Malta's International Legal Firm Guide to Residency

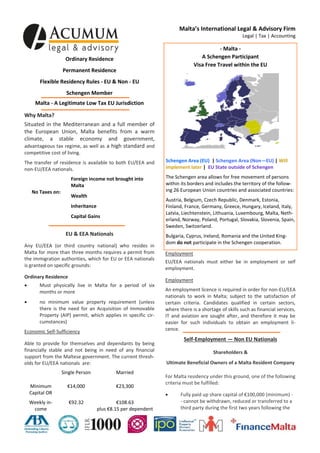

- 1. Malta’s International Legal & Advisory Firm Legal | Tax | Accounting - Malta A Schengen Participant Visa Free Travel within the EU Ordinary Residence Permanent Residence Flexible Residency Rules - EU & Non - EU Schengen Member Malta - A Legitimate Low Tax EU Jurisdiction Why Malta? Situated in the Mediterranean and a full member of the European Union, Malta benefits from a warm climate, a stable economy and government, advantageous tax regime, as well as a high standard and competitive cost of living. The transfer of residence is available to both EU/EEA and non-EU/EEA nationals. Foreign income not brought into Malta No Taxes on: Wealth Schengen Area (EU) | Schengen Area (Non—EU) | Will implement later | EU State outside of Schengen The Schengen area allows for free movement of persons within its borders and includes the territory of the following 26 European Union countries and associated countries: Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherland, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland. Inheritance Capital Gains EU & EEA Nationals Any EU/EEA (or third country national) who resides in Malta for more than three months requires a permit from the immigration authorities, which for EU or EEA nationals is granted on specific grounds: Ordinary Residence Must physically live in Malta for a period of six months or more no minimum value property requirement (unless there is the need for an Acquisition of Immovable Property (AIP) permit, which applies in specific circumstances) Economic Self-Sufficiency Able to provide for themselves and dependants by being financially stable and not being in need of any financial support from the Maltese government. The current thresholds for EU/EEA nationals are: Single Person Married Minimum Capital OR €14,000 €23,300 Weekly income €92.32 €108.63 plus €8.15 per dependent Bulgaria, Cyprus, Ireland, Romania and the United Kingdom do not participate in the Schengen cooperation. Employment EU/EEA nationals must either be in employment or self employment. Employment An employment licence is required in order for non-EU/EEA nationals to work in Malta; subject to the satisfaction of certain criteria. Candidates qualified in certain sectors, where there is a shortage of skills such as financial services, IT and aviation are sought after, and therefore it may be easier for such individuals to obtain an employment licence. Self-Employment — Non EU Nationals Shareholders & Ultimate Beneficial Owners of a Malta Resident Company For Malta residency under this ground, one of the following criteria must be fulfilled: Fully paid up share capital of €100,000 (minimum) - cannot be withdrawn, reduced or transferred to a third party during the first two years following the

