Frequently Asked Questions about Not-for-Profit Audits

•

0 j'aime•315 vues

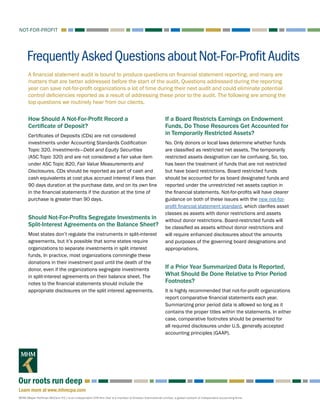

A financial statement audit is bound to produce questions on financial statement reporting, and many are matters that are better addressed before the start of the audit. Questions addressed during the reporting year can save not-for-profit organizations a lot of time during their next audit and could eliminate potential control deficiencies reported as a result of addressing these prior to the audit. The following are among the top questions we routinely hear from our clients.

Signaler

Partager

Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

Recommandé

The time has come for public companies to adopt the new revenue recognition standard. Early adopters have already given us an indication of what the audit risks will be, and they've also been the guinea pig for comments from regulators. As expected, the adoption and application of the new guidance is an item that the Securities and Exchange Commission (SEC) is paying attention to, already having sent comment letters to several early adopters. The ongoing public company adoption and comment process is important for private companies as well. The questions the SEC raised will influence how certain types of contracts are approached and the types of information that will be expected to comply with the disclosure requirements.Three Questions Regulators May Have About Your Revenue Recognition Adoption

Three Questions Regulators May Have About Your Revenue Recognition AdoptionMHM (Mayer Hoffman McCann P.C.)

Contenu connexe

Tendances

The time has come for public companies to adopt the new revenue recognition standard. Early adopters have already given us an indication of what the audit risks will be, and they've also been the guinea pig for comments from regulators. As expected, the adoption and application of the new guidance is an item that the Securities and Exchange Commission (SEC) is paying attention to, already having sent comment letters to several early adopters. The ongoing public company adoption and comment process is important for private companies as well. The questions the SEC raised will influence how certain types of contracts are approached and the types of information that will be expected to comply with the disclosure requirements.Three Questions Regulators May Have About Your Revenue Recognition Adoption

Three Questions Regulators May Have About Your Revenue Recognition AdoptionMHM (Mayer Hoffman McCann P.C.)

Tendances (20)

Global Withholding On Restricted Stock And Restricted Stock Units - Ohio NA...

Global Withholding On Restricted Stock And Restricted Stock Units - Ohio NA...

Private Company // Long Term Incentive Plan Design Template Guidance

Private Company // Long Term Incentive Plan Design Template Guidance

FTI: Financial Statement Frauds - Chinese-Style (Article)

FTI: Financial Statement Frauds - Chinese-Style (Article)

Forensic Accounting Examination in a Minority Shareholder Oppression Case

Forensic Accounting Examination in a Minority Shareholder Oppression Case

Financial audits reasons behind failures & some suggestions

Financial audits reasons behind failures & some suggestions

FTI: Financial Statement Frauds - Chinese-Style (Presentation)

FTI: Financial Statement Frauds - Chinese-Style (Presentation)

Financial Reports - Relevant Information for Enhanced Performance

Financial Reports - Relevant Information for Enhanced Performance

Fairness Considerations in Going Private Transactions

Fairness Considerations in Going Private Transactions

Fairness Considerations in Going Private Transactions

Fairness Considerations in Going Private Transactions

Three Questions Regulators May Have About Your Revenue Recognition Adoption

Three Questions Regulators May Have About Your Revenue Recognition Adoption

Smooth Sailing for a Successful IPO: Finance & Legal Tips for Going Public an...

Smooth Sailing for a Successful IPO: Finance & Legal Tips for Going Public an...

