Hindustan Zinc

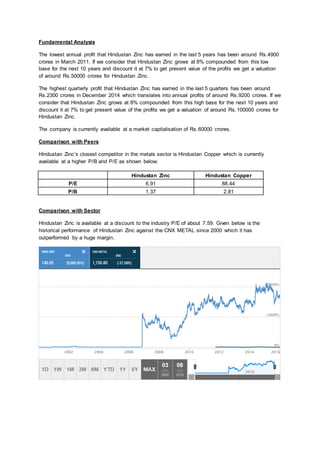

- 1. Fundamental Analysis The lowest annual profit that Hindustan Zinc has earned in the last 5 years has been around Rs.4900 crores in March 2011. If we consider that Hindustan Zinc grows at 8% compounded from this low base for the next 10 years and discount it at 7% to get present value of the profits we get a valuation of around Rs.50000 crores for Hindustan Zinc. The highest quarterly profit that Hindustan Zinc has earned in the last 5 quarters has been around Rs.2300 crores in December 2014 which translates into annual profits of around Rs.9200 crores. If we consider that Hindustan Zinc grows at 8% compounded from this high base for the next 10 years and discount it at 7% to get present value of the profits we get a valuation of around Rs.100000 crores for Hindustan Zinc. The company is currently available at a market capitalisation of Rs.60000 crores. Comparison with Peers Hindustan Zinc’s closest competitor in the metals sector is Hindustan Copper which is currently available at a higher P/B and P/E as shown below. Hindustan Zinc Hindustan Copper P/E 6.91 88.44 P/B 1.37 2.81 Comparison with Sector Hindustan Zinc is available at a discount to the industry P/E of about 7.59. Given below is the historical performance of Hindustan Zinc against the CNX METAL since 2000 which it has outperformed by a huge margin.

- 2. Comparison with Index Hindustan Zinc is available at a discount to the index P/E of about 18.62. Given below is the historical performance of Hindustan Zinc against the SENSEX since 2000 which it has outperformed by a huge margin. Technical Analysis Technically Hindustan Zinc is trading below the 50,100 and 200 day moving averages as shown below.

- 3. Recommendation If you are a long term investor (time horizon of a year or more) now is a good time to buy. If you are a medium term investor (time horizon of more than 3 months but less than a year) you should wait for prices to stop falling and stabilising above at least one of the moving averages before buying. If you are a trader (time horizon up to 3 months) you should wait to buy when the RSI is near 30 which indicates an oversold position and book profits near the 30 day moving average or when RSI reaches near 70.