Contenu connexe Similaire à IFF 2016 DCF (20) Plus de Franklin Monzon (8) 1. Discounted Cash Flow Valuation Operating Scenario: Base

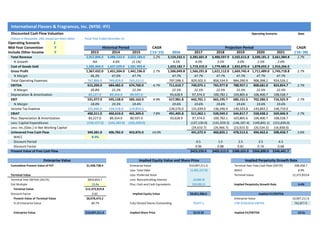

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

Operating Scenario 1

Mid-Year Convention Y CAGR CAGR

Include Other Income Y 2013 2014 2015 ('13-'15) 2016 2017 2018 2019 2020 2021 ('16-'20)

Total Revenue 2,952,896.0 3,088,533.0 3,023,189.0 1.2% 3,159,232.5 3,285,601.8 3,400,597.9 3,502,615.8 3,590,181.2 3,661,984.8 2.7%

% Growth NA 4.6% (2.1%) 4.5% 4.0% 3.5% 3.0% 2.5% 2.0%

Cost of Goods Sold 1,585,464.0 1,637,029.0 1,581,993.0 1,653,182.7 1,719,310.0 1,779,485.8 1,832,870.4 1,878,692.2 1,916,266.0

Gross Profit 1,367,432.0 1,451,504.0 1,441,196.0 2.7% 1,506,049.8 1,566,291.8 1,621,112.0 1,669,745.4 1,711,489.0 1,745,718.8 2.7%

% Margin 46.3% 47.0% 47.7% 47.7% 47.7% 47.7% 47.7% 47.7% 47.7%

Total Operating Expenses 767,866.0 769,829.0 763,252.0 797,598.3 829,502.3 858,534.9 884,290.9 906,398.2 924,526.1

EBITDA 615,204.0 684,482.0 674,760.0 4.7% 711,610.7 740,075.1 765,977.8 788,957.1 808,681.0 824,854.7 2.7%

% Margin 20.8% 22.2% 22.3% 22.5% 22.5% 22.5% 22.5% 22.5% 22.5%

Depreciation & Amortization 83,227.0 89,354.0 89,597.0 93,628.9 97,374.0 100,782.1 103,805.6 106,400.7 108,528.7

EBIT 531,977.0 595,128.0 585,163.0 4.9% 617,981.8 642,701.1 665,195.7 685,151.5 702,280.3 716,325.9 2.7%

% Margin 18.0% 19.3% 19.4% 19.6% 19.6% 19.6% 19.6% 19.6% 19.6%

Income Tax Expense 131,666.0 134,518.0 119,854.0 126,576.0 131,639.0 136,246.4 140,333.8 143,842.2 146,719.0

EBIAT 400,311.0 460,610.0 465,309.0 7.8% 491,405.8 511,062.1 528,949.2 544,817.7 558,438.2 569,606.9 2.7%

Plus: Depreciation & Amortization 83,227.0 89,354.0 89,597.0 93,628.9 97,374.0 100,782.1 103,805.6 106,400.7 108,528.7

Less: Capital Expenditures (134,157.0) (143,182.0) (101,030.0) (137,130.0) (141,929.5) (146,187.4) (149,842.1) (152,839.0)

Less: Inc./(Dec.) in Net Working Capital (29,633.7) (26,966.7) (23,923.3) (20,534.2) (16,838.0)

Unlevered Free Cash Flow 349,381.0 406,782.0 453,876.0 14.0% 441,672.4 460,835.1 478,512.6 494,462.6 508,458.7 3.6%

WACC 8.9%

Discount Period 0.5 1.5 2.5 3.5 4.5

Discount Factor 0.96 0.88 0.81 0.74 0.68

Present Value of Free Cash Flow $423,239.6 $405,512.0 $386,655.0 $366,890.0 $346,441.7

Cumulative Present Value of FCF $1,928,738.4 Enterprise Value $10,007,211.6 Terminal Year Free Cash Flow (2017E) 508,458.7

Less: Total Debt (1,491,157.0) WACC 8.9%

Terminal Value Less: Preferred Stock Terminal Value 12,372,819.8

Terminal Year EBITDA (2017E) $824,854.7 Less: Noncontrolling Interest (4,060.0)

Exit Multiple 15.0x Plus: Cash and Cash Equivalents 539,992.0 Implied Perpetuity Growth Rate 4.4%

Terminal Value $12,372,819.8

Discount Factor 0.65 Implied Equity Value $9,051,986.6

Present Value of Terminal Value $8,078,473.2 Enterprise Value 10,007,211.6

% of Enterprise Value 80.7% Fully Diluted Shares Outstanding 79,877.1 LTM 9/30/2016 EBITDA 742,877.0

Enterprise Value $10,007,211.6 Implied Share Price $113.32 Implied EV/EBITDA 13.5x

Implied EV/EBITDA

International Flavors & Fragrances, Inc. (NYSE: IFF)

Historical Period Projection Period

Enterprise Value Implied Equity Value and Share Price Implied Perpetuity Growth Rate

2. DCF Sensitivity Analysis Operating Scenario: Base

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

14.0x 14.5x 15.0x 15.5x 16.0x 14.0x 14.5x 15.0x 15.5x 16.0x

7.9% 9,867,929 10,149,923 10,431,917 10,713,911 10,995,906 7.9% 80.0% 80.6% 81.1% 81.6% 82.1%

8.4% 9,665,614 9,941,164 10,216,714 10,492,265 10,767,815 8.4% 79.8% 80.4% 80.9% 81.4% 81.9%

8.9% 9,468,647 9,737,929 $10,007,211.6 10,276,494 10,545,776 8.9% 79.6% 80.2% 80.7% 81.2% 81.7%

8.4% 9,665,614 9,941,164 10,216,714 10,492,265 10,767,815 9.4% 79.4% 80.0% 80.5% 81.0% 81.5%

7.9% 9,867,929 10,149,923 10,431,917 10,713,911 10,995,906 9.9% 79.2% 79.8% 80.4% 80.9% 81.4%

14.0x 14.5x 15.0x 15.5x 16.0x 14.0x 14.5x 15.0x 15.5x 16.0x

7.9% 8,912,704 9,194,698 9,476,692 9,758,686 10,040,681 7.9% 111.58 115.11 118.64 122.17 125.70

8.4% 8,710,389 8,985,939 9,261,489 9,537,040 9,812,590 8.4% 109.05 112.50 115.95 119.40 122.85

8.9% 8,513,422 8,782,704 $9,051,986.6 9,321,269 9,590,551 8.9% 106.58 109.95 $113.32 116.70 120.07

9.4% 8,321,636 8,584,821 8,848,006 9,111,191 9,374,376 9.4% 104.18 107.48 110.77 114.07 117.36

9.9% 8,134,872 8,392,124 8,649,376 8,906,628 9,163,880 9.9% 101.84 105.06 108.28 111.50 114.72

