Weekly media update 28 02_2022

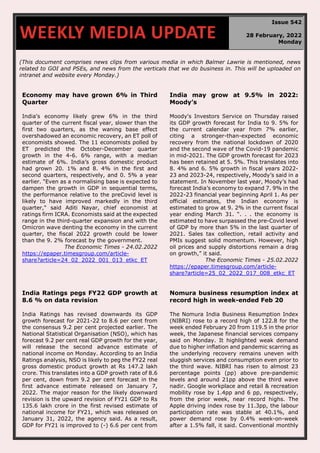

- 1. 670 (This document comprises news clips from various media in which Balmer Lawrie is mentioned, news related to GOI and PSEs, and news from the verticals that we do business in. This will be uploaded on intranet and website every Monday.) Economy may have grown 6% in Third Quarter India's economy likely grew 6% in the third quarter of the current fiscal year, slower than the first two quarters, as the waning base effect overshadowed an economic recovery, an ET poll of economists showed. The 11 economists polled by ET predicted the October-December quarter growth in the 4-6. 6% range, with a median estimate of 6%. India’s gross domestic product had grown 20. 1% and 8. 4% in the first and second quarters, respectively, and 0. 5% a year earlier. "Even as a normalising base is expected to dampen the growth in GDP in sequential terms, the performance relative to the preCovid level is likely to have improved markedly in the third quarter," said Aditi Nayar, chief economist at ratings firm ICRA. Economists said at the expected range in the third-quarter expansion and with the Omicron wave denting the economy in the current quarter, the fiscal 2022 growth could be lower than the 9. 2% forecast by the government. The Economic Times - 24.02.2022 https://epaper.timesgroup.com/article- share?article=24_02_2022_001_013_etkc_ET India may grow at 9.5% in 2022: Moody’s Moody's Investors Service on Thursday raised its GDP growth forecast for India to 9. 5% for the current calendar year from 7% earlier, citing a stronger-than-expected economic recovery from the national lockdown of 2020 and the second wave of the Covid-19 pandemic in mid-2021. The GDP growth forecast for 2023 has been retained at 5. 5%. This translates into 8. 4% and 6. 5% growth in fiscal years 2022- 23 and 2023-24, respectively, Moody’s said in a statement. In November last year, Moody’s had forecast India’s economy to expand 7. 9% in the 2022-23 financial year beginning April 1. As per official estimates, the Indian economy is estimated to grow at 9. 2% in the current fiscal year ending March 31. “. . . the economy is estimated to have surpassed the pre-Covid level of GDP by more than 5% in the last quarter of 2021. Sales tax collection, retail activity and PMIs suggest solid momentum. However, high oil prices and supply distortions remain a drag on growth,” it said. The Economic Times - 25.02.2022 https://epaper.timesgroup.com/article- share?article=25_02_2022_017_008_etkc_ET India Ratings pegs FY22 GDP growth at 8.6 % on data revision India Ratings has revised downwards its GDP growth forecast for 2021-22 to 8.6 per cent from the consensus 9.2 per cent projected earlier. The National Statistical Organisation (NSO), which has forecast 9.2 per cent real GDP growth for the year, will release the second advance estimate of national income on Monday. According to an India Ratings analysis, NSO is likely to peg the FY22 real gross domestic product growth at Rs 147.2 lakh crore. This translates into a GDP growth rate of 8.6 per cent, down from 9.2 per cent forecast in the first advance estimate released on January 7, 2022. The major reason for the likely downward revision is the upward revision of FY21 GDP to Rs 135.6 lakh crore in the first revised estimate of national income for FY21, which was released on January 31, 2022, the agency said. As a result, GDP for FY21 is improved to (-) 6.6 per cent from Nomura business resumption index at record high in week-ended Feb 20 The Nomura India Business Resumption Index (NIBRI) rose to a record high of 122.8 for the week ended February 20 from 119.5 in the prior week, the Japanese financial services company said on Monday. It highlighted weak demand due to higher inflation and pandemic scarring as the underlying recovery remains uneven with sluggish services and consumption even prior to the third wave. NIBRI has risen to almost 23 percentage points (pp) above pre-pandemic levels and around 21pp above the third wave nadir. Google workplace and retail & recreation mobility rose by 1.4pp and 6 pp, respectively, from the prior week, near record highs. The Apple driving index rose by 11.3pp, the labour participation rate was stable at 40.1%, and power demand rose by 0.4% week-on-week after a 1.5% fall, it said. Conventional monthly WEEKLY MEDIA UPDATE Issue 542 28 February, 2022 Monday

