Affidavit of Robert Wolfe

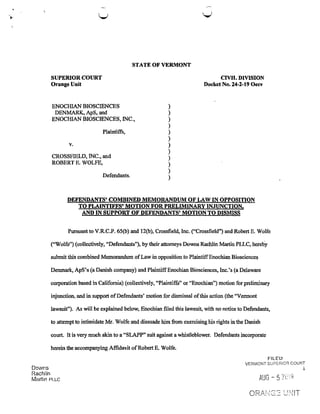

- 1. STATE OF VERMONT SUPERIOR COURT CIVIL DIVISION Orange Unit Docket No. 24-2-19 Oecv ENOCHIAN BIOSCIENCES DENMARK, ApS, and ENOCHIAN BIOSCIENCES, INC., Plaintiffs, v. CROSSFIELD, INC., and ROBERT E. WOLFE, Defendants. DEFENDANTS’ COMBINED MEMORANDUM OF LAW IN OPPOSITION T0 PLAINTIFFS’MOTION FOR PRELIMINARY INJUNCTION, AND IN SUPPORT OF DEFENDANTS’ MOTION TO DISMISS Pursuant to V.R.C.P. 65(1)) and 120)), Crossfield, Inc. (“Crossfield”) and Robert E. Wolfe (“Wolfe”) (collectively, “Defendants”), by their attorneys Downs Rachlin Martin PLLC, hereby submit this combined Memorandum ofLaw in opposition to PlaintiffEnochian Biosciences Denmark, ApS’s (a Danish company) and Plaintiff Enochian Biosciences, Inc.’s (a Delaware corporation based in California) (collectively, “Plaintiffs” or “Enochian”) motion for preliminary injunction, and in support ofDefendants’ motion for dismissal ofthis action (the “Vermont lawsuit”). As will be explained below, Enochian filed this lawsuit, with no notice to Defendants, to attempt to intimidate Mr. Wolfe and dissuade him from exercising his rights in the Danish court. It is very much akin to a “SLAPP” suit against a whistleblower. Defendants incorporate herein the accompanying Affidavit ofRobert E. Wolfe. FILED D VERMONT SUPERIOR COURT owns 3 Rachlin .— . ’t | _ / MU Martm PLLC H96 5 4. ORANGE UNlT ))))))))))))

- 2. A. BACKGROUND 1. On or about June 30, 2017, PlaintiffEnochian Biosciences Denmark, ApS, a Danish company that is a subsidiary ofPlaintiff Enochian Bioscienccs, Inc., entered into a CFO Service Agreement (the “Agreement”) with Defendants Crossfield, 1110., and Mr. Wolfe. Plaintiffs’ Complaint, at 3, 1] ll. A copy ofthe Agreement is attached as Exhibit A to Plaintiffs’ Complaint.‘ Crossfield is owned by Mr. Wolfe. The Agreement was drafied by Enochian. Affidavit of Robert E. Wolfe (“Wolfe Aff.”), at 11 8. The Agreement was amended on December 29, 2017 (the “Amendmen ”) to alter Defendants’ compensation but was otherwise lefi intact. Complaint, at 3, 1i 12; Wolfe Aff., at 1] ll. A copy ofthe Amendment is attached as Exhibit B to Plaintiffs’ Complaint. Pursuant to the Agreement, Mr. Wolfe acted as Enochian’s Chief Financial Officer (CFO) and provided CFO services to Enochian. Complaint, at 3, 1m 13-15; Wolfe Affi, at 11 9. Pursuant to Danish law, the Agreement is considered an employment agreement, conferring upon Mr. Wolfe all ofthe rights ofan employee under Danish law. _S_ee Employers’ and Salaried Employees Legal Relationship Consolidation Act of2017.2, Enochian’s annual report for the year ending June 30, 2018 counted Mr. Wolfe as one of four (4) “full-time employees.” SQ Exhibit l hereto (annual report).3 2. The Agreement provided at all times that it “is to be governed by and construed in accordance with Danish law.” 3. The Agreement further provided that “any dispute arising out ofthis ongoing relationship or the conclusion, construction or end ofthis CFO Service Agreement is to be settled 1 At the time, Plaintiffwas called DanDrit Biotech A/S. Complaint, at 3, 1] ll. 2 The Danish law is referenced in Defendant’s Danish Complaint, which is attached (in its Danish language and as an unofficial English translation) to Plaintiff’s Complaint as Exhibit C. 3 Available at hltnstllwiwwsmgov/Archiyes/cdgar/dalall5277-31000l73'l 122 l 8000094lel I46 form l Oklilm. FlLED ggxirifi'i VERMONT SUPERIOR COURT f: a"! Martin mtc 2 AUG ~ 5 2033‘ ORANGE UNIT

- 3. bl finally by binding arbitration according to the ‘Rules ofArbitration Procedure ofDanish Arbitration’ and the arbitral tribunal is to be made up ofarbitrators appointed by the Danish Institute ofArbitration. The arbitral tribunal is to sit in Copenhagen.” 4. Enochian terminated the Agreement on December 13, 2018. Wolfe Aff., at 1i 19. On that date Enochian’s Chief Executive Officer, Dr. Eric J. Leire, telephoned Mr. Wolfe and informed him that the Agreement was terminated, efi‘ective immediately, and that the compensation owing to Defendants would be paid immediately. E, Dr. Leire (who himselfwas subsequently terminated by Enochian) made clear to Mr. Wolfe that the termination was due to Mr. Wolfe’s raising ofconcerns about Enochian’s hiring ofand payments to an individual as an “advisor” who was a convicted criminal. I_d., at 1] 20. The allegation in Paragraph 23 of Plaintiffs’ Complaint, that Enochian terminated Defendants’ services on or about January 9, 2019, is false. On December l8, 2018 Enochian Biosciences, Inc.’s Board Chairman, Rene Sindlev, telephoned Mr. Wolfe and confirmed that Defendants’ services had been terminated by Dr. Leire on December 13. 1i, at 11 21. The termination was further documented in an email of December 18, 2018 fiom Mr. Sindlev to Mr. Wolfe and other Enochian employees, and Enochian’s attorney. gg Exhibit 2 hereto. A Form 8-K filed by Enochian Biosciences, Inc., on January 9, 2019 states that Enochian had hired Luisa Puche to take over Defendants’ responsibilities as CFO ofEnochian efl‘ective January 7, 2018. S+ee Exhibit 3 hereto; Wolfe Aff., at 1} 22. 5. Enochian then sent Defendants a letter dated January 9, 2019 purporting to inform them that Enochian was terminating the Agreement effective as of that date (Jan. 9). The letter 4 Enochian acknowledges that the December 29, 2017 amendment did not alter the governing law and forum requirements of the Agreement. Plaintiffs’ Motion for Emergency Ex Par-re Temporary Remaining Order and Preliminary Injunction, at 2. Downs FILED Rach'm 3 VERMONT SUPERIOR COURT Martin PLLc AUG - 5 2019 ORAKG‘: UNIT

- 4. stated that, “On the Termination Date, you will be paid all compensation earned through the Termination Date.” fig Exhibit 4 hereto; Wolfe Aft, at 1] 23. 6. To date, Defendants have not been paid all that they are owed. Wolfe Aff, at 1] 23. 7. In post-tennination negotiations, Enochian refused to agree to provide full compensation to Defendants; then it agreed to pay certain compensation but only provided that Defendants continue to provide services to Enochian, even though Enochian itself had terminated the Agreement and owed Defendants compensation for services that Defendants had already provided pre-termination; and then Enochian refiised to pay any compensation to Defendants except for a lesser amount mover a six-month time period. Si: Exhibits 5 and 6 hereto; Wolfe Affi, at 1]1] 24-26. Mr. Wolfe perceived that Enochian was playing games with him and had decidedjust not to pay the compensation owed Defendants. 8. Because ofEnochian’s refusal to honor its contractual commitments and because of its bad faith behavior, Mr. Wolfe — following the choice oflaw andforum dictates of Plaintiff's Agreement — consulted Danish counsel concerning Defendants’ rights under Danish law, and on February 7, 2019 commenced a legal action in Denmark against Enochian.5 Wolfe Aff., at 1]1] 29, 35. A copy ofDefendants’ Danish filing (including an unofficial English translation) is attached as Exhibit C to Plaintiffs’ Complaint. Mr. Wolfe’s only motivation for commencing the action in Denmark — which, again, is where Enochian’s Agreement demanded that he go — was to end Enochian’s games and compel it to fully compensate Defendants under 5 As explained below, Defendants provided Enochian with advance notice ofthe lawsuit, including a c0py ofthe anticipated filing itself. FILED DOV??? VERMONT SUPERIOR COURT Rae ’t in M"rtir LC 4 ,. at art. AUG—55d”; ORANGE UNlT

- 5. stated that, “On the Termination Date, you will be paid all compensation earned through the Termination Date.” fig Exhibit 4 hereto; Wolfe Aft, at 1] 23. 6. To date, Defendants have not been paid all that they are owed. Wolfe Aff, at 1] 23. 7. In post-tennination negotiations, Enochian refused to agree to provide full compensation to Defendants; then it agreed to pay certain compensation but only provided that Defendants continue to provide services to Enochian, even though Enochian itself had terminated the Agreement and owed Defendants compensation for services that Defendants had already provided pre-termination; and then Enochian refiised to pay any compensation to Defendants except for a lesser amount mover a six-month time period. Si: Exhibits 5 and 6 hereto; Wolfe Affi, at 1]1] 24-26. Mr. Wolfe perceived that Enochian was playing games with him and had decidedjust not to pay the compensation owed Defendants. 8. Because ofEnochian’s refusal to honor its contractual commitments and because of its bad faith behavior, Mr. Wolfe — following the choice oflaw andforum dictates of Plaintiff's Agreement — consulted Danish counsel concerning Defendants’ rights under Danish law, and on February 7, 2019 commenced a legal action in Denmark against Enochian.5 Wolfe Aff., at 1]1] 29, 35. A copy ofDefendants’ Danish filing (including an unofficial English translation) is attached as Exhibit C to Plaintiffs’ Complaint. Mr. Wolfe’s only motivation for commencing the action in Denmark — which, again, is where Enochian’s Agreement demanded that he go — was to end Enochian’s games and compel it to fully compensate Defendants under 5 As explained below, Defendants provided Enochian with advance notice ofthe lawsuit, including a c0py ofthe anticipated filing itself. FILED DOV??? VERMONT SUPERIOR COURT Rae ’t in M"rtir LC 4 ,. at art. AUG—55d”; ORANGE UNlT

