Management accounting

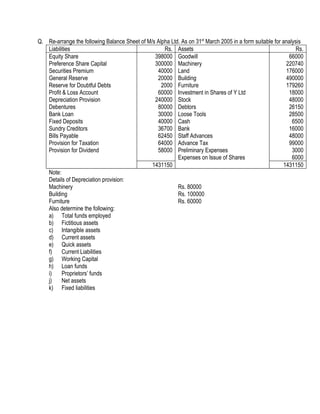

- 1. Q. Re-arrange the following Balance Sheet of M/s Alpha Ltd. As on 31st March 2005 in a form suitable for analysis Liabilities Rs. Assets Rs. Equity Share 398000 Goodwill 66000 Preference Share Capital 300000 Machinery 220740 Securities Premium 40000 Land 176000 General Reserve 20000 Building 490000 Reserve for Doubtful Debts 2000 Furniture 179260 Profit & Loss Account 60000 Investment in Shares of Y Ltd 18000 Depreciation Provision 240000 Stock 48000 Debentures 80000 Debtors 26150 Bank Loan 30000 Loose Tools 28500 Fixed Deposits 40000 Cash 6500 Sundry Creditors 36700 Bank 16000 Bills Payable 62450 Staff Advances 48000 Provision for Taxation 64000 Advance Tax 99000 Provision for Dividend 58000 Preliminary Expenses 3000 Expenses on Issue of Shares 6000 1431150 1431150 Note: Details of Depreciation provision: Machinery Rs. 80000 Building Rs. 100000 Furniture Rs. 60000 Also determine the following: a) Total funds employed b) Fictitious assets c) Intangible assets d) Current assets e) Quick assets f) Current Liabilities g) Working Capital h) Loan funds i) Proprietors’ funds j) Net assets k) Fixed liabilities

- 2. Q. Balance Sheet as on _________ 31.12.2004 Rs. 31.12.2005 Rs. Current Assets: Cash at Bank 123000 153000 Debtors 211200 197700 Bills Receivable 120000 91500 Prepaid Expenses 9000 12000 Fixed Assets: Building 480000 465000 Plant 405000 375000 Furniture 151500 55800 1500000 1350000 Current Liabilities: Creditor 270000 15000 Bills Payable 120000 241500 Outstanding Expenses 45000 49500 Reserve & Surplus 165000 144000 Share Capital 900000 900000 1500000 1350000 Prepare the comparative Balance Sheet from the above and comment on the financial position of the company. Q. Prepare a Comparative Financial Statement from the following details and offer comments. Balance Sheet as on 31st March 2005 (Rs. In thousands) Liabilities X Ltd Rs. Y.Ltd. Rs. Assets X Ltd Rs. Y.Ltd. Rs. 10 % Pref. Share Capital 36 54 Land 80 40 Equity Share Capital 80 100 Machinery 220 300 Securities Premium 40 50 Investments 10 5 General Reserve 40 10 Sundry Debtors 28 36 Profit & Loss A/c 21 Stock 42 45 Depreciation Reserve 180 170 Bills Receivable 7 4 12 % Debentures 10 15 Prepaid Expenses 2 3 Long Term Loans 5 10 Bank 10 Bank Overdraft 15 Cash 3 2 Sundry Creditors 10 24 Preliminary Expenses 8 15 Outstanding Expenses 5 10 Goodwill 20 10 Unclaimed Dividends 3 2 430 460 430 460

