McKinsey COVID-19 impact Morocco wave 3

•

1 j'aime•667 vues

Results of a McKinsey global survey of financial decision-maker sentiment during COVID-19.

Signaler

Partager

Signaler

Partager

Recommandé

Colombian consumers are most worried about public health, caring for their families, and the country’s economy during the COVID-19 crisis.

These exhibits are based on survey data collected in Colombia from September 1–11, 2020. Check back for regular updates on Argentines consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Colombian consumer sentiment during the coronavirus crisis

McKinsey Survey: Colombian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Chinese optimism has improved to the highest level since March. Most Chinese consumers expect their routines and finances to return to normal within three months.

These exhibits are based on survey data collected in China from September 16–24, 2020. Check back for regular updates on Chinese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

B2B decision-maker preferences and behaviors have shifted dramatically since the onset of COVID. The GTM revolution is here and B2B sales is forever changed.McKinsey Survey: Spanish B2B decision maker response to COVID-19 crisis

McKinsey Survey: Spanish B2B decision maker response to COVID-19 crisisMcKinsey on Marketing & Sales

Consumer optimism regarding the United Arab Emirates’ economic recovery has increased significantly, but overall spending remains low as consumers adopt ways to save more.

These exhibits are based on survey data collected in the UAE from January 25 to February 10, 2021. Check back for regular updates on UAE consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Emirati consumer sentiment during the coronavirus crisis

McKinsey Survey: Emirati consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Mexican consumers continue to be worried about their economy during the COVID-19 crisis, with optimism about a recovery climbing slowly.

These exhibits are based on survey data collected in Mexico from February 20–March 2, 2021. Check back for regular updates on Mexican consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Mexican consumer sentiment during the coronavirus crisis

McKinsey Survey: Mexican consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Recommandé

Colombian consumers are most worried about public health, caring for their families, and the country’s economy during the COVID-19 crisis.

These exhibits are based on survey data collected in Colombia from September 1–11, 2020. Check back for regular updates on Argentines consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Colombian consumer sentiment during the coronavirus crisis

McKinsey Survey: Colombian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Chinese optimism has improved to the highest level since March. Most Chinese consumers expect their routines and finances to return to normal within three months.

These exhibits are based on survey data collected in China from September 16–24, 2020. Check back for regular updates on Chinese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

B2B decision-maker preferences and behaviors have shifted dramatically since the onset of COVID. The GTM revolution is here and B2B sales is forever changed.McKinsey Survey: Spanish B2B decision maker response to COVID-19 crisis

McKinsey Survey: Spanish B2B decision maker response to COVID-19 crisisMcKinsey on Marketing & Sales

Consumer optimism regarding the United Arab Emirates’ economic recovery has increased significantly, but overall spending remains low as consumers adopt ways to save more.

These exhibits are based on survey data collected in the UAE from January 25 to February 10, 2021. Check back for regular updates on UAE consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Emirati consumer sentiment during the coronavirus crisis

McKinsey Survey: Emirati consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Mexican consumers continue to be worried about their economy during the COVID-19 crisis, with optimism about a recovery climbing slowly.

These exhibits are based on survey data collected in Mexico from February 20–March 2, 2021. Check back for regular updates on Mexican consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Mexican consumer sentiment during the coronavirus crisis

McKinsey Survey: Mexican consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Since May 2020, more Canadians are feeling more pessimistic about the economic recovery and believe COVID-19 will have a lasting impact on the economy .

These exhibits are based on survey data collected in Canada from August 14–19, 2020. Check back for regular updates on Canadian consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Canadian consumer sentiment during the coronavirus crisis

McKinsey Survey: Canadian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

After steadily improving, Japanese consumer optimism stabilizes and a majority of consumers remain cautious about returning to out-of-home activities.

These exhibits are based on survey data collected in Japan from October 15 to 22, 2021. Check back for regular updates on Japanese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

B2B decision-maker preferences and behaviors have shifted dramatically since the onset of COVID. The GTM revolution is here and B2B sales is forever changed.McKinsey Survey: European B2B decision maker response to COVID-19 crisis

McKinsey Survey: European B2B decision maker response to COVID-19 crisisMcKinsey on Marketing & Sales

Central American consumers from Panama, Costa Rica, Guatemala, Honduras, and El Salvador are most concerned about their safety, the health and safety of their families, and public health generally during the COVID-19 crisis.