- 6. compensation and damages owed to Defendants by Enochian. 9. Unlike Enochian’s secret filing in this Court, Defendants’ Danish attorney notified Enochian on January 17, 2019 — three (3) weeks before filing suit in Denmark -oftheir legal claims for compensation under Danish law. §_e§ Exhibit 7 hereto; Wolfe Aff., at 1] 30. 10. Having been unsuccessful in resolving their claims against Enochian, on February 5, 2019 Defendants’ Danish attorney emailed Enochian a copy oftheir anticipated lawsuit to be filed in Danish court, i.e., two (2) days before they filed it. mExhibit 8 hereto; Wolfe Aff., at 1i 33. As noted above, the pleading expressly made reference to Mr. Wolfe’s concerns about- - In other words, Enochian was explicitly informed, two days before Defendants filed in Danish court, that Defendants’ Danish filing would contain what Enochian is now claiming is its “confidential” information. ll. On February 6, 2019, Enochian’s Danish counsel sent a letter to Defendants’ Danish counsel regarding various matters about which the parties had been communicating. §_§ Exhibit 9 hereto; Wolfe Aff., at 1[ 34. Regarding Defendants’ anticipated filing in Danish court, however, Enochian’s letter said only that the parties had agreed to arbitration and that Enochian would seek a dismissal ofthe case on that basis. Significantly, Enochian did not bother to warn Defendants that their anticipated court filing would purportedly disclose Enochian’s alleged confidential information or cause Enochian irreparable harm. Nor, Lite; Defendants made their filing, did Enochian move the Danish court for any kind ofinjunctive relief against Defendants or ask the Danish court to place Defendants’ filing under seal. In short, Enochian did simply nothing to prevent or address the disclosure of alleged Enochian confidential information. Wolfe Aff., at 1 37. One can readily infer that Enochian knew that it could not in good faith tell the Danish court that the information at issue was “confidentia .” FILED VERMONT SUPERIOR COURT Downs Rachlin pUG _ 5 293,1. Martin PLLC 6 ‘ ~ ORANGE UNIT

- 7. L.) 12. Instead ofaddressing their confidentiality concerns with Defendants before they filed in Denmark, or immediately responding in the Danish court, or both, on Saturday, February 9 Enochian’s attorneys sent a letter to Defendant’s Danish counsel and to Defendants themselves (despite the fact that Enochian’s attorneys knew that Defendants were represented by Danish counsel) accusing Defendants of having disclosed Enochian’s confidential information in their Danish filing.8 Wolfe Aff., at 11 36. A copy ofthe letter is attached as Exhibit D to Plaintiffs’ Complaint. In sending its letter, Enochian waited over three (3) weeks afier Enochian had been notified in writing of Defendants’ claim, and four (4) days after Enochian had actually seen the filing (before it was filed) — despite now claiming that thefiling disclosed confidential information that irregarablz harms Enochian. l3. Defendants’ Danish attorney, Carsten Busk, promptly responded to Enochian’s attorneys on Monday, February 11, denying that Defendants breached the confidentiality provisions of the Agreement, and advising them that under Danish law regarding employee rights, Defendants were entitled to file a lawsuit notwithstanding the arbitration clause in the Agreement. Wolfe Affi, at 1] 38. A copy ofthe letter is attached as Exhibit E to Plaintiffs’ Complaint.9 14. Again, instead ofresponding to Attorney Busk, or responding in the Danish court, on February 12, 2019 Enochian responded by filing — secretly — this improper collateral action in Orange Superior Court in Vermont, a forum that: a) has no connection to Enochian Biosciences Denmark, ApS (a Danish company) or its parent company, Enochian Biosciences, Inc. (a 8 Although the letter is dated February 8, it was sent to Defendants on February 9. Wolfe Affi, at 1 36. 9 Under Danish law, when a dispute is about dismissal ofan employee,.the employee can pursue'his or her rights in court regardless ofan arbitration clause. Sic Employers' and Salaried Employees Legal Relationship Consolidation Act of2017. FILED - VERMONT SUPERIOR COURT Downs Rachlin ,‘ ,1 ,1», Martin 91.1.0 7 AUG — 5 11.31.»; C iT<T,3,{"'-E "MT

- 8. compensation and damages owed to Defendants by Enochian. 9. Unlike Enochian’s secret filing in this Court, Defendants’ Danish attorney notified Enochian on January 17, 2019 — three (3) weeks before filing suit in Denmark -oftheir legal claims for compensation under Danish law. §_e§ Exhibit 7 hereto; Wolfe Aff., at 1] 30. 10. Having been unsuccessful in resolving their claims against Enochian, on February 5, 2019 Defendants’ Danish attorney emailed Enochian a copy oftheir anticipated lawsuit to be filed in Danish court, i.e., two (2) days before they filed it. mExhibit 8 hereto; Wolfe Aff., at 1i 33. As noted above, the pleading expressly made reference to Mr. Wolfe’s concerns about- - In other words, Enochian was explicitly informed, two days before Defendants filed in Danish court, that Defendants’ Danish filing would contain what Enochian is now claiming is its “confidential” information. ll. On February 6, 2019, Enochian’s Danish counsel sent a letter to Defendants’ Danish counsel regarding various matters about which the parties had been communicating. §_§ Exhibit 9 hereto; Wolfe Aff., at 1[ 34. Regarding Defendants’ anticipated filing in Danish court, however, Enochian’s letter said only that the parties had agreed to arbitration and that Enochian would seek a dismissal ofthe case on that basis. Significantly, Enochian did not bother to warn Defendants that their anticipated court filing would purportedly disclose Enochian’s alleged confidential information or cause Enochian irreparable harm. Nor, Lite; Defendants made their filing, did Enochian move the Danish court for any kind ofinjunctive relief against Defendants or ask the Danish court to place Defendants’ filing under seal. In short, Enochian did simply nothing to prevent or address the disclosure of alleged Enochian confidential information. Wolfe Aff., at 1 37. One can readily infer that Enochian knew that it could not in good faith tell the Danish court that the information at issue was “confidentia .” FILED VERMONT SUPERIOR COURT Downs Rachlin pUG _ 5 293,1. Martin PLLC 6 ‘ ~ ORANGE UNIT

- 9. and served (on February 15) on Defendants its 93 p_a_r§ temporary restraining order in this action restraining Defendants from “disclosing Plaintiffs’ confidential infonnation.”“ 17. Subsequent to this Court’s issuance ofthe e__x par; temporary restraining order, on February 26 Enochian responded to the Danish court’s order by filing a brief asking the court to: a) transfer the Danish case to Danish arbitration, and b) limit public access to Defendants’ filing.- id” at 1111 46-47. The court did not grant either request, but has directed Defendants to respond to Enochian’s filing by March 27. 11., at 1[ 49. Notably, despite Enochian’s contention in this Court that Defendants’ filing in the Danish court disclosed confidential information and caused Enochian irreparable harm, Enochian waited nineteen (19) days to reSpond to the Danish filing. And when, on February 26, Enochian finally responded, it made no mention whatsoever that it had filed an action against Defendants in a US. court, i.e., this action, two (2) weeks earlier. I_d., at 1[ 48. B. ARGUMENT 1. This Action is Not Properly Brought Before This Court-and Sh'duld Be Dismissed Because the Parties Expre’ssly. Contracted to Resolve Any and All Disputes -.Sueh As This One — in Denmark Per Enochian’s Agreement. It is fora Danish'Tribunal to Decide the Merits of Enochian’s "Claims lneludin Whether Any of the Information Defendants Have Diselosedin TheirDanish .Pleadin sis Confidential Wh‘ieh it is Not and the A re riate Remed As explained above and as expressly alleged in Enochian’s Complaint, the Agreement between Enochian and Defendants contains a forum selection clause providing that “any dispute arising out ofthis ongoing relationship or the conclusion, construction or end ofthis CFO Service Agreemen ” must be brought in Denmark, through arbitration under Danish rules. The Vermont Supreme Court has observed that “forum selection ‘clauses are prima facie valid and I 1 Although Enochian was aware that Defendants were represented by Danish counsel, such counsel does not appear to have been copied on the correspondence and papers served on Defendants. FILED Gowns VERMONT SUPERIOR COURT Raehlin Martin mo 9 .. AUG .. 5 2029 ORANGE UNET

