TATA AIA SMART GROWTH PLUS

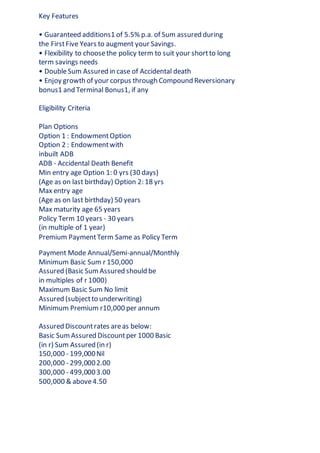

- 1. Key Features • Guaranteed additions1 of 5.5% p.a. of Sum assured during the FirstFive Years to augment your Savings. • Flexibility to choosethe policy term to suit your shortto long term savings needs • DoubleSum Assured in case of Accidental death • Enjoy growth of your corpus through Compound Reversionary bonus1 and Terminal Bonus1, if any Eligibility Criteria Plan Options Option 1 : EndowmentOption Option 2 : Endowmentwith inbuilt ADB ADB - Accidental Death Benefit Min entry age Option 1: 0 yrs (30 days) (Age as on last birthday) Option 2: 18 yrs Max entry age (Age as on last birthday) 50 years Max maturity age 65 years Policy Term 10 years - 30 years (in multiple of 1 year) Premium PaymentTerm Same as Policy Term Payment Mode Annual/Semi-annual/Monthly Minimum Basic Sum r 150,000 Assured (Basic SumAssured should be in multiples of r 1000) Maximum Basic Sum No limit Assured (subjectto underwriting) Minimum Premium r10,000 per annum Assured Discountrates areas below: Basic SumAssured Discountper 1000 Basic (in r) Sum Assured (in r) 150,000 - 199,000Nil 200,000 - 299,0002.00 300,000 - 499,0003.00 500,000 & above4.50

- 2. How does Tata AIA Life InsuranceSmart Growth Plus work? • Choosethe Plan Option that suits your need • Choosethe Basic Sum Assured as per your need and requirement • Choosethe Policy Term as per your goal • Your premium will be calculated basis Age, Policy Term, Basic Sum Assured, PremiumPaymentMode and Option chosen. What are your benefits? You are eligible for the following benefits under this product: Guaranteed Addition (GA) Guaranteed additions will accruein the first5 years of your policy at the rate of 5.5% p.a. of Basic Sum Assured. The Guaranteed additions will accrueat the policy anniversary provided all premiums till date havebeen paid. The accrued guaranteed additions will be paid on Maturity, Death or Surrender. Guaranteed Addition will not accrue further once the policy becomes reduced paid up. Maturity Benefit On maturity we will pay, the Basic SumAssured, accrued Guaranteed additions, vested Compound Reversionary Bonus and Terminal Bonus, if any, provided the policy is in forceand all due premiums have been paid. Bonus • Compound Reversionary Bonus (CRB) - Itwill accrueevery year fromthe 6th policy anniversary provided the policy is in force - Accrued CRB will be payable on death or maturity or Surrender - Compound Reversionary Bonus will be declared by the company annually and credited on policy anniversary • Terminal Bonus - Terminal Bonus will be a percentage of the accrued Compound Reversionary Bonus - Itwill be payable on death, if the policy is in force for 10 years, or on maturity

- 3. Death Benefit In caseof unfortunateevent of the death of the insured; Sum Assured on death along with the accrued Guaranteed additions (GA) plus vested Compound Reversionary Bonus and Terminal Bonus, if any, will be payable. This total amount will be subject to a minimum of 105% of Total Premiums Paid, as on the date of death. Where, "SumAssured on death' shall be the higher of the following: • 10 times Annualised Premium • Basic Sum Assured If you have chosen Option 2, we will pay an additional amount equal to the Basic Sum assured in case of unfortunatedeath due to accident2. 2Definition of Accident: An accident is a sudden, unforeseen and involuntary event caused by external visible and violent means. The Policy will terminate upon death of the insured and no other benefit under the policy shall be payable "Annualised Premium" shall be the premium paid in a year with respect to the basic sumassured chosen by the Policy holder, excluding the underwriting extra premiums and loading for modal premiums, if any. "Total Premiums Paid" means amount equal to the total premiums paid during the premium paymentterm of the policy. Such amount should be excluding interest, tax, underwriting extra premiums and loading for modal premiums, if any. Benefit Illustration: Following are the benefits payable at the given ages for term 25 years for a healthy life and for standard age proof:- AGE B.S.A. PREMIUM G.A. C.R.B. T.B. MATURITY 25 5 LACS 30760 1,37,500 4,75,845 5,94,806 17,08,151