These exhibits are based on survey data collected in Central America from September 1–11, 2020. Check back for regular updates on Central American consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Central American consumer sentiment during the coronavirus c...

McKinsey Survey: Central American consumer sentiment during the coronavirus c...McKinsey on Marketing & Sales

Consumer optimism in UAE has remained steady since mid-March, but spending patterns have changed.

These exhibits are based on survey data collected in the UAE from June 16–18, 2020. Check back for regular updates on UAE consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Emirati consumer sentiment during the coronavirus crisis

McKinsey Survey: Emirati consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

B2B decision-maker preferences and behaviors have shifted dramatically since the onset of COVID. The GTM revolution is here and B2B sales is forever changed.McKinsey Survey: Italian B2B decision maker response to COVID-19 crisis

McKinsey Survey: Italian B2B decision maker response to COVID-19 crisisMcKinsey on Marketing & Sales

Despite an ongoing lockdown, German consumers’ expectations for economic recovery are stable, with half believing their routines will return to normal by the end of 2021.

These exhibits are based on survey data collected in Germany from February 23–27, 2021. Check back for regular updates on German consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Peruvian consumers are most concerned about taking care of their families, public health, and the economy during the COVID-19 crisis.

These exhibits are based on survey data collected in Peru from September 1–11, 2020. Check back for regular updates on Peruvian consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Peruvian consumer sentiment during the coronavirus crisis

McKinsey Survey: Peruvian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Although Japanese consumer optimism about economic recovery is improving steadily, the majority of consumers are still cautious about reengaging in out-of-home activities.

These exhibits are based on survey data collected in Japan from February 24–27, 2021. Check back for regular updates on Japanese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Spanish consumers’ overall economic pessimism has decreased since November, but caution about engaging in out-of-home activities continues.

These exhibits are based on survey data collected in Spain from February 23–27, 2021. Check back for regular updates on Spanish consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Spanish consumer sentiment during the coronavirus crisis

McKinsey Survey: Spanish consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Chileans remain concerned about the COVID-19 crisis and uncertain about economic recovery, with only one in three consumers being optimistic about a quick recovery.

These exhibits are based on survey data collected in Chile from September 1–16, 2020. Check back for regular updates on Chilean consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Chilean consumer sentiment during the coronavirus crisis

McKinsey Survey: Chilean consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Consumer optimism in Saudi Arabia has remained steady since mid-March, but spending patterns have changed to focus more on essential goods.

In KSA, a smaller proportion of consumers saw a decline in income and savings, but more than half continue to report a decline. The effect is seen in spending patterns and new habits adopted by consumers. Category spending indicates that consumers are stocking up in anticipation of the country’s upcoming tax increase on July 1, 2020. Consumers are not yet fully comfortable going back to “regular” out-of-home activities and are waiting for milestones beyond government lifting restrictions to return to normal patterns. Thus, they have started adopting new digital and low-touch activities, including grocery delivery.

These exhibits are based on survey data collected in KSA from June 16–18, 2020. Check back for regular updates on KSA consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Saudi consumer sentiment during the coronavirus crisis

McKinsey Survey: Saudi consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

B2B decision-maker preferences and behaviors have shifted dramatically since the onset of COVID. The GTM revolution is here and B2B sales is forever changed.McKinsey Survey: Japanese B2B decision maker response to COVID-19 crisis

McKinsey Survey: Japanese B2B decision maker response to COVID-19 crisisMcKinsey on Marketing & Sales

Contenu connexe

Tendances

Since May 2020, more Canadians are feeling more pessimistic about the economic recovery and believe COVID-19 will have a lasting impact on the economy .

These exhibits are based on survey data collected in Canada from August 14–19, 2020. Check back for regular updates on Canadian consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Canadian consumer sentiment during the coronavirus crisis

McKinsey Survey: Canadian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

After steadily improving, Japanese consumer optimism stabilizes and a majority of consumers remain cautious about returning to out-of-home activities.

These exhibits are based on survey data collected in Japan from October 15 to 22, 2021. Check back for regular updates on Japanese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

B2B decision-maker preferences and behaviors have shifted dramatically since the onset of COVID. The GTM revolution is here and B2B sales is forever changed.McKinsey Survey: European B2B decision maker response to COVID-19 crisis

McKinsey Survey: European B2B decision maker response to COVID-19 crisisMcKinsey on Marketing & Sales

Central American consumers from Panama, Costa Rica, Guatemala, Honduras, and El Salvador are most concerned about their safety, the health and safety of their families, and public health generally during the COVID-19 crisis.

