Report on derivative securities

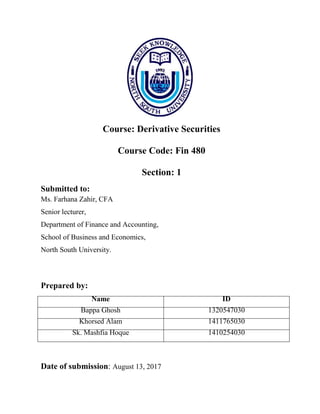

- 1. Course: Derivative Securities Course Code: Fin 480 Section: 1 Submitted to: Ms. Farhana Zahir, CFA Senior lecturer, Department of Finance and Accounting, School of Business and Economics, North South University. Prepared by: Name ID Bappa Ghosh 1320547030 Khorsed Alam 1411765030 Sk. Mashfia Hoque 1410254030 Date of submission: August 13, 2017

- 2. Letter of Transmittal August 13, 2017 Ms. Farhana Zahir Instructor, School of Business and Economics North South University. Subject: Submission of group report. Dear Madam, We are grateful to submit a group project on the derivative security analysis of Apex Footwear and Barger paint shares. All members worked perfectly and successfully in teamwork. The project has been completed by the knowledge that we have gathered from the course. The studies we have conducted have been greatly beneficial for us. The experience and knowledge gained will help us greatly in future. We would like to thank you for assigning us for the project. We have learned how to evaluate the derivative securities. We can now also apply the knowledge that we have learned in the course. This group project has given us the opportunity to combine our theoretical knowledge with a practical scenario in the market. We worked as a team to find out many things that we have learned in the class. We, therefore, would like to request you to accept our report and oblige thereby. We have put our utmost effort and dedication to make the project more successful, presentable and precise. We are highly grateful for your cooperation and guidance. Sincerely, Bappa Ghosh Khorsed Alam Sk. Mashfia Hoque

- 3. Acknowledgement We would like to express our gratitude to the people that guided and encouraged us through this study. Firstly, we would like to thank the Almighty Allah for his faithfulness and protection throughout our study that made it possible for us to finish this project. We take this great opportunity to sincerely thank a number of people and organization that has made it possible for our report. We would also like to thank our course faculty Ms. Farhana Zahir who gave us such an opportunity to work on such a project, which encouraged our knowledge before the process ever started and helped us bring it to fruition. I would also like to thank the participants that shared their information for this study. I also thank the team mates for doing their part on time. Without their participation, this term paper could not have been written so nicely. Finally, we are very proud and happy to present such a project to our faculty, hopefully, the project will meet his expectation. Thank you, Bappa Ghosh Khorsed Alam Sk. Mashfia Hoque

- 4. Executive Summary Our effort in preparing this group project has been an amazing learning experience. We are highly grateful to our honorable instructor Farhana Zahir for giving us the opportunity to do this group project. We have experienced many practical phenomena from selecting our two stocks Apex Footwear and Berger Paint to the last of the project. All of our three group members worked very hard to complete the project. Our honorable instructors advise, guidance, and support helped us in every way in conducting this project. We have gathered valuable experience in the process of doing this project. We hope this will help us in the near future. We had chosen the stocks by two methods. For Apex we used market multiplier method and for Berger paint, we used dividend discount method to value them. Then prepared the price volume chart, return distribution chart for both of the stocks. Then calculated put options price for Apex footwear and call options price for Berger paint. And lastly the Black Scholes- Merton model and compound annual growth rate (CAGR). We have learned a lot of technical things during this projects preparation.