- 10. should be enforced unless enforcement is shown by the resisting party to be ‘unreasonablc’ under the circumstances?” Im’l Collection Serv. Inc. v. Gibbs, 147 Vt. 105, 107 (1986) (citing and quoting The Bremen v. Zapata Off-Shore C0,, 407 U.S. 1, 10 (1972)). To escape a contractually agreed forum selection clause, the resisting patty must “show that trial in the contractual forum will be so gravely diflicult and inconvenient that he will for all practical purposes be deprived of his day in court.” I_d; (quoting The Bremen, 407 U.S. at 18). Enochian — a Danish company that specified Danish forum and Danish law in its Agreement, and which has already made a filing in the Danish case — cannot possibly meet this burden. There can be no doubt here that the claims made in Enochian’s Vermont lawsuit fall squarely within the Agreement’s forum selection clause, and therefore dismissal is warranted under V.R.C.P. 12(b)(3) and l2(b)(6). One need not look any further than Count I, which alleges breach ofthe Agreement — i.e., “a binding an enforceable contract between Plaintiffs and Defendants.” Complaint, at fl 33. Clearly, Enochian’s assertion that Defendants breached the Agreement “aris[es] out ofthis ongoing relationship or the conclusion, construction or end of this CFO Service Agreement.”12 That Enochian’s filing in this Court is improper is further underscored by the fact that Enochian alleges that Defendants’ “wrongfiil conduct” included not adhering to the forum selection clause. 13 l_d., at 1i 27.a. In view ofthat allegation, how can Enochian possiblyjustify filing the Vermont action in the first place? Nor can Enochian claim that this Court’s enforcement ofthe forum selection clause 12 Counts It and III, which allege breach offiduciary duty and breach ofduty of loyalty, respectively, also fall under the forum selection clause, as they each are premised on obligationsthat Enochian alleges existed under the Agreement and continue to exist at the end ofthe Agreement. Complaint, at w 38-39, 43. l3 As noted above, the fact that Defendants instituted a lawsuit in Denmark rather than arbitration there is not, by operation ofDanish law, a violation ofthe clause. HLED D VERMONT SUPERIOR COURT owns Rachlin A H Martin Rue 10 AUU _ 5 mm ORANGE UM?!"

- 11. Delaware company based in California); b) has no connection to the Agreement or to the dispute between the parties; and c) is not well-suited to the application ofDanish law, which expressly governs the Agreement.” Worse yet, there was simply no good faith basis for Enochian to seek its restraining order on an g gm basis, premised upon (false) allegations of improper disclosures ofEnochian’s confidential information (in Denmark). Mr. Wolfe resides in Randolph, Vermont, in Orange County, a drive ofless than thirty (30) minutes to the Chelsea courthouse via VT Route 66. Wolfe Aff., at 1] 42. Indeed, Mr. Wolfe was at his residence at all times between Tuesday, February 12 (the date on which Enochian filed its secret lawsuit and obtained the g order) and Friday February 15 (the date on which the order was served on him by sheriff) — completely unaware ofthis action. LL, at 1] 44. Defendants gave Enochian advance warning of its Danish filing, and exactly what it would contain. By contrast, Plaintiffs did nothing, and then, a week later, filed a secret SLAPP-style action in Vermont. Had Mr. Wolfe received notice ofthe motion for restraining order, he would readily have come to the Court and explained why the information is not confidential — that it can be found in Enochian’s own SEC filings and a public video, and by a search ofpublic sources — but is apparently embarrassing to Enochian. m” at 1] 42. 15. On February 13, the day afier Enochian filed this g arts lawsuit, the Danish court issued an order requiring Enochian to respond to Defendants’ lawsuit there by February 28. Q, at 11 45. 16. Before Enochian was required to, and did, respond to the Danish court, it obtained 10 Although Enochian filed the present action on February 12, there can be no doubt — based upon the sheer volume and complexity ofthe papers filed —- that Enochian had been working on this filing for several days prior to filing. Thus, instead ofacting quickly in Denmark to address what it believed was an irreparably hannful disclosure of “confidential information” in Denmark, Enochian focused its efforts on concocting a U.S. lawsuit. FILED Downs VERMONT SUPERIOR COURT Rachlin 8 Martin PLLc: AUG _ S 26E? O UNIT

- 12. Defendants. 2. Even ifThis Action is Not Dismissed, Enochian is Not Entitled to Any Form of lniunetive Relief Because ta) the Information Disclosed in 'Defendants’ Danish Filing is Not Confidential Information, (b) Enochian Cannot Claim lrreparable Harm Under the Circumstances, and (c) Neither the Balance of Harms Nor the Public Interest Warrant Such Relief. As detailed further below, Enochian obtained an ex page temporary restraining order in this action on the flimsiest allegations of disclosure by Defendants of “confidential information” but with no explanation in their motion of exactly what information Defendants disclosed and why it is (allegedly) confidential. Assuming the Court does not dismiss this action, it should not convert the restraining order to a preliminary injunction. The Vermont Supreme Court has cautioned that “[a] preliminary injunction is an extraordinary remedy never awarded as of right.” Taylor v. 'l‘oWn of‘ Cabot, 2017 V'l‘, 1] 19, 205 Vt. 586 (citing Winter v; Nat. Res..Def. Council Inc. 555 US. 7, 24 (2008)). As the party seeking injunctive relief, Enochian bears the burden ofestablishing the various factors that must be considered in granting such relief: “(1) the threat of irreparable harm to the movant; (2) the potential harm to the other parties; (3) the likelihood ofsuccess on the merits; and (4) the public interest.” 11, a. Irregarable Harm Regarding the irreparable harm factor, Enochian’s argument rests entirely on its contention that Defendants have disclosed (and will continue to disclose) Enochian’s “confidential information.” The alleged confidential information is mentioned only at the I bottom ofpage 3 ofEnochian’s “Motion for Emergency Ex Parte Temporary Restraining Order” (Motion 1) and is not described in any detail whatsoever. Enochian identifies the confidential information only as “allegations concerning payments made by Enochian Bioscience to an FILED VERMONT SUPERIOR COURT Downs 019 Rachlin AUG ~ 5 2 Martin PLLC 12 ORANGE UNIT

- 13. advisor” (in-ad the “quanti[ty] [or] those payments.” Motion at 3. How does this vague identification substantiate to this Court that the information Defendants disclosed in their Danish filing is actually confidential? Enochian simply alleges that this information was not public (which is false) and they do not explain: a) why or how it is confidential; b) why or how it is irreparably harmful to Enochian (except to conclusorily claim it is “confidential”); and c) why or how Mr. Wolfe, with fiduciary responsibilities as CFO ofa publicly-traded company to Enochian’s shareholders and to the SEC, was not at liberty -indeed, was not required -to disclose it. Enochian’s vague allegation does not even come close to meeting its heavy burden of explaining why Enochian is legally entitled to restrain Defendants from disclosing it — in a foreign judicial proceeding applying that country’s laws, no less. As summarized below and in Mr. wolfe’s affidavit accompanying this Memorandum ofLaw, the information at issue is not confidential and, instead, is publicly available,” to wit: 0 The fact that Enochian hired and paid—consulting firm was disclosed by Enochian itselfin its annual report for lheyear ending June 30 2018 filed with the US. Securi ' ‘ ’ ' ° “ ” _e_e_ Exhibit 10 hereto;'6 Wolfe Affi, at 1] S4. is also public a The fact that-isowned and controlled by ‘- ' " ' ry ofState Statement of information. & Exhibit 1] hereto Information, '5 Section 9.4 ofthe Agreement provides examples of what constitutes “confidential information." g5 Complaint, at Ex. A. Although none ofthose examples encompass the information at issue here, Section 9.4 makes clear that its reach is limited to information “that is not publicly available.” l6 17 —ILED —UPERIOR COURT Downs . , : Rachlin | R gin“; Martin PLLC 13 ALE —

- 14. should be enforced unless enforcement is shown by the resisting party to be ‘unreasonablc’ under the circumstances?” Im’l Collection Serv. Inc. v. Gibbs, 147 Vt. 105, 107 (1986) (citing and quoting The Bremen v. Zapata Off-Shore C0,, 407 U.S. 1, 10 (1972)). To escape a contractually agreed forum selection clause, the resisting patty must “show that trial in the contractual forum will be so gravely diflicult and inconvenient that he will for all practical purposes be deprived of his day in court.” I_d; (quoting The Bremen, 407 U.S. at 18). Enochian — a Danish company that specified Danish forum and Danish law in its Agreement, and which has already made a filing in the Danish case — cannot possibly meet this burden. There can be no doubt here that the claims made in Enochian’s Vermont lawsuit fall squarely within the Agreement’s forum selection clause, and therefore dismissal is warranted under V.R.C.P. 12(b)(3) and l2(b)(6). One need not look any further than Count I, which alleges breach ofthe Agreement — i.e., “a binding an enforceable contract between Plaintiffs and Defendants.” Complaint, at fl 33. Clearly, Enochian’s assertion that Defendants breached the Agreement “aris[es] out ofthis ongoing relationship or the conclusion, construction or end of this CFO Service Agreement.”12 That Enochian’s filing in this Court is improper is further underscored by the fact that Enochian alleges that Defendants’ “wrongfiil conduct” included not adhering to the forum selection clause. 13 l_d., at 1i 27.a. In view ofthat allegation, how can Enochian possiblyjustify filing the Vermont action in the first place? Nor can Enochian claim that this Court’s enforcement ofthe forum selection clause 12 Counts It and III, which allege breach offiduciary duty and breach ofduty of loyalty, respectively, also fall under the forum selection clause, as they each are premised on obligationsthat Enochian alleges existed under the Agreement and continue to exist at the end ofthe Agreement. Complaint, at w 38-39, 43. l3 As noted above, the fact that Defendants instituted a lawsuit in Denmark rather than arbitration there is not, by operation ofDanish law, a violation ofthe clause. HLED D VERMONT SUPERIOR COURT owns Rachlin A H Martin Rue 10 AUU _ 5 mm ORANGE UM?!"