- 2. the provisional estimate of (-)7.3 per cent released on May 31, 2021. Besides this, the second revised estimate of national income for FY20 stood at 3.7 per cent compared to 4 per cent projected earlier while the third estimate retained FY19 growth at 6.5 per cent. Pioneer - 24.02.2022 https://www.dailypioneer.com/2022/world/india- ratings-pegs-fy22-gdp-growth-at-8-6---on-data- revision.html# data until January suggest the third wave had a mild impact on demand, while the supply side remained unscathed. “This imbalance should correct in February,” Nomura said, adding that this is evidenced by the rapid rise across indicators – NIBRI, railway passenger and freight revenues, flight departures and stable GST E-way bills. The Economic Times - 22.02.2022 https://economictimes.indiatimes.com/news/e conomy/indicators/nomura-business- resumption-index-at-record-high-in-week- ended-feb-20/articleshow/89727368.cms Economic recovery will be ‘Severely Hampered’, Says FM Finance minister Nirmala Sitharaman said global peace has never faced challenges of this significance since World War II, and the economic recovery will be “severely hampered” not just in India but across the world. "India's development is going to be challenged by the newer challenges emanating in the world. Peace is being threatened and after the Second World War, (a) war of this significance, this impact, on the globe probably is not felt," Sitharaman said on Friday. She was speaking at the annual Asia Economic Dialogue organised by the Ministry of External Affairs and think-tank Pune International Centre. Sitharaman said human welfare needs a conducive environment without any disruptions or disturbances to make the post-pandemic economic recovery sustainable. “We need for the welfare of the globe, for the welfare of humanity, to have this recovery sustainable and to have this recovery continue without any disruption," she said, exuding hope that peace may be restored soon. "Hopefully, some kind of restoration of peace at the earliest will happen, based on which, recoveries can be sustainable," she added. The Economic Times - 26.02.2022 https://epaper.timesgroup.com/article- share?article=26_02_2022_009_011_etkc_ET Conflict adds major risks to global eco, says IMF, WB The war in Ukraine adds significant economic risk for the region and the world and will have far reaching economic and social impacts, the IMF chief and World Bank president have said. “I am deeply concerned about what is happening in Ukraine and, first and foremost, impact on innocent people. We are assessing the implications & stand ready to support our members as needed,” Kristalina Georgieva, MD of the International Monetary Fund (IMF), said on Twitter. Russia’s invasion of Ukraine has added uncertainty to the global economic recovery and has roiled financial and commodity markets. Experts reckon it has the potential to further fan inflationary pressures across the world as supply chains are disrupted. “The devastating developments in Ukraine will have far-reaching economic and social impacts. We are coordinating closely with the IMF to assess these costs,” David Malpass, World Bank president, said. He said he had met Ukraine President Volodymyr Zelenskyy, and reaffirmed the World Bank Group’s strong support and commitment to the people of Ukraine. The Times of India - 26.02.2022 https://epaper.timesgroup.com/article- share?article=26_02_2022_015_007_toikc_TO I Consumer cos brace for inflation, supply issues India Inc executives have red-flagged further inflation and supply disruptions as Russia has launched a major military assault on Ukraine and crude oil prices have topped $105 a barrel. A steep surge in crude oil prices would impact household budgets since crude oil related products have a share of close to 10% in the Wholesale Price Index (WPI) basket, executives said. “Oil prices crossing $100 is a matter of huge concern and there is lot of uncertainty on how the situation will move forward,” said Harsh Agarwal, director at edible oils maker Emami. Analysts said oil prices are Goods exports may cross lofty $400-bn target in FY22: Piyush Goyal Merchandise exports will exceed $30 billion for an 11th straight month in February, commerce and industry minister Piyush Goyal said on Thursday, adding that outbound shipments can potentially cross even the ambitious target of $400 billion set for the current fiscal. Addressing industry executives virtually at a CII event, Goyal said goods exports already hit $25.3 billion in the first three weeks of February, up 26.4% from a year before and 26.7% from the pre-pandemic (same period in FY20) level. The exports stood at $336 billion

