10 June Daily market report

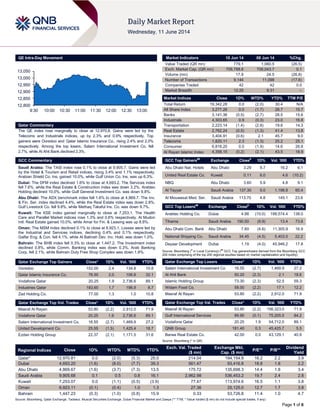

- 1. Page 1 of 6 QE Intra-Day Movement Qatar Commentary The QE index rose marginally to close at 12,970.8. Gains were led by the Telecoms and Industrials indices, up by 2.3% and 0.9% respectively. Top gainers were Ooredoo and Qatar Islamic Insurance Co., rising 2.4% and 2.0% respectively. Among the top losers, Salam International Investment Co. fell 2.7%, while Al Ahli Bank declined 2.3%. GCC Commentary Saudi Arabia: The TASI index rose 0.1% to close at 9,905.7. Gains were led by the Hotel & Tourism and Retail indices, rising 3.4% and 1.1% respectively. Arabian Shield Co. Ins. gained 10.0%, while Gulf Union Co. Ins. was up 6.3%. Dubai: The DFM index declined 1.6% to close at 4,693.2. The Services index fell 7.6%, while the Real Estate & Construction index was down 3.2%. Arabtec Holding declined 10.0%, while Gulf General Investment Co. was down 9.8%. Abu Dhabi: The ADX benchmark index fell 1.6% to close at 4,869.7. The Inv. & Fin. Ser. index declined 4.4%, while the Real Estate index was down 2.8%. Gulf Livestock Co. fell 9.8%, while Methaq Takaful Ins. Co. was down 9.7%. Kuwait: The KSE index gained marginally to close at 7,253.1. The Health Care and Parallel Market indices rose 1.3% and 0.6% respectively. Al Mudon Intl. Real Estate gained 10.0%, while Amar for Fin. & Leasing was up 8.8%. Oman: The MSM index declined 0.1% to close at 6,923.1. Losses were led by the Industrial and Services indices, declining 0.4% and 0.1% respectively. Galfar Eng. & Con. fell 4.1%, while Al Batinah Dev. Inv. Hold. was down 1.0%. Bahrain: The BHB index fell 0.3% to close at 1,447.2. The Investment index declined 0.8%, while Comm. Banking index was down 0.3%. Arab Banking Corp. fell 2.1%, while Bahrain Duty Free Shop Complex was down 1.8%. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Ooredoo 152.00 2.4 134.8 10.8 Qatar Islamic Insurance Co. 76.50 2.0 106.8 32.1 Vodafone Qatar 20.25 1.9 2,736.6 89.1 Industries Qatar 183.60 1.7 196.9 8.7 Zad Holding Co. 77.00 1.3 1.0 10.8 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% Masraf Al Rayan 53.80 (2.2) 2,912.0 71.9 Vodafone Qatar 20.25 1.9 2,736.6 89.1 Salam International Investment Co. 16.55 (2.7) 1,469.9 27.2 United Development Co. 25.55 (1.5) 1,425.4 18.7 Ezdan Holding Group 22.37 (2.1) 1,171.5 31.6 Market Indicators 10 Jun 14 09 Jun 14 %Chg. Value Traded (QR mn) 779.1 1,060.5 (26.5) Exch. Market Cap. (QR mn) 706,788.8 706,043.7 0.1 Volume (mn) 17.9 24.5 (26.8) Number of Transactions 9,144 11,098 (17.6) Companies Traded 42 42 0.0 Market Breadth 12:25 9:31 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,342.28 0.0 (2.0) 30.4 N/A All Share Index 3,277.26 0.0 (1.7) 26.7 15.7 Banks 3,141.36 (0.5) (2.7) 28.5 15.6 Industrials 4,303.65 0.9 (0.3) 23.0 16.8 Transportation 2,223.14 (1.4) (2.8) 19.6 14.3 Real Estate 2,762.24 (0.5) (1.3) 41.4 13.8 Insurance 3,404.91 (0.6) 2.1 45.7 9.0 Telecoms 1,820.11 2.3 (1.3) 25.2 25.1 Consumer 6,818.20 0.0 (1.9) 14.6 26.8 Al Rayan Islamic Index 4,358.15 (0.2) (2.1) 43.5 18.9 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Hotels Abu Dhabi 3.29 9.7 16.2 6.1 United Real Estate Co. Kuwait 0.11 6.0 4.6 (10.2) NBQ Abu Dhabi 3.60 5.9 4.8 9.1 Al Tayyar Saudi Arabia 137.30 5.0 1,198.8 60.4 Al Mouwasat Med. Ser. Saudi Arabia 113.70 4.8 145.1 23.6 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Arabtec Holding Co. Dubai 4.88 (10.0) 188,574.4 138.0 Tihama Saudi Arabia 190.50 (9.9) 13.4 73.6 Abu Dhabi Com. Bank Abu Dhabi 7.60 (4.6) 11,305.9 16.9 National Shipping Co. Saudi Arabia 34.45 (4.5) 5,403.0 22.2 Deyaar Development Dubai 1.19 (4.0) 45,946.2 17.8 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Salam International Investment Co 16.55 (2.7) 1,469.9 27.2 Al Ahli Bank 50.20 (2.3) 2.1 18.6 Islamic Holding Group 73.30 (2.3) 52.5 59.3 Widam Food Co. 58.00 (2.2) 17.1 12.2 Masraf Al Rayan 53.80 (2.2) 