Similaire à Frequently Asked Questions about Not-for-Profit Audits

Similaire à Frequently Asked Questions about Not-for-Profit Audits (20)

Comparing The Annual Financial Statements Of H&Amp;M And A&Amp;F

Comparing The Annual Financial Statements Of H&Amp;M And A&Amp;F

Financial Account group assignment on Financial statement of Golden Agriculture

Financial Account group assignment on Financial statement of Golden Agriculture

No More Smoke and Mirrors: Knowing and Demonstrating Business Numbers

No More Smoke and Mirrors: Knowing and Demonstrating Business Numbers

Why is the process of financial reporting important.pdf

Why is the process of financial reporting important.pdf

First, the retained earnings increased by 85.35 compared from

First, the retained earnings increased by 85.35 compared from

GAAP Accounting Update: A Review of Recent Changes in GAAP - Derek Daniel

GAAP Accounting Update: A Review of Recent Changes in GAAP - Derek Daniel

AUDITING Accounts PayableDiscussion TopicIm Done Top .docx

AUDITING Accounts PayableDiscussion TopicIm Done Top .docx

Best Practices in Accounting for Fundraising Costs

Best Practices in Accounting for Fundraising Costs

Kingdom of Saudi ArabiaMinistry of EducationUniversity of Ha.docx

Kingdom of Saudi ArabiaMinistry of EducationUniversity of Ha.docx

Financial Accounting Standards Board For Profit And...

Financial Accounting Standards Board For Profit And...

Plus de MHM (Mayer Hoffman McCann P.C.)

Air date: Oct. 15, 2018

Recording available at http://www.mhmcpa.com

Lease accounting underwent a major revision with the issuance of the Financial Accounting Standards Board’s Accounting Standards Update 2016-02, Leases (Topic 842). The update made adjustments to the recording of leases and this course will specifically discuss the changes in lessor accounting. We'll also discuss where lessees may struggle with implementation and where they may look for help from lessors in these lease contracts.Webinar Slides: Changes to Lessor Accounting under the New Leasing Standard

Webinar Slides: Changes to Lessor Accounting under the New Leasing StandardMHM (Mayer Hoffman McCann P.C.)

Air date: Oct. 2, 2018

Recording available at http://www.mhmcpa.com

This quarterly webinar will bring you up-to-date on hot topics, technical matters and current events impacting financial reporting and the accounting profession.

Professionals from CBIZ and MHM will discuss recent happenings at the Financial Accounting Standards Board, American Institute of Certified Public Accountants, Securities and Exchange Commission, Public Company Accounting Oversight Board and other relevant governance bodies. We will also touch on recent tax changes and proposed legislation.Webinar Slides: Third Quarter Accounting and Financial Reporting Issues Update

Webinar Slides: Third Quarter Accounting and Financial Reporting Issues UpdateMHM (Mayer Hoffman McCann P.C.)

Air date: Oct. 1, 2018

Recording available at http://www.mhmcpa.com

Public companies are adopting the new revenue recognition standard under ASC Topic 606 for 2018, and private companies won’t be far behind. Our webinar will cover lessons learned from early adopters and steps your organization can take now to make the necessary changes and process updates.Webinar Slides: Your Guide to Adopting the New Revenue Recognition Standard

Webinar Slides: Your Guide to Adopting the New Revenue Recognition StandardMHM (Mayer Hoffman McCann P.C.)

Air date: Sept. 28, 2018

Recording available at http://www.mhmcpa.com

New revenue recognition standards under ASC Topic 606 and changes to ASC Topic 958 are taking effect, and not-for-profit organizations should be getting ready. Tax-exempt entities will need to consider transactions other than contributions and investment returns in order to correctly record revenue under the new accounting criteria. Not-for-profits must also consider the guidance that was recently released clarifying how the new standards relate to contributions made and received.

In our webinar, we will discuss how not-for-profit organizations can prepare for the changes, which are effective for years ended December 31, 2018 for conduit debt issuers and for years ended December 31, 2019 for others.Webinar Slides: How Not-for-Profit Organizations Can Prepare for Revenue Reco...

Webinar Slides: How Not-for-Profit Organizations Can Prepare for Revenue Reco...MHM (Mayer Hoffman McCann P.C.)

