Capitalizing on the shifting consumer food value equation

•

62 j'aime•21,840 vues

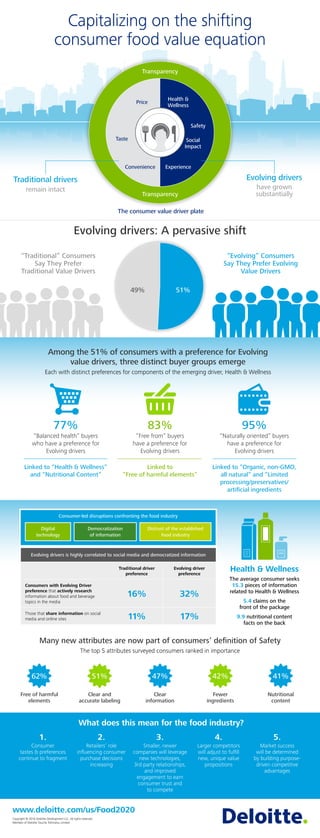

The drivers of consumer value appear to have fundamentally changed, with far reaching implications for the food and beverage industry. This infographic examines these consumer-led disruptions and how they represent an opportunity, even an imperative, for manufacturers and retailers to reposition themselves with consumers and shoppers. http://www2.deloitte.com/us/en/pages/consumer-business/articles/us-food-industry-consumer-trends-report.html

Signaler

Partager

Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

Recommandé

Contenu connexe

Tendances

Tendances (20)

Capitalizing on the ICD-10 Coding System: What Healthcare Organizations Need ...

Capitalizing on the ICD-10 Coding System: What Healthcare Organizations Need ...

Life Sciences: Leveraging Customer Data for Commercial Success

Life Sciences: Leveraging Customer Data for Commercial Success

Consumer Insights: Finding and Guarding the Treasure Trove

Consumer Insights: Finding and Guarding the Treasure Trove

Accenture personal-lines insurance -US consumer survey

Accenture personal-lines insurance -US consumer survey

Fintech Data: Unpacking Digital Wealth Advice Components

Fintech Data: Unpacking Digital Wealth Advice Components

Gould Scholastic Award – Julian Fung, Lasse Fuss, Tommy Ng

Gould Scholastic Award – Julian Fung, Lasse Fuss, Tommy Ng

Health insurance exchanges critical success factors for payers

Health insurance exchanges critical success factors for payers

Research Paper | Counting the Cost of Debt Recovery 2018

Research Paper | Counting the Cost of Debt Recovery 2018

En vedette

Are you ready for a digital future? Nearly 90 percent of managers and executives surveyed expect “great” or “moderate” digital disruption, but fewer than half say their organizations are adequately preparing. Companies can take steps toward digital maturity, though—without necessarily putting technologists in charge.

To read more and download the full report, visit: http://deloi.tt/2fnahoeMoving digital transformation forward: Findings from the 2016 digital busines...

Moving digital transformation forward: Findings from the 2016 digital busines...Deloitte United States

En vedette (12)

Achieving digital maturity: Adapting your company to a changing world

Achieving digital maturity: Adapting your company to a changing world

Moving digital transformation forward: Findings from the 2016 digital busines...

Moving digital transformation forward: Findings from the 2016 digital busines...

Findings on health information technology and electronic health records

Findings on health information technology and electronic health records

TMT Outlook 2017: A new wave of advances offer opportunities and challenges

TMT Outlook 2017: A new wave of advances offer opportunities and challenges

2017 holiday survey: An annual analysis of the peak shopping season

2017 holiday survey: An annual analysis of the peak shopping season

Similaire à Capitalizing on the shifting consumer food value equation

Similaire à Capitalizing on the shifting consumer food value equation (20)

