Business Structures Homework Explained

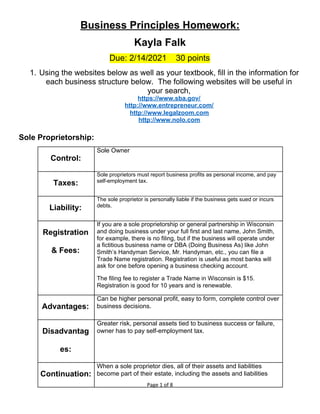

- 1. Business Principles Homework: Kayla Falk Due: 2/14/2021 30 points 1. Using the websites below as well as your textbook, fill in the information for each business structure below. The following websites will be useful in your search, https://www.sba.gov/ http://www.entrepreneur.com/ http://www.legalzoom.com http://www.nolo.com Sole Proprietorship: Page 1 of 8 Control: Sole Owner Taxes: Sole proprietors must report business profits as personal income, and pay self-employment tax. Liability: The sole proprietor is personally liable if the business gets sued or incurs debts. Registration & Fees: If you are a sole proprietorship or general partnership in Wisconsin and doing business under your full first and last name, John Smith, for example, there is no filing, but if the business will operate under a fictitious business name or DBA (Doing Business As) like John Smith’s Handyman Service, Mr. Handyman, etc., you can file a Trade Name registration. Registration is useful as most banks will ask for one before opening a business checking account. The filing fee to register a Trade Name in Wisconsin is $15. Registration is good for 10 years and is renewable. Advantages: Can be higher personal profit, easy to form, complete control over business decisions. Disadvantag es: Greater risk, personal assets tied to business success or failure, owner has to pay self-employment tax. Continuation: When a sole proprietor dies, all of their assets and liabilities become part of their estate, including the assets and liabilities

- 2. General Partnership: Page 2 of 8 generated from the business activity. Through a will, the owner’s wishes can be carried out and title to their personal assets that they used in the business can be transferred to the person who will be taking over. Control: Equal rights/control between two partners. Taxes: Taxed through personal taxes of each partner, all profits subject to self-employment tax. Liability: Each partner is equally liable legally and financially, with unlimited personal liability. Registration & Fees: The filing fee in the state of Wisconsin is $20. Advantages: Fast, easy and inexpensive to start, two perspectives, two people to fund, possibly starting a business with a friend or partner, Disadvantag es: As Dell describes it, “marriage without the sex” - many times the relationship gets tricky, liability tied to each partner’s personal assets, Continuation: Your agreement or your applicable state law may require the continuation of the business upon a partner's death. However, your deceased partner's estate becomes a transferee of the business. This means that the transferee continues to share in the partnership's profits and losses, just as the deceased person would have if he or she were alive. The transferee, though, cannot participate in any managing or voting. If the agreement does not transfer the deceased partner's share of the business to the estate, the share is calculated based on the division of the profits and debts of the company, divided among all of the partners, on the day the individual died and paid to the estate if the business's assets are higher than its debts. On the other hand, the partner's estate may owe the business money if the debts are greater than the assets.

- 3. Additional Note: Establishing a general partnership agreement between the partners is not legally required but is highly recommended. Having an agreement in place will prevent disagreements and stipulate the rules that each general partner needs to comply with. Limited Partnership: Page 3 of 8 Control: Typically one partner is in control, the other is simply an investor. Taxes: Profits taxed on personal taxes - typically proportional to ownership but should be outlined in partnership agreement, Limited partners don't pay self-employment tax on their distributive share of partnership income, but do pay self-employment tax on guaranteed payments. Liability: Limited partner only liable up to the amount of their investment Registration & Fees: The state of Wisconsin charges a filing fee of $70 to form a limited partnership. Advantages: Often extra funding by having an investor partner, ability for one partner to assert complete control with financial backing, often easier to purchase real estate, limited partners often buy private companies in hopes to increase value, Disadvantag es: Funds contributed by limited partner is the extent of their involvement and liability, for limited partner - often cannot withdraw funds without approval of other partner, the limited partner doesn’t have decision-making power, limited partner can lose limited partnership if becomes too involved and then assumes more liability Continuation: Whoever has rights to a partner’s estate after death has power of that partner’s full rights in the company.