- 5. Contents Berger Paints Bangladesh Limited.................................................................................................. 1 Reasons behind choosing this company:.............................................................................................1 Fundamental Analysis: ..........................................................................................................................1 Net Profit Growth Calculation: ............................................................................................................2 Technical Analysis:................................................................................................................................3 Multi-Stage Model:................................................................................................................................3 Interpretation of regression:..................................................................................................................5 Skewness:................................................................................................................................................6 Kurtosis: ..................................................................................................................................................6 Company Profile of Berger Paints Bangladesh Limited (BPBL):...................................................6 Apex Footwear Limited .................................................................................................................. 9 Fundamental Analysis: ..........................................................................................................................9 Price Volume Chart: ..............................................................................................................................9 Net Profit Growth Calculation: ..........................................................................................................10 Technical Analysis:..............................................................................................................................11 Market Multiplier Model....................................................................................................... 11 Market Multiple Model: ......................................................................................................................11 Interpretation of Regression: ..............................................................................................................13 Skewness:..............................................................................................................................................14 Kurtosis: ................................................................................................................................................14 Company Profile of Apex Footwear Limited (APEXFOOT): .......................................................14 Binomial Pricing........................................................................................................................... 16 Black Scholes-Merton- model ...................................................................................................... 19

- 6. 1 Berger Paints Bangladesh Limited Reasons behind choosing this company: Fundamental Analysis: • For the fundamental analysis, we first collected 9 years net profit starting from 2009 till 2017 from stockbangladesh.com • We then calculated the change in net profit by subtracting the previous year’s net profit from next year’s net profit and calculated the percentage change as well. • After that we calculated the EPS for these 9 years by dividing the net profit by number of shares outstanding. • Using these values, we found the average change in net profit for the past 9 years for Berger Paints Bangladesh Limited is 19.99% for 9 years and for 5 years it is 26.33%. So, the net profit grew up. This totally goes with the requirements given in the project outline. • To construct the price volume chart, we have taken one year’s price and volume data of Baeger Paints Bangladesh Limited from DSE website. This data was from August 03, 2016 to August 03, 2017. The price is on the left Axis and the volume is on right axis. As we

- 7. 2 can see from the chart, the price of Berger’s shares was increasing from August 3, 2016 to October 2016 after that the price had been decreasing. Net Profit Growth Calculation: Fundamental Analysis of Berger Paints Bangladesh Limited Year Net Profit Difference Change in NP Share Number EPS 2009 579,681,000 23188940 25.00 2010 704,636,000 124,955,000 21.56% 23188940 30.39 2011 721,163,000 16,527,000 2.35% 23188940 31.10 2012 752,790,000 31,627,000 4.39% 23188940 32.46 2013 860,939,000 108,149,000 14.37% 23188940 37.13 2014 1,097,609,000 236,670,000 27.49% 23188940 47.33 2015 1,425,955,000 328,346,000 29.91% 23188940 61.49 2016 1,708,289,000 282,334,000 19.80% 23188940 73.67 2017 2,392,649,000 684,360,000 40.06% 23188940 103.18 Average Change in NP in last 5 years 26.33% Average Change in NP in last 9 years 19.99%

- 8. 3 Technical Analysis: Multi-Stage Model: • We first collected 7 years EPS starting from 2010 till 2016 from stockbangladesh.com. • We collected the dividends of the company for these 7 years from their Annual report. Berger Paints Bangladesh Limited Year EPS Dividend Share NumberDPS Div payout EPS growth PE ratio 2010 30.39 347834000 23188940 15.00 49.36% 2011 31.1 417401000 23188940 18.00 57.88% 2.34% 17.68 2012 32.46 417401000 23188940 18.00 55.45% 4.37% 16.34 2013 38.8 417401000 23188940 18.00 46.39% 19.53% 22.60 2014 49.64 510156000 23188940 22.00 44.32% 27.94% 28.71 2015 64.37 742047000 23188940 32.00 49.71% 29.67% 29.57 2016 82.17 626102000 23188940 27.00 32.86% 27.65% 28.21 Average P/E ratio for last 6 years 24.51 Average dividend payout 48.00% Average growth rate 21.83% Multistage dividend growth model Year EPS DPS PV 1 2017 100.11086 48.04909706 42.6038 2 2018 121.96889 58.54005519 46.0234 3 2019 148.59937 71.32159126 49.7175 4 2020 181.04431 86.89382619 53.7081 5 2021 220.57321 105.8660764 58.0191 Terminal Value Ending EPS*Avg. P/E Ratio 5 Price 5405.9784 2962.7 Intrinsic Value 3212.78 Market price (as of June 8, 2017) 2101 The stock is undervalued by 34.60% The stock is undervalued and we should buy MarketReturn 26.89% RF 3.55% Beta 0.395582 CAPM 12.78% D1 32.89516665 K 12.78% G 21.83% V0 -363.3822984

