Healthcare Procurement - Custom Contracting through GPOs

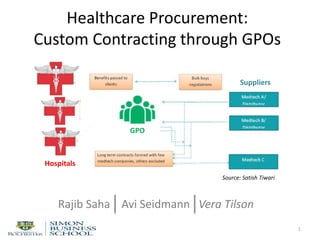

- 1. Healthcare Procurement: Custom Contracting through GPOs 1 Rajib Saha Avi Seidmann Vera Tilson GPO Hospitals Suppliers Source: Satish Tiwari

- 2. There are multiple procurement challenges for US hospitals 1. Difficult to control labor costs, employee:patient ratios are often mandated 2. Inelastic demand (hospitals must buy clinical supplies) 3. Supplies are 25% of all hospital expenses 2 4. 3% of line items (mostly physician preference items) are responsible for 40% of supply expenses 5. Difficult to standardize on expensive supplies because of diverse physician preferences and training 6. Oligopoly manufacturers of the most expensive supplies e.g. surgical implants. 7. Hospital industry is fragmented, over 5,000 hospitals in the US

- 3. There are multiple procurement challenges for US hospitals 1. Difficult to control labor costs, employee:patient ratios are often mandated 2. Inelastic demand (hospitals must buy clinical supplies) 3. Supplies are 25% of all hospital expenses 3 4. 3% of line items (mostly physician preference items) are responsible for 40% of supply expenses 5. Difficult to standardize on expensive supplies because of diverse physician preferences and training 6. Oligopoly manufacturers of the most expensive supplies e.g. surgical implants. 7. Hospital industry is fragmented, over 5,000 hospitals in the US

- 4. There are multiple procurement challenges for US hospitals 1. Difficult to control labor costs, employee:patient ratios are often mandated 2. Inelastic demand (hospitals must buy clinical supplies) 3. Supplies are 25% of all hospital expenses 4 4. 3% of line items (mostly physician preference items) are responsible for 40% of supply expenses 5. Difficult to standardize on expensive supplies because of diverse physician preferences and training 6. Oligopoly manufacturers of the most expensive supplies e.g. surgical implants. 7. Hospital industry is fragmented, over 5,000 hospitals in the US

- 5. Physician Preference: •Orthopedic Implants •Spinal Implants •Pacemakers •AICDs •Coronary Stents •Special Procedure Devices •Heart Valves •Endosurgical Supplies •Bone Products •Perfusion Supplies •Pacemakers •Contrast Media •Balloons and Wires Physician preference items are 3% of line items driving 40% of supply expenses 5 Hospital Supply Expenses: Physician Preference vs. Others by # Line Items by $$ Food products, gloves, IV solutions, gowns, wound drainage, tubing, draping, generic drugs, IV admin kits, disposables

- 6. Diverse physician preferences are partially due to training history, and ‘funding’ ties 6

- 7. Hospital procurement managers “bow” to physician preferences for particular devices 7

- 8. There are multiple procurement challenges for US hospitals 1. Difficult to control labor costs, employee:patient ratios are often mandated 2. Inelastic demand (hospitals must buy clinical supplies) 3. Supplies are 25% of all hospital expenses 8 4. 3% of line items (mostly physician preference items) are responsible for 40% of supply expenses 5. Difficult to standardize on expensive supplies because of diverse physician preferences and training 6. Oligopoly manufacturers of the most expensive supplies e.g. surgical implants. 7. Hospital industry is fragmented, over 5,000 hospitals in the US

- 9. There are multiple procurement challenges for US hospitals 1. Difficult to control labor costs, employee:patient ratios are often mandated 2. Inelastic demand (hospitals must buy clinical supplies) 3. Supplies are 25% of all hospital expenses 9 4. 3% of line items (mostly physician preference items) are responsible for 40% of supply expenses 5. Difficult to standardize on expensive supplies because of diverse physician preferences and training 6. Oligopoly manufacturers of the most expensive supplies e.g. surgical implants. 7. Hospital industry is fragmented, over 5,000 hospitals in the US

- 10. The US healthcare supply chain often includes group purchasing intermediaries 10 Oligopolistic manufacturers >5000 Fragmented buyers Group purchasing organizations (GPOs)

- 11. To obtain ‘quantity discounts’ hospitals join a GPO which aggregates their demand 11 Oligopolistic manufacturers Fragmented buyers GPO

