Colliers Office And Investment Market Report Q2 2011

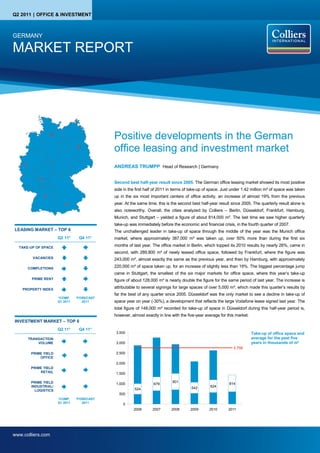

- 1. Q2 2011 | OFFICE & INVESTMENT GERMANY MARKET REPORT Positive developments in the German office leasing and investment market ANDREAS TRUMPP Head of Research | Germany Second best half-year result since 2005. The German office leasing market showed its most positive side in the first half of 2011 in terms of take-up of space. Just under 1.42 million m² of space was taken up in the six most important centers of office activity, an increase of almost 19% from the previous year. At the same time, this is the second best half-year result since 2005. The quarterly result alone is also noteworthy. Overall, the cities analyzed by Colliers – Berlin, Düsseldorf, Frankfurt, Hamburg, Munich, and Stuttgart – yielded a figure of about 814,000 m². The last time we saw higher quarterly take-up was immediately before the economic and financial crisis, in the fourth quarter of 2007. LEASING MARKET – TOP 6 The unchallenged leader in take-up of space through the middle of the year was the Munich office Q2 11* Q4 11* market, where approximately 387,000 m² was taken up, over 50% more than during the first six TAKE-UP OF SPACE months of last year. The office market in Berlin, which topped its 2010 results by nearly 26%, came in second, with 289,800 m² of newly leased office space, followed by Frankfurt, where the figure was VACANCIES 243,000 m², almost exactly the same as the previous year, and then by Hamburg, with approximately COMPLETIONS 220,000 m² of space taken up, for an increase of slightly less than 19%. The biggest percentage jump came in Stuttgart, the smallest of the six major markets for office space, where this year’s take-up PRIME RENT figure of about 128,000 m² is nearly double the figure for the same period of last year. The increase is PROPERTY INDEX attributable to several signings for large spaces of over 5,000 m², which made this quarter’s results by far the best of any quarter since 2005. Düsseldorf was the only market to see a decline in take-up of *COMP. *FORECAST Q1 2011 2011 space year on year (-30%), a development that reflects the large Vodafone lease signed last year. The total figure of 148,000 m² recorded for take-up of space in Düsseldorf during this half-year period is, however, almost exactly in line with the five-year average for this market. INVESTMENT MARKET – TOP 6 Q2 11* Q4 11* 3,500 Take-up of office space and TRANSACTION average for the past five VOLUME 3,000 years in thousands of m² 2,758 PRIME YIELD 2,500 OFFICE 2,000 PRIME YIELD RETAIL 1,500 PRIME YIELD 801 1,000 679 814 INDUSTRIAL/ 542 624 LOGISTICS 524 500 *COMP. *FORECAST Q1 2011 2011 0 2006 2007 2008 2009 2010 2011 www.colliers.com

