Ratio analysis @ gadag textile mill project report mba finance

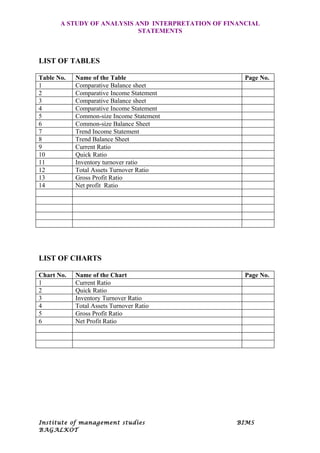

- 1. A STUDY OF ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS LIST OF TABLES Table No. Name of the Table Page No. 1 Comparative Balance sheet 2 Comparative Income Statement 3 Comparative Balance sheet 4 Comparative Income Statement 5 Common-size Income Statement 6 Common-size Balance Sheet 7 Trend Income Statement 8 Trend Balance Sheet 9 Current Ratio 10 Quick Ratio 11 Inventory turnover ratio 12 Total Assets Turnover Ratio 13 Gross Profit Ratio 14 Net profit Ratio LIST OF CHARTS Chart No. Name of the Chart Page No. 1 Current Ratio 2 Quick Ratio 3 Inventory Turnover Ratio 4 Total Assets Turnover Ratio 5 Gross Profit Ratio 6 Net Profit Ratio Institute of management studies BIMS BAGALKOT

- 2. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI I Chapter 1 Executive summary Purpose of the Study Objectives of the Study Methodology Limitations of the study II Chapter 2 Introduction to the company History of the company Introduction Profile of the company Organization structure III Chapter 3 Introduction to the topic Techniques of analysis and Interpretation Findings Suggestions Conclusion SWOT Analysis of the company IV Chapter 4 Appendix Bibliography Annexure BABASAB PATIL Page 2

- 3. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI CHAPTER-1 EXECUTIVE SUMMARY: BABASAB PATIL Page 3

- 4. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI Gadag Co-Operative Textile Mill Ltd Hulkoti established in 1972 by late shri.K.H.Patil at Hulkoti in Gadag district. It is producing main product as yarn. The company started with a production cost of RS.220lakhs.It is started producing yarn in the year 1973. It was a great experience to undergo summer in plant training on “A study on financial Analysis and Interpretation” .During the study I found that the company is carrying its activity in producing yarn. .This study is conducted in order to know how the organization is maintaining the financial statements. So as to identify the problems of such a title and give suggestions and conclusions. In addition to this concept studying the over all organization role of different department functions of their respective departments, procedures and policies. In this report I made an effort to know the financial position of the GCTM Company .My topic is “A study of financial Analysis and Interpretation” which means that a process to identify the financial performance of a firm by properly establishing the relationship between the items of balance sheet and profit or loss account. Thus, we can say that, Financial Analysis is a starting point for making plans before using any sophisticated forecasting and planning. Purpose of the study A company’s balance sheet and profit & loss accounts are valuable information sources for identifying risk taking and assessing risk management effectiveness. Although amounts found on these statements does not provide valuable insights of performance so Financial analysis and Interpretation is required for determining good or bad performance of company and also for determining its causes. The study includes the calculation of different financial ratios, Trend analysis, BABASAB PATIL Page 4

- 5. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI comparative income and Balance sheet, common size cash flow and fund flow statements. It compares five years financial statements of the company to know its performance in these different years. This report includes the profile of the G.C.T.M.Hulkoti. It contains brief introduction ,nature of the business, product profile and process and organization structure. This report includes the findings and suggestions, conclusions of the study done in order to give better suggestions. This study has done by taking the past five years financial statements of the company. For the analysis of data the simple percentage method is used and the data is shown by using the some graphs. Finally the study has helped to me in many ways to acquire the knowledge about the company performance and its profitability. OBJECTIVES OF ANALYSIS AND INTERPRETATION : Following are the main objectives of analysis and interpretation of financial statements. 1.To study the earning capacity of the firm 2. To study the progress of the firm BABASAB PATIL Page 5

- 6. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 3 To assess the efficiency of the firm. 4 To determine the firms paying capacity to measure the financial Performance of the firm. 5. To prepare the comparative statements of the mill. By using the Financial Statements of past years 6. To know past performance and financial position of the mill. METHODOLOGY OF DATA COLLECTION: Before the collection of data, it is often advisable to all other aspects of the study. We need to recognize the scope, need and importance as well as the objectives of the study. After the purpose has been defined, the next step is to decide about the sources of data. The sources of information may be primary as well as secondary sources. This chapter entails a review of all the data obtained and it relevance to the study being undertaken. DATA COLLECTION METHOD: There are two types of data collection methods. 1. Primary data collection method 2. Secondary data collection method PRIMARY SOURCES: The primary data are collected by the thorough and detailed discussion was conducted with the financial controller and Accounts officer and also discussion with college internal guide. SECONDARY SOURCES: The secondary data includes sales reports, purchase reports and financial statements of the company. BABASAB PATIL Page 6

- 7. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI And also information from the text sources. SAMPLING DESIGN: 0Sampling unit : Financial Statements 1Sampling Size :Last five years financial statements 2Sampling procedure : Direct LIMITATIOMS OF THE STUDY • The study is conducted on a general basis. • Time Constraint • Restrictions on Behalf of the company • Inter firm and intra firm comparison is not possible BABASAB PATIL Page 7

- 8. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI CHAPTER-2 HISTORY OF THE COMPANY : GADAG CO-OPERATIVE TEXTILE MILL LTD HULKOTI Hulkoti is small village has a population of 10000, having a different sections of people. The main occupation of the maximum people is agriculture. In this village there is no irrigation facilities; dry land cultivation is the only way to forming committee. In the village the main crops are cotton, jawar, chilly, groundnut etc. The main commercial crops are chilly & cotton. All these marketed in and around Gadag. Farmers are exploited by the private traders and commission agents. To protect the forming committees late Shri.K.H.Patil decided to establish the co-operative mill in BABASAB PATIL Page 8

- 9. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI Hulkoti. Most of the farm laborers are unemployed due to dry land cultivation. To solve the unemployment problem and also to protect the forming committees from commission agents they started the mill. The mill is situated in village Hulkoti near Gadag i.e. 6k.m from Gadag. Late shri.K.H.Patil, politician leader decided to start the mill in this place. The main purpose of starting the mil is to provide the employment opportunities to the people. He is devoted fully for the establishment of co operative network around Hulkoti providing various amenities and scope for development of farmers The mill is started with mission of providing employment opportunities and save the formers from the commission agents. The main crop grown surrounding Hulkoti is cotton, this was an opportunity to start the mill . This is one of the co- operative society located on either side Karwar-Bellary road between Hulkoti and Gadag. It is started with a Ginning and pressing unit. After successful setting up of Ginning and Pressing unit by Gadag co- operative cotton sale society ,the next ambition of the Co operators was to establish a Textile Mill of 25,000 spindles capacity which would consume the main agriculture produce by paying remunerative price to cotton growers and to the farming community. The Gadag Co-operative Textile Mill is established in the year 1972 by late shri K.H.Patil .It is started with project cost of Rs.220 Lakhs. INTRODUCTION The Gadag Co-operative Textile Mill is started by Late Shri.K.H.Patil, to protect the forming committee by private traders and the commission agents. It is started in this place because of availability of raw materials and also the labours. BABASAB PATIL Page 9