14.0x 14.5x 15.0x 15.5x 16.0x 14.0x 14.5x 15.0x 15.5x 16.0x

7.9% 3.2% 3.3% 3.5% 3.6% 3.7% 7.9% 13.3x 13.7x 14.0x 14.4x 14.8x

8.4% 3.6% 3.8% 4.0% 4.1% 4.2% 8.4% 13.0x 13.4x 13.8x 14.1x 14.5x

8.9% 4.1% 4.3% 4.4% 4.6% 4.7% 8.9% 12.7x 13.1x 13.5x 13.8x 14.2x

8.4% 3.6% 3.8% 4.0% 4.1% 4.2% 9.4% 12.5x 12.8x 13.2x 13.6x 13.9x

7.9% 3.2% 3.3% 3.5% 3.6% 3.7% 9.9% 12.2x 12.6x 12.9x 13.3x 13.6x

Implied Perpetuity Growth Rate Implied Enterprise Value / LTM EBITDA

Exit Multiple Exit Multiple

WACC

WACC

WACC

Enterprise Value PV of Terminal Value % of Enterprise Value

Exit Multiple Exit Multiple

WACC

WACC

Implied Share Price

Exit Multiple

WACC

Implied Equity Value

Exit Multiple

International Flavors & Fragrances, Inc. (NYSE: IFF)

3. Discounted Cash Flow Valuation Operating Scenario: Upside

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

Operating Scenario 3

Mid-Year Convention Y CAGR CAGR

Include Other Income Y 2013 2014 2015 ('13-'15) 2016 2017 2018 2019 2020 2021 ('16-'20)

Total Revenue 2,952,896.0 3,088,533.0 3,023,189.0 1.2% 3,174,348.5 3,317,194.1 3,449,881.9 3,570,627.8 3,677,746.6 3,769,690.3 3.2%

% Growth NA 4.6% (2.1%) 5.0% 4.5% 4.0% 3.5% 3.0% 2.5%

Cost of Goods Sold 1,585,464.0 1,637,029.0 1,581,993.0 1,618,917.7 1,691,769.0 1,759,439.8 1,821,020.2 1,875,650.8 1,922,542.0

Gross Profit 1,367,432.0 1,451,504.0 1,441,196.0 2.7% 1,555,430.7 1,625,425.1 1,690,442.1 1,749,607.6 1,802,095.8 1,847,148.2 3.2%

% Margin 46.3% 47.0% 47.7% 49.0% 49.0% 49.0% 49.0% 49.0% 49.0%

Total Operating Expenses 767,866.0 769,829.0 763,252.0 761,843.6 796,126.6 827,971.7 856,950.7 882,659.2 904,725.7

EBITDA 615,204.0 684,482.0 674,760.0 4.7% 809,458.9 845,884.5 879,719.9 910,510.1 937,825.4 961,271.0 3.2%

% Margin 20.8% 22.2% 22.3% 25.5% 25.5% 25.5% 25.5% 25.5% 25.5%

Depreciation & Amortization 83,227.0 89,354.0 89,597.0 88,881.8 92,881.4 96,596.7 99,977.6 102,976.9 105,551.3

EBIT 531,977.0 595,128.0 585,163.0 4.9% 720,577.1 753,003.1 783,123.2 810,532.5 834,848.5 855,719.7 3.2%

% Margin 18.0% 19.3% 19.4% 22.7% 22.7% 22.7% 22.7% 22.7% 22.7%

Income Tax Expense 131,666.0 134,518.0 119,854.0 147,589.7 154,231.3 160,400.5 166,014.5 170,995.0 175,269.8

EBIAT 400,311.0 460,610.0 465,309.0 7.8% 572,987.4 598,771.8 622,722.7 644,518.0 663,853.5 680,449.8 3.2%

Plus: Depreciation & Amortization 83,227.0 89,354.0 89,597.0 88,881.8 92,881.4 96,596.7 99,977.6 102,976.9 105,551.3

Less: Capital Expenditures (134,157.0) (143,182.0) (101,030.0) (132,687.8) (137,995.3) (142,825.1) (147,109.9) (150,787.6)

Less: Inc./(Dec.) in Net Working Capital (34,695.8) (32,228.6) (29,328.0) (26,018.1) (22,332.2)

Unlevered Free Cash Flow 349,381.0 406,782.0 453,876.0 14.0% 524,269.6 549,095.5 572,342.4 593,702.4 612,881.3 4.0%

WACC 8.9%

Discount Period 0.5 1.5 2.5 3.5 4.5

Discount Factor 0.96 0.88 0.81 0.74 0.68

Present Value of Free Cash Flow $502,389.7 $483,176.8 $462,472.8 $440,525.7 $417,590.8

Cumulative Present Value of FCF $2,306,155.9 Enterprise Value $11,720,665.6 Terminal Year Free Cash Flow (2017E) 612,881.3

Less: Total Debt (1,491,157.0) WACC 8.9%

Terminal Value Less: Preferred Stock Terminal Value 14,419,065.2

Terminal Year EBITDA (2017E) $961,271.0 Less: Noncontrolling Interest (4,060.0)

Exit Multiple 15.0x Plus: Cash and Cash Equivalents 539,992.0 Implied Perpetuity Growth Rate 4.3%

Terminal Value $14,419,065.2

Discount Factor 0.65 Implied Equity Value $10,765,440.6

Present Value of Terminal Value $9,414,509.7 Enterprise Value 11,720,665.6

% of Enterprise Value 80.3% Fully Diluted Shares Outstanding 79,877.1 LTM 9/30/2016 EBITDA 742,877.0

Enterprise Value $11,720,665.6 Implied Share Price $134.78 Implied EV/EBITDA 15.8x

Implied EV/EBITDA

International Flavors & Fragrances, Inc. (NYSE: IFF)

Historical Period Projection Period

Enterprise Value Implied Equity Value and Share Price Implied Perpetuity Growth Rate

4. DCF Sensitivity Analysis Operating Scenario: Upside

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

14.0x 14.5x 15.0x 15.5x 16.0x 14.0x 14.5x 15.0x 15.5x 16.0x

7.9% 11,559,827 11,888,458 12,217,089 12,545,721 12,874,352 7.9% 79.6% 80.2% 80.7% 81.2% 81.7%

8.4% 11,323,305 11,644,427 11,965,549 12,286,670 12,607,792 8.4% 79.4% 80.0% 80.5% 81.0% 81.5%

8.9% 11,093,032 11,406,849 $11,720,665.6 12,034,483 12,348,300 8.9% 79.2% 79.8% 80.3% 80.8% 81.3%

8.4% 11,323,305 11,644,427 11,965,549 12,286,670 12,607,792 9.4% 79.0% 79.6% 80.1% 80.7% 81.1%

7.9% 11,559,827 11,888,458 12,217,089 12,545,721 12,874,352 9.9% 78.8% 79.4% 79.9% 80.5% 81.0%

14.0x 14.5x 15.0x 15.5x 16.0x 14.0x 14.5x 15.0x 15.5x 16.0x

7.9% 10,604,602 10,933,233 11,261,864 11,590,496 11,919,127 7.9% 132.76 136.88 140.99 145.10 149.22

8.4% 10,368,080 10,689,202 11,010,324 11,331,445 11,652,567 8.4% 129.80 133.82 137.84 141.86 145.88