2,912.0 71.9 Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% Masraf Al Rayan 53.80 (2.2) 156,323.0 71.9 Gulf International Services 89.90 (0.1) 75,205.5 84.2 Vodafone Qatar 20.25 1.9 54,712.0 89.1 QNB Group 181.40 0.3 45,425.7 5.5 Barwa Real Estate Co. 42.00 0.0 43,129.1 40.9 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,970.81 0.0 (2.0) (5.3) 25.0 214.04 194,154.9 16.2 2.2 3.9 Dubai 4,693.20 (1.6) (8.0) (7.7) 39.3 561.47 93,416.8 18.8 1.8 2.2 Abu Dhabi 4,869.67 (1.6) (3.7) (7.3) 13.5 175.72 135,698.3 14.4 1.8 3.4 Saudi Arabia 9,905.68 0.1 0.5 0.8 16.1 2,962.98 536,453.2 19.7 2.4 2.8 Kuwait 7,253.07 0.0 (1.1) (0.5) (3.9) 77.47 113,974.6 16.5 1.1 3.8 Oman 6,923.11 (0.1) (0.4) 1.0 1.3 27.36 25,125.0 12.7 1.7 3.8 Bahrain 1,447.23 (0.3) (1.0) (0.8) 15.9 0.33 53,726.8 11.4 1.0 4.7 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,800 12,850 12,900 12,950 13,000 13,050 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QE index rose marginally to close at 12,970.8. The Telecoms and Industrials indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. Ooredoo and Qatar Islamic Insurance Co. were the top gainers, rising 2.4% and 2.0% respectively. Among the top losers, Salam International Investment Co. fell 2.7%, while Al Ahli Bank declined 2.3%. Volume of shares traded on Tuesday fell by 26.8% to 17.9mn from 24.5mn on Monday. Further, as compared to the 30-day moving average of 27.5mn, volume for the day was 35.0% lower. Masraf Al Rayan and Vodafone Qatar were the most active stocks, contributing 16.3% and 15.3% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Global Economic Data Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 06/10 US NFIB NFIB Small Business Optimism May 96.6 95.8 95.2 06/10 US BLS JOLTS Job Openings April 4455 4050 4166 06/10 France Banque De France Bank of France Bus. Sentiment May 97.0 98.0 98.0 06/10 France INSEE Industrial Production MoM April 0.30% 0.30% -0.40% 06/10 France INSEE Industrial Production YoY April -2.00% -2.00% -0.50% 06/10 France INSEE Manufacturing Production MoM April 0.30% 0.40% -0.40% 06/10 France INSEE Manufacturing Production YoY April 0.00% -0.40% 1.70% 06/10 UK ONS Industrial Production MoM April 0.40% 0.40% 0.10% 06/10 UK ONS Industrial Production YoY April 3.00% 2.80% 2.50% 06/10 UK ONS Manufacturing Production MoM April 0.40% 0.40% 0.50% 06/10 UK ONS Manufacturing Production YoY April 4.40% 4.00% 3.50% 06/10 UK NIESR NIESR GDP Estimate May 0.90% – 1.10% 06/10 Italy ISTAT Industrial Production MoM April 0.70% 0.40% -0.40% 06/10 Italy ISTAT Industrial Production WDA YoY April 1.60% 0.40% -0.10% 06/10 Italy ISTAT Industrial Production NSA YoY April 0.10% – 1.30% 06/10 China NBS PPI YoY May -1.40% -1.50% -2.00% 06/10 China NBS CPI YoY May 2.50% 2.40% 1.80% 06/10 Japan METI Tertiary Industry Index MoM April -5.40% -3.40% 2.40% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar QCB to issue QR4bn in bonds – The Qatar Central Bank (QCB) will issue 3-year government bonds worth QR2.1bn, as well as 5-year and 7-year bonds worth QR950mn each. All the bonds will be issued on June 15, 2014. (QCB) QCSD amends calculation of the foreign ownership percentage in QE-listed companies – Qatar Central Securities Depository Company (QCSD) has announced that in accordance with the guidance issued by HH the Emir Sheikh Tamim Bin Hamad Al Thani, it has amended the calculation of the foreign ownership percentage in the companies listed on the Qatar Exchange (QE) to be from the capital of the company and not from the free float. QCSD said that the procedure has been carried out in accordance with instructions received from the Qatar Financial Markets Authority (QFMA). (QE) QE mulls remote membership for foreign brokerages to boost liquidity – Qatar may see the advent of foreign stock brokerages with its local bourse contemplating remote membership. This move by the Qatar Exchange (QE) is part