Air date: Aug. 15, 2018

Recording at http://www.mhmcpa.com

The 20% QBI deduction under Section 199A affects all businesses other than C corporations. The pervasive importance of this complicated new deduction has attracted extraordinary interest in IRS regulations to help resolve many ambiguities in the law. Join us as we unpack these new and anxiously awaited regulations.Webinar Slides: Now Arriving - Qualified Business Income Deduction Regulation...

Webinar Slides: Now Arriving - Qualified Business Income Deduction Regulation...MHM (Mayer Hoffman McCann P.C.)

Original air date: Aug. 14, 2018

Recording available at http://www.mhmcpa.com

Administrative, legislative and judicial updates emerge from Washington each quarter that may affect your business. Our free, quarterly webinars provide insight to help prepare you for the tax developments of the most interest to you, your business and other interested stakeholders.

Our Eye on Washington webinars assist CEOs, CFOs, financial executives and advisors, and other interested parties in navigating the complex tax environment. From federal tax reform to IRS guidance and healthcare reform, topics covered will provide the up-to-date information you need to help you plan for the future.Webinar Slides: Eye on Washington - Quarterly Business Tax Update, Q2 2018

Webinar Slides: Eye on Washington - Quarterly Business Tax Update, Q2 2018MHM (Mayer Hoffman McCann P.C.)

Sometimes a revision to an accounting standard will have an impact that takes a while to become apparent to the financial reporting community. Accounting standard changes tend to affect financial statements, and so changes to the financial statements may affect the business operations that rely on them, such as lending arrangements.How to Prepare Debt Covenants for Recent Changes to the Accounting for Debt I...

How to Prepare Debt Covenants for Recent Changes to the Accounting for Debt I...MHM (Mayer Hoffman McCann P.C.)

Original air date: July 2, 2018

Recording at http://www.mhmcpa.com

This quarterly webinar will bring you up-to-date on hot topics, technical matters and current events impacting financial reporting and the accounting profession.

Professionals from CBIZ and MHM will discuss recent happenings at the Financial Accounting Standards Board, American Institute of Certified Public Accountants, Securities and Exchange Commission, Public Company Accounting Oversight Board and other relevant governance bodies. We will also touch on recent tax changes and proposed legislation.Webinar Slides: Second Quarter Accounting and Financial Reporting Issues Update

Webinar Slides: Second Quarter Accounting and Financial Reporting Issues UpdateMHM (Mayer Hoffman McCann P.C.)

On June 21, 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2018-08, Not-for-Profit Entities (Topic 958): Clarifying the Scope and the Accounting Guidance for Contributions received and Contributions Made, which provides accounting guidance around contributions of cash and other assets received and made by not-for-profit organizations and business enterprises.Guidance Issued Regarding Contributions Made and Received for Not-for-Profit ...

Guidance Issued Regarding Contributions Made and Received for Not-for-Profit ...MHM (Mayer Hoffman McCann P.C.)

Original air date: May 17, 2018

Recording at http://www.mhmcpa.com

Service businesses that transact business across state lines and nationally are subject to state income taxes in many jurisdictions. The tax laws for each state are different, including the manner in which states determine the location of sales for apportionment purposes. Service businesses must contend with varying rules to determine the state to which sales revenues should be assigned.

This webinar will examine the common approaches utilized by state taxing jurisdictions to source service revenue in order to provide an overview of the principles involved.Webinar Slides: Source Your Sales - A Multi-State Primer for Apportionment in...

Webinar Slides: Source Your Sales - A Multi-State Primer for Apportionment in...MHM (Mayer Hoffman McCann P.C.)

Original air date: May 15, 2018

Recording available at http://www.mhmcpa.com

Administrative, legislative and judicial updates emerge from Washington each quarter that may affect your business. Our free, quarterly webinars provide insight to help prepare you for the tax developments of the most interest to you, your business and other interested stakeholders.