8.9% 10,137,807 10,451,624 $10,765,440.6 11,079,258 11,393,075 8.9% 126.92 130.85 $134.78 138.70 142.63

9.4% 9,913,586 10,220,297 10,527,008 10,833,719 11,140,430 9.4% 124.11 127.95 131.79 135.63 139.47

9.9% 9,695,230 9,995,028 10,294,825 10,594,622 10,894,419 9.9% 121.38 125.13 128.88 132.64 136.39

14.0x 14.5x 15.0x 15.5x 16.0x 14.0x 14.5x 15.0x 15.5x 16.0x

7.9% 3.0% 3.2% 3.3% 3.5% 3.6% 7.9% 15.6x 16.0x 16.4x 16.9x 17.3x

8.4% 3.5% 3.7% 3.8% 3.9% 4.1% 8.4% 15.2x 15.7x 16.1x 16.5x 17.0x

8.9% 4.0% 4.1% 4.3% 4.4% 4.6% 8.9% 14.9x 15.4x 15.8x 16.2x 16.6x

8.4% 3.5% 3.7% 3.8% 3.9% 4.1% 9.4% 14.6x 15.0x 15.5x 15.9x 16.3x

7.9% 3.0% 3.2% 3.3% 3.5% 3.6% 9.9% 14.3x 14.7x 15.1x 15.5x 16.0x

Implied Perpetuity Growth Rate Implied Enterprise Value / LTM EBITDA

Exit Multiple Exit Multiple

WACC

WACC

WACC

Enterprise Value PV of Terminal Value % of Enterprise Value

Exit Multiple Exit Multiple

WACC

WACC

Implied Share Price

Exit Multiple

WACC

Implied Equity Value

Exit Multiple

International Flavors & Fragrances, Inc. (NYSE: IFF)

5. Discounted Cash Flow Valuation Operating Scenario: Downside 1

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

Operating Scenario 4

Mid-Year Convention Y CAGR CAGR

Include Other Income N 2013 2014 2015 ('13-'15) 2016 2017 2018 2019 2020 2021 ('16-'20)

Total Revenue 2,952,896.0 3,088,533.0 3,023,189.0 1.2% 3,144,116.6 3,262,020.9 3,376,191.7 3,485,917.9 3,590,495.4 3,689,234.1 3.1%

% Growth NA 4.6% (2.1%) 4.0% 3.8% 3.5% 3.3% 3.0% 2.8%

Cost of Goods Sold 1,585,464.0 1,637,029.0 1,581,993.0 1,697,822.9 1,761,491.3 1,823,143.5 1,882,395.7 1,938,867.5 1,992,186.4

Gross Profit 1,367,432.0 1,451,504.0 1,441,196.0 2.7% 1,446,293.6 1,500,529.6 1,553,048.2 1,603,522.2 1,651,627.9 1,697,047.7 3.1%

% Margin 46.3% 47.0% 47.7% 46.0% 46.0% 46.0% 46.0% 46.0% 46.0%

Total Operating Expenses 767,866.0 769,829.0 763,252.0 801,749.7 831,815.3 860,928.9 888,909.1 915,576.3 940,754.7

EBITDA 599,566.0 681,675.0 677,944.0 6.3% 644,543.9 668,714.3 692,119.3 714,613.2 736,051.6 756,293.0 3.1%

% Margin 20.3% 22.1% 22.4% 20.5% 20.5% 20.5% 20.5% 20.5% 20.5%

Depreciation & Amortization 83,227.0 89,354.0 89,597.0 100,611.7 104,384.7 108,038.1 111,549.4 114,895.9 118,055.5

EBIT 516,339.0 592,321.0 588,347.0 6.7% 543,932.2 564,329.6 584,081.2 603,063.8 621,155.7 638,237.5 3.1%

% Margin 17.5% 19.2% 19.5% 17.3% 17.3% 17.3% 17.3% 17.3% 17.3%

Income Tax Expense 131,666.0 134,518.0 119,854.0 110,806.1 114,961.3 118,985.0 122,852.0 126,537.6 130,017.3

EBIAT 384,673.0 457,803.0 468,493.0 10.4% 433,126.0 449,368.3 465,096.2 480,211.8 494,618.1 508,220.1 3.1%

Plus: Depreciation & Amortization 83,227.0 89,354.0 89,597.0 100,611.7 104,384.7 108,038.1 111,549.4 114,895.9 118,055.5

Less: Capital Expenditures (134,157.0) (143,182.0) (101,030.0) (146,790.9) (151,928.6) (156,866.3) (161,572.3) (166,015.5)

Less: Inc./(Dec.) in Net Working Capital (25,284.8) (24,484.1) (23,531.0) (22,426.9) (21,174.7)

Unlevered Free Cash Flow 333,743.0 403,975.0 457,060.0 17.0% 381,677.2 396,721.5 411,363.8 425,514.8 439,085.4 3.6%

WACC 8.9%

Discount Period 0.5 1.5 2.5 3.5 4.5

Discount Factor 0.96 0.88 0.81 0.74 0.68

Present Value of Free Cash Flow $365,748.2 $349,095.3 $332,396.5 $315,730.9 $299,173.8

Cumulative Present Value of FCF $1,662,144.7 Enterprise Value $9,069,137.6 Terminal Year Free Cash Flow (2017E) 439,085.4

Less: Total Debt (1,491,157.0) WACC 8.9%

Terminal Value Less: Preferred Stock Terminal Value 11,344,394.7

Terminal Year EBITDA (2017E) $756,293.0 Less: Noncontrolling Interest (4,060.0)

Exit Multiple 15.0x Plus: Cash and Cash Equivalents 539,992.0 Implied Perpetuity Growth Rate 4.7%

Terminal Value $11,344,394.7

Discount Factor 0.65 Implied Equity Value $8,113,912.6

Present Value of Terminal Value $7,406,992.9 Enterprise Value 9,069,137.6

% of Enterprise Value 81.7% Fully Diluted Shares Outstanding 79,877.1 LTM 9/30/2016 EBITDA 748,546.0

Enterprise Value $9,069,137.6 Implied Share Price $101.58 Implied EV/EBITDA 12.1x

Implied EV/EBITDA

International Flavors & Fragrances, Inc. (NYSE: IFF)

Historical Period Projection Period

Enterprise Value Implied Equity Value and Share Price Implied Perpetuity Growth Rate

6. DCF Sensitivity Analysis Operating Scenario: Downside 1

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

14.0x 14.5x 15.0x 15.5x 16.0x 14.0x 14.5x 15.0x 15.5x 16.0x

7.9% 8,939,035 9,197,590 9,456,145 9,714,700 9,973,255 7.9% 81.0% 81.5% 82.0% 82.5% 83.0%

8.4% 8,754,746 9,007,393 9,260,040 9,512,687 9,765,333 8.4% 80.8% 81.3% 81.9% 82.3% 82.8%

8.9% 8,575,338 8,822,238 $9,069,137.6 9,316,037 9,562,937 8.9% 80.6% 81.2% 81.7% 82.2% 82.6%

