DARA BioSciences (NASDAQ: DARA), Zacks Research Report Update 11/18/11

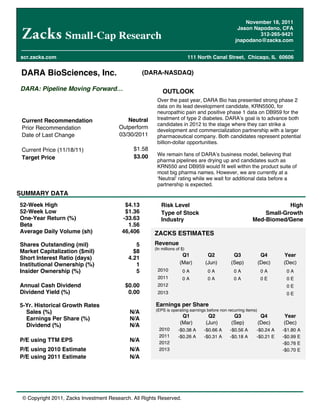

- 1. November 18, 2011 Jason Napodano, CFA Small-Cap Research 312-265-9421 jnapodano@zacks.com scr.zacks.com 111 North Canal Street, Chicago, IL 60606 DARA BioSciences, Inc. (DARA-NASDAQ) DARA: Pipeline Moving Forward OUTLOOK Over the past year, DARA Bio has presented strong phase 2 data on its lead development candidate, KRN5500, for neuropathic pain and positive phase 1 data on DB959 for the Current Recommendation Neutral treatment of type 2 diabetes. DARA s goal is to advance both candidates in 2012 to the stage where they can strike a Prior Recommendation Outperform development and commercialization partnership with a larger Date of Last Change 03/30/2011 pharmaceutical company. Both candidates represent potential billion-dollar opportunities. Current Price (11/18/11) $1.58 $3.00 We remain fans of DARA s business model, believing that Target Price pharma pipelines are drying up and candidates such as KRN550 and DB959 would fit well within the product suite of most big pharma names. However, we are currently at a Neutral rating while we wait for additional data before a partnership is expected. SUMMARY DATA 52-Week High $4.13 Risk Level High 52-Week Low $1.36 Type of Stock Small-Growth One-Year Return (%) -33.63 Industry Med-Biomed/Gene Beta 1.56 Average Daily Volume (sh) 46,406 ZACKS ESTIMATES Shares Outstanding (mil) 5 Revenue (In millions of $) Market Capitalization ($mil) $8 Q1 Q2 Q3 Q4 Year Short Interest Ratio (days) 4.21 Institutional Ownership (%) 1 (Mar) (Jun) (Sep) (Dec) (Dec) Insider Ownership (%) 5 2010 0A 0A 0A 0A 0A 2011 0A 0A 0A 0E 0E Annual Cash Dividend $0.00 2012 0E Dividend Yield (%) 0.00 2013 0E 5-Yr. Historical Growth Rates Earnings per Share (EPS is operating earnings before non recurring items) Sales (%) N/A Q1 Q2 Q3 Q4 Year Earnings Per Share (%) N/A (Mar) (Jun) (Sep) (Dec) (Dec) Dividend (%) N/A 2010 -$0.38 A -$0.66 A -$0.56 A -$0.24 A -$1.80 A 2011 -$0.26 A -$0.31 A -$0.18 A -$0.21 E -$0.99 E P/E using TTM EPS N/A 2012 -$0.76 E P/E using 2010 Estimate N/A 2013 -$0.70 E P/E using 2011 Estimate N/A © Copyright 2011, Zacks Investment Research. All Rights Reserved.

