7 Report Body of Report

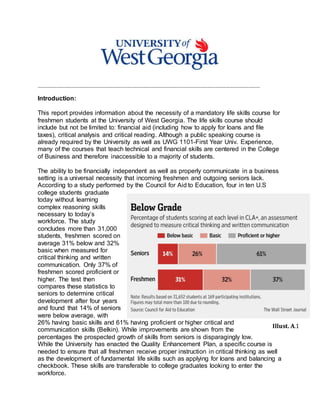

- 1. ___________________________________________________________ Introduction: This report provides information about the necessity of a mandatory life skills course for freshmen students at the University of West Georgia. The life skills course should include but not be limited to: financial aid (including how to apply for loans and file taxes), critical analysis and critical reading. Although a public speaking course is already required by the University as well as UWG 1101-First Year Univ. Experience, many of the courses that teach technical and financial skills are centered in the College of Business and therefore inaccessible to a majority of students. The ability to be financially independent as well as properly communicate in a business setting is a universal necessity that incoming freshmen and outgoing seniors lack. According to a study performed by the Council for Aid to Education, four in ten U.S college students graduate today without learning complex reasoning skills necessary to today’s workforce. The study concludes more than 31,000 students, freshmen scored on average 31% below and 32% basic when measured for critical thinking and written communication. Only 37% of freshmen scored proficient or higher. The test then compares these statistics to seniors to determine critical development after four years and found that 14% of seniors were below average, with 26% having basic skills and 61% having proficient or higher critical and communication skills (Belkin). While improvements are shown from the percentages the prospected growth of skills from seniors is disparagingly low. While the University has enacted the Quality Enhancement Plan, a specific course is needed to ensure that all freshmen receive proper instruction in critical thinking as well as the development of fundamental life skills such as applying for loans and balancing a checkbook. These skills are transferable to college graduates looking to enter the workforce. Illust. A.1

- 2. Crystal Shelnutt April 14, 20152 Purpose: The purpose of this report is to suggest the installation of a mandatory course for all freshmen. The course will focus on critical thinking and written communication as well as establishing a working knowledge of independent adult skills in finance. According to a study by the Council for Economic Education, only 13 states require high school students to take a personal-finance class in order to graduate. A pole by investment bank Charles Schwab has also found that 86% of students between the ages of sixteen and eighteen agree “they would rather learn about money management in the classroom than make financial mistakes in the real world” (Bortz). The need for a curriculum designed specifically to prepare students for life and workplace skills is lacking and has the potential to ensure that students graduate with a fundamental understanding of basic adult and business skills. Methods: The methods used to conduct this report include several interviews with staff and current University of West Georgia Students as well a grouping of high school seniors preparing to enter college in the fall of 2015. This report also includes several references to studies conducted by individuals concerning the lack of feasible financial and life skills of graduates including employers, investment banks, and mass media outlets. An examination of current University courses will reveal the disparity of financial classes to the mass majority of the student body. When conducting this research the results proved that a need for a life skills/ financial course has been recognized by several other University systems and the issue has either been resolved or modified to meet the growing demand for graduate financial and business credibility. Results: Information gathered from outside sources underline the necessity for the inclusion of a life skills/financial introductory course for freshmen students. As previously remarked, according to a study performed by the Council for Aid to Education, 4 in 10 U.S college students graduate today without learning complex reasoning skills necessary to today’s workforce. The study concludes more than 31,000 students, freshmen scored on average 31% below and 32% basic when measured for critical thinking and written communication. Only 37% of freshmen scored proficient or higher. The test then compares these statistics to seniors to determine critical development after four years and found that 14% of seniors were below average, with 26% having basic skills and 61% having proficient or higher critical and communication skills (Belkin).

- 3. Crystal Shelnutt April 14, 20153 A study conducted by the Council for Economic Education has found that only 17 states offer mandatory personal finance courses or require it to be built into an economic or civics course in order to graduate. Georgia does require an economic course to be taken but does not have a personal finance course requirement outside of its inclusion in the Economic curriculum. The CEE also notes that in 2014 “only 6 states [Georgia excluded] require the testing of student knowledge in personal finance, only one more than in 2011. An interactive video created by the CEE presents the statistics for the 2014 year, confirming the necessity of financial/ life skills courses in the United States. Only 22 states require a high school course in economics and while Georgia is one of them as a graduate in 2012 just two years after this survey I can conclude that the economics course did not contain relevant information to such activities as filing taxes, applying for loans or the management of personal finances. This severe disparity between states that do and do not require a financial aid course further indicates the necessity for colleges to ensure their students. Illust. B.1 Illust. B. 2

- 4. Crystal Shelnutt April 14, 20154 The CEE’s 2014 Survey of the States also includes statistics for the growth of economic/financial courses in the United States on a state by state basis. In 2002, 27 states require student testing in economics. However, in 2014, only 16 states require student testing in economics, meaning that in twelve years (almost the entire span of a child’s mandatory education) 11 states remanded their curriculum to where it is not required students learn basic economics. Alan Greenspan, 13th Chairman of the Federal Reserve, argues that “The number one problem of today’s generation and economy is the lack of financial literacy” (CEE). The Council for Economic Education further concludes that student debt has tripled between 2013 and 2014, a key indication of the rising cost of tuition and the inability college students to monetarily orientate themselves. Illust. B.3 Illust. B.4 Illust. B.5

- 5. Crystal Shelnutt April 14, 20155 Statistically speaking, the University of West Georgia caters to roughly 12,000 students with approximately 9,000 undergraduates. An interactive map on the Cappex student website concludes that 1,841 freshmen from the University of West Georgia live in or are originally from Georgia. This suggests that approximately 97% of the freshmen on campus were not required to take a life skills/ financial course outside of basic economics to graduate high school. An examination of other colleges leads to the conclusion that many others have noticed the disparity between students entering and graduating who lack financial and critical analytical skills. Harvard and Boston College professors offer testimonials that encourage the introduction of life skills courses on campus based on the heartening responses of their students to seminars and workshops now offered. Julia Fox, a professor at Harvard, notes that “the response so far has been, in a word, gratitude” (Julia Fox qtd. Bradt). Further investigation into the lack of adult life skills high school graduates have will reveal the need for mandated university education in finance, critical thinking and effective written communication. A poling of University students and local high school seniors will also be assessed to determine the validity of the expansion of our curriculum to include a course designated towards teaching freshmen financial/ life skills. Illust. C.1

- 6. Crystal Shelnutt April 14, 20156 In this pole conducted on University of West Georgia students (13 respondents total with 38.4% freshmen, 30.77 % sophomore and 30.77% juniors) the statistics reveal a feeling of inadequacy in financial, time, technical communication skills with 2 out of 13 students claiming they believed high school had prepared them, and 11 believing themselves to be underprepared. In hindsight, these 11 also agree that they wish they had taken a course that focused on these specific skills so that they would have felt duly prepared for their transition into adulthood. Taking from the same source, when asked “What skills do you wish you could learn before graduating?” several of the answers coincided with the proposed curriculum that would be established by a life skills/ finance course. The survey further concluded that 61.54% of those polled were unopposed to the college offering a mandatory life skill course for freshmen, with only 38.46% opposed. The readiness of the student body to accept the introduction of a life skills/ finance course points to the necessity of its inclusion into the current University of West Georgia curriculum. With the lack of high school preparation more and more college students find themselves in capable of conducting basic adult financial skills such as filing taxes or establishing budgets. Illust. D.1 Illust. D.2

- 7. Crystal Shelnutt April 14, 20157 Discussion: The information provided above directly points to the necessity and desire for the inclusion of a life skills/ financial mandated course for freshmen students here at the University of West Georgia. It is crucial that students are instructed in a manner that promotes the growth and expansion not only of their education, but of the University as a whole. 97% of the freshmen on our campus were not required to take a financial class outside their economics course in their high schools that was not also a mixture of macro and microeconomics. 1 in 3 U.S adults believe that they have made bad financial decisions based on a lack of financial education (Survey). Only 6 states, including Georgia, require high school students to take a personal finance course, however; Georgia includes financial coursework in their Economics curriculum, which can vary from Macro to Micro. Here, at the University of West Georgia, a survey conducted in 2013 concludes that 21 percent of graduates from our University graduated with a degree in Business, Management, Marketing, and Related Support Services (University). With over 12,000 students and only roughly 21% taking courses that introduce financing the amount of students that leave college unprepared for basic adult life skills is unexaggerated. These students should depart with a working knowledge of finance and the skills necessary to succeed in the work force; however, a survey of business owners released by the American Association of Colleges and Universities reveals that nine out of ten employers found “recent college graduates as poorly prepared for the work force in such areas as critical thinking, communication, and problem solving” (Am. Qtd. Belkin). School systems are governed by the states in which they reside and therefore the chance of a federally mandated financial education override is unlikely. This places the pressure to provide for financial and life skills education in the university setting. Given the amount of time and effort students spend in the pursuance of their degrees it makes sense to ensure their skills are not wasted at the professional level. By providing students with a mandatory critical development and financial basics course, we can ensure their education reaps the full benefits of our capabilities as a growing university.

- 8. Crystal Shelnutt April 14, 20158 Conclusions: 63% of incoming freshmen scored basic or below basic in effectiveness in communication skills (Belkin). 40% of seniors scored basic or below basic in effectiveness in communication skills. In 2002 27 states required testing in economics, in 2014 only 16 require it to graduate high school. Only 6 states require testing in financial skills and Georgia is one of them. The University of West Georgia’s freshmen population contains 97% of in state- tuition students meaning that of the 1,841 freshmen, there is the possibility that only 3% were required by their respective high schools to take a financial course to graduate. A pole of University of West Georgia student grades freshman to junior found that 61.53% were unopposed to the introduction of a required financial and life skills course, while only 38.46 were opposed. Alan B. Krueger, Former chairman of the Council of Economic Advisors, argues that “Economic education is about much more than money, it provides students with a framework for making good decisions that will help them and the country” (Krueger, qtd. ECC). With the inability of the federal government to mandate financial and life skill courses in the state run education system, private institutions such as the University of West Georgia must take it upon themselves to educate students in basic financial and analytical skills. A large number of college graduates remain unprepared for the real world application of their degrees, requiring those who are hired to receive extra training or face termination. By using the proven curriculum of other universities, a program can be developed on campus to ensure the readiness of graduates as they enter the workforce. As a scholar at our University, I have found many students who feel they lack the skills necessary to be an established, successful adult. Many students entering college come straight from high school and are still heavily dependent on their parents allowing them room to put off learning mandatory adult skills. Several high schools do not mandate finance or critical thinking courses making teaching today’s freshmen how to be adults a necessity. The introduction of the proposed course will establish a basic knowledge of adult skills and promote a firm foundation for the growth and development of freshmen.

- 9. Crystal Shelnutt April 14, 20159 Works Cited Belkin, Douglas. “Test Finds College Graduates Lack Skills for White-Collar Jobs.” Education. 16 Jan. 2015. The Wall Street Journal. Web. 18 Mar. 2015. Bortz, Daniel. “Why Most High Schoolers Don’t Know How to Manage Their Money.” Money. 8 Oct. 2012. U.S News and World Report. Web. 18 Mar. 2015. Bradt, Steve. “College adds ‘Life Skills’ to its menu.” FAS Communications. 22 Mar. 2007. Harvard Gazette. Web. 19 Mar. 2015. “Catalog Year 2016 from 201205 to 201601.” Catalog. The University of West Georgia. 2015. Web 17 Apr. 2015. Selingo, Jeffrey. “Why are so many college students failing to gain job skills before graduation?” Gradepoint. 26, Jan. 2015. The Washington Post. Web. 20 Mar. 2015. “Survey of the States.” Survey of the States and the Progression of Economic Education. Council for Economic Education. 2015. Web. 18 Apr. 2015. <http://www.councilforeconed.org/policy-and-advocacy/survey-of-the- states/#findings> “University of West Georgia.” Education. U.S News and World Report. Web. 18 Mar. 2015. http://colleges.usnews.rankingsandreviews.com/best-colleges/university- west-georgia-1601/academics “University of West Georgia: Your Fit.” Cappex.2015. Web. 17 Apr. 2015 https://www.cappex.com/colleges /University-of- West-Georgia/your-fit

- 10. Crystal Shelnutt April 14, 201510 Appendix Appendix A: Belkin, Council for Aid to Education Chart These results are presented by the Wall Street Journal who credits the result as an intriguing expansion upon the declining ability of graduates to compete in critical and written communication in the business world. The article’s writer goes on to argue, however, that the over 3,000 students polled did not all come from the same institution and that the study was done over the course of one year, so the freshmen and seniors are not the same group, allowing for some disparity in the results.

- 11. Crystal Shelnutt April 14, 201511 Appendix B: Survey, Council for Economic Education The “Survey of the States” findings catalogue all fifty states and closely examine those states that do or do not mandate financial and economic courses. The statistics of the document argue that the number of institutions that support financial classes is on the decline leading to the necessity of universities to pick up the slack. The website offers an educational video that highlights the key points of their survey and includes testimony from high-ranking financial advisors. http://www.councilforeconed.org/policy-and-advocacy/survey-of-the- states/#findings The website also offers an interactive map that shows that Georgia does require a economics and finance course to be offered, however, an examination of the high school graduation requirements course evaluations under Social Sciences reveals that only economics is required and the school system has placed financial education inside of it. As a recent product of the Georgia School System, I can argue (and my survey supports the idea that) students are not being duly prepared for basic adult necessities that require financial and critical analytical skills.

- 12. Crystal Shelnutt April 14, 201512

- 13. Crystal Shelnutt April 14, 201513 Appendix C: Sample Survey The following is a detailed list of all the questions and data gained from my survey of 13 University of West Georgia students. The results are classified but all respondents are asked to identity their class. The questions are presented in a non-bias fashion and offer input from the taker as to what improvements or skills they feel high school and the University has failed to teach them thus far.

- 14. Crystal Shelnutt April 14, 201514

- 15. Crystal Shelnutt April 14, 201515

- 16. Crystal Shelnutt April 14, 201516

- 17. Crystal Shelnutt April 14, 201517

- 18. Crystal Shelnutt April 14, 201518