- 3. likely to remain elevated for several months as the US and many other countries are announcing fresh sanctions on Russia, which accounts for 11% of global crude-oil exports. Brent crude on Thursday rose above $105 a barrel for the first time since 2014. “There will further be inflationary impact in the short term,” said Saugata Gupta, managing director of hair oils and health foods maker Marico. “Organisations have to absorb some of the cost push through more aggressive optimisation measures and partially pass the balance to consumers". The Economic Times - 25.02.2022 https://epaper.timesgroup.com/article- share?article=25_02_2022_016_007_etkc_ET until January this fiscal. Merchandise exports had shrunk 7% in FY21 from a year earlier to $292 billion in the wake of the pandemic. However, global demand for goods improved dramatically this fiscal following an industrial resurgence in advanced economies. Similarly, services exports will likely scale a fresh peak of $250 billion this fiscal, the minister said, adding that robust growth in this sector prompted his ministry to revise the targets for FY22 twice from the initial goal of $225 billion. Services exports were to the tune of $206 billion in FY21. The Financial Express - 24.02.2022 https://www.financialexpress.com/economy/ex ports-to-exceed-30-bn-in-february-may-even- cross-record-target-of-400-bn-in-fy22-piyush- goyal/2443624/ India expects fuel demand to grow 5.5% in the next fiscal year India's fuel demand is likely to grow 5.5% in the next fiscal year beginning April 1, initial government estimates show, reflecting a pick-up in industrial activity and mobility in Asia's third largest economy after months of stagnation. India's fuel consumption in 2022-23, a proxy for oil demand, could rise to 214.5 million tonnes from the revised estimates of 203.3 million tonnes for the current fiscal year ending March 2022, according to government forecasts. The estimates were released on the website of the Petroleum Planning and Analysis Cell (PPAC), a unit of the federal oil ministry. Local demand for gasoline, used mainly in passenger vehicles, is expected to rise by 7.8% to 33.3 million tonnes, while gasoil consumption was slated to grow by about 4% to 79.3 million tonnes, the data showed. Consumption of aviation fuel would likely increase by nearly 50% to 7.6 million tonnes, compared with the revised estimate of 5.1 million tonnes for the year ending March 2022. The Economic Times - 21.02.2022 https://economictimes.indiatimes.com/industry/e nergy/oil-gas/india-expects-fuel-demand-to- grow-5-5-in-the-next-fiscal- year/articleshow/89727396.cms India watching global energy markets, supports release of oil from strategic storage India, the world's third largest energy importing and consuming nation, on Saturday said it is closely monitoring the global energy markets to track any supply disruptions following the Russia-Ukraine conflict, and will support release of oil from strategic storages to cool prices. International oil prices climbed to an over seven-year high of USD 105.58 on February 24 over concerns of supplies being disrupted as a result of Russia attacking Ukraine. The rates have cooled to below USD 100 as western sanctions against Russia kept out energy supplies. "The Government of India is closely monitoring global energy markets as well as potential energy supply disruptions as a fall out of the evolving geopolitical situation," an oil ministry statement said. While supply routes remain open, prices are likely to pinch. Petrol, diesel and cooking gas (LPG) rates continue to be on the election-related freeze for nearly four months now but PSU oil firms are expected to pass on the elevated global oil prices to consumers soon after elections in Uttar Pradesh end next month. The Economic Times - 27.02.2022 https://energy.economictimes.indiatimes.com/ news/oil-and-gas/india-watching-global- energy-markets-supports-release-of-oil-from- strategic-storage/89861207 IEA vows to ensure global energy security in wake of Ukraine invasion The International Energy Agency vowed to protect global energy security, the Paris-based watchdog said in a statement after convening a meeting on Friday of its 31 member countries to discuss Russia's invasion of Ukraine. "We reviewed how Oil price spike may dent govt revenues by ₹1L cr High global crude oil prices beyond $90 a barrel could lead to a revenue loss of Rs 95,000 crore to Rs 1 lakh crore in fiscal year 2022-23, a report by the economic research wing of the country’s largest lender SBI said on Friday. It

