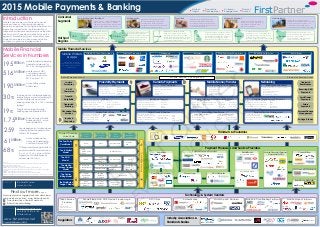

FirstPartner 2015 Mobile Payments & Banking Market Map

•

8 j'aime•2,022 vues

Download a free copy from our website at www.firstpartner.net. This Map provides a comprehensive overview of all the key aspects of and fundamental developments in the mobile payments and banking sector. This includes the launch of Apple Pay which, supported by the formalisation of tokenisation standards and biometric authentication, has put NFC payments clearly back on the agenda.

Signaler

Partager

Signaler

Partager

Recommandé

The financial services industry is utilizing new technologies and channels, in order to become more efficient, more reliant, more convenient and above all – simpler. Among such new channels are internet websites, social media platforms, smartphone / tablet apps and others. Banks, credit card companies and insurance companies are using those digital channels along the entire service chain, including sales & marketing, communications, consumer service and CRM.2014 Digital-Inspired Trends in the Financial Services Industry: Banks, Card ...

2014 Digital-Inspired Trends in the Financial Services Industry: Banks, Card ...Carmelon Digital Marketing

Recommandé

The financial services industry is utilizing new technologies and channels, in order to become more efficient, more reliant, more convenient and above all – simpler. Among such new channels are internet websites, social media platforms, smartphone / tablet apps and others. Banks, credit card companies and insurance companies are using those digital channels along the entire service chain, including sales & marketing, communications, consumer service and CRM.2014 Digital-Inspired Trends in the Financial Services Industry: Banks, Card ...

2014 Digital-Inspired Trends in the Financial Services Industry: Banks, Card ...Carmelon Digital Marketing

Contenu connexe

Plus de FirstPartner

Plus de FirstPartner (6)

FirstPartner 2015 Automotive In-Vehicle Infotainment Market Map

FirstPartner 2015 Automotive In-Vehicle Infotainment Market Map

FirstPartner Data Driven Marketing Market Map 2014

FirstPartner Data Driven Marketing Market Map 2014

Dernier

Dernier (20)

Marel Q1 2024 Investor Presentation from May 8, 2024

Marel Q1 2024 Investor Presentation from May 8, 2024

GUWAHATI 💋 Call Girl 9827461493 Call Girls in Escort service book now

GUWAHATI 💋 Call Girl 9827461493 Call Girls in Escort service book now

PARK STREET 💋 Call Girl 9827461493 Call Girls in Escort service book now

PARK STREET 💋 Call Girl 9827461493 Call Girls in Escort service book now

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Paradip CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Paradip CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Jual Obat Aborsi ( Asli No.1 ) 085657271886 Obat Penggugur Kandungan Cytotec

Jual Obat Aborsi ( Asli No.1 ) 085657271886 Obat Penggugur Kandungan Cytotec

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

QSM Chap 10 Service Culture in Tourism and Hospitality Industry.pptx

QSM Chap 10 Service Culture in Tourism and Hospitality Industry.pptx

UAE Bur Dubai Call Girls ☏ 0564401582 Call Girl in Bur Dubai

UAE Bur Dubai Call Girls ☏ 0564401582 Call Girl in Bur Dubai

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

Chennai Call Gril 80022//12248 Only For Sex And High Profile Best Gril Sex Av...

Chennai Call Gril 80022//12248 Only For Sex And High Profile Best Gril Sex Av...

