social security cola increase

•

0 j'aime•24 vues

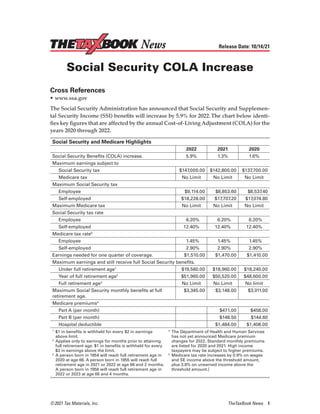

The Social Security Administration has announced that Social Security and Supplemental Security Income (SSI) benefits will increase by 5.9% for 2022. The chart below identifies key figures that are affected by the annual Cost-of-Living Adjustment (COLA) for the years 2020 through 2022.

Signaler

Partager

Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

Contenu connexe

Tendances

Tendances (16)

Retirement Planning With Cash Value Life Insurance Final

Retirement Planning With Cash Value Life Insurance Final

2022 medicare update Citizens Insurance Solutions - More than Medicare

2022 medicare update Citizens Insurance Solutions - More than Medicare

Similaire à social security cola increase

Similaire à social security cola increase (20)

Bridget Gainer: June 19 2013 Pension Committee Report

Bridget Gainer: June 19 2013 Pension Committee Report

CBO's Analysis of Health Care Spending and Policy Proposals

CBO's Analysis of Health Care Spending and Policy Proposals

News Flash October 27 2014 - IRS Inflation Adjustments for 2015

News Flash October 27 2014 - IRS Inflation Adjustments for 2015

Everything you should know about the Health and Social Care Levy

Everything you should know about the Health and Social Care Levy

Overview of Tax Provisions of Health Care Act and HIRE Act

Overview of Tax Provisions of Health Care Act and HIRE Act

Albidress, Adrian Key Financial Data 2014-publication

Albidress, Adrian Key Financial Data 2014-publication

Plus de FinnKevin

Plus de FinnKevin (20)

Dernier

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...dipikadinghjn ( Why You Choose Us? ) Escorts

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️9953056974 Low Rate Call Girls In Saket, Delhi NCR

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...dipikadinghjn ( Why You Choose Us? ) Escorts

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...From Luxury Escort : 9352852248 Make on-demand Arrangements Near yOU

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...dipikadinghjn ( Why You Choose Us? ) Escorts

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...Call Girls in Nagpur High Profile

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X79953056974 Low Rate Call Girls In Saket, Delhi NCR

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...roshnidevijkn ( Why You Choose Us? ) Escorts

Dernier (20)

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

VIP Call Girl in Mira Road 💧 9920725232 ( Call Me ) Get A New Crush Everyday ...

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Business Principles, Tools, and Techniques in Participating in Various Types...

Business Principles, Tools, and Techniques in Participating in Various Types...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

( Jasmin ) Top VIP Escorts Service Dindigul 💧 7737669865 💧 by Dindigul Call G...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Independent Call Girls in Andheri 🌹 9920725232 ( Call Me ) Mumbai Escorts...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

(Sexy Sheela) Call Girl Mumbai Call Now 👉9920725232👈 Mumbai Escorts 24x7

(Sexy Sheela) Call Girl Mumbai Call Now 👉9920725232👈 Mumbai Escorts 24x7

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

VIP Call Girl in Mumbai 💧 9920725232 ( Call Me ) Get A New Crush Everyday Wit...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Call Girls in New Ashok Nagar, (delhi) call me [9953056974] escort service 24X7

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...

social security cola increase

- 1. © 2021 Tax Materials, Inc. TheTaxBook News 1 Release Date: 10/14/21 Social Security COLA Increase Cross References • www.ssa.gov The Social Security Administration has announced that Social Security and Supplemen- tal Security Income (SSI) benefits will increase by 5.9% for 2022.The chart below identi- fies key figures that are affected by the annual Cost-of-Living Adjustment (COLA) for the years 2020 through 2022. Social Security and Medicare Highlights 2022 2021 2020 Social Security Benefits (COLA) increase. 5.9% 1.3% 1.6% Maximum earnings subject to Social Security tax $147,000.00 $142,800.00 $137,700.00 Medicare tax No Limit No Limit No Limit Maximum Social Security tax Employee $9,114.00 $8,853.60 $8,537.40 Self-employed $18,228.00 $17,707.20 $17,074.80 Maximum Medicare tax No Limit No Limit No Limit Social Security tax rate Employee 6.20% 6.20% 6.20% Self-employed 12.40% 12.40% 12.40% Medicare tax rate5 Employee 1.45% 1.45% 1.45% Self-employed 2.90% 2.90% 2.90% Earnings needed for one quarter of coverage. $1,510.00 $1,470.00 $1,410.00 Maximum earnings and still receive full Social Security benefits. Under full retirement age1 $19,560.00 $18,960.00 $18,240.00 Year of full retirement age2 $51,960.00 $50,520.00 $48,600.00 Full retirement age3 No Limit No Limit No limit Maximum Social Security monthly benefits at full retirement age. $3,345.00 $3,148.00 $3,011.00 Medicare premiums4 Part A (per month) $471.00 $458.00 Part B (per month) $148.50 $144.60 Hospital deductible $1,484.00 $1,408.00 1 $1 in benefits is withheld for every $2 in earnings above limit. 2 Applies only to earnings for months prior to attaining full retirement age. $1 in benefits is withheld for every $3 in earnings above the limit. 3 A person born in 1954 will reach full retirement age in 2020 at age 66. A person born in 1955 will reach full retirement age in 2021 or 2022 at age 66 and 2 months. A person born in 1956 will reach full retirement age in 2022 or 2023 at age 66 and 4 months. 4 The Department of Health and Human Services has not yet announced Medicare premium changes for 2022. Standard monthly premiums are listed for 2020 and 2021. High income taxpayers may be subject to higher premiums. 5 Medicare tax rate increases by 0.9% on wages and SE income above the threshold amount, plus 3.8% on unearned income above the threshold amount.[ News