- 15. 273, 277 (2d Cir. 1985) (reversing grant ofpreliminary injunction and observing that “failure to act sooner undercuts the sense ofurgency that ordinarily accompanies a motion for preliminary relief and suggests that there is, in fact, no irreparable injury”) (quotation omitted). Most notably, on February 5, 2019, afier receiving a copy ofDefendants’ anticipated Danish court filing with two days? advance notice, Enochian did nothing to intervene and stop the filing on the supposed grounds that it contained confidential information. Instead, it waited four days, until February 9, to send a letter (dated February 8) to Defendants and their Danish counsel complaining about the filing (which was made on February 7). Enochian then waited, according to the docket in this ease, another three (3) days, until February 12, to file its (improper) action in this Court. Enochian also waited l9 days afier Defendants made their filing in Denmark to submit a response to the Danish court. Enochian had the opportunity all along to move to seal Defendants’ Danish filing on the grounds ofconfidentiality and irreparable harm, but demonstrated no urgency at all. There simply is no irreparable harm here. Finally, even ifthe Court should allow this lawsuit to continue, a preliminary injunction is improper because any alleged harm to Enochian fi'om a disclosure ofactual confidential information — to be determined by a Danish tribunal under Danish lawpursuant to Enochian ’s Agreement — can be compensated by money damages. b. Likelihood at Success on the Merits Regarding the likelihood of success factor, Enochian’s argument fails for two primary reasons. First, as with irreparable harm, Enochian’s position on the merits of its claims is grounded on its unjustified conclusion that the information disclosed in Defendants’ Danish filing is confidential — which it isn’t, as explained above and in Mr. Wolfe’s afiidavit. Second, Enochian contends that the information at issue is not relevant to Defendants’ claims in the FILED VERMONT SUPERIOR COURT Downs R“cl' lin _ I" Mhrtiin m Ln 15 AUG 5 7.0 =9- UNIT

- 16. Danish action. But as explained above, Defendants’ raising ofconcerns regarding Enochian’s relationship with-isvery relevant, as it forms the basis for Defendants’ position as to why Enochian wrongfully terminated the Agreement. c. Balance at Harms and Public Inferes! Once again, Enochian’s argument on each of these factors revolves substantially around the disclosure ofwhat it contends is confidential information, but in actuality is publicly- available information. Thus, for the reasons discussed above, these factors tip toward the denial of injunctive relief. And on a broader level, courts should be especially reluctant to enjoin speech involving publicly-known matters (as here), and even more so when that speech is a necessary component in court filings in a foreign tribunal, which tribunal is capable of determining whether the information is or is not confidential and should or should not be sealed. In summary, Defendants have not disclosed any confidential information in their Danish lawsuit, and they have no intention of doing so in the future. As such, injunctive relief is not necessary or warranted.22 But Defendants take to heart the final paragraph ofthis Court’s temporary restraining order: that it is up to the Danish court to decide what information is and is not confidential, and what information may or may not be publicly filed in that court. Defendant must and will, as ordered by the Danish court, respond by March 27 to Enochian’s February 26 filing, pursuant to Danish law and represented by a Danish attorney. 22 In granting the temperary restraining order, the Court determined that EIiOchian need not post a bond because “there is; no indication that Defendants will be harmed ifthey are enjoined ii'om further disclosing confidential information under the parties’ agreement at least until thismatter can be further heard.” Ifthe Court' Is inclined to grant furthcr'Injunctivereliefalter review ofthe papers andahearing, Defendants will request that the Court revisit the bondIssue at that time. As explained herein,the information En‘ochian argues is “confidential”‘ Is niatcrial to Defendants‘ claimsIn the Danish court action, and, accordingly, any restriction on Defendants’ ability to make use}: lLED ofsuch informatirin for purposes of'Its Danish action will create a risk of.harm to Defendants. VERMONT SUPERIOR COURT Downs I r‘ - '21:? Rachlin 16 AUIJ 5 . ., . Martin PLLC ‘r‘*"" E gLH—r— l’iv'iier E

- 17. Defendants. 2. Even ifThis Action is Not Dismissed, Enochian is Not Entitled to Any Form of lniunetive Relief Because ta) the Information Disclosed in 'Defendants’ Danish Filing is Not Confidential Information, (b) Enochian Cannot Claim lrreparable Harm Under the Circumstances, and (c) Neither the Balance of Harms Nor the Public Interest Warrant Such Relief. As detailed further below, Enochian obtained an ex page temporary restraining order in this action on the flimsiest allegations of disclosure by Defendants of “confidential information” but with no explanation in their motion of exactly what information Defendants disclosed and why it is (allegedly) confidential. Assuming the Court does not dismiss this action, it should not convert the restraining order to a preliminary injunction. The Vermont Supreme Court has cautioned that “[a] preliminary injunction is an extraordinary remedy never awarded as of right.” Taylor v. 'l‘oWn of‘ Cabot, 2017 V'l‘, 1] 19, 205 Vt. 586 (citing Winter v; Nat. Res..Def. Council Inc. 555 US. 7, 24 (2008)). As the party seeking injunctive relief, Enochian bears the burden ofestablishing the various factors that must be considered in granting such relief: “(1) the threat of irreparable harm to the movant; (2) the potential harm to the other parties; (3) the likelihood ofsuccess on the merits; and (4) the public interest.” 11, a. Irregarable Harm Regarding the irreparable harm factor, Enochian’s argument rests entirely on its contention that Defendants have disclosed (and will continue to disclose) Enochian’s “confidential information.” The alleged confidential information is mentioned only at the I bottom ofpage 3 ofEnochian’s “Motion for Emergency Ex Parte Temporary Restraining Order” (Motion 1) and is not described in any detail whatsoever. Enochian identifies the confidential information only as “allegations concerning payments made by Enochian Bioscience to an FILED VERMONT SUPERIOR COURT Downs 019 Rachlin AUG ~ 5 2 Martin PLLC 12 ORANGE UNIT

- 18. CERTIFICATE 0F SERVICE Pursuant to Rule 5(h) ofthe Vermont Rules of Civil Procedure, undersigned counsel hereby certifies that a copy ofthe above document was served on March 8, 2019, by FedEx, on the following attorneys of record in the above-captioned action: Christopher J. Valente, Esq. K&L GATES LLP State Street Financial Center One Lincoln Street Boston, MA 021 1 l Phone: 617-261-3100 Fax: 617-261-3175 christopher.valente@klgates.com David M. Pocius, Esq. PAUL FRANK + COLLINS P.C. One Church Street P.0. Box 1307 Burlington, VT 05402-1307 Phone: 802-658-231 1 Fax: 802-658-0042 dpocius@pfclaw.com 190642553 FILED VERMONT SUPERIOR COURT AUG — 5 283$? ORANGE UNIT Downs Rachlin Martin PLLC 18 407W» / Walter E. Judge, W

- 19. STATE OF VERMONT SUPERIOR COURT _ CIVIL DIVISION Orange Unit Docket No. 24-2—19 Oecv ENOCHIAN BIOSCIENCES DENMARK, Aps, and . ENOCHIAN BIOSCIENCES, INC, Plaintiffs, V. CROSSFIELD, INC, and- ROBERT WOLFE,_ Defendants. AFFIDAVIT OF ROBERT E. WOLFE I, Robert E. Wolfe, being duly sworn, depose and: say as follows: I. My name is Robert E. Wolfe. I am over theage of 18 and understand the obligations of an oath. 2. I make this affidavit in oppositiOn to Enochian’s Complaint and Motion for Preliminary Injunction, and in support of Defendants’ Motion to Dismiss. 3. I make this affidavit based upon my personal knowledge or upon information and belief, which I believe to be true. 4. I am the founder and CEO Of Crossfield, Inc. Crossfield is _a business consulting company. 5. On June 30, 20.17 my company Crossfield, Inc., and I entered into a “CFO Service Agreement” With Enochian' Biosciences Denmark, ApS (“Enochian”), a Danish FILED VERMONT SUPERIOR COURT AUG w 5 2019 ORANGE UNIT - ))))))))))))

- 20. o on the floor of the Nasdaq stOck exchange, in a public speech durlng e nngmg o 1e “closing bell,” Enochian’s then-CEO Dr. Eric Leire trumpeted association with Enochian.” Wolfe Aff., at ‘fl 5 6. Dr. Leire referred to s the company’s s“scientific founder” and a key member ofthe “ cam, an even brought him up to the podium to “ring that bell together as a team.”19 Q o The facts mamascharged in 2017 with thirteen (1 3) felony criminal violations in a 1 omi'a, mc uding financial fraud; that in 2018 he plead guilty to one ofthe charges (Cal. Penal Code 459 (commercial theft»; and that he was convicted of that offense and sewed time injail e is all also public infonnation. gee Exhibit 12 hereto o Finally, the fact that Enochian paid enormous sums for private security services, i.e., bodyguards, that can only be associated with— is also public information disclosed in Enochian’s SEC filings. S_eg Exhibit l3 hereto (excerpts fiom SEC quarterly reports)?‘ Wolfe Aff., at ‘fl 59. These filings identify specific dollar amounts paid for “security,” which was the subject ofthe relevant allegation in Defendant’s Danish action. SE Complaint, at Ex. D. In sum, Defendants have disclosed Q confidential information whatsoever in their lawsuit against Enochian in Denmark, and Enochian’s Vermont lawsuit against Defendants plays fast and loose with the truth, is profoundly unfair to Defendants, and should be dismissed with fees awarded to Defendants. Further support for the fact that Enochian has not, and will not, suffer irreparable harm is shown by Enochian’s glaring lack of urgency. _Se_e, 1g, Citibank. NA. v. Citytrust, 756 F.2d v: IVIU IbUPERlOR COURT Down s Rachiin 14 AUG ‘ 5 20W Martin PLLC 18 l9 2| iLED ORANGE UNIT