- 4. the Russian invasion has increased concerns among oil market participants against the backdrop of already tight global markets and heightened price volatility," executive director Fatih Birol was quoted as saying. Citing the risk of a further escalation, IEA member countries agreed "to continue to act in solidarity to ensure global energy security". The Economic Times - 26.02.2022 https://energy.economictimes.indiatimes.com/ne ws/oil-and-gas/iea-vows-to-ensure-global- energy-security-in-wake-of-ukraine- invasion/89840282 said that if the government reduces the excise duty on petroleum products further by Rs 7 per litre in March, when the state elections are over, and prevents the prices of petrol and diesel from rising, then the Centre’s excise duty loss will be Rs 8,000 crore for a month. “If we assume that the reduced excise duty continues in the next fiscal and assuming petrol and diesel consumption grows 8-10% in FY23, then the revenue loss to the government would be Rs 95,000 crore to Rs 1 lakh crore for FY23,” according to the SBI Research Ecowrap. Russia’s invasion of Ukraine has stoked inflationary pressures with global crude oil prices breaching the $100 per barrel mark, the highest since 2014. Experts say soaring crude oil prices have the potential to stoke domestic inflationary pressure and upset the Centre’s fiscal maths. The Times of India - 26.02.2022 https://epaper.timesgroup.com/article- share?article=26_02_2022_015_018_toikc_TO I India's oil import bill to top $100 bn in current fiscal India's crude oil import bill is set to exceed $100 billion in the current fiscal year ending March 31, almost double its spending last year, as international oil prices trade at seven-year highs. India spent $94.3 billion in the first 10 months (April-January) of the ongoing financial year that started April 1, 2021, according to data from the oil ministry's Petroleum Planning & Analysis Cell (PPAC). It spent USD 11.6 billion in January alone when oil prices had started to surge. This compared with USD 7.7 billion spending in the same month last year. In February, oil prices crossed USD 100 per barrel and going at this rate, India, which imports 85 per cent of its crude oil requirements, is expected to almost double its import bill to USD 110-115 billion by the end of the fiscal year 2021-2022. The imported crude oil is turned into value-added products like petrol and diesel at oil refineries, before being sold to automobiles and other users. India has surplus refining capacity and it exports some petroleum products but is short on production of cooking gas LPG, which is imported from nations like Saudi Arabia. The Economic Times - 27.02.2022 https://economictimes.indiatimes.com/news/eco nomy/finance/indias-oil-import-bill-to-top-100- bn-in-current-fiscal/articleshow/89865935.cms Fear of supply disruption pushes oil to $105 a barrel The surge in oil prices in the wake of Russia- Ukraine conflict has the potential to upset the government maths, which will inhibit its ability to pump-prime economic recovery, and raise the cost of living for people. Global benchmark Brent crude spiked to $105 a barrel — breaching the $100-mark for the first time since August 14, 2014 — on Thursday as Russian troops entered Ukraine, heightening fears of supply disruption in a market already struggling to meet rising demand. Oil prices have risen more than $20 a barrel since the start of 2022. The mix of crude bought by India, otherwise known as the ‘Indian Basket’, too has topped $97/ barrel and will hit a century in a few days if Brent hovers at the current level. According to Crisil Research, the conflict will also have a major bearing on global natural gas markets, which will see spot prices go up. India meets 50% of its gas needs by importing LNG in ships. While most of these imports are tied up under term contracts with West Asian and Australian suppliers, higher spot prices will affect additional imports needed to meet rising demand as economic activities pick up. The Economic Times - 25.02.2022 https://epaper.timesgroup.com/article- share?article=25_02_2022_024_006_toikc_TO I