Berhampur Call Girl Just Call 8084732287 Top Class Call Girl Service Available

Berhampur Call Girl Just Call 8084732287 Top Class Call Girl Service Available

FirstPartner 2015 Mobile Payments & Banking Market Map

- 1. Introduction Mobile has become a mainstream financial services channel. Global mobile banking adoption is significant & the high profile launch of Apple Pay, supported by the formalisation of tokenisation standards and biometric authentica- tion has put NFC payments clearly back on the agenda. Wearable payment propositions have started to emerge & mobile money adoption continues to grow in emerging markets. Market Insight Proposition Development Product Launch Customer Engagement 2015 Mobile Payments & Banking Mobile Financial Services in Numbers www.firstpartner.net Richard Warren Helen Motha +44 (0) 870 874 8700 @firstpartner Find out more..... Contacts Authors www.firstpartner.net Copyright FirstPartner Ltd 2015 FirstPartner Regular need to transfer money between family members and to provide parental control of spend. One of the most common use cases for UK P2P service Paym. Families High adopters of mobile financial services, demanding new service concepts such social payments. Receptive to innovative services from non-banking service providers. Millennials Mobile Wallets & Apps Players from multiple sectors battle to package & brand the consumer experience Technology & System Vendors NFC Chips Wallet Apps & PlatformsAuthentication Sophisticated Banked Heavy users of cards, digital banking and commerce services . Mobile commerce and banking services fulfil needs for immediacy and control. Migrant Worker Often cash centric, the need to send money home drives use of international and domestic remittance services. Unbanked Those without ready access to traditional banking facilities, or having a low propensity to use them for cultural reasons. Mobile makes essential financial service accessible. Hot Spot Regions For more detail on tagged content download companion Maps from -Transformation of Retail Payments -Data Driven Marketing Payment Processors Challengers Retailers Remittance ServicesMobile Network Operators Retail Banks Industry Associations & Standards Bodies Regulators Mobile & Core Banking Platforms 195 1 Mobile & tablet commerce transactions forecast for 2019. 3x the figure for 2014 Billion Carrier Bill/Prepaid Balance Mobile Network Operator Mobile PSP Consumer Account Provider Source of Funds Funds Transfer Funds Withdrawal/ Settlement Payment Processing Value Chain The Four Party Card Model Bank Issuer Card Network • Acquirer • PSP Wallet Provider • Card • Stored Value • Bank The E-Wallet Model • Carrier Bill • Mobile Money Agent • Mobile Wallet • Agent • Bank/ATM Bank/Interbank Network Mobile Network Operator Partner Bank The Mobile Money Transfer Model The Carrier Billing Model The ACH Model Bank Bank Scheme ACH Network Bank The Distributed “Ledger” Model Bank/ Virtual Currency Balance Gateway/ Exchange Provider “Ledger” server network Gateway/ Exchange/ PSP Transfers & Remittances Savings & Loans Small Trader Payments Recurring & Bill Payments Salary Payments Personal Finance Management In-store Purchases Travel& Hospitality Transport & Ticketing E & M Commerce Loyalty & Couponing Occasional Use Services Mobile Financial Services Retail Payments Led Proximity Payments Mobile Point of Sale MPoS has revolutionised acceptance terminals with dedicated tablet- like hardware & apps now appearing NFC - Apple Pay - Android Pay - Samsung Pay - Vodafone SmartPass - BBVA - NTT DoCoMo - BankWallet - Samsung/China Unionpay Remote Payments Retail App Payment Integration of payment into merchant branded apps could become significant. Open payment APIs are a major enabler - Starbucks - Subway - Dominos - Uber - Hailo Digital Goods & Services App store & third party enabled in-app & carrier billing offer frictionless payments & address non- card users - Apple App Store - Google Play - Microsoft Store - Skrill - Boku - Zong - PayWizard E/M-Commerce - Visa V.me & Checkout - Mastercard MasterPass - PayPal - Apple Pay - Zapp Mobile Money Transfer Person to Person & Small Trader Payments International Remittance Established Providers - Western