Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

Recommandé

Contenu connexe

Tendances

Tendances (20)

Employee vs. Independent Contractor - How to Differentiate and Avoid Penalties?

Employee vs. Independent Contractor - How to Differentiate and Avoid Penalties?

What is Control in Contracting and Subcontracting?

What is Control in Contracting and Subcontracting?

Employees vs. Independent Contractors - James Irving

Employees vs. Independent Contractors - James Irving

Employers_on_the_Edge_Strategies_for_Dealing_with_the_Affordable_Care_Act

Employers_on_the_Edge_Strategies_for_Dealing_with_the_Affordable_Care_Act

Independent contractor or common law employee 2013

Independent contractor or common law employee 2013

En vedette

Keynote presentation for the Metro Detroit Medical Librarians Group, November 2015. But is an Emerging Technologies Informationist a Librarian?

But is an Emerging Technologies Informationist a Librarian? University of Michigan Taubman Health Sciences Library

En vedette (15)

But is an Emerging Technologies Informationist a Librarian?

But is an Emerging Technologies Informationist a Librarian?

Similaire à May 2014 IRS 20 factor test re Employee or IC

Similaire à May 2014 IRS 20 factor test re Employee or IC (20)

White Paper: Complying With Regulations Regarding Temporary Workers

White Paper: Complying With Regulations Regarding Temporary Workers

Tax Court Cautionary Tale: Classifying Workers as Contractors

Tax Court Cautionary Tale: Classifying Workers as Contractors

Common and Costly Employee Benefits and HR Mistakes

Common and Costly Employee Benefits and HR Mistakes

Employee or independent contractor - IRS, DOL, Florida

Employee or independent contractor - IRS, DOL, Florida

News Flash July 10 2013 IRS Clarifies Pay-or-Play Delay

News Flash July 10 2013 IRS Clarifies Pay-or-Play Delay

Lean Start-up Business Tactics Seminar - HR Issues and Your Start-up

Lean Start-up Business Tactics Seminar - HR Issues and Your Start-up

Independent Contractor or Employee: Avoiding the Game of Guess Who

Independent Contractor or Employee: Avoiding the Game of Guess Who

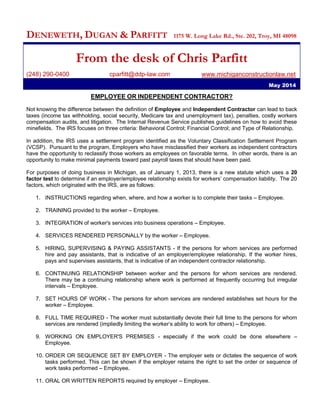

May 2014 IRS 20 factor test re Employee or IC

- 1. DENEWETH, DUGAN & PARFITT 1175 W. Long Lake Rd., Ste. 202, Troy, MI 48098 From the desk of Chris Parfitt (248) 290-0400 cparfitt@ddp-law.com www.michiganconstructionlaw.net May 2014 EMPLOYEE OR INDEPENDENT CONTRACTOR? Not knowing the difference between the definition of Employee and Independent Contractor can lead to back taxes (income tax withholding, social security, Medicare tax and unemployment tax), penalties, costly workers compensation audits, and litigation. The Internal Revenue Service publishes guidelines on how to avoid these minefields. The IRS focuses on three criteria: Behavioral Control; Financial Control; and Type of Relationship. In addition, the IRS uses a settlement program identified as the Voluntary Classification Settlement Program (VCSP). Pursuant to the program, Employers who have misclassified their workers as independent contractors have the opportunity to reclassify those workers as employees on favorable terms. In other words, there is an opportunity to make minimal payments toward past payroll taxes that should have been paid. For purposes of doing business in Michigan, as of January 1, 2013, there is a new statute which uses a 20 factor test to determine if an employer/employee relationship exists for workers’ compensation liability. The 20 factors, which originated with the IRS, are as follows: 1. INSTRUCTIONS regarding when, where, and how a worker is to complete their tasks – Employee. 2. TRAINING provided to the worker – Employee. 3. INTEGRATION of worker's services into business operations – Employee. 4. SERVICES RENDERED PERSONALLY by the worker – Employee. 5. HIRING, SUPERVISING & PAYING ASSISTANTS - If the persons for whom services are performed hire and pay assistants, that is indicative of an employer/employee relationship. If the worker hires, pays and supervises assistants, that is indicative of an independent contractor relationship. 6. CONTINUING RELATIONSHIP between worker and the persons for whom services are rendered. There may be a continuing relationship where work is performed at frequently occurring but irregular intervals – Employee. 7. SET HOURS OF WORK - The persons for whom services are rendered establishes set hours for the worker – Employee. 8. FULL TIME REQUIRED - The worker must substantially devote their full time to the persons for whom services are rendered (impliedly limiting the worker’s ability to work for others) – Employee. 9. WORKING ON EMPLOYER'S PREMISES - especially if the work could be done elsewhere – Employee. 10. ORDER OR SEQUENCE SET BY EMPLOYER - The employer sets or dictates the sequence of work tasks performed. This can be shown if the employer retains the right to set the order or sequence of work tasks performed – Employee. 11. ORAL OR WRITTEN REPORTS required by employer – Employee.

- 2. 12. PAYMENT BY THE HOUR, WEEK OR MONTH – Employee. 13. PAYMENT OF BUSINESS AND/OR TRAVEL EXPENSE by employer – Employee. 14. FURNISHING OF TOOLS AND MATERIALS (employer furnishes significant tools & materials) – Employee. 15. SIGNIFICANT INVESTMENT in facilities by worker that are not normally maintained by employees is indicative of an independent contractor. The lack of investment by the worker is indicative of an employer-employee relationship. 16. REALIZATION OF PROFIT OR LOSS - A worker who can realize a gain or loss as a result of their services is generally an independent contractor, but a worker who cannot is generally an employee. 17. WORKING FOR MORE THAN ONE FIRM AT A TIME – Independent Contractor. 18. MAKING SERVICES AVAILABLE TO GENERAL PUBLIC (on a regular and consistent basis) – Independent Contractor. 19. RIGHT TO DISCHARGE at will by employer - Employee. Termination of an independent contractor is usually based on the contract. 20. RIGHT TO TERMINATE by worker without liability – Employee. If an employer hires an independent contractor, the employer should request a copy of the contractor’s certificate of insurance for workers’ compensation. IRS Guidelines Recently, the IRS has attempted to simplify the guidelines and has consolidated the twenty factors into eleven main tests and has organized them into the three main groups: Behavioral Control, Financial Control, and the Type of Relationship of the Parties. Employers can contact the IRS and fill out form SS-8 – “Determination of Employee Work Status for Purposes of Federal Employment Taxes and Income Tax Withholding”. However, some employers use the form only for a self-audit and do not actually ask the IRS for a determination. The IRS may have a tendency to classify the worker as an employee if there is any doubt. The consequences of misclassifying an employee as an independent contractor can be severe. Thus, a self- audit is wise. Chris Parfitt, Attorney Deneweth, Dugan & Parfitt, P.C. 1175 W. Long Lake Rd., Ste. 202 Troy, MI 48098 (248) 290-0400 (phone) (248) 290-0415 (fax) cparfitt@ddp-law.com