Our Eye on Washington webinars assist CEOs, CFOs, financial executives and advisors, and other interested parties in navigating the complex tax environment. From federal tax reform to IRS guidance and healthcare reform, topics covered will provide the up-to-date information you need to help you plan for the future.Webinar Slides: Eye on Washington - Quarterly Business Tax Update Q1 2018

Webinar Slides: Eye on Washington - Quarterly Business Tax Update Q1 2018MHM (Mayer Hoffman McCann P.C.)

Original air date: Dec. 20, 2017

Recording available at http://www.mhmcpa.com

A number of updates from the SEC and the Financial Accounting Standards Board (FASB) have had an effect on public company accounting and SEC reporting. The AICPA Conference on Current SEC and PCAOB Developments, held December 4-6 in Washington D.C., highlights some of the key topics that will have an impact on SEC registrants and other public business entities moving forward.

Members of our team who attended the conference will provide a debriefing on the key points, tips and other guidance shared at the conference.Webinar Slides: AICPA Conference on Current SEC and PCAOB Developments Debrief

Webinar Slides: AICPA Conference on Current SEC and PCAOB Developments DebriefMHM (Mayer Hoffman McCann P.C.)

Plus de MHM (Mayer Hoffman McCann P.C.) (20)

Webinar Slides: Changes to Lessor Accounting under the New Leasing Standard

Webinar Slides: Changes to Lessor Accounting under the New Leasing Standard

CBIZ & MHM Executive Education Series Webinar Overview - Q4 2018

CBIZ & MHM Executive Education Series Webinar Overview - Q4 2018

Webinar Slides: Third Quarter Accounting and Financial Reporting Issues Update

Webinar Slides: Third Quarter Accounting and Financial Reporting Issues Update

Webinar Slides: Your Guide to Adopting the New Revenue Recognition Standard

Webinar Slides: Your Guide to Adopting the New Revenue Recognition Standard

Webinar Slides: How Not-for-Profit Organizations Can Prepare for Revenue Reco...

Webinar Slides: How Not-for-Profit Organizations Can Prepare for Revenue Reco...

Webinar Slides: Now Arriving - Qualified Business Income Deduction Regulation...

Webinar Slides: Now Arriving - Qualified Business Income Deduction Regulation...

Webinar Slides: Eye on Washington - Quarterly Business Tax Update, Q2 2018

Webinar Slides: Eye on Washington - Quarterly Business Tax Update, Q2 2018

Public Companies Catch a Break with Leasing Standard Update

Public Companies Catch a Break with Leasing Standard Update

How to Prepare Debt Covenants for Recent Changes to the Accounting for Debt I...

How to Prepare Debt Covenants for Recent Changes to the Accounting for Debt I...

Webinar Slides: Second Quarter Accounting and Financial Reporting Issues Update

Webinar Slides: Second Quarter Accounting and Financial Reporting Issues Update

Guidance Issued Regarding Contributions Made and Received for Not-for-Profit ...

Guidance Issued Regarding Contributions Made and Received for Not-for-Profit ...

FASB Simplifies Accounting for Non-employee Stock-based Compensation

FASB Simplifies Accounting for Non-employee Stock-based Compensation

Webinar Slides: Key International Tax Considerations

Webinar Slides: Key International Tax Considerations

Webinar Slides: The Latest on the New Partnership Audit Rules

Webinar Slides: The Latest on the New Partnership Audit Rules

Webinar Slides: Source Your Sales - A Multi-State Primer for Apportionment in...

Webinar Slides: Source Your Sales - A Multi-State Primer for Apportionment in...

Webinar Slides: Eye on Washington - Quarterly Business Tax Update Q1 2018

Webinar Slides: Eye on Washington - Quarterly Business Tax Update Q1 2018

Webinar Slides: AICPA Conference on Current SEC and PCAOB Developments Debrief

Webinar Slides: AICPA Conference on Current SEC and PCAOB Developments Debrief

Dernier

(NEHA) Call Girls Nagpur Call Now: 8250077686 Nagpur Escorts Booking Contact Details WhatsApp Chat: +91-8250077686 Nagpur Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus, they look fabulously elegant, making an impression. Independent Escorts Nagpur understands the value of confidentiality and discretion; they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide: (NEHA) Call Girls Nagpur Call Now 8250077686 Nagpur Escorts 24x7

(NEHA) Call Girls Nagpur Call Now 8250077686 Nagpur Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Top Rated Pune Call Girls Bhosari ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Bhosari ⟟ 6297143586 ⟟ Call Me For Genuine Sex Ser...

