Contenu connexe Similaire à What Not to Do In Equity: The Hexagon of Equity Pitfalls (20) 1. WHAT NOT TO DO IN EQUITY:

THE HEXAGON

OF EQUITY

PITFALLS

PABLO E. VERRA

January2020

Underestimating

the macro

environment

Driving

equity

based on

volume

targets

Rushing

structuring &

giving up

rights

Lack of

accountability &

proper

incentives

for staff

Using a

blanket

approach for

industries &

countries

Picking the

wrong sponsor

for equity

© Pablo E. Verra – 2020

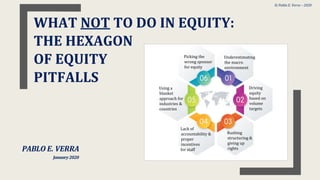

2. The Infamous Hexagon of Equity Pitfalls

1

Underestimating

the macro

environment

Driving

equity

based on

volume

targets

Rushing

structuring &

giving up

rights

Lack of

accountability &

proper incentives

for staff

Using a

blanket

approach for

industries &

countries

Picking the wrong

sponsor for

equity

If you are an impact investor, you should beware of the infamous hexagon of equity pitfalls. Clearly,

avoiding these 6 rather common traps will not guarantee you record-breaking IRRs but, at least, you would

not be making what I consider, in my humble opinion, 6 avoidable mistakes in equity investing.

© Pablo E. Verra – 2020

3. 1. Underestimating the Macro Environment

2

Equity investments, unless hedged (and hedging equity is rarely feasible and usually expensive!), are

denominated in local currency and, as such, carry FX risk. Understanding and predicting, as good as you

can, the macro conditions is critical to better project US$ returns – great IRRs in local currency do not

mean great IRRs in US$, Euros or Swiss Francs. What really matters is what is the currency you are

raising, and, thus, deploying!

Oops! I spent 3

months arguing

whether the

EBITDA margin

needed to be 20 or

25% and whether

to pay 1.4x or 1.5x

value... and the

local currency

devalued 50% 6

months after I

invested! There is

no way I can turn

this around for my

US$ investors!

Source: Bloomberg.

© Pablo E. Verra – 2020

4. 1. Underestimating the Macro Environment (cont’d)

3

Local presence has proven to be critical to better foresee macro and industry dynamics that may affect

equity investments. It is proven that funds with a local presence perform better than fly-ins!

Comparing LAC PE/VC Returns

in Local Currency & US$

(since inception)

Multiple of Invested Capital

for Realized Latin American Investments (in US$)

Source: Cambridge Associates. The Private Path to Latin America’s Most Dynamic Sectors.

© Pablo E. Verra – 2020

5. 2. Driving Equity Based on Volume Targets

4

PE & VC funds correct based on macro trends – they raise less money and invest on fewer deals if the

environment is less conducive for equity. Some impact investors, including some multilaterals, define their

equity targets based on “annual invested volume” – this is a recipe for disastrous over-investing, bias in

favor of big tickets and reduced leverage when structuring. Absolute volume targets go against this

recommended behavior and should be avoided.

Annual EM-focused PE Fundraising Annual LAC-focused PE Fundraising

# & Aggregate Value of PE Deals in LAC # & Aggregate Value of VC Deals in LAC

Source: Preqin

Private Equity

Online &

LAVCA.

© Pablo E. Verra – 2020

6. 3. Rushing Structuring & Giving Up Rights

5

As an impact equity investor, there is a universe of structural clauses that should be avoided in order not to

restrict the investor’s capacity to maneuver an equity investment. Furthermore, rushing the processing of a

transaction could derive into operational mistakes that can end up costing a lot of US$.

• Clauses that limit the investor’s exit options, hence minimizing liquidity for the

investor’s shares

• Rights of First Refusal (ROFR); Rights of First Offer (ROFO).

• Clauses that are value distractive for the investor

• Call Options, Drag-Along Rights, ROFO, ROFR.

• Believing that a put “guarantees” the investor an exit

• Puts may not be enforceable in times of distress;

• Put agreements may have to be litigated before NY courts and enforced

before local courts law; and

• The bylaws of the company may not even reflect the put agreement.

• Overly complicating formulas or clauses

• If not properly reflected in the agreements, the sponsor may not respect the

original commercial understanding at the time of signing.

• Allowing the sponsor to sell a key subsidiary without a veto right

• Price incentives between the sponsor and the investor may not necessarily be

aligned (e.g., sponsor may have a much lower entry multiple).

You guessed right! I

have personally

been burnt by

many of these

clauses. And I will

dedicate another

chapter of this

primer series to

proper structuring

and the rationale

for accepting / not

accepting certain

rights. Please,

include anything

you want me to

cover in your

comments!

© Pablo E. Verra – 2020

7. 4. Lack of Accountability & Proper Incentives for Staff

6

Often, impact investors manage both equity and debt funds. This may seem obvious, but I have seen several

situations where there is an unintentional bias to prefer debt deals because, in most cases, they are

easier to negotiate and funds can be deployed more rapidly. If you are in this dual investment scenario,

remember that you owe fiduciary duties to all your limited partners. I have also seen structures in which deals

are negotiated and signed by senior executives and then ‘transferred’ to be monitored by junior team

members – this reduces accountability and the capacity to detect operational mistakes.

