Keynote technicals intraday future levels for 161112

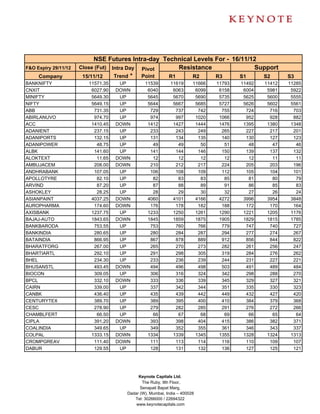

- 1. NSE Futures Intra-day Technical Levels For - 16/11/12 F&O Expiry 29/11/12 Close (Fut) Intra Day Pivot Resistance Support Company 15/11/12 Trend * Point R1 R2 R3 S1 S2 S3 BANKNIFTY 11571.35 UP 11539 11619 11666 11793 11492 11412 11285 CNXIT 6027.90 DOWN 6040 6063 6099 6158 6004 5981 5922 MINIFTY 5649.30 UP 5645 5670 5690 5735 5625 5600 5555 NIFTY 5649.15 UP 5644 5667 5685 5727 5626 5602 5561 ABB 731.35 UP 729 737 742 755 724 716 703 ABIRLANUVO 974.70 UP 974 997 1020 1066 952 928 882 ACC 1410.45 DOWN 1412 1427 1444 1476 1395 1380 1348 ADANIENT 237.15 UP 233 243 249 265 227 217 201 ADANIPORTS 132.15 UP 131 134 135 140 130 127 123 ADANIPOWER 48.75 UP 49 49 50 51 48 47 46 ALBK 141.60 UP 141 144 146 150 139 137 132 ALOKTEXT 11.65 DOWN 12 12 12 12 12 11 11 AMBUJACEM 208.00 DOWN 210 212 217 224 205 203 196 ANDHRABANK 107.05 UP 106 108 109 112 105 104 101 APOLLOTYRE 82.10 UP 82 83 83 85 81 80 79 ARVIND 87.20 UP 87 88 89 91 86 85 83 ASHOKLEY 28.25 UP 28 29 30 32 27 26 24 ASIANPAINT 4037.25 DOWN 4060 4101 4166 4272 3996 3954 3848 AUROPHARMA 174.60 DOWN 176 178 182 188 172 170 164 AXISBANK 1237.75 UP 1233 1250 1261 1290 1221 1205 1176 BAJAJ-AUTO 1843.65 DOWN 1845 1859 1875 1905 1829 1815 1785 BANKBARODA 753.55 UP 753 760 766 779 747 740 727 BANKINDIA 280.65 UP 280 284 287 294 277 274 267 BATAINDIA 866.95 UP 867 878 889 912 856 844 822 BHARATFORG 267.00 UP 265 270 273 282 261 256 247 BHARTIARTL 292.10 UP 291 298 305 319 284 276 262 BHEL 234.30 UP 233 236 239 244 231 227 221 BHUSANSTL 493.45 DOWN 494 496 498 503 491 489 484 BIOCON 309.05 UP 306 316 324 342 298 288 270 BPCL 332.10 DOWN 333 336 339 345 329 327 321 CAIRN 339.00 UP 337 342 344 351 335 330 323 CANBK 436.40 UP 435 439 442 449 432 427 420 CENTURYTEX 389.70 UP 389 395 400 410 384 379 368 CESC 278.90 UP 279 282 285 291 276 272 266 CHAMBLFERT 66.50 UP 66 67 68 69 66 65 64 CIPLA 391.20 DOWN 393 398 404 415 386 382 371 COALINDIA 349.65 UP 349 352 355 361 346 343 337 COLPAL 1333.15 DOWN 1334 1339 1345 1355 1328 1324 1313 CROMPGREAV 111.40 DOWN 111 113 114 116 110 109 107 DABUR 129.55 UP 128 131 132 136 127 125 121 Keynote Capitals Ltd. The Ruby, 9th Floor, Senapati Bapat Marg, Dadar (W), Mumbai, India – 400028 Tel: 30266000 / 22694322 www.keynotecapitals.com

- 2. NSE Futures Intra-day Technical Levels For - 16/11/12 F&O Expiry 29/11/12 Close (Fut) Intra Day Pivot Resistance Support Company 15/11/12 Trend * Point R1 R2 R3 S1 S2 S3 DENABANK 113.45 UP 113 115 116 119 112 110 107 DISHTV 79.30 UP 78 81 82 87 77 74 70 DIVISLAB 1204.55 DOWN 1205 1219 1234 1264 1190 1176 1146 DLF 210.35 UP 207 215 219 231 203 195 183 DRREDDY 1731.95 DOWN 1741 1760 1789 1837 1713 1694 1646 EXIDEIND 138.20 UP 138 140 141 144 137 135 132 FEDERALBNK 465.05 DOWN 466 470 474 482 462 458 450 FINANTECH 1175.40 DOWN 1176 1216 1257 1339 1135 1095 1013 GAIL 354.70 DOWN 356 360 