of the broader strategies to help enhance the liquidity in the market. The bourse, which has recently been upgraded to ‘emerging’ market by MSCI, finds growth opportunities in remote membership. According to sources, the remote membership is likely to be rolled out in the third phase of development. At present, the QE has 11 brokerage companies, including four subsidiaries of commercial banks. (Gulf-Times.com) Commercial Bank of Qatar (CBQK) considers US Dollar bond offering – According to sources, CBQK has hired BofA Merrill Lynch, HSBC and Morgan Stanley to arrange a series of meetings with bond investors starting tomorrow. A US$ benchmark Reg S transaction may follow subject to market conditions. (Bloomberg) Qatargas awards $125mn wastewater facility contract at LNG plant to Kentz – Qatargas Operating Company (Qatargas) has awarded a $125mn contract to Kentz Engineering & Construction Group for the turnkey process package of a new wastewater facility located in the Qatargas LNG Plant, Ras Laffan Industrial City. Kentz will supply process engineering, procurement, installation, construction, and commissioning (EPICC) services to deliver wastewater recycling & reduction Overall Activity Buy %* Sell %* Net (QR) Qatari 54.40% 59.94% (43,148,274.41) Non-Qatari 45.60% 40.06% 43,148,274.41

- 3. Page 3 of 6 facilities to four LNG trains. The contract will be executed through Kentz's Engineering and Projects (E&P) business unit. Kentz will be employing approximately 440 staff and field personnel and the project is scheduled to be completed in 2016. (Bloomberg) Qatar plans to set up farmers association – Qatar is setting up an association of farmers to help boost private sector investment in the agricultural sector and promote close coordination between private and public sectors in the field. Qatari individuals and companies owning farms, as well as government agencies concerned with agricultural development, will be part of the proposed association. The association will have two separate corpuses — one for giving away loans for farming, the other for helping members tackle emergencies. The government has announced that people can apply for membership of the proposed association between June 15 and 26, 2014. On June 29, 2014, successful applicants will be called by the Ministry of Economy & Trade to hold a founding meeting and pave the way for the formal launch of the association. (Peninsula Qatar) Realty transactions worth QR1.4bn between June 1–5 – The Real Estate Registration Department said that real estate transactions registered at the Ministry of Justice between June 1 and 5 were worth QR1.4bn. (Peninsula Qatar) Hyder Consulting completes Qatar Cool plant's EPC design – Hyder Consulting has completed the engineering, procurement & construction (EPC) design of Qatar Cool's third district cooling plant in Doha. The new plant is intended to supply district cooling to residential and commercial buildings in the West Bay area, and forms part of a cooling network in that quarter of the city. (GulfBase.com) International WB cuts global growth to 2.8% for 2014 – The World Bank (WB) has trimmed its global growth forecast, saying a confluence of events, from the Ukraine crisis to unusually cold weather in the US, has dampened economic expansion in the first half of the year. WB predicted the world economy would grow 2.8% this year, below its prior forecast of 3.2% made in January, but it expressed confidence that activity was already shifting to a more solid footing. In its half-yearly Global Economic Prospects report, the WB said tensions between Ukraine and Russia hit confidence worldwide. The bank also cut its growth forecast for the US to 2.1% from 2.8% to account for the toll taken on growth by the weather at the start of the year. The WB expects growth to quicken later this year as richer economies continue their recovery. Meanwhile, the bank