- 3. Q. Prepare a Comparative Revenue Statement from the following details and offer comments. KND Ltd. Profit & Loss Account for the years ended 31st March (Rs. In thousands) Particulars 2005 Rs. 2006 Rs. Particulars 2005 Rs. 2006 Rs. To Opening Stock 75 100 By Sales 1500 2000 To Purchases 750 1070 By Closing Stock 100 120 To Interest on Debentures 50 50 By Discount 3 4 To Depreciation By Goods Destroyed 10 Furniture 5 5 by fire Machinery 12 10 By Profit on Sale of 8 To Administrative Exp. 98 147 Machinery To Selling Expenses 150 250 To Discount 2 1 To Carriage 25 105 To Loss by Fire 5 To Wages 65 100 To Provision for Tax 190 145 To Net Profit 190 145 Total 1612 2133 Total 1612 2133 Q. Prepare a Common size Comparative Financial Position Statement from the following Balance Sheets Balance Sheets as on 31st March 2006 Liabilities A Ltd Rs. B Ltd Rs. Assets A Ltd Rs. B Ltd Rs. Equity Share Capital 250 105 Fixed Assets 120 90 Reserve Surplus 180 10 Investments 80 20 10 % Debentures 50 100 Prepaid Expenses 10 12 Bank Overdraft 45 Stock 240 268 Creditors 90 200 Debtors 160 80 Provision for Tax 70 25 Cash 30 10 Preliminary Expenses 5 640 485 640 485

- 4. Q. From the following Balance Sheet as on 31st March 2005 and the Trading, Profit & Loss Account for the year ending 31st March 2005, prepare: a) Common Size Balance Sheet b) Common Size Income Statement Balance Sheet Liabilities Rs. Assets Rs. Equity Share Capital 2000000 Goodwill 1000000 General Reserve 400000 Building 2000000 Profit & Loss Account 600000 Machinery 800000 Preference Share Capital 600000 Furniture 200000 Secured Loan 400000 Stock 800000 Income Tax Provision 200000 Debtors 600000 Bank Overdraft 600000 Bank Balance 400000 Creditors 1200000 Bills Receivable 200000 6000000 6000000 Trading Profit & Loss Account Rs. Rs. To Opening Stock 800000 By Sales 4200000 To Purchases 2200000 Less: Returns 200000 4000000 To Wages 500000 By Closing Stock 1000000 To Factory Expenses 500000 To Gross Profit c/d 1000000 5000000 5000000 To Administrative Exp. 150000 By Gross Profit b/d 1000000 To Selling Expenses 100000 By Commission 75000 To Finance Expenses 50000 To Depreciation 125000 To Income Tax Profit 200000 To Net Profit 450000 1075000 1075000 Q. Calculate the Trend Percentage from the following information extracted from the financial statement of X Company. Offer your comments. 2005 Rs. 2004 Rs. 2003 Rs. Sales 16400 13640 9880 Cost of Sales 14970 12490 8810 Expenses 80 130 50 Interest Expenses 500 370 200 Tax 390 190 450 Fixed Assets (Net) 5480 5110 4770 Working Capital 5080 4880 3290 Investments 770 180 420 Net Worth 6660 6010 5850 External Loans 4680 4160 2640

- 5. Q. Analyze and comment on the trend Balance Sheet of Efficient Ltd. as on 31st March (Rs. in thousand) 2003 Rs. 2004 Rs. 2005 Rs. Assets: Fixed Assets (at cost less Depreciation) 15.00 12.50 12.00 Investment 1.00 0.50 1.00 Stock in Trade 6.00 5.00 4.00 Accounts Receivable 9.00 7.50 6.00 Loans and Advances 4.00 4.00 3.00 Cash and Bank Balances 0.50 0.50 0.50 35.50 30.00 26.50 Liabilities: Share Capital 20.50 17.00 14.50 Bank Loans 4.00 3.00 3.00 Sundry Creditors 11.00 10.00 9.00 35.50 30.00 26.50 Q. Following is the Profit and Loss Account of Saurav Balanced Limited for the year ended 31st March 2005. you are required to prepare Vertical Income Statement for the purpose of analysis. Rs. Rs. To Opening Stock 700 By Sales To Purchases 900 Cash 520 To Wages 150 Credit 1500 To Factory Expenses 350 2020 To Office Salaries 25 Less: Return and 20 2000 To Office Rent 39 Allowance To Postage and Telegram 5 By Closing Stock 600 To Directors Fee 6 By Dividend on Investment 10 To Salesman Salaries 12 By Profit on Sale of Furniture 20 To Advertising 18 To Delivery Expenses 20 To Debenture Interest 20 To Depreciation On Office Furniture 10 On Plant 30 On Delivery Van 20 To Loss on Sale of Van 5 To Income Tax 175 To Net Profit 145 2630 2630

