19 January Daily market report

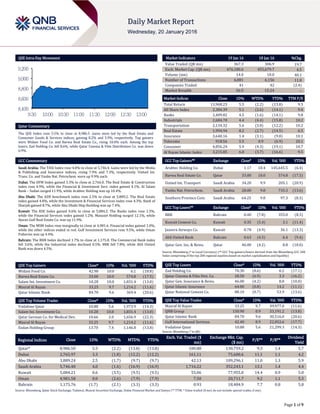

- 1. Page 1 of 9 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 5.5% to close at 8,986.5. Gains were led by the Real Estate and Consumer Goods & Services indices, gaining 8.2% and 5.9%, respectively. Top gainers were Widam Food Co. and Barwa Real Estate Co., rising 10.0% each. Among the top losers, Zad Holding Co. fell 8.6%, while Qatar Cinema & Film Distribution Co. was down 6.9%. GCC Commentary Saudi Arabia: The TASI Index rose 4.0% to close at 5,746.4. Gains were led by the Media & Publishing and Insurance indices, rising 7.9% and 7.3%, respectively. United Int. Trans. Co. and Yanbu Nat. Petrochem. were up 9.9% each. Dubai: The DFM Index gained 3.3% to close at 2,766.0. The Real Estate & Construction index rose 4.9%, while the Financial & Investment Serv. index gained 4.1%. Al Salam Bank – Sudan surged 11.9%, while Arabtec Holding was up 10.4%. Abu Dhabi: The ADX benchmark index rose 2.5% to close at 3,889.2. The Real Estate index gained 4.8%, while the Investment & Financial Services index rose 4.3%. Bank of Sharjah gained 8.7%, while Abu Dhabi Ship Building was up 7.4%. Kuwait: The KSE Index gained 0.6% to close at 5,084.2. The Banks index rose 1.5%, while the Financial Services index gained 1.2%. Manazel Holding surged 12.1%, while Ajwan Gulf Real Estate Co. was up 11.9%. Oman: The MSM Index rose marginally to close at 4,981.6. Financial index gained 1.0%, while the other indices ended in red. Gulf Investment Services rose 9.5%, while Oman Fisheries was up 4.4%. Bahrain: The BHB Index declined 1.7% to close at 1,175.8. The Commercial Bank index fell 3.6%, while the Industrial index declined 0.5%. BBK fell 7.8%, while Ahli United Bank was down 4.5%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Widam Food Co. 42.90 10.0 6.1 (18.8) Barwa Real Estate Co. 33.00 10.0 574.8 (17.5) Salam Int. Investment Co. 10.28 10.0 1,831.4 (13.0) Masraf Al Rayan 33.25 9.7 1,214.2 (11.6) Qatar Islamic Bank 84.70 9.6 369.4 (20.6) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 10.88 5.6 1,973.9 (14.3) Salam Int. Investment Co. 10.28 10.0 1,831.4 (13.0) Qatar German Co. for Medical Dev. 10.66 2.0 1,656.9 (22.3) Masraf Al Rayan 33.25 9.7 1,214.2 (11.6) Ezdan Holding Group 13.70 7.4 1,146.8 (13.8) Market Indicators 19 Jan 16 18 Jan 16 %Chg. Value Traded (QR mn) 367.3 306.9 19.7 Exch. Market Cap. (QR mn) 476,180.6 455,679.7 4.5 Volume (mn) 14.0 10.0 40.1 Number of Transactions 6,881 6,156 11.8 Companies Traded 41 42 (2.4) Market Breadth 36:5 15:24 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 13,968.23 5.5 (2.2) (13.8) 9.3 All Share Index 2,384.39 5.1 (2.6) (14.1) 9.4 Banks 2,409.82 4.5 (1.6) (14.1) 9.8 Industrials 2,684.70 4.4 (4.4) (15.8) 10.2 Transportation 2,134.32 5.6 (3.0) (12.2) 10.2 Real Estate 1,994.94 8.2 (2.7) (14.5) 6.5 Insurance 3,640.16 1.4 (3.1) (9.8) 10.1 Telecoms 918.56 5.5 0.9 (6.9) 20.1 Consumer 4,856.24 5.9 (4.3) (19.1) 10.7 Al Rayan Islamic Index 3,215.85 6.0 (3.7) (16.6) 9.5 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Arabtec Holding Co. Dubai 1.17 10.4 145,645.5 (6.4) Barwa Real Estate Co. Qatar 33.00 10.0 574.8 (17.5) United Int. Transport Saudi Arabia 34.20 9.9 205.1 (20.9) Yanbu Nat. Petrochem. Saudi Arabia 28.00 9.8 735.3 (13.6) Southern Province Cem. Saudi Arabia 64.25 9.8 97.3 (8.3) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% BBK Bahrain 0.40 (7.8) 355.0 (8.3) Kuwait Cement Co. Kuwait 0.35 (5.4) 3.1 (11.4) Jazeera Airways Co. Kuwait 0.78 (4.9) 36.1 (13.3) Ahli United Bank Bahrain 0.63 (4.5) 6.4 (9.4) Qatar Gen. Ins. & Reins. Qatar 46.00 (4.2) 8.8 (10.0) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Zad Holding Co. 70.30 (8.6) 0.2 (17.1) Qatar Cinema & Film Dist. Co. 28.50 (6.9) 3.3 (16.2) Qatar Gen. Insurance & Reins. 46.00 (4.2) 8.8 (10.0) Qatar Islamic Insurance 64.00 (0.8) 14.2 (11.1) Qatar National Cement Co. 88.10 (0.7) 53.9 (13.6) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Masraf Al Rayan 33.25 9.7 39,977.0 (11.6) QNB Group 150.90 0.9 33,191.2 (13.8) Qatar Islamic Bank 84.70 9.6 30,516.0 (20.6) Gulf International Services 42.40 8.9 22,052.6 (17.7) Vodafone Qatar 10.88 5.6 21,299.3 (14.3) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 8,986.50 5.5 (2.2) (13.8) (13.8) 100.88 130,759.2 9.3 1.4 5.7 Dubai 2,765.97 3.3 (1.8) (12.2) (12.2) 161.11 75,600.6 11.1 1.1 4.2 Abu Dhabi 3,889.24 2.5 (1.7) (9.7) (9.7) 42.13 109,296.1 11.0 1.3 5.9 Saudi Arabia 5,746.40 4.0 (1.6) (16.9) (16.9) 1,716.22 352,243.1 13.1 1.4 4.4 Kuwait 5,084.21 0.6 (3.5) (9.5) (9.5) 55.06 77,955.0