- 12. GPO negotiates a purchasing contract with a vendor 12 Vendor Manufacturer Fragmented buyers GPO

- 13. Hospitals purchase supplies from the vendor at GPO-negotiated prices 13 Vendor Fragmented buyers $$$ @ GPO negotiated price products GPO

- 14. To cover operating expenses, GPO collects an administrative fee from the vendor 14 Vendor Fragmented buyers $$$ @ GPO negotiated price products GPO

- 15. Group purchasing organizations advertise benefits to both hospital and vendors Benefits to Hospitals: – Cost savings from quantity discount – Operational savings in procurement – Vendor qualification – Managerial support Benefits to Vendors: – Volume sales – Marketing opportunity – Reduced marketing costs – Hospital contract compliance monitoring 15

- 16. Any problems here? 16 Vendor Fragmented buyers $$$ @ GPO negotiated price products GPO

- 17. 17 In many settings involving federal contracts, payments from vendors to procurement departments are illegal

- 18. 18 However, the hospital GPOs are permitted to receive sales fees from manufacturers (a special Congressional exemption from federal anti-kickback laws)

- 19. 19 GPO practices have been criticized by manufacturers and distributors

- 20. GPO practices have been investigated by various government entities In 2002 following a series of articles in the New York Times, Premier and Novation ( two of the largest GPOs) were investigated by: • the Federal Trade Commission (FTC) who wanted to know whether the buying groups wield too much power (negotiated contracts were worth more than $30 billion) • the inspector general for the Centers for Medicare and Medicaid Services (CMS) • the General Accounting Office, the investigative arm of Congress • the antitrust subcommittee of the Senate Judiciary Committee • NY State Attorney General Office 20

- 21. In response to the various investigations GPOs promised to adopt a code of conduct • Eliminate self-dealing, i.e. stop investing in supply companies. • Contract with more companies, no longer sign exclusive contracts with single manufacturers for certain medical supplies • Limit the length of the contracts (long contracts protected incumbents) • Limit contracts that condition discounts on bundling of unrelated products 21

- 22. A 2002 GAO investigation found that GPO contracts did not always offer hospitals better prices 22

- 23. The 2010 GAO investigation was unable to identify any published peer-reviewed studies that included an empirical analysis of pricing data that indicated whether or not GPO customers obtain lower prices from vendor 23

- 24. In response - GPOs introduced custom contracting The practice of custom contracting is described in GAO-12-126, a 2012 GAO report on hospital purchasing of implantable devices 24

- 25. Our research focus is custom contracting 25 Who benefits: • GPO • GPO vendor • member hospitals and to what extent?

- 26. Relevant literature falls into four broad categories o Group purchasing: • The mechanism for price reduction obtained through GPOs • Effect of contract administration fees (CAF) on supply chain participants • Allocation of savings in group purchasing alliance o Reasons for existence of supply chain intermediaries 26

- 27. Relevant literature falls into four broad categories o Group purchasing: • The mechanism for price reduction obtained through GPOs • Effect of contract administration fees (CAF) on supply chain participants • Allocation of savings in group purchasing alliance o Reasons for existence of supply chain intermediaries 27

- 28. Analytical game-theoretic models have been used to examine how GPOs provide savings when dealing with multiple suppliers O’Brien and Shaffer(1997), Dana (2003) prices are lowered through the exclusive dealing mechanism, i.e. ability to shift demand to a competitor Marvel and Yang (2008) hospitals differ in preferences for products from different supplies, price is lowered through competition-intensifying effect of non-linear tariff. Hu and Schwartz (2011) GPOs increase competition between manufacturers and lower prices for healthcare providers. However, GPOs reduce manufacturers' incentives to introduce innovations to existing products. 28

- 29. Relevant literature falls into four broad categories o Group purchasing: • The mechanism for price reduction obtained through GPOs • Effect of contract administration fees (CAF) on supply chain participants • Allocation of savings in group purchasing alliance o Reasons for existence of supply chain intermediaries 29

- 30. Hu, Schwartz (2011) conclude that elimination of contract administration fee (CAF) would not affect any party's profits or costs. Hu, Schwartz, and Uhan (2012) conclude that CAF does not affect hospital costs, but affects distribution of profits between a GPO and vendors. 30