365 374 351 347 338 GMRINFRA 19.40 DOWN 20 20 21 22 19 19 17 GODREJIND 308.00 UP 306 312 316 326 302 296 286 GRASIM 3244.95 DOWN 3267 3301 3358 3449 3210 3176 3085 GSPL 73.00 DOWN 74 76 78 82 72 70 66 GUJFLUORO 325.80 DOWN 326 329 331 336 323 321 316 GVKPIL 12.80 UP 13 13 13 14 12 12 11 HAVELLS 584.15 DOWN 585 589 595 605 579 575 565 HCLTECH 623.75 DOWN 625 632 640 656 617 610 595 HDFC 793.70 UP 760 829 865 970 725 656 551 HDFCBANK 647.30 UP 646 650 652 658 643 640 633 HDIL 106.35 UP 106 109 111 117 103 100 94 HEROMOTOCO 1848.25 DOWN 1852 1869 1889 1926 1832 1816 1779 HEXAWARE 107.00 UP 107 111 115 122 103 99 92 HINDALCO 111.90 UP 112 113 115 117 110 109 106 HINDPETRO 298.00 DOWN 299 302 306 312 296 293 287 HINDUNILVR 535.55 UP 535 539 542 549 532 528 521 HINDZINC 133.85 DOWN 134 136 138 142 132 131 127 IBREALEST 69.05 UP 67 71 74 80 65 61 55 ICICIBANK 1061.50 UP 1058 1067 1073 1087 1053 1044 1030 IDBI 107.50 UP 107 108 109 111 106 105 103 IDEA 95.50 UP 95 97 99 103 93 91 87 IDFC 165.60 UP 164 168 171 177 162 158 151 IFCI 30.40 UP 30 31 32 34 29 28 26 IGL 263.55 UP 261 267 270 279 258 253 244 INDHOTEL 63.90 UP 64 64 65 66 63 63 61 INDIACEM 86.80 DOWN 87 88 90 92 86 84 82 INDUSINDBK 378.35 UP 377 381 384 391 375 371 364 INFY 2304.75 DOWN 2311 2336 2368 2425 2280 2254 2198 IOB 76.75 UP 76 78 79 82 75 73 70 IOC 260.15 DOWN 261 262 264 268 259 257 254 IRB 128.70 UP 127 132 135 143 124 119 111 Keynote Capitals Ltd. The Ruby, 9th Floor, Senapati Bapat Marg, Dadar (W), Mumbai, India – 400028 Tel: 30266000 / 22694322 www.keynotecapitals.com

- 3. NSE Futures Intra-day Technical Levels For - 16/11/12 F&O Expiry 29/11/12 Close (Fut) Intra Day Pivot Resistance Support Company 15/11/12 Trend * Point R1 R2 R3 S1 S2 S3 ITC 278.10 DOWN 280 282 287 293 276 273 266 IVRCLINFRA 42.15 UP 41 43 44 47 40 38 36 JINDALSTEL 370.20 DOWN 373 378 386 399 365 359 346 JISLJALEQS 65.90 DOWN 66 67 68 70 65 64 63 JPASSOCIAT 91.15 UP 90 93 94 99 88 86 81 JPPOWER 36.60 UP 36 37 37 38 36 36 35 JSWENERGY 62.50 UP 62 63 64 67 61 59 57 JSWSTEEL 741.35 DOWN 744 751 760 776 734 727 711 JUBLFOOD 1332.45 DOWN 1340 1350 1368 1396 1322 1311 1283 KOTAKBANK 637.35 UP 631 646 655 679 623 608 584 KTKBANK 146.40 UP 145 149 151 157 143 139 133 LICHSGFIN 249.95 DOWN 250 253 256 261 247 245 239 LT 1613.05 UP 1613 1632 1652 1691 1593 1574 1535 LUPIN 578.10 DOWN 580 584 590 601 574 569 559 M&M 906.05 UP 904 912 919 933 898 889 874 MARUTI 1475.60 UP 1470 1490 1504 1539 1455 1435 1400 MCDOWELL-N 1854.25 DOWN 1864 1942 2031 2197 1776 1698 1531 MCLEODRUSS 319.00 UP 315 324 329 343 310 301 287 MPHASIS 397.20 UP 397 400 403 409 394 391 385 MRF 10192.45 DOWN 10199 10253 10314 10429 10138 10084 9969 NHPC 22.85 UP 23 23 23 24 22 22 21 NMDC 168.70 DOWN 170 173 177 183 166 164 158 NTPC 167.30 UP 167 168 169 171 166 165 163 OFSS 2860.55 UP 2857 2884 2906 2956 2834 2807 2758 ONGC 254.80 DOWN 255 257 259 263 253 251 247 OPTOCIRCUI 115.85 DOWN 116 