These exhibits are based on survey data collected in Central America from September 1–11, 2020. Check back for regular updates on Central American consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Central American consumer sentiment during the coronavirus c...

McKinsey Survey: Central American consumer sentiment during the coronavirus c...McKinsey on Marketing & Sales

Consumer optimism in UAE has remained steady since mid-March, but spending patterns have changed.

These exhibits are based on survey data collected in the UAE from June 16–18, 2020. Check back for regular updates on UAE consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Emirati consumer sentiment during the coronavirus crisis

McKinsey Survey: Emirati consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

B2B decision-maker preferences and behaviors have shifted dramatically since the onset of COVID. The GTM revolution is here and B2B sales is forever changed.McKinsey Survey: Italian B2B decision maker response to COVID-19 crisis

McKinsey Survey: Italian B2B decision maker response to COVID-19 crisisMcKinsey on Marketing & Sales

Despite an ongoing lockdown, German consumers’ expectations for economic recovery are stable, with half believing their routines will return to normal by the end of 2021.

These exhibits are based on survey data collected in Germany from February 23–27, 2021. Check back for regular updates on German consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Peruvian consumers are most concerned about taking care of their families, public health, and the economy during the COVID-19 crisis.

These exhibits are based on survey data collected in Peru from September 1–11, 2020. Check back for regular updates on Peruvian consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Peruvian consumer sentiment during the coronavirus crisis

McKinsey Survey: Peruvian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Although Japanese consumer optimism about economic recovery is improving steadily, the majority of consumers are still cautious about reengaging in out-of-home activities.

These exhibits are based on survey data collected in Japan from February 24–27, 2021. Check back for regular updates on Japanese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Spanish consumers’ overall economic pessimism has decreased since November, but caution about engaging in out-of-home activities continues.

These exhibits are based on survey data collected in Spain from February 23–27, 2021. Check back for regular updates on Spanish consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Spanish consumer sentiment during the coronavirus crisis

McKinsey Survey: Spanish consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Chileans remain concerned about the COVID-19 crisis and uncertain about economic recovery, with only one in three consumers being optimistic about a quick recovery.

These exhibits are based on survey data collected in Chile from September 1–16, 2020. Check back for regular updates on Chilean consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Chilean consumer sentiment during the coronavirus crisis

McKinsey Survey: Chilean consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Consumer optimism in Saudi Arabia has remained steady since mid-March, but spending patterns have changed to focus more on essential goods.

In KSA, a smaller proportion of consumers saw a decline in income and savings, but more than half continue to report a decline. The effect is seen in spending patterns and new habits adopted by consumers. Category spending indicates that consumers are stocking up in anticipation of the country’s upcoming tax increase on July 1, 2020. Consumers are not yet fully comfortable going back to “regular” out-of-home activities and are waiting for milestones beyond government lifting restrictions to return to normal patterns. Thus, they have started adopting new digital and low-touch activities, including grocery delivery.

These exhibits are based on survey data collected in KSA from June 16–18, 2020. Check back for regular updates on KSA consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Saudi consumer sentiment during the coronavirus crisis

McKinsey Survey: Saudi consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

B2B decision-maker preferences and behaviors have shifted dramatically since the onset of COVID. The GTM revolution is here and B2B sales is forever changed.McKinsey Survey: Japanese B2B decision maker response to COVID-19 crisis

McKinsey Survey: Japanese B2B decision maker response to COVID-19 crisisMcKinsey on Marketing & Sales

Tendances (20)

McKinsey Survey: Korean B2B decision maker response to COVID-19 crisis

McKinsey Survey: Korean B2B decision maker response to COVID-19 crisis

McKinsey Survey: Canadian consumer sentiment during the coronavirus crisis

McKinsey Survey: Canadian consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

20200407 asia covid 19 - grocery retail survey - south korea v final-ds v2

20200407 asia covid 19 - grocery retail survey - south korea v final-ds v2

McKinsey Survey: European B2B decision maker response to COVID-19 crisis

McKinsey Survey: European B2B decision maker response to COVID-19 crisis

McKinsey Survey: Central American consumer sentiment during the coronavirus c...

McKinsey Survey: Central American consumer sentiment during the coronavirus c...

