Cormedix ($CRMD) - Maxim June 2011 Update

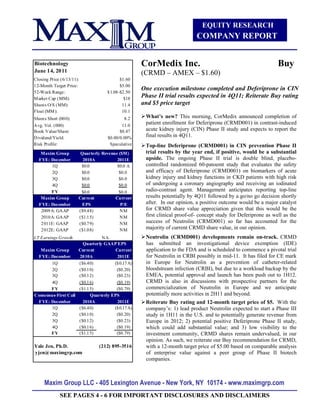

- 1. EQUITY RESEARCH COMPANY REPORT Biotechnology CorMedix Inc. Buy June 14, 2011 (CRMD – AMEX – $1.60) Closing Price (6/13/11): $1.60 12-Month Target Price: $5.00 One execution milestone completed and Deferiprone in CIN 52-Week Range: $1.08-$2.50 M arket Cap (MM): $18 Phase II trial results expected in 4Q11; Reiterate Buy rating Shares O/S (MM): 11.4 and $5 price target Float (MM ): 10.1 Shares Short (000): 8.2 What’s new? This morning, CorMedix announced completion of Avg. Vol. (000) 11.0 patient enrollment for Deferiprone (CRMD001) in contrast-induced Book Value/Share: $0.47 acute kidney injury (CIN) Phase II study and expects to report the Dividend/Yield: $0.00/0.00% final results in 4Q11. Risk Profile: Speculative Top-line Deferiprone (CRMD001) in CIN prevention Phase II Maxim Group Quarterly Revenue ($M) trial results by the year end, if positive, would be a substantial FYE: December 2010A 2011E upside. The ongoing Phase II trial is double blind, placebo- 1Q $0.0 $0.0 A controlled randomized 60-patoemt study that evaluates the safety 2Q $0.0 $0.0 and efficacy of Deferiprone (CRMD001) on biomarkers of acute 3Q $0.0 $0.0 kidney injury and kidney functions in CKD patients with high risk 4Q $0.0 $0.0 of undergoing a coronary angiography and receiving an iodinated FY $0.0 $0.0 radio-contrast agent. Management anticipates reporting top-line Maxim Group Current Current results potentially by 4Q11 followed by a go/no go decision shortly FYE: December EPS P/E after. In our opinion, a positive outcome would be a major catalyst 2009A: GAAP ($9.48) NM for CRMD share value appreciation given that this would be the 2010A: GAAP ($1.15) NM first clinical proof-of- concept study for Deferiprone as well as the 2011E: GAAP ($0.79) NM success of Neutrolin (CRMD001) so far has accounted for the 2012E: GAAP ($1.08) NM majority of current CRMD share value, in our opinion. LT Earnings Growth NA Neutrolin (CRMD001) developments remain on-track. CRMD Quarterly GAAP EPS has submitted an investigational device exemption (IDE) Maxim Group Current Current application to the FDA and is scheduled to commence a pivotal trial FYE: December 2010A 2011E for Neutrolin in CRBI possibly in mid-11. It has filed for CE mark 1Q ($6.40) ($0.17 A) in Europe for Neutrolin as a prevention of catheter-related 2Q ($0.10) ($0.20) bloodstream infection (CRBI), but due to a workload backup by the 3Q ($0.12) ($0.23) EMEA, potential approval and launch has been push out to 1H12. 4Q ($0.16) ($0.19) CRMD is also in discussions with prospective partners for the FY ($1.15) ($0.79) commercialization of Neutrolin in Europe and we anticipate Consensus-First Call Quarterly EPS potentially more activities in 2H11 and beyond. FYE: December 2010A 2011E Reiterate Buy rating and 12-month target price of $5. With the 1Q ($6.40) ($0.17 A) company’s: 1) lead product Neutrolin expected to start a Phase III 2Q ($0.10) ($0.20) study in 1H11 in the U.S. and to potentially generate revenue from 3Q ($0.12) ($0.23) Europe in 2012; 2) potential positive Deferiprone Phase II study, 4Q ($0.16) ($0.19) which could add substantial value; and 3) low visibility to the FY ($1.15) ($0.79) investment community, CRMD shares remain undervalued, in our opinion. As such, we reiterate our Buy recommendation for CRMD, Yale Jen, Ph.D. (212) 895-3516 with a 12-month target price of $5.00 based on comparable analysis yjen@maximgrp.com of enterprise value against a peer group of Phase II biotech companies. Maxim Group LLC - 405 Lexington Avenue - New York, NY 10174 - www.maximgrp.com SEE PAGES 4 - 6 FOR IMPORTANT DISCLOSURES AND DISCLAIMERS