- 21. 12. Enochian counted me as one of its “full-time employees” in SEC filings. Exhibit 1 hereto (cover and relevafit pages of form). 13. In my work for Enochian, I became aware that the company was spendifig what I considered to be significant sums on retaining a company — 14. I further learned that the top managers of Enochian had effectively retained I - as a consultant, or “advisor,” to the company. . 15. I was also made aware, from sources outside Enochian, that - had - been involved in criminal proceedings. 16. —— _II— _I_—I_ _- - 17. My subsequent online research revealed that in 201-7 - was ‘ criminally charged in California with 13 felonies involving financial fraud and that in 2018 he pleaded guilty to one ofthe counts and was convicted on that count and was sentenced to time in jail. As explained further below, this information about — is publicly- available 18. I was unwilling to stop expressing my concerns about the company’s association with a convicted felon. FILED VERMONT SUPERIOR COURT AUG ~ 5 2013 Page} ORANGE UNIT

- 22. 19. On December 13, 2018, the company’s then Chief Executive Officer, Dr. Eric J. Leire, called me and informed me that the Agreement was terminated effective immediately; that the company had hired Luisa Puche as the new CFO; and that I would immediately be paid all sums due and owing to me under the Agreement. 20. Dr. Leire made clear t0 me that the termination was because I was continuing to raise concerns about - — — 21. Subsequently, on December 18, the company’s Board Chairman, Rene Sindlev, called me and confirmed Dr. Leire’s termination ofthe Agreement on December 13. After the telephone call, Mr. Sindlev sent an email to me and others confirming the termination. _Se_e Exhibit 2 hereto. 22. Enochian filed a Form 8-K with the SEC om January 9, 2019 confirming its hiring of Luisa Puche as the company’s new CFO. g Exhibit 3 hereto (cover and relevant ' pages of form). 23. Enochian then sent Defendants, i.e., me, a letter dated January 9, 2019 purporting to inform them that Enochian was terminating the Agreement effective as ofthat date (Jan. 9). The letter stated that, “On the Termination Date, you will be paid all compensation earned through the Termination Date.” Exhibit 4 hereto. To date, l have not been paid all that l am owed. 24. After that, I had various phone calls and requests from Enochian to continue working for the company during the transition to Ms. Puche, and to make sure that certain SEC filings that the company had to file, were timely filed. I agreed to continue working for the company until Ms. Puche was prepared to fully take over, subject to negotiated FILED VERMONT SUPERIOR COURT gg4 . mm-szmg ORANGE UNIT

- 23. Danish action. But as explained above, Defendants’ raising ofconcerns regarding Enochian’s relationship with-isvery relevant, as it forms the basis for Defendants’ position as to why Enochian wrongfully terminated the Agreement. c. Balance at Harms and Public Inferes! Once again, Enochian’s argument on each of these factors revolves substantially around the disclosure ofwhat it contends is confidential information, but in actuality is publicly- available information. Thus, for the reasons discussed above, these factors tip toward the denial of injunctive relief. And on a broader level, courts should be especially reluctant to enjoin speech involving publicly-known matters (as here), and even more so when that speech is a necessary component in court filings in a foreign tribunal, which tribunal is capable of determining whether the information is or is not confidential and should or should not be sealed. In summary, Defendants have not disclosed any confidential information in their Danish lawsuit, and they have no intention of doing so in the future. As such, injunctive relief is not necessary or warranted.22 But Defendants take to heart the final paragraph ofthis Court’s temporary restraining order: that it is up to the Danish court to decide what information is and is not confidential, and what information may or may not be publicly filed in that court. Defendant must and will, as ordered by the Danish court, respond by March 27 to Enochian’s February 26 filing, pursuant to Danish law and represented by a Danish attorney. 22 In granting the temperary restraining order, the Court determined that EIiOchian need not post a bond because “there is; no indication that Defendants will be harmed ifthey are enjoined ii'om further disclosing confidential information under the parties’ agreement at least until thismatter can be further heard.” Ifthe Court' Is inclined to grant furthcr'Injunctivereliefalter review ofthe papers andahearing, Defendants will request that the Court revisit the bondIssue at that time. As explained herein,the information En‘ochian argues is “confidential”‘ Is niatcrial to Defendants‘ claimsIn the Danish court action, and, accordingly, any restriction on Defendants’ ability to make use}: lLED ofsuch informatirin for purposes of'Its Danish action will create a risk of.harm to Defendants. VERMONT SUPERIOR COURT Downs I r‘ - '21:? Rachlin 16 AUIJ 5 . ., . Martin PLLC ‘r‘*"" E gLH—r— l’iv'iier E

- 24. ball Offer — much less‘ than 'I would be entitled to under Danish law — plus demanded that I accept the payout over an extended period of time. I refused. 32. As ofthis date I have not been paid all ofwhat I am owed, although I agreed to, and did, provide services to Enochian even after the termination. 33. On February 5, 2019 my Danish counsel emailed Enochian’s Danish counsel a copy of my anticipated filing in Danish court. The copy contained the material that Enochian now claims is confidential. The transmittal email from my Danish counsel advised Enochian’s counsel that the filing would be made on February 7 and offered once again to resolve the dispute prior to filing. Exhibit 8 hereto. 34. V On February 6, 2019, Enochian’s Danish counsel emailed a letter to my Danish counsel regarding various matters about which the parties had been communicating. Enochian’s counsel confirmed that they had received my counsel’s Feb. .5 email regarding my ' anticipated filing in Danish court. In response thereto, Enochian’s counsel said only that the parties had agreed to arbitration and that Enochian would seek a dismissal ofthe case on that basis. Despite having seen my anticipated filing, Enochian’s Danish counsel did not mention that it would disclose Enochian’s alleged confidential information or cause Enochian irreparable harm. Exhibit 9 hereto. 35. Having failed to reach an agreement with Enochian, on February 7, my Danish attorney made our filing with the Danish court, as We had informed Enochian that we would do on Feb. 5 36. On February 9, 2019 my Danish counsel and I received a letter (dated Feb. 8) _ from Enochian’s U.S. attorneys claiming that the filing I had made in Danish court revealed FILED VERMONT suPERIOR COURT l x m . Page 6 AJb Q LUIS ORANGE UNIT

- 25. a” confidential information and demanding that it be withdrawn. flExhibit D to Plaintiffs’ Complaint. I 37. Despite my being terminated on December 13, 2018 because of my unwillingness not toquestion the company’s relationship with —; despite the formal claim letter. that my Danish attorney sent to Enochian’s attorneys on January 17, 2019; ' and despite all of the back-and—forths and negotiations between the parties that persisted right up until February 5 — when my Danish attorney sent Enochian’s attorneys a copy ofmy anticipated Danish filing — despite all of these events and communications, at no time before February 9 did Enochian or its attorneys ever warn me not to say anything about I _ in any pleadings I might file. In fact, they waited until after I filed my "complaint in Denmark, and then-proceeded to make this secret filing in a Vermont court. 38. On February 11, my Danish counsel responded by email, rejecting Enochian’s counsel’s claim that I had disclosed confidential information, and asserting my rights under Danish law to petition the Danish court to remedy Enochian’s wrongful termination of the Agreement notwithstanding the arbitration clause in the Agreement. §e_e, Exhibit E to Plaintiffs’ Complaint. 39. Enochian’s attorneys did not respond to my Danish attorney. Instead, the very next day (February l2), they filed this secret lawsuit. 40. Given that the lawsuit involves a 45-paragraph, 8-page Complaint with five exhibits; a 10-page motion for temporary restraining order; a 3-page motion to seal; a 2'-page affidavit of Luisa Puche; and redacted versions'of all ofthe above; and given the fact that Enochian’s attorneys also had to secure Vermont counsel, it is quite obvious that they must have been crafting this lawsuit long before February 9, the date on which they responded to FILED VERMONT SUPERIOR COURT Pa e7 r I g AUG r 5 ZUEQ ORANGE UNIT

- 26. CERTIFICATE 0F SERVICE Pursuant to Rule 5(h) ofthe Vermont Rules of Civil Procedure, undersigned counsel hereby certifies that a copy ofthe above document was served on March 8, 2019, by FedEx, on the following attorneys of record in the above-captioned action: Christopher J. Valente, Esq. K&L GATES LLP State Street Financial Center One Lincoln Street Boston, MA 021 1 l Phone: 617-261-3100 Fax: 617-261-3175 christopher.valente@klgates.com David M. Pocius, Esq. PAUL FRANK + COLLINS P.C. One Church Street P.0. Box 1307 Burlington, VT 05402-1307 Phone: 802-658-231 1 Fax: 802-658-0042 dpocius@pfclaw.com 190642553 FILED VERMONT SUPERIOR COURT AUG — 5 283$? ORANGE UNIT Downs Rachlin Martin PLLC 18 407W» / Walter E. Judge, W

- 27. 46. Despite Enochian’s emergency claims in this Court of “confidential” information allegedly being disclosed in my Danish filing, Enochian did not respond in the Danish court until February 26, almost three weeks after I made my filing. 47. In Enochian’s February 26 response, Enochian requested that the Danish court transfer the case to arbitration, and asked the court to limit access tomy filing, without explaining why the information is confidential. There 'was no expression ofurgency in Enochian’s filing. 48. Enochian’s February 26 filing did not disclose to the Danish court that it had filed an action in the United States against rne two Weeks earlier. 49. TheDanish court has not acted on Enochian’s request, but ordered me to respond to Enochian’s filing by March 28. 50. It is my understanding that under Danish law the Agreementis considered an employment agreement, affording me certain rights to compensation under Danish law and I imposing certain obligations of compensation on Enochian. SQ Exhibit 7 hereto (January l7, 2019 letter from my Danish-counsel to Enochian’s Danish counsel asserting and explaining my claim under Danish law) and Exhibit C to Plaintiffs’ Complaint (copy ofmy Complaint filed in the Danish court on February‘7, 2019). 51. It is my further understanding that under Danish law, as an employee I am able to file my dispute with the Danish court system and am not required to submit to arbitration unless ordered to by the court. Exhibit E to Plaintiffs’ Complaint 52. Dr. Leire, who was the Enochian official who informed me ofthe termination on December 13, 2018 has himself since been terminated by Enochian. FILED VERMONT SUPERIOR COURT AUG - 5 2019 Page9 ORANGE UNIT