- 5. Oil, natural gas prices may see sharp rise over Ukraine tensions: Moody's Global oil and liquified natural gas (LNG) prices are likely to see a sharp rise in the event of a Russia- Ukraine conflict, which would have negative implications for net energy importers, Moody's Investors Service said on Wednesday. Moody's Investors Service Managing Director Michael Taylor said trade effects are likely to arise from import diversion and diversification, although there may be opportunities for commodities producers in Central Asia to increase supply to China. Supply chain bottlenecks will also be aggravated, adding to inflation pressures in the region. Tensions have been escalating between Ukraine and Russia in recent weeks, and on Monday Moscow decided to recognise two separatist regions of eastern Ukraine as independent and deployed Russian troops there. "The global price of oil and liquified natural gas (LNG) is likely to rise sharply in the event of a conflict, which will be positive for the relatively few exporters in the Asia Pacific region and negative for the substantially greater number of net energy importers. Business Standard - 23.02.2022 https://www.business- standard.com/article/international/oil-natural- gas-prices-may-see-sharp-rise-over-ukraine- tensions-moody-122022301057_1.html India's oil production drops 2.4% in January India's crude oil production fell to 2,511.66 thousand metric tonnes (TMT) in January 2022, which is 2.40 per cent lower than the output registered during the same month last year and 6.04 per cent lower than the official target for the month, the government data showed on Wednesday. Cumulative crude oil production during the April-January period of the current financial year stood at 24890.07 TMT, which is 2.61 per cent lower than the output registered during the corresponding period of 2020-21, according to data released by the Ministry of Petroleum & Natural Gas. The cumulative output for the April-January 2021-22 is 4.63 per cent lower than the official target for the period. Crude oil production by ONGC (Oil and Natural Gas Corporation) in the nomination block during January 2022 was 1662.79 TMT, which is 3.68 per cent lower than the target of the month and 3.09 per cent lower when compared with production of January 2021. Cumulative crude oil production by ONGC during April-January 2021-22 was 16259.10 TMT, which is 4.29 per cent and 3.93 per cent lower than the target for the period and production during the corresponding period last year respectively. The Economic Times - 23.02.2022 https://economictimes.indiatimes.com/industr y/energy/oil-gas/indias-oil-production-drops-2- 4-in-january/articleshow/89779100.cms India’s fuel appetite seen at a record even as oil nears $100 India, the world’s third-biggest oil user, expects consumption of petroleum fuels to touch a record next year even as crude prices move toward the $100-a-barrel mark. Demand has been pegged at 214.5 million tons in the year starting on April 1, according to predictions by the Indian oil ministry’s Petroleum Planning and Analysis Cell. If achieved, that would be an all-time high and an increase of 5.5% from a revised estimate for 2021-22. Local sales of gasoline, diesel and other fuels have started picking up after being whipsawed by several virus waves and tax-inflated pump prices in the past two years. However, the nation is yet to recoup the losses caused by the pandemic that had decapitated consumption by as much as 70% at one stage following the world’s strictest lockdown in 2020. Any rise in consumption in India, the third-biggest crude oil buyer that relies on the global market for about 85% of its requirements, would raise the country’s import bill at a time when the South Asian nation is facing one of the deepest budget deficits among major economies. The Economic Times - 23.02.2022 Global LNG trade revives in 2021 despite supply constraints, volatile prices Global trade of liquefied