Capitalizing on the shifting consumer food value equation

Capitalizing on the shifting consumer food value equation

Emerging Markets: Healthy food and drinks, leaders and laggards - Aug 2016

Emerging Markets: Healthy food and drinks, leaders and laggards - Aug 2016

Innovate or die: predictions for the food industry in 2017

Innovate or die: predictions for the food industry in 2017

Material in slides 2-14 of this overview adapted from Prin

Material in slides 2-14 of this overview adapted from Prin

Material in slides 2-14 of this overview adapted from Prin

Material in slides 2-14 of this overview adapted from Prin

Material in slides 2 14 of this overview adapted from prin

Material in slides 2 14 of this overview adapted from prin

Session 4. Hoffmann - Discussant on Solving Market Failures in Safety

Session 4. Hoffmann - Discussant on Solving Market Failures in Safety

Plus de Deloitte United States

C-suite and other executives see artificial intelligence (AI) – which includes generative AI and machine learning – as the emerging technology that poses both the top risk (44.7%) and the top opportunity (35.9%) for their organizations’ internal controls environments in the year ahead, according to a new Deloitte poll.Emerging Technologies in Transformations Drive the Need for Evolving Internal...

Emerging Technologies in Transformations Drive the Need for Evolving Internal...Deloitte United States

Of over 1,000 C-suite and other executives, almost half (44.9%) expect an increase in the number and size of cyber events targeting their organizations’ supply chains in the year ahead, according to a new Deloitte poll. The expected increase seems to indicate higher go-forward concerns, as just 33.8% of respondents say their organizations experienced one or more supply chain cybersecurity events during the past year.Almost Half of Executives Expect Supply Chain Security Challenges in Year Ahead

Almost Half of Executives Expect Supply Chain Security Challenges in Year AheadDeloitte United States

Against the backdrop of continued economic uncertainty, inflation and rising interest rates, nearly half (47.9%) of M&A professionals say they are likely to pursue a divestiture in the coming 12 months, according to a recent Deloitte poll. Among those contemplating divestitures, 40.4% of those polled say their organizations are likely to pursue 1-2 divestitures in the year ahead while 7.5% say their organization may pursue as many as 3-4.

Divestiture Trends: 2023 Could See More Sell-Offs, but Expect Lengthier and M...

Divestiture Trends: 2023 Could See More Sell-Offs, but Expect Lengthier and M...Deloitte United States

Despite high expectations of a recession in the next 18 months and declining confidence in cash and liquidity management, C-suite and other executives are turning to cost containment strategies and advanced technologies to ease concerns, according to a recent Deloitte poll.

Cash and Liquidity Management Confidence Levels Declining Among Executives, a...

Cash and Liquidity Management Confidence Levels Declining Among Executives, a...Deloitte United States

Nearly half (48.8%) of C-suite and other executives expect the number and size of cyber events targeting their organizations’ accounting and financial data to increase in the year ahead according to a new Deloitte Center for Controllership poll. Yet just 20.3% of those polled say their organizations’ accounting and finance teams work closely and consistently with their peers in cybersecurity.Almost Half of Executives Expect a Rise in Cyber Events Targeting Accounting ...

Almost Half of Executives Expect a Rise in Cyber Events Targeting Accounting ...Deloitte United States

In the year ahead, 40.6% of finance and accounting professionals say their organizations will increase the time and effort put into intercompany accounting (ICA) management, according to a new Deloitte poll.Putting intercompany accounting back in the spotlight: Controllership Perspec...

Putting intercompany accounting back in the spotlight: Controllership Perspec...Deloitte United States

In the next year, 61.3% of C-suite executives say that their organizations will work to improve trust levels with key stakeholders — including customers, employees, third parties and shareholders — yet few report having a C-suite-level leader in place to manage efforts (19%) and fewer still have a way to track stakeholder trust levels (13.8%), according to a new Deloitte poll.

Many C-suite Executives Say Their Organizations Want to Build Trust in Year A...

Many C-suite Executives Say Their Organizations Want to Build Trust in Year A...Deloitte United States

Just over half of responding professionals at organizations considering quantum computing benefits believe that their organizations are at risk for “harvest now, decrypt later” (HNDL) cybersecurity attacks (50.2%), according to a new Deloitte poll. Harvest Now, Decrypt Later Attacks Pose a Security Concern as Organizations C...

Harvest Now, Decrypt Later Attacks Pose a Security Concern as Organizations C...Deloitte United States

According to a new poll from Deloitte’s Center for Controllership, public companies are facing significant challenges (more so than private companies) in the war for financial talent, including attrition caused by the Great Resignation which remains a top three issue.A new working relationship: Aligning organizations with the workforce of the ...