Union - MoneyGram - Retail Banks Low Cost Challengers - Transferwise - Xoom - Azimo - Transfer Go - KlickEx - WorldRemit - CurrencyFair Mobile Money for the Unbanked - Vodafone & Partners - M-PESA - Orange Money - Airtel Money - Telenor easypaisa - MTN Mobile Money M-Banking Personal Finance Management Mobile PFM tools are a focus for established banks, fintech start ups & invetors. Customer Engagement & Retention High consumer adoption in developed markets is driving banks to focus on mobile as a critical channel for retention & service differentiation - Barclays - BBVA - Citi - ICICI Bank - Santander Banking the Unbanked - Safaricom/CBA - M-Shwari (kenya) - Ecobank - United Bank for Africa - Musoni (Kenya) - WIZZIT (South Africa) Financial Services LedMobile Service Convergence China Driven by a rapidly growing economy, massive smartphone population & dominant innovative players (notably Alipay, Tencent & China UnionPay), users of mobile financial services already exceed 200 M. Japan A pioneer in proximity mobile payments, based on the FeliCa standard. NTT Docomo launched Osaifu-Ketai in 2004 & Japan has the world's most developed contactless acceptance infrastructure. India A high unbanked population & growing economy coupled with a strong technology sector & major initiatives by carriers, FIs and government gives India the potential to be a leader in mobile Finance. Kenya The birthplace of mobile money, Kenya still boasts the highest levels of adoption & increasingly sophisticated mobile banking & payment service offerings. UK European fintech centre & a leader in contactless acceptance & same day interbank settlement. UK banks are actively backing ACH based mobile P2P & merchant payments. Consumer Segments Other BLE Beacons, QR codes, SMS, mag loop & cloud based technologies offer an alternative to NFC, especially for "online 2 offline" payments - PayPal - MCX - CurrentC - Samsung/LoopPay - WeChat - Zapp USA A leader in mobile fintech & launch country for flagship services such as Apple Pay, & Square. M-banking adoption relatively high, but key payment scheme launches have so far lagged adoption aspirations. Payment Service Providers MobileMulti-Channel Acquirers Carrier Billing Card/Debit Networks Closed Loop ACH Networks Remittance Networks Secure Elements & HCE, Device Provisioning &Token Service Providers - Visa - MasterCard - American Express - Most leading PSPs ATM Deposit/Withdrawal Handsets & Wearables Mobile Financial Services Operators/MNOs Retail Banks Developing Markets Developed Markets % The growth in usage of mobile banking apps worldwide in 2014 19% 516Million mobile users of NFC contactless payment services by the end of 2019, up from 1011 190Million Active AliPay mobile wallet users 2 30 The proportion of worldwide banking transactions now conducted through mobile. Mobile is the most used banking channel in 13 of 22 countries studied3 3 1.75Billion Forecast users of mobile banking by 2019 - more than double 2014 4 259 Live deployments of mobile money schemes for the unbanked with a further 102 planned 5 61Million Active mobile money accounts in developing countries in in June 20136 68% Of Kenyan adults using a mobile to pay bills or send & receive money. 8 out of 10 countries with the highest use of mobile financial services are in Africa 7 Sources: 1)Juniper Research Mobile Commerce Markets: Key Sector Strategies, Opportunities & Forecasts 2014-2019 (Nov 2014) 2)Alibaba Group statement October 2014 3)Bain & Company: Customer Loyalty in Retail Banking Global Edition 2014 4) Juniper Research: Mobile & Online Banking Developed & Developing Market Strategies 2014-2019 5)GSMA: MMU Deployment Tracker Accessed Feb 2015 6)GSMA: Mobile Financial Services State of the Industry Report Feb 2014 7)Boston Consulting Group: Mobile Financial Services in Africa Today—and Tomorrow Feb 2015 R R D R Payment Processors and Service Providers Mobile Money Platforms D hello@firstpartner.net www.firstpartner.net FirstPartner EVALUATIO N C O PY Interbank Services: - Paym (UK) - Pingit (UK) - IMPS (India) - Swish (Sweden) Others: - PayPal - Google - Dwolla - Venmo - Facebook - WeChat - Line Pay - ClearXchange(US) - Popmoney (US) Internet & Tech Companies