Mercer Capital's BankWatch | October 2013 | Loan Growth Resumes, Remains Slow

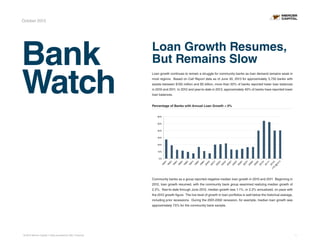

- 1. October 2013 Bank Watch Loan Growth Resumes, But Remains Slow Loan growth continues to remain a struggle for community banks as loan demand remains weak in most regions. Based on Call Report data as of June 30, 2013 for approximately 3,750 banks with assets between $100 million and $5 billion, more than 50% of banks reported lower loan balances in 2010 and 2011. In 2012 and year-to-date in 2013, approximately 40% of banks have reported lower loan balances. Percentage of Banks with Annual Loan Growth < 0% % of Banks with Annual Loan Growth < 0% 60% 50% 40% 30% 20% 10% 2 YT 012 Y D @ 6/ 13 Y 11 Y 20 Y 10 20 Y 09 20 Y 08 20 Y 07 20 Y 06 20 Y 05 20 Y 04 20 Y 03 20 Y 02 20 Y 01 20 Y 00 20 Y 99 19 Y 98 19 Y 97 19 Y 96 19 Y 95 19 Y 94 19 93 92 19 19 Y 0% Community banks as a group reported negative median loan growth in 2010 and 2011. Beginning in 2012, loan growth resumed, with the community bank group examined realizing median growth of 2.2%. Year-to-date through June 2013, median growth was 1.1%, or 2.2% annualized, on pace with the 2012 growth figure. The low level of growth in loan portfolios is well below the historical average, including prior recessions. During the 2001-2002 recession, for example, median loan growth was approximately 7.5% for the community bank sample. © 2013 Mercer Capital // Data provided by SNL Financial 1

- 2. Mercer Capital’s Bank Watch October 2013 An analysis of mortgage data by SNL Financial indicates that residential loan growth has been Median Annual Loan Growth consistent across the country, with 932 of the 955 metro areas with available data reporting Median Annual Loan Growth increases in originations.1 The analysis by SNL looks at comprehensive data filed by lenders 14.00% 12.00% pursuant to the Home Mortgage Disclosure Act for the 2012 fiscal year. The analysis shows 10.00% the largest increases in mortgage lending activity in the areas that were hardest-hit by the 8.00% recession, including Orlando, Phoenix, Las Vegas, Detroit, and Sacramento, which all posted 6.00% growth in mortgage lending over 75% in 2012. Overall, funded mortgage loan volume was up 4.00% 43% from 2011, increasing from $1.5 trillion to $2.1 trillion for the metro areas included in the 2.00% data set. 0.00% For the community bank sample, total growth in single-family mortgages was slower than the Y 13 12 6/ 20 YT D @ Y 11 Y 20 Y 10 20 Y 09 20 Y 08 20 Y 07 20 Y 06 20 Y 05 20 Y 04 20 Y 20 03 Y 20 02 Y 20 01 Y 00 20 Y 19 99 Y 98 19 Y 97 19 Y 96 19 Y 19 95 Y 94 19 93 19 19 92 Y -2.00% The modest loan growth realized in 2012 and year-to-date in 2013 has been spread across aggregate mortgage data for all institutions, with loan volume up 6.5% for the 2012 fiscal year, indicating that the majority of loan growth, at least in the residential mortgage sector, was led by larger institutions. portfolio sectors, with all non-agricultural loan categories up 6.8% at June 30, 2013 from year-end 2011. Within the non-ag categories, 1-4 family mortgages were up 6.4%, CRE loans Madeleine G. Davis davism@mercercapital.com were up 7.4% with most of the increase in nonowner-occupied CRE loans, and commercial/ industrial loans were up 11.3%. Construction and development credits were the only sector that saw declines in the last 18 months, with total C&D loans down 4.9% from year-end 2011. Loan Portfolio Trends Endnotes 1 “Loan Growth Spanned Entire US in 2012,” by Sam Carr and Fox, Zach. Published by SNL Financial, LC, October 3, 2013. Loan Portfolio Trends $250 What We’re Reading $200 ($ in billions) $150 The OCC released an updated version of its Bank Accounting Advisory Series, which includes frequently asked questions about acquired loans and fair-value accounting: $100 http://mer.cr/17042iR $50 $- Closed-End 1-4 Family RE Loans Owner Occupied CRE Loans NonownerOccupied CRE Loans C&D Loans C&I Loans 4Q11 $211 $165 $172 $77 $151 2Q12 $216 $166 $176 $73 $155 4Q12 $225 $170 $181 $72 $162 2Q13 $225 $174 $187 $73 Mercer Capital’s own Jeff Davis discussed the pros and cons of leveraged transactions that can often unlock value for equity holders in his presentation entitled “Leveraged Lending, Dividend Recaps, and Solvency Opinions”: $168 © 2013 Mercer Capital // Data provided by SNL Financial http://mer.cr/solvency-opinion-ppt 2