8.4% 8,754,746 9,007,393 9,260,040 9,512,687 9,765,333 9.4% 80.4% 81.0% 81.5% 82.0% 82.4%

7.9% 8,939,035 9,197,590 9,456,145 9,714,700 9,973,255 9.9% 80.2% 80.8% 81.3% 81.8% 82.3%

14.0x 14.5x 15.0x 15.5x 16.0x 14.0x 14.5x 15.0x 15.5x 16.0x

7.9% 7,983,810 8,242,365 8,500,920 8,759,475 9,018,030 7.9% 99.95 103.19 106.43 109.66 112.90

8.4% 7,799,521 8,052,168 8,304,815 8,557,462 8,810,108 8.4% 97.64 100.81 103.97 107.13 110.30

8.9% 7,620,113 7,867,013 $8,113,912.6 8,360,812 8,607,712 8.9% 95.40 98.49 $101.58 104.67 107.76

9.4% 7,445,433 7,686,742 7,928,051 8,169,360 8,410,669 9.4% 93.21 96.23 99.25 102.27 105.30

9.9% 7,275,334 7,511,203 7,747,073 7,982,942 8,218,811 9.9% 91.08 94.03 96.99 99.94 102.89

14.0x 14.5x 15.0x 15.5x 16.0x 14.0x 14.5x 15.0x 15.5x 16.0x

7.9% 3.4% 3.6% 3.7% 3.9% 4.0% 7.9% 11.9x 12.3x 12.6x 13.0x 13.3x

8.4% 3.9% 4.1% 4.2% 4.3% 4.5% 8.4% 11.7x 12.0x 12.4x 12.7x 13.0x

8.9% 4.4% 4.5% 4.7% 4.8% 4.9% 8.9% 11.5x 11.8x 12.1x 12.4x 12.8x

8.4% 3.9% 4.1% 4.2% 4.3% 4.5% 9.4% 11.2x 11.5x 11.9x 12.2x 12.5x

7.9% 3.4% 3.6% 3.7% 3.9% 4.0% 9.9% 11.0x 11.3x 11.6x 11.9x 12.3x

Implied Perpetuity Growth Rate Implied Enterprise Value / LTM EBITDA

Exit Multiple Exit Multiple

WACC

WACC

WACC

Enterprise Value PV of Terminal Value % of Enterprise Value

Exit Multiple Exit Multiple

WACC

WACC

Implied Share Price

Exit Multiple

WACC

Implied Equity Value

Exit Multiple

International Flavors & Fragrances, Inc. (NYSE: IFF)

7. Discounted Cash Flow Valuation Operating Scenario: Downside 2

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

Operating Scenario 5

Mid-Year Convention Y CAGR CAGR

Include Other Income N 2013 2014 2015 ('13-'15) 2016 2017 2018 2019 2020 2021 ('16-'20)

Total Revenue 2,952,896.0 3,088,533.0 3,023,189.0 1.2% 3,129,000.6 3,230,693.1 3,327,613.9 3,419,123.3 3,504,601.4 3,583,454.9 2.6%

% Growth NA 4.6% (2.1%) 3.5% 3.3% 3.0% 2.8% 2.5% 2.3%

Cost of Goods Sold 1,585,464.0 1,637,029.0 1,581,993.0 1,720,950.3 1,776,881.2 1,830,187.7 1,880,517.8 1,927,530.8 1,970,900.2

Gross Profit 1,367,432.0 1,451,504.0 1,441,196.0 2.7% 1,408,050.3 1,453,811.9 1,497,426.3 1,538,605.5 1,577,070.6 1,612,554.7 2.6%

% Margin 46.3% 47.0% 47.7% 45.0% 45.0% 45.0% 45.0% 45.0% 45.0%

Total Operating Expenses 767,866.0 769,829.0 763,252.0 813,540.2 839,980.2 865,179.6 888,972.1 911,196.4 931,698.3

EBITDA 599,566.0 681,675.0 677,944.0 6.3% 594,510.1 613,831.7 632,246.6 649,633.4 665,874.3 680,856.4 2.6%

% Margin 20.3% 22.1% 22.4% 19.0% 19.0% 19.0% 19.0% 19.0% 19.0%

Depreciation & Amortization 83,227.0 89,354.0 89,597.0 103,257.0 106,612.9 109,811.3 112,831.1 115,651.8 118,254.0

EBIT 516,339.0 592,321.0 588,347.0 6.7% 491,253.1 507,218.8 522,435.4 536,802.4 550,222.4 562,602.4 2.6%

% Margin 17.5% 19.2% 19.5% 15.7% 15.7% 15.7% 15.7% 15.7% 15.7%

Income Tax Expense 131,666.0 134,518.0 119,854.0 100,074.7 103,327.1 106,426.9 109,353.7 112,087.5 114,609.5

EBIAT 384,673.0 457,803.0 468,493.0 10.4% 391,178.4 403,891.7 416,008.4 427,448.7 438,134.9 447,992.9 2.6%

Plus: Depreciation & Amortization 83,227.0 89,354.0 89,597.0 103,257.0 106,612.9 109,811.3 112,831.1 115,651.8 118,254.0

Less: Capital Expenditures (134,157.0) (143,182.0) (101,030.0) (148,611.9) (153,070.2) (157,279.7) (161,211.7) (164,838.9)

Less: Inc./(Dec.) in Net Working Capital (21,249.6) (20,252.5) (19,121.7) (17,861.4) (16,477.1)

Unlevered Free Cash Flow 333,743.0 403,975.0 457,060.0 17.0% 340,643.1 352,497.0 363,878.4 374,713.7 384,930.9 3.1%

WACC 8.9%

Discount Period 0.5 1.5 2.5 3.5 4.5

Discount Factor 0.96 0.88 0.81 0.74 0.68

Present Value of Free Cash Flow $326,426.7 $310,179.9 $294,026.5 $278,036.6 $262,275.2

Cumulative Present Value of FCF $1,470,945.0 Enterprise Value $8,139,126.4 Terminal Year Free Cash Flow (2017E) 384,930.9

Less: Total Debt (1,491,157.0) WACC 8.9%

Terminal Value Less: Preferred Stock Terminal Value 10,212,846.5

Terminal Year EBITDA (2017E) $680,856.4 Less: Noncontrolling Interest (4,060.0)

Exit Multiple 15.0x Plus: Cash and Cash Equivalents 539,992.0 Implied Perpetuity Growth Rate 4.8%

Terminal Value $10,212,846.5

Discount Factor 0.65 Implied Equity Value $7,183,901.4

Present Value of Terminal Value $6,668,181.4 Enterprise Value 8,139,126.4

% of Enterprise Value 81.9% Fully Diluted Shares Outstanding 79,877.1 LTM 9/30/2016 EBITDA 748,546.0

Enterprise Value $8,139,126.4 Implied Share Price $89.94 Implied EV/EBITDA 10.9x

Implied EV/EBITDA

International Flavors & Fragrances, Inc. (NYSE: IFF)

Historical Period Projection Period

Enterprise Value Implied Equity Value and Share Price Implied Perpetuity Growth Rate

