GeoLivi_T24_Banking (2)

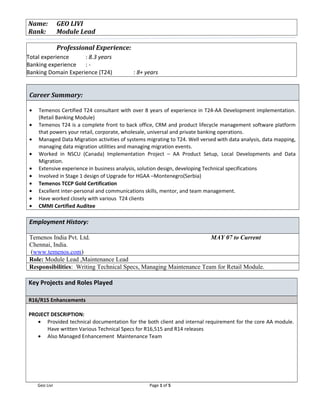

- 1. Name: GEO LIVI Rank: Module Lead Professional Experience: Total experience : 8.3 years Banking experience : - Banking Domain Experience (T24) : 8+ years Career Summary: • Temenos Certified T24 consultant with over 8 years of experience in T24-AA Development implementation. (Retail Banking Module) • Temenos T24 is a complete front to back office, CRM and product lifecycle management software platform that powers your retail, corporate, wholesale, universal and private banking operations. • Managed Data Migration activities of systems migrating to T24. Well versed with data analysis, data mapping, managing data migration utilities and managing migration events. • Worked in NSCU (Canada) Implementation Project – AA Product Setup, Local Developments and Data Migration. • Extensive experience in business analysis, solution design, developing Technical specifications • Involved in Stage 1 design of Upgrade for HGAA –Montenegro(Serbia) • Temenos TCCP Gold Certification • Excellent inter-personal and communications skills, mentor, and team management. • Have worked closely with various T24 clients • CMMI Certified Auditee Employment History: Temenos India Pvt. Ltd. MAY 07 to Current Chennai, India. (www.temenos.com) Role: Module Lead ,Maintenance Lead Responsibilities: Writing Technical Specs, Managing Maintenance Team for Retail Module. Key Projects and Roles Played R16/R15 Enhancements PROJECT DESCRIPTION: • Provided technical documentation for the both client and internal requirement for the core AA module. Have written Various Technical Specs for R16,515 and R14 releases • Also Managed Enhancement Maintenance Team Geo Livi Page 1 of 5

- 2. Some Key Enhancements worked : Product Bundle : Client : Canadian Western Bank - Canada A new product line called Product Bundle. This product line would allow banks to implement & offer to their customers, various packaged products such as Notional Pooling, Offset Mortgages. The essence of this product line is that there is a pool of financial arrangements of which one of them is a recipient participant and the all of them (may or may not include the recipient participant) are donor participants. The participation here is in the context of Interest processing only. The balances of the donor participants are notionally combined (without actually sweeping) and one interest is calculated based on the combined balance. The tier conditions/rates for this combined balance is driven by the Interest condition of the recipient participant. This Product line has 3 property Classes – Customer, Bundle and Interest Compensation. The Bundle property class would define who the participant product groups are; what is the minimum mandatory participation required to meet the definition of the package etc. The Interest Compensation property class would define the Interest property of the Donor participants and the recipient participant. It also allows to specify if the Donors would/could still accrue interest on their own balance or not. The way the Bundle was designed allowed variants of the Notional Pooling products there by giving banks the ability to offer value added packages like Interest Upgrade (if the Customer opened a Savings account as well, they get a boost to their interest on their Current account balance) or Bonus Interest (if the Customer opened a Savings Account as well, they get an bonus interest on their Current account which otherwise is non-interest bearing) etc. Broker Commission Client : KBC Ireland Financial institutions encourage brokers for getting additional business apart from their direct marketing channel. Brokers can be individuals or a group who are enrolled by financial institutions & managed by a sales person of the financial institution, who can also be called as ‘Broker relationship manager’. Brokers are compensated by means of brokerage commissions, which would be calculated based on the terms and conditions amongst the bank. Calculation of Brokerage commissions can happen online or can happen at regular intervals. Financial institutions claw back the commission paid when a broker generated business is closed ahead of agreed term. For the T24 Arrangement Architecture suite, a full Brokerage solution, covering calculation, collecting and processing functionality isn’t currently available in any of the product lines, Lending, Deposits and Accounts. Similar requirements in the past have been customized locally, by configuring a CHARGE property and crediting a designated account. However the functionality would be limited when compared to scalability & changing market requirements. This enhancement is aimed at incorporating brokerage processing into Arrangement Architecture suite and to provide a framework to satisfy the retail brokerage requirements across the product lines Lending, Deposits and Accounts. Geo Livi Page 2 of 5

- 3. Rebatable Insurance Client : Trinovus USA Insurance is an integral part of housing loan business in the US. Banks encourage the customers to cover the risks associated by means of insurance. Banks also fund the insurance portion as part of the loan amount, which would be repaid by the customers as part of the loan. Insurance can be of different types like Credit Life Insurance, Accident & Health insurance or Personal Mortgage insurance. Credit life insurance is a term insurance, which covers the risk of death of a loan borrower. In the event of a risk, insurance company would indemnify the bank for the outstanding loan amount. Accident and health insurance is a short term cover, which in the event a borrower is unable to work due to a disability, the insurance company would honour the loan repayments till the end of the disability period or till the last instalment date, whichever is earlier. As is the case with any insurance, there would an option to define a “look back” (Grace) period & a feature the cancel the insurance cover. Cancellations done within the grace period would result in full amount getting refunded to the customer. When cancellation is done after the grace period, customer would get back the unutilized insurance portion, applicable for the residual term. Hypo Group Alpe Adria (HGAA-Serbia) : R10 Upgrade PROJECT DESCRIPTION: Hypo Group Alpe Adria (HGAA) is a leading bank operating in various countries, one of which is Montenegro. HGAA currently running on T24 release R08.The major T24 module used in this site is AA for loans. HGAA is currently on the process of Upgrading to R10. Job Profile : • Designed Stage 1 of Upgrade • Designed automated tools to perform contract closure. • Created Data mapping and injection documents for upgrade • Did Performance tuning for AA Contracts takeover • Single point of contact from AA Development Team for AA Upgrade R11/R12 Enhancements PROJECT DESCRIPTION: • Provided technical documentation for the both client and internal requirement for the core AA module. Have written Various Technical Specs from R09 TO R13 • Develop Test Case scenarios and test cases to test the development Some Key Enhancements worked in AA module: • Change Product Property Class(Renewals) In AA, transactions on a contract are performed by an activity on the particular product. Using this Property class, users can change the Product P1 to P2 during the course of the loan. User can even default the particular property condition from the Product level. • Simulation In AA, user can define simulate the future dated activity and see what will be the result when the particular activity was triggered on future date. NSCU (Pilot AA Client) used this option in the branch office and they used to simulate the Change product Activity using Simulation. This Functionality is new to T24. Geo Livi Page 3 of 5