- 10. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI The Gadag co-operative textile mill is started in the year 1972 with a project cost of Rs.220 Lakhs. The G.C.T.M commenced is production in the year 1973. The project cost is met with the following manner. 1 Members Shares Contribution - Rs.040.00 lakhs 2 Government Share Contribution - Rs.080.00lakhs 3 Term Loans (IFCI) - Rs.100.00lakhs Total - Rs.220.00lakhs INFRUSTRUCTURE FACILITY: Land and building 33.71 Lakhs Plant and machinery 177.70 Lakhs Miscellaneous 24.08 Lakhs Contingency 6.00 Lakhs Working capital margin 22.00 Lakhs Free op 15.00 Lakhs erative expenses BABASAB PATIL Page 10

- 11. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 220 lakhs Total Project cost of Rs.220Lakhs is met for all these facilities i.e. to establishment of the company. CUSTMORS: 1) Samrudha Over Sales Ltd., Mumbai 2) Suryajoti International mill ltd ,. Sinkandrabad 3) Dhanalaxmi (C&R) Mill, Ganapavaram. 4) Suryalaxmi Cotton Mills Ltd., Sinkandrabad Nature of the business: The first step the company purchases the raw material i.e. cotton from the farmers. Then it mixes it with different quality cotton according to the quality of yarn needed. BABASAB PATIL Page 11

- 12. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI The next step is cleaning the minor part and spraying the water to it. Then it kept 1 day in the cool place. Next step it goes to major cleaning part it goes to all cleaning of the cotton. The next process is carding process. Here the cotton will become smoothly and white. Next goes to the simplex method. In this cotton becomes big layers and it makes the group of layers. The next procedure is rolling and grilling. Here the big layers are rolled and it is separated from the group and comes in the form of loose thread and next process is drafting and twisting and the thread becomes strong and it comes layer by layer in the form of thin yearn. The next step is noting here if thread goes into two parts the machine will join it. It is called noting process. Finally after all these process the raw material is converted into the finished goods which are in the form of yarn. MISSION: “To Purchase the creation of values for all its Customers, Employees, members (shareholders) and society at large” BABASAB PATIL Page 12

- 13. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI VISION: “To be a premier Textile company with a clear focus to become globally competitive through growth and Technology up gradation committed to excellence in quality service and co- operatives. “ COMPITATORS:. Modern days are the competitive days wherever you go, in which ever field you enter there is competition; one must know how competition in the market makes it absolutely necessary for manufacturers to think of advertising. For new product, strategies and by doing all these to in areas the sales. These following companies are the competitors of the G.C.T.M. 1) Banahatti Co-operative Spinning Mill Ltd. 2) Sangola Co-operative Spinning Mill Ltd. 3) Farmers Co-operative Spinning Mill Ltd. COMPANY PROFILE: THE GADAG CO-OPERATIVE TEXTILE MILL LTD. HULKOTI Name – 582 205. This Co-operative Society registered under the Co-operatives Status Societies Act of 1959 Location Karnataka state, Gadag Dist, Hulkoti BABASAB PATIL Page 13

- 14. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI Chairman Shri D.R. Patil, Ex M.L.A. Gadag. Area of operation Gadag Haveri New-Delhi, South Korea, China and Couple of European Export places countries(through agents& Govt institutes) Nature of Business Production and sale of YARN Membership and Share capital 3021 Co-operative societies and 817.71 Lakhs No of departments 8 [Eight] Departments Number of employees 450 Elected members – 18 No of Board of Ex – office members – 1 Directors Nominated by Govt – 3 Production capacity 8,500 kgs of yarn per day as per the 2008-09 report. Storage capacity 7500 Million TON. Land area-90525 sq.ft Area of mill Buildup area- 643.45 sq.mtrs ORGANIZATION STRUCTURE: Share Holders BABASAB PATIL Page 14

- 15. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI Board of Directors Chairman Managing Director P&I Production Finance Administration Security Marketing Dy. Dy. Dy. Dy. Sr. Dy. Manager Manager Manager Manager Supervisor Manger Extension Q.C. Accounts Assistants Jr. Assistants Officer Officer. Assistants Supervisors Helpers Assistants Helpers Helpers Helpers Workers HUMAN RESUORCE MANAGEMENT: BABASAB PATIL Page 15

- 16. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI Human Resources is an activity involved in direction & co-ordination of human relations in a organization there by obtaining maximum production at the minimum effort stress & strain on individual workers. Functions . 1. Staffing & Employment 2. Welfare Amenities 3. Training & Development. 4. Compensation, Wage & Salary Administration. 5. Motivation & Incentives. 6. Employee records. 7. Labour on Industrial Relation. 8. Organizational planning, development & task specification Management is considered as an art of getting thing done through others with a view to achieve the common objectives of the organization . but these objectives can be achieved only if the organization is managed efficiently . The management of the organization is considered to be efficient of it is able to contribute their maximum towards the realization of the organization. The organization believes that the management should not primarily be considered with full and proper utilization of physical factors such as raw material and machinery but also pay attention to the human factors . On which the maximum utilization of physical factors depend. BABASAB PATIL Page 16

- 17. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI The Personnel Manager also says that Material may be purchased at the most competitive prices and machines was worked to their full capacity but the output cannot be maximized without the co-operation of the workers. The company works 24 hours a daily. The work is divided into 3 shifts i.e. AM to 4.30 PM First shift 4.30 PM to 12.30AM second shift 12.30 AM to 8.30AM third shift CLASSIFICATION OF THE WORK FORCE : Work force of the society shall be classified as under : 1) Permanent 2) Badli 3) Trainee or apprentice WELFARE FACILITIES IN GCTM: Following are the Welfare Facilities provided by GCTM to its workers. BABASAB PATIL Page 17

- 18. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 1) Canteen: The personnel department administers the canteen . the main responsibilities are to prepare and distribute the food stuff as per the scheduled timings the different counters and to maintain hygienic condition printed and supplied by the company. 2) Medical Facilities : Workmen covered under the ESI scheme and their family members will receive medical facility under the employees state insurance as in force from time to time.And also one hospital is their in the organization premises for general and first aid treatments. 3) Quarter’s Facilities : The quarters are provided for the permanent employees who are working in the GCTM. There are A,B,C,D and E type of quarter are being provided to the employees on the seniority basis . 4) Transport Facilities; The employees are provided with bus facilities.There are one bus and one maxi cab is there which pickups the people scattered in the Gadag city and after the duty hours they are dropped back at the same fixed points 5) School and College : A school and pre university colleges has been constructed in the Hulakoti near to the company which are handed to the state education department . For the maintenance and repairs or replacements of furniture and electrical fitting is carried out by the company. ATTENDANCE: BABASAB PATIL Page 18

- 19. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 1) Every employee shall be at this place or work at the time fixed and notified under clause and of these standing orders from time to time. 2) The starting and closing of work and starting and finishing of intervals period will be signaled by means of siren, bell or similar devices. 3) After the siren bell every employee should present at the place of work. 4) The attendance register shall be entered from time to time cards and any employees failing to record or get marked the time on the card is liable to be treated as absent. 5) Employee coming late or leaving early without permission shall be liable to deductions from their salary /wages as provided for in the payment of wages act 1936. For this purpose time shall be calculated in units of 30 minutes. SALARY AND WAGES : BABASAB PATIL Page 19