8. DCF Sensitivity Analysis Operating Scenario: Downside 2

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

14.0x 14.5x 15.0x 15.5x 16.0x 14.0x 14.5x 15.0x 15.5x 16.0x

7.9% 8,021,307 8,254,072 8,486,837 8,719,603 8,952,368 7.9% 81.3% 81.8% 82.3% 82.8% 83.2%

8.4% 7,855,751 8,083,197 8,310,643 8,538,090 8,765,536 8.4% 81.1% 81.6% 82.1% 82.6% 83.0%

8.9% 7,694,581 7,916,854 $8,139,126.4 8,361,399 8,583,672 8.9% 80.9% 81.4% 81.9% 82.4% 82.9%

8.4% 7,855,751 8,083,197 8,310,643 8,538,090 8,765,536 9.4% 80.7% 81.2% 81.7% 82.2% 82.7%

7.9% 8,021,307 8,254,072 8,486,837 8,719,603 8,952,368 9.9% 80.5% 81.1% 81.6% 82.1% 82.5%

14.0x 14.5x 15.0x 15.5x 16.0x 14.0x 14.5x 15.0x 15.5x 16.0x

7.9% 7,066,082 7,298,847 7,531,612 7,764,378 7,997,143 7.9% 88.46 91.38 94.29 97.20 100.12

8.4% 6,900,526 7,127,972 7,355,418 7,582,865 7,810,311 8.4% 86.39 89.24 92.08 94.93 97.78

8.9% 6,739,356 6,961,629 $7,183,901.4 7,406,174 7,628,447 8.9% 84.37 87.15 $89.94 92.72 95.50

9.4% 6,582,436 6,799,675 7,016,915 7,234,154 7,451,394 9.4% 82.41 85.13 87.85 90.57 93.29

9.9% 6,429,633 6,641,976 6,854,318 7,066,661 7,279,003 9.9% 80.49 83.15 85.81 88.47 91.13

14.0x 14.5x 15.0x 15.5x 16.0x 14.0x 14.5x 15.0x 15.5x 16.0x

7.9% 3.6% 3.7% 3.8% 4.0% 4.1% 7.9% 10.7x 11.0x 11.3x 11.6x 12.0x

8.4% 4.0% 4.2% 4.3% 4.4% 4.6% 8.4% 10.5x 10.8x 11.1x 11.4x 11.7x

8.9% 4.5% 4.6% 4.8% 4.9% 5.0% 8.9% 10.3x 10.6x 10.9x 11.2x 11.5x

8.4% 4.0% 4.2% 4.3% 4.4% 4.6% 9.4% 10.1x 10.4x 10.7x 10.9x 11.2x

7.9% 3.6% 3.7% 3.8% 4.0% 4.1% 9.9% 9.9x 10.1x 10.4x 10.7x 11.0x

Implied Perpetuity Growth Rate Implied Enterprise Value / LTM EBITDA

Exit Multiple Exit Multiple

WACC

WACC

WACC

Enterprise Value PV of Terminal Value % of Enterprise Value

Exit Multiple Exit Multiple

WACC

WACC

Implied Share Price

Exit Multiple

WACC

Implied Equity Value

Exit Multiple

International Flavors & Fragrances, Inc. (NYSE: IFF)

9. Discounted Cash Flow Valuation

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

Working Capital Summary

2013 2014 2015 2016 2017 2018 2019 2020 2021

Total Revenue $2,952,896.0 $3,088,533.0 $3,023,189.0 $3,159,232.5 $3,285,601.8 $3,400,597.9 $3,502,615.8 $3,590,181.2 $3,661,984.8

Cost of Goods Sold 1,585,464.0 1,637,029.0 1,581,993.0 1,653,182.7 1,719,310.0 1,779,485.8 1,832,870.4 1,878,692.2 1,916,266.0

Current Assets

Accounts Receivable 524,493.0 493,768.0 537,896.0 562,101.3 584,585.4 605,045.9 623,197.2 638,777.2 651,552.7

Inventories 533,806.0 568,729.0 589,019.0 615,524.9 640,145.8 662,551.0 682,427.5 699,488.2 713,477.9

Prepaid Expenses and Other 148,910.0 141,248.0 146,981.0 153,595.1 159,739.0 165,329.8 170,289.7 174,547.0 178,037.9

Total Current Assets $1,207,209.0 $1,203,745.0 $1,273,896.0 $1,331,221.3 $1,384,470.2 $1,432,926.6 $1,475,914.4 $1,512,812.3 $1,543,068.5

Current Liabilities

Accounts Payable 226,733.0 216,038.0 302,473.0 316,084.3 328,727.7 340,233.1 350,440.1 359,201.1 366,385.1

Accrued Liabilities

Other Current Liabilities 301,744.0 256,712.0 262,482.0 274,293.7 285,265.4 295,249.7 304,107.2 311,709.9 317,944.1

Total Current Liabilities $528,477.0 $472,750.0 $564,955.0 $590,378.0 $613,993.1 $635,482.9 $654,547.3 $670,911.0 $684,329.2

Net Working Capital $678,732.0 $730,995.0 $708,941.0 $740,843.3 $770,477.1 $797,443.8 $821,367.1 $841,901.3 $858,739.3

% Total Revenue 23.0% 23.7% 23.5% 23.5% 23.5% 23.5% 23.5% 23.5% 23.5%

(Increase)/Decrease in NWC ($52,263.0) $22,054.0 ($31,902.3) ($29,633.7) ($26,966.7) ($23,923.3) ($20,534.2) ($16,838.0)

Assumptions

Current Assets

Days Sales Outstanding 64.8 58.4 64.9 64.9 64.9 64.9 64.9 64.9 64.9

Days Inventory Held 122.9 126.8 135.9 135.9 135.9 135.9 135.9 135.9 135.9

Prepaids and Other CA (% of Total Revenue) 5.0% 4.6% 4.9% 4.9% 4.9% 4.9% 4.9% 4.9% 4.9%

Current Liabilities

Days Payable Outstanding 52.2 48.2 69.8 69.8 69.8 69.8 69.8 69.8 69.8

Accrued Liabilities (% of Total Revenue)

Other Current Liabilities (% of Total Revenue) 10.2% 8.3% 8.7% 8.7% 8.7% 8.7% 8.7% 8.7% 8.7%

International Flavors & Fragrances, Inc. (NYSE: IFF)

Historical Period Projection Period

10. Discounted Cash Flow Valuation

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

Assumptions Page 1

Scenario 1 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Income Statement Assumptions

