Principals of Business Finance

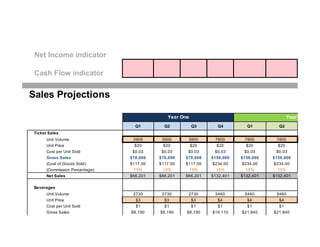

- 1. Net Income indicator Cash Flow indicator Q1 Q2 Q3 Q4 Q1 Q2 Unit Volume 3900 3900 3900 7800 7800 7800 Unit Price $20 $20 $20 $20 $20 $20 Cost per Unit Sold $0.03 $0.03 $0.03 $0.03 $0.03 $0.03 Gross Sales $78,000 $78,000 $78,000 $156,000 $156,000 $156,000 (Cost of Goods Sold) $117.00 $117.00 $117.00 $234.00 $234.00 $234.00 (Commission Percentage) 15% 15% 15% 15% 15% 15% Net Sales $66,201 $66,201 $66,201 $132,401 $132,401 $132,401 Unit Volume 2730 2730 2730 5460 5460 5460 Unit Price $3 $3 $3 $4 $4 $4 Cost per Unit Sold $1 $1 $1 $1 $1 $1 Gross Sales $8,190 $8,190 $8,190 $19,110 $21,840 $21,840 Year Two Sales Projections Year One Ticket Sales Beverages

- 2. (Cost of Goods Sold) $2,730 $2,730 $2,730 $5,460 $5,460 $5,460 (Commission Percentage) 0% 0% 0% 0% 0% 0% Net Sales $5,460 $5,460 $5,460 $13,650 $16,380 $16,380 Unit Volume 1170 1170 1170 2340 2340 2340 Unit Price $15 $15 $15 $15 $15 $18 Cost per Unit Sold $3.25 $3.25 $3.25 $3.25 $3.25 $3.25 Gross Sales $17,550 $17,550 $17,550 $35,100 $35,100 $42,120 (Cost of Goods Sold) $3,803 $3,803 $3,803 $7,605 $7,605 $7,605 (Commission Percentage) 50% 50% 50% 50% 50% 50% Net Sales $6,874 $6,874 $6,874 $13,748 $13,748 $17,258 Total Unit Volume 7,800 7,800 7,800 15,600 15,600 15,600 Total Gross Sales $103,740 $103,740 $103,740 $210,210 $212,940 $219,960 (Total Cost of Goods Sold) $6,650 $6,650 $6,650 $13,299 $13,299 $13,299 (Total Commissions Paid) $18,556 $18,556 $18,556 $37,112 $37,112 $40,622 Total Net Sales $78,534 $78,534 $78,534 $159,799 $162,529 $166,039 Assumptions: Merchanside (locked) 30% of ticket buyers buy merchandise Beverages (changeable) 70% of ticket buyers buy an average of 1 beverages Beverage Industry Average for U.S. Bar & Nightclub (estimate) 65% order drinks most to all the time with males ordering more frequently than females. Surprisingly, Millenni http://www.nciaa.com/content.aspx?page_id=22&club_id=160641&module_id=29898 Total: All Products/Services Merchandise

- 3. The average consumer order 2.3 drinks per occasion with males ordering more than females and Millennials ordering m

- 4. (803,390) Year One Year Two 2-Year Total Q3 Q4 Total Total 1 2 11700 11700 19,500 39,000 58,500 $668 $3,900 $20 $20 - - Q2 vs. Q1 $0.03 $0.03 - - 0% $234,000 $234,000 $390,000 $780,000 $1,170,000 $351.00 $351.00 Sales growing over time? 15% 15% - - 200% $198,602 $198,602 $331,003 $662,006 $993,008 points for this dynamic (allocatio your growth points 8190 8190 13,650 27,300 40,950 Perfectly Exponential $4 $5 - Perfectly Linear $1 $1 - This Forecast $32,760 $40,950 $43,680 $117,390 $161,070 As a proportion out of 100% Year OneYear Two FORECAST SUMMARY

- 5. $8,190 $8,190 points for this dynamic (allocatio 0% 0% - - - your growth points $24,570 $32,760 $30,030 $90,090 $120,120 YOUR TOTAL POINTS % Total Points Possible 3510 3510 5,850 11,700 17,550 Your Total Points $20 $20 - - - $3.25 $3.25 - - - $70,200 $70,200 $87,750 $217,620 $305,370 $11,408 $11,408 50% 50% - - - $29,396 $29,396 $34,369 $89,798 $124,166 23,400 23,400 39,000 78,000 117,000 $336,960 $345,150 $521,430 $1,115,010 $1,636,440 $19,949 $19,949 $33,248 $66,495 $99,743 $64,444 $64,444 $92,781 $206,622 $299,403 $252,568 $260,758 $395,402 $841,893 $1,237,295 rprisingly, Millennials order less frequently than older consumers

- 6. llennials ordering more than the older consumers.