- 28. v Q 53. The information contained in my Danish filing is not confidential and is relevant to the reason for my claim of wrongful termination ofthe Agreement. The filing explains that Enochian terminated the Agreement because I, in my capacity as Chief Financial Officer of the company, raised concerns about Enochian’s relationship with, and large payments to, a felon convicted of a financial crime. The allegations that this information is “company confidential” are utterly false. All of the information is publicly-available. 54. Enochian itself disclosed the fact that it had retained — - — m_ - - m Exhibit 10 hereto. ' 55. The fact that _ owns and controls the consulting firm - is public information. Exhibit 1 l hereto _ — I _ I —I_- 56. .——l— _—II- _-| —I_-—I- 57. _Il—I— _— 58. The facts that _ was charged in 2017 with thirteen felony criminal violations in California, including financial fraud; that in 2018 he pled guilty to one of the charges (Cal. Penal Code 459 (commercial theft»; and that he was convicted of that offense ' FILED VERMONT SUPERIOR COURT AUG — 5 30:9 Page 10 ORANGE UNlT

- 29. c-ompany (the “Agreement”). A copy of the Agreement is attached as Exhibit A to Enochian’s Complaint.‘ 6. Enochian contacted me to be their CFO and oftheir parent company, Enochiatl Biosciences Inc., as I had previously been their CFO from Jan 2014 to April 2015. 7. . Enochian’s parent company, Enochian Biosciences Inc., is a publicly-traded biopharmaceutical research company. It is registered on the Nasdaq exchange and subject to regulation by the U.S. Securities and Exchange Commission (“SEC”). 8. The Agreement was drafted by Enochian; 9. My responsibilities under the Agreement were to act as the Chief Financial Officer of Enochian. As set forth in the Agreement, my responsibilities included the following: “safeguard the financial assets ofthe Company,” “coordinat[e] . . . with [the Company’s] independent auditors,” “monitor banking activities ofthe [Company],” “deliver financial information [to management and the board],” “prepar[e] and file all SEC filings,” and “oversee the management and coordination of all fiscal reporting activities for the [Company].” As such, I believe I had obligations to the shareholders of Enochian to understand the company’s finances, and obligations to the SEC to make sure that the company’s reporting was open, honest, and accurate. 10. The Agreement also required both parties to resolve any disputes between them in Denmark under Danish law. 1 l. The Agreement was amended on December 29, 2017 to alter my compensation, but otherwise was not changed. l At the time of the signing ofthe Agreement EnOchian was known as DanDrit Biotech A/S DanDrit becamemLEg ' ' ‘ ’ ' - s '. NOR COURT Enochian in Apn12018. VCR ON l LJDFI AUG ~ 5 2019 Page2 ORANGE UNIT

- 30. EXHIBIT 1 FILED VERMONT SUPERIOR COURT AL! CT.) » 5 2039 ORANGE UNIT

- 31. D v Page 1 of8l lO-K l ell46_form10k.htm FORM lO-K . UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended June 30,2018 El TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from. Commission file number 000-54478 ENOCHIAN BIOSCIENCES, INC. (Name of registrant in its charter) Delaware . . 45-2559340 (State'or other jurisdiction of (IRS. Employer incorporation or organization) Identification No.) 2080 Century Park East Suite 906 Los Angeles, CA _ 90067~20l2 (Address ofprincipal executive offices) (Zip Code) +l(5|0)203-4857 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Class I I ' . Name of Exchange Not applicable ’ Not applicable Securities registered pursuant to Section 12(g) ofthe Act: Common Stock, $0.000! par value Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Cl Yes IX No Indicate by check mark ifthe registrant is not required to file reports pursuant to Section l3 or Section 15(d) of the Act. El _ Yes No _ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d)»of the Exchange Act during the last12 months (or for such shorter period that -the registrant was required to file such reports); . and (2) has been subject to such filing requirements for the past 90 days. Yes El No Cl ' Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required-to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes IX] No El ' -. . . .' . r5 I 15.. Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K IS ggmoatai‘ngébgéfig 3 ' and will not be contained, to the bestof registrant‘s knowledge, in definitive proxy or information statements incorporate ‘ COURT by reference in Part III of this Form lO-K'or any amendment to this Form 10-K. Cl C _V , AU“ » 5 rs ib‘ https://www.sec.gov/Archives/edgar/data/1527728/0001731 12218000094/e1 '146V_formiallal-1AN @5201‘9‘! lT _

- 32. 19. On December 13, 2018, the company’s then Chief Executive Officer, Dr. Eric J. Leire, called me and informed me that the Agreement was terminated effective immediately; that the company had hired Luisa Puche as the new CFO; and that I would immediately be paid all sums due and owing to me under the Agreement. 20. Dr. Leire made clear t0 me that the termination was because I was continuing to raise concerns about - — — 21. Subsequently, on December 18, the company’s Board Chairman, Rene Sindlev, called me and confirmed Dr. Leire’s termination ofthe Agreement on December 13. After the telephone call, Mr. Sindlev sent an email to me and others confirming the termination. _Se_e Exhibit 2 hereto. 22. Enochian filed a Form 8-K with the SEC om January 9, 2019 confirming its hiring of Luisa Puche as the company’s new CFO. g Exhibit 3 hereto (cover and relevant ' pages of form). 23. Enochian then sent Defendants, i.e., me, a letter dated January 9, 2019 purporting to inform them that Enochian was terminating the Agreement effective as ofthat date (Jan. 9). The letter stated that, “On the Termination Date, you will be paid all compensation earned through the Termination Date.” Exhibit 4 hereto. To date, l have not been paid all that l am owed. 24. After that, I had various phone calls and requests from Enochian to continue working for the company during the transition to Ms. Puche, and to make sure that certain SEC filings that the company had to file, were timely filed. I agreed to continue working for the company until Ms. Puche was prepared to fully take over, subject to negotiated FILED VERMONT SUPERIOR COURT gg4 . mm-szmg ORANGE UNIT

- 33. Page 71 of81 ENOCHIAN BIOSCIENCES INC. (FORMERLY DANDRIT BIOTECH USA INC.) AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS NOTE ll — COMMITMENTS AND CONTINGENCIES Consulting Agreements — On February 16, 2018, the Registrant entered into a consulting agreement with Weird Science under which Weird Science was to provide ongoing medical sen/ices related to the development of the Company’s products for the treatment of HIV and cancer. ln consideration for such consulting services, the Company was to pay up to $30,000 per monthfor the consulting services. On July 9, 2018, the consulting agreement was terminated (See Note l3). On February 16, 2018, the Registrant entered into a consulting agreement with Carl Sandler, a board member and shareholder of the Registrant (through his holdings in Weird Science) for sewices related to clinical development and new business opportunities. In consideration for services actually rendered, the Registrant paid $10,000 per month for 6 months. For the year ended June 30, 2018, Carl Sandler was paid $45,000 for Consulting services. The agreement with Mr. Sandler terminated pursuant to its terms on August l6, 2018. This amount is included in “Consulting Expenses” in our Condensed Consolidated Statement of Operations. Pre-Clinical Trial Loan — On July l4, 2017, the Registrant agreed to loan to Enochian Biopharma up to $500,000 in eXchange for the Enochian Biopharma Note to fund pre-clinical study programs, including a study with syngeneic and humanized mice models. The Enochian Biopharma Note was assumed and forgiven upon the completion of the Acquisition on February l6, 201,8, and the Company is continuing Enochian Biopharma’s pre-clinical study programs as research and development expenses of the Company (see Note l, Research and Development Expenses). Shares held for non-consenting shareholders - In connection with the Share Exchange certain shareholders of DanDrit Denmark had not been identified or did not consent to the exchange of shares. 1n accordance with Section 70 of the Danish Companies Act and the Articles of Association of DanDrit Denmark, the Non-Consenting Shareholders that did not exchange the DanDrit Denmark equity interests owned by such Non-Consenting Shareholders for shares of the Company, will be entitled to receive up to 185,053 shares of Common Stock of the Company that each such Non- Consenting Shareholder would have been entitled to receive if such shareholder had consented to the Share Exchange. During the year ended June 30, 2018, the Registrant issued 55,457 shares of Common Stock to such non-consenting shareholders of DanDrit Denmark. The 129,596 remaining shares have been reflected as issued and outstanding in the accompanying financial statements. Food and Drug Administration (FDA) - The FDA has extensive regulatory authority over biopharmaceutical products (drugs and biological products), manufacturing protocols and procedures and the facilities in which they will be manufactured. Any new bio product intended for use in humans is subject to rigorous testing requirements imposed by the FDA with respect to product efficacy and safety, possible toxicity and side effects. FDA approval for the use of new bio products (which can never be assured) requires several rounds of extensive preclinical testing and clinical investigations conducted by the sponsoring pharmaceutical company prior to sale and use of the product. At each stage, the approvals granted by the FDA include the manufacturing process utilized to produce the product. Accordingly, the Company’s cell systems used for the production of therapeutic or bio therapeutic products are subject to significant regulation by the FDA under the Federal Food, Drug and Cosmetic Act, as amended. Product Iiability- The contract production services for therapeutic products offered exposes an inherent risk of liability as bio therapeutic substances manufactured, at the request and to the specifications of customers, could foreseeably cause adverse effects The Company seeks to obtain agreements from contract production customers indemnifying andgdefending the Company from any potential liability arising from such risk. There ean be no assurance, however, that the Company will be successful in obtaining such agreements in the future or that such indemnification agreements will adequately protect the Company against potential claims relating to such contract production services. The Company may also be exposed to potential product liability claims by users of its products. A successful partial or completely uninsured claim against the Company could have a material adverse effect on the Company‘s operations. Employment Agreements- The Com any has an employment agreement with Eric Leire, the Chic Bxecgtiye Officer with a base compensation of $3 l3,775.(The Com m‘p‘an ' h'a'sTan e plb‘y’m"e‘ntIagreem'e‘fiJWIth‘Robert Wolfe, the Chief I r h AUG 52039 WERIOR COURT W455 https://www.sec.gov/Archives/edgar/data/1527728/0001731 12218000094/e1 146_fom10kyQR/M812})t£9 UNIT