Revenue (% Growth) NA 4.6% (2.1%) 4.5% 4.0% 3.5% 3.0% 2.5% 2.0% 1.5%

Base 1 NA 4.6% (2.1%) 4.5% 4.0% 3.5% 3.0% 2.5% 2.0% 1.5%

Management 2

Upside 3 NA 4.6% (2.1%) 5.0% 4.5% 4.0% 3.5% 3.0% 2.5% 2.0%

Downside 1 4 NA 4.6% (2.1%) 4.0% 3.8% 3.5% 3.3% 3.0% 2.8% 2.5%

Downside 2 5 NA 4.6% (2.1%) 3.5% 3.3% 3.0% 2.8% 2.5% 2.3% 2.0%

COGS (% Revenue) 53.7% 53.0% 52.3% 52.3% 52.3% 52.3% 52.3% 52.3% 52.3% 52.3%

Base 1 53.7% 53.0% 52.3% 52.3% 52.3% 52.3% 52.3% 52.3% 52.3% 52.3%

Management 2

Upside 3 53.7% 53.0% 52.3% 51.0% 51.0% 51.0% 51.0% 51.0% 51.0% 51.0%

Downside 1 4 53.7% 53.0% 52.3% 54.0% 54.0% 54.0% 54.0% 54.0% 54.0% 54.0%

Downside 2 5 53.7% 53.0% 52.3% 55.0% 55.0% 55.0% 55.0% 55.0% 55.0% 55.0%

Operating Expenses (% Revenue) 26.0% 24.9% 25.2% 25.2% 25.2% 25.2% 25.2% 25.2% 25.2% 25.2%

Base 1 26.0% 24.9% 25.2% 25.2% 25.2% 25.2% 25.2% 25.2% 25.2% 25.2%

Management 2

Upside 3 26.0% 24.9% 25.2% 24.0% 24.0% 24.0% 24.0% 24.0% 24.0% 24.0%

Downside 1 4 26.0% 24.9% 25.2% 25.5% 25.5% 25.5% 25.5% 25.5% 25.5% 25.5%

Downside 2 5 26.0% 24.9% 25.2% 26.0% 26.0% 26.0% 26.0% 26.0% 26.0% 26.0%

D&A (% Revenue) 2.8% 2.9% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0%

Base 1 2.8% 2.9% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0%

Management 2

Upside 3 2.8% 2.9% 3.0% 2.8% 2.8% 2.8% 2.8% 2.8% 2.8% 2.8%

Downside 1 4 2.8% 2.9% 3.0% 3.2% 3.2% 3.2% 3.2% 3.2% 3.2% 3.2%

Downside 2 5 2.8% 2.9% 3.0% 3.3% 3.3% 3.3% 3.3% 3.3% 3.3% 3.3%

International Flavors & Fragrances, Inc. (NYSE: IFF)

Historical Period Projection Period

11. Discounted Cash Flow Valuation

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

Assumptions Page 2

Scenario 1 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Cash Flow Statement Assumptions

Capex (% Revenue) 4.5% 4.6% 3.3% 4.2% 4.2% 4.2% 4.2% 4.2% 4.2% 4.2%

Base 1 4.5% 4.6% 3.3% 4.2% 4.2% 4.2% 4.2% 4.2% 4.2% 4.2%

Management 2

Upside 3 4.5% 4.6% 3.3% 4.0% 4.0% 4.0% 4.0% 4.0% 4.0% 4.0%

Downside 1 4 4.5% 4.6% 3.3% 4.5% 4.5% 4.5% 4.5% 4.5% 4.5% 4.5%

Downside 2 5 4.5% 4.6% 3.3% 4.6% 4.6% 4.6% 4.6% 4.6% 4.6% 4.6%

Balance Sheet Assumptions: Current Assets

Days Sales Outstanding (DSO) 64.8 58.4 64.9 64.9 64.9 64.9 64.9 64.9 64.9 64.9

Base 1 64.8 58.4 64.9 64.9 64.9 64.9 64.9 64.9 64.9 64.9

Management 2

Upside 3 64.8 58.4 64.9 65.0 65.0 65.0 65.0 65.0 65.0 65.0

Downside 1 4 64.8 58.4 64.9 65.0 65.0 65.0 65.0 65.0 65.0 65.0

Downside 2 5 64.8 58.4 64.9 65.0 65.0 65.0 65.0 65.0 65.0 65.0

Days Inventory Held (DIH) 122.9 126.8 135.9 135.9 135.9 135.9 135.9 135.9 135.9 135.9

Base 1 122.9 126.8 135.9 135.9 135.9 135.9 135.9 135.9 135.9 135.9

Management 2

Upside 3 122.9 126.8 135.9 136.0 136.0 136.0 136.0 136.0 136.0 136.0

Downside 1 4 122.9 126.8 135.9 125.0 125.0 125.0 125.0 125.0 125.0 125.0

Downside 2 5 122.9 126.8 135.9 125.0 125.0 125.0 125.0 125.0 125.0 125.0

Prepaid & Other CA (% Revenue) 5.0% 4.6% 4.9% 4.9% 4.9% 4.9% 4.9% 4.9% 4.9% 4.9%

Base 1 5.0% 4.6% 4.9% 4.9% 4.9% 4.9% 4.9% 4.9% 4.9% 4.9%

Management 2

Upside 3 5.0% 4.6% 4.9% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0%

Downside 1 4 5.0% 4.6% 4.9% 4.5% 4.5% 4.5% 4.5% 4.5% 4.5% 4.5%

Downside 2 5 5.0% 4.6% 4.9% 4.3% 4.3% 4.3% 4.3% 4.3% 4.3% 4.3%

Historical Period Projection Period

International Flavors & Fragrances, Inc. (NYSE: IFF)

12. Discounted Cash Flow Valuation

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

Assumptions Page 3

Scenario 1 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

Balance Sheet Assumptions: Current Liabilities

Days Payable Outstanding (DPO) 52.2 48.2 69.8 69.8 69.8 69.8 69.8 69.8 69.8 69.8

Base 1 52.2 48.2 69.8 69.8 69.8 69.8 69.8 69.8 69.8 69.8

Management 2

Upside 3 52.2 48.2 69.8 66.0 66.0 66.0 66.0 66.0 66.0 66.0

Downside 1 4 52.2 48.2 69.8 70.0 70.0 70.0 70.0 70.0 70.0 70.0

Downside 2 5 52.2 48.2 69.8 70.0 70.0 70.0 70.0 70.0 70.0 70.0

Accrued Liabilities (% Revenue) 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Base 1

Management 2

Upside 3

Downside 1 4

Downside 2 5

Other Current Liabilities (% Revenue) 10.2% 8.3% 8.7% 8.7% 8.7% 8.7% 8.7% 8.7% 8.7% 8.7%

Base 1 10.2% 8.3% 8.7% 8.7% 8.7% 8.7% 8.7% 8.7% 8.7% 8.7%

Management 2

Upside 3 10.2% 8.3% 8.7% 8.3% 8.3% 8.3% 8.3% 8.3% 8.3% 8.3%

Downside 1 4 10.2% 8.3% 8.7% 9.0% 9.0% 9.0% 9.0% 9.0% 9.0% 9.0%

Downside 2 5 10.2% 8.3% 8.7% 9.5% 9.5% 9.5% 9.5% 9.5% 9.5% 9.5%

Other Income (% Revenue) 0.53% 0.09% (0.11%) 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% 0.10%

Base 1 0.53% 0.09% (0.11%) 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% 0.10%