- 2. WHAT S NEW Q2 2011 10Q Filed On November 15, 2011, DARA Bio filed its 10Q for the third quarter 2011. The company reported no revenues during the quarter, or in 2010 for that matter. Operating loss for the quarter was $0.92 million, or $0.18 per share. Operating cash burn in the quarter was roughly $1.2 million. DARA exited the third quarter with $2.2 million in cash and investments. We forecast burn is around $0.9 million per quarter. We see the current cash balance as sufficient to fund operations into the third quarter 2012. We believe the company may seek to raise funds during the first half of 2012 to keep the clinical pipeline on track. We note that in March 2011, the company filed a shelf registration statement with the SEC allowing the company to offers and sell up to $30 million of securities, including equity, debt and other securities as described in the registration statement. DARA s last offering was in December 2010, where the company secured $4.8 million in a registered direct offering. Positive Phase 1b On DB959 On November 1, 2011, DARA announced positive results from a successfully completed phase 1b clinical study for DB959, the company s once daily peroxisome proliferator activated receptor (PPAR) delta/gamma agonist, a non- TZD oral drug in development for the treatment of type 2 diabetes. The study was a randomized, placebo- controlled, double-blind, escalating multiple dose clinical trial that enrolled 32 healthy male and female volunteers at Quintiles' Phase 1 facility in Overland Park, Kansas. The company plans to present detailed results at an upcoming scientific meeting in the first half of 2012. However, initial analysis of the data show that DB959 was safe and well-tolerated throughout the 40-fold dose-range tested, with an overall safety profile similar to placebo when dosed for 1 week. Pharmacokinetic (PK) analysis indicates that DB959 is highly likely to meet the target dosing regimen of once-a-day. The data confirm DARA s phase 1a data from a single-ascending dose study showing excellent safety and tolerability, previously presented at the American Diabetes Association (ADA) meeting in June 2011. Changes in the circulating profile of adiponectin, the established biomarker of PPAR agonism, seen in this study suggests that DB959 will be pharmacologically active in patients with type 2 diabetes within the well tolerated dose range utilized in this study. Adiponectin is a fat tissue-derived plasma protein whose expression is regulated by PPAR-gamma. It may play a modulatory role in multiple metabolic processes; plasma levels of adiponectin correlate with insulin sensitivity and correlate inversely with percent body fat. Improvements in one's metabolic health, as may be seen with weight loss, can be accompanied by increases in plasma adiponectin. Plasma adiponectin levels can be used as a biomarker or indicator of in vivo PPAR-gamma agonism. Numerous published studies have shown that PPAR-gamma agonists dose-dependently increase plasma adiponectin levels in both non-diabetic and diabetic populations at doses known to improve glucose homeostasis and insulin sensitivity. Previous Data Suggest Unique Profile Preclinical results demonstrated that DB959 lowered glucose to normal levels, raised HDL, raised the HDL:LDL ratio, and lowered triglycerides. These beneficial effects on glucose and lipids were observed without causing the weight gain which has been seen with other PPAR agonists. Positive lipid effects on cholesterol and triglycerides would provide a unique profile to DB959 in the treatment of type 2 diabetes. We note approximately 85% of patients with type 2 diabetes also have mixed dyslipidemia. Zacks Investment Research Page 2 www.zacks.com

- 3. INVESTMENT OVERVIEW KRN5500 Impressive In Early-Stage DARA Bio presented positive study results from its phase 2a dose escalation study with KRN5500 at the 13th World Congress on Pain. The multicenter, placebo-controlled phase 2a study was designed to evaluate the safety and efficacy of KRN5500 for treatment of neuropathic pain in patients with cancer. The trial assessed KRN550 vs. placebo to compare treatment differences in median changes from baseline in pain scores recorded by patients in a daily diary as measured by the numeric rating scale (NRS). Results show: KRN5500 significantly reduced neuropathic pain when compared to placebo (24% vs. 0%; p = 0.03) when looking at the median decrease in pain intensity from baseline. KRN5500 significantly reduced neuropathic pain when compared to placebo (29.5% vs. 0%; p = 0.02) when looking at the median decrease in maximum pain score reduction from baseline. KRN5500 significantly improved the number of patients achieving pain reduction from baseline of > 20% when compared to placebo (83% vs. 29%; p = 0.04). KRN5500 improved the number of patients achieving pain reduction from baseline of > 30% when compared to placebo (50% vs. 14%; p = ns). Regression analysis of the best response for each patient over doses showed a significant linear decrease in pain intensity with increase in dose (slope = -18.2; p = 0.009). Showed improvement in Dynamic Allodynia (touch-induced pain) compared to placebo (33% vs. 0%; p = ns). Showed improvement in Thermal Allodynia (cold-induced pain) compared to placebo (33% vs. 8%; p = ns). Source: DARA BioSciences, Inc. These results indicate that KRN5500 was effective in reducing pain in patients with chemotherapy induced peripheral neuropathy (CIPN) in a dose-response relationship. The data show that higher doses of KRN5500 result in greater reductions in pain over time. KRN5500 was generally well tolerated with adverse reactions limited to nausea and vomiting. We are encouraged by the phase 2a results. DARA has been presenting data from the trial at medical conferences, most recently the 2011 International Conference on Accelerating the Development of Enhanced Pain Treatments, and published the findings in peer-review journals, including the Journal of Pain and Symptom Management. The article can be found online here: JPSM-KRN5500 In April 2010, DARA Bio announced that it has entered into a clinical trial agreement on KRN5500 with the Division of Cancer Prevention (DCP), National Cancer Institute (NCI), National Institutes of Health (NIH), for the treatment of Chemotherapy Induced Peripheral Neuropathy (CIPN) in patients with cancer. Under the terms of the collaboration, NCI will fund the studies and DARA will supply KRN5500 at costs plus expenses. We note that DARA will supply (at cost) DCP-NCI with a new improved nano-emulsion formulation of KRN5500. The new formulation has been proved equivalent and is that is lyophilized to provide for easier dosing administration. Zacks Investment Research Page 3 www.zacks.com