- 31. Relevant literature falls into four broad categories o Group purchasing: • The mechanism for price reduction obtained through GPOs • Effect of contract administration fees (CAF) on supply chain participants • Allocation of savings in group purchasing alliance o Reasons for existence of supply chain intermediaries 31

- 32. Empirical and analytical studies examine the stability of purchasing alliances: • Survey-based studies identify drivers of success and failures of alliances: Doucette (1997), Nollet & Beaulieu (2003), Schotanus (2005). Unfair allocation of savings is identified as one of the reasons for the failure of an alliance. • Game-theoretic models are used to examine the trade-offs in allocating cost savings to group members of alliances: Heijboer (2002), Schotanus (2004), Schotanus et al. (2008), Nagarajan et al. (2008), Chen et al. (MSOM Conf., 2013) 32

- 33. Relevant literature falls into four broad categories o Group purchasing: • The mechanism for price reduction obtained through GPOs • Effect of contract administration fees (CAF) on supply chain participants • Allocation of savings in group purchasing alliance o Reasons for existence of supply chain intermediaries 33

- 34. Wu (2004) categorizes supply chain intermediaries into two broad types: • Transactional intermediaries – aggregate supply and demand, reduce costs associated with searching and matching • Informational intermediaries – synthesize dispersed information or reduce information asymmetry, create trusted institution Other reasons for existence of intermediaries and intermediary profits are examined in Belavina and Girotra (2012), Yang and Babich (2013), Adida et al. (2013) 34

- 35. None of the literature explains the custom contracting arrangement, also healthcare GPOs are unlike most supply chain intermediaries • they aggregate demand, but do not hold inventory • operate in a highly regulated environment • margins are set externally 35

- 36. We create a game-theoretic model to analyze the impact of custom contracting 36

- 37. Assumption I: From the point of view of any particular hospital the demand qty is inelastic 37 A hospital will have to purchase needed implants from some manufacturer.

- 38. Assumption II: Prices are negotiated, hospitals do not simply pay the list price 38

- 39. Assumption II: Price negotiations are costly for both hospitals and vendors 39

- 40. 40

- 41. 41

- 42. 42

- 43. 43

- 44. 44

- 45. 45

- 46. Price secrecy exits not only with physician preference items, but also with commodities such as saline solution 46

- 47. In healthcare market, product quality is known, while price information is not readily available 47 Uncertain Price Quality UncertainKnown Known

- 48. In healthcare market, product quality is known, while price information is not readily available 48 Uncertain Price Quality UncertainKnown Known

- 49. In healthcare market, product quality is known, while price information is not readily available 49 Uncertain Price Quality UncertainKnown Known ‘Market for Lemons’

- 50. In healthcare market, product quality is known, while price information is not readily available 50 Uncertain Price Quality UncertainKnown Known ‘Market for Lemons’ ‘Market for Healthcare’

- 51. Assumption III: Price attainable through vendor- hospital negotiations is random & stochastically decreasing in demand 51 Upper limit on attainable price Lower limit on attainable price PurchasePrice,$/unit Expected price Hospitals’ purchase volume [units/period]

- 52. Assumption IV: GPO member hospitals are heterogeneous in terms of demand volume. This distribution is known to the GPO vendor. 52 #ofmemberhospitals Hospitals’ purchase volumes [units/period]

- 53. Assumption V: Decision timing 53 TreePlan Trial Version, For Evaluation Only www.TreePlan.com Hospital: don't negotiate 0 0 0 0.5 Negotiated price above GPO price 0 0 0 1 0 0 0 0.5 Negotiated price below GPO price 0 0 0 Hospital: negotiate 0.5 1 Negotiated price above GPO price 0 0 0 0 0 0 0 0.5 Negotiated price below GPO price 0 0 0 1 0 0 0.5 Negotiated price above GPO price 0 0 0 GPO vendor: participate 0.5 0 0 GPO vendor selected 0.5 0 0 0 0 0 0.5 GPO vendor not selected 0 0 0For Evaluation Only GPO vendor set price Pg λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) Hospital:invite GPO vendor Hospital: don't invite GPO vendor GPO vendor: don't participate Negotiated price below GPO price λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) GPO vendor payoff Hospital cost λ q P g q P g λ q P g - k v q P g + c (k,1 ) GPO-selected vendor sets the GPO-wide contract price for all members

