Keynote technicals daily report for 150213

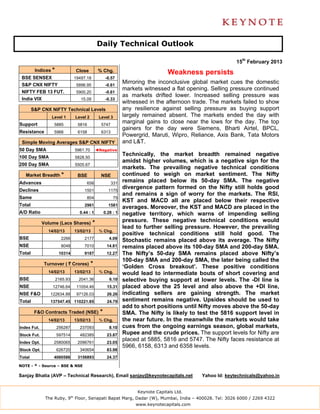

- 1. Daily Technical Outlook 15th February 2013 Indices * Close % Chg. Weakness persists BSE SENSEX 19497.18 -0.57 S&P CNX NIFTY 5896.95 -0.61 Mirroring the inconclusive global market cues the domestic markets witnessed a flat opening. Selling pressure continued NIFTY FEB 13 FUT. 5900.20 -0.61 as markets drifted lower. Increased selling pressure was India VIX 15.09 -0.33 witnessed in the afternoon trade. The markets failed to show S&P CNX NIFTY Technical Levels any resilience against selling pressure as buying support Level 1 Level 2 Level 3 largely remained absent. The markets ended the day with Support 5885 5816 5747 marginal gains to close near the lows for the day. The top gainers for the day were Siemens, Bharti Airtel, BPCL, Resistance 5966 6158 6313 Powergrid, Maruti, Wipro, Reliance, Axis Bank, Tata Motors Simple Moving Averages S&P CNX NIFTY and L&T. 50 Day SMA 5961.70 ◄Negative 100 Day SMA 5828.50 Technically, the market breadth remained negative amidst higher volumes, which is a negative sign for the 200 Day SMA 5505.67 markets. The prevailing negative technical conditions Market Breadth * BSE NSE continued to weigh on market sentiment. The Nifty Advances 656 331 remains placed below its 50-day SMA. The negative Declines 1501 1175 divergence pattern formed on the Nifty still holds good and remains a sign of worry for the markets. The RSI, Same 804 75 KST and MACD all are placed below their respective Total 2961 1581 averages. Moreover, the KST and MACD are placed in the A/D Ratio 0.44 : 1 0.28 : 1 negative territory, which warns of impending selling Volume (Lacs Shares) * pressure. These negative technical conditions would lead to further selling pressure. However, the prevailing 14/02/13 13/02/13 % Chg. positive technical conditions still hold good. The BSE 2266 2177 4.09 Stochastic remains placed above its average. The Nifty NSE 8048 7010 14.81 remains placed above its 100-day SMA and 200-day SMA. Total 10314 9187 12.27 The Nifty’s 50-day SMA remains placed above Nifty’s 100-day SMA and 200-day SMA, the later being called the Turnover ( ` Crores) * ‘Golden Cross breakout’. These positive conditions 14/02/13 13/02/13 % Chg. would lead to intermediate bouts of short covering and BSE 2165.93 2041.36 6.10 selective buying support at lower levels. The -DI line is NSE 12746.64 11054.46 15.31 placed above the 25 level and also above the +DI line, NSE F&O 122634.88 97126.03 26.26 indicating sellers are gaining strength. The market Total 137547.45 110221.85 24.79 sentiment remains negative. Upsides should be used to add to short positions until Nifty moves above the 50-day F&O Contracts Traded (NSE) * SMA. The Nifty is likely to test the 5816 support level in 14/02/13 13/02/13 % Chg. the near future. In the meanwhile the markets would take Index Fut. 256287 237093 8.10 cues from the ongoing earnings season, global markets, Stock Fut. 597514 482385 23.87 Rupee and the crude prices. The support levels for Nifty are Index Opt. 2580065 2096761 23.05 placed at 5885, 5816 and 5747. The Nifty faces resistance at 5966, 6158, 6313 and 6358 levels. Stock Opt. 626720 340654 83.98 Total 4060586 3156893 24.37 NOTE - * - Source – BSE & NSE Sanjay Bhatia (AVP – Technical Research), Email sanjay@keynotecapitals.net Yahoo Id: keytechnicals@yahoo.in Keynote Capitals Ltd. The Ruby, 9th Floor, Senapati Bapat Marg, Dadar (W), Mumbai, India – 400028. Tel: 3026 6000 / 2269 4322 www.keynotecapitals.com