has kept its global growth forecasts for the next two years unchanged at 3.4% and 3.5%, respectively. The WB also fretted about the possibility of financial volatility in emerging markets once the US Federal Reserve starts to raise interest rates, mopping up the liquidity glut in global markets. (Reuters) US small business, jobs data bolster growth picture – The US economy has decisively turned the corner with small business confidence hitting its highest level in more than 6-1/2 years in May 2014 and the number of jobs available rising to pre-recession levels in April. These new figures added to employment, auto sales, manufacturing and services sector data in suggesting that the economy was now in a full-fledged expansion. The National Federation of Independent Business said its Small Business Optimism Index rose 1.4 points to 96.6 in May, the highest reading since September 2007. In another report, the Labor Department said job openings increased by 289,000 to a seasonally adjusted 4.46mn in April, the highest reading since August 2007. Despite the rise in job openings, hiring was little changed in April, a potential suggestion that employers are having trouble finding workers with the right skills. In another report, the Commerce Department said wholesale inventories increased 1.1% after advancing by the same margin in March. (Reuters) BSI: Japan corporate mood worsens in April-June, but rebound expected – The Business Survey Index (BSI) of sentiment showed that big Japanese manufacturers have turned pessimistic about business conditions in April-June 2014. The index for large Japanese manufacturers released by the Ministry of Finance and a branch of the Cabinet Office slid down to -13.9 in April-June from 12.5 in the previous quarter. However, companies anticipate the sentiment index to improve to 16.0 in July-September due to expectations that consumer spending will quickly rebound. The survey also showed that companies are turning more positive on capital expenditure. The survey bodes well for the Bank of Japan's closely-watched Tankan Sentiment Index due next month and points to a declining need for further monetary easing. (Reuters) UK economy regains pre-recession peak – Britain’s strengthening recovery has probably pushed the economy back above its pre-crisis level, ending the longest period of below- peak output in a century. The National Institute of Economic and Social Research (Niesr) estimated that GDP rose 0.9% in the three months through May. That puts it about 0.2% above where it was in January 2008. Britain is the last of the Group of Seven nations barring Italy to regain its pre-recession level. The development may add to the debate among the Bank of England officials about when to raise interest rates from a record low as they begin to diverge on the timing of policy tightening. Niesr published its estimate after data today showed UK industrial production rose for a third month in April, driving the annual increase to 3%, the most since 2011. Today’s data also showed manufacturing rose 0.4% in April from March. That was a fifth consecutive increase, the longest streak of gains since 2010. (Bloomberg) IMF warns of reform fatigue holding back Greece – The International Monetary Fund said Greece needs to improve the efficiency of its public sector dramatically to meet fiscal targets and avoid new austerity measures. The IMF said in its latest review of Greece's progress under its €240bn bailout that reform fatigue had set in among the ruling coalition and the coalition government has a reduced majority of just two seats in the 300- member parliament. This is making it difficult to move forward boldly with needed reforms. Greece's reform record has been patchy since the start of its EU-IMF bailout in 2010, and has often led to delays in the disbursement of rescue funds. The IMF warned the country's public debt remained very