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: Emirati consumer sentiment during the coronavirus crisis

McKinsey Survey: Emirati consumer sentiment during the coronavirus crisis

McKinsey Survey: Italian B2B decision maker response to COVID-19 crisis

McKinsey Survey: Italian B2B decision maker response to COVID-19 crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: Peruvian consumer sentiment during the coronavirus crisis

McKinsey Survey: Peruvian consumer sentiment during the coronavirus crisis

Survey results: Consumer discretionary spending in China

Survey results: Consumer discretionary spending in China

20200330 asia covid 19 - grocery retail survey - indonesia v final-ds

20200330 asia covid 19 - grocery retail survey - indonesia v final-ds

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Spanish consumer sentiment during the coronavirus crisis

McKinsey Survey: Spanish consumer sentiment during the coronavirus crisis

McKinsey Survey: Chilean consumer sentiment during the coronavirus crisis

McKinsey Survey: Chilean consumer sentiment during the coronavirus crisis

McKinsey Survey: German B2B decision maker response to COVID-19 crisis

McKinsey Survey: German B2B decision maker response to COVID-19 crisis

McKinsey Survey: Saudi consumer sentiment during the coronavirus crisis

McKinsey Survey: Saudi consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese B2B decision maker response to COVID-19 crisis

McKinsey Survey: Japanese B2B decision maker response to COVID-19 crisis

Similaire à McKinsey COVID-19 impact Morocco wave 3

Mexican consumers continue to be worried about their economy during the COVID-19 crisis, with optimism about a recovery climbing slowly.

These exhibits are based on survey data collected in Mexico from February 20–March 2, 2021. Check back for regular updates on Mexican consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Mexican consumer sentiment during the coronavirus crisis

McKinsey Survey: Mexican consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Mexican consumers continue to be worried about their economy during the COVID-19 crisis, with optimism about a recovery climbing slowly.

These exhibits are based on survey data collected in Mexico from February 20–March 2, 2021. Check back for regular updates on Mexican consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Mexican consumer sentiment during the coronavirus crisis

McKinsey Survey: Mexican consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Portuguese consumers are concerned about the health of family members as well as the economy, and are cutting back on spending.

Portuguese consumers continue to feel the economic effects of the crisis, and their concerns about health, safety, and the economy are increasing. Most consumers still believe that the personal and financial impact of COVID-19 will continue to last well beyond two months. They expect to cut their spending across almost all categories. However, the proportion of consumers’ income, spending, and savings affected by the COVID-19 situation has decreased slightly since the last pulse. Portuguese consumers have been leaving home mainly to shop and meet family, and expect to continue doing so in the near future. In addition to lifted restrictions, consumers are waiting for the endorsement of medical authorities prior to engaging in out-of-home activities.

These exhibits are based on survey data collected in Portugal from June 19–21, 2020. Check back for regular updates on Portuguese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Portuguese consumer sentiment during the coronavirus crisis

McKinsey Survey: Portuguese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Indonesian consumers remain optimistic on the economy, expecting higher incomes and spending. Many tried and plan to keep using digital services and omnichannel methods.

In Indonesia, optimism about future economic conditions increased more than 25 percent over September 2020 from an already high base, boosted by planning for the upcoming holiday season. Eight out of ten consumers say they will dine out, shop for gifts, and redecorate. Out-of-home activities are generally rising but remain far below prepandemic levels. Optimism about the economy is tempered by views of household finances; half predict finances won’t return to normal before June. The loyalty shake-up continues, with 60 percent citing value as their primary reason to try a new brand. New digital behaviors are starting to show evidence of stickiness: 60 percent say they intend to use new shopping methods when the pandemic subsides.McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisis

McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Indonesian consumers remain optimistic on the economy, expecting higher incomes and spending. Many tried and plan to keep using digital services and omnichannel methods.

In Indonesia, optimism about future economic conditions increased more than 25 percent over September 2020 from an already high base, boosted by planning for the upcoming holiday season. Eight out of ten consumers say they will dine out, shop for gifts, and redecorate. Out-of-home activities are generally rising but remain far below prepandemic levels. Optimism about the economy is tempered by views of household finances; half predict finances won’t return to normal before June. The loyalty shake-up continues, with 60 percent citing value as their primary reason to try a new brand. New digital behaviors are starting to show evidence of stickiness: 60 percent say they intend to use new shopping methods when the pandemic subsides.McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisis

McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Indonesian consumers remain optimistic on the economy, expecting higher incomes and spending. Many tried and plan to keep using digital services and omnichannel methods.

