Slideshow: Analysis of the Tax Provisions in the "Grand Bargain"

•

1 j'aime•381 vues

O

OCPPA short presentation on why cutting the tax rate on pass-through income is misguided that further explains the issues raised in the Oregon Center for Public Policy's (OCPP) issue brief A GRANDLY FLAWED BARGAIN available at www.ocpp.org.

Signaler

Partager

Signaler

Partager

Télécharger pour lire hors ligne

Recommandé

Recommandé

Presentation from Drexel School of Economics / Econsult Solutions, Inc. Joint Conference on Urban Economic Policy

April 27, 2016Dr. Matthew Knittel: Implications of Economic Demographic Trends for State an...

Dr. Matthew Knittel: Implications of Economic Demographic Trends for State an...Econsult Solutions, Inc.

Contenu connexe

Tendances

Presentation from Drexel School of Economics / Econsult Solutions, Inc. Joint Conference on Urban Economic Policy

April 27, 2016Dr. Matthew Knittel: Implications of Economic Demographic Trends for State an...

Dr. Matthew Knittel: Implications of Economic Demographic Trends for State an...Econsult Solutions, Inc.

Tendances (19)

Dr. Matthew Knittel: Implications of Economic Demographic Trends for State an...

Dr. Matthew Knittel: Implications of Economic Demographic Trends for State an...

Testimony: Mississippi Tax Policy: Options for Reform

Testimony: Mississippi Tax Policy: Options for Reform

En vedette

En vedette (14)

Hands-On Security Breakout Session- Disrupting the Kill Chain

Hands-On Security Breakout Session- Disrupting the Kill Chain

Similaire à Slideshow: Analysis of the Tax Provisions in the "Grand Bargain"

Hanrick Curran is delighted to share with you the highlights from their Pre Financial Year End and Post Federal Budget Update Event. Our straight talking presenters explain how the Government will use the 2015 Federal Budget to address Australia’s growing budget challenge. They highlight key points of interest for business owners and professionals, then recap on the Pre Financial Year End initiatives that can be considered during the tax planning seasonHanrick curran 2015 tax and superannuation post budget presentation

Hanrick curran 2015 tax and superannuation post budget presentationMazars Qld (Formerly Hanrick Curran)

Similaire à Slideshow: Analysis of the Tax Provisions in the "Grand Bargain" (20)

Tax Reform and the Impact to your Franchise by Honkamp Krueger4 2018

Tax Reform and the Impact to your Franchise by Honkamp Krueger4 2018

Albidress, Adrian Key Financial Data 2014-publication

Albidress, Adrian Key Financial Data 2014-publication

Hanrick curran 2015 tax and superannuation post budget presentation

Hanrick curran 2015 tax and superannuation post budget presentation

Your Taxes 2013 - What will change (and what won't)

Your Taxes 2013 - What will change (and what won't)

Tax planning for the dentist in an era of uncertainty

Tax planning for the dentist in an era of uncertainty

Plus de OCPP

Plus de OCPP (6)

Outsized Gains at the Top Worsen Oregon Income Inequality

Outsized Gains at the Top Worsen Oregon Income Inequality

Slideshow: Analysis of Tax Provisions in "Grand Bargain"

Slideshow: Analysis of Tax Provisions in "Grand Bargain"

Cutting Tax Rate on "Small Business" Pass-Through Income

Cutting Tax Rate on "Small Business" Pass-Through Income

Dernier

Dernier (20)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Gurgaon Sector 47 (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Gurgaon Sector 47 (Gurgaon)

BDSM⚡Call Girls in Sector 135 Noida Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Sector 135 Noida Escorts >༒8448380779 Escort Service

Busty Desi⚡Call Girls in Sector 62 Noida Escorts >༒8448380779 Escort Service

Busty Desi⚡Call Girls in Sector 62 Noida Escorts >༒8448380779 Escort Service

Powerful Love Spells in Phoenix, AZ (310) 882-6330 Bring Back Lost Lover

Powerful Love Spells in Phoenix, AZ (310) 882-6330 Bring Back Lost Lover

Nurturing Families, Empowering Lives: TDP's Vision for Family Welfare in Andh...

Nurturing Families, Empowering Lives: TDP's Vision for Family Welfare in Andh...