- 34. EXHIBIT 2 FILED VERMONT SUPERIOR COURT AUG '~ 5 2019 ORANGE UNIT

- 35. ball Offer — much less‘ than 'I would be entitled to under Danish law — plus demanded that I accept the payout over an extended period of time. I refused. 32. As ofthis date I have not been paid all ofwhat I am owed, although I agreed to, and did, provide services to Enochian even after the termination. 33. On February 5, 2019 my Danish counsel emailed Enochian’s Danish counsel a copy of my anticipated filing in Danish court. The copy contained the material that Enochian now claims is confidential. The transmittal email from my Danish counsel advised Enochian’s counsel that the filing would be made on February 7 and offered once again to resolve the dispute prior to filing. Exhibit 8 hereto. 34. V On February 6, 2019, Enochian’s Danish counsel emailed a letter to my Danish counsel regarding various matters about which the parties had been communicating. Enochian’s counsel confirmed that they had received my counsel’s Feb. .5 email regarding my ' anticipated filing in Danish court. In response thereto, Enochian’s counsel said only that the parties had agreed to arbitration and that Enochian would seek a dismissal ofthe case on that basis. Despite having seen my anticipated filing, Enochian’s Danish counsel did not mention that it would disclose Enochian’s alleged confidential information or cause Enochian irreparable harm. Exhibit 9 hereto. 35. Having failed to reach an agreement with Enochian, on February 7, my Danish attorney made our filing with the Danish court, as We had informed Enochian that we would do on Feb. 5 36. On February 9, 2019 my Danish counsel and I received a letter (dated Feb. 8) _ from Enochian’s U.S. attorneys claiming that the filing I had made in Danish court revealed FILED VERMONT suPERIOR COURT l x m . Page 6 AJb Q LUIS ORANGE UNIT

- 36. i SubjectzTransitioning from Robert Wolfe to Luisa Puche Date:Tuesday, December 18, 2018 7:34 am Linked to:Rene Sindlev FromzRenA© Sindlev<rsindlev@enochianbio.com> TozEvelyn DAn <evedan@dfsresources.com> Cc:Clayton Parker <Clayton.Parkereklgates.com>; Eric Leire <el@enochianbio.com>; Robert Wolfe <bob.wolfe@crossfield.net>; Henrik GrA‘nfeldt <hgs@rsgroup.dk> MIME Version:l.0 MIME Type:multipart/alternative; boundary="_000_8597376CAA4F491BAE3B2083089EEA29enochianbiocom_" l4LED Dear Robert, Eric and Evelyn, VERMONTSUPEWORCOURT AUG‘ 5 20% ORANGE UNIT I just had a phonecall with Robert today.

- 37. Robert confirms that once he receives his termination as a consultant in writing, that will be the effective end date of his services. Robert will continue business and services as usual in the termination period, until a final transition and hand over job has taken place. Dear Evelyn and Eric, Can I kindly ask you to take control of this process? Once we have both contracts signed by Robert and Luisa it needs to be filed as an 8K. Thank you Rene Sindlevfls Chairman & Co—founder Enochian BioSciences Inc Century City Medical Plaza 2080 Century Park East, suite # 906 90067 Los Angeles, CA USA a Cell: +1 (305) 833—9391 Mail: RsindlevGEnochianBio.com Web: www.enochianbio.com FILED VERMONT SUPERIOR COURT AUk ZU 4 t LC) L1.) ORANGE UNIT

- 38. U _ my Feb. 7 Danish filing with their accusation about the disclosure of confidential information. Given that they were advised on February 5 of what my Danish filing would say, it is telling that Enochian’s attorneys spent their time after that (and quite possibly before that) working on a secret Vermont lawsuit rather than crafting a prompt response to the Danish lawsuit. In fact, they did not bother to respond to the Danish lawsuit until February 26 (19 days after it was filed), and then without any sense of urgency. 41. On February 12, unbeknownst to me, Enochian filed this action and sought an “ex parte” temporary restraining order against me to prevent me from disclosing Enochian’s supposedly confidential information. 42. I live and work out ofmy home in Randolph, Vermont, not far from the courthouse, and l believe I should have been notified ofthe motion for temporary restraining order so that I could have explained to the Court that there is nothing at all “confidential” about the information contained in my Danish filing, and that the information is relevant to' why Enochian abruptly and wrongfully terminated the Agreement. 43. I knew nothing about this lawsuit until the temporary restraining order was served on me at my home by the sheriff on February 15. 44. I Although l travel regularly on business, I was at my home at all times between February 12—15, and could and would easily have attended a hearing at the courthouse if I had known about this lawsuit. 45. On February 13, the day after Enochian obtained its ex pane order in this Court (but before I Was served with it) the Danish court directed Enochian to respond to my filing there. FILED VERMONT SUPERIOR COURT Page 8 AUG ~ 5 2mg ORANGE UNIT

- 39. EXHIBIT 3 FILED VERMONT SUPERIOR COURT AUG - 5 2an ORANGE UNIT

- 40. UNITED STATES SECURITIES AND EXCHANGE COMNIISSION Washington, DC 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date ofReport (Date ofearliest event reported): January 7, 2018 ENOCHIAN BIOSCIENCES INC. (Exact name ofregistrant as specified in its charter) Delaware . 000'54478 45-2559340 (State or other jurisdiction (Commission File Nlimber) (I.R.S. Employer of incorporation) Identification No.) Fl LED VERMONT SUPERIOR COURT 2080 Century City East AUG * 5 ZU'R?) ORANGE UNIT

- 41. v Q 53. The information contained in my Danish filing is not confidential and is relevant to the reason for my claim of wrongful termination ofthe Agreement. The filing explains that Enochian terminated the Agreement because I, in my capacity as Chief Financial Officer of the company, raised concerns about Enochian’s relationship with, and large payments to, a felon convicted of a financial crime. The allegations that this information is “company confidential” are utterly false. All of the information is publicly-available. 54. Enochian itself disclosed the fact that it had retained — - — m_ - - m Exhibit 10 hereto. ' 55. The fact that _ owns and controls the consulting firm - is public information. Exhibit 1 l hereto _ — I _ I —I_- 56. .——l— _—II- _-| —I_-—I- 57. _Il—I— _— 58. The facts that _ was charged in 2017 with thirteen felony criminal violations in California, including financial fraud; that in 2018 he pled guilty to one of the charges (Cal. Penal Code 459 (commercial theft»; and that he was convicted of that offense ' FILED VERMONT SUPERIOR COURT AUG — 5 30:9 Page 10 ORANGE UNlT