Time of Investment

▪ Much more time

consuming than debt;

▪ Requires developing

trust with a client.

▪ Better to align deal

breakers (e.g.,

valuation

expectations) as early

as possible;

▪ Extensive negotiations

are usual;

▪ No ‘cookie cutter’

approach – each deal

is different.

▪ Usually performed by more junior team members;

▪ Closely monitor performance – mark to market needed if

company is listed in an active market;

▪ Choose the ‘right’ Board member and organize frequent

calls with him/her;

▪ Resolution of operational problems – utilization of

supermajority / veto rights (e.g., in the event of a merger

or an acquisition).

▪ Usually negotiated

by senior officers;

▪ Rapid and intense

process (weeks can

make all the

difference).

Senior Officer Investment Team Junior Officer Senior Officer

PREFERRED: Investment Leader

Sourcing

Execution

& Signing Portfolio Monitoring Exit

Most of the work

happens HERE!I recommend that

the “deal maker”

stays as the

ultimate

responsible

officer from the

origination of the

deal until its exit. In

equity, we say that

the “real work

begins when you

sign the

subscription

agreement”.

© Pablo E. Verra – 2020

8. 5. Use a Blanket Approach for All Industries & Countries

7

I have been lucky enough to have worked in 22 different Emerging Markets. Each deal, each context, each

sponsor and each negotiation has been different. Due to this, I naturally have a bias to favor industry and

region-specific funds than global ones. When an investor approaches me with a global fund, the first question

I usually ask is “how are you going to know what happens in Indonesia from your office in Midtown?”.

Granted, there are successful global funds (it may be easier in public equity than in private equity), but, in

most cases, even these global funds have separate, dedicated, teams to look at each industry and region.

Source: Private Equity

International.

© Pablo E. Verra – 2020

9. 6. Picking the Wrong Sponsor for Equity

8

When doing debt, your counterparty – in most cases – is the company; when doing equity, your

counterparty is the sponsor.

• Sponsors usually negotiate harder on equity than on debt (e.g., they are giving you a part of “their”

company);

• It is very difficult to determine the financial “capacity” of a sponsor to honor e.g., a put (and this

financial capacity may easily change over time);

• Sponsors may not reflect the full extent of the equity agreements in the company’s by-laws and

may drive a potential litigation into local courts (where by-laws usually take precedence);

• Sponsors will probably not be aligned with the investor on valuation when exploring a potential

exit (e.g., their entry valuation multiple may be much lower than the investor’s);

• Sponsors may delegate on management the negotiation of the agreements, but may be behind the

negotiation of “key” clauses;

• Sponsors may lie, threaten the investor and use the press to bad-mouth the investor;

• Sponsors may tell one story to you and a completely different one to the other shareholders; and

• You will never know more about the company that you are investing in than what the sponsor

knows (that is why it is essential to carefully structure an equity investment).

© Pablo E. Verra – 2020

10. Being Selective is Good, and It Is Expected!

9

“Most buyout firms that I know do 1 deal per general partner per year. You could

think of that as a maximum. One firm I know very well has 8 practice leaders and aims

to do 4 deals a year.”

Josh Lerner – Faculty Chair of Private Equity – Harvard Business School

30 investments discussed

at final investments committee stage

250 unique investments discussed at

investment committee

1,000+ investments

evaluated in a typical

year

Prioritization by industry

investment team

Investments brought by senior advisors,

PE firm relationships, other business lines and industry expertise

Source: streetofwalls.com.

10 completed investments!

© Pablo E. Verra – 2020

11. Being Selective is Good, and It Is Expected! (cont’d)

10

Do’s

• Well managed companies with good sponsors;

• Historical perspective and conservatism on valuations;

• Attractive ex-ante risk return balance;

• Find the value of the investee company on a pre-money

basis (e.g., how much the company is worth as is and

without the injection of new capital);

• Specific situations in large under-penetrated markets with

good growth prospects (e.g., insurance in LAC,

infrastructure finance in Mexico or Colombia, health

insurance in middle-income countries with poor public

health services);

• Large under penetrated countries/regions where you are

underweight;

• Opportunistic situations (e.g., forced sales or retrenchment

from European players; new private sector banks - but not

all new private sector banks; remaining bank privatizations

- but not all bank privatizations);

• Encourage South-South M&A across your portfolio;

• Help bring strategic investors into new markets (e.g.,

Chinese, Japanese, and Western banks and insurance

companies into Latin America).

Don’ts

• Compromise on management or sponsor quality;

• Compromise on valuation;

• Invest in very hot markets;

• Overly rely on financial projections and/or comparables

instead of historical perspective on valuation;

• Pay for the value that you are expected to add as investor;

• Make large investments in small and/or over-penetrated

markets;

• Pay a premium to market;

• Assume that you will exit at a higher multiple than entry;

• Invest in publicly listed shares in particular during book

building processes;

• Accept weak terms, particularly sales restrictions and call

options.

Source: IFC. Reproduced with Flavio Guimaraes’ permission.

© Pablo E. Verra – 2020