In Indonesia, optimism about future economic conditions increased more than 25 percent over September 2020 from an already high base, boosted by planning for the upcoming holiday season. Eight out of ten consumers say they will dine out, shop for gifts, and redecorate. Out-of-home activities are generally rising but remain far below prepandemic levels. Optimism about the economy is tempered by views of household finances; half predict finances won’t return to normal before June. The loyalty shake-up continues, with 60 percent citing value as their primary reason to try a new brand. New digital behaviors are starting to show evidence of stickiness: 60 percent say they intend to use new shopping methods when the pandemic subsides.McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisis

McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Filipino consumers generally remained as optimistic in October as they were in April; however, optimism among lower-income groups declined significantly.

As the government’s COVID-19 restrictions ease, Filipino consumers are cautiously resuming spending activity. While overall optimism remained the same from April to October, optimism in the lowest income group dropped significantly, while those in the highest income group increased. Optimism among 20- to 24-year-olds also declined. Additionally, approximately 50 percent of respondents believe their finances will be impacted for at least six more months, up from only about 10 percent last April. Overall decreases in spending are expected to soften after the pandemic, but most categories will likely see spending declines linger for the long term.

These exhibits are based on survey data collected in the Philippines from April 17 to 20, and October 1 to 12, 2020. McKinsey Survey: Filipino consumer sentiment during the coronavirus crisis

McKinsey Survey: Filipino consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

In Qatar, the prevailing sentiment is uncertainty about the health of family members and the duration of the COVID-19 crisis. Although consumers are optimistic about the country’s economic recovery after the COVID-19 situation subsides, they are cutting their spending on almost all categories. During the crisis, consumers have both adopted and increased their usage of digital activities such as remote learning, videoconferencing, and contactless delivery and pickup of food and supplies.

These exhibits are based on survey data collected in Qatar from April 24–May 1, 2020. Check back for regular updates on Qatari residents’ consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Qatari consumer sentiment during the coronavirus crisis

McKinsey Survey: Qatari consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Most Korean consumers expect that normalcy will return to routines only after June 2022, yet there are signs of pre-COVID-19 routines returning.

Korean customers have been less optimistic than those in other countries about the economic recovery. But optimism in Korea is much higher now than two years ago. Half of consumers indicate a desire to splurge, with intent to do so being the strongest in Gen Z and millennials. One-eighth of consumers say they have returned to out-of-home activities.McKinsey Survey: Korean consumer sentiment during the coronavirus crisis

McKinsey Survey: Korean consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Most Korean consumers expect that normalcy will return to routines only after June 2022, yet there are signs of pre-COVID-19 routines returning.

Korean customers have been less optimistic than those in other countries about the economic recovery. But optimism in Korea is much higher now than two years ago. Half of consumers indicate a desire to splurge, with intent to do so being the strongest in Gen Z and millennials. One-eighth of consumers say they have returned to out-of-home activities.McKinsey Survey: Korean consumer sentiment during the coronavirus crisis

McKinsey Survey: Korean consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Japanese consumers’ behaviors and finances are gradually recovering to normal, though their responses indicate a slight increase in pessimism. The long-lasting impact of COVID-19 is prolonging Japanese consumers’ intent to stay conservative about spending across categories. In a further sign of cautiousness, the trend of shrinking pessimism over the past few years reversed for the first time. Meanwhile, people’s demand for travel is rising, considering the next seasonal vacations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Although Japanese consumer optimism about economic recovery is improving steadily, the majority of consumers are still cautious about reengaging in out-of-home activities.

These exhibits are based on survey data collected in Japan from February 24–27, 2021. Check back for regular updates on Japanese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

In China, almost all consumers have already returned to normal out-of-home activities, and 97 percent of respondents report working outside the home in the two weeks prior to being surveyed.