- 20. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 1. Notice specifying pay days shall be displayed on the notice board of the Society . 2. An employee shall check his salary or wages immediately on receipt. No claim for shortages will be considered once the recipient has left the immediate presence of the person making payment. Any dispute or complaint regarding wages shall be brought to the notice of the management or any other officer appointed for the purpose as early as possible. It shall be the duty of the management or the officer appointed to attend to such complaints without much delay. 3. Unpaid Salaries and Wages : Any salaries and wages due to the employee Not paid on the usual pay day on account of the salaries and wages remaining unclaimed or for any other reason will be paid 3 days after the specified date of payment or when claim has been substantiated by the employee or on his behalf of his legal representative provided such claim is made and substantiated within one year from the date on which the salary or wages become due to the employee. BABASAB PATIL Page 20

- 21. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI ADMINISTRATION DEPARTMENT Administrative department play very important role in the organization for its smooth running of the business and success of this company is mainly depending on the efficient administration of the G.C.T.M. This department looks after administrative functions such as payment of salaries, arrangement of meetings, and formation of policies etc, the general functions of this department are as follows. Maintenance of files, records etc. up to date, collecting and presenting data in the form of useful information from the records. Implementing the organization systems, procedures and policies in a coordinated manner. Ensuring smooth running of the office buy interfacing with the eternal agencies as required. For ex-payment of telephone bills, electricity, water supply bills etc. Maintenance of the office premises. Providing required facilities. BABASAB PATIL Page 21

- 22. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI MODERNIZATION PROGRAMME After a period of 18 years there was a need for upgrading technology of certain machines and to eater to the export needs, the Management proposed a Modernization Programme at a cost of Rs. 429.00 Lakhs. The term, lending institutions sanctioned Rs. 236.69 Lakhs and the balance Rs. 192.31 lakhs was from the internal resources of the Mills. The Mill replaced Carding Machines, winding machines and added one Open End Spinning machine and one Imported Auto Conner of latest technology. With the implementation of this Project there was improvement in the productivity and the quality of the finished product. To meet the standards of the quality yarn in demand, both in domestic as well as in International markets, the Management of the Mills thought it inevitable to launch another Modernization Programme covering Machinery from blow room to Spinning was planned. This programme, with an estimated cost of Rs. 920 Lakhs was approved by the national Co-operative Development Corporation (N.C.D.C.) and the Government of Karnataka. As part as Modernization Programme, N.C.D.C. has sanctioned Rs. 736.00 Lkahs, while Government of Karnataka contributed Rs. 136.00 Lkahs as share capital. The rest amount of Rs. 46.00 Lkahs was mobilized from Members of the Society through shares. With successful implementation of 2nd Phase of Modernization Programme, the latest version of Auto leveler Machinery at Carding and Drawing Sections are inducted and commissioned. Following this, efforts are being made to raise the productivity to high standards. Further, completion of Modernization enables us to qualitative requirement of requirement of International market Standards. BABASAB PATIL Page 22

- 23. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI PURCHASE DEPARTMENT: The purchase department is play the important role in every organization. To run the business continuously purchase department plays a vital role. Purchase activity has developed the long relationship with the vendors of the company. Purchasing is a social and managerial function which creates the value for production unit. To satisfy the needs of the company there is a need of purchases as per requirements of the company by considering the price quality and quantity. OBJECTIVES OF THE PURCHASE DEPARTMENT The company should have deep knowledge of variety of cottons. The company should know the Quality assurance Buying quality cotton. Experimenting the quality cotton. Proper arrangement of the transportation facilities. Minimizing transportation cost. Observing quality of the cotton. Minimization of the purchase cost. BABASAB PATIL Page 23

- 24. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI COTTON PURHASES: The mill purchase its cotton at the open auction held by co-operative namely Gadag cotton sale society and T.A.P.C.S.M. society of the Annigeri , Gokak and also mill has purchases cotton from other states like Maharashtra Federation Punjab Federation, Tamilnadu, and from CCI(cotton co-operation of India). The purchase department decides the when to purchase ,where to purchase and how much to purchase by discussing with a managing director and the production manager. Purchasing dept sends the purchase order to the vendors. The company major purchases are in CCI only. Because the required quality of the cotton is available in one place and also in more quantity. BABASAB PATIL Page 24

- 25. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI PURCHASE PROCEDURE: 1. The company collects the samples from the various suppliers. 2. That cotton will be check in laboratory 3. After getting a results they are conducting a meeting at where they are finalizing which cotton to purchase. 4. The purchase committee includes: 1) Managing Director 2) General Manager 3)Production Manager 4) Quality Controller 5)Cost Department Head 5. Then they bargain with the suppliers relating to the price. If suppliers if a farmer or any of the private cotton trader then the bargaining is necessary. If they purchase the cotton form CCI or MSCF the prices are fixed. 6. The payment period is usually 30 days to all suppliers. 7. Before bargaining with suppliers the company collecting the daily cotton market reports which helps them to determining the price. MAIN SUPPLIERS: Cotton corporation of India Maharastra State Cotton Federation PVT Cotton Traders. From Members and Formers. BABASAB PATIL Page 25

- 26. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI The following table indicates purchase of cotton. Year Cotton(lakhs kg) 2003-04 37.37 2004-05 33.37 2005-06 30.67 2006-07 29.40 2007-08 33.83 Table showing purchase of cotton from 2004-08 BABASAB PATIL Page 26

- 27. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI MARKETING DEPARTMENT Marketing department is a vital department of the organization . Marketing has developed the long relationship with the customer from purchasing and selling products. “ Marketing is a social and managerial function which by individual and group obtained want and need and want through creating exchange products and value with other’’. Marketing of Yarn : The mill manufactures 10s, 20s, 30s, 40s, 60s, 80s, 100s, 2/20s, 2/40s, 2/60s etc. In the form of hanks as well as cones as per the prevailing market demand sale of hank yarn and cone yarn from 50:50 respectively we have been fulfilling the hank yarn obligation stipulated by the textile commissioner , government of India at the end of every quarter . The daily production of yarn is about 8,500 kgs and mill is working round the clock for all the seven days of the week. Special preference in selling yarn is given to weavers co-operative Apex organization and Karnataka Handloom Development Corporation export of yarn has been our priority yarn is being exported to countries like South Korea through agency. Packing of Yarn: BABASAB PATIL Page 27

- 28. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI Packing is a process of converting to a product for protection hanks yarn are packing in the bale from and cones yarn are packing from bags. Bales is consist of 181.6 kgs. And bag is consists of 50 kgs Mode of Sales : In this organization orders are normally done through: 1) By phone 2) By their own sales depots and 3) By local sales agents. Sales promotion: The company not adopted any Aggressive measures for the promotion of its sales such as advertising lotteries etc. But some basic measures which are adopted normally by every concern such as discounts. BABASAB PATIL Page 28

- 29. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI STORES DEPARTMENT In G.C.T.M there is Stores Department is one which stores all the materials, equipments and spare parts etc. Which are needed in the signalization for its smooth running .The main function of this department is to provide the needs of the organization i.e. machines spares parts, packaging materials, tools, oils ect. To run business continuasally this department plays very important rolein the organization. In this department they provide materials according to order made by the different departments in the organization. The orderslip must be sing by the M.Director department head. Objectives of the Stores Department : 1) Concentrating towards smooth running of the production process. 2) Facilitating all required equipments on time . 3) Reduction of Inventory equipments on time . 4) Working like a traffic signal to signalize to all equipments. 5) Proper maintenance of all equipments. This Stores Department is divided in to two sub departments they are: a) Materials stores b) General Stores. BABASAB PATIL Page 29