- 54. Assumption V: Decision timing 54 TreePlan Trial Version, For Evaluation Only www.TreePlan.com Hospital: don't negotiate 0 0 0 0.5 Negotiated price above GPO price 0 0 0 1 0 0 0 0.5 Negotiated price below GPO price 0 0 0 Hospital: negotiate 0.5 1 Negotiated price above GPO price 0 0 0 0 0 0 0 0.5 Negotiated price below GPO price 0 0 0 1 0 0 0.5 Negotiated price above GPO price 0 0 0 GPO vendor: participate 0.5 0 0 GPO vendor selected 0.5 0 0 0 0 0 0.5 GPO vendor not selected 0 0 0For Evaluation Only GPO vendor set price Pg λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) Hospital:invite GPO vendor Hospital: don't invite GPO vendor GPO vendor: don't participate Negotiated price below GPO price λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) GPO vendor payoff Hospital cost λ q P g q P g λ q P g - k v q P g + c (k,1 ) Hospital decides whether to purchase supplies at this price, or to negotiate with other vendors

- 55. Assumption V: Decision timing 55 TreePlan Trial Version, For Evaluation Only www.TreePlan.com Hospital: don't negotiate 0 0 0 0.5 Negotiated price above GPO price 0 0 0 1 0 0 0 0.5 Negotiated price below GPO price 0 0 0 Hospital: negotiate 0.5 1 Negotiated price above GPO price 0 0 0 0 0 0 0 0.5 Negotiated price below GPO price 0 0 0 1 0 0 0.5 Negotiated price above GPO price 0 0 0 GPO vendor: participate 0.5 0 0 GPO vendor selected 0.5 0 0 0 0 0 0.5 GPO vendor not selected 0 0 0For Evaluation Only GPO vendor set price Pg λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) Hospital:invite GPO vendor Hospital: don't invite GPO vendor GPO vendor: don't participate Negotiated price below GPO price λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) GPO vendor payoff Hospital cost λ q P g q P g λ q P g - k v q P g + c (k,1 ) If the hospital is able to find a lower price from another vendor, it purchases supplies from that vendor. Otherwise, from the GPO vendor at the general price

- 56. Assumption V: Decision timing 56 TreePlan Trial Version, For Evaluation Only www.TreePlan.com Hospital: don't negotiate 0 0 0 0.5 Negotiated price above GPO price 0 0 0 1 0 0 0 0.5 Negotiated price below GPO price 0 0 0 Hospital: negotiate 0.5 1 Negotiated price above GPO price 0 0 0 0 0 0 0 0.5 Negotiated price below GPO price 0 0 0 1 0 0 0.5 Negotiated price above GPO price 0 0 0 GPO vendor: participate 0.5 0 0 GPO vendor selected 0.5 0 0 0 0 0 0.5 GPO vendor not selected 0 0 0For Evaluation Only GPO vendor set price Pg λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) Hospital:invite GPO vendor Hospital: don't invite GPO vendor GPO vendor: don't participate Negotiated price below GPO price λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) GPO vendor payoff Hospital cost λ q P g q P g λ q P g - k v q P g + c (k,1 ) When custom contracting is allowed, a hospital can invite the GPO vendor to participate in custom negotiations

- 57. Assumption V: Decision timing 57 TreePlan Trial Version, For Evaluation Only www.TreePlan.com Hospital: don't negotiate 0 0 0 0.5 Negotiated price above GPO price 0 0 0 1 0 0 0 0.5 Negotiated price below GPO price 0 0 0 Hospital: negotiate 0.5 1 Negotiated price above GPO price 0 0 0 0 0 0 0 0.5 Negotiated price below GPO price 0 0 0 1 0 0 0.5 Negotiated price above GPO price 0 0 0 GPO vendor: participate 0.5 0 0 GPO vendor selected 0.5 0 0 0 0 0 0.5 GPO vendor not selected 0 0 0For Evaluation Only GPO vendor set price Pg λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) Hospital:invite GPO vendor Hospital: don't invite GPO vendor GPO vendor: don't participate Negotiated price below GPO price λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) GPO vendor payoff Hospital cost λ q P g q P g λ q P g - k v q P g + c (k,1 ) The GPO vendor can choose to participate or not to participate