natural gas (LNG) recovered in 2021 despite supply constraints and volatile prices, said a report by Shell. The exports growth was witnessed amid a number of unexpected outages that dented LNG available for delivery. The USA led export growth with a year-on-year increase of 24 million tonnes and is expected to become the world’s largest LNG exporter in 2022. According to Shell’s latest annual LNG Outlook rising LNG demand, combined with supply constraints, caused gas and LNG prices to remain volatile throughout the year. Prices reached record levels in October 2021 as Europe, with historically low storage levels, struggled to secure LNG cargoes to meet expected winter gas demand. The volatility emphasises the need for a more strategic approach to secure reliable and flexible gas supply in future to avoid exposure to price spikes. An LNG supply- demand gap is forecast to emerge in the mid- 2020s and focuses attention on the need for more investment to increase supply and meet

- 6. https://energy.economictimes.indiatimes.com/ne ws/oil-and-gas/indias-fuel-appetite-seen-at-a- record-even-as-oil-nears-100/89778133 rising LNG demand, especially in Asia, as per the report. Mint - 25.02.2022 https://www.livemint.com/industry/energy/glo bal-lng-trade-revives-in-2021-despite-supply- constraints-volatile-prices- 11645463018556.html Global crunch likely to double local gas prices The full force of the global gas crunch will hit home in April: domestic gas prices will double, driving up costs of cooking, commuting and electricity, while increasing the fertilizer subsidy bill for the government. An accelerated recovery in energy demand from the covid-lows coupled with inadequate supply expansion in 2021 vaulted prices to record highs, sending shockwaves through the global economy. Domestic industries are already paying higher prices for LNG imported under long-term contracts where rates are linked to crude oil and have sharply cut purchases from the spot market where prices have been berserk for months. But the most dramatic fallout will unfold in April when the government revises domestic price of natural gas, which industry executives and analysts expect to rise from the current $2.9 to $6-7 per mmBtu. The price ceiling for gas from deep-sea fields will rise from $6.13 to about $10, as per Reliance Industries, which is also auctioning some gas next month from a field with no price restrictions and has set a floor rate linked to crude oil that at current prices would be about $14 per mmBtu. The Economic Times - 22.02.2022 https://economictimes.indiatimes.com/industry/e nergy/oil-gas/global-crunch-likely-to-double- local-gas-prices/articleshow/89733386.cms BPCL Divestment: Investors Seek Clear Policy Direction Bidders for the government’s stake in Bharat Petroleum Corp (BPCL) have sought more clarity on autonomy in the pricing of fuel products. They also want the government to give a realistic timeline for the blending of ethanol with petrol to give them more flexibility. Bidders are keen on clarity about these issues as despite deregulation, oil marketing companies do not enjoy full freedom on fuel pricing, people aware of the matter told ET. The Centre is planning to sell its entire 53% stake in BPCL. The Cabinet had cleared the strategic sale in November 2019. Expressions of interest (EoIs) were invited in March 2020, generating interest from some overseas and domestic players. However, despite BPCL having access to more than 14% of India's oil refining capacity and 23% of the fuel market share, none of the big energy players submitted an EoI. The three contenders now for the company are Anil Agarwal-led Vedanta Group, Apollo Global Management and Think Gas, backed by private equity major I Squared Capital. “The petrol and diesel prices are deregulated, but still there is an invisible cap on it. The Economic Times - 23.02.2022 https://epaper.timesgroup.com/article- share?article=23_02_2022_013_011_etkc_ET Rising crude prices: Aviation sector facing headwinds Hopes of recovery could hit an air pocket for airline companies, as the continuous rise in aviation turbine fuel (ATF) rates on the back of increasing crude oil prices, will hurt their financials. The surge in prices comes at a time when the operating and yield environment was improving for air carriers, as passenger load factors were