120 123 131 112 109 102 ORIENTBANK 326.50 UP 324 332 337 351 318 310 296 PANTALOONR 192.80 DOWN 193 197 201 209 189 186 178 PEL 470.60 DOWN 473 477 484 494 467 463 452 PETRONET 161.55 DOWN 163 165 169 174 159 157 152 PFC 187.75 UP 188 191 194 200 185 181 175 PNB 767.95 UP 768 773 779 790 762 757 746 POWERGRID 120.05 UP 120 121 121 122 119 119 117 PTC 71.65 UP 71 73 74 77 70 68 65 PUNJLLOYD 52.65 UP 52 54 54 57 51 50 47 RANBAXY 529.80 DOWN 531 535 540 549 526 522 513 RAYMOND 407.25 DOWN 409 412 417 425 404 401 393 RCOM 63.90 UP 63 66 67 72 61 58 53 RECLTD 226.90 UP 226 230 234 241 222 218 210 RELCAPITAL 389.35 UP 388 394 399 411 383 377 365 Keynote Capitals Ltd. The Ruby, 9th Floor, Senapati Bapat Marg, Dadar (W), Mumbai, India – 400028 Tel: 30266000 / 22694322 www.keynotecapitals.com

- 4. NSE Futures Intra-day Technical Levels For - 16/11/12 F&O Expiry 29/11/12 Close (Fut) Intra Day Pivot Resistance Support Company 15/11/12 Trend * Point R1 R2 R3 S1 S2 S3 RELIANCE 786.00 UP 786 792 797 808 780 775 763 RELINFRA 477.20 UP 474 485 493 511 466 455 436 RENUKA 32.10 UP 32 33 33 34 31 31 29 RPOWER 95.90 DOWN 96 97 99 101 95 93 91 SAIL 79.70 DOWN 80 80 81 83 79 78 77 SBIN 2165.00 DOWN 2166 2185 2206 2245 2145 2126 2086 SESAGOA 170.65 DOWN 171 172 174 177 169 168 165 SIEMENS 674.55 DOWN 675 682 690 705 667 660 645 SINTEX 67.20 UP 67 68 69 71 66 65 62 SRTRANSFIN 634.60 UP 631 644 654 676 621 608 585 STER 99.20 DOWN 99 100 101 103 98 98 96 SUNPHARMA 684.85 UP 678 696 706 734 668 650 622 SUNTV 368.50 UP 360 381 393 425 348 328 296 SUZLON 15.10 UP 15 15 16 17 15 14 13 SYNDIBANK 123.75 UP 123 125 127 130 122 120 116 TATACHEM 318.60 DOWN 319 320 322 325 318 316 314 TATACOMM 238.20 UP 238 239 241 244 236 235 232 TATAGLOBAL 180.10 UP 178 185 190 202 173 166 154 TATAMOTORS 272.25 DOWN 272 275 277 282 270 268 263 TATAMTRDVR 165.85 DOWN 166 168 170 173 164 162 159 TATAPOWER 100.50 UP 100 101 102 103 100 99 97 TATASTEEL 377.35 DOWN 379 383 388 398 373 370 360 TCS 1300.25 DOWN 1308 1319 1338 1368 1289 1279 1249 TECHM 923.85 DOWN 930 941 958 985 913 902 875 TITAN 300.65 UP 298 306 310 323 293 285 273 UCOBANK 74.65 UP 74 76 76 79 73 72 69 ULTRACEMCO 1914.45 DOWN 1926 1971 2028 2130 1869 1824 1723 UNIONBANK 231.65 UP 231 234 236 242 228 225 220 UNIPHOS 110.00 UP 110 112 114 118 108 106 102 UNITECH 28.55 UP 28 29 30 33 27 25 23 VIJAYABANK 55.95 UP 56 57 57 59 55 54 53 VOLTAS 110.15 DOWN 111 112 114 118 109 107 104 WELCORP 102.20 UP 102 103 104 107 101 99 96 WIPRO 363.55 DOWN 365 369 374 383 360 357 348 Keynote Capitals Ltd. The Ruby, 9th Floor, Senapati Bapat Marg, Dadar (W), Mumbai, India – 400028 Tel: 30266000 / 22694322 www.keynotecapitals.com