- 7. 3 4 5 6 7 8 slope $3,900 $7,800 $7,800 $7,800 $11,700 $11,700 11032 7 1,576.00 Q3 vs. Q2 Q4 vs. Q3 Q1 vs. Q4 Q2 vs. Q1 Q3 vs. Q2 Q4 vs. Q3 0% 100% 0% 0% 50% 0% LINEST SLOPE L/S Sales growing over time? 1 1522.905 1,576 1 overall rate oints for this dynamic (allocation) 25% our growth points 25% Perfectly Exponential L/S = 2 Perfectly Linear L/S = 1 his Forecast L/S = 0.97 As a proportion out of 100% 48% Year One Year Two

- 8. oints for this dynamic (allocation) 75% our growth points 36% YOUR TOTAL POINTS % 61% otal Points Possible 20 Your Total Points 12

- 10. Q1 Q2 Q3 Brochures, flyers, Mobile signs, bus/metro signs, billboards ba $400 $500 $500 $500 Samples, premiums, logo merchandise, "swag" pb Print: newspaper, magazines ba $150 $150 $150 $150 Television, radio ba $250 $300 $300 $300 Television, radio pb $250 $300 $300 $300 Banner Ads, Paid Search Engine Marketing pb/ba $300 $300 $300 $350 Paid Facebook promotions, Twitter ads, Linkedin ads Social media contests, Deal-of-the-day: Groupon, Google Offers, LivingSocial sp $150 $150 $150 $200 Tweetups, Meetups l&r $100 $100 $200 $200 Sticker bombing, flyposting, Flashmobs, streetart pb $300 $250 $250 $300 Street teams, campus promotions, Crowd-sourced ads l&r $15 $20 $20 $25 Marketing Budget Purpose (optonal) Tangible Marketing Media Advertising Social Media Marketing Guerilla & Viral Marketing Networking & Client Development Activities Purpose/Strategy Key: (Optional) PB: Personal Branding BA: Brand Awareness/Brand Building SP: Product/Service Sampling, Trial L&R: Brand Loyalty/Customer Rewards Pre-Launch Year One

- 11. Launch party, Memberships, meetings, Entertaining Clients l&r Wrapped vehicles, food trucks, booths, exhibits, signs sp Design, development, programming Maintenance, hosting, domains Marketing, Public Relations Branding, Advertising $1,915 $2,070 $2,170 $2,325 Trade Shows, Events, Street Promotions Website Professional Assistance & Consultants TOTAL

- 12. Q4 Q1 Q2 Q3 Q4 $500 $750 $750 $750 $750 $5,400 $150 $150 $175 $175 $175 $1,425 $300 $400 $400 $400 $400 $3,050 $300 $400 $400 $400 $400 $3,050 $350 $350 $375 $375 $375 $3,075 $200 $200 $225 $225 $225 $1,725 $200 $250 $250 $250 $250 $1,800 $300 $325 $325 $350 $350 $2,750 $25 $30 $30 $40 $40 $245 Year Two Total One

- 13. $2,325 $2,855 $2,930 $2,965 $2,965 $22,520

- 14. Pre-Launch Year 1 Year 2 $14,984 $1,500 $1,500 $65,000 $2,000 $5,500 $220,000 $15,000 $24,500 $12,500 $975 $1,075 $24,500 $1,225 $1,225 $16,500 $8,800 $8,800 $353,484 $29,500 $42,600 Company Vehicles Research and Development Costs TOTAL Capital Expenses Capital Expenses Office Equipment, Furniture, and Supplies Remodeling Needs Industry Specific Supplies and Technical Equipment Licensing Needs (liquor license etc)

- 15. 2Live Venue Pre-Launch Q1 Q2 Q3 Q4 $0 $78,534 $78,534 $78,534 $159,799 Capital expenses $353,484 $29,500 $0 $0 $0 Salaries and wages $84,067 $126,100 $126,100 $126,100 $126,100 Employee benefits $0 $0 $0 $0 Payroll taxes $12,610 $18,915 $18,915 $18,915 $18,915 Accounting Services $1,025 $1,025 $1,025 $1,025 Rent $8,000 $8,000 $8,000 $8,000 Maintenance $1,000 $1,000 $1,000 $1,000 Legal $9,000 $375 $375 $375 $375 Insurance $1,217 $1,825 $1,825 $1,825 $1,825 Utilities $1,000 $1,500 $1,700 $1,800 $1,500 Internet & public wifi $1,995 $175 $175 $175 $175 Telephone service $75 $75 $75 $75 $75 Filing fees $450 Postage and shipping $250 Marketing $1,915 $2,070 $2,170 $2,325 $2,325 Travel $2,500 $2,500 $2,500 $2,500 $2,500 Entertainment $3,500 $1,500 $1,500 $1,500 $1,500 Bank Fees $0 $472,062 $194,560 $165,360 $165,615 $165,315 Operating Profit (472,062) (116,026) (86,826) (87,081) (5,516) Provision for taxes 0 0 0 0 0 INCOME (NET SALES) EXPENSES TOTAL EXPENSES Income Statement Year 1