picking up and revenues were stabilising. Crude oil prices, which are now nearing $100 per barrel, remains a major headwind for the airline industry. The three months of January-March are traditionally soft for the airline companies, and this continuous rise in ATF could have a detrimental impact on this seasonally weak quarter thereby further straining their finances. The sharp increase in jet fuel prices has continued over the past three months. In K. Mohan Reddy takes charge as Director (P&P) of NLC India Limited Kalasani Mohan Reddy has assumed charge as Director (Planning & Projects) of NLC India Limited on 21st February, 2022. He is a Mining Engineer from the reputed “Institution of Engineers (India), Kolkata”. He holds a First Class Mine Manager Competency Certificate (Coal) from the Directorate General of Mines Safety and an MBA degree in Finance. He did a course on “Advanced Programme in Strategic Management for Business Excellence” from prestigious Indian Institute of Management, Lucknow. Prior to his appointment, he was Chief Executive Officer of Neyveli Uttar Pradesh Power Limited (NUPPL), a Joint Venture between NLC India Limited and Uttar Pradesh Rajya Vidyut Utpadan Nigam Limited

- 7. December, ATF prices were up 50% year-on-year and 13% quarter-on-quarter to average around Rs 78,000 per kilolitre. Brent crude prices were up 50% y-o-y and 43% year-to-date to $74/bbl. ATF prices were further hiked by Rs 6,743.25 per kilolitre or 8.5% to Rs 86,038.16 per kl in the national capital effective February 1. Last week again, the state-owned retailers revised the prices upwards by Rs 4,481.63 or 5.2% to Rs 90,519.79 per kl in line with the rise in oil prices. The Financial Express - 24.02.2022 https://www.financialexpress.com/market/comm odities/rising-crude-prices-aviation-sector-facing- headwinds/2443158/ (UPRVUNL). Reddy started his initial career with Western Coalfields Limited of Coal India Limited, served in Singareni Collieries Company Limited for over 24 years holding various responsible positions in Mining Sector prior to joining NLC India Limited in 2013. Hailing from an agrarian family in Mahbubabad District of Telangana, he has worked his way from humble moorings to reach the pinnacle of success with dedication and perseverance. Sarkaritel.com - 23.02.2022 https://www.sarkaritel.com/k-mohan-reddy- takes-charge-as-director-pp-of-nlc-india- limited/ Shri Sanjay Khanna takes over as Director Refinery, BPCL Shri Sanjay Khanna has assumed the charge of Director Refineries, BPCL. A Chemical Engineering graduate from NIT, Tiruchirappalli and a Post Graduate in Finance Management from University of Mumbai, he has more than 30 years of experience in Refinery Operations. In his illustrious career, he previously held the positions of Chief General Manager-in-Charge (Mumbai Refinery), Executive Director (Kochi Refinery) and Executive Director-in-Charge of Refineries, where he headed refineries operations at BPCL. Sarikaritel.com - 23.02.2022 https://www.psuconnect.in/news/-sanjay- khanna-takes-over-as-director-refinery-of- bpcl/31443 Sujoy Choudhury takes over as Director (Planning & Business Development) on IndianOil Board Sujoy Choudhury has taken charge as Director (Planning & Business Development), Indian Oil Corporation Limited, one of India’s largest commercial enterprises and among the leading Indian companies in the Fortune Global 500 listings. A Mechanical Engineer and MBA (Finance) from Jadavpur University, Kolkata, Choudhury brings with him a vast cross- functional experience spanning every facet of the Indian energy business. He has rich experience working in Eastern, Western and Northern regions of the country and across various oil industry functions, including Engineering, Retail Sales, and Petrochemicals functions of the Corporation. During his more than three decades of service, Choudhury has held several leadership positions. Before assuming the office of Director (Planning and Business Development), Choudhury was heading IndianOil’s Punjab State office wherein he was in-charge of all petroleum activities in the States of Punjab and Himachal Pradesh, and in the Union Territories of Jammu & Kashmir, Ladakh and Chandigarh. sarkaritel.com - 24.02.2022 https://www.sarkaritel.com/sujoy-choudhury- takes-over-as-director-planning-business- development-on-indianoil-board/