- 30. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI a) Material Stores: It is a sub department of the stores , which maintain the stock of raw material needed in the plant i.e. cotton , paper cones , bags . This department mainly concerned with storage of 30 days stock of raw material in the plant. b) General Stores: It is also a sub department of the stores which maintaining the stock of general material like ,paper ,files ,uniforms of workers ,shoes ,goggles, helmets, glows, cups, spare parts of machines , stationeries and other lubricants and packing materials. These all materials are stored under bin system. In this department each material or item will be assigned a number to it which is called as Bin number. There are about 11,000 items are maintained in this department and all have been assigned in No’s. Bin number is a 9 digit number, which will help in recognizing the item very quickly and accurately. The first three numbers in Bin card will giving the information about which section . and the second 3 digit will gives information about which equipment and the last 3 digit will gives information of which item it is. The stores department is maintaining mainly two ledgers , they are: BABASAB PATIL Page 30

- 31. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 1) Material Receipts Ledger. 2) Material Issued Ledger. At he time of each entry in the ledger they are quoting the date, item number quantity price / piece, total price. PRODUCTION DEPARTMENT: Production means conversion of raw materials into a finished product. In this mill they are producing the yarn. i.e. cotton is converted as yarn (finished product). The G.C.T.M is one of spinning mill, it is taken permission from the government spinning and textile. In future it is plan to produce a cloths but now it is producing only Yarn. The G.C.T.M has a well equipped building and also plant and machineries. In mill they set the machines sequentially as per work flow i.e. plant layout system is applied very systematically. In production to control the wastages, to save the time, to increase work efficiency and to increase the productivity the plant layout play a vital role. We study about plant layout in theoretically but this project helps me to know it in practically . BABASAB PATIL Page 31

- 32. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI THE WORK FLOW MODEL: MIXING: Bales of different counts are mixed along with usable wastes, on different percentage in the mixing bins, cotton bales of different quality are opened and stacked, called stock mixing, 24 Hours for conditioning before it is process further. BLOW ROOM: Cotton in losses form is spending on mixing bale openers and taken further of different cleaning points where the cotton is beaten and trash is extracted. Finally converted into Lap form of different length, weigh per yard, depending on the count. CARDING: Lap form Blow room feed to Cards where the cotton is converted from Lap form to slive form. During this process trash, short fibers and other impurities are extracted the different cleaning points, like licker in, Flats section Units. The sliver is produced of different Hank depending on the counts. BABASAB PATIL Page 32

- 33. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI PREPARATORY: Cards sliver is drawn through different drafting Rollers and the sliver is elongated and increasingly the length of the sliver and radiating in the cross section by passing through different drafting rollers and convert into a suitable package by giving little twist to the material called Rove and wound on a Bobbin. SPINNING: The bobbins from the Preparatory process are feed to the drafting rollers as final treatment to the material and further increasing the length and reduction the cross section of the material. This process the material process through Ring and Traveler and would on the bobbin to form a suitable package the giving optimum of the twist depending on count of the yarn. CONE WINDING: Here the yarn spun is cleaned by passing through cleaning devise called slub catcher and would through suitable package of required length and weight in the form of a Cone. DOUBLING: Here two yarn of the same count are doubled by giving necessary twist in the form of package called bobbins. REELING: Here single yarn or doubled yarn are wound on the swifting of the machine called Reel in the form of Hank and are make in the form of Knots. There are two types, a Plain or Cross Reel. BUNDLING & BALING: Here the number of knots plain or cross is in a press depending on the count and weight of the boundless are as per requirements. Bundles are pressed in the form of Bale depending on the count, Plain or Cross as per the requirement from the market. PACKING: Here number of cones or cheeses is bagged depending on the count of the yarn number of cones and weight of the cones. Depending on the requirement of the market. BABASAB PATIL Page 33

- 34. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI QUALITY CONTROL DEPARTMENT: Quality Control Department is a vital department of this organization. Because it provide information regarding quality of the raw materials and also finished goods. To purchasea standard quality materials there should be quality control department. According to the experts the first step is imported in business i.e. in production activities the first step is the raw material. Therefore while purchasing the raw material the quality control department is important. Quality Control Department is the key factor to producing the quality products. Quality control Department plays an important role in controlling and increasing the quality of the product and it also helps in increasing the efficiency of the products. Quality control should be exercised at the all key stages of the production processes, so that it helps in the stoppage of the variation in the final product. In the GCTM Quality Control Department there is laboratory where the samples of the cotton are tested before purchase. In this lab 1.25 crore worth machine is installed which is completely computerized machine and it is also one of the well equipped lab in the Karnataka. FUNCTION OF THE QUALITY CONTROL DEPARTMENT : o Random lab weight checking o Within lap variation BABASAB PATIL Page 34

- 35. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI o Cleaning efficiency o Waste study speeds o Wrapping checking o Naps study o Uniformity checking o Idle spindle o Top roller pressure checking o Rewinding study o Gauge and tension weight checking o Knot inspection o Knot weight checking OBJECTIVE OF THE QUALITY CONTROL DEPARTMENT: Increasing customer satisfaction Producing the quality products. Reduction in the scrap Continuous improvement in the productivity. Reduction in production overheads. Quick response to order fulfillment. BABASAB PATIL Page 35

- 36. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI BASIC CONCEPTS USED IN TEXTILE MILL Fiber : A slender filament ; a fine thread like part of a substance . Kapas : Cotton with seeds and impurities Lint : Cotton free from seeds and impurities Ginning : The mechanical process of separating the cotton fibers from seeds Bale : A bundle or packages of cotton compressed and bound with cord or wire weight round about 170 Kgs. Spinning : The process of drawing out and twisting the fiber of cotton, Wool etc. Into thread or yarn either by hand or machine. Spindles : The rods or pins of spinning machine known as the ring frame holding the bobbins on the which yarn wound as it is spun . Such spinning is expressed in terms of the number or spindles or rotors. Rotors : In the modern of spinning known as the open end spinning instead of BABASAB PATIL Page 36

- 37. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI spindles rollers are used. Yarn : A textile thread obtained by twisting of consecutively disposed and Straightened ultimate composite fibers. Hank & cones: Yarn is supplied to the market in to different forms hank yarn and cone yarn . Hank yarn is convenient form of bleaching, , and transport but needs winding before placing on the loom . It is used by hand loom weavers .Cone yarn however eliminates the Need form winding and can be directly used in power looms . Count : A count is measure of thickness or fitness of yarn ,The various counts groups manufactured are 10s , 20s , 24s, 30s,32s,34s,40s, 60s, 80s 100s both in Hank and Cone. Lower counts indicates coarse yarn and higher counts indicates fine Yarn BABASAB PATIL Page 37

- 38. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI FINANCE DEPARTMENT Finance department is vital department of a organization .Finance is concerned with providing and using cash and credit for carrying on business correctly. The mill has membership and paid up share capital as on 31st march 2007 SI.NO Category No.of Share Holders Share Captial 1) ‘A’ Class Individual /Member 3019 107.46 2) ‘B’ Class (K.A.I.C.) 1 015.00 3) ‘C’ Class (State Government) 1 695.26 Total 3021 817.72 BABASAB PATIL Page 38