- 6. Q. Common India Ltd. Balance Sheet as on 31st December 2005 Liabilities Rs. Assets Rs. Capital Reserve 126000 Copyright 100000 General Reserve 120000 Cash 21000 Provision for Tax 50000 Calls in Arrears 9575 Commission received in Advance 10875 Plant and Machinery 420000 15% debentures 160000 Debtors 300425 12% Bank Loan 40000 Prepaid Insurance 15375 6% Preference Share Capital 200000 Land and Building 500000 Equity Share Capital 1000000 Fixtures 25000 Bills Payable 49125 Furniture 75000 Profit and Loss Account 9000 Preliminary Expenses 18625 Bank Overdraft 10740 Goodwill 100000 Share Premium 15000 Investments (Long Term) 175000 Sundry Creditors 189260 Stock 200700 Market Investments 19300 1980000 1980000 You are required to rearrange above Balance Sheet in vertical form and compute the following ratios: (a) Current Ratio, (b) Proprietary Ratio, (c) Capital Gearing Ratio.

- 7. Q. Shinkanshan Limited commenced business on 1st January 1990. The Balance Sheet as on 31st December 2004 and as on 31st December 2005, the Profit nd Loss Account for the year ended 31st December 2004 and for the year ended 31st December 2005 are given below:- Liabilities 31.12.2004 31.12.2005 Assets 31.12.2004 31.12.2005 Rs. Rs Rs. Rs Equity Share of 200000 200000 Fixed Assets Rs. 10 each Less: Derecia. 396000 416000 General Reserve 40000 20000 Stock in Trade 120000 60000 Profit & Loss A/c 4000 28000 Debtors 160000 80000 Mortgage Loan 160000 220000 Cash & Bank 4000 60000 Bank Overdraft 40000 Creditors 180000 60000 Provision for 26000 68000 Taxation Proposed Dividend 30000 20000 680000 616000 680000 616000 Profit and Loss Account for the year ended ------- 31.12.2004 31.12.2005 31.12.2004 31.12.2005 Rs. Rs Rs. Rs Directors 60000 20000 Balance b/f 28000 4000 Remuneration Net Profit after 121600 160800 Interest on Loan 9600 8800 Depreciation On Mortgage Provision for Taxation 26000 68000 Proposed dividend 30000 20000 Transfer to Reserve 20000 20000 Balance c/d 4000 28000 149600 164800 149600 164800 Sales for the year 2004 amounted to Rs. 1000000 and for 2005 amounted to Rs. 1200000 Calculate a) Net Profit Ratio b) Current Ratio c) Liquidity Ratio d) Debt/Equity Ratio and e) Debt Service ratio f) Net Operating Profit Ratio Give your comments on profitability and solvency of the company. Do you think that there is an improvement in performance of the Company in 2005?