Verified Love Spells in Little Rock, AR (310) 882-6330 Get My Ex-Lover Back

Verified Love Spells in Little Rock, AR (310) 882-6330 Get My Ex-Lover Back

WhatsApp 📞 8448380779 ✅Call Girls In Chaura Sector 22 ( Noida)

WhatsApp 📞 8448380779 ✅Call Girls In Chaura Sector 22 ( Noida)

AI as Research Assistant: Upscaling Content Analysis to Identify Patterns of ...

AI as Research Assistant: Upscaling Content Analysis to Identify Patterns of ...

Enjoy Night ≽ 8448380779 ≼ Call Girls In Gurgaon Sector 48 (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Gurgaon Sector 48 (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Gurgaon Sector 46 (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Gurgaon Sector 46 (Gurgaon)

BDSM⚡Call Girls in Indirapuram Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Indirapuram Escorts >༒8448380779 Escort Service

Julius Randle's Injury Status: Surgery Not Off the Table

Julius Randle's Injury Status: Surgery Not Off the Table

Transformative Leadership: N Chandrababu Naidu and TDP's Vision for Innovatio...

Transformative Leadership: N Chandrababu Naidu and TDP's Vision for Innovatio...

Enjoy Night⚡Call Girls Iffco Chowk Gurgaon >༒8448380779 Escort Service

Enjoy Night⚡Call Girls Iffco Chowk Gurgaon >༒8448380779 Escort Service

Nara Chandrababu Naidu's Visionary Policies For Andhra Pradesh's Development

Nara Chandrababu Naidu's Visionary Policies For Andhra Pradesh's Development

Enjoy Night ≽ 8448380779 ≼ Call Girls In Palam Vihar (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Palam Vihar (Gurgaon)

Slideshow: Analysis of the Tax Provisions in the "Grand Bargain"

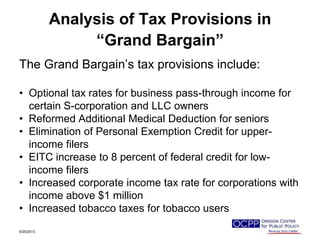

- 1. Analysis of Tax Provisions in “Grand Bargain” The Grand Bargain’s tax provisions include: • Optional tax rates for business pass-through income for certain S-corporation and LLC owners • Reformed Additional Medical Deduction for seniors • Elimination of Personal Exemption Credit for upper- income filers • EITC increase to 8 percent of federal credit for low- income filers • Increased corporate income tax rate for corporations with income above $1 million • Increased tobacco taxes for tobacco users 9/25/13

- 2. Will the tax provisions of the proposed Grand Bargain cover the costs for the proposed new investments in education, mental health care, and services for seniors? 9/25/13

- 3. Revenue to Pay for New Investments Shrinks After Current Budget $189 $50 $24 $0 $50 $100 $150 $200 $250 2013-15 2015-17 2017-19 Projected new revenue 9/25/13 Inmillions $201 million in new investments Source: Oregon Legislative Revenue Office

- 4. Business Pass-Through Income Subsidy is More Costly After Current Biennium -$38 -$205 -$239 -$300 -$250 -$200 -$150 -$100 -$50 $0 2013-15 2015-17 2017-19 9/25/13 ProjectedCostofSubsidyinmillions Source: Oregon Legislative Revenue Office

- 5. How do Oregonians at different levels of the income scale fare under the combined personal income tax (PIT) provisions of the proposed Grand Bargain tax changes? 9/25/13

- 6. Beneficiaries of Tax Cuts Are Roughly Evenly Distributed; Tax Increases Mainly Impact Higher End of Income Scale 0% 20% 40% 60% 80% 100% Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% 9/25/13 Source: Institute on Taxation and Economic Policy, September 2013 Share with Tax Increase Share with Tax Cut Combined Impact of All PIT Provisions

- 7. Lion’s Share of the Tax Cut Goes to Some of the Top 1 Percent 0% 20% 40% 60% 80% 100% Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% 9/25/13 Source: Institute on Taxation and Economic Policy, September 2013 Share of Tax Increase Share of Tax Cut Combined Impact of All PIT Provisions

- 8. For Top 1 Percent, Average Tax Cut Dwarfs Average Tax Increase $51 $27 $152 $328 $357 $573 $745 -$31 -$60 -$67 -$108 -$99 -$726 -$9,246-$10,000 -$8,000 -$6,000 -$4,000 -$2,000 $0 $2,000 Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% 9/25/13 Source: Institute on Taxation and Economic Policy, September 2013 Average Increase for Those with Increase Average Cut for Those with Tax Cut