- 2. MARKET REPORT | Q2 2011 | OFFICE LEASING AND INVESTMENT | GERMANY Comparison of prime rents (€/m²) Vacancies declining on the whole. After three some parties on the demand side to increase quarters of stagnation in terms of vacancies their leasing activities in central locations, and 40.00 across the cities analyzed, where absolute va- thus pay higher rental prices, which led to an 35.00 30.00 cancies hovered just over 8 million m² despite upward trend in prime rents. The leading market 25.00 increasing leasing activity, the positive market in this regard is still Frankfurt, where the prime 20.00 trends that had been noted previously began to rent at the end of the second quarter was 15.00 show on the supply side as well. The rising € 37.50/m², an increase of € 2.50/m² from one Q1 06 Q1 07 Q1 08 Q1 09 Q1 10 Q1 11 figures for take-up of space, combined with a year ago. By comparison to the previous quarter, Berlin Düsseldorf Frankfurt Hamburg Munich Stuttgart decline in new project completions, added up to however, no change was noted. At € 29.00/m², a vacancy figure that was some 261,000 m² Munich came in second, with an increase of lower than in the previous quarter. With 7.75 € 1.00/m² year on year and 50 cents over the million m² of office space vacant at the end of previous quarter. The largest increases by com- Comparison of average rents (€/m²) June 2011, there was also slightly less space parison to both the previous year and the last 25.00 vacant in absolute terms than one year ago. As a quarter were noted in Berlin, with prime rent of 20.00 result, the vacancy rate for all markets fell by ten € 22.00/m², and Stuttgart, where the figure rose 15.00 base points year on year, to 9.7%. All of the to € 18.50/m². Düsseldorf was the only market to 10.00 office markets posted declining vacancies com- see a decrease from last year, with prime rent pared with the preceding quarter, except Düssel- declining from € 25.00 to € 23.00/m², but this 5.00 Q1 06 Q1 07 Q1 08 Q1 09 Q1 10 Q1 11 dorf, where nearly 900,000 m² of office space figure is in line with the value for the three pre- Berlin Düsseldorf Frankfurt stood vacant at the end of June, an increase of ceding quarters. It is not, or not yet, possible to Hamburg Munich Stuttgart about 23,000 m² over the figure at the end of discern a uniform upward trend in terms of aver- March. When viewed year on year, by contrast, age rents overall, however. In this area as well, vacancies rose slightly in three markets (Düssel- Frankfurt has the top figure among the cities Comparison of vacancy rates (%) dorf, Hamburg, and Munich) and fell in the other analyzed, at € 20.00/m², followed by Düsseldorf 20.0 three (Berlin, Frankfurt, and Stuttgart). Frankfurt (€ 14.10/m²), Munich (overall market, continues to have the largest amount of vacant € 13.81/m²), Hamburg (€ 13.70/m²), Berlin 15.0 office space, but the figure at the end of the first (€ 12.30/m²), and Stuttgart (€ 11.03/m²). 10.0 half of this year dipped back below 2 million m² of 5.0 office space for the first time in four quarters, Commercial investment market still shows 0.0 making for a vacancy rate of 17.0%. This is strong momentum. This year’s strong start was Q1 06 Q1 07 Q1 08 Q1 09 Q1 10 Q1 11 followed by Munich (1.79 million m² of vacant followed by a similarly brisk second quarter, with Berlin Düsseldorf Frankfurt Hamburg Munich Stuttgart space, 8.0% vacancy rate), Berlin (1.45 transaction volume nearly the same as in the million m², 8.1%), Hamburg (1.17 million m², three months before. In total, the volume in- 9.0%), Düsseldorf (899,900 m², 11.6%), and vested in commercial real estate during the first Stuttgart (465,500 m², 6.3%). half of 2011 comes to some € 11 billion. This is a Prime yields for office properties (%) significant increase – 24% – by comparison to 6.5 Prime rents on an upward trend, average the same period of last year In the first quarter, 6.0 5.5 rents varied widely. The prosperous overall most of the investment volume went toward 5.0 economic situation increased the willingness of 4.5 4.0 3.5 35.00 Commercial transaction Q1 06 Q1 07 Q1 08 Q1 09 Q1 10 Q1 11 volume in the top six mar- Berlin Düsseldorf Frankfurt 30.00 kets, in billions of euros Hamburg Munich Stuttgart 25.00 (gray: average value in- cluding 2006/2007 red: average value not 20.00 including 2006/2007) 15.00 10.82 10.00 7.36 5.00 4.51 0.00 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Q2 2011 P. 2 | COLLIERS INTERNATIONAL

- 3. MARKET REPORT | Q2 2011 | OFFICE LEASING AND INVESTMENT | GERMANY COMPARISON OF GERMAN OFFICE AND INVESTMENT CENTERS Q1-Q2 2011 BERLIN DÜSSELDORF FRANKFURT HAMBURG MUNICH STUTTGART Existing office space (millions of m²) 17.9 7.8 11.6 13.1 22.3 7.4 Take-up of office space, 2011, in m² 289,800 148,000 243,000 220,000 387,000 128,000 Take-up of office space, 2010, in m² 230,100 210,000 243,300 185,000 255,900 66,000 Percentage change +25.9 -29.5 -0.1 +18.9 +51.2 +93.9 Prime rent, 2011, in €/m² 22.00 23.00 37.50 23.50 29.00 18.50 Prime rent, 2010, in €/m² 20.00 25.00 35.00 23.00 28.00 17.00 Percentage change +10.0 -8.0 +7.1 +2.2 +3.6 +8.8 Average rent, 2011, in €/m² 12.30 14.10 20.00 13.70 13.81 11.03 Average rent, 2010, in €/m² 11.90 14.50 18.00 13.20 14.19 11.56 Percentage change +3.4 -2.8 +11.1 +3.8 -2.7 -4.6 Vacant office space, 2011, in m² 1,450,000 899,900 1,977,500 1,174,000 1,787,000 465,500 Vacant office space, 2010, in m² 1,553,000 873,100 2,027,800 1,161,700 1,742,100 484,000 Vacancy rate in % 8.1 11.6 17.0 9.0 8.0 6.3 PropertyIndex 2.5 3.0 4.3 2.4 2.9 2.4 Transaction volume in millions of 882 190 1,309 1,250 751 128 euros, 2011 Transaction volume in millions of 2,091 458 344 505 869 245 euros, 2010 Percentage change -57.8 -58.4 +280.5 +147.5 -13.6 -47.8 Top yields, office, in % 5.00 5.25 5.20 4.70 4.50 5.40 Top yields, retail, in % 4.80 4.50 4.20 4.70 3.75 4.50 Top yields, industry/logistics, in % 7.40 7.50 6.50 7.20 7.00 7.10 Largest group of investors by per- Open- Project Closed- Open- Project Corporates / centage ended real developers / ended real ended real developers / Owner- estate funds building estate funds estate funds building occupants contractors contractors 31 36 45 45 27 25 Largest group of sellers by percen- Project Open- Banks Project Opportunity / Corporates / tage developers / ended real developers / Private Owner- building estate funds building Equity occupants contractors contractors Funds 75 38 52 49 41 49 Most important type of real estate Retail Office Office Office Retail Office by percentage 69 67 76 48 36 35 Sources: Colliers Deutschland, Grossmann & Berger GmbH (Hamburg); Photo: Owner of metris P. 3 | COLLIERS INTERNATIONAL