- 4. Phase 2b To Start Q2-2012 The NCI will utilize its established national network of investigators (Community Clinical Oncology Program -- CCOP) to conduct the phase 2b study. They will also handle all costs to run the trial, which we estimate at around $4 million, except for the drug supply as noted above. This should cost DARA only around $250K. We expect this program will begin around March / April 2012 and will enroll approximately 100 subjects with CIPN in a multi-center, randomized, double-blind, placebo-controlled format. The trial should take approximately 18 months to complete. Similar to the phase 2a program, we expect that patients will have to have had confirmed CIPN for a period of time, actively failing standard-of-care pain meds, including NSAIDs, anticonvulsants, antidepressants, and opioids. We note the phase 2a data showed a meaningful reduction in CIPN patients taking KRN5500 even after having failed previous cycles with high-dose opioids. It s a difficult trial, but one that should work to the benefit of KRN5500 if positive given the significant treatment opportunity and limited competition. We remind investors that the U.S. FDA has granted DARA Fast Track status for KRN5500 in this indication. We believe data from this program will be highly intriguing to a potential partner if positive. With DCP-NCI handling the costs and expenses for the planned phase 2b program in CIPN, we believe that KRN5500 will work in other neuropathic pain indications, including post-herpetic neuralgia (PHN), diabetic peripheral neuropathy (DPN), and HIV-associated distal neuropathy (HIV-DSP). No clinical trials are planned to test this hypothesis, but it certainly presents upside to the DARA story, especially after a development partnership is signed on the drug because DARA can bake in additional milestones and regulatory payments on label expansion. Partnership After phase 2b Management has reported being in discussion with several interested parties on KNR5500. We see neuropathic pain as a sizable market opportunity for KRN5500. CIPN represents an excellent niche indication with a quick route to market, especially with the FDA Fast Track designation and funding from the NCI. Larger indications within neuropathic pain and fibromyalgia represent a billion-dollar opportunity. However, given the highly competitive nature of the indications and the fact that the market is dominated by generic gabapentin, along with billion-dollar branded pharmaceuticals in Lyrica and Cymbalta, and the recently approved gabapentin extended release molecule, Gralise, we are not expecting that DARA will be able to secure an upfront payment and phase 3 development partnership until after the phase 2b data on KRN5500 has been released. Based on expected timelines, this would be around late 2013. At that time investors and potential partners will have a much better understanding of the market potential for the drug. Partnering now, we believe the company would receive vastly less than if the phase 2b data are positive. Zacks Investment Research Page 4 www.zacks.com

- 5. Positive Phase 1b On DB959 On November 1, 2011, DARA announced positive results from a successfully completed phase 1b clinical study for DB959, the company s once daily peroxisome proliferator activated receptor (PPAR) delta/gamma agonist, a non- TZD oral drug in development for the treatment of type 2 diabetes. The study was a randomized, placebo- controlled, double-blind, escalating multiple dose clinical trial that enrolled 32 healthy male and female volunteers at Quintiles' Phase 1 facility in Overland Park, Kansas. The company plans to present detailed results at an upcoming scientific meeting in the first half of 2012. However, initial analysis of the data show that DB959 was safe and well-tolerated throughout the 40-fold dose-range tested, with an overall safety profile similar to placebo when dosed for 1 week. Pharmacokinetic (PK) analysis indicates that DB959 is highly likely to meet the target dosing regimen of once-a-day. The data confirm DARA s phase 1a data from a single-ascending dose study showing excellent safety and tolerability, previously presented at the American Diabetes Association (ADA) meeting in June 2011. Changes in the circulating profile of adiponectin, the established biomarker of PPAR agonism, seen in this study suggests that DB959 will be pharmacologically active in patients with type 2 diabetes within the well tolerated dose range utilized in this study. Adiponectin is a fat tissue-derived plasma protein whose expression is regulated by PPAR-gamma. It may play a modulatory role in multiple metabolic processes; plasma levels of adiponectin correlate with insulin sensitivity and correlate inversely with percent body fat. Improvements in one's metabolic health, as may be seen with weight loss, can be accompanied by increases in plasma adiponectin. Plasma adiponectin levels can be used as a biomarker or indicator of in vivo PPAR-gamma agonism. Numerous published studies have shown that PPAR-gamma agonists dose-dependently increase plasma adiponectin levels in both non-diabetic and diabetic populations at doses known to improve glucose homeostasis and insulin sensitivity. Previous Data Suggest Unique Profile Preclinical results demonstrated that DB959 lowered glucose to normal levels, raised HDL, raised the HDL:LDL ratio, and lowered triglycerides. These beneficial effects on glucose and lipids were observed without causing the weight gain which has been seen with other PPAR agonists. Data with DB959 suggest HbA1c efficacy on par with PPAR-gamma agonist, rosiglitazone (Avandia), with the ability to raise HDLc (good cholesterol) on part with PPAR-delta agonists, such as GlaxoSmithKline s GW501516 (currently in phase 2 development). Finally, the drug has shown powerful triglyceride lowering capabilities far beyond rosiglitazone. Positive lipid effects on cholesterol and triglycerides would provide a unique profile to DB959 in the treatment of type 2 diabetes. We note approximately 85% of patients with type 2 diabetes also have mixed dyslipidemia. The key differentiator for DB959, however, is its potential to be weight neutral. Thiazolidinedione (TZD) drugs like rosiglitazone (Avandia) and pioglitazone (Actos) have been shown to contribute to weight gain with regular use. This is an important stat because over 80% of patients with type 2 diabetes are considered over-weight (BMI > 28). TZDs have also been associated with greater incidence fractures and macular edema. Despite this, sales of Actos and Avandia eclipsed $6 billion worldwide in 2007, prior to the meta-analysis calling into question the cardiovascular safety of Avandia. The potential to have a weight neutral effect with DB959, with similar HbA1c lowering efficacy and positive effects on cholesterol and triglycerides equates to a potential blockbuster profile for DB959. Zacks Investment Research Page 5 www.zacks.com