- 9. 4 • We also gathered the data about the number of shares outstanding for these 7 years from their Annual report. • After collecting these necessary data, we calculated DPS (Dividend per Share), Dividend Payout Ratio, EPS (Earnings per Share) growth rate for the year 2010 to 2016. • Besides, we collected the P/E ratios of 7 years of the company from stockbd.com. • We then calculated the average dividend payout ratio for 7 years, average growth rate for 5 years starting from 2012 to 2016, and average PE ratio for 6 years starting from 2011 till 2016. • Using these information, we found that the average EPS over the past 7 years of Berger Paints Bangladesh Limited grew by 18.58%, average dividend payout grew up by 48% and average P/E ratio grew up by 23.85%. • We found out the risk free rate prevailing in Bangladesh by assuming that it is the rate of the one year T-bills and in Bangladesh the rate is 3.55%. • We took the growth rate we calculated, which is 18.58%. Moreover, we also calculated D1 (Dividend next year) and its value is 32.89517. • We then calculated the intrinsic value (V0) and it was -363.382. • We also forecasted the EPS, DPS and present values of the stocks for the next 5 year which starts from 2017 and ends in 2021. • After summing all the present value of the stocks and present value of the price, we found the intrinsic value of Berger Paints Bangladesh Limited. The intrinsic value is 3212.78 taka. • We found out from DSE’s website that the stocks of this company were trading at 2101 on 8th June, 2017. • So, the intrinsic value of the stock is lower than the market price. Therefore, we can conclude that the stock is undervalued. Through calculation, we found out that the stock is undervalued by 34.60%. • Investors should buy the stock since it is undervalued.

- 10. 5 Interpretation of regression: R^2 = 0.0182 This lower R^2 means that the return of Berger Paints Bangladesh Limited is weakly positively correlated to the return of DSEX index. Return of Berger moves in the same direction as DSEX index. If the return of DSEX increases (decreases) by 1, return of Berger increases (decreases) by 0.0182. Beta = 0.3796 Beta of less than 1 means the security is less risky than the entire market. Beta of 0.3796 means that systematic risk of Berger Paints Bangladesh Limited is less than the market. This lower beta will reduce the investors’ exposure to risk if they include this stock in their portfolio. This stock will give a better diversification benefit. y = 0.3796x - 0.0003 R² = 0.0182 -0.04 -0.03 -0.02 -0.01 0 0.01 0.02 0.03 0.04 0.05 0.06 -0.02 -0.015 -0.01 -0.005 0 0.005 0.01 0.015 0.02 DSEX vs Berger DSEX vs Berger Linear (DSEX vs Berger)

- 11. 6 Skewness: Berger Paints Bangladesh Limited has an Skewness of 0.36396723. Among the two stocks we have chosen, Barger has lower skewness. This lower skewness means that the stock has longer left side tail than its right tail. It indicates that there is greater chance of getting negative outcome than positive returns. On the other hand, normal distribution has equal chance of earning gains and losses. The length of both left and right tail is same in normal distribution. Kurtosis: It refers to the number of peaks in the distribution. A normal distribution has Kurtosis of three. Kurtosis of lower than normal distribution means there are less chance of getting as much return as normal distribution. Kurtosis of Berger Paints Bangladesh Limited is 2.30192. Normal distribution has a kurtosis is 3. This is referred to a platykurtic distribution. This lower skewness means that values are not that much clustered to the mean and there are frequent small changes. Here large fluctuation is less likely in the long tail. Company Profile of Berger Paints Bangladesh Limited (BPBL): Berger was incepted back in 1760 by a German individual Louis Berger, who started dry and pigment making business in England. He incorporated his family members into the business and changed the name of the company to Louis Berger & Sons Limited. Since then it gained reputation for excellence in innovation and entrepreneurship. Berger Paints started its journey in Bangladesh 0 10 20 30 40 50 60 70 80 90 -3.40% -2.99% -2.58% -2.17% -1.76% -1.35% -0.94% -0.53% -0.12% 0.29% 0.70% 1.11% 1.52% 1.93% 2.34% 2.75% 3.16% 3.57% 3.98% 4.39% 4.80% Return distribution of Berger Double Frequency