- 9. The Overall Average Tax Change is Negligible for All Except the Windfall for the Top 1 Percent -$8 -$15 -$16 $21 $49 $149 -$2,694-$3,000 -$2,000 -$1,000 $0 $1,000 Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% 9/25/13 Source: Institute on Taxation and Economic Policy, September 2013 AverageTaxChange–AllTaxpayers Combined Impact of All PIT Provisions

- 10. Who benefits from the Grand Bargain’s business pass- through income tax subsidy? 9/25/13

- 11. Business Pass-Through Income Subsidy Is Mainly for Some at the Top 0% 20% 40% 60% 80% 100% Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% 9/25/13 Source: Institute on Taxation and Economic Policy, September 2013 Optional Rates for Business Pass-Thru Income SharewithTaxCut

- 12. Average Savings for Someone in the Top 1 Percent Getting a Subsidy Is Over $6,000 $0 -$46 -$71 -$53 -$75 -$458 -$6,011 -$10,000 -$8,000 -$6,000 -$4,000 -$2,000 $0 Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% 9/25/13 Source: Institute on Taxation and Economic Policy, September 2013 AverageCutforThoseReceivingaSubsidy Optional Rates for Business Pass-Thru Income

- 13. Most of the Total Tax Cut Goes to a Portion of the Top 1 Percent 0% 20% 40% 60% 80% 100% Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% 9/25/13 Source: Institute on Taxation and Economic Policy, September 2013 Optional Rates for Business Pass-Thru Income ShareofTaxCut

- 14. Top 1 Percent Saves, on Average, about $3,300 $0 $0 -$3 -$3 -$8 -$113 -$3,298 -$10,000 -$8,000 -$6,000 -$4,000 -$2,000 $0 Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% 9/25/13 Source: Institute on Taxation and Economic Policy, September 2013 AverageTaxChange–AllTaxpayers Optional Rates for Business Pass-Thru Income

- 15. How would Oregonians at different levels of the income scale fare under the combined PIT provisions if the Grand Bargain did not include the business pass-through income tax subsidy? 9/25/13

- 16. Without Pass-Through Subsidy, Plan More Fair: Tax Increases Concentrated at the Top, Tax Cuts for Some Low- & Middle-Income Families 0% 20% 40% 60% 80% 100% Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% 9/25/13 Impact of PIT provisions, excluding pass-through business income rates. Source: Institute on Taxation and Economic Policy, September 2013 Share with Tax Increase Share with Tax Cut

- 17. Without Pass-Through Subsidy, Tax Changes Would Be More Closely Based on Ability to Pay 0% 20% 40% 60% 80% 100% Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% 9/25/13 Share of Tax IncreaseShare of Tax Cut Impact of PIT provisions, excluding pass-through business income rates. Source: Institute on Taxation and Economic Policy, September 2013

- 18. Without Pass-Through Subsidy, the Tax Cuts & Increases Are Fairly Modest for Everyone $51 $27 $153 $328 $357 $607 $629 -$31 -$60 -$64 -$118 -$140 -$153 $0 -$500 -$250 $0 $250 $500 $750 $1,000 Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% 9/25/13 Average Increase for Those with Increase Average Cut for Those with Tax Cut Impact of PIT provisions, excluding pass-through business income rates. Source: Institute on Taxation and Economic Policy, September 2013

- 19. Without Pass-Through Subsidy, Average Overall Change Would Be Based on Ability to Pay -$8 -$15 -$13 $24 $58 $284 $614 -$500 -$250 $0 $250 $500 $750 $1,000 Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% 9/25/13 AverageTaxChange–AllTaxpayers Impact of PIT provisions, excluding pass-through business income rates. Source: Institute on Taxation and Economic Policy, September 2013

- 20. Conclusion In its current form, after the current biennium the Grand Bargain’s tax package won’t deliver the money needed to pay for the proposed new investments in education, mental health care, and services for seniors. The cause of the sharp drop in revenue is the ballooning costs of business pass-through income provision, a subsidy that by-and- large only benefits some of Oregon’s wealthiest 1 percent. Eliminating the business pass-through income provision would retain revenue to pay for the new investments and make the package more equitable. 9/25/13