- 4. Limited Liability Company: Additional Note: Page 4 of 8 Control: The owner or owners control(s) the company and make(s) the decisions. Taxes: In lieu of federal taxes on the company, the owner(s) can claim profits and losses on their personal taxes. Liability: The owner is not personally liable for the company’s debts or liabilities. Registration & Fees: To start an LLC in Wisconsin, you need to file Articles of Organization, which cost $130 if filed online. Advantages: Profits and losses can be passed through to owner’s personal taxes, owner shielded from liability Disadvantag es: More taxes and paperwork, may have to be dissolved with death of an owner or member, might not be suitable if end goal is to be publicly traded Continuation: In the event of a sale or transfer of the business, a business continuation agreement is the only way to ensure the smooth transfer of interests when one of the owners leaves or dies. Without a business continuation agreement, the remaining partners must dissolve the LLC and create a new one if a partner files bankruptcy or dies.

- 5. “C” Corporation: Additional Note: C corporations are mandated to hold annual meetings and have a board of directors that is voted on by shareholders. Corporations pay corporate taxes on earnings before distributing remaining amounts to the shareholders in the form of dividends. Individual shareholders are then subject to personal income taxes on the dividends they receive. Page 5 of 8 Control: Company directors, shareholders, board members, investors Taxes: Owners and shareholders are taxed separately from the corporation on profits AND the company is subject to corporate income taxation (double taxation). C corporations are required to submit state, income, payroll, unemployment, and disability taxes. Liability: C corporations limit the liability of investors and firm owners since the most that they can lose in the business's failure is the amount they have invested in it. The legal obligations of the business cannot become a personal debt obligation of any individual associated with the company. Registration & Fees: Need to file Articles of Incorporation with IRS - $100 in Wisconsin. It is required to register with the Securities and Exchange Commission (SEC) upon reaching specific thresholds. Advantages: Ability to reinvest profits in the company at a lower corporate tax rate, no one involved is personally liable beyond their investment, ability to be publicly traded. Disadvantag es: Double taxation - taxes profits at corporate and personal level, many people involved, lots of paperwork. Continuation: The C corporation continues to exist as owners change and members of management are replaced.

- 6. “S” Corporation: Additional Note: Because S corporations can disguise salaries as corporate distributions to avoid paying payroll taxes, the IRS scrutinizes how S corporations pay their employees. An S corporation must pay reasonable salaries to shareholder-employees for services rendered before distributions are made. While rare, noncompliance such as mistakes in an election, Page 6 of 8 Control: <100 shareholders. S corporation shareholders must be individuals, specific trusts and estates, or certain tax-exempt organizations. Taxes: Passes income directly to shareholders and avoids double taxation (doesn’t pay taxes at entity level), shareholders pay ordinary tax rates. Shareholders can be company employees, earn salaries, and receive corporate dividends that are tax-free if the distribution does not exceed their stock basis. If dividends exceed a shareholder's stock basis, the excess is taxed as capital gains. Liability: Owners’ personal assets are shielded from liability. Registration & Fees: Need to file Articles of Incorporation with IRS - $100 in Wisconsin. Advantages: Avoids double taxation - saves money on corporate taxes, benefit of incorporation. Registering as an S corporation may help establish credibility with potential customers, employees, suppliers, and investors by showing the owner’s formal commitment to the company. Transfer of interests in an S corporation without facing adverse tax consequences, the ability to adjust property basis, and complying with complex accounting rules. Disadvantag es: IRS scrutiny (see below), lots of paperwork that involves time and money, Continuation: When a shareholder dies, their share is passed on to their estate.

