Debunking 5 to-stay-alive

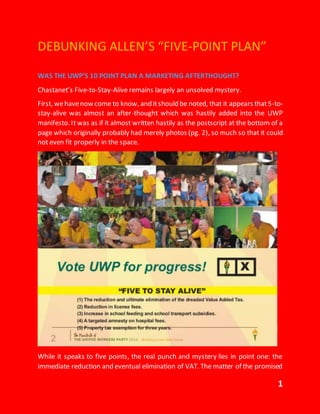

- 1. 1 DEBUNKING ALLEN’S “FIVE-POINT PLAN” WAS THE UWP’S 10 POINT PLAN A MARKETING AFTERTHOUGHT? Chastanet’s Five-to-Stay-Alive remains largely an unsolved mystery. First, wehavenow come to know, and itshould be noted, that it appears that5-to- stay-alive was almost an after-thought which was hastily added into the UWP manifesto. It was as if it almost written hastily as the postscript at the bottom of a page which originally probably had merely photos (pg. 2), so much so that it could not even fit properly in the space. While it speaks to five points, the real punch and mystery lies in point one: the immediate reduction and eventual elimination of VAT. The matter of the promised

- 2. 2 amnesty of hospital bills, for instance, an initiative taken on by my Governmentin 2012, is found nowhere within the body of the 4-page section on Health. Five-to-Stay-Aliveis first and foremost an election gimmick that hopes to deceive the Saint Lucian population. Five-to-Thriveis of that same vein. In fact, ALL 5 points in the 5-to-Thrivedo not even exist in the UWP Manifesto, therefore suggesting it was an afterthought aimed at seduction of the young people towards the UWP. PROMISED REDUCTION & ELIMINATION OF VAT Out of the 72 page manifesto, the mention of the reduction and elimination removal of VAT receives 1 line: “Reduce the Value-Added-Tax (VAT) and outline a plan for its ultimate elimination; and replace it with a restructured tax regime that will be less burdensome but without compromising the revenue base.” Now, what does this really mean? The UWP would like you to believe that removing VAT is the solution to all of Saint Lucia’s problems and in particular the cost of living. Yet still, Allen Chastanet has admitted that: “VAT is the most effective tax worldwide. Period.” That is truly a gimmick and nothing more. VAT raised about $346 million, out of Government’s 985 million in tax revenue last financial year (2015/16). In fact, VAT represents 35% of all of Government’s tax revenue. If we might speak hypothetically for a moment, if your boss took off 35% of your salary tomorrow, would you be able to survive? Five-to-Stay-Alive contains three tax measures that will cost the Government in excess of $365 million is lost revenue. But clearly, the UWP manifesto says thatthere will be NO compromiseof the revenue base. The way that Allen Chastanet expressed it on his election platform and at public meetings, however, he drops off the important point: “without compromising the tax revenue” disclaimer. If implemented without any replacement tax, what it will do is send SAINTLUCIA BANKRUPT in less than 5 years.

- 3. 3 Our debt-to-GDP ratio which currently stands at 75% would jump to at least 125% of GDP in under 5 years. That’s way beyond whatis manageable. We will not be able to serviceour debts as we would have to borrow moreto keep afloat; that is assuming you would still be able to borrow. The Government would eventually start defaulting on debt payments and would have a hard time paying anything else (salaries, purchase of goods and services, etc). The Government would eventually have to retrench workers. The ECCB, of which the Saint Lucia is the largestmember, will be forced to devalue the EC Dollar, probably by at least 10-15%. You would then need EC$3.10 to get US$1.00. The $150 more in your pocket that the UWP claims you would get for every $1000.00wouldbecomemeaningless by 2020becauseof increased taxation which will be imposed by the IMF and the fact that your dollar is worth less than before. This is the sad reality of what WILL HAPPEN IF you remove VAT. VAT is not bringing in that much more new revenue as the UWP may want you to believe. VATis a replacement tax which taxes consumption. Remember that in the pastthere weretaxes on goodsand services:consumptiontax, environmentallevy, telephone tax, hotel accommodation tax, cellular phone tax. In fact, sometimes consumption tax was well over 30% on some goods. Those taxes before raised about $200 million in pre-VAT 2011. A summary of this is shown on the next page:

- 4. 4 Table 1 Revenue Collections for VAT & Taxes which it replaced Revenue 2005/6 2006/7 2007/8 2008/9 2009/10 2010/11 2011/12 2012/13 2013/14 2014/15 2015/16 Cellular Tax 7.63 9.05 11.95 12.81 12.56 17.74 18.63 10.47 0.01 0.00 0.00 Consumption Tax (Domestic) 8.32 8.05 9.85 6.38 6.35 5.67 6.11 4.22 0.11 0.01 0.02 Consumption Tax (Imports) 104.67 111.54 112.24 136.28 140.17 113.70 111.93 48.30 0.64 0.10 0.27 Hotel Accommodation Tax 28.69 29.53 33.45 35.02 25.50 34.25 39.62 22.40 1.94 2.58 0.67 Environmental Levy 17.45 21.56 18.03 15.97 14.35 16.18 16.19 8.17 0.17 0.01 0.00 Pre-VAT Taxes TOTAL 166.76 179.73 185.52 206.46 198.93 187.54 192.48 93.56 2.87 2.70 0.96 VAT (Goods & Services) 63.12 157.40 183.25 183.87 VAT (Int'l Trade & Transactions) 75.30 141.49 151.14 162.50 Total VAT 138.42 298.89 334.39 346.37 Today, since the implementation of VAT, the difference between these taxes (at the 2011/12 level) and VAT (2015/16) is about $153 million in revenue. Nearly all of that has gone into paying for the 14.5% salary increase that King gave in 2007 and the increased debts and interest payments left by the last Government. RUNAWAY EXPENDITURE UNDER THE UWP You see, the hard reality was that the UWP Government of which Allen Chastanet sat in as minister for Tourism, was spending more than the country could reasonably afford.