Top Rated Pune Call Girls Bhosari ⟟ 6297143586 ⟟ Call Me For Genuine Sex Ser...Call Girls in Nagpur High Profile

Top Rated Pune Call Girls Dapodi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Service At Affordable Rate

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Top Rated Pune Call Girls Dapodi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...

Top Rated Pune Call Girls Dapodi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...Call Girls in Nagpur High Profile

celebrity 💋 Agra Escorts Just Dail 8250092165 service available anytime 24 hour

Booking Now open +91- 8005736733

Why you Choose Us- +91- 8005736733

HOT⇄ 8005736733

Mr ashu ji

Call Mr ashu Ji +91- 8005736733

𝐇𝐨𝐭𝐞𝐥 𝐑𝐨𝐨𝐦𝐬 𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐑𝐚𝐭𝐞 𝐒𝐡𝐨𝐭𝐬/𝐇𝐨𝐮𝐫𝐲🆓 .█▬█⓿▀█▀ 𝐈𝐍𝐃𝐄𝐏𝐄𝐍𝐃𝐄𝐍𝐓 𝐆𝐈𝐑𝐋 𝐕𝐈𝐏 𝐄𝐒𝐂𝐎𝐑𝐓

Hello Guys ! High Profiles young Beauties and Good Looking standard Profiles Available , Enquire Now if you are interested in Hifi Service and want to get connect with someone who can understand your needs.

Service offers you the most beautiful High Profile sexy independent female Escorts in genuine ✔✔✔ To enjoy with hot and sexy girls ✔✔✔$V15

★providing:-

• Models

• vip Models

• Russian Models

• Foreigner Models

• TV Actress and Celebrities

• Receptionist

• Air Hostess

• Call Center Working Girls/Women

• Hi-Tech Co. Girls/Women

• Housewife

celebrity 💋 Agra Escorts Just Dail 8250092165 service available anytime 24 hour

celebrity 💋 Agra Escorts Just Dail 8250092165 service available anytime 24 hourCall Girls in Nagpur High Profile

Dernier (20)

VIP Call Girls Agra 7001035870 Whatsapp Number, 24/07 Booking

VIP Call Girls Agra 7001035870 Whatsapp Number, 24/07 Booking

The Economic and Organised Crime Office (EOCO) has been advised by the Office...

The Economic and Organised Crime Office (EOCO) has been advised by the Office...

Booking open Available Pune Call Girls Shukrawar Peth 6297143586 Call Hot In...

Booking open Available Pune Call Girls Shukrawar Peth 6297143586 Call Hot In...

Call Girls Nanded City Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Nanded City Call Me 7737669865 Budget Friendly No Advance Booking

(NEHA) Call Girls Nagpur Call Now 8250077686 Nagpur Escorts 24x7

(NEHA) Call Girls Nagpur Call Now 8250077686 Nagpur Escorts 24x7

Top Rated Pune Call Girls Bhosari ⟟ 6297143586 ⟟ Call Me For Genuine Sex Ser...

Top Rated Pune Call Girls Bhosari ⟟ 6297143586 ⟟ Call Me For Genuine Sex Ser...

A Press for the Planet: Journalism in the face of the Environmental Crisis

A Press for the Planet: Journalism in the face of the Environmental Crisis

Top Rated Pune Call Girls Dapodi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...

Top Rated Pune Call Girls Dapodi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Serv...

The U.S. Budget and Economic Outlook (Presentation)

The U.S. Budget and Economic Outlook (Presentation)

Call On 6297143586 Viman Nagar Call Girls In All Pune 24/7 Provide Call With...