- 6. Next Step: Wrap-Up Preclinical Work, Then Move Into Phase 2a The next clinical step for DB959 is a phase 2a study in which DARA plans to study DB959 as both monotherapy and in combination with other standard glucose lowering agents such as metformin, dipeptidyl-peptidase IV (DPP-4) inhibitors, and sulphonylureas (SU). However, before that trial can begin, management must complete some preclinical toxicology and animal (rodent and non-human primate) model data. We expect that DARA will also conduct a 2-year carcinogenicity program on DB959, as well as a 29-day toxicology study so that all the preclinical data can be analyzed and in hand by the time the company is ready to seek a development or out-license partner on DB959 after the phase 2a program is complete. We are expecting that the preclinical work will be completed during the first half of 2012, meaning that the phase 2a trial should be under-way by the fourth quarter 2012. We are not expecting a partner on DB959 until 2013. Love The Story, But Need More Data We are big fans of the DARA business model. The company is well-positioned to take advantage of the growing pipeline drain at big pharma companies. Both candidates, KRN5500 and DB959, represent a potential billion-dollar market opportunity that surely peak interest at big pharma. Source: DARA BioSciences, Inc. However, the partnering environment remains difficult. There are hundreds of small biotech companies looking for deals and big pharma has been hesitant to spend money given the uncertain economic outlook around the world. We believe both DARA s candidates are partnerable, but we do not see the market bidding up DARA shares significantly until a deal is in hand. In that regard, we do not see a deal on either KRN5500 or DB959 until after the next planned trial with each candidate. The NCI plans to take KRN5500 into a phase 2b program during the first half of next year. Data should be available late 2013. With DB959, management must complete some preclinical data during the first half of 2012, and then move into phase 2a late 2012. That would put a data read-out on the phase 2b DB959 program mid-2013. Therefore, our financial model expects no deal on either KRN5500 or DB959 until the second half of 2013. In the meantime, DARA hold $2.2 million in cash. We forecast burn is around $0.9 per quarter. Therefore, we find the current cash balance to be sufficient to fund operations into the third quarter 2012. We believe that management may seek to raise funds in the second quarter 2012 in order to keep the clinical programs for KRN5500 and DB959 moving forward at full speed. We remind investors that DARA currently holds around 400K shares and 100K warrants in privately-held MRI Interventions (formerly SurgiVision, Inc.). MRII had filed an S-1 earlier in the year to go public through an IPO, but it was delayed by the difficult equity market. We suspect that MRII will seek to re- initiate its IPO at some point in 2012. This could provide significant non-dilutive cash to DARA. The potential aslo exists that DARA may seek to sell a portion of these privately-held shares back to MRII before the IPO in an attempt to raise non-dilutive cash. Zacks Investment Research Page 6 www.zacks.com