- 8. Q. The following data are extracted from the published accounts of two companies in an industry. ABC Ltd. Rs. XYZ Ltd. Rs. Sales 3200000 3000000 Net Profit after Tax 123000 158000 Equity Capital (Rs. 10 per shre fully paid) 1000000 800000 General Reserves 232000 642000 Long Term Debt 800000 660000 Creditors 382000 549000 Bank Credit (Short Term) 60000 200000 Fixed Assets 1599000 1590000 Investments 331000 809000 Other Current Assets 544000 452000 You are required to prepare a statement of comparative ratios showing liquidity, profitability, activity and financial position of the two companies. As a Finance Analyst give a report to the management about financial evaluation of both the companies. Q. You have the following information on the performance of Prosper Co., as also the industry averages: a) Determine the indicated ratios for Prosper Co. b) Indicate the Company’s strengths and weakness as shown by your analysis Balance Sheet as on 31st December 2005 Rs. Rs. Equity Share Capital 2400000 Net Fixed Assets 1210000 10 % Debentures 460000 Cash 445000 Sundry Creditors 330000 Sundry Debtors 550000 Bills Payable 440000 Stocks 1650000 Other Current Liabilities 220000 3850000 3850000 st Statement of Profit for the year ending 31 December 2005 Rs. Rs. Sales 5500000 Less: Cost of goods Sold Materials 2090000 Wages 1320000 Factory Overheads 649000 4059000 Gross Profit 1441000 Less: Selling and Distribution Cost 550000 Administration and General Expenses 614000 1164000 Earnings before Interest and Tax 277000 Less: Interest Charges 46000 Earnings before Tax 231000 Less: Tax 950 %) 115500 Net Profit 115500 Ratios to be computed: 1) Current Ratio 2) Liquid Ratio 3) Earning per Share 4) Net Profit Ratio 5) Operating Ratio 6) Proprietary Ratio 7) Stock Turnover Ratio 8) Debt Collection Period

- 9. 9) Capital Gearing 10) Return on Capital Employed Ratio Q. The following is the Balance Sheet of J Ltd on 31st March 2005 Liabilities Rs. Assets Rs. Share Capital 2000000 Fixed Assets 1800000 Reserves 400000 Debtors 500000 Creditors 300000 Stock 400000 Bank Overdraft 100000 Bank Balance 100000 2800000 2800000 Total Sales were Rs. 9000000 and Cash Sales were 10% of the total sales. Cost of goods sold was Rs. 7000000. Net profit before payment of tax at 50 % was Rs. 900000. opening Stock figure was 75 % of the stock figure on 31st March 2005. Debtors on 31st March 2005 include advances of Rs. 50000 to suppliers. Advances were given in March 2005. Debtors on 1st April 2004 were 50 % of Debtors on 31st March 2005 There were no non-operating expenses and non-operating incomes Calculate the following ratios: a) Current Ratio b) Liquid Ratio c) Operating Ratio d) Net Profit Ratio e) Stock Turnover Ratio f) Debtors Turnover Ratio and Collection Period g) Stock/Working Capital Ratio Q. From the information given below prepare a Balance Sheet in a vertical form suitable for analysis and calculate the following ratio: 1) Capital Gearing Ratio 2) Proprietary Ratio 3) Current Ratio 4) Liquid Ratio 5) Debtor Equity Ratio Rs. Bank 50000 Land and Building 800000 Advance Payments 62000 Stock 273000 Creditors 406000 Debtors 523000 Bills Receivable 21000 Plant and Machinery 544000 12% Debentures 250000 Loan from a Director 400000 Equity Share Capital 1000000 Profit and Loss Account 217000

- 10. Q. From the following Balance Sheet of B Ltd. As on 31st December 2005 and the Trading Profit & Loss Account for the year ending 31st December 2005, calculate the following ratios. a) Current Ratio b) Liquid Ratio c) Inventory Turnover Ratio d) Debtors Turnover Ratio e) Operating Ratio f) Capital Gearing Ratio g) Net Profit Ratio h) Stock Working Capital Ratio i) Earning Per Equity Share j) Interest Coverage Ratio k) Creditors Turnover l) Dividend Payment Ratio Balance Sheet Liabilities Rs. Assets Rs. 10 % Preference Capital 200000 Fixed Assets 2600000 Equity Capital (Rs. 10) 1000000 Bank Balance 100000 General Reserve 800000 Short Term Investment 300000 12 % Debentures 1400000 Debtors 400000 Creditors 120000 Last year Rs. 200000 Outstanding Expenses 220000 Stock 600000 Income Tax Provision 260000 4000000 4000000 Trading Profit & Loss Account Rs. Rs. To Opening Stock 600000 By Sales 6000000 To Purchases 5160000 By Closing Stock 600000 To Gross Profit 840000 6600000 6600000 To Administrative Expenses 80000 By Gross Profit 840000 To Rent 56000 By Profit on Sale of Fixed Asset 110000 To Interest 90000 To Selling Expenses 44000 To Depreciation 200000 To Income Tax Provision 240000 To Net Profit 240000 950000 950000 The Company declared dividend on equity share @ 20 % Q. The following items appear in the accounts as at 31st December 2005 of Overseas Ltd. Cash Rs. Land and Building (at cost) 48600 Deposits and Payments in advance 800000 Stock 62000 Trade Creditors 272800 General Reserve 405750 Debtors 100000 Bills Receivable 523000 Plant & Machinery at cost less Depreciation 22600 Debentures-Repayable 2005 (Secured) 544000