high, adding that EU help was essential to make it sustainable. Greece is expected to begin talks for further debt relief from its European partners later this year. (Reuters) Regional OPEC majority at ease with markets before Vienna meet – OPEC nations representing 85% of the group’s output said they were at ease with supply and demand in the global oil market before a meeting in Vienna today to decide a collective production limit. Oil ministers from Angola, Ecuador, Kuwait and Venezuela all said they anticipated that the OPEC would roll over its existing ceiling of 30mn bpd. Saudi Arabia, Libya, Nigeria and the UAE said supply and demand are well matched. Iraq’s oil minister said there are indications that the limit will be retained. According to the data compiled by Bloomberg, these nine nations accounted for about 25.4mn bpd of output in May, while the group’s combined production stood at about 30mn

- 4. Page 4 of 6 bpd. The data showed that Brent oil, Europe’s benchmark, has traded above $100 a barrel for a year and is the least volatile ever. Still, there will pressure on Saudi Arabia to produce record amounts in 2H2014 to cover disruptions in Libya, Iran and Iraq. (Gulf-Times.com) Saudi MoF seizes SR105.3mn land from STC – Saudi Arabia’s Ministry of Finance (MoF) has seized land in the country’s capital from Saudi Telecom Company (STC). The 1.05mn square meters plot in Riyadh has a book value of SR105.3mn, but the government is yet to tell STC what compensation it will receive for this land. The compensation level and financial impact will be disclosed at a later date. (GulfBase.com) SAR invites bids for Saudi Landbridge project – Saudi Railway Company (SAR) has invited prequalification bids for the construction supervision consultancy contract of the Saudi Landbridge project. The applications are to be submitted by July 22, 2014. The Landbridge project involves the construction of around 1,200 km of railway line linking the Red Sea port city of Jeddah with Saudi capital Riyadh, where it would connect with the existing line to Dammam on the Gulf coast. The Landbridge project is expected to take 84 months from the start of the contract period. Meanwhile, SAR expects to appoint an operating partner for its North–South railway shortly, following the evaluation of bids from international consortium. (GulfBase.com) SABIC to produce technical grade urea – Saudi Basic Industries Corporation (SABIC) is set to produce a specific grade of urea ‘Technical Grade Urea,’ that will allow diesel engines to run more efficiently and reduce hazardous emissions. The new urea grade will be produced at SABIC’s manufacturing affiliate, Al-Jubail Fertiliser Company (Al-Bayroni) in Jubail, with a capacity of 80,000 tons per year. It will enable cleaner diesel technology in engines through liquid injection of urea solution into the exhaust stream of the diesel engine prior to its catalytic converter. This allows the engine to perform better to use fuel more efficiently, while eliminating the increased nitrogen oxides with urea. (GulfBase.com) STC completes debut Sukuk issue worth SR2bn – The Saudi Telecom Company (STC) has announced the successful closing and settlement of the Sukuk series with an aggregate subscription amount of SR2bn and tenure of 10 years (maturing in June 2024). The Sukuk has a floating profit rate of 70bps over a three-month SIBOR. STC’s debut Sukuk issuance was almost two times oversubscribed with interest from a mix of government investors, banks, asset managers and insurance companies. JP Morgan Saudi Arabia, NCB Capital and Standard Chartered Capital Saudi Arabia acted as joint arrangers and managers on the Sukuk program. Earlier in May 2014, STC had begun meetings with potential qualified investors for its first Sukuk series under its newly-established SR5bn private placement Sukuk program. (Tadawul) Saudi bank investments in G-secs