- 58. Assumption V: Decision timing 58 TreePlan Trial Version, For Evaluation Only www.TreePlan.com Hospital: don't negotiate 0 0 0 0.5 Negotiated price above GPO price 0 0 0 1 0 0 0 0.5 Negotiated price below GPO price 0 0 0 Hospital: negotiate 0.5 1 Negotiated price above GPO price 0 0 0 0 0 0 0 0.5 Negotiated price below GPO price 0 0 0 1 0 0 0.5 Negotiated price above GPO price 0 0 0 GPO vendor: participate 0.5 0 0 GPO vendor selected 0.5 0 0 0 0 0 0.5 GPO vendor not selected 0 0 0For Evaluation Only GPO vendor set price Pg λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) Hospital:invite GPO vendor Hospital: don't invite GPO vendor GPO vendor: don't participate Negotiated price below GPO price λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) GPO vendor payoff Hospital cost λ q P g q P g λ q P g - k v q P g + c (k,1 ) The hospital will purchase supplies at the lowest negotiated price

- 59. TreePlan Trial Version, For Evaluation Only www.TreePlan.com Hospital: don't negotiate 0 0 0 0.5 Negotiated price above GPO price 0 0 0 1 0 0 0 0.5 Negotiated price below GPO price 0 0 0 Hospital: negotiate 0.5 1 Negotiated price above GPO price 0 0 0 0 0 0 0 0.5 Negotiated price below GPO price 0 0 0 1 0 0 0.5 Negotiated price above GPO price 0 0 0 GPO vendor: participate 0.5 0 0 GPO vendor selected 0.5 0 0 0 0 0 0.5 GPO vendor not selected 0 0 0For Evaluation Only GPO vendor set price Pg λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) Hospital:invite GPO vendor Hospital: don't invite GPO vendor GPO vendor: don't participate Negotiated price below GPO price λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) GPO vendor payoff Hospital cost λ q P g q P g λ q P g - k v q P g + c (k,1 ) Result I: The GPO vendor is never worse off with custom contracting 59 The GPO vendor can always refuse to participate in custom negotiations

- 60. TreePlan Trial Version, For Evaluation Only www.TreePlan.com Hospital: don't negotiate 0 0 0 0.5 Negotiated price above GPO price 0 0 0 1 0 0 0 0.5 Negotiated price below GPO price 0 0 0 Hospital: negotiate 0.5 1 Negotiated price above GPO price 0 0 0 0 0 0 0 0.5 Negotiated price below GPO price 0 0 0 1 0 0 0.5 Negotiated price above GPO price 0 0 0 GPO vendor: participate 0.5 0 0 GPO vendor selected 0.5 0 0 0 0 0 0.5 GPO vendor not selected 0 0 0For Evaluation Only GPO vendor set price Pg λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) Hospital:invite GPO vendor Hospital: don't invite GPO vendor GPO vendor: don't participate Negotiated price below GPO price λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) GPO vendor payoff Hospital cost λ q P g q P g λ q P g - k v q P g + c (k,1 ) Result II: The GPO is never worse off with custom contracting 60 If the GPO vendor agreed to participate means that its expected revenue is higher than when it does not participate

- 61. Illustrative Example: GPO with three member hospitals 61 Demand: 52 units per period Demand: 69 units per period Demand: 180 units per period

- 62. Illustrative Example: GPO with three member hospitals 62 Per unit price attainable in negotiations with a single vendor: $6,674 to $10, 674 Per unit price attainable in negotiations with a single vendor: $6,173 to $10, 173 Per unit price attainable in negotiations with a single vendor: $2,632 to $6,632

- 63. The unit price the hospitals expect to pay after negotiations with outside vendors depends on the contract GPO price 63 This is the expected minimum of the negotiated price for this hospital and the GPO-wide contract price

- 64. The unit price the hospitals expect to pay after negotiations with outside vendors depends on the contract GPO price 64 When the GPO- wide contract price is low, the expected price is the GPO-wide contract price

- 65. The unit price the hospitals expect to pay after negotiations with outside vendors depends on the contract GPO price 65 The curves are different for different hospitals, larger hospitals will start negotiating at lower GPO-wide prices

- 66. Another way to look at the decisions is to look at which value of GPO-wide contract price, the hospitals can expect to experience cost savings from negotiations 66 larger hospitals will start negotiating at lower GPO-wide prices

- 67. Result III: Decision to negotiate is non-decreasing in hospital size and in GPO-wide contract price 67 larger hospitals will start negotiating at lower GPO-wide prices