Management 2

Upside 3 0.53% 0.09% (0.11%) 0.50% 0.50% 0.50% 0.50% 0.50% 0.50% 0.50%

Downside 1 4 0.53% 0.09% (0.11%) 0.05% 0.05% 0.05% 0.05% 0.05% 0.05% 0.05%

Downside 2 5 0.53% 0.09% (0.11%) 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01%

Historical Period Projection Period

International Flavors & Fragrances, Inc. (NYSE: IFF)

13. Discounted Cash Flow Valuation

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

Consolidated Statements of Income

CAGR CAGR

2013 A 2014 A 2015 A ('13-'15) 2016 E 2017 E 2018 E 2019 E 2020 E ('16-'20)

Revenue

Net Sales 2,952,896.0 3,088,533.0 3,023,189.0 1.2% 3,159,232.5 3,285,601.8 3,400,597.9 3,502,615.8 3,590,181.2 3.2%

% Growth NA 4.6% (2.1%) 4.5% 4.0% 3.5% 3.0% 2.5%

Cost of Goods Sold 1,585,464.0 1,637,029.0 1,581,993.0 (0.1%) 1,652,278.6 1,718,369.7 1,778,512.7 1,831,868.1 1,877,664.8 3.2%

% Net Sales 53.7% 53.0% 52.3% 52.3% 52.3% 52.3% 52.3% 52.3%

Gross Profit 1,367,432.0 1,451,504.0 1,441,196.0 2.7% 1,506,953.9 1,567,232.1 1,622,085.2 1,670,747.7 1,712,516.4 3.2%

Gross Profit Margin (%) 46.3% 47.0% 47.7% 47.7% 47.7% 47.7% 47.7% 47.7%

Operating Expenses

Selling, General & Administrative 505,877.0 514,891.0 509,557.0 0.4% 537,069.5 558,552.3 578,101.6 595,444.7 610,330.8 3.2%

% Net Sales 17.1% 16.7% 16.9% 17.0% 17.0% 17.0% 17.0% 17.0%

Research & Development 259,838.0 253,640.0 246,101.0 (2.7%) 255,897.8 266,133.7 275,448.4 283,711.9 290,804.7 3.2%

% Net Sales 8.8% 8.2% 8.1% 8.1% 8.1% 8.1% 8.1% 8.1%

Restructuring & Other, Net 2,151.0 1,298.0 7,594.0 87.9% 631.8 657.1 680.1 700.5 718.0 3.2%

% Net Sales 0.07% 0.04% 0.25% 0.02% 0.02% 0.02% 0.02% 0.02%

Total Operating Expenses 767,866.0 769,829.0 763,252.0 (0.3%) 793,599.2 825,343.2 854,230.2 879,857.1 901,853.5 3.2%

% Net Sales 26.0% 24.9% 25.2% 25.1% 25.1% 25.1% 25.1% 25.1%

Other (Expense) Income, Net 15,638.0 2,807.0 (3,184.0) 3,159.2 3,285.6 3,400.6 3,502.6 3,590.2

% Net Sales 0.53% 0.09% (0.11%) 0.10% 0.10% 0.10% 0.10% 0.10%

EBITDA 615,204.0 684,482.0 674,760.0 4.7% 716,513.9 745,174.5 771,255.6 794,393.3 814,253.1 3.2%

EBITDA Margin (%) 20.8% 22.2% 22.3% 22.7% 22.7% 22.7% 22.7% 22.7%

Depreciation & Amortization 83,227.0 89,354.0 89,597.0 3.8% 0.0 0.0 0.0 0.0 0.0 #DIV/0!

% Net Sales 2.8% 2.9% 3.0% 0.0% 0.0% 0.0% 0.0% 0.0%

EBIT 531,977.0 595,128.0 585,163.0 4.9% 716,513.9 745,174.5 771,255.6 794,393.3 814,253.1 3.2%

EBIT Margin (%) 18.0% 19.3% 19.4% 22.7% 22.7% 22.7% 22.7% 22.7%

Interest 46,767.0 46,067.0 46,062.0 (0.8%) 0.0 0.0 0.0 0.0 0.0 #DIV/0!

% Net Sales 1.6% 1.5% 1.5% 0.0% 0.0% 0.0% 0.0% 0.0%

EBT 485,210.0 549,061.0 539,101.0 5.4% 716,513.9 745,174.5 771,255.6 794,393.3 814,253.1 3.2%

EBT Margin (%) 16.4% 17.8% 17.8% 22.7% 22.7% 22.7% 22.7% 22.7%

Income Tax Expense 131,666.0 134,518.0 119,854.0 (4.6%) 176,424.2 183,481.1 189,903.0 195,600.1 200,490.1 3.2%

Tax Rate (%) 27.1% 24.5% 22.2% 24.6% 24.6% 24.6% 24.6% 24.6%

Net Income 353,544.0 414,543.0 419,247.0 8.9% 540,089.8 561,693.3 581,352.6 598,793.2 613,763.0 3.2%

International Flavors & Fragrances, Inc. (NYSE: IFF)

Historical Period Projection Period

14. Discounted Cash Flow Valuation

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

Consolidated Statements of Income

CAGR CAGR

2013 A 2014 A 2015 A ('13-'15) 2016 E 2017 E 2018 E 2019 E 2020 E ('16-'20)

Net Income 353,544.0 414,543.0 419,247.0 8.9% 540,089.8 561,693.3 581,352.6 598,793.2 613,763.0 3.2%

Other Comprehensive Income

Foreign Currency Translation Adj. (10,556.0) (69,064.0) (124,156.0)

(Loss) Gain on Derivative Hedges (3,794.0) 16,383.0 (2,970.0)

Pension & Postretirement Liability Adj. 25,264.0 (95,038.0) 54,117.0

Total Other CI 10,914.0 (147,719.0) (73,009.0) (78,980.8) (82,140.0) (85,014.9) (87,565.4) (89,754.5)

Other CI as a % Net Sales 0.37% (4.78%) (2.41%) (2.50%) (2.50%) (2.50%) (2.50%) (2.50%)

Comprehensive Income 364,458.0 266,824.0 346,238.0 (2.5%) 461,108.9 479,553.3 496,337.7 511,227.8 524,008.5 3.2%

Earnings Per Share

Basic 4.32 5.09 5.19 9.6% 6.79 7.13 7.45 7.75 8.03 4.3%

Diluted 4.29 5.06 5.19 10.0% 6.76 7.10 7.43 7.73 8.00 4.3%

*Avg. Common Shares Outstanding

Basic 81,838.9 81,442.6 80,779.8 79,591.8 78,795.9 78,008.0 77,227.9 76,455.6

Diluted 82,411.2 81,925.5 80,779.8 79,877.1 79,081.2 78,293.2 77,513.1 76,740.8

Shares Repurchased 396.3 662.9 1,187.9 795.9 788.0 780.1 772.3

Percentage of Shares Repurchased 0.48% 0.81% 1.47% 1.00% 1.00% 1.00% 1.00%

For the Historical Period (2013A-2015A), the Average Commmon Shares Outstanding are presented, back-calculated from the EPS numbers

provided in the most recent 10-K (IFF Form 10-K, 03/01/16, pg. 62; pg 71 in the AR). This is due to the fact that as a result of changes in

"Purchased Restricted Stock," EPS differs slightly from that calculated by the two-class method.