surges to SR288bn – According to a financial report, Saudi-based banks have invested SR287.8bn in government bonds and treasury bills (G- secs) at the end of April 2014, spending SR235.7bn on treasury bills and SR52.2bn on government bonds. These investments were 36% higher as compared to the same period in 2013, which stood at SR211.8bn, while on a YoY basis, bank investments in G-secs registered the highest levels in 2013 at SR228.7bn, or a 26% increase as compared to figures of 2012, which stood at SR220.8bn. Treasury bills captured 78% (SR179.1bn) of the total investments in 2013, while the remaining 22% (SR49.6bn) went to government bonds. (GulfBase.com) SWC plans world’s largest desalination plant – Saudi-based Saline Water Conversion (SWC) has announced plans for building the world’s largest desalination plant in Rabigh on the country’s west coast. The plant would be able to produce up to 600,000 meters cubed of desalinated water per day through reverse osmosis process. (GulfBase.com) UAE CB: Money supply, credit growth accelerates in April – According to the UAE Central Bank, bank deposits rose 1% MoM and 8.3% YoY in April 2014, up from 7.6% YoY in March. The total increase in deposits in the year-to-April was AED66.1bn, as compared to AED74.0bn in the same period last year. The government deposits increased 8.6% MoM, while it decreased by more than one-third YoY. The narrow money supply aggregate (M1) increased by 3.5% from AED412bn at the end of March 2014 to AED426.3bn by the end of April 2014. Broad money supply (M2) increased in April to reach 23.6% YoY from 22.8%. M2 declined 0.1% on the back of a 2.1% drop in quasi money on a MoM basis. Broad Money (M3) increased by 1% from AED1.28tn to AED1.29tn. Loans and advances increased by AED37.4bn in the first four months of 2014 up from an increase of AED26.6bn over the same period last year. Total bank loans and advances (gross basis) reached AED1.31tn, while total bank assets (gross basis) decreased by 0.2% to reach AED2.17tn, over the same period. Loan growth in April alone was 0.6% MoM, while it was 8.3% YoY. (GulfBase.com) UNB Islamic unit joins DMCC platform – Union National Bank’s (UNB) Islamic unit, Al Wifaq Finance Company, has joined the Dubai Multi Commodities Centre (DMCC) Tradeflow platform. With this move, Al Wifaq aims to conduct new innovative commodity Murabaha transactions for its retail and SME clients. (GulfBase.com) FSI reveal systemic strength of UAE banks – According to a Financial Stability Report, Financial Soundness Indicators (FSIs), an important component in the Central Bank’s financial sector surveillance point to the robust systemic strength of the UAE banking sector. The UAE banks remain highly capitalized with a capital adequacy ratio of 19% at the end of December 2013, slightly below the 21% in 2012, due to a partial or full repayment of the Tier-2 capital granted by the Ministry of Finance in 2009. The Tier-1 capital stood at 17.2% and was more or less unchanged from 2012. The UAE banks had an aggregate net profit of AED31.6bn in 2013 as compared to AED26.5bn in 2012. The high level of profitability of the UAE banks indicates a strong internal capital generation capacity. The steady increase in banks’ profits since 2009 is largely driven by the growth of banks’ net interest margins (NIM). The NIM (net interest income over gross interest income) increased from 56.6% in 2009 to 72.4% in 2013, reflecting a decline in banks funding cost over the same period. (GulfBase.com) DSO, PAIiIZ sign MoU – Dubai Silicon Oasis Authority (DSOA), the regulatory body for Dubai Silicon Oasis (DSO), has signed a MoU with the Polish Information and Foreign Investment Agency (PAIiIZ). Under the agreement, DSOA and PAIiIZ will facilitate the exchange of delegations, promote collaboration & investment opportunities, transfer knowledge, and work toward enabling business environments in the UAE and Poland. (Bloomberg) Emirates NBD launches mePay – Emirates NBD has launched Emirates NBD mePay, an innovative money transfer service that enables an account holder of the bank to transfer money to another customer using mobile numbers instead of account numbers. (Bloomberg)