- 2. Jaldi 5 (Short Term Technical Ideas for 5 Trading Days) Stop Initiation Stop Loss Stock Close Action Price Loss * (%) Target Target (%) Remarks Arvind Fut 84.70 Sell Below 84.25 85.75 1.78 81 3.86 Bharti Airtel Fut 312.90 Sell Below 312.00 317.50 1.76 300 3.85 TGT of 292 Achieved given Sell @ 301.20 on CESC Fut 292.50 Sell Below 291.20 296.25 1.73 280 3.85 14/02/13 TGT of 934 Achieved given Sell @ 965 on Fin. Tech. Fut 930.80 Sell Below 925.00 945.25 2.19 880 4.86 14/02/13 * Stop Losses are to be considered strictly on closing basis. Intra-day Resistance Intra-day Support Indices Close Pivot Point R1 R2 R3 S1 S2 S3 BSE SENSEX 19497 19527 19610 19723 19918 19414 19332 19136 S&P CNX NIFTY 5897 5907 5930 5963 6019 5874 5852 5796 NIFTY FEB 13 FUT. 5900 5893 5896 5893 5893 5896 5893 5893 Keynote Capitals Ltd. The Ruby, 9th Floor, Senapati Bapat Marg, Dadar (W), Mumbai, India – 400028. Tel: 3026 6000 / 2269 4322 www.keynotecapitals.com

- 3. Stocks To Watch Out Today HDFC, HDFC Bank, HUL, Infosys Tech; M&M, NTPC, Petroner, Sun Pharma, TCS, Ultratech Cemco AB Nuvo, Adani Enter; Adani Ports, Adani Power, Arvind, Ashok Leyland, Axis Bank, Bharti Airtel, Biocon, BPCL, Cairn India, Century Textiles, CESC, Colgate, Crompton Greaves, Cummins, DCB, Dish TV, DLF, Dr. Reddys, Escorts, Federal Bank, FT, Fortis Healthcare, GE Shipping, GMR Infra, Hexaware, HOECL, HPCL, ICICI Bank, IDBI, Idea, IFCI, Indian Hotels, India Cement, India Infoline, IOC, JSW Steel, Jubilant Foods, KotakBank, LIC Hsg; L&T, Lupin, Maruti, OFSS, OBC, Pantaloon, PFC, Powergrid, Praj, Ranbaxy, Raymond, REC, Rel .Comm; Rel. Capital, Reliance, Rel. Power, Renuka Sugar, SAIL, SBI, SCI, Sesa Goa, Siemens, Sintex, Sterlite, Syndicate Bank, Tata Motors; Tata Global, TTK Prestige, Uniphos, Videocon, Voltas, Welcorp, Wipro, Yes Bank, ZEEL NOTE: TECHNICAL ANALYSIS ABBREVATIONS SMA – Simple Moving Average EMA – Exponential Moving Average WMA – Weighted Moving Average Disclaimer This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of Keynote Capitals Ltd. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Keynote Capitals Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions -including those involving futures, options and other derivatives as well as non-investment grade securities - involve substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock’s price movement and trading volume, as opposed to focusing on a company’s fundamentals and as such, may not match with a report on a company’s fundamentals. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. We and our affiliates, officers, directors, and employees world wide may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (ies) discussed herein or act as advisor or lender / borrower to such company (ies) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. No part of this material may be duplicated in any form and/or redistributed without Keynote Capitals Ltd’s., prior written consent. Keynote Capitals Ltd. The Ruby, 9th Floor, Senapati Bapat Marg, Dadar (W), Mumbai, India – 400028. Tel: 3026 6000 / 2269 4322 www.keynotecapitals.com