These exhibits are based on survey data collected in China from Feb. 20 to March 8, 2021. Check back for regular updates on Chinese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Japanese consumers’ behaviors and finances are gradually recovering to normal, though their responses indicate a slight increase in pessimism. The long-lasting impact of COVID-19 is prolonging Japanese consumers’ intent to stay conservative about spending across categories. In a further sign of cautiousness, the trend of shrinking pessimism over the past few years reversed for the first time. Meanwhile, people’s demand for travel is rising, considering the next seasonal vacations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Similaire à McKinsey COVID-19 impact Morocco wave 3 (20)

McKinsey Survey: Mexican consumer sentiment during the coronavirus crisis

McKinsey Survey: Mexican consumer sentiment during the coronavirus crisis

McKinsey Survey: Mexican consumer sentiment during the coronavirus crisis

McKinsey Survey: Mexican consumer sentiment during the coronavirus crisis

McKinsey Survey: Portuguese consumer sentiment during the coronavirus crisis

McKinsey Survey: Portuguese consumer sentiment during the coronavirus crisis

McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisis

McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisis

McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisis

McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisis

McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisis

McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisis

McKinsey Survey: Filipino consumer sentiment during the coronavirus crisis

McKinsey Survey: Filipino consumer sentiment during the coronavirus crisis

McKinsey Survey: Qatari consumer sentiment during the coronavirus crisis

McKinsey Survey: Qatari consumer sentiment during the coronavirus crisis

McKinsey Survey: Korean consumer sentiment during the coronavirus crisis

McKinsey Survey: Korean consumer sentiment during the coronavirus crisis

McKinsey Survey: Korean consumer sentiment during the coronavirus crisis

McKinsey Survey: Korean consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

Dernier

VIP Call Girls Napur Anamika Call Now: 8617697112 Napur Escorts Booking Contact Details WhatsApp Chat: +91-8617697112 Napur Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable. Independent Escorts Napur understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Dernier (20)

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait

BAGALUR CALL GIRL IN 98274*61493 ❤CALL GIRLS IN ESCORT SERVICE❤CALL GIRL

BAGALUR CALL GIRL IN 98274*61493 ❤CALL GIRLS IN ESCORT SERVICE❤CALL GIRL

Call Now ☎️🔝 9332606886🔝 Call Girls ❤ Service In Bhilwara Female Escorts Serv...

Call Now ☎️🔝 9332606886🔝 Call Girls ❤ Service In Bhilwara Female Escorts Serv...

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: Empowering Your Business Growth

Call Girls In Nangloi Rly Metro ꧂…….95996 … 13876 Enjoy ꧂Escort

Call Girls In Nangloi Rly Metro ꧂…….95996 … 13876 Enjoy ꧂Escort

Malegaon Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

Malegaon Call Girls Service ☎ ️82500–77686 ☎️ Enjoy 24/7 Escort Service

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Ludhiana Just Call 98765-12871 Top Class Call Girl Service Available

Call Girls Ludhiana Just Call 98765-12871 Top Class Call Girl Service Available

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

Falcon Invoice Discounting: Unlock Your Business Potential

Falcon Invoice Discounting: Unlock Your Business Potential

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

McKinsey COVID-19 impact Morocco wave 3

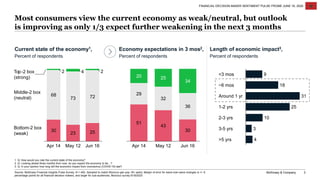

- 1. McKinsey & Company 3 Most consumers view the current economy as weak/neutral, but outlook is improving as only 1/3 expect further weakening in the next 3 months FINANCIAL DECISION MAKER SENTIMENT PULSE FROME JUNE 16, 2020 30 23 25 68 73 72 2 4 2Top-2 box (strong) Apr 14 Middle-2 box (neutral) May 12 Bottom-2 box (weak) Jun 16 51 43 30 29 32 36 20 25 34 Apr 14 Jun 16May 12 Current state of the economy1, Percent of respondents Economy expectations in 3 mos2, Percent of respondents Length of economic impact3, Percent of respondents 1. Q: How would you rate the current state of the economy? 2. Q: Looking ahead three months from now, do you expect the economy to be…? 3. Q: In your opinion how long will the economic impact from coronavirus (COVID-19) last? 9 18 31 25 10 3 4 3-5 yrs Around 1 yr <3 mos 2-3 yrs ~6 mos 1-2 yrs >5 yrs Source: McKinsey Financial Insights Pulse Survey, N = 493, Sampled to match Morocco gen pop 18+ years; Margin of error for wave-over-wave changes is +/- 6 percentage points for all financial decision makers, and larger for sub-audiences; Morocco survey 6/16/2020