- 68. The expected demand for the GPO vendor is a function of the GPO-wide contract price 68 When the GPO- wide contract price is low, all the hospitals buy the supplies from the GPO vendor

- 69. The expected demand for the GPO vendor is a function of the GPO-wide contract price 69 As the price increases , the larger hospital will buy supplies from the GPO vendor only if the hospital does not find a lower price elsewhere

- 70. The expected demand for the GPO vendor is a function of the GPO-wide contract price 70 The “jump” results from the fact that the negotiations are not costless for the hospital

- 71. The expected demand for the GPO vendor is a function of the GPO-wide contract price 71 As the GPO-wide contract price increases further, the midsize hospital also starts to negotiate with other vendors

- 72. The GPO vendor sets the GPO-wide contract price to maximize its expected profit 72 Price x Expected Demand

- 73. Result III: The GPO-wide contract price is never lower than the price at which the largest hospital is indifferent between purchasing from the GPO vendor and negotiating further. 73 Setting the price lower will result in lower expected profit

- 74. Result IV: Having access to a GPO contract results in expected savings for member hospitals 74 Hospital Demand Total 180 69 52 Expected price without a GPO $3,431 $6,936 $7,473 Total expected cost without a GPO $642,684 $503,642 $413,632 Total cost with GPO contract, GPO vendor acts optimally. $540,000 $207,000 $156,000 Savings from having access to the GPO contract $102,684 $296,642 $257,632 $656,958 Percentage savings 16% 59% 62% 42% Assumed negotiations with 4 vendors

- 75. Result IV: Having access to a GPO contract results in expected savings for member hospitals 75 Hospital Demand Total 180 69 52 Expected price without a GPO $3,431 $6,936 $7,473 Total expected cost without a GPO $642,684 $503,642 $413,632 Total cost with GPO contract, GPO vendor acts optimally. $540,000 $207,000 $156,000 Savings from having access to the GPO contract $102,684 $296,642 $257,632 $656,958 Percentage savings 16% 59% 62% 42% Includes the cost of negotiations with 4 vendors

- 76. Result IV: Having access to a GPO contract results in expected savings for member hospitals 76 Hospital Demand Total 180 69 52 Expected price without a GPO $3,431 $6,936 $7,473 Total expected cost without a GPO $642,684 $503,642 $413,632 Total cost with GPO contract, GPO vendor acts optimally. $540,000 $207,000 $156,000 Savings from having access to the GPO contract $102,684 $296,642 $257,632 $656,958 Percentage savings 16% 59% 62% 42% Assumes GPO vendor sets price of $3K, optimal for all hospitals not to negotiate

- 77. Result IV: Having access to a GPO contract results in expected savings for member hospitals 77 Hospital Demand Total 180 69 52 Expected price without a GPO $3,431 $6,936 $7,473 Total expected cost without a GPO $642,684 $503,642 $413,632 Total cost with GPO contract, GPO vendor acts optimally. $540,000 $207,000 $156,000 Savings from having access to the GPO contract $102,684 $296,642 $257,632 $656,958 Percentage savings 16% 59% 62% 42% Largest % savings for the smallest hospital

- 78. Result V: The GPO vendor benefits at the expense of other vendors 78 Hospital Demand Total 180 69 52 Expected price without a GPO $3,431 $6,936 $7,473 Expected demand without a GPO contract 180/4 69/4 52/4 Total expected profit without a GPO vendor contract $134,421 $99,661 $77,158 Total profit with GPO vendor contract $511,840 $196,205 $147,865 Increase in profit from having access to the GPO contract $377,419 $96,544 $70,707 $544,670 Percentage increase in GPO vendor profit 281% 97% 92% 175%Includes the cost of negotiations with the hospital

- 79. Result V: The GPO vendor benefits at the expense of other vendors 79 Hospital Demand Total 180 69 52 Expected price without a GPO $3,431 $6,936 $7,473 Expected demand without a GPO contract 180/4 69/4 52/4 Total expected profit without a GPO vendor contract $134,421 $99,661 $77,158 Total profit with GPO vendor contract $511,840 $196,205 $147,865 Increase in profit from having access to the GPO contract $377,419 $96,544 $70,707 $544,670 Percentage increase in GPO vendor profit 281% 97% 92% 175% Additional demand plus lower cost of negotiations

