Feet: 229,366 Price: $2,224,363 Price/SF: $22.24 Buyer: ICP, LLC Seller: PNC Financial Services Group, Inc. © 2020 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof.

- 4. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Andrew Batson Vice President, Director of Research +1 216 937 4374 andrew.batson@am.jll.com Employment Abby Armbruster Senior Research Analyst +1 513 252 2148 abby.armbruster@am.jll.com Contact: 11.7%U.S. unemployment -9.5%U.S. 12-month job growth 12.7%Dayton unemployment -11.2%Dayton 12-month job growth 13.7%Ohio unemployment -13.6%Ohio 12-month job growth Summer 2020 Dayton Office Market -18.0% -15.0% -12.0% -9.0% -6.0% -3.0% 0.0% 3.0% 201 3 201 4 201 5 201 6 201 7 201 8 201 9 Dayton U.S. Job growth* Historical employment Office employment* * Represents 12-month change in employment. All charts represent the latest economic data available from the Bureau of Labor Statistics as of May 2020. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. 0% 4% 8% 12% 16% 100,000 200,000 300,000 400,000 500,000 2013 2014 2015 2016 2017 2018 2019 2020 Employment Unemployment -5.0 -3.0 -1.0 1.0 3.0 5.0 7.0 2014 2015 2016 2017 2018 2019 2020 Professional & Business Services Information Government Financial Activities © 2020 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof.