Diploma of Finance and Mortgage Broking Management (FNS50311) - Results

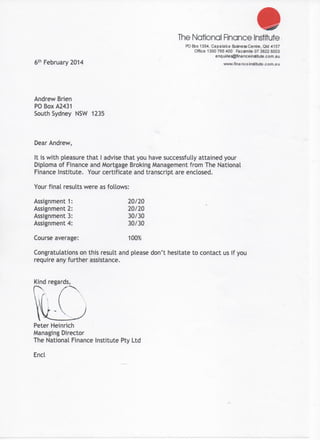

- 1. The National Finance institute PO Box 1354, Capalaba Business Centre, Qld 4157 Office 1300 765 400 Facsimile 07 3822 6003 enquiries@financeinstitute.com.au 6t h February 2014 www.financeinstitute.com.au Andrew Brien PO Box A2431 South Sydney NSW 1235 Dear Andrew, It is with pleasure that I advise that you have successfully attained your Diploma of Finance and Mortgage Broking Management from The National Finance Institute. Your certificate and transcript are enclosed. Your final results were as follows: Assignment 1: 20/20 Assignment 2: 20/20 Assignment 3: 30/30 Assignment 4: 30/30 Course average: 100% Congratulations on this result and please don't hesitate to contact us if you require any further assistance. Kind regards, Peter Heinrich Managing Director The National Finance Institute Pty Ltd End

- 2. Results of Assignments This page is for NFI Office Use ONLY Trainee Name: Andrew Robert Brien FNS50311 Diploma of Finance and Mortgage Broking Management Name of Assessor: Peter Stannard Date Marked 24/01/2014 ASSIGNMENT 1 Mark 20 / 20 Assessor's Comments: Following the 7 headings in the assignment the following comments are made: 1. Borrower Details Criteria Met Trust identified. 2. Loan Purpose Criteria Met You could mention why the current lender has not been approached. It's the first question a lender thinks of when assessing an application, so you are better to address it, simply saying that the zoning is outside the existing Bankers current policy. 3. Facility Details Criteria Met Term is accurate. It is unlikely that a lender would want to commit too long a term until the rezoning is finalised. 4. Serviceability Criteria Met 5. Risk Assessment Including Security Criteria Met This may be acceptable as outlined, but given that there is reliance on the real estate business for at least some of the rent and all of the guarantors' income, it is most likely that a lender would want to secure the cash flow from this source as well. Most probably by way of GSI but possibly a guarantee only would suffice. Very sound risk identification and discussion / mitigation. 6. Recommendation Criteria Met 7. Attachments Criteria Met Additional or Overall Comments If Applicable. Tlis is a comprehensive application. The only constructive feedback I can provide is that property deals like this often have the W.A.L.E calculated by tenants and by rent. It is not in the course material, but stands for Weighted Average Lease Expiry and the name is self explanatory. Provides an idea of term of the likely rental reliability. The term of the loan is often linked to the remaining WALE and is usually calculated by the valuer and included in the valuation. ASSIGNMENT 2 Mark 20 / 20 Assessor's Comments: Pre Meeting List of Requirements and Post Meeting Correspondence to Client: Criteria Met First class fact find and letter to the prospective customer. One of the best that I have marked. Presentation and spelling was also correct which is rare. Following the 7 headings in the assignment the following comments are made: The National Finance Institute. Page 1

- 3. Results of Assignments l. Borrower Details Criteria Met Correct borrower identified. 2. Loan Purpose Criteria Met Excellent you mentioned the seed capital as well as the internal hiring. Both these were important as the private debt will be repaid in two years and free up additional cash flow. The internal hiring also explains where the cash flow will come from to service the loans. 3. Facility Details Criteria Met Information included was correct. (48 months, GST refunded, zero balloon.) 4. Serviceability Criteria Met 5. Risk Assessment Including Security Criteria Met Noted as met as the information was correct in the client submission. However, proposed security was not actually listed in the lender submission. That is; • The Goods (Trucks and Trailer) • Directors' Guarantees • Guarantee from Henman Holdings Pty Ltd as Trustee for the Henman Discretionary Trust. Risk discussion sound although you could discuss the goods. Make, model, secondary market etc. 6. Recommendation Criteria Met 7. Attachments Criteria Met Additional or Overall Comments If Applicable. Also good work. ASSIGNMENT 3 Mark 30 / 30 Assessor's Comments: Criteria Met ASSIGNMENT 4 Mark 30 / 30 Assessor's Comments: Criteria Met All assignments, but particularly assignments 3 and 4 were most comprehensive and amongst the best that 1 have marked. The work is clearly that of an experienced lender. Often the assignments from experienced individuals are barely sufficient to demonstrate competency. Some would regard this as an indication of their professionalism. However, in this case considerable time and effort has gone into the work for which you should be commended and congratulated. Thank you. Result: Competent The National Finance Institute. Page 2