- 2. McKinsey & Company 4 Most consumers describe their current financial situation as weak, but ¾ expect it to remain the same or improve in the next 3 months FINANCIAL DECISION MAKER SENTIMENT PULSE FROME JUNE 16, 2020 33 27 27 46 49 46 19 21 23 2 3 4 May 12Apr 14 Strong Somewhat strong Somewhat weak Weak Jun 16 Describe your current financial situation1 Percent of respondents In the next 3 months, your financial situation will2… Percent of respondents 18 14 7 29 30 17 38 33 38 14 19 33 Become slightly better Become substantially better 4 Become substantially worse Apr 14 1 May 12 Remain the same Become slightly worse Jun 16 4 1. Q: How would you describe your current personal financial situation? 2. Q: In the next 3 months, what do think is most likely to happen to your personal financial situation? It will … Source: McKinsey Financial Insights Pulse Survey, N = 493, Sampled to match Morocco gen pop 18+ years; Margin of error for wave-over-wave changes is +/- 6 percentage points for all financial decision makers, and larger for sub-audiences; Morocco survey 6/16/2020

- 3. McKinsey & Company 5 Similarly, over 2/3rds of consumers report decreased income and savings over the past month 66 71 67 32 26 29 Apr 14 2 3 May 12 Jun 16 4 51 54 48 21 23 27 28 23 24 Jun 16Apr 14 May 12 72 76 73 21 18 18 7 6 9 Apr 14 Jun 16May 12 Household income Household spendingHousehold savings Increase About the same Decrease How has COVID-19 affected the following over the past month?1 Percent of respondents 1. How has the coronavirus (COVID-19) situation affected the following over the past month? | Your (household) income, amount of income put away as savings, overall household spending FINANCIAL DECISION MAKER SENTIMENT PULSE FROME JUNE 16, 2020 Source: McKinsey Financial Insights Pulse Survey, N = 493, Sampled to match Morocco gen pop 18+ years; Margin of error for wave-over-wave changes is +/- 6 percentage points for all financial decision makers, and larger for sub-audiences; Morocco survey 6/16/2020

- 4. McKinsey & Company 6 Over half of consumers are concerned or somewhat concerned about job security and have 4 months or fewer of savings to live off Overall job security concerns1 Percent of respondents 1. Q: How concerned are you about your job security given the Corona virus (COVID-19) impact? 2.Q: If your household experienced loss of your job, how many months would you be able to live off your savings, without making any changes to your current standard of living? 6 5 5 32 31 39 28 36 30 35 28 26 Apr 14 May 12 Top-2 box (concerned) Middle box (somewhat concerned) Bottom-2 box (not concerned) NA / don’t know Jun 16 FINANCIAL DECISION MAKER SENTIMENT PULSE FROME JUNE 16, 2020 How long can you live off of your current savings?2 Percent of respondents 36 31 31 36 40 34 14 11 12 6 6 7 9 12 15 2-4 months Apr 14 Jun 16 <1 month May 12 1 yr+ 9-12 months 5-8 months Source: McKinsey Financial Insights Pulse Survey, N = 493, Sampled to match Morocco gen pop 18+ years; Margin of error for wave-over-wave changes is +/- 6 percentage points for all financial decision makers, and larger for sub-audiences; Morocco survey 6/16/2020

- 5. McKinsey & Company 7 Bank performance is below expectations for 28% of consumers FINANCIAL DECISION MAKER SENTIMENT PULSE FROME JUNE 16, 2020 Bank performance vs. consumer expectations1 Percent of respondents 1. Q: How is your bank meeting your expectations during the Coronavirus crisis in serving your needs? 2. Net impact calculated top two box minus bottom two box 8 19 19 23 61 55 56 11 9 11 4 9 5 Apr 14 4 Performing somewhat above my expectations May 12 Performing much above my expectations Performing per my expectations Performing somewhat below my expectations Performing much below my expectations Jun 16 5 -12% Net impact2 Source: McKinsey Financial Insights Pulse Survey, N = 493, Sampled to match Morocco gen pop 18+ years; Margin of error for wave-over-wave changes is +/- 6 percentage points for all financial decision makers, and larger for sub-audiences; Morocco survey 6/16/2020