- 39. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI Mill has funds that may be raised 1) By issue of Shares 2) By receiving deposits from members. 3) By raising loans 4) By entrance fees 5) By accepting donations, subsidies and grants. 6) By commercial institutions. Deduction can be made from the sale of proceeds of the cotton brought by members at rate not exceeding 7% of the sale products. The mill may raise loans discount on the bill and overdrafts as and when necessary from the industrial finance corporation of India. WORKING CAPITAL FINANCE Introduction : Funds available for a period of one year or less are called short term finance. The short term funds are used to finance working capital. The main source of short term working capital are as follows: 1) Trade Credit: Trade credit refers to the credit that a customer gets from supplier of goods in the normal course of business. In practice , the buying firm do not have to pay cash immediately for the purchase made . This deferral of payments is a short term financing called trade credit .It contributes to about one third of the short term BABASAB PATIL Page 39

- 40. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI financing .Open account trade credit appears as sundry creditors on the buyers balance sheet . Trade credit may also take the form of bills payable. 2) Bank Finance For Working Capital : Banks are the main institutional source of working capital finance. After trade credit, bank credit is the most important source of financing working capital requirements of firms. A bank considers a firm’s sales and production plan and desirable levels of current assets in the determining its working capital requirements. The amount approved by the bank for the firms working capital is called credit limit. Bank do not lend 100% of the credit limit. A firm can draw funds from its bank within the maximum credit limit sanctioned. It can draw funds in the following forms. a) Overdrafts: Under the overdraft facility, the barrower is allowed to withdraw funds in excess of the balance in his current in his current account up to a certain specified limit during as stipulated period. b) Cash Credit: A borrower is allowed to withdraw funds form the bank up to the sanctioned credit limit. He is not required to borrow the entire sanction credit, rather, he can draw periodically. 3) Commercial Paper : Commercial paper represent unsecured promissory notes by firm to raise short term funds. Commercial paper is cheaper source of raising short term finance as compared to the bank credit and proves to be effective even during a period of tight bank credit. However , it can be used as a source of finance only by large companies enjoying high credit rating and sound financial health. 4) Installment Credit : This is another method by which the asset are purchased and the possession of goods is taken immediately but the payment is made in installment over a BABASAB PATIL Page 40

- 41. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI predetermined period of time Generally interest is charged on the unpaid price or it may be adjusted in the price. It is used as source of short term working capital. 5) Accrued Expenses : Accrued Expenses are the expenses which have been incurred but not yet due and hence not yet paid also. The most important item of accruals are wages and salaries, interest and taxes. Wages and Salaries are usually paid on monthly, fortnightly or weekly basis for the service already rendered by employees. In the same manner, accrued interest and taxes also constitute a short term source of finance SOURCE OF FINANCE USED BY THE GADAG CO-OPERATIVE TEXTILE MILL LTD. HULKOTI The GCTM have raised different variety of Finance for working capital purpose. Which are as follows : 1) Trade Credit: We already set the trade credit is the credit that a customer gets from the suppliers. GCTM purchased the cotton from different organization like Cotton sale society of Gadag and Cotton Society of Annigeri . We can know the percentage of trade credit in the balance sheet of GCTM. 2) The GCTM make the sale of different areas like Bangalore ,Solapur and also other states .It also sells the yarn to Karnataka Handloom Development Corporation etc., from these some percentage of Advance they get. 3) Other Source of Finance: 1) K.C.C. Bank Ltd., BABASAB PATIL Page 41

- 42. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 2) N.C.D.C. Loan 3) Bijapur D.C.C. Bank Ltd Objective and Finance Department; To have permanent record of all the transaction for future reference. To know the result of the business in terms of profit and losses. To the exact reason for profit and loss. To know the financial position of the business. To know the progress of the business from year to year To have valuable information for legal and purpose Functions of Financial Department: • To prepare Trading A/c • To prepare Profit and Loss A/c • To prepare Balance Sheet • Maintenance of accounts is under taken • Rate fixing • Suppliers bill paying BABASAB PATIL Page 42

- 43. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI • Maintenance of cash and bank balance. CHAPTER- 3 BABASAB PATIL Page 43

- 44. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI INTRODUCTION TO THE TOPIC ANALYSIS AND ITERPRETATION OF FINANCIIAL STATEMENTS : Financial statements provide summarized view of the financial position and operation of the company. Many parties are interested in financial statement analysis to know about the financial position of the firm. They include investors, creditors, lenders, suppliers etc It is process of establishing the meaningful relationship between the items of financial statements. To know financial position of the company with the help of past and present performance of the company. Items includes Balance sheet, Profit and loss account, Reports and Explanatory notes. Meaning of financial statements: Financial statements are the consolidated and summarized form of business transactions which are pre-pared at the end of each accounting year. These statements reveal the financial information of the business enterprises for a certain period. The financial statements are prepared for ascertainment of results of a business and communicate the accounting information to the users. The financial statement provides answers to the following questions. 1) What is the financial status of the firm on a particular date? 2) How is the firm’s financial performance over the period? Here for the project the profit and loss a/cs, balance sheet are used for comparative analysis and interpretation of the study. BABASAB PATIL Page 44

- 45. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 1) Balance sheet: Balance sheet is the statement of financial position of a business concern as on specified date. It represents all the assets owned by the firm and liability owed to others. In other words, it contains the various assets, liabilities and owners equity as on particular date. The balance sheetis prepared on the basis of following equation. ASSETS = EQUITIES (A) = (E) Or Assets = Owners equity + creditors equity Or Assets = (Share capital + Reserves + surplus-Losses) +outside liabilities 2)Income statement(Profit and loss a/cs: This statement explains the financial performance of a business concern for the particular period. It explains the net result of the business operation between two balance sheet dates. The income statement is pre-pared on the basis of revenue principle, realization principle and also on the basis of matching principle. The realized revenues are matched against its related expired cost. The result is net profit or loss for the year. The equation is as under: BABASAB PATIL Page 45

- 46. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI Revenues = gains – (Expenses + Losses) = net profit or loss. THE FINANCIAL ANALYSIS AND INTERPRETATION. The significance of financial statement not lies in their preparation but in their analysis and interpretation. Therefore analysis and interpretation is an attempt to determine the importance of financial statements. It increases the meaning of accounting data. To provide more understanding in layman’s language. That helps to forecast the future earnings, ability to pay dividend policy etc. the analysis and interpretation are 2 terms complementary to each other. For interpretation analysis is necessary. And analysis without interpretation is meaningless. ANALYSIS : “A process of grouping or sub grouping of a given data for the purpose of developing some relationships among the groups either for decisions or for future prediction” The financial analysis involves the division of facts or information on the basis of some definite plans and to classify them into groups on the basis of some conditions and presenting them in most convenient, simple and understandable. Therefore analysis involves the following: 1. Study and understanding of the data presented in the financial statements. 2. Collection of additional information necessary for interpretation. 3. presentation of the financial data in logical and simple manner 4. Grouping and sub grouping of the items given in the financial statements on the basis of common characteristics. BABASAB PATIL Page 46