- 3. Mercer Capital’s Public Market Indicators October 2013 Mercer Capital’s Bank Group Index Overview Return Stratification of U.S. Banks by Asset Size 150 ! 40% 140 ! As of September 30, 2013 September 28, 2012 = 100! 130 ! 120 ! 110 ! 100 ! 90 ! 30% 20% 10% 0% 20 12 11 ! /2 8/ 20 12 12 ! /2 8/ 20 12 1/ ! 28 /2 01 3! 2/ 28 /2 01 3! 3/ 31 /2 01 3! 4/ 30 /2 01 3! 5/ 31 /2 01 3! 6/ 30 /2 01 3! 7/ 31 /2 01 3! 8/ 31 /2 01 3! 9/ 30 /2 01 3! 8/ 28 /2 01 2! 80 ! Assets $250 - $500 MM Month-to-Date Assets $500 MM $1 BN Assets $1 $5 BN Assets $5 $10 BN Assets > $10 BN SNL Bank! S&P 500! 2.27% 5.70% 5.54% 0.61% 27.75% 25.54% 28.17% 33.38% 22.23% Last 12 Months /2 10 9/ MCM Index - Community Banks! 2.22% Year-to-Date 34.20% 24.85% 27.89% 30.46% 30.71% Median Valuation Multiples Median Total Return Valuation Multiples as of September 30, 2013 Month-to-Date Year-to-Date Last 12 Months Price/ LTM EPS Price / 2013 (E) EPS Price / 2014 (E) EPS Price / Book Value Price / Tangible Book Value Dividend Yield Atlantic Coast Index 3.08% 24.16% 23.44% 14.55 17.36 13.71 106.4% 117.9% 2.3% Midwest Index 6.40% 30.12% 27.69% 12.66 13.06 13.49 107.9% 121.2% 2.1% Northeast Index 4.16% 23.12% 19.55% 14.43 14.84 12.97 123.0% 131.2% 2.7% Southeast Index 2.84% 24.38% 20.06% 13.39 14.22 12.61 119.9% 124.2% 2.4% West Index 4.65% 23.42% 25.65% 13.60 14.88 13.90 128.6% 130.7% 1.9% Community Bank Index 4.23% 24.72% 23.51% 13.88 14.53 13.57 116.8% 127.5% 2.4% SNL Bank Index 3.14% 19.80% 19.34% na na na na na na Indices © 2013 Mercer Capital // Data provided by SNL Financial 3