- 11. Bank Overdraft 250000 Ordinary Share Capital of Rs. 10 each 52000 Profit and Loss Account Balance 1000000 Proposed Dividend for 2005 Net 217000 Trade Investments 86250 Advance payment of Tax 20000 Provision for Taxation 100000 Bills Payable 264000 Net Sales for the year 2005 18000 2182400 You are required to arrange the above items in the form of Financial Statements to indicate a) Working Capital b) Total Funds Employed c) Shareholders’ Equity and calculate the following ratios: a) Current Ratio b) Turnover of Debentures Q. The Balance Sheet and the Income Statement of Fiat Ltd. Are given hereunder:- Balance Sheet as on 31st March 2005 Liabilities Rs. Assets Rs. Equity Capital (Rs.10 each) 120 Fixed Assets 100 Returned Earnings 36 Prepaid Expenses 1 6% Debentures 50 Inventory 10 Creditors 10 Debtors 70 Wages Payable 4 Cash 10 Taxes 1 221 221 Profit & Loss Account for the year ended 31st March 2005 To Opening Stocks Rs. Rs. To Purchases 30 By Sales 400 To Operating Expenses 300 By Closing Stocks 40 To Income Tax 80 To Net Profit 12 18 440 440 From the above statement compute a) Current Ratio b) Acid Rest Ratio c) Stock Turnover Ratio d) No. of days sales invested in Debtors e)No. of days purchases in Creditors f) Return on Capital employed g) Return on Proprietor’s equity h) Earning per Share i) Gross Profit Ratio Mr. Prudent is interested in purchasing share of Flat Ltd. He seeks your advise regarding the purchase of share of the company. If you are a supplier would you grant credit to this company?

- 12. Q. The following are the Balances as on 31st March 2005 of Ambika Ltd. Rs. Share Capital (20000 Equity Shares of Rs. 10 each of Rs. 5 called up) 100000 Land and Building 125000 Machinery 50000 Stock 50000 Reserves and Surplus: General Reserve 50000 Profit and Loss Account 15000 5% Debentures 100000 Bills Payable 7000 Bills Receivable 5000 Furniture 25000 Debtors (less than 6 months) 11000 Preliminary Expenses 5000 Creditors 18000 Cash on Hand 2000 Bank Balance (Dr.) 18000 Provision for Doubtful Debts 1000 Calculate the following Ratios: a) Debt Equity Ratio b) Proprietary Ratio c) Current Ratio d) Liquid Ratio e) Stock to Working Capital Ratio Answer the following questions: 1) How is the short term solvency position of the company? 2) Is the company financially stable? 3) How is the liquidity position of the company? 4) give your opinions about working capital position of the company. Q. The Capital of B & Co. is as follows: Rs. 10 % Preference Share Capital (Rs. 10) 1200000 Equity Shares of Rs. 10 each 3200000 4400000 Profit after tax at 50% 1080000 Depreciation 120000 Equity dividend paid 20 % Market price per Equity share Rs. 90 Calculate: a) Earning per Share b) Dividend Payout Ratio

- 13. Q. From the following data, prepare a statement of proprietor’s funds with as much details possible: Current Ratio 25 Liquid Ratio 15 Proprietary Ratio (Fixed Assets/Proprietary fund) 0.75 Working Capital Rs. 60000 Reserves and Surplus Rs. 40000 Bank Overdraft Rs. 10000 There are no Long Term Loans for fictitious assets