- 2. Malta’s International Legal & Advisory Firm Legal | Tax | Accounting Malta Residency Handbook issue of the Employment Licence Capital expenditure of €100,000 (minimum) to be used by the company, i.e fixed assets - immovable property, plant and machinery. Rental contracts do not qualify Company is leading a project, formally approved by Malta Enterprise and the Employment and Training Corporation. Applications containing a firm commitment to engage EEA/Swiss/Maltese nationals will assist in the favourable consideration of an application Status of a highly skilled innovator, with a sound business plan, committed to recruiting at least three EU/ EEA nationals within eighteen months of establishment of business Education Temporary residence is granted for the entire period of education to students in any Private School, College, or at the University of Malta. If the student is a minor, his or her legal guardian can apply for Malta residence to accompany him or her. The accompanying individual must confirm that he or she is in receipt of stable and regular income and has a suitable place to live. Income Tax Individuals who are ordinarily resident, but not domiciled in Malta, are subject to income tax on income arising in Malta, on income arising outside Malta but received in Malta and on capital gains arising in Malta. No tax is chargeable on capital gains which arise overseas but which are remitted to Malta. Personal income tax is charged at progressive rates up to a maximum of 35 per cent, as illustrated by the following tables: Or: Deduct € Chargeable Income € 0 - 11,900 If a director is not a shareholder, the above criteria does not need to be met, however labour market considerations will apply - Malta’s situation in respect of surpluses or shortages in the given occupation and sector, the third country national's skill level, relevant experience and overall suitability for the position in question. Long-Term Residence Long-term residence status may be granted to individuals who have been legally residing in Malta for five continuous years. The term “continuous” means that such individuals must not have absented themselves from Malta for more than six consecutive months in any given year of the said five-year period and further must not have been absent from Malta for more than a total of ten months throughout this five year period. Residency Granted by Other EU State A third country national who has been granted long-term residence status by another Member State other than Malta, may reside in Malta, for a period exceeding three months, for the exercise of an economic activity in an employed or self-employed capacity, provided that such person is in possession of an employment licence; is pursuing studies or vocational training; or is engaged in other such activities. 0.25 3,905 0.32 5,914 0.35 7,714 0 0 0.15 1,275 14,501 19,500 0.25 2,725 19,501 60,000 0.32 4,090 60,001 and over 0.35 5,890 0 - 9,300 0 0 9,301 - 15,800 Excellence| Superb Client Service | Cost Efficient 21,201 28,700 8,501 - 14,500 0.15 1,395 15,801 21,200 0.25 2,975 21,201 60,000 0.32 4,459 60,001 and over Parent Rates 1,785 0 - 8,500 Single Rates 0.15 60,001 and over Married Rates 0 28,701 60,000 (sound reputation and established for at least three years abroad) wishing to open a branch in Malta. 0 11,901 21,200 Status of sole representative of an overseas company Rate 0.35 6,259 Dubai, Luxembourg & Portugal Representative Offices info@acumum.com | www.acumum.com | Skype ID: acumum Malta Office: +356 2778 1700 260 Triq San Albert, Gzira, GZR 1150, Malta (EU) Information for guidance purposes only © Acumum 2014 All Rights Reserved

- 3. Malta’s International Legal & Advisory Firm Legal | Tax | Accounting High Net Worth Individuals Scheme (HNWI) Special Tax Status for EU/EEA/Swiss Nationals Flat Rate 15% Income Tax (Non - EU Nationals: Please Refer to the Global Residency Programme) Malta - A Legitimate Low Tax EU Jurisdiction EU/EEA/Swiss nationals who are High Net Worth Individuals (HNWIs) who wish to reside in Malta may benefit from a special and favourable Malta tax status and incentives: Eligibility - Malta HNWI Rules A HNWI seeking to benefit from the favourable Malta tax treatment described above would be eligible to apply to the Malta tax authorities for confirmation of his/her special status as such provided that the following key conditions are satisfied (on an initial and ongoing basis): Acquires immovable residential property in Malta worth at least €400,000, or leases such property for a total annual rent of at least €20,000. The property need not be acquired or leased at application stage income arising outside Malta which is received in Malta is taxed in Malta at the flat rate of 15% 0% Malta tax chargeable on income arising outside Malta which is not received in Malta 0% Malta tax chargeable on capital gains realised outside of Malta even if these are received in Malta income and capital gains realised in Malta is taxable in Malta at the higher rate of 35% Double Taxation Relief A HNWI is also be entitled to relief of double taxation otherwise suffered on income arising outside of Malta which is received in Malta. Such relief would be available in the form of unilateral relief (in terms of the Malta Income Tax Act) or, alternatively, under a treaty in force between Malta and the country of source of the relevant income. The applicant and his/her family must occupy the residential property in Malta as their principal place of residence and no person other than the applicant and his/her family may reside in the property Be in receipt of stable and regular resources, sufficient to maintain him/herself and his/her dependants without recourse to the local social assistance system Be in possession of private health insurance which covers him/herself and his/her dependants in respect of all risks across the EU Must not be domiciled in Malta or be a long-term resident The applicant must be a fit and proper person Minimum Tax Payable However, after taking any double tax relief claimed into account, an EU/EEA/Swiss national HNWI would be required to make an annual minimum Malta income tax payment of at least €20,000 plus an additional €2,500 per dependant. Additional Tax Considerations Malta does not levy any wealth taxes or estate or such other duties. However, duty is chargeable in Malta upon any inter vivos or causa mortis transfer of immovable property or marketable securities when located or arising in Malta. Excellence| Superb Client Service | Cost Efficient Dubai, Luxembourg & Portugal Representative Offices info@acumum.com | www.acumum.com | Skype ID: acumum Malta Office: +356 2778 1700 260 Triq San Albert, Gzira, GZR 1150, Malta (EU) Information for guidance purposes only © Acumum 2014 All Rights Reserved