- 80. Result V: The GPO vendor benefits at the expense of other vendors 80 Hospital Demand Total 180 69 52 Expected price without a GPO $3,431 $6,936 $7,473 Expected demand without a GPO contract 180/4 69/4 52/4 Total expected profit without a GPO vendor contract $134,421 $99,661 $77,158 Total profit with GPO vendor contract $511,840 $196,205 $147,865 Increase in profit from having access to the GPO contract $377,419 $96,544 $70,707 $544,670 Percentage increase in GPO vendor profit 281% 97% 92% 175% Significant increase, due primarily to capturing the demand of the large hospital

- 81. TreePlan Trial Version, For Evaluation Only www.TreePlan.com Hospital: don't negotiate 0 0 0 0.5 Negotiated price above GPO price 0 0 0 1 0 0 0 0.5 Negotiated price below GPO price 0 0 0 Hospital: negotiate 0.5 1 Negotiated price above GPO price 0 0 0 0 0 0 0 0.5 Negotiated price below GPO price 0 0 0 1 0 0 0.5 Negotiated price above GPO price 0 0 0 GPO vendor: participate 0.5 0 0 GPO vendor selected 0.5 0 0 0 0 0 0.5 GPO vendor not selected 0 0 0For Evaluation Only GPO vendor set price Pg λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) Hospital:invite GPO vendor Hospital: don't invite GPO vendor GPO vendor: don't participate Negotiated price below GPO price λ q P g q P g + c (k,0 ) 0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 ) λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 ) GPO vendor payoff Hospital cost λ q P g q P g λ q P g - k v q P g + c (k,1 ) Next, we take a closer look at custom contracting 81

- 82. Because the GPO vendor can participate in negotiations, it will occasionally be the low- price bidder & get additional sales 82 So the additional revenue can be thought of as coming from expected additional demand at the GPO-wide price

- 83. Because the GPO vendor can participate in negotiations, it will occasionally be the low- price bidder & get additional sales 83 Prob of being lowest cost bidder x Expected per unit price x full demand / GPO-wide contract price

- 84. Result VI: The GPO vendor does NOT reduce price when custom contracting is allowed 84 Prob of being Maximum expected profit with custom contracting

- 85. Result VI: The GPO vendor does NOT reduce price when custom contracting is allowed 85 Prob of being Maximum expected profit without custom contracting

- 86. An increase in GPO-wide price leads to an increase in costs even for hospitals that engage in negotiations 86 Hospital Demand Total 180 69 52 Per unit GPO-wide price without custom contracting $3,000 Total cost with GPO contract, GPO vendor acts optimally $540,000 $207,000 $156,000 Per unit GPO-wide price with custom contracting $6,900 Total expected cost (including negotiations) with custom contracting $642,684 $476,100 $358,800 Expected increase in costs $102,684 $269,100 $202,800 $574,584 Percentage expected increase 19% 130% 130% 39% It is optimal for the large hospital to negotiate, still its costs are higher

- 87. The total expected profit for the GPO vendor increases, even though the expected profit coming from large hospitals may decrease 87 Hospital Demand Total 180 69 52 Per unit GPO-wide price without custom contracting $3,000 Total cost with GPO contract, GPO vendor acts optimally $523,800 $200,790 $151,320 Per unit GPO-wide price with custom contracting $6,900 Total expected cost (including negotiations) with custom contracting $129,788 $461,817 $348,036 Expected increase in costs -$394,012 $261,027 $196,716 $63,731 Percentage expected increase -75% 130% 130% 7% This large hospital will be buying the supplies from the GPO vendor less frequently

- 88. Interestingly, that with custom contracting the procurement manager of a large hospital looks good, because it looks like s/he negotiated significant savings relative to the GPO price 88 Purchase at GPO price: $6,900 x 180 = $1,242,000 Negotiated unit price: $3,431 Purchase at negotiated price: $3,431 x 180 = $617,684 Cost of negotiations: $25,000 Total cost: $642,684 Savings: 48%

- 89. Managerial Conclusions (I/II): Custom contracts generate an illusion of additional savings The ‘Custom Contracting’ flexibility option comes at a price! We prove that Custom contracts: o increase profits for GPOs and vendors, o do not increase the savings for hospitals 89

- 90. GPO price becomes a misleading benchmark for measuring relative cost savings But, ‘Custom Contracting’ makes the procurement managers look better (And they are the one who ‘select’ the GPO to use) The hospital industry, therefore, may have a hard time effectively blocking this costly practice 90 Managerial Conclusions (II/II): Custom contracts generate an illusion of additional savings