A new working relationship: Aligning organizations with the workforce of the ...Deloitte United States

Plus de Deloitte United States (20)

Digital Asset Risk and Regulatory Compliance Expectations for 2024

Digital Asset Risk and Regulatory Compliance Expectations for 2024

Turning diligence insights into actionable integration steps

Turning diligence insights into actionable integration steps

Emerging Technologies in Transformations Drive the Need for Evolving Internal...

Emerging Technologies in Transformations Drive the Need for Evolving Internal...

Almost Half of Executives Expect Supply Chain Security Challenges in Year Ahead

Almost Half of Executives Expect Supply Chain Security Challenges in Year Ahead

Divestiture Trends: 2023 Could See More Sell-Offs, but Expect Lengthier and M...

Divestiture Trends: 2023 Could See More Sell-Offs, but Expect Lengthier and M...

Cash and Liquidity Management Confidence Levels Declining Among Executives, a...

Cash and Liquidity Management Confidence Levels Declining Among Executives, a...

Few are Confident in Their Organizations’ Ability to Report on ESG Financials

Few are Confident in Their Organizations’ Ability to Report on ESG Financials

Deloitte Poll: Legacy Tech Poses a Challenge to Zero Trust Adoption

Deloitte Poll: Legacy Tech Poses a Challenge to Zero Trust Adoption

Private Equity Leads Corporate Deal Teams on ESG in M&A

Private Equity Leads Corporate Deal Teams on ESG in M&A

Almost Half of Executives Expect a Rise in Cyber Events Targeting Accounting ...

Almost Half of Executives Expect a Rise in Cyber Events Targeting Accounting ...

Could M&A Activity be a Springboard for Controllership Transformation?

Could M&A Activity be a Springboard for Controllership Transformation?

Putting intercompany accounting back in the spotlight: Controllership Perspec...

Putting intercompany accounting back in the spotlight: Controllership Perspec...

Many C-suite Executives Say Their Organizations Want to Build Trust in Year A...

Many C-suite Executives Say Their Organizations Want to Build Trust in Year A...

Harvest Now, Decrypt Later Attacks Pose a Security Concern as Organizations C...

Harvest Now, Decrypt Later Attacks Pose a Security Concern as Organizations C...

SOX modernization: Optimizing compliance while extracting value

SOX modernization: Optimizing compliance while extracting value

A new working relationship: Aligning organizations with the workforce of the ...

A new working relationship: Aligning organizations with the workforce of the ...

Dernier

Dernier (20)

Call Girls Vanasthalipuram - 8250092165 Our call girls are sure to provide yo...

Call Girls Vanasthalipuram - 8250092165 Our call girls are sure to provide yo...

Call Girls Surat ( 8250092165 ) Cheap rates call girls | Get low budget

Call Girls Surat ( 8250092165 ) Cheap rates call girls | Get low budget

Foreigner Call Girls in junagadh 8250092165 Call Girls Advance Cash On Deliv...

Foreigner Call Girls in junagadh 8250092165 Call Girls Advance Cash On Deliv...

Call Girls in Rajpur Sonarpur / 8250092165 Genuine Call girls with real Photo...

Call Girls in Rajpur Sonarpur / 8250092165 Genuine Call girls with real Photo...

原版1:1定制(IC大学毕业证)帝国理工学院大学毕业证国外文凭复刻成绩单#电子版制作#留信入库#多年经营绝对保证质量

原版1:1定制(IC大学毕业证)帝国理工学院大学毕业证国外文凭复刻成绩单#电子版制作#留信入库#多年经营绝对保证质量

Call Girls in Moshi - 8250092165 Our call girls are sure to provide you with ...

Call Girls in Moshi - 8250092165 Our call girls are sure to provide you with ...

High Profile Call Girls Service in Sangli 9332606886 HOT & SEXY Models beaut...

High Profile Call Girls Service in Sangli 9332606886 HOT & SEXY Models beaut...

Call Girls in Anand - 8250092165 Our call girls are sure to provide you with ...

Call Girls in Anand - 8250092165 Our call girls are sure to provide you with ...