- 47. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 5. Development relationship from one group to another group for further study. 6. The data provided in the financial statements is re arranged and methodically classified for comparisons. For this purpose some standards are established for comparison such as : 1. Past year figures may be used as standard for comparison with the present year figures. 2. Future years estimated figures may be used as standards. 3. Another progressive or successful firm‘s figures may be us e used as standards. 4. over all industry figures may be used as standards for a Comparison. The relationship can also be established from one item of statement to the other item of statement. E.g.Net profit or gross profit to sales, current assets to current liabilities, cost of sales to inventory, fixed assets to capital etc. INTERPRETATION: To interpret means to put the meaning of data in simple and understandable manner to a layman. Interpretation can be made only after analysis. It is the explanation of the conclusion drawn from analysis in simple terms. The interpretation involves the following. 1) Study of relationship among the of items of financial statements. 2) Study of trend over a period or actual data with the standard data used for comparison BABASAB PATIL Page 47

- 48. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 3) Conclusions or inferences are put in simple terms for easy and more understanding for a common man. USES OR ADVANTAGES OF ANALYSIS OF FINANCIAL STATEMENTS. 1) It helps to determine financial strength or weakness of the business firm. 2) It highlights the significant facts and relations which cannot be understood by mere reading of financial statements. 3) It is based on some logical and scientific method and is useful for decisions. 4) It is useful to understood multidirectional relationships of the various items of financial statements. 5) It minimizes the threat of wrong or delayed decisions. 6) It helps to evaluate correctness and accuracy of the decisions. TOOLS OF FINANCIAL ANALYSIS OR TECHNIQUES OF ANALYSIS 1) Comparative Financial statements 2) Common size statement 3) Ratio Analysis 4) Trend Analysis Comparative statements BABASAB PATIL Page 48

- 49. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI Comparative financial statements are those statements which summaries and present related accounting data for number of years. It is an arrangement of the financial statements in such a manner that each element of the financial statement is comparable with same element of the financial statement of another period. Generally the financial statements of two periods are used for comparable study. While pre- paring comparative statements one should keep in mind that the accounting principles, policies should be same. Any material change in such principles policies etc. comparative statements useless. A comparative statement provides the following. 1.Absolute change in amount or figures. 2.Absolute change in percentages. 3.Increase or decrease in figures and percentages. Advantages of comparative statements. 1. It is helpful for inter period comparison. 2. It is helpful for inter firm comparison. 3. It is useful to study the trends of various elements of financial statements. Types of comparative statements. For the purpose of comparative analysis the financial statements are classified into 2 types namely, 1) Comparative balance sheet. 2) Comparative income statement. BABASAB PATIL Page 49

- 50. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 1)Comparative balance sheet. Under this technique the balance sheet of two different dates or balance sheets of one firm to another firm may be used for comparative study. an item or group of item of one balance sheet is compared with the same item or group of item of another balance sheet. The comparative balance sheet is helpful to study the liquidity position, financial status, long term financial position etc. following are the steps for pre-pare comparative balance sheet. I) Redraft the balance sheet in vertical form. II) Pre-pare two additional columns one for absolute change and and another for percentage change. III) Study the trend (increase or decrease) and form the opinions. IV) Interpret the same. 2)Comparative income statements: The comparative income statement is pre-pared to study growth rate in profitability, expenses, cost of goods sold etc. usually two years income statements are compared. For this purpose two additional columns are prepared for recording the absolute change and percentage change. The facts and figures in the financial statements i.e.( Balance sheet P&L a/c Reports & also some notes )can be transformed into meaningful and useful figures through a process called Analysis and Interpretation. BABASAB PATIL Page 50

- 51. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI Comparative Income Statements for the year 2008-09 ParticularsTHE GADAG CO-OPERATIVE TEXTILE MILL.LTD- HULKOTI 2007-08 2008-09 Absolute Absolute increase/d increase/ ecrease in decrease Rs in % A) Net sales 274253348. 256739185 -17514163 -6.38% Less : cost of 185292474 180378194 -4914280 -2.65% goods sold (Op.stock+purch ase-clo.stock) . Material 78144336 72311126 -5833210 -7.46% consumed Less: manufacturing expenses(cost of .263436810. 252689320 -10747490 -4.07% production) Cost of goods 108165378 4049865 -6766673 -62.55% sold Gross profit 9848419.5 10967021 1118602 11.35% Less : operating 968119 -6917156 -9764268 -76.42% expenses Administration expenses Add : Non operating 12776730 3012462 -17649513 128.44% Incomes -3520-176 -0.37% Operating profit 13744848.97 -3904694 14307 Less: Interest 9295525 9260319 4449324 -13165013 395.88% Net Profit/loss BABASAB PATIL Page 51

- 52. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI Comparative Balance Sheet As on 31-3-2008-09 PARTICULARS 2007-08 2008-09 INCREASE/DECREASE INCREASE/DECREASE IN Rs IN % Current Assets Cash in hand 40460.35 27094 -13366 -33% S. debtors 51709943 51003132 -706811 -1.4% Other C. Assets 86804486.9 75843397 -10961090 -13% (cash at bank , 8 advances, other receivables ,closing stock.etc) A) Total current 138554890 12687362 -11678267 -8.4 assets 3 Less : current liabilities 49593595. 52486226 2892631 5.8 Others payables 19831776 20192707 360931 1.8 B) Total current liabilities 69425372 72678933 3253561 4.7 Working capital 69129518 54194690 -14934828 - 21 C) = (A-B) D) Fixed assets 180660460 18121183 551374 0.3 4 E) capital employed E) =(C+D) 249789979 23540652 -14383455 -5.75 4 81773300 81773300 - - Share capital 12945560 12945560 - Reserve fund 180562312 18323387 2671558 1.4 Other Funds 0 66940000 -38900000 -5.8 Long term loans 63050000 92431193 13165013 14 Less: loss 10559620 (previous year) 6 Capital 249789979 23540652 -14383455 -5.75 employed 4 BABASAB PATIL Page 52

- 53. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI ANALYSIS: 1. The above Income statement realize that there is decrease in cost of goods sold (4.07%),net sales(6.38%) and also Gross Profit compare to 2007-08. There is 62.55% decrease in gross profit i.e. Rs.6766673. It is more than 50% decrease in gross profit. 2. In the statement we can realize that for 27,42,53,348 net sales the manufacturing expenses is 7,81,44,366 in the year 2008, but compare to present year(2008-09) the manufacturing cost is more i.e. for 25,67,39,185 net sales the m. expenses are Rs. 7,23,11,126 3. There is also increase in operating cost RS. 1118602 i.e. 11.35% in the year 2008-09 compare to 2007-08 4. There is an decrease in Non-operating Income i.e. 76.42%. These all results in Net loss during the year 2008-09 of Rs. 13165013. 5. The above comparative balance sheet shows the liabilities are more compare to previous year. INTERPRETATION: The company’s financial performance is not appreciable because there is heavy loss in the year 2008-09. There is need of control on manufacturing expenses and also other expenses and liabilities. BABASAB PATIL Page 53

- 54. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI Comparative Income Statements for the year 2007-08 Particulars 2006-07 2007-08 Absolute Abso increase/decrease incre in Rs in % BABASAB PATIL Page 54