- 2. CorMedix Inc. (CRMD) Expected milestones for 2011 and beyond Program Indication Event Timing Commence pivotal trial 2Q11 Potentially receive CE mark approval in EU 1H12 Potential EU partnership 2H11 / 2012 Prevention of catheter related Neutrolin (CRMD003) bactermia (CRB) Potential product launch in EU 1H12 Potential FDA decision on Zuragen PMA 2011 Potential release interim results of pivotal trial Early '12 Release complete results from biomarker Phase II proof-of- 4Q11 concept study Contrast Induced Nephropathy (CIN) Potential making go/no go decision 4Q11 Deferiprone (CRMD001) Potential initiate Phase III study with SPA designation 2012 Potentially commence of proof of concept trial in high risk CKD Chronic Kidney Disease (CKD) 2012 patients Source: Company reports and Maxim Group estimates Maxim Group LLC 2

- 3. CorMedix Inc. (CRMD) CorMedix, Inc. Annual Income Statement (IN MILLIONS, EXCEPT PER SHARE AMOUNTS) ($ 000s) 2009 2010 2011E 2012E 2013E 1Q11 2Q11E 3Q11E 4Q11E Revenue Revenue - - - - - - - 1,000 17,676 Others (upfront, milestone, etc.) - - - - - - - - - Total revenue - - - - - - - 1,000 17,676 COGS 3,535 Research and development 4,889 5,494 1,176 1,516 1,789 2,290 6,772 16,523 19,497 General and administrative 1,167 3,013 834 885 920 948 3,586 3,766 19,846 Total Operating Expenses 6,055 8,507 2,010 2,401 2,709 3,238 10,358 20,289 42,878 Operating income (losses) (6,055) (8,507) (2,010) (2,401) (2,709) (3,238) (10,358) (19,289) (25,203) Other income 30 27 24 22 103 103 103 Interest income 2 415 5 5 5 5 21 21 21 Interest expense, including amortization of deferred financin (2,068) (3,094) - - - - - - - Total other income (expense) (2,066) (2,679) 35 32 29 27 123 123 123 Net income (loss) before tax (8,121) (11,186) (1,975) (2,369) (2,680) (3,211) (10,235) (19,166) (25,080) Tax 281 - Net income (loss) (8,121) (10,905) (1,975) (2,369) (2,680) (3,211) (10,235) (19,166) (25,080) Basic and diluted net income (loss) per share (9.48) (1.15) (0.17) (0.20) (0.23) (0.19) (0.79) (1.08) (1.27) Shares outstanding—basic & diluted 857 9,473 11,408 11,608 11,808 17,208 13,008 17,708 19,775 Margin Analysis (% of Total operating expenses) COGS 0% 0% 0% 0% 0% 0% 0% 0% 20% R&D 81% 65% 58% 63% 66% 71% 65% 81% 45% G&A 19% 35% 42% 37% 34% 29% 35% 19% 46% Operating Income (loss) 100% 100% 100% 100% 100% 100% 100% 100% 100% Financial Indicator Growth Analysis (YoY%) Revenue NA NA NA NA NA NA NA NA 1668% Total revenue NA NA NA NA NA NA NA NA 1668% COGS NA NA NA NA NA NA NA NA NA Research and development 59% 12% -62% 170% 135% 113% 23% 144% 18% General and administrative -33% 158% 29% 43% 43% -14% 19% 5% 427% Total Operating Expenses 26% 40% -46% 104% 93% 48% 22% 96% 111% Interest income -92% 19365% 18350% -9% -50% -99% -95% 0% 0% Interest expense, including amortization of deferred financing co -51% 50% -100% NA NA NA -100% -5% 7% Net income (loss) -10% 34% -71% 102% 92% 114% -6% 87% 31% Basic and diluted net income (loss) per share -13% -88% -97% 99% 86% 19% -32% 38% 17% SOURCE: MAXIM GROUP LLC RESEARCH AND SEC FILING Maxim Group LLC 3