- 12. 7 in 1970. Over the past few decades the company has been the leading paint solution provider in the country with a diversified product range. BPBL has heavily invested in technology and Research & Development than any other competitor in the market. It has its dealer network throughout the country with 8 sales depots located in Dhaka, Chittagong, Rajshahi, Khulna, Bogra, Sylhet, Comilla, and Mymenshing. BPBL has the mission to increase its turnover by 100% in every 5 years. 95% of BPBL’s share is owned by its directors, 0.49% is owned by the general public. The main activity of the company is manufacturing and marketing liquid and non-liquid paints and varnishes, emulsion and coating. The product range includes specialized outdoor paints, Color Bank, Superior Marine Paints, Textured Coatings, Heat Resistant Paints, Roofing Compounds, Epoxies and Power Coatings and many more. Berger Paints Bangladesh Limited Market Capitalization 49,404,036,670 Shareholders' Equity 4,322,816,000 Free Float (5%) 2470201834 Net Profit (Q2 2017) 426,737,000 Total Share 23,188,940 EPS (Q2 2017) 18.40260917 Annual EPS (Stock BD) 73.6 Market price per share (5-08-2017) 2,148 P/E Ratio 29.18478261 Book value per Share 186.42 Price to Book 11.52236884 Sales 14,128,113,000 Sales per Share 609.2608373 Price to sales 3.525583574

- 13. 8 Cashflow 804,331,000 Cashflow per share 34.6859753 Price to cashflow 61.92704635 Dividend per share 27.00 Price per share 2,148 Dividend yield 1.257% CAGR using earnings: Earning 2011 721,163,000 Earning 2016 1,794,415,000 CAGR (Earning) 19.999% CAGR using revnues: Revenue 2011 6,321,274,000 Revenue 2016 14,128,113,000 CAGR (Revenue) 17.451%

- 14. 9 Apex Footwear Limited Fundamental Analysis: • The fundamental analysis of Apex is done in exactly the same way we did the fundamental analysis of Berger. • For the fundamental analysis, we first collected 10 years net profit starting from 2007 till 2016 from stockbangladesh.com. • We then calculated the change in net profit by subtracting the previous year’s net profit from next year’s net profit and calculated the percentage change as well. • After that we calculated the EPS for these 10 years by dividing the net profit by number of shares outstanding. • Using these values, we found the average change in net profit for the past 10 years for Berger Paints Bangladesh Limited is -55.30% for 5years and for 10 years it is -19.58%. This totally goes with the requirements given in the project outline. Price Volume Chart: • To construct the price volume chart, we have taken one year’s price and volume data of Apex footwear Limited from DSE website. This data was from August 03, 2016 to August

- 15. 10 03, 2017. The price is on the left Axis and the volume is on right axis. As we can see from the chart, the price of Apex’s shares very high in November 2016. Through the price had been fluctuating. Net Profit Growth Calculation: Year Net Profit Difference Change in NP Share Number EPS 2007 169,358,000 1,125,000 150.54 2008 189,827,956 20,469,956 12.09% 1,125,000 168.74 2009 211,532,251 21,704,295 11.43% 1,125,000 188.03 2010 228,226,667 16,694,416 7.89% 11,250,000 20.29 2011 261,011,193 32,784,526 14.36% 11,250,000 23.20 2012 258,854,949 -2,156,244 -0.83% 11,250,000 23.01 2013 265,633,182 6,778,233 2.62% 11,250,000 23.61 2014 203,094,736 -62,538,446 -23.54% 11,250,000 18.05 2015 -138,493,402 -341,588,138 -168.19% 11,250,000 -12.31 2016 -94,051,040 44,442,362 -32.09% 11,250,000 -8.36 Average Change in NP in last 5 years -55.30% Average Change in NP in last 10 years -19.58%