- 4. MARKET REPORT | Q2 2011 | OFFICE LEASING AND INVESTMENT | GERMANY locations outside of the traditional real estate centers as a result of various factors, including large- volume transactions such as the sale of the Metro portfolio and a 50% share in the CentrO shopping 512 offices in and leisure center in Oberhausen. Then, in the second quarter, investors resumed their activities in 61 countries on traditional locations, especially in Frankfurt and Hamburg, each of which saw about € 1 billion in capital invested in the period from April to June alone. In all, investment in the cities of Berlin, Düsseldorf, 6 continents Frankfurt, Hamburg, Munich, and Stuttgart came to € 4.5 billion, slightly less than 41% of the total USA: 125 transaction volume. Canada: 38 Latin America: 18 Investors focusing on retail properties. The biggest transaction involving any office property so far Asia / Pacific: 214 this year took place in the second quarter, when a closed-ended DWS fund invested nearly € 584 EMEA: 117 million in the Greentowers development, in Frankfurt, which is occupied by Deutsche Bank. The two • $1.5 billion in annual revenue office buildings underwent extensive renovations that were completed recently. All in all, though, retail • 978.6 million square feet under properties continued to lead all other use categories by a wide margin at the close of the first half of the management • Over 12,500 professionals year. Investors put some € 5.9 billion into retail real estate, nearly twice as much as they invested in office properties, at just under € 2.9 billion. These categories are trailed at a significant distance by a near tie between hotel properties, at about € 582 million, and warehouse, logistics, and industrial properties, at about € 573 million, indicating that the latter groups are still more in line with the invest- COLLIERS DEUTSCHLAND ment profile of specialized investors. The biggest transactions in the hotel segment include the sale of HOLDING GMBH the Grand SPA Resort A-ROSA Sylt for nearly € 63 million. The warehouse, logistics, and industry Dachauer Straße 65 segment is represented among the top ten biggest transactions so far this year by the sale of the ING D-80335 Munich Industrial Fund portfolio for about € 160 million. At the close of the first half of the year, open-ended and special real estate funds accounted for trans- TEL +49 89 540411-050 FAX +49 89 540411-199 action volume of about € 2.3 billion, just ahead of investors with an opportunistic or added value- oriented investment profile, who also accounted for about € 2.3 billion in transaction volume. Closed- ended real estate funds accounted for about € 1.9 billion, and project developers for approximately € 1.3 billion, which meant that both groups also made up noteworthy portions of the transaction vo- lume. Nearly 38% of the investors were based outside Germany. Transaction volume in the major real estate centers has increased – prime yield values re- mained more or less unchanged. Transaction volume in the major real estate centers has increased significantly in the past three months, reaching some € 4.5 billion at the end of June, slightly over the previous year’s level. Only two cities are responsible for these gains, however. Transactions including the sale of the Greentowers pushed investment volume in Frankfurt to about € 1.31 billion, an increase of 281% over the previous year; in Hamburg, investments totaled about € 1.25 billion, about 148% more than in 2010. All other cities suffered significant declines to one degree or another. The lack of major transactions such as those finalized in the first six months of 2010 resulted in lower transaction FOR FURTHER INFORMATION volumes this year, although the number of deals, and thus market activity levels, increased year on Andreas Trumpp Head of Research | Germany year in all of the cities analyzed by Colliers, in some cases by a considerable margin. Prime yield values remained unchanged in all of the cities analyzed except Hamburg and Frankfurt, the TEL +49 89 540411-040 two cities with the strongest sales figures: The prime yield for an ideal office property fell by ten base E-MAIL a.trumpp@colliers.de points from the previous quarter in both markets, to 4.70% in Hamburg and 5.20% in Frankfurt. At The information contained herein has been obtained from 4.50%, Munich remains the most expensive location. First-rate office properties are more favorably sources deemed reliable. While every reasonable effort priced in top locations in Berlin (5.00%), Düsseldorf (5.25%), and Stuttgart (5.40%). has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their Outlook. On the whole, the investment market is being buoyed by excellent overall economic trends, professional advisors prior to acting on any of the material contained in this report. positive development on the office leasing market in particular, and a lack of investment alternatives. © 2011 Colliers Deutschland Holding GmbH The focus on core products is gradually subsiding somewhat in favor of riskier investment options, although high levels of interest have not yet yielded a large number of finalized transactions. In light of the sales currently in negotiations, we stand by our annual forecast of over € 20 billion in transaction volume on the commercial investment market. For the next few months, we believe that continuing above-average demand in the office leasing mar- ket will run up against widespread declines in supply in the new construction segment. On the whole, we expect this to continue to push vacancies downward as growth in rental prices slowly assumes a Accelerating success. steady curve. P. 4 | COLLIERS INTERNATIONAL