- 55. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI A) Net sales 254655866. 274253348. 19597481.6 7.69 5 1 Less : cost of 46274537 55889767 9615230 20.7 goods sold 153536359 180187848 26651489 17.3 Opening stock 55889767 50785141 -5104626 -9.13 + purchases -closing stock 110734727. 88960874.1 -21773853.4 -19.6 Material 5 consumed 83442868.2 78144336.1 -5298532.1 -6.34 Less: 4 4 manufacturing 36072802.9 15.8 expenses(cost 227364007. 263436810. of production) 2 1 Cost of goods sold 27291869.3 108165378 -16475331.3 -60.3 Gross profit 11396502.5 9848419.5 -1548083 -13.5 Less : 15895366.8 968118.5 -14927248.3 -93.9 operating expenses Administratio 29619683.9 12776730.4 -16842953.48 -56.8 n expenses 5 7 -5112501.78 -27.1 18857350.7 13744848.9 5 7 -2140602.93 -18.7 Add : Non operating 11436127.9 9295525.04 Incomes 7 -2971898.89 -40% Operating 4449323.89 profit 7421222.78 Less: Interest Net Profit BABASAB PATIL Page 55

- 56. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI THE GADAG CO-OPERATIVE TEXTILE MILL.LTD- HULKOTI Comparative Balance Sheet As on 31-3-2007-08 BABASAB PATIL Page 56

- 57. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI PARTICULARS 2006-07 2007-08 INCREASE/DECREASE INCREASE/DECREASE IN Rs IN % Current Assets Cash in hand 20530 40460.35 19930 97% S. debtors 47320434 51709943 4389509 9.0% Other C. Assets 91604851 86804486.9 -4800364.02 -5.24% (cash at bank , 8 advances, other receivables ,closing stock.etc) 138945815 138554890 -390924.7 -0.28% A) Total current assets 58462247.0 49593595. -8868651.11 -15.16% Less : current 1 liabilities 19831776 958911.05 5.08% Others payables 18872865 B) Total current 77335112 69425372 -7909740.05 -10.23% liabilities 61610703 69129518 7518815.4 12.20% Working capital C) = (A-B) D) Fixed assets 180401907 180660460 513850.4 0.28% E) capital employed 242012610 249789979 7777369 3.21% E) =(C+D) 81772700 81773300 600 - Share capital 12945560 12945560 - Reserve fund 177234868 180562312 3327444 1.87% Other Funds 66940000 66940000 Long term loans 96880517 92431193 -4449324 4.59% Less: loss (previous year) Capital 242012610 249789979 7777369 3.21% employed ANALYSIS: BABASAB PATIL Page 57

- 58. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 1) In the year 2007 increase in sales is amounted to Rs.19597481.60 that is 7.69%. The opening stock and purchases has increased by 20.77%& 17.35% and The closing manufacturing expenses is decreased in the 2008 to 5104626 & 5298532.1(9.13% & 6.34%). The cost of goods sold is increased to Rs. 36072802.9(15.86%). Due to decrease in closing stock the Gross Profit is decreased to 16475331.3(60.36) in the year 2008. 2) The operating expenses have reduced in the year 2008 by Rs. 1548083(13.58%). This is because of control over administrative expenses. 3) There is decrease in Non-operating income in 2008 to Rs.16842953.48i.e. 56.86%. and Non-operating Expenses is reduced to Rs. 2140602.93 i.e. 18.71% The Gross Profit is reduced in the year 2008 to Rs.2971898.89(40%) compare to the year 2007. 4) By seeing the comparative Balance Sheet, there is slight difference in capital employed and also liabilities. 5) There is increase in working capital i.e.12.20% compare to previous year. INTERPRETATION: The company ‘s Financial performance in the year 2008 is not appreciable because of decrease in revenue and control over cost results into decrease in Gross Profit and the Net Profit compare to 2007. BABASAB PATIL Page 58

- 59. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI ANALYSIS AND ITERPRETATION OF FINANCIAL STATEMENTS: 2.COMMON SIZE STATEMENTS: The financial statements are prepared with the absolute figures. Reading of absolute figures is not easy for quick grasping or understanding. Therefore they are converted into simple figures such as percentages to their totals for easy understandings. In case of balance sheet each item of the asset is expressed to the total assets and each liability to the total liability. Similarly in case of income statement each item of revenue or expenses are expressed to total sales. When the financial statements of the same concern for several years are converted into percentages and presented for the comparative study are called comparative statements. The total size of the financial statement is fixed as 100 . All the items of the statements are expressed as percentages to the total. PROCEDURE: 1.Incase of Balance Sheet total assets and total liabilities are considered as 100. 2. Each item of asset is expressed interms of percentage to the total assets. Similarly each liability to total liabilities. 3. Incase of Income statement total sales is treated as 100. 4. Each item of revenue and expense is expressed as a percentage to the total sales. 5. Study of these percentages to establish relationship 6. Interpretation of the relationship in simple terms. TYPES OF COMMON SIZE STATEMENTS: 1. Common Size Income Statement 2. Common Size Balance Sheet BABASAB PATIL Page 59

- 60. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 1.Common Size Income Statements: These statements are prepared to study the proportion of various elements of income statement items to the total sales revenue.The total sales items is considered Rs.100 and all other items are expressed as a percentage to the total sales. In case of increase in sales tends to increase in the expenses directly related to sales. This kind of analysis helps to study the operational efficiency and financial performance of the concern. 1. COMMON SIZE BALANCE SHEET: Common Size Balance Sheet means the size of the balance sheet of various years or items or firms is to brought to a common figure. That is the totals of the assets and liabilities are considered as 100 and all the items of assets and liabilities are expressed in terms of percentages. The relationships are established with one item to its respective total and is compared with another years Balance Sheet. Alternatively capital employed may also be considered as 100 and all other items of the balance sheet are expressed in percentages. This kind of Analysis is helpful to study the Financial Position Liquidity Solvency etc. of the concern in various years THE GADAG CO-OPERATIVE TEXTILE MILL-HULKOTI. COMMON SIZE INCOME STATEMENT FOR THE YEAR ENDING 31-3-2008-09 BABASAB PATIL Page 60

- 61. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 2008 2009 Particulars RS % RS % Sales 27425334 100 256739185 100 -cost of 8 96 252689320 98 sales 26343681 0 4.0 4049865 2 Gross 0 10967021 4.27 profit 10816538 3.6 -6917156 -2.2 -operating 9848419 0.4 -9260319 7 expenses 968119 0 -16177475 -3.6 9295525 3.3 3012462 0 -Non -8327406 -2.9 -13165013 -5.8 operating 12776730 8 7 exp 4449324 4.6 1.17 5 -5 +Non 1.6 operating 7 Incomes Net profit/ loss WORKING NOTES: 1.Calculation of cost of goods sold 2008 2009 Opening stock 55889767 50785141 +purchases 18018784 168779141 -closing stock 8 39186088 Materiaconsumed 50785141 180378194 Manufacturing exp 18529247 72311126 4 252689320 Cost of sales 78144336 26343681 BABASAB PATIL Page 61

- 62. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 0 COMMON SIZE BALANCA SHEET: Particulars Rs(2008) % Rs(2009) % Liabilities Sharecapital 81773300 19.78 8177300 19.70 Reserves 12945560 3.12 12945560 3.12 Other long 24750232 60.00 24628387 59.35 term loans 1 0 Current liabilities 17.00 17.58 68874222 100 72678933 100 Assets: Fixed assets 43.60 43.85 Current assets 18091575 33.46 18121183 30.57 P&La/c(loss) 6 22.80 4 25.45 13829959 100 12687362 100 2 1 92431193 10559620 6 BABASAB PATIL Page 62