- 16. 11 Technical Analysis: Market Multiplier Model: APEX FOOTWEAR LIMITED (Market Multiplier) P/E APEX TANNERY LIMITED 72.04 BATA SHOE 22.5 APEX FOOTWEAR LIMITED 27.43 SAMATA LEATHER COMPLEX LTD -303 LEGACY FOOTWEAR LTD 286.25 Fortune Shoes Limited 25.06 Average P/E 21.71 Market Multiple Model: • In order to use the Market Multiple Model, we took the P/E ratio of 6 different companies from the Leather and Footwear industry. • By using the average function in excel, we averaged the P/E ratios of these 6 companies and calculated the industry P/E. • We collected the company EPS from stockbangladesh.com. • We then calculated the intrinsic value of Apex’s stock by multiplying the industry P/E with the company EPS. The intrinsic value is 277.224 taka. • From the DSE website we found out that the price of the stock on 12th June, 2017 was 342.3 taka. • Therefore, we concluded that the stock is overvalued by 20.83%. • Thus, we can say that investors should sell the stocks of Apex. Industry PE 21.71 Company EPS 12.48 Intrinsic value 270.9824 Price 12th June 342.3 overvalued by percentage 20.83% The stock is overvalued so we will not buy it

- 17. 12 Revenue Growth Operating Profit Growth ROA ROE Apex Tannery 0.000% 8.862% -1.012% -1.670% Bata Shoe 3.071% 19.392% 15.914% 29.326% Apex Footwear 45.608% -0.187% -0.709% -3.796% Samata Leather Complex -44.559% -549.118% -0.885% -1.020% Legacy Footwear -66.537% -73.587% 0.346% 0.676% Fortune Shoes 6.333% 7.470% Average -12.483% -118.927% 3.331% 5.164% • Here we can see that Apex Footwear has a higher PE ratio than the industrial average. It also has a higher revenue and operating profit growth rate than the industrial average. But the company has a lower ROA & ROE than the industry average. So, we think it to be highly priced. • We found out that the intrinsic value of company’s share is BDT 270.9824 but it is being traded in DSE at 342.3 on June 12, 2017. On the other hand, the ROA & ROE of Apex is lower than the industry average. So, the company’s share price is overvalued by 20.83% and it should be sold.

- 18. 13 Interpretation of Regression: R^2 = .0102 There is a weak positive correlation between DSEX index and Apex Footwear. Return of Apex and DSEX will move in the same direction but the degree of movement in low. If return of DSEX increases (decreases) by 1, return of Apex will increase (decrease) by 0.0102. Beta = 0.3256 As the beta is less than 1, Apex Footwear is less risky than the market. So, the stock will give the investors a better diversification benefit by reducing the amount of risk exposure. y = 0.3256x - 2E-05 R² = 0.0102 -0.05 -0.04 -0.03 -0.02 -0.01 0 0.01 0.02 0.03 0.04 0.05 0.06 -0.02 -0.015 -0.01 -0.005 0 0.005 0.01 0.015 0.02 DSEX vs Apex DSEX vs Apex Linear (DSEX vs Apex)

- 19. 14 Skewness: Apex Footwear Limited has a Skewness of 0.61811052. Among the two stocks we have chosen, Apex has higher skewness. This higher skewness means that the stock has longer right tail than its left tail. It indicates that there is greater chance of getting positive outcome than negative returns. On the other hand, normal distribution has equal chance of earning gains and losses. The length of both left and right tail is same in normal distribution. So, among the two stocks, Apex will generate a higher return. Kurtosis: It is used to describe the distribution or skewness of observed data around mean. A normal distribution has Kurtosis of three. Kurtosis of lower than normal distribution means there are less chance of getting as much return as normal distribution. Kurtosis of Apex Footwear Limited is 1.202096. Normal distribution has a kurtosis is 3. This is referred to a platykurtic distribution. This lower skewness means that values are not that much clustered around the mean and there are frequent small changes. Here large fluctuation is less likely to be occurred in the long tail as happens in normal distribution. Company Profile of Apex Footwear Limited (APEXFOOT): APEXFOOT is the leading footwear manufacturer and exporter of Bangladesh. It exports its shoes to the major retailers in Western Europe, North America, and Japan. APEXFOOT is the pioneer of the export in leather sector of Bangladesh. It is also the second largest shoe retail network of the Bangladesh. The company has the capacity to produce 5,616,582 pairs of sandals and 0 10 20 30 40 50 Return distribition of Apex Footwear Double Frequency