- 4. Malta’s International Legal & Advisory Firm Legal | Tax | Accounting Retirement Programme EU/EEA/Swiss Nationals 15% Flat Rate Income Tax Malta - A Legitimate Low Tax EU Jurisdiction Mediterranean Climate Low Crime Rate For retirees from EU, EEA countries and Switzerland when High Standard of Living bringing their pension into Malta, the Maltese Government Strategic EU Location has retained its very attractive retirement programme. Subject to acceptance on the Malta Retirement Programme Rules 2012, a fixed tax rate of only 15% is payable on any pension remitted to Malta with the minimum tax payable of €7,500 for the beneficiary of the programme and €500 for each of his/ her dependants (if any). The pension, which is received in Malta, must constitute at least 75% of the beneficiary's chargeable income. Therefore, the beneficiary may only generate up to 25% of his/her total chargeable income from any non-executive posts The main features of the Malta Retirement Programme Rules 2012 are: Must have health insurance in respect of all risks across the all the EU (also covering her/ her dependants, if any) The beneficiary must be an EU/ EEA/ Swiss national who is not in employment; Must not be domiciled in Malta and should not have any intention of so establishing his/her domicile in The beneficiary may Malta within a period of 5 years - hold a non-executive post on the board of a company resident in Malta, or - take part in activities relating to an institution, trust or The beneficiary must reside in Malta for a minimum of foundation of a public character, which is engaged in 90 days in each calendar year (the mentioned 90 days philanthropic, educational, or research and develop- are averaged over any 5-year period) ment work in Malta or Gozo The beneficiary must not reside in any other jurisdic- The beneficiary must purchase or rent property in tion for more than 183 days in any calendar year during which the retirement programme is availed of. Malta or Gozo. The rules establish minimum values of €275,000 (Malta), or €250,000 (Gozo) for purchased properties whilst for rented properties these minimum Acumum can take the hassle and strain and assist you in values are set at €9,600 per annum (Malta), or €8,750 retiring to Malta, please contact us for more information. (Gozo) Excellence| Superb Client Service | Cost Efficient Dubai, Luxembourg & Portugal Representative Offices info@acumum.com | www.acumum.com | Skype ID: acumum Malta Office: +356 2778 1700 260 Triq San Albert, Gzira, GZR 1150, Malta (EU) Information for guidance purposes only © Acumum 2014 All Rights Reserved

- 5. Malta’s International Legal & Advisory Firm Legal | Tax | Accounting - Malta A Schengen Participant Visa Free Travel within the EU Global Residency Programme Non - EU Nationals 15% Flat Tax Rate Malta - A Legitimate Low Tax EU Jurisdiction The Global Residence Program Rules (GRP) for non EU nationals, were recently brought into law on 30th June 2013 and substantially reduce the financial standards required by the previous residency programme. Schengen Area (EU) | Schengen Area (Non—EU) | Will implement later | EU State outside of Schengen The Benefits Foreign income not brought into Malta No Taxes on: The Schengen area allows for free movement of persons within its borders and includes the territory of the following 26 European Union countries and associated countries: Wealth Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherland, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland. Inheritance Capital Gains Persons who qualify for the GRP benefit from: For foreign income brought into Malta, a flat tax rate of Bulgaria, Cyprus, Ireland, Romania and the United Kingdom do not participate in the Schengen cooperation. 15%, subject to a minimum tax liability of €15,000, payto the Malta Government being assured that they are in able each year fact dependents The minimum tax covers income of that individual as well as that person’s spouse and dependents. Depend- Employees are also permitted to come to Malta under ents are children up to age 25, dependent brothers,, the GRP, subject to them having been employed for 2 sisters and direct relatives in an ascending line, subject years. Property Requirements North of Malta Gozo & South of Malta Purchase of Immovable Property €275,000 €220,000 Rental of Property €9,600 €8,750 Minimum Tax Payable €15,000 €15,000 Non-Refundable Application Fee €6,000 €5,500 Minimums Excellence| Superb Client Service | Cost Efficient Dubai, Luxembourg & Portugal Representative Offices info@acumum.com | www.acumum.com | Skype ID: acumum Malta Office: +356 2778 1700 260 Triq San Albert, Gzira, GZR 1150, Malta (EU) Information for guidance purposes only © Acumum 2014 All Rights Reserved