- 63. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI ANALYSIS: 1.By seeing the above statement we come to know that there is slight changes in long term liabilities, but in current liabilities is increased to 0.58% in the year 2009. 2. In the 2009 the current assets are less compare to the year 2008. It shows that the company is not utilizing the working capital properly. 3.From the common size Income statement we can see that the operating expenses are increased compare to previous year. It is because of not control over on expenses 4.This increasing expenses will results in the losses. INTERPRETATION: BABASAB PATIL Page 63

- 64. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI The above statement reveals that the company is not utilizing the funds properly. The cost goods sold are increasing . This will results in the loss of the company. 3. TREND ANASLYSIS: The trend analysis is another tool of financial analysis. Trend means a tendency. Trend analysis is review and appraisal of tendency in accounting variables. This analysis is more suitable for forecasting or budgeting. This analysis a series of trends information. It discloses the direction of items in the financial statement either upward , downward on constant over a period of time. For the purpose of calculating trend percentages number of years financial statements are required. Trend ratio are calculated on the basis of base year information .The trend ratios on popular is statistics and are similar to index numbers. Which indicate the movement or fluctuation in various elements financial of statements of the business. PROCEDURE: 1. Arrangement of years of the financial statements in ascending order. 2. Select a normal year as a base year usually first year may be considered as the base year. 3. Consider all the figures of base year as 100 4. Conversion of other years figures on the basis of base year percentage. 5. Study the trend percentages by establishing some relationship among them. 6. Interpretation of the trend series in simple terms. FORMULA FOR CALCULATION OF TREND PERCENTAGES. 100 *Next years figures Base year figures TREND ANALYSIS: BABASAB PATIL Page 64

- 65. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI The following figures are extracted from the annual repots of the G.C.T.M Particulars 2005 2006 2007 2008 2009 Sales 269932512 231390442 254655866 274253348 256739185 Cost of 267396134 215622553 227364007 263436840 252689320 goods sold Profit -7733598 -228728 7421223 4449324 -13165013 TREND RATIOS:(Base year is 2005) particular 2005 2006 2007 2008 2009 s Sales 100 85.6 94.2 101.4 94.99 1 2 7 Cost of 100 94.25 goods 80.4 84.8 98.26 sold 2 1 Profit 100 -170.22 57.53 -2.95 95.9 5 BABASAB PATIL Page 65

- 66. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI ANALYSIS: 1. The sales is increased constantly except 2006.The cost of goods sold is increasing as compare to sales. i.e. in the year 2007 the sales are 94.22, the cost of goods sold is 84.81 but in the year 2006 the sales are 85.61 the cost of goods sold is 80.42. by seeing this we come to know that the cost of sales are increase. 2. The Trend Analysis shows that there is loss in the year 2006 and 2009. 3. The above statement reveals that the sales are decreased but the costs are same compared to all years. 4. From the above Analysis we come to know that there is a profits in the year 2007 & 08. Except these years the company is under loss. 5. The above statement reveals that the cost of goods are increased compare to sales. ITERPRETATION: The above statements reveals that the company sales is less in the present year. It indicates that the production is less compare to previous year. BABASAB PATIL Page 66

- 67. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI RATIO ANALYSIS: INTRODUCTION: The financial statement of a company contains a lot of information about the financial performance of the company. Financial statements mainly consist of the Balance Sheet and Profit and Loss Accounts. These statements give the overall picture of the company, but to analyse each aspect of business extensively, financial ratios are used. The Balance Sheet and the Statement of Income are essential, but they are only the starting point for successful financial management. Financial Ratio BABASAB PATIL Page 67

- 68. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI Analysis derived from Financial Statements analyses the success, failure, and progress of business. Ratio Analysis is a very powerful analytical tool useful for measuring the performance of an organization. The ratio analysis concentrates on the interrelationship among the figures appearing in the mentioned financial statements. The ratio analysis helps the management to analyze the past performance of the firm and to make further projections As the organization employs capital on fixed assets for the purpose of equipping itself with the required manufacturing facilities to produce goods and services which are saleable to the customers to earn revenue, it is necessary to measure the degree of success achieved in this bearing. This ratio establishes the relationship between the amount of sales revenue and the amount of capital employed on fixed assets. Ratio refers to the establishment of relationship between any two inter-related variables .For example, both the amount of profit and the amount of sales revenue earned are inter-related as one is influenced by another. Accounting Ratios shows the inter-relationships that exist among various accounting data. Accounting Ratios express the relationships, in the mathematical terms, between two or more items(of financial statements and others) which have a cause and effect relationship or which are connected with each other in one way or the other. Since the Analysis and Interpretation of Financial Statements is made with the help of ratios it is called Ratio Analysis. The ratio analysis is , an effective tool or a device to diagnose the financial and operational diseases of business enterprises. The Ratio Analysis of Financial Statements stands for the purpose of arrangement of data, computation of ratios, interpretation of the ratios so computed and projections through ratios. STEPS IN RATIO ANALYSIS: BABASAB PATIL Page 68

- 69. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI 1) Collect all the data required for computing the necessary ratios which in turn depends upon the purpose of calculating the ratios 2) With the help of above information, compute the necessary accounting ratios. 3) Compare the ratios so computed either with the ratios of the same company for the previous year/s. 4) Interpret the ratios in the light of the comparison, draw inferences, and prepare reports. Various Accounting Ratios (Functional wise classification) • Liquidity Ratios • Turnover/activity Ratios • Profitability Ratios LIQUIDITY RATIOS: Liquidity refers to the ability of the organization to generate cash internally from business operations or to raise cash externally from the financial institutions so that it can meet all its cash requirements and discharge all its current obligations. It is not an exaggeration but a fact that liquidity is very essential for the very survival of the organization. The liquidity ratios measure the firm’s ability to meet its short-term (less than one year) obligations as and when they become due. Liquidity ratios establish a relationship between cash and other current assets to provide a measure of then liquidity of the organization. The corporate liquidity has two dimensions namely, quantitative and qualitative concepts. The quantitative concept includes the quantum, structure and utilizations of liquid assets and in qualitative concepts, it is the ability to meet all BABASAB PATIL Page 69

- 70. ANALYSIS AND INTERPRETATION OF FINANCIAL STATEMENTS GCTM HULKOTI present and potential demands on cash from any source in manner that minimizes cost and maximize the value of the form. Thus corporate liquidity is vital facto in business excess liquidity, through a generator of solvency would reflect lower profitability, deteriorations in managerial efficiency increased speculation and unjustified expansion, extension of too liberal credit and dividend policies. Too little liquidity then may lead to frustrations of business objections, reduced rate of return, business opportunity missed and weakening of morale. The important ratios to measure the liquidity of a firm are: A) Current Ratio B) Quick/Acid Test Ratio A) Current Ratio: The ability of a company to meet its short-term commitment is normally assessed by comparing Current Assets with Current Liabilities. As the Working Capital is equivalent to the difference between Current Assets and Current Liabilities, or as the Working Capital is the excess of Current Assets over Current liabilities, this ratio is called Working Capital Ratio. This ratio establishes the relationship between Current Assets and Current Liabilities CURRENT ASSETS TO CURRENT LIABILITIES = Current Assets / current liabilities BABASAB PATIL Page 70