- 5. Page 5 of 6 Etisalat plans €3.1bn bond issue in four tranches – Emirates Telecommunications Corporation (Etisalat) is planning a bond issue worth up to €3.1bn split into four tranches. The UAE’s largest telecom operator is considering two dollar tranches of the bond, of probably five- and 10-year tenors, plus two euro- denominated tranches of seven and 12 years’ duration. (GulfBase.com) FGB to sell $1bn securities on Tokyo Pro-Bond Market – First Gulf Bank (FGB) has registered to sell up to $1bn of securities on the Tokyo Pro-Bond Market, effective June 11, 2014. The bank intends to use the fund for its expansion program. (Bloomberg) DoFA, National Bank of Umm Al Quwain sign cooperation agreement – Umm Al Quwain's Department of Finance and Administration (DoFA) has signed a cooperation agreement with National Bank of Umm Al Quwain. Under the agreement, UAQ National Bank will provide banking services to the staff of local and federal government entities in the emirate. (Bloomberg) Oil Minister: Kuwait in favor of keeping OPEC production ceiling unchanged – Kuwait’s Oil Minister Ali Al-Omair said that Kuwait is in favor of keeping current OPEC production ceiling unchanged as the country was content with oil prices, with enough supplies for oil markets. He added that Kuwait is satisfied with the general condition of the international oil markets as well as the balance of the major factors of the supply & demand, and supports keeping the production ceiling unchanged when OPEC oil ministers meet today. Al-Omair said the current oil prices were suitable for producers & consumers and there was a strong possibility that the production ceiling of 30mn bpd would not be touched. He noted that OPEC member states realize that the current stability in the oil markets was serving the interests of producers & consumers, and should thus continue. (Bloomberg) OTH Director resigns – Oman Textile Holding Company’s (OTH) Director, Harish Abichandani has resigned from his post with effect from June 2014. He also held the post of Deputy Chairman of the board of directors. (MSM) BHB to implement new market rules in September – Bahrain Bourse’s (BHB) board of directors has approved to implement the new market rules form September 1, 2014. The brokers will be given a six-month transitional period from the date of implementation to meet the requirements of the new market rules. (Bahrain Bourse)

- 6. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 210.0 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 QE Index S&P Pan Arab S&P GCC 0.1% 0.0% 0.0% (0.3%) (0.1%) (1.6%) (1.6%) (2.4%) (1.6%) (0.8%) 0.0% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,259.91 0.6 0.5 4.5 DJ Industrial 16,945.92 0.0 0.1 2.2 Silver/Ounce 19.20 0.7 0.9 (1.4) S&P 500 1,950.79 (0.0) 0.1 5.5 Crude Oil (Brent)/Barrel (FM Future) 109.52 (0.4) 0.8 (1.2) NASDAQ 100 4,338.00 0.0 0.4 3.9 Natural Gas (Henry Hub)/MMBtu 4.57 (2.0) (1.8) 5.1 STOXX 600 349.71 0.3 0.7 6.5 LPG Propane (Arab Gulf)/Ton 101.75 (0.2) 0.7 (19.6) DAX 10,028.80 0.2 0.4 5.0 LPG Butane (Arab Gulf)/Ton 120.50 (0.4) 0.8 (11.2) FTSE 100 6,873.55 (0.0) 0.2 1.8 Euro 1.35 (0.3) (0.7) (1.4) CAC 40 4,595.00 0.1 0.3 7.0 Yen 102.35 (0.2) (0.1) (2.8) Nikkei 14,994.80 (0.9) (0.5) (8.0) GBP 1.68 (0.3) (0.3) 1.2 MSCI EM 1,057.59 0.8 1.2 5.5 CHF 1.11 (0.2) (0.6) (0.7) SHANGHAI SE Composite 2,052.53 1.1 1.1 (3.0) AUD 0.94 0.2 0.4 5.1 HANG SENG 23,315.74 0.9 1.6 0.0 USD Index 80.82 0.2 0.5 1.0 BSE SENSEX 25,583.69 0.0 0.7 20.8 RUB 34.35 0.1 (0.2) 4.5 Bovespa 54,604.34 0.6 2.8 6.0 BRL 0.45 0.3 1.1 6.3 RTS 1,368.84 0.5 0.7 (5.1) 186.4 154.3 140.3