- 20. 15 5,616,582 pairs of shoes. APEXFOOT established in 1990. It is utilized most modern state of art machinery for production of footwear and all its manufacturing operations are automated and manual both. Most of the leather use in this factory is tanned and developed by its sister concern. It can produce 20,000 pairs of complete shoes per day. Apex footwear Limited Market Capitalization 3,898,125,000 Shareholders' Equity 2,477,498,441 Free Float (80.9%) 3153583125 Net Profit (Q1 2017) 45,880,000 Total Share 11,250,000 EPS (Q1 2017) 4.078222222 Annual EPS (Stock BD) 12.48 Market price per share (5-08-2017) 347 P/E Ratio 27.82051282 Book value per Share (Lanka BD) 220.22 Price to Book 1.576605213 Sales 16,692,333,081 Sales per Share 1483.762941 Price to sales 0.233999644 Cashflow 206,680,739 Cashflow per share 18.37162124 Price to cashflow 18.89871315 Dividend per share (50%) 5.00 Price per share 347

- 21. 16 Dividend yield 1.440% CAGR using earnings: Earning 2010-2011 261,011,193 Earning 2015-2016 -34,339,740 CAGR (Earning) -166.654% CAGR using revnues: Revenue 2010-2011 9,499,256,667 Revenue 2015-2016 16,692,333,081 CAGR (Revenue) 11.935% Binomial Pricing Berger Paint Bangladesh Limited (Call Option) So (Spot price) 2,122 Rf (Risk free rate) 4.47% X (Exercise Price) 2440.3 u (Up factor) 1.15 d (Down factor) 0.85 ƛ(Risk neutral probability of going up) 64.90% 1-ƛ (Risk neutral probability of going down) 35.10%

- 22. 17 YEAR-1 YEAR-2 S++ 2806.345 64.90% C++ 366.045 S+ 2440.3 64.90% C+ 227.3985 35.10% S+- 2074.255 S0= 2,122 C+- 0 C0= 141.267 64.90% 35.10% S- 1803.7 C- 0 35.10% S-- 1533.145 C-- 0 Apex Footwear Limited (Put Option) So (Spot price) 348 Rf (Risk free rate) 4.47% X (Exercise Price) 295.8 u (Up factor) 1.15

- 23. 18 d (Down factor) 0.85 ƛ (Risk neutral probability of going up) 64.900% 1-ƛ (Risk neutral probability of going down) 35.100% S++ 460.23 C++ 0 64.900% S+ 400.2 C+ 0 64.900% 35.100% S+- 340.17 C+- 0 S0= 348 C0= 5.008648 64.900% 35.100% S- 295.8 C- 14.9075 35.100% S-- 251.43 C-- 44.37

- 24. 19 Black Scholes-Merton- model Black Scholes-Merton- model Berger Paints Bangladesh Limited Apex Footwear Limited Current stock price, So 2,122 Current stock price, So 348 Exercise price, X 2440.3 Exercise price, X 295.8 T 2 T 2 1.414214 1.414214 Volatility 0.180611 Volatility 0.207192 Rf, Risk free rate 4.37% Rf, Risk free rate 4.37% d1 -0.07706 d1 0.999635 d2 -0.33248 d2 0.706621 N(d1) 0.469289 N(d1) 0.841256 N(d2) 0.369764 N(d2) 0.760099 Call Option Price, C 169.0626 Put Option Price, P 9.777241 Formula Used: Call Option price (C): S0N(d1) – Xe-rcTN(d2) Put Option price (P): Xe-rcT[1 - N(d2)] – S0[1-N(d1)] 𝑑1 = ln ( So X ) + [rc + ( σ2 2 ] T σ√T 𝑑2 = 𝑑1 ∗ σ√T

- 25. 20