- 7. PROJECTED FINANCIALS DARA BioSciences, Inc. Income Statement 2009 A 2010 A Q1 A Q2 A Q3 A Q4 E 2011 E 2012 E 2013 E KRN5500 (Neuro Pain) $0 $0 $0 $0 $0 $0 $0 $0 $0 YOY Growth - - - - - - - - - DB959 (T-2 Diabetes) $0 $0 $0 $0 $0 $0 $0 $0 $0 YOY Growth - - - - - - - - - Licensing & Collaborative $0 $0 $0 $0 $0 $0 $0 $0 $0 YOY Growth - - - - - - - - - Total Revenues $0 $0 $0 $0 $0 $0 $0 $0 $0 YOY Growth - - - - - - - - - Cost of Goods Sold $0 $0 $0 $0 $0 $0 $0 $0.0 $0.0 Product Gross Margin - - - - - - - - - SG&A $2.85 $3.14 $0.92 $0.67 $0.71 $0.75 $3.05 $3.25 $3.50 % SG&A - - - - - - - - - R&D $1.89 $3.34 $0.40 $0.99 $0.56 $0.45 $2.40 $2.75 $3.00 % R&D - - - - - - - - - Operating Income ($4.95) ($6.48) ($1.32) ($1.66) ($1.27) ($1.20) ($5.45) ($6.00) ($6.50) Operating Margin - - - - - - - - - Interest & Other Net $1.17 $0.49 ($0.00) $0.00 $0.09 ($0.00) $0.09 ($0.01) ($0.01) Pre-Tax Income ($3.78) ($5.99) ($1.32) ($1.66) ($1.18) ($1.20) ($5.36) ($6.01) ($6.51) Taxes / Other $0 $0 $0 $0 ($0.2) $0 $0 $0 $0 Tax Rate 0% 0% 0% 0% 0% 0% 0% 0% 0% Non-Controlling Interest $0.22 $0.34 $0.07 $0.09 $0.07 $0.10 $0.33 $0.30 $0.20 Net Income ($3.56) ($5.65) ($1.25) ($1.57) ($0.92) ($1.10) ($5.03) ($5.71) ($6.31) YOY Growth - 58.7% - - - - -11.0% 13.5% 10.5% Net Margin - - - - - - - - - Reported EPS ($1.63) ($1.80) ($0.26) ($0.31) ($0.18) ($0.21) ($0.99) ($0.76) ($0.70) YOY Growth - 10.9% - - - - -45.3% -22.9% -7.9% Shares Outstanding 2.2 3.1 4.7 5.1 5.2 5.3 5.1 7.5 9.0 Source: Zacks Investment Research, Inc. Jason Napodano, CFA © Copyright 2011, Zacks Investment Research. All Rights Reserved.

- 8. HISTORICAL ZACKS RECOMMENDATIONS DISCLOSURES The following disclosures relate to relationships between Zacks Investment Research ( ZIR ) and Zacks Small-Cap Research ( Zacks SCR ) and the issuers covered by the Zacks SCR analysts in the Small-Cap Universe. ZIR or Zacks SCR Analysts do not hold or trade securities in the issuers which they cover. Each analyst has full discretion on the rating and price target based on their own due diligence. Analysts are paid in part based on the overall profitability of Zacks SCR. Such profitability is derived from a variety of sources and includes payments received from issuers of securities covered by Zacks SCR for non-investment banking services. No part of analyst compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in any report or blog. ZIR and Zacks SCR do not make a market in any security nor do they act as dealers in securities. Zacks SCR has never received compensation for investment banking services on the small-cap universe. Zacks SCR does not expect received compensation for investment banking services on the small-cap universe. Zacks SCR has received compensation for non-investment banking services on the small-cap universe, and expects to receive additional compensation for non-investment banking services on the small-cap universe, paid by issuers of securities covered by Zacks SCR. Non-investment banking services include investor relations services and software, financial database analysis, advertising services, brokerage services, advisory services, investment research, and investment management. Additional information is available upon request. Zacks SCR reports are based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed by Zacks SCR Analysts are subject to change. Reports are not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks SCR uses the following rating system for the securities it covers. Buy/Outperform: The analyst expects that the subject company will outperform the broader U.S. equity market over the next one to two quarters. Hold/Neutral: The analyst expects that the company will perform in line with the broader U.S. equity market over the next one to two quarters. Sell/Underperform: The analyst expects the company will underperform the broader U.S. Equity market over the next one to two quarters. The current distribution of Zacks Ratings is as follows on the 1039 companies covered: Buy/Outperform- 17.3%, Hold/Neutral- 74.1%, Sell/Underperform 6.7%. Data is as of midnight on the business day immediately prior to this publication. © Copyright 2011, Zacks Investment Research. All Rights Reserved.