However, for possible future needs, the Avg. Common Shares Outstanding are presented below should they be relevant later.

*Avg. Common Shares Outstanding

Basic 81,322.0 80,936.0 80,449.0

Diluted 81,930.0 81,494.0 80,891.0

Shares Repurchased 386.0 487.0

Percent of Shares Repurchased 0.47% 0.60%

Historical Period Projection Period

International Flavors & Fragrances, Inc. (NYSE: IFF)

15. Discounted Cash Flow Valuation

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

Current Share Price (Closing Price 9/30/2016) 142.97

Number of Basic Shares Outstanding 79,591,844.0

Number of Outstanding Options (In-the-Money) 851,000.0

Average Option Strike Price 95.05

Total Option Proceeds 80,887,330.0

Treasury Stock Method Shares Repurchased 565,764.0

Additional Shares Outstanding 285,236.0

Total Fully Diluted Shares Outstanding 79,877,080.0

Stock Options Data (See IFF 2015 AR, pg. 84-87)

Award Shares Proceeds

SSAR 38,000.0 52.10 1,979,800.0

RSU 495,000.0 93.88 46,470,600.0

PRS 219,000.0 94.03 20,592,570.0

Liability RSU 99,000.0 119.64 11,844,360.0

Total 851,000.0 95.05 80,887,330.0

International Flavors & Fragrances, Inc. (NYSE: IFF)

Avg. Exercise Price

16. Discounted Cash Flow Valuation

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

Consolidated Statements of Income LTM

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 09/30/2016 A

Revenue

Net Sales 774,907.0 767,541.0 765,092.0 715,649.0 783,312.0 793,478.0 3,057,531.0

% Growth N/A (1.0%) (0.3%) (6.5%) 9.5% 1.3% N/A

Cost of Goods Sold 408,645.0 401,445.0 393,908.0 353,497.0 390,345.0 405,722.0 1,543,472.0

% Net Sales 52.7% 52.3% 51.5% 49.4% 49.8% 51.1% 50.5%

Gross Profit 366,262.0 366,096.0 371,184.0 362,152.0 392,967.0 387,756.0 1,514,059.0

Gross Profit Margin (%) 47.3% 47.7% 48.5% 50.6% 50.2% 48.9% 49.5%

Operating Expenses

Selling, General & Administrative 120,835.0 134,063.0 127,663.0 126,996.0 123,543.0 132,784.0 510,986.0

% Net Sales 15.6% 17.5% 16.7% 17.7% 15.8% 16.7% 16.7%

Research & Development 63,462.0 62,514.0 62,750.0 57,375.0 63,385.0 63,252.0 246,762.0

% Net Sales 8.2% 8.1% 8.2% 8.0% 8.1% 8.0% 8.1%

Restructuring & Other, Net 187.0 (358.0) 0.0 7,765.0 0.0 0.0 7,765.0

% Net Sales 0.02% (0.05%) 0.00% 1.09% 0.00% 0.00% 0.25%

Total Operating Expenses 184,484.0 196,219.0 190,413.0 192,136.0 186,928.0 196,036.0 765,513.0

% Net Sales 23.8% 25.6% 24.9% 26.8% 23.9% 24.7% 25.0%

Other (Expense) Income, Net 5,710.0 (436.0) (1,959.0) (6,499.0) 154.0 2,635.0 (5,669.0)

% Net Sales 0.74% (0.06%) (0.26%) (0.91%) 0.02% 0.33% (0.19%)

EBITDA 187,488.0 169,441.0 178,812.0 163,517.0 206,193.0 194,355.0 742,877.0

EBITDA Margin (%) 24.2% 22.1% 23.4% 22.8% 26.3% 24.5% 24.3%

Depreciation & Amortization 19,985.0 21,056.0 24,058.0 24,498.0 32,758.0 22,115.0 103,429.0

% Net Sales 2.6% 2.7% 3.1% 3.4% 4.2% 2.8% 3.4%

EBIT 167,503.0 148,385.0 154,754.0 139,019.0 173,435.0 172,240.0 639,448.0

EBIT Margin (%) 21.6% 19.3% 20.2% 19.4% 22.1% 21.7% 20.9%

Interest 11,095.0 11,407.0 11,855.0 11,705.0 12,478.0 15,060.0 51,098.0

% Net Sales 1.4% 1.5% 1.5% 1.6% 1.6% 1.9% 1.7%

EBT 156,408.0 136,978.0 142,899.0 127,314.0 160,957.0 157,180.0 588,350.0

EBT Margin (%) 20.2% 17.8% 18.7% 17.8% 20.5% 19.8% 19.2%

Income Tax Expense 28,150.0 31,604.0 36,452.0 23,648.0 36,293.0 35,317.0 131,710.0

Tax Rate (%) 18.0% 23.1% 25.5% 18.6% 22.5% 22.5% 22.4%

Net Income 128,258.0 105,374.0 106,447.0 103,666.0 124,664.0 121,863.0 456,640.0

International Flavors & Fragrances, Inc. (NYSE: IFF)

Quarterly Data

17. Discounted Cash Flow Valuation

(Values in thousands, USD, except per-share data) Fiscal Year Ended December 31

Consolidated Statements of Income LTM

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 09/30/2016 A

Net Income 128,258.0 105,374.0 106,447.0 103,666.0 124,664.0 121,863.0 456,640.0

Other Comprehensive Income

Foreign Currency Translation Adj. (50,515.0) 17,557.0 (48,368.0) (42,830.0) 14,077.0 (4,689.0) (81,810.0)

(Loss) Gain on Derivative Hedges 12,083.0 (5,966.0) (12,498.0) 3,411.0 (10,192.0) 800.0 (18,479.0)

Pension & Postretirement Liability Adj. 5,547.0 5,476.0 5,478.0 37,616.0 2,555.0 2,578.0 48,227.0

Total Other CI (32,885.0) 17,067.0 (55,388.0) (1,803.0) 6,440.0 (1,311.0) (52,062.0)

Other CI as a % Net Sales (4.24%) 2.22% (7.24%) (0.25%) 0.82% (0.17%) (1.70%)

Comprehensive Income 95,373.0 122,441.0 51,059.0 101,863.0 131,104.0 120,552.0 404,578.0

Earnings Per Share

Basic 1.59 1.31 1.33 1.30 1.56 1.53 5.74

Diluted N/A N/A N/A N/A N/A N/A 5.72

Avg. Common Shares Outstanding

Basic 80,886.4 80,585.5 80,250.2 79,867.9 79,713.9 79,591.8 79,591.8

Diluted N/A N/A N/A N/A N/A 79,877.1 79,877.1

Shares Repurchased N/A 300.8 335.3 382.3 154.0 122.0 N/A

Percent of Shares Repurchased N/A 0.37% 0.42% 0.48% 0.19% 0.15% N/A

International Flavors & Fragrances, Inc. (NYSE: IFF)

Quarterly Data