- 4. CorMedix Inc. (CRMD) DISCLOSURES Source: Investars Maxim Group LLC Stock Rating System As of: 6/14/2011 % of Coverage % of Ratings Universe that Firm received Expected Performance* with Rating Banking fees Buy Expected total return of 15% or more over next 12 months 67.1% 23.5% Hold Expected total return of plus or minus 14% over next 12 months 25.0% 0.0% Sell Expected total negative return of at least 15% over next 12 months 7.9% 0.0% * Relative to Nasdaq Composite. An Under Review (UR) rating represents a stock that the Firm has temporarily placed under review due to a material change. Maxim makes a market in CorMedix, Inc. Maxim Group has received compensation for investment banking services from CorMedix, Inc. in the past 12 months. Maxim Group expects to receive or intends to seek compensation for investment banking services from CorMedix, Inc. in the next 3 months. Maxim Group has managed or co-managed a public offering of CorMedix, Inc. in the past 12 months. I, Yale Jen, attest that the views expressed in this research report accurately reflect my personal views about the subject security and issuer. Furthermore, no part of my compensation was, is, or will be directly or indirectly related to the specific recommendation or views expressed in this research report. The research analyst(s) primarily responsible for the preparation of this research report have received compensation based upon various factors, including the firm’s total revenues, a portion of which is generated by investment banking activities. Valuation Methods: One or more of the following valuation methods are used by Maxim Group analysts in making a ratings or price projection: Analysis of companies’ P/E ratio, price/book ratio, earnings expectations or sales growth as they relate within an industry group or to the broader market, enterprise value/sales, individual sector analysis, sum of the parts analysis and discounted cash flow. Maxim Group LLC 4

- 5. CorMedix Inc. (CRMD) Price Target Risks: Investment risks associated with the achievement of the price target include, but are not limited to, the company’s failure to achieve our earnings and revenue estimates, unforeseen macroeconomic and/or industry events that adversely impact demand for the company’s products and services, product obsolescence, the company’s ability to recruit and retain competent personnel, changes in investor sentiment regarding the specific company or industry, changing competitive pressures and adverse market conditions. For a complete discussion of the risk factors that could affect the market price of the company’s shares, refer to the most recent form 10-Q or 10-K that the company has filed with the SEC. Investment Risks: Aside from general market and other economic risks, risks particular to our CorMedix Inc. rating include: 1) the success of pivotal clinical trials for both Neutrolin and Deferiprone would have major impact for CRMD shareholders; 2) sales potential for the two products could be different significantly from expected; 3) lack of cash could impede corporate development; and 4) thinly traded stock limits shareholder options. RISK RATINGS Risk ratings take into account both fundamental criteria and price volatility. Speculative – Fundamental Criteria: This is a risk rating assigned to early-stage companies with minimal to no revenues, lack of earnings, balance sheet concerns, and/or a short operating history. Accordingly, fundamental risk is expected to be significantly above the industry. Price Volatility: Because of the inherent fundamental criteria of the companies falling within this risk category, the price volatility is expected to be significant with the possibility that the investment could eventually be worthless. Speculative stocks may not be suitable for a significant class of individual investors. High – Fundamental Criteria: This is a risk rating assigned to companies having below-average revenue and earnings visibility, negative cash flow, and low market cap or public float. Accordingly, fundamental risk is expected to be above the industry. Price volatility: The price volatility of companies falling within this category is expected to be above the industry. High-risk stocks may not be suitable for a significant class of individual investors. Medium – Fundamental Criteria: This is a risk rating assigned to companies that may have average revenue and earnings visibility, positive cash flow, and is fairly liquid. Accordingly, both price volatility and fundamental risk are expected to approximate the industry average. Low – Fundamental Criteria: This is a risk rating assigned to companies that may have above-average revenue and earnings visibility, positive cash flow, and is fairly liquid. Accordingly, both price volatility and fundamental risk are expected to be below the industry. Maxim Group LLC 5

- 6. CorMedix Inc. (CRMD) DISCLAIMERS Some companies that Maxim Group LLC follows are emerging growth companies whose securities typically involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Maxim Group LLC research reports may not be suitable for some investors. Investors must make their own determination as to the appropriateness of an investment in any securities referred to herein, based on their specific investment objectives, financial status and risk tolerance. This communication is neither an offer to sell nor a solicitation of an offer to buy any securities mentioned herein. This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or disclosed to another party, without the prior written consent of Maxim Group, LLC (“Maxim”). Information and opinions presented in this report have been obtained or derived from sources believed by Maxim to be reliable, but Maxim makes no representation as to their accuracy or completeness. Maxim accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Maxim. This report is not to be relied upon in substitution for the exercise of independent judgment. Maxim may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect the different assumptions, views and analytical methods of the analysts who prepared them and Maxim is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a judgment at its original date of publication by Maxim and are subject to change without notice. The price, value of and income from any of the securities mentioned in this report can fall as well as rise. The value of securities is subject to exchange rate fluctuation that may have a positive or adverse effect on the price or income of such securities. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk. Securities recommended, offered or sold by Maxim: (1) are not insured by the Federal Deposit Insurance Company; (2) are not deposits or other obligations of any insured depository institution; and (2) are subject to investment risks, including the possible loss of principal invested. Indeed, in the case of some investments, the potential losses may exceed the amount of initial investment and, in such circumstances; you may be required to pay more money to support these losses. ADDITIONAL INFORMATION IS AVAILABLE UPON REQUEST Maxim Group LLC 6