Top profile Call Girls In Kharagpur [ 7014168258 ] Call Me For Genuine Models...![Top profile Call Girls In Kharagpur [ 7014168258 ] Call Me For Genuine Models...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Top profile Call Girls In Kharagpur [ 7014168258 ] Call Me For Genuine Models...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Top profile Call Girls In Kharagpur [ 7014168258 ] Call Me For Genuine Models...

Erotic Vadodara Call Girls Service 👉📞 6378878445 👉📞 Just📲 Call Ruhi Call Gir...

Erotic Vadodara Call Girls Service 👉📞 6378878445 👉📞 Just📲 Call Ruhi Call Gir...

Call girls Service Bhosari ( 8250092165 ) Cheap rates call girls | Get low bu...

Call girls Service Bhosari ( 8250092165 ) Cheap rates call girls | Get low bu...

Call girls Service Beeramguda - 8250092165 Our call girls are sure to provide...

Call girls Service Beeramguda - 8250092165 Our call girls are sure to provide...

+97470301568>>buy weed in qatar>>buy thc oil in doha qatar>>

+97470301568>>buy weed in qatar>>buy thc oil in doha qatar>>

Call Girls in Sihor - 8250092165 Our call girls are sure to provide you with ...

Call Girls in Sihor - 8250092165 Our call girls are sure to provide you with ...

Berhampur Escorts Service Girl ^ 9332606886, WhatsApp Anytime Berhampur

Berhampur Escorts Service Girl ^ 9332606886, WhatsApp Anytime Berhampur

Call Girls in Morbi - 8250092165 Our call girls are sure to provide you with ...

Call Girls in Morbi - 8250092165 Our call girls are sure to provide you with ...

Call Girls in Rajkot / 8250092165 Genuine Call girls with real Photos and Number

Call Girls in Rajkot / 8250092165 Genuine Call girls with real Photos and Number

Call girls Service Songadh / 8250092165 Genuine Call girls with real Photos a...

Call girls Service Songadh / 8250092165 Genuine Call girls with real Photos a...

Capitalizing on the shifting consumer food value equation

- 1. Capitalizing on the shifting consumer food value equation 1. Consumer tastes & preferences continue to fragment 2. Retailers’ role influencing consumer purchase decisions increasing 3. Smaller, newer companies will leverage new technologies, 3rd party relationships, and improved engagement to earn consumer trust and to compete 4. Larger competitors will adjust to fulfill new, unique value propositions 5. Market success will be determined by building purpose- driven competitive advantages What does this mean for the food industry? www.deloitte.com/us/Food2020 Copyright © 2016 Deloitte Development LLC. All rights reserved. Member of Deloitte Touche Tohmatsu Limited The consumer value driver plate Among the 51% of consumers with a preference for Evolving value drivers, three distinct buyer groups emerge Each with distinct preferences for components of the emerging driver, Health & Wellness 77% “Balanced health” buyers who have a preference for Evolving drivers Linked to “Health & Wellness” and “Nutritional Content” Linked to “Free of harmful elements” Linked to “Organic, non-GMO, all natural” and “Limited processing/preservatives/ artificial ingredients 95% “Naturally oriented” buyers have a preference for Evolving drivers 83% “Free from” buyers have a preference for Evolving drivers Traditional drivers remain intact Evolving drivers have grown substantially Evolving drivers: A pervasive shift “Traditional” Consumers Say They Prefer Traditional Value Drivers “Evolving” Consumers Say They Prefer Evolving Value Drivers Health & Wellness Price Taste Convenience Experience Safety Social Impact 51%49% Transparency Transparency Consumer-led disruptions confronting the food industry Digital technology Democratization of information Distrust of the established food industry Evolving drivers is highly correlated to social media and democratized information Traditional driver preference Evolving driver preference Consumers with Evolving Driver preference that actively research information about food and beverage topics in the media 16% 32% Those that share information on social media and online sites 11% 17% Many new attributes are now part of consumers’ definition of Safety The top 5 attributes surveyed consumers ranked in importance Free of harmful elements Clear and accurate labeling Clear information Fewer ingredients Nutritional content 62% 51% 47% 42% 41% Health Wellness The average consumer seeks 15.3 pieces of information related to Health Wellness 5.4 claims on the front of the package 9.9 nutritional content facts on the back