Call On 6297143586 Viman Nagar Call Girls In All Pune 24/7 Provide Call With...

2024: The FAR, Federal Acquisition Regulations, Part 30

2024: The FAR, Federal Acquisition Regulations, Part 30

celebrity 💋 Agra Escorts Just Dail 8250092165 service available anytime 24 hour

celebrity 💋 Agra Escorts Just Dail 8250092165 service available anytime 24 hour

2024: The FAR, Federal Acquisition Regulations - Part 29

2024: The FAR, Federal Acquisition Regulations - Part 29

Junnar ( Call Girls ) Pune 6297143586 Hot Model With Sexy Bhabi Ready For S...

Junnar ( Call Girls ) Pune 6297143586 Hot Model With Sexy Bhabi Ready For S...

VIP Model Call Girls Shikrapur ( Pune ) Call ON 8005736733 Starting From 5K t...

VIP Model Call Girls Shikrapur ( Pune ) Call ON 8005736733 Starting From 5K t...

best call girls in Pune - 450+ Call Girl Cash Payment 8005736733 Neha Thakur

best call girls in Pune - 450+ Call Girl Cash Payment 8005736733 Neha Thakur

Call Girls Sangamwadi Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Sangamwadi Call Me 7737669865 Budget Friendly No Advance Booking

Frequently Asked Questions about Not-for-Profit Audits

- 1. NOT-FOR-PROFIT MHM (Mayer Hoffman McCann P.C.) is an independent CPA firm that is a member of Kreston International Limited, a global network of independent accounting firms. Learn more at www.mhmcpa.com Our roots run deep A financial statement audit is bound to produce questions on financial statement reporting, and many are matters that are better addressed before the start of the audit. Questions addressed during the reporting year can save not-for-profit organizations a lot of time during their next audit and could eliminate potential control deficiencies reported as a result of addressing these prior to the audit. The following are among the top questions we routinely hear from our clients. FrequentlyAskedQuestionsaboutNot-For-ProfitAudits How Should A Not-For-Profit Record a Certificate of Deposit? Certificates of Deposits (CDs) are not considered investments under Accounting Standards Codification Topic 320, Investments—Debt and Equity Securities (ASC Topic 320) and are not considered a fair value item under ASC Topic 820, Fair Value Measurements and Disclosures. CDs should be reported as part of cash and cash equivalents at cost plus accrued interest if less than 90 days duration at the purchase date, and on its own line in the financial statements if the duration at the time of purchase is greater than 90 days. Should Not-For-Profits Segregate Investments in Split-Interest Agreements on the Balance Sheet? Most states don’t regulate the instruments in split-interest agreements, but it’s possible that some states require organizations to separate investments in split interest funds. In practice, most organizations commingle these donations in their investment pool until the death of the donor, even if the organizations segregate investments in split-interest agreements on their balance sheet. The notes to the financial statements should include the appropriate disclosures on the split interest agreements. If a Board Restricts Earnings on Endowment Funds, Do Those Resources Get Accounted for in Temporarily Restricted Assets? No. Only donors or local laws determine whether funds are classified as restricted net assets. The temporarily restricted assets designation can be confusing. So, too, has been the treatment of funds that are not restricted but have board restrictions. Board restricted funds should be accounted for as board designated funds and reported under the unrestricted net assets caption in the financial statements. Not-for-profits will have clearer guidance on both of these issues with the new not-for- profit financial statement standard, which clarifies asset classes as assets with donor restrictions and assets without donor restrictions. Board-restricted funds will be classified as assets without donor restrictions and will require enhanced disclosures about the amounts and purposes of the governing board designations and appropriations. If a Prior Year Summarized Data Is Reported, What Should Be Done Relative to Prior Period Footnotes? It is highly recommended that not-for-profit organizations report comparative financial statements each year. Summarizing prior period data is allowed so long as it contains the proper titles within the statements. In either case, comparative footnotes should be presented for all required disclosures under U.S. generally accepted accounting principles (GAAP).

