Daily Commodity Report: Gold edges higher

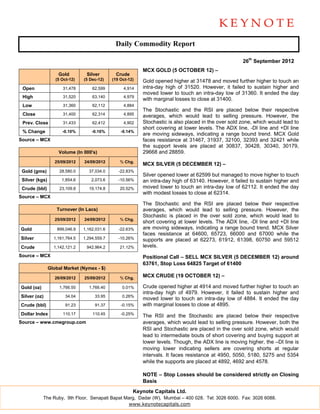

- 1. Daily Commodity Report 26th September 2012 MCX GOLD (5 OCTOBER 12) – Gold Silver Crude (5 Oct-12) (5 Dec-12) (19 Oct-12) Gold opened higher at 31478 and moved further higher to touch an Open 31,478 62,599 4,914 intra-day high of 31520. However, it failed to sustain higher and moved lower to touch an intra-day low of 31360. It ended the day High 31,520 63,140 4,979 with marginal losses to close at 31400. Low 31,360 62,112 4,884 The Stochastic and the RSI are placed below their respective Close 31,400 62,314 4,895 averages, which would lead to selling pressure. However, the Prev. Close 31,433 62,412 4,902 Stochastic is also placed in the over sold zone, which would lead to short covering at lower levels. The ADX line, -DI line and +DI line % Change -0.10% -0.16% -0.14% are moving sideways, indicating a range bound trend. MCX Gold Source – MCX faces resistance at 31467, 31937, 32100, 32393 and 32421 while the support levels are placed at 30837, 30428, 30340, 30179, Volume (In 000's) 29668 and 28859. 25/09/2012 24/09/2012 % Chg. MCX SILVER (5 DECEMBER 12) – Gold (gms) 28,580.0 37,034.0 -22.83% Silver opened lower at 62599 but managed to move higher to touch Silver (kgs) 1,854.6 2,073.6 -10.56% an intra-day high of 63140. However, it failed to sustain higher and Crude (bbl) 23,109.8 19,174.8 20.52% moved lower to touch an intra-day low of 62112. It ended the day with modest losses to close at 62314. Source – MCX The Stochastic and the RSI are placed below their respective Turnover (In Lacs) averages, which would lead to selling pressure. However, the Stochastic is placed in the over sold zone, which would lead to 25/09/2012 24/09/2012 % Chg. short covering at lower levels. The ADX line, -DI line and +DI line Gold 899,046.9 1,162,031.6 -22.63% are moving sideways, indicating a range bound trend. MCX Silver faces resistance at 64600, 65723, 66000 and 67000 while the Silver 1,161,764.5 1,294,559.7 -10.26% supports are placed at 62273, 61912, 61398, 60750 and 59512 Crude 1,142,121.2 942,964.2 21.12% levels. Source – MCX Positional Call – SELL MCX SILVER (5 DECEMBER 12) around 63761, Stop Loss 64825 Target of 61400 Global Market (Nymex - $) 26/09/2012 25/09/2012 % Chg. MCX CRUDE (19 OCTOBER 12) – Gold (oz) 1,766.50 1,766.40 0.01% Crude opened higher at 4914 and moved further higher to touch an intra-day high of 4979. However, it failed to sustain higher and Silver (oz) 34.04 33.95 0.26% moved lower to touch an intra-day low of 4884. It ended the day Crude (bbl) 91.23 91.37 -0.15% with marginal losses to close at 4895. Dollar Index 110.17 110.45 -0.25% The RSI and the Stochastic are placed below their respective Source – www.cmegroup.com averages, which would lead to selling pressure. However, both the RSI and Stochastic are placed in the over sold zone, which would lead to intermediate bouts of short covering and buying support at lower levels. Though, the ADX line is moving higher, the –DI line is moving lower indicating sellers are covering shorts at regular intervals. It faces resistance at 4950, 5050, 5180, 5275 and 5354 while the supports are placed at 4892, 4692 and 4578. NOTE – Stop Losses should be considered strictly on Closing Basis Keynote Capitals Ltd. The Ruby, 9th Floor, Senapati Bapat Marg, Dadar (W), Mumbai – 400 028. Tel: 3026 6000. Fax: 3026 6088. www.keynotecapitals.com

- 2. Commodity News: Brent climbs above $110, Iran tensions in focus Brent crude climbed above $110 a barrel on Tuesday, recovering from a more than 1% drop in the previous session, as escalating tensions surrounding Iran offset concerns about weak demand in a still-fragile global economy. Gold edges up; central banks add to bullion holdings in July and August Gold edged higher on Tuesday, defying a steady dollar, following data that showed central banks added to their bullion holdings in July and August, led by South Korea and Paraguay. Spot gold rose 0.2% to $1,766.84 an ounce by 1200 GMT. The price has risen by 4.6% so far in September and is on course for a fourth consecutive monthly gain. The rise has been sustained by anticipation that the US Federal Reserve will keep credit flowing through the economy and interest rates low by buying government bonds. Price of molasses spikes on cane shortage fears Prices of sugar cane byproducts such as molasses, alcohol and rectified spirit have increased by up to 50 per cent anticipating a shortage of the raw material in drought-hit Maharashtra and Karnataka. Molasses, which is used in making alcohol and rectified spirit, is one of the main byproducts of sugar production. Its price has increased by 50% in the last six weeks and 100% in the last four months. Economic Calendar: Countries / Wednesday Thursday Friday Monday Regions 26/Sep 27/Sep 28/Sep 01/Oct Federal Fiscal Deficit, India INR (Aug) External Debt (Q2) FX Reserves, USD (Sep 16) Core Personal MBA Mortgage Durable Goods Orders Consumption Markit Manufacturing US Applications (Sep (Aug) Expenditure - Prices PMI (Sep) 21) Index (YoY) (Aug) New Home Sales Gross Domestic Product Chicago Purchasing Construction Spending (MoM) (Aug) Annualized (Q2) Managers' Index (Sep) (MoM) (Aug) EIA Crude Oil Initial Jobless Claims Stocks change (Sep (Sep 22) 21) Euro Consumer China HSBC EUR Unemployment UK Halifax House Global Price Index (MoM) Manufacturing PMI Change (Sep) Prices (3m/YoY) (Sep) (Sep) (Sep) Spain Purchasing Euro Retail Sales EUR M3 Money Supply France Gross Domestic Manager Index (MoM) (Aug) (3m) (Aug) Product (YoY) (Q2) Manufacturing (Sep) Japan Foreign bond GBP Gross Domestic China Real Retail Sales investment (Sep 21) Product (QoQ) (Q2) (YoY) (Aug) Keynote Capitals Ltd. The Ruby, 9th Floor, Senapati Bapat Marg, Dadar (W), Mumbai – 400 028. Tel: 3026 6000. Fax: 3026 6088. www.keynotecapitals.com

- 3. Disclaimer This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of Keynote Capitals Ltd. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Keynote Capitals Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions -including those involving futures, options and other derivatives as well as non-investment grade securities - involve substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock’s price movement and trading volume, as opposed to focusing on a company’s fundamentals and as such, may not match with a report on a company’s fundamentals. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. We and our affiliates, officers, directors, and employees world wide may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (ies) discussed herein or act as advisor or lender / borrower to such company (ies) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. No part of this material may be duplicated in any form and/or redistributed without Keynote Capitals Ltd’s., prior written consent. Keynote Capitals Ltd. The Ruby, 9th Floor, Senapati Bapat Marg, Dadar (W), Mumbai – 400 028. Tel: 3026 6000. Fax: 3026 6088. www.keynotecapitals.com