- 6. McKinsey & Company 8 Many consumers expect to increase use of digital and mobile banking services even after the crisis ends Once “normal life” resumes after COVID-19…1 Percent of respondents 1. Q: Once “normal life” resumes after the Coronavirus / Covid-19 crisis, do you expect to use the following bank services more often, less often, or the same as you were using before the crisis? Please check one answer for each channel. FINANCIAL DECISION MAKER SENTIMENT PULSE FROME JUNE 16, 2020 -11 -12 -22 -30 -24 -37 35 31 22 19 14 10 Online banking, e.g., paying bills online Phone call with your bank advisor or branch staff Visiting a branch for making a transaction Mobile banking, e.g., using a mobile app Will use less Mobile payment, e.g., Jibi, Inwi money Video chat with your bank advisor or branch staff Will use more +24% +19% - -11% -10% -27% Net change Source: McKinsey Financial Insights Pulse Survey, N = 493, Sampled to match Morocco gen pop 18+ years; Margin of error for wave-over-wave changes is +/- 6 percentage points for all financial decision makers, and larger for sub-audiences; Morocco survey 6/16/2020

- 7. McKinsey & Company 9 Consumers would like their banks to improve websites and waive late fees Desired support from banks during economic uncertainty; Top 3 box rank1, Percent of respondents 1. Q: How would you like your banks to support you during this period of economic uncertainty? 44 36 30 30 26 21 20 18 45 38 37 32 11 43 43 34 31 23 24 16 8 Reduce minimum payments on my credit cards Improve website further to allow seamless online transactions for all banking activities Educate me on using the variety of mobile/online tools available for transacting/interacting with the bank Waive late fees on my credit card/loan payments Allow me to skip loan/mortgage repayment for one month Introduce/Expand web-based customer service through live video chat Introduce/Expand web-based customer service through live video chat Introduce check cashing service using home delivery 19 14 15 FINANCIAL DECISION MAKER SENTIMENT PULSE FROME JUNE 16, 2020 Source: McKinsey Financial Insights Pulse Survey, N = 493, Sampled to match Morocco gen pop 18+ years; Margin of error for wave-over-wave changes is +/- 6 percentage points for all financial decision makers, and larger for sub-audiences; Morocco survey 6/16/2020 Jun 16 May 12 Apr 14

- 8. McKinsey & Company 10 Consumers report decreased usage of most payment types over the past month, though some are using more cash 1. Q: Over the past month, how have you changed your use of the following? FINANCIAL DECISION MAKER SENTIMENT PULSE FROME JUNE 16, 2020 Over the past month, changes in usage of the following financial vehicles1 Percent of respondents 16 12 9 5 20 33 5 11 13 -52 -50 -51 -57 -43 -32 -55 -50 -48 ChecksGeneral purpose credit card Debit card Store credit card Mobile payment, e.g., Jibi, Inwi money Cash Gift card/prepaid card Contactless payment Other electronic payments Increased usage Decreased usage -36% -39% -42% -53% -23% -50% -39% -35% Net change +1% Source: McKinsey Financial Insights Pulse Survey, N = 493, Sampled to match Morocco gen pop 18+ years; Margin of error for wave-over-wave changes is +/- 6 percentage points for all financial decision makers, and larger for sub-audiences; Morocco survey 6/16/2020

- 9. McKinsey & Company 11 About half of financial decision makers are optimistic about economic recovery after COVID-19 Financial decision maker confidence level on economic conditions after the COVID-19 situation1 Percent of respondents 8 4 8 41 45 40 51 51 52 May 12Apr 14 Jun 16 1. Q: How is your overall confidence level on economic conditions after the COVID-19 situation? Rated from 1 Very optimistic to 6 very pessimistic Unsure: The economy will be impacted for 6-12 months or longer and will stagnate or show slow growth thereafter Pessimistic: COVID-19 will have a long lasting impact on the economy and show regression / fall into lengthy recession Optimistic: The economy will rebound within 2-3 months and grow just as strong or stronger than before COVID-19 FINANCIAL DECISION MAKER SENTIMENT PULSE FROME JUNE 16, 2020 Source: McKinsey Financial Insights Pulse Survey, N = 493, Sampled to match Morocco gen pop 18+ years; Margin of error for wave-over-wave changes is +/- 6 percentage points for all financial decision makers, and larger for sub-audiences; Morocco survey 6/16/2020

- 10. McKinsey & Company 12 Disclaimer McKinsey does not provide legal, medical or other regulated advice or guarantee results. These materials reflect general insight and best practice based on information currently available and do not contain all of the information needed to determine a future course of action. Such information has not been generated or independently verified by McKinsey and is inherently uncertain and subject to change. McKinsey has no obligation to update these materials and makes no representation or warranty and expressly disclaims any liability with respect thereto.