- 42. "EXHIBIT 4 FILE?) VERMONT SLJPFRIOR COURT AUG -5 Z’Uak ORANGE UNIT

- 44. EXHIBIT 1 FILED VERMONT SUPERIOR COURT AL! CT.) » 5 2039 ORANGE UNIT

- 46. _ FILED VERMONT SUPERIOR COURT AUG ~ 5 ZOIQ ORANGE UNIT

- 47. Page 23 of 81 Em ployees -'-t‘ime ,wjemplogesegjWe are in the process of building a research and development NE ‘JIITJ 30 a0) Hzi‘da Et'fi’i functionally and are led by an experienced research and development management team We use rigorous project management techniques. to assist us in making disciplined strategic research and development program deci-sions and to help limit the riskprofile of our product pipeline We also access relevant market infomiation and key opinion leadersIn creating target product profles when appropriate, as we advance our programs towards commercialization We engage third parties to conduct portions ofour preclinical research. 1n addition, we plan to utilize multiple clinical sites to condtrct our clinical trials ma 'CXtc’l expertise n gene therapy and relate Itific disciplmes. We operate ross- Facilitics and Offices . Our corporate headquarters are located at Century City Medical Plarm, 2080 Century Park East, Suite 906, Los Angeles CA, 90067. We have a ten-year lease for approximately 2,453 square feet at this location. The base rent for this leased premises increases by 3% each year over the term, and ranges from $12,265 per month for the first year to $16,003 per month for the tenth year. The Company is entitled to $108,168 in contributions toward tenant improvements. - We also have a 5-year lease for 2,325 rentable square feet of office space at '5901 W. Olympic Blvdf Suite 419, Los Angeles, CA 90036. The base rent increases by 3% each year over the life of the lease, and ranges from approximately $8,719 per month for the first year'to $10,107 per month for the two months of the sixth car. We are entitled to $70,800In tenant improvement allowanceIn the form of free rent applied over 10 monthsIn equal’installments from January 2018. Corporate Information We were incorporated in January 18, 201 1 in the state of Delaware and on March 2, 2018 we changed our name from “DanDrit Biotech USA, Inc.” to Enochian BioSciences, lnc. ” Our website is http://www.enochianbio.com We make available free of charge on or through our internet site, our annual, quarterly, and current reports and any amendments to those reportsr f'led or furnished pursuant to Section 13(a) of the Exchange Act as soon as reasOnably practicable after we electronically file such material with, or furnish it to the SEC. 1nf0rmation contained in our website is not part of, nor incurporated by reference into, this report. - we originally incorporated in Delaware on under the'name “Putnam Hills Corp.” We filed a Registration Statement on Form 10 with the US. Securities and Exchange Commission, or the SEC, on August 12,, 201 1. On February 12, 2014, pursuant to a Share Exchange Agreement, the Registrant acquired 100% of the issued and outstanding capital stock of DanDrit. Denmark and as a result became DanDrit Denmark’s parent company (the “Share Exchange”). Prior to the Share Exchange, the Registrant and an existing shareholder agreed to cancel 4,400,000 out of 5,000,000 shares of Gammon Stock of DanDrit Denmark outstanding, and the Company issued 1,440,000 shares of Common Stock for legal and consulting services related to the Share Exchange and a future public offering. At the time of the Share Exchange each outstandingshare of common stock of DanDrit Denmark was exchanged for 1.498842 shares of Common Stock, for a total of 6,000,000 shares of Common Stock, resulting in 8,040,000 shares of Common Stock outstanding immediately following the Share Exchange, including the Escrow Shares, which are ‘deemed issued and outstanding for accounting purposes (See also'Note l to the Consolidated Financial Statements). In June 2015, the‘Board approved a change to the Registrant’s fiscal year end from Dec-ember 31 to June 30. On February 16, 2018, we completed. our acquisition of Enochian Biopharma pursuant to the Acquisition Agreement, with Enochian Biopharma surviving as a wholly owned subsidiary of the Registrant. As consideration for the Acquisition, the stockholders of Enochian Biopharma received (i) 18,081,962 shares of Common Stock and (ii) the right to receive Contingent Shares pro rata upon the exercise or conversion of warrants which were outstanding at closing (See also Note 2 to the Consolidated Financial Statements). . FILED 17 . . , ' VERMONT SUPERIOR COURT AUG-"- 5 2039 ORANGE UNIT https://www.see.g0v/Archives/edgar/data/1527728/0001731 12218000094/e1 I.46_form10k.h... 3/8/2019

- 48. 'FEMOHT 53L! V

- 49. i ----- -~ a' '- r“ l "' ' l : f' I l - _ _ I I ___ — I : l n I I 1' . h 'x a“ .3 I f" .“ / H C _ ' " ..—~. I I , - ---. . , .’~‘ ———-- - ~ --— / .— x — - " ' I _ ___ . // {I ‘ . .‘I I" I L/ .' ‘ / ." R .. I , I, f I .. - . . -. i - “ / .' ' / ' l ‘ i [ -—-- . .- x . != '--- --5 ' ‘ | ‘ _ ___ _ ___ - ,1 _. I . _ __ __ ___ _. ' ' I . ‘ |‘ I: . ‘ j - K :— [ 2| '. j , . x x“ . ._ , .‘ . ,r-v ' . . ’ ‘ — ,J < k X 1 '~ / ' ‘- . ' ‘- " . . l. _ . a - _,./_-. __ ;:..»’ xii/1.

- 50. EXHIBIT 2 FILED VERMONT SUPERIOR COURT AUG '~ 5 2019 ORANGE UNIT

- 52. FILED VERMONT SUPERIOR COURT ME ~ 5 2013‘ ORANGE UNIT 3

- 53. i SubjectzTransitioning from Robert Wolfe to Luisa Puche Date:Tuesday, December 18, 2018 7:34 am Linked to:Rene Sindlev FromzRenA© Sindlev<rsindlev@enochianbio.com> TozEvelyn DAn <evedan@dfsresources.com> Cc:Clayton Parker <Clayton.Parkereklgates.com>; Eric Leire <el@enochianbio.com>; Robert Wolfe <bob.wolfe@crossfield.net>; Henrik GrA‘nfeldt <hgs@rsgroup.dk> MIME Version:l.0 MIME Type:multipart/alternative; boundary="_000_8597376CAA4F491BAE3B2083089EEA29enochianbiocom_" l4LED Dear Robert, Eric and Evelyn, VERMONTSUPEWORCOURT AUG‘ 5 20% ORANGE UNIT I just had a phonecall with Robert today.

- 55. FILED VERMONT SUPERIOR COURT AUG *5 2019 ORANGE UNIT

- 56. OTCQB: ENOB This email is written on my cell phone while traveling or working away from my computer, so key errors or spelling mistakes can occur. In any case and/or for that reason I cannot and will not be held liable and/or responsible for matters occurring hereof. . FILED VERMONT SUPEREOR COURT AUG - 5 2033 ORANGE UNIT

- 59. UNITED STATES SECURITIES AND EXCHANGE COMNIISSION Washington, DC 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date ofReport (Date ofearliest event reported): January 7, 2018 ENOCHIAN BIOSCIENCES INC. (Exact name ofregistrant as specified in its charter) Delaware . 000'54478 45-2559340 (State or other jurisdiction (Commission File Nlimber) (I.R.S. Employer of incorporation) Identification No.) Fl LED VERMONT SUPERIOR COURT 2080 Century City East AUG * 5 ZU'R?) ORANGE UNIT

- 60. 0:3“ m :(C .Cf(.( DU D ZDH. _ :13.

- 62. "EXHIBIT 4 FILE?) VERMONT SLJPFRIOR COURT AUG -5 Z’Uak ORANGE UNIT

- 65. OURT Vl:|'|V|K./'l I Q)I |.l 3 EU U”D AU" flDAMCE | “MIT

- 68. _ FILED VERMONT SUPERIOR COURT AUG ~ 5 ZOIQ ORANGE UNIT

- 70. ORANGE UNIT

- 71. 'FEMOHT 53L! V

- 73. EXHIBIT 9 FILES VERMONT SUPERIOR COURT AUG ~ 5 20‘59 ORANGE UNIT

- 74. w w A ‘ ‘ w

- 77. EXHIBIT 10 FILED . . VERMONT SUE-‘EFUGR COURT AUG ~ 5 2819 ORANGE UNIT

- 80. FILED VERMONT SUPERIOR COURT AUG *5 2019 ORANGE UNIT

- 81. _ U U ENOCHIAN BIOSCIENCES, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS September 30, June _30, 2018 2018 (Unaudited) ASSETS CURRENT ASSETS: Cash 13,405,185 ' $ 15,600,865 Other Receivables — 122,866 Prepaid Expenses 142,390 38,284 Total Current Assets 13,547,575 $ 15,762,015 PROPERTY AND EQUIPMENT, Net Accumulated Depreciaticn 334,077 27,402 OTHER ASSETS _ Definite Life Intangible Assets, Net Accumulated Amortization 150,137,800 S 152,095,459 Deposits 137,550 137,550 Goodwill _ 11,640,000 11,640,000 TOtal Other Assets 161,915,350 163,873,009 TOTAL ASSETS , 175,797,002 s _ 179,662,426 LIABILITIES AND STOCKHOLDER’S EQUITY ’ CURRENT LIABILITIES: Accounts Payable- Trade 478,126 $ 571,809 Accounts Payable— Related Party 235,000 235,000 Accrued Expenses 71,757 66,913 Total Current Liabilities 784,883 873,722 Contingent Consideration Liability 21,423,000 $ 22,891,000 Total Liabilities 22,207,883 $ 23,764,722 STOCKHOLDERS EQUITY. Preferred stock, $00001 par value, 10,000,000 shares authorized, no shares issued and outstanding — — Common stock, par value 30.0001, 100,000,000 shares authorized, 36,173,924 shares issued and outstanding at September 30, 2018; 36,163,924 issued and outstanding at June 30, 2018 3,617 $ 3,616 Additional Paid-In Capital 193,369,962 193,283,798 Accumulated Deficit (39,898,622) (37,595,389) Other Comprehensive Income, Net 114,162 205,679 .Total Stockholder’s Equity 153,589,119 155,897,704 TOTAL LIABILITIES AND STOCKHOLDER’S EQUITY 175,797,002 179,662,426 - See accompanying notes to the unaudited condensed consolidated financial statements. 2 FILED VERMONT SUPEI‘K‘IDR COURT lleU I“ 5 ZU l9 ORANGE UNIT

- 82. LJ V ENOCHIAN BIOSCIENCES, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS 0F OPERATIONS (UNAUDITED) For the Three Months Ended September 30, 2018 2017 ReVenues $ — S — Cost of Goods Sold — _ Gross profit (Loss) _ _ Operating Expenses General and Administrative Expenses 1,165,708 288,123 ' Non-Cash and Stock-Based Compensation Expense 86,166 112,837 Research and Development Expenses 493,555 153,652 Depreciation and Amortization 1,958,562 3,946 Consulting Expenses 62,035 67,210 Total Operating Expense $ 3,766,026 $ 625,768 LOSS FROM OPERATIONS (3,766,026) (625,768) Other Income (Expense) Change in Fair value of contingent consideration $ 1,468,000 $ — Interest (Expense) (44) (177) Interest (Expense) — Related Party — (592) (Loss) Income on Currency Transactions (31,978) 387,409 Interest and Other Income, net 26,815 . 8,715 Total Other Income $ 1,462,793 S 395,355 Loss Before Income Taxes (2,303,233) _ (230,413) Income Tax (Benefit) — (4,638) NET Loss $ _ (2,303,233) s (225,775) BASIC AND DILUTED Loss PER SHARE $ (0.06) $ (0.02) WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING - BASIC AND DILUTED 36,170,882 12,685,832 See accompanying notes to the unaudited condensed consolidated financial statements. I‘f‘ILED VERrweNT SUPERIOR COURT AU“ ~ 5 ORANGE UNIT