- 5. 5 Table 2 Comparison of Government Spending Between 2 Regimes UWP Administration (07-11) SLP Administration (12-15) ITEM 2006/7 2011/12 2015/16 Diff % Change Avg Annual % Change Diff % Change Avg Annual % Change Total Current Revenue 655.98 835.96 984.79 179.98 27% 5.5% 148.83 18% 4.5% Of which: Tax Revenue (Income) 620.31 764.59 933.73 144.28 23% 4.7% 169.14 22% 5.5% Non-Tax Income (Fines, Fees, Etc) Total Current Expenditure 554.91 776.63 910.95 221.72 40% 8.0% 134.32 17% 4.3% Of which: Wages & Salaries 255.65 349.52 381.68 93.87 37% 7.3% 32.16 9% 2.3% Interest Payments 78.72 105.82 162.29 27.1 34% 6.9% 56.47 53% 13.3% Goods & Services 102.7 145.99 169.7 43.29 42% 8.4% 23.71 16% 4.1% Current Transfers 117.84 175.3 197.29 57.46 49% 9.8% 21.99 13% 3.1% Current Revenue less Current Expenditure 101.07 59.33 73.84 -41.74 -41% -8.3% 14.51 24% 6.1% Total Expenditure (Spending) 845.9 1142.77 1177.02 296.87 35% 7.0% 34.25 3% 0.7% To summarise, under the 5 years of the UWP Administration, the following happened: overall spending went up by 35%, or on average by 7% per year. Critically, current expenditure went up even faster by 40%, or by 8% per year on average. The main pressures were seen across all spending areas: 1. Wages & salaries up by 37%, a whopping $93.87 million; 2. Current Transfers up by 49%, or by $57.46 million;

- 6. 6 3. Interest Payments up by 34%; and 4. Goods & Services up by 42%. The UWP left Governmentwith an economic time bomb ticking away. By 2012/13, the Governmentwasnoteven making enough money to meet currentexpenditure. In 2012/13, the year VAT became effective, Government ran a negative current balance of over -$52 million. Labour had no choice but to correct these matters. Otherwise, we would have faced the fate which I described, the dreaded IMF. In contrast to the 40% increase in spending under the UWP, current spending under Labour increased by 17%. In fact, total spending per annum only increased by 7% under Labour’s tenure, compared to the 35% increase under the UWP’s term. Revenue increased by 18%, and was just enough to eliminate the negative current balance. Today, we are back to enjoying a positive current balance. REMOVAL OF EXEMPTIONS Today, however, we now understand that Allen Chastanet’s true intent is to introduce changes that in fact not to the benefit of the ordinary Saint Lucian. Allen himself, at a Town Hall Meeting in Gros Islet, admits that VAT is the best and most effective tax system in the world. But, you see, his true intent lies in his very own words again. He said the following at the UWP Economic forum this week: “When VAT has zero exemptions, it also meansthat it allows you to reduce on the tax rate….Themoreexemptionsthatyou putinto VAT, whatit then causesis for the VATrate to go up and the administration of the VATbzecomeseven more difficult.” Herein lies Allen’s trueintentions. Hemay promisea reduction of VAT,buthesubtly implies his true butunstated intention to reducethe number of goodsthat are VAT exempt. Currently, the number of items upon which people do not pay VAT is over 70. THE TRINIDAD EXPERIENCE We need only take the recent example of Trinidad & Tobago where the PNM Government came in promising to reduce VAT from 15% to 12.5%.

- 7. 7 They did so while drastically reducing on the number of items that were exempted or zero-rated. What does this mean in a Saint Lucian context. Most of the zero- rated and exempted items are groceries, electricity, water and pharmaceuticals. Allen’s suggestion of broad difficulty with administration of the VAT is misleading. The supermarketmonopoly is the company that would havethe most value added items. Removing theseitems fromthe zero-ratedlist would mean theprice of basic food items increasing even more. This movedoes not benefit the poor. In fact, it is anti-poor as persons with low incomes areknown to spend proportionally moreon food. Furthermore,Governmenttook a decision earlier on notto introduceVATon water and electricity. This amount to foregone revenue in the region of $40 million. Would Allen Chastanet remove these exemptions as well in the name of his reduction? Any 1% reduction in the VAT rate would result in the loss of approximately $23 million. Would Allen reduce VAT by 2.5% or about $60 million and simply offset this by reducing exemptions? He needs to come clean with his true intentions and stop deceiving the people of Saint Lucia, particularly the youth. TRUE INTENTIONS Saint Lucia, be smart! Don’t let gimmicks and sweet sounding promises fool you. Demand plans that are well though out. That are calculated. The truth is, Allen Chastanet will never remove VAT. He probably will never reduce VAT either. If anything, he may well remove the many exemptions to VAT that he’s already complained about in smaller private meetings and his economic forum. VAT is a tax that nearly every country around the world has. The UWP always intended onimplementing VAT, they justneverhad the courageto do so,butwould have been forced to at some point. They had already promised the IMF this. VATwas always meantto beset at 15%. They also planned on having VAT on water and electricity. VATon thoseutilities wouldresultin another $40million in revenue but the Kenny Anthony Government decided to protect the consumer from this. STAY ALIVE. STAY AWAY FROM DELIBERATELY MURKY PLANS. STAY CLEAR FROM SOMETHING THAT JUST DOESN’T ADD UP.