- 91. Healthcare Procurement: Custom Contracting through GPOs 91 Rajib Saha Vera Tilson Avi Seidmann

Notes de l'éditeur

- Eliminate self-dealing: not to steer contracts to a vendor in which the GPO holds a stake. Not to receive stock or other securities from vendors in exchange for business

- to the 2002 US GAO investigation

- to the 2002 US GAO investigation

- For example, Kaufmann & Wang (2001), Anand & Aron (2003), studies pricing in Internet-based group buying in a B2C context. Burns and Lee (2008) studies the effectiveness of healthcare GPOs in the Unites States. Schotanus (2004) identifies the unfair allocation of cost savings among members as one of the important reasons behind the failure of some consortia. Hu and Schwarz (2008) studies duopoly competition between GPO vendors to analyze the impact of group purchasing on cost of procurement, incentive to innovate, etc.

- For example, Kaufmann & Wang (2001), Anand & Aron (2003), studies pricing in Internet-based group buying in a B2C context. Burns and Lee (2008) studies the effectiveness of healthcare GPOs in the Unites States. Schotanus (2004) identifies the unfair allocation of cost savings among members as one of the important reasons behind the failure of some consortia. Hu and Schwarz (2008) studies duopoly competition between GPO vendors to analyze the impact of group purchasing on cost of procurement, incentive to innovate, etc.

- For example, Kaufmann & Wang (2001), Anand & Aron (2003), studies pricing in Internet-based group buying in a B2C context. Burns and Lee (2008) studies the effectiveness of healthcare GPOs in the Unites States. Schotanus (2004) identifies the unfair allocation of cost savings among members as one of the important reasons behind the failure of some consortia. Hu and Schwarz (2008) studies duopoly competition between GPO vendors to analyze the impact of group purchasing on cost of procurement, incentive to innovate, etc.

- For example, Kaufmann & Wang (2001), Anand & Aron (2003), studies pricing in Internet-based group buying in a B2C context. Burns and Lee (2008) studies the effectiveness of healthcare GPOs in the Unites States. Schotanus (2004) identifies the unfair allocation of cost savings among members as one of the important reasons behind the failure of some consortia. Hu and Schwarz (2008) studies duopoly competition between GPO vendors to analyze the impact of group purchasing on cost of procurement, incentive to innovate, etc.

- For example, Kaufmann & Wang (2001), Anand & Aron (2003), studies pricing in Internet-based group buying in a B2C context. Burns and Lee (2008) studies the effectiveness of healthcare GPOs in the Unites States. Schotanus (2004) identifies the unfair allocation of cost savings among members as one of the important reasons behind the failure of some consortia. Hu and Schwarz (2008) studies duopoly competition between GPO vendors to analyze the impact of group purchasing on cost of procurement, incentive to innovate, etc.

- Efficient Market: Both price and product quality are readily available (e.g., Securities) Opaque Pricing: Price is known but product details are not (e.g., HotWire, Priceline) Market for Lemons: Price is known but the product quality is hidden (e.g., used cars) Market for Health: Product quality is known but price information is not readily available (e.g., medical devices)

- Efficient Market: Both price and product quality are readily available (e.g., Securities) Opaque Pricing: Price is known but product details are not (e.g., HotWire, Priceline) Market for Lemons: Price is known but the product quality is hidden (e.g., used cars) Market for Health: Product quality is known but price information is not readily available (e.g., medical devices)

- Efficient Market: Both price and product quality are readily available (e.g., Securities) Opaque Pricing: Price is known but product details are not (e.g., HotWire, Priceline) Market for Lemons: Price is known but the product quality is hidden (e.g., used cars) Market for Health: Product quality is known but price information is not readily available (e.g., medical devices)

- Efficient Market: Both price and product quality are readily available (e.g., Securities) Opaque Pricing: Price is known but product details are not (e.g., HotWire, Priceline) Market for Lemons: Price is known but the product quality is hidden (e.g., used cars) Market for Health: Product quality is known but price information is not readily available (e.g., medical devices)

- GPO prices become a misleading benchmark for measuring cost savings. But, it makes the procurement managers look better. (And they are the one who ‘select’ the GOP to use)

- . The highly fragmented hospital industry may have a hard time effectively blocking this practice.