- 4. Mercer Capital’s M&A Market Indicators October 2013 Median Price/Earnings Multiples Median Price/Tangible Book Value Multiples Target Banks Assets <$5BN and LTM ROE >5% Target Banks Assets <$5BN and LTM ROE >5% 350% 25 300% 20 Price / Tangible Book Value Price / Last 12 Months Earnings 30 15 10 250% 200% 150% 100% 5 50% 0 U.S. 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 22.6 22.2 22.2 22.4 20.7 18.2 18.1 21.9 16.8 15.8 0% U.S. 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 248% 242% 242% 229% 195% 150% 143% 125% 128% 142% Median Core Deposit Multiples Median Valuation Multiples for M&A Deals Target Banks Assets <$5BN and LTM ROE >5% Target Banks Assets <$5BN and LTM ROE >5%, through September 30, 2013 Price / LTM Earnings Price / Tang. BV Price / Core Dep Premium No. of Deals Median Deal Value Target’s Median Assets Target’s Median LTM ROAE (%) Atlantic Coast 14.47 1.38 4.0% 9 77.66 741,713 7.32% Midwest 17.12 1.44 6.3% 41 40.51 122,905 9.02% Northeast 16.06 1.49 7.7% 4 110.80 649,359 8.02% Southeast 18.76 1.32 2.7% 4 122.22 1,296,520 5.76% West 25% 10.67 1.25 2.9% 12 31.82 242,113 7.15% Nat’l Community Banks 15.76 1.42 5.2% 70 43.99 232,922 8.15% Regions Core Deposit Premiums 20% 15% 10% 5% 0% U.S. 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 18.5% 19.7% 19.7% 18.9% 11.9% 8.2% 6.4% 3.5% 3.5% 5.2% © 2013 Mercer Capital // Data provided by SNL Financial 4

- 5. Mercer Capital’s Bank Watch September 2013 Mercer Capital’s Regional Public Bank Peer Reports Updated weekly, Mercer Capital’s Regional Public Bank Peer Reports offer a closer look at the market pricing and performance of publicly traded banks in the states of five U.S. regions. Click on the map to view the reports from the representative region. Atlantic Coast Midwest Southeast © 2013 Mercer Capital // Data provided by SNL Financial Northeast West 5

- 6. Mercer Capital Financial Institutions Services Mercer Capital assists banks, thrifts, and credit unions with significant corporate valuation requirements, transactional advisory services, and other strategic decisions. Mercer Capital pairs analytical rigor with industry knowledge to deliver unique insight into issues facing banks. These insights underpin the valuation analyses that are at the heart of Mercer Capital’s services to depository institutions. Mercer Capital is a thought-leader among valuation firms in the banking industry. In addition to scores of articles and books, The ESOP Handbook for Banks (2011), Acquiring a Failed Bank (2010), The Bank Director’s Valuation Handbook (2009), and Valuing Financial Institutions (1992), Mercer Capital professionals speak at industry and educational conferences. The Financial Institutions Group of Mercer Capital publishes Bank Watch, a monthly e-mail newsletter covering five U.S. regions. In addition, Jeff Davis, Managing Director, is a regular contributor to SNL Financial. For more information about Mercer Capital, visit www.mercercapital.com. Contact Us Jeff K. Davis, CFA 615.345.0350 jeffdavis@mercercapital.com Andrew K. Gibbs, CFA, CPA/ABV 901.322.9726 gibbsa@mercercapital.com Mercer Capital 5100 Poplar Avenue, Suite 2600 Memphis, Tennessee 38137 901.685.2120 (P) Jay D. Wilson, Jr., CFA, ASA, CBA 901.322.9725 wilsonj@mercercapital.com www.mercercapital.com Copyright © 2013 Mercer Capital Management, Inc. All rights reserved. It is illegal under Federal law to reproduce this publication or any portion of its contents without the publisher’s permission. Media quotations with source attribution are encouraged. Reporters requesting additional information or editorial comment should contact Barbara Walters Price at 901.685.2120. Mercer Capital’s Industry Focus is published quarterly and does not constitute legal or financial consulting advice. It is offered as an information service to our clients and friends. Those interested in specific guidance for legal or accounting matters should seek competent professional advice. Inquiries to discuss specific valuation matters are welcomed. To add your name to our mailing list to receive this complimentary publication, visit our web site at www.mercercapital.com.