- 16. (472,062) (116,026) (86,826) (87,081) (5,516)NET PROFIT

- 17. Year One Year Two Quarter 1 Quarter 2 Quarter 3 Quarter 4 Y1 Total Y2 Total 2-Year Total $162,529 $166,039 $252,568 $260,758 $395,402 $841,893 $1,237,295 $42,600 $0 $0 $0 $0 $42,600 $42,600 $157,625 $157,625 $157,625 $157,625 $504,400 $630,500 $1,134,900 $0 $0 $0 $0 $0 $0 $0 $23,644 $23,644 $23,644 $23,644 $75,660 $94,575 $170,235 $1,025 $1,025 $1,025 $1,025 $4,100 $4,100 $8,200 $8,000 $8,000 $8,000 $8,000 $32,000 $32,000 $64,000 $1,000 $1,000 $1,000 $1,000 $4,000 $4,000 $8,000 $375 $375 $375 $375 $1,500 $1,500 $3,000 $1,825 $1,825 $1,825 $1,825 $7,300 $7,300 $14,600 $1,500 $1,700 $1,800 $1,500 $6,500 $6,500 $13,000 $175 $175 $175 $175 $700 $700 $1,400 $75 $75 $75 $75 $300 $300 $600 $0 $0 $0 $0 $0 $0 $2,855 $2,930 $2,965 $2,965 $8,890 $11,715 $20,605 $10,000 $10,000 $10,000 $300 $10,000 $30,300 $40,300 $1,500 $1,500 $1,500 $1,500 $6,000 $6,000 $12,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $252,199 $209,874 $210,009 $200,009 $661,350 $829,490 $1,490,840 (89,670) (43,835) 42,559 60,749 (295,449) (30,197) $(325,646) 0 0 2,341 3,341 0 0 $0 Year Two FORECAST SUMMARY

- 18. (89,670) (43,835) 40,218 57,408 (767,511) (35,879) (803,390) Is this number positive?

- 19. Pre-Launch Q1 Q2 Q3 Q4 Starting Balance $0 $(603,562) $(720,594) $(810,673) $(902,656) Cash Ins Net sales $78,534 $78,534 $78,534 $159,799 Investments $1,000 Loans Interest income $(1,006) $(1,201) $(1,351) $(1,504) Owner contributions $7,500 TOTAL CASH INS $8,500 $77,528 $77,333 $77,183 $158,294 Cash Outs Operating expenses $472,062 $194,560 $165,360 $165,615 $165,315 Loan payments Tax payments $0 $0 $2,052 $3,551 $3,315 Contingency fund $140,000 Owner's draw (Entrepreneur) Investor's draw Other: Other: Other: Other: Other: Other: TOTAL CASH OUTS $612,062 $194,560 $167,412 $169,166 $168,630 Year 1 Cash Flow

- 20. CASH AT END OF MONTH (603,562) (720,594) (810,673) (902,656) (912,991)

- 21. Q1 Q2 Q3 Q4 $(912,991) $(1,006,294) $(1,107,217) $(1,072,797) $162,529 $166,039 $252,568 $260,758 $(1,522) $(1,677) $(1,845) $(1,788) $161,007 $164,361 $250,723 $258,970 $252,199 $209,874 $210,009 $200,009 $2,110 $5,411 $6,293 $7,457 $50,000 $50,000 $254,309 $265,285 $216,302 $257,466 Year 2

- 22. (1,006,294) (1,107,217) (1,072,797) (1,071,293)

- 23. Investment Amount ($) Equity Offered (%) Private Investor $1,000 25% Contribution Amount ($) Equity Retained (%) Owner $7,500 75% Total Capital Raised EQUITY OWNERSHIP % $1,000 25% $7,500 75% $8,500 100% Outside Investors Owners TOTAL Capital Investment aka "Shark Tank" Page Investor Name Owner Name TOTAL INVESTMENTS The Total Investment Amount (Capital) should be theamount of thelargest negative number on your Cash Flow Statement (theamount of cash you need to eliminateany and all negative cash balances throughout thetwo years whileyour business is breaking even.