- 7. consent, notification, stock ownership, or filing requirements, may result in the termination of an S corporation. Quick rectification of noncompliance errors can avoid any adverse consequences. 2. Identify which type of business structure you will have for your mock business. Explain why you have chosen this structure. I would form an LLC to protect my personal assets should any financial or legal issue arise with the business. Additionally, being a small business, it would be beneficial to include any profits or losses in my personal taxes. 3. Using the website below search the minimum wage for Wisconsin employees? What is the minimum wage for Minnesota, Illinois, Iowa, and Michigan employees? From a business owner’s perspective, why is it important to consider the minimum wage of the neighboring states? http://www.dol.gov/whd/minwage/america.htm Wisconsin: $7.25 Illinois: $11.00 Iowa: $7.25 Michigan: $9.65 It’s important to consider minimum wage across your region to because of both business competition - other companies could have less payroll overhead and could undercut you on pricing - and hiring competition - employees could be harder to hire if a minimum wage in another state is higher and you’re not able to pay more/find suitable candidates. Additionally, income tax might be lower in an adjacent state. Possibility of tax subsidies if set up business in high areas of unemployment. 4. Location, Location, Location! Read the article, How to Find the Best Location, on Entrepreneur.com. Answer the questions below: http://www.entrepreneur.com/article/73784 a. What are some examples of demographics to consider when analyzing where to setup shop? Why should you consider the demographics of an area? Age, income, households, etc. This is important to consider in order to target a particular audience and attract them to your business via foot traffic or other ways. b. How can being located near your competitors be a “boon to business”? Landing the “perfect” customer (one possibly shopping at a nearby competitor) is beneficial - and you can benefit from their marketing efforts. Competition also breeds more business and traffic. Page 7 of 8

- 8. c. The article listed 22 questions to answer when considering the specific sites you would like to locate your business. List 5 of the 22 questions that directly relate to where you would like to set up your mock business. Describe why these questions are important to answer before you choose the exact location of your business. 1. Do the existing utilities-lighting, heating and cooling-meet your needs or will you have to do any rewiring or plumbing work? Is ventilation adequate? This would be important if I would need to store plants - both an adequate heating and cooling system would be necessary to maintain vitality. Additionally, for long-term storage, I’d need to install grow lights or a greenhouse. 2. Do people you want for customers live nearby? Is the population density of the area sufficient for your sales needs? This is important because my business should likely target an affluent area, ideally with larger properties to work with. 3. Is the facility located in a safe neighborhood with a low crime rate? This would be important to ensure my storage facility is safe and not tampered with. Such areas are also typically associated with the ideal clientele for my business. 4. Is the facility easily accessible to your potential customers? This is important if I would need to have any meetings to review plans in a meeting space - I’d need to center it near my ideal demographic. Alternatively, I’d need to commit to a satellite meeting space. This also would affect the travel to the properties of likely customers. 5. If your business expands in the future, will the facility be able to accommodate this growth? If storage would become an issue due to the expansion of business, I could simply rent a satellite storage space or condense into a larger space. 5. Identify 2 different locations you would consider as locations to set-up/start your mock business. Write those locations below and explain why those particular locations are ideal for your business. The following websites may be helpful in searching for facts on location demographics, wages, etc. Middleton, WI & Whitefish Bay, WI - a range of household and family sizes and demographics, a range of property sizes, median household income is higher. Many events happen in the area, many residents are likely to host an event at their home. Easy driving access to each of their nearby larger cities. United States Census: http://factfinder2.census.gov/faces/nav/jsf/pages/index.xhtml http://www.dol.gov/whd/minwage/america.htm http://www.bls.gov/tus/#news - American Time Use Survey (Focus: Household Activities and Leisure Activities) - Married Parents’ Use of Time Survey (Focus: Work Activities of Married Parents, Household Activities, and Leisure Activities) Page 8 of 8

- 9. http://www.bls.gov/tus/current/household.htm#a1 http://www.bls.gov/news.release/pdf/atus.pdf Small Business Associations: https://www.sba.gov/content/demographics https://www.sba.gov/content/what-sba-offers-help-small-businesses-grow https://www.nolo.com https://www.claritas.com/MyBestSegments/Default.jsp?ID=20. 6. After reading the Forbes Magazine website article, 5 Ways to Fund Your Small Business, list your thoughts and ideas as to how you would fund your mock business? http://www.forbes.com/sites/moneybuilder/2013/09/24/5-ways-to-fund-your-small-business/ As I would ideally start on the smaller side and scale as clients increase, I would likely take out a small business loan after researching any grants available to me. As jobs roll in, using the profits for direct investment into the company by continuing to purchase assets seems like a reasonable approach. The tricky part is not taking an income over the first few (likely) years and still having a business loan payment to make every month. Page 9 of 8