As 16 32

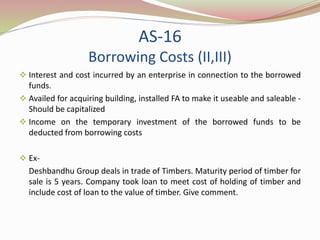

- 1. AS-16 Borrowing Costs (II,III) Interest and cost incurred by an enterprise in connection to the borrowed funds. Availed for acquiring building, installed FA to make it useable and saleable - Should be capitalized Income on the temporary investment of the borrowed funds to be deducted from borrowing costs Ex- Deshbandhu Group deals in trade of Timbers. Maturity period of timber for sale is 5 years. Company took loan to meet cost of holding of timber and include cost of loan to the value of timber. Give comment.

- 2. AS-17 Segment Reporting It consists of 2 segment:- 1. Business segment 2. Geographical segment A business segment or geographical segment is a reportable segment if Revenue from sales to external customers and from transactions with other segments exceed 10% of total revenues (external and internal) of all segments; or Segment result, whether profit or loss is 10% or more of combined result of all segments in profit or combined result of all segments in loss whichever is greater in absolute amount; or segment assets are 10% or more of all the assets of all the segments

- 3. AS-18 Related party disclosure Related party are those party that controls or significantly influence the management or operating policies of the company during reporting period Disclosure: Related party relationship Transactions between a reporting enterprises and its related parties. Volume of transactions Amt written off in the period in respect of debts

- 4. AS-19 Accounting for Leases Agreement between Lessor and Lessee Two types of leases: Operating lease – risk & reward not transfer Finance lease – risk transferred but ownership. Lessee get ownership at last. Classification to be made at the inception Not applied on – Explore for or use natural resources Land items such as motion pictures, films, video recordings plays, etc.

- 5. AS-20 Earning per share Earning capacity of the firm Assessing market price for share AS gives computational methodology for determination and presentation of EPS 2 types of EPS – Basic & Diluted Basic EPS should be calculated by dividing net profit or loss for the period attributable to equity shareholders by weighted average of equity shares outstanding during the period For calculating diluted EPS, net profit or loss attributable to equity shareholders and the weighted average number of shares are adjusted for the effects of dilutive potential equity shares

- 6. AS-21 Consolidated Financial Statements Parent having controlling stake (more than 50%) in subsidiary A subsidiary shall have more than one parent company Parent co. record investment as per AS 13 Disclosure:- List of all subsidiaries Proportion of ownership interest Nature of relation whether direct or indirect Consolidated financial statements except- Investment is temporary Subsidiary unable to transfer the fund due to restriction

- 7. AS-22 Accounting for taxes and income (II,III) Deals with the calculation of taxes on Income for period in which are accounted Deferred tax assets and liabilities should be measured using the tax rates and tax laws that have been enacted or substantively enacted by the balance sheet date Current tax should be measured at the amount expected to be paid to (recovered from) the taxation authorities, using the applicable tax rates and tax laws. It should be accrued and not liability to pay Deals in 2 taxes:- Current tax Deferred tax

- 8. AS-23 Accounting for investments in Associates in CFS This statement should be applied in accounting for investments in associates in the preparation and presentation of CFS An investment in an associate should be accounted for in a CFS under the equity method except when: The investment is temporary, or The associate operates under severe long-term restrictions that significantly impair its ability to transfer funds to its investors. Investment in such associates should be accounted for in accordance with the Accounting Standard (AS)-13 An investor should discontinue the use of equity method from the date when It ceases to have significant influence in an associate but retains, either in whole or in part, its investments.

- 9. AS-24 Discontinuing operations The objective of this statement is to establish principles for reporting information about discontinuing operations Establishes principles for reporting information about discontinuing operations Types of discontinuing Operation – Disposing of substantially Disposing of piecemeal Terminating through abandonment Disclosure– for any gain or loss that is recognized on the disposal of assets or settlement of liabilities the net selling price or range of prices of those net assets for which the enterprise has entered into one or more binding sale agreements

- 10. AS-25 Interim Financial Reporting (IFR) Interim period is a financial reporting period shorter than a full financial year. Interim financial report means a financial report containing either a complete set of financial statements or a set of condensed financial statements (as described in this Statement) for an interim period An interim financial report should include, at a minimum, the following components Condensed balance sheet; Condensed statement of profit and loss; Condensed cash flow statement; and Selected explanatory notes

- 11. AS-26 Intangible Assets (II,III) No physical existence Can not be seen or even touched An acquired intangible asset is recognised if it is Identifiable, Controllable by enterprise, Where future benefit is expected and Cost of acquisition can be measured reliably. Expenditure incurred on internally generated intangible asset is expensed to the extent that it related to Research Phase.

- 12. AS-27 Financial Reporting of Interest in Joint Venture JV is a contractual arrangement whereby two or more parties undertake an economic activity, which is subject to joint control. Joint control is the contractually agreed sharing of control over an economic activity Disclosure- In case of standalone financial statements the investments are accounted at cost in accordance with AS-13 whereas in case of consolidated financial statements where these are prepared (or required to be prepared) the investment in joint venture is accounted using proportionate consolidation method unless these are subsidiaries in which case these are consolidated under AS-21

- 13. AS-28 Impairment of Assets (II,III) Impairment means Weakening of Assets value Occurs when carrying cost more than recoverable amount Not applied on- Inventories (see AS-2, Valuation of Inventories); Assets arising from construction contracts (see AS-7, Accounting for Construction Contracts); Financial assets, including investments that are included in the scope of AS-13, Accounting for Investments; and Deferred tax assets (see AS-22, Accounting for Taxes on Income).

- 14. AS-29 Provision, contingent liabilities and assets Provisions as a liability which can be measured only by using a substantial degree of estimation. Recognized when, and only when: An entity has a present obligation as a result of a past event; It is probable that an outflow of resources embodying economic benefits will be required to settle the obligation; and A reliable estimate can be made of the amount of the obligation. Contingent liability as: A possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity; or A present obligation that arises from past events but is not recognized because: (i) it is not probable that an outflow of resources embodying economic benefits will be required to settle the obligation; or (ii) the amount of the obligation cannot be measured with sufficient reliability

- 15. AS-30, 31 & 32 Financial Instruments AS 30 – Recognition and Measurement AS 31 – Presentation AS 32 – Disclosures The objective of the three standards is to establish requirements for all aspects of accounting for financial instruments, including distinguishing debt from equity, netting, recognition, derecognition, measurement, hedge accounting and disclosure.

- 16. Googlies Jet airway ltd had 1800 equity shares fully paid of Rs. 10 as on 1.4.2018. On 31.12.2018 it issued 1 equity share of Rs. 10 each for each debenture. Company had 300 debenture. Net profit for equity shareholder is Rs. 18 lac for 31.03.2018 & Rs. 36 lac for 31.03.2019. Calculate Basic EPS on 31.03.2018 and diluted on 31.03.2019. During 2018-19, Induja group acquire 50% of NAV Co. Inter company sale during the year Rs 15 lac and loan to officer is Rs. 10 lac. What to be disclosed in books?