- 6. Malta’s International Legal & Advisory Firm Legal | Tax | Accounting Kirkop - Vittoriosa Income not brought into Malta is 0% taxed Any other income brought into (remitted to) Malta is subject to tax at 35%, including any bank interest in Malta and income from employment in Malta Luqa - Xgħajra - Marsascala - Żabbar Marsaxlokk - Żejtun Mqabba - Żurrieq, Paola No provisional tax payable during first year; thereafter provisional tax payments to be paid three times a year Inheritance of GRP The special tax status under GRP may now be inherited; subject to the beneficiary continuously satisfying the GRP conditions. Application Standards Maltese Citizenship NB: The law relating to Malta’s Citizenship by Investment Scheme is still under review To apply for Maltese citizenship, the applicant must be over 18 years of age and have: • resided in Malta throughout the twelve months imme- To apply to the Global Residence Program Rules, the applicant must: diately preceding the date of application; and • you have resided in Malta for periods amounting in the 1. Not be or become a Maltese/ EEA/ Swiss national aggregate to a minimum of four years, during the six 2. Not benefit from any other special tax status years preceding the above period of twelve months; and 3. Hold a qualifying residential property 4. Be in receipt of stable and regular resources which are sufficient to maintain himself and his dependants with- • you are of good character; and you have an adequate knowledge of the Maltese or the English language; and out recourse to the social assistance system in Malta 5. Have a valid travel document you would be a suitable citizen of Malta. 6. Maintain an all risk health insurance to cover the EU At the time of application a letter must be submitted 7. Be fluent in either Maltese or English explaining why the applicant wishes to become a citizen 8. be a fit and proper person of Malta. This letter should contain information about the 9. The individual must not stay in any other jurisdiction for more than 183 days in a calendar year 10. Special reporting obligations (the filing of an annual tax return) and notifications must be complied with. applicant, including period/s of stay in Malta, details about employment in Malta if applicable, participation in social activities and any other information which might be considered appropriate. Subsequently a two supporting let- Localities specified as South of Malta: Birżebbuġia - Qrendi, Cospicua - Safi Fgura - Santa Luċija, Għaxaq - Senglea ters of sponsorship must be filled with the application. Please contact us to find out how you can benefit by residing and having Malta, a low tax EU jurisdiction at your tax base. Gudja - Siġġiewi, Kalkara - Tarxien Excellence| Superb Client Service | Cost Efficient Dubai, Luxembourg & Portugal Representative Offices info@acumum.com | www.acumum.com | Skype ID: acumum Malta Office: +356 2778 1700 260 Triq San Albert, Gzira, GZR 1150, Malta (EU) Information for guidance purposes only © Acumum 2014 All Rights Reserved

- 7. Malta’s International Legal & Advisory Firm Legal | Tax | Accounting Acumum - Legal & Advisory ‘Uniquely local - Uniquely International’ Located in the EU tax efficient jurisdiction of Malta, Acumum Legal & Advisory employs Maltese, UK, & international lawyers & tax accountants - with extensive on-location & off-shore international experience providing appropriate, bespoke solutions. Taxation Corporate & Company Formation Financial Services Licenses Gaming Aviation Insurance Licenses Intellectual Property Trusts & Foundations Maritime & Yachts Telco, Tech, Media Estate & Wealth Management Arbitration & Litigation Immigration & Residency Divisions Compliance Accounting, Tax & Back Office Excellence| Superb Client Service | Cost Efficient Outsourcing Dubai, Luxembourg & Portugal Representative Offices info@acumum.com | www.acumum.com | Skype ID: acumum Malta Office: +356 2778 1700 260 Triq San Albert, Gzira, GZR 1150, Malta (EU) Information for guidance purposes only © Acumum 2014