- 4. • Reverse and Replay This is new functionality in T24 where user can triggered the backdated activity. System reverses all the activity between today and the activity effective date and replay accordingly to new Changed Property condition. NSCU used this option to trigger backdated Change Product activity which is the main business activity for them. • Penalty Calculations Based on Bills (Client : APAP ) New Functionality to calculate Penalty Interest Based on Bill outstanding amounts just like how PD module calculates penalty interest. Repayment of penalty interest should follow the same order of “By Bills” definition in payment rules. North Shore Credit Union, Vancouver -Canada : New Implementation PROJECT DESCRIPTION: North Shore Credit Union (NSCU) is a credit union in Canada with over 40,000 members and $2.0 billion in assets under administration. Based in North Vancouver, British Columbia, NSCU operates as a full service financial institution for its members, the organization has 13 branches throughout the Lower Mainland of British Columbia and in Squamish, Whistler, and Pemberton. Its subsidiaries include United Mortgage Group, North Shore Capital Corporation, North Shore Leasing, and Pacific Spirit Properties. NSCU IS first AA client for Temenos. Roles and Responsibilities: Provided Onsite Support for NSCU for 1 year and helped them in going LIVE using T24 (AA) Testing Support: • Provided support for UAT. • Provided knowledge transfer to client during the course of the NSCU Project to overcome Knowledge Issues. • Provided workarounds. Migration Support: • Technical support was done to NSCU during Migration. • As NSCU was first AA client, there was lot of issues regarding Performance and data mapping. • Performed detailed analysis and helped migration team for improving the performance and accuracy. Local Developments: • Coded enquiry routines to customize AA overview screens. • Designed delivery routines as per client requirement. • Designed local API for supporting Advanced Payment. • Designed payment schedule hook routine to support client’s requirement. Post Live Support: • Got appreciation from NSCU Management for my Support provided to them on and before GO Live. • Provided live support to help end users. • Designed automated correction routines to perform contracts correction. Geo Livi Page 4 of 5

- 5. AA Maintenance PROJECT DESCRIPTION: During this period, I have been involved in designing, coding and perform programmer level testing to Client reported Issues and some critical enhancements related to AA. AA being new product faced numerous challenges after rollout .Involved in various phases of product stabilization. Job Profile : • Maintenance Team Leader – responsible for Retail Products Maintenance and helped quick turnaround of client defects. • Solved many critical AA bugs • Increased Regression coverage for the product ACADEMIC BACKGROUND: Degree College/University Year of Passing B.Tech – Information Technology St. Xavier’s Catholic College of Engineering, Anna University ,Nagercoil, India 2005 TECHNICAL SKILLS: Languages InfoBasic, C, C++, JAVA Database JBase, SQL Automation Testing Selenium , testNG Platform Windows Vista, XP, Unix Product Knowledge AA-Lending, Deposits ,FT,TT,DD,LD ,SMS,ENQUIRY,VERSIONS AA Migration ,Customization PERSONAL DETAILS: Name GEO LIVI Age & Marital Status 31 & Married Address for communication No:3/14, 2nd street, SwamiNager Extn :1, Ullagaram, Chennai 600 091. India Passport No. F8641712 Emigration check required No Expiry Date 21st June 2016 Phone Mobile: 9894554703 Email: geolivi@gmail.com Languages known English, Tamil & Malayalam. Geo Livi Page 5 of 5

- 6. AA Maintenance PROJECT DESCRIPTION: During this period, I have been involved in designing, coding and perform programmer level testing to Client reported Issues and some critical enhancements related to AA. AA being new product faced numerous challenges after rollout .Involved in various phases of product stabilization. Job Profile : • Maintenance Team Leader – responsible for Retail Products Maintenance and helped quick turnaround of client defects. • Solved many critical AA bugs • Increased Regression coverage for the product ACADEMIC BACKGROUND: Degree College/University Year of Passing B.Tech – Information Technology St. Xavier’s Catholic College of Engineering, Anna University ,Nagercoil, India 2005 TECHNICAL SKILLS: Languages InfoBasic, C, C++, JAVA Database JBase, SQL Automation Testing Selenium , testNG Platform Windows Vista, XP, Unix Product Knowledge AA-Lending, Deposits ,FT,TT,DD,LD ,SMS,ENQUIRY,VERSIONS AA Migration ,Customization PERSONAL DETAILS: Name GEO LIVI Age & Marital Status 31 & Married Address for communication No:3/14, 2nd street, SwamiNager Extn :1, Ullagaram, Chennai 600 091. India Passport No. F8641712 Emigration check required No Expiry Date 21st June 2016 Phone Mobile: 9894554703 Email: geolivi@gmail.com Languages known English, Tamil & Malayalam. Geo Livi Page 5 of 5