- 2. NOT-FOR-PROFIT MHM (Mayer Hoffman McCann P.C.) is an independent CPA firm that is a member of Kreston International Limited, a global network of independent accounting firms. Learn more at www.mhmcpa.com Our roots run deep ©Copyright2017.MayerHoffmamMcCannP.C.Allrightsreserved. Do Significant Contributions from an Officer or Board Member Require a Financial Statement Disclosure? Officers and board members of the organization are considered related parties and therefore fall under ASC Topic 850, Related Party Disclosures. If the contribution is material or significant, then disclosure of such contribution should be made. When in doubt, you should probably disclose it. How Should Reports Be Issued When Material Errors Are Found After the Financial Statement Has Been Issued? If a material error is identified that occurred during a period for which the financial statements have already been issued, there are several things that should be considered. First, it needs to be determined whether or not the financial statements containing the error should be recalled and re-issued. This should include a conversation with your auditor and your board about the best course of action. The auditor will also have to consider the controls within the organization that did not prevent such an error from occurring and whether a material weakness in internal control needs to be reported. If everyone is in agreement that the financial statement should be recalled, management must notify the users of the financial statements about the recall. If the error is going to be corrected with the issuance of the current year financial statements, prior period adjustment accounting must be applied by pushing through the correction to retrospectively restate the prior period balances being presented in the current period financial statements and the appropriate disclosures need to be reported. If a Not-For-Profit Changes Its Year End, Can a Longer than Normal Fiscal Year Be Presented? Yes, longer reporting periods can be presented. It is important for the not-for-profit organization to consider the users of the financial statements (board members, banks and others) when reporting on a period other than 12 months to ensure their needs are being met. Also keep in mind that when presenting comparative financial statements and one period is presented on the fiscal year and the other period is longer (or shorter), the comparability of the financial statements period over period is no longer achieved. ASC Topic 205, Presentation of Financial Statements, requires that disclosures and comparability issues be explicitly disclosed but does not limit financial statements to a 12-month period. Should Not-For-Profit Reporting Be Used if An Organization Does Not Have An Approved IRS Determination Letter? Yes. Not-for-profit organizations can follow tax-exempt reporting before receiving their IRS determination letter. For financial statement purposes, management would need to assess this as part of their overall assessment of tax positions and whether their status of being tax exempt is uncertain or not. The issue of being exempt from federal income taxes is a matter of tax law. Generally, the auditor verifies such exemption by obtaining the IRS determination letter. The exemption approval by the IRS is not a lengthy process, and is the best evidence that management can obtain to support the organization’s position that it is a tax- exempt organization. Is the Loss of an Exempt Status Automatically a Going Concern? No. Tax-exempt status is a tax position. The loss of a tax- exempt status does not mean the organization presents a risk of not continuing as a going concern. It means the organization is now taxable and must modify its tax and disclosure reporting.

- 3. NOT-FOR-PROFIT MHM (Mayer Hoffman McCann P.C.) is an independent CPA firm that is a member of Kreston International Limited, a global network of independent accounting firms. Learn more at www.mhmcpa.com Our roots run deep Does a Not-For-Profit Qualify to Use the Equity Method of Accounting? A not-for-profit may encounter the equity method of accounting question if it holds an equity investment in a for-profit company. The not-for-profit organization should first determine if an election was made to report such interests at fair value in accordance with the fair value option. If the organization has not made the election to report these type of investments at fair value, for example the not-for-profit accounts for other investments at market value, and if the arrangement meets the criteria outlined in ASC Topic 323, Investments- Equity Method and Joint Ventures, the organization would follow the equity method of accounting. For More Questions If you have any additional comments, questions or concerns, contact us. Related Reading • Spring Cleaning: What Not-for-Profits Should Annually Review to Manage Their Compliance Requirements • Compliance Checklist: How Not-for-Profits Can Meet Their IRS Filing Requirement • Presenting the New Not-for-Profit Financial Statement