- 5. NSE Futures Intra-day Technical Levels For - 16/11/12 F&O Expiry 29/11/12 Close (Fut) Intra Day Pivot Resistance Support Company 15/11/12 Trend * Point R1 R2 R3 S1 S2 S3 YESBANK 420.50 DOWN 421 422 424 427 419 417 414 ZEEL 199.40 UP 196 204 208 220 192 184 172 Sanjay Bhatia (AVP – Technical Research), Email Id sanjay@keynotecapitals.net Pivot Point: Intra- Day Trading Tool. - The key to the use of this tool is the use of Stop Loss Intra Day Trend: It is valid only till the point where Price trades above Pivot Point. For Eg. “UP” would be valid till Price remains above Pivot Point. It would become “DOWN” in event Price trades below Pivot Point. Pivot Point (PP): This is a trigger point for Intra Day Buy / Sell based on the price range of the previous day. R1: Resistance 1: 1st Resistance level over Pivot Point, R2: Resistance 2: Next Resistance level after R1. R3: Resistance 3: Next Resistance level after R2. S1: Support 1: 1st Support level after Pivot Point, S2: Support 2: Next Support level after S1. S3: Support 3: Next Support level after S2. Note: As per this tool, the trader should take BUY position just above the Pivot Point and keep the Pivot Point level as stop loss and the first target would be R1 level (Resistance 1). If R1 is crossed then R2 (Resistance 2) becomes the next target with the stop loss placed at R1 level. If R2 is crossed then R3 (Resistance 3) becomes the next target with the stop loss placed at R2 level. Similarly if price goes below the Pivot Point the trader should take a SELL position and keep the Pivot Point level as the stop loss and the first target would be S1 level (Support 1). If S1 level is breached then S2 level (Support 2) becomes the next target with the stop loss placed at S1 level. If S2 level is breached then S3 level (Support 3) becomes the next target with the stop loss placed at S2 level. Disclaimer: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of Keynote Capitals Ltd. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. We have reviewed the report and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Keynote Capitals Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions including those involving futures, options and other derivatives as well as non-investment grade securities involve substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock’s price movement and trading volume, as opposed to focusing on a company’s fundamentals and as such, may not match with a report on a company’s fundamentals. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. We and our affiliates, officers, directors, and employees world wide may: (a) from time to time have long or short positions in and buy or sell the securities thereof of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (ies) discussed herein or act as advisor or lender/ borrower to such company (ies) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. No part of this material may be duplicated in any form and/or redistributed without Keynote Capitals Ltd’s., prior written consent. Keynote Capitals Ltd. The Ruby, 9th Floor, Senapati Bapat Marg, Dadar (W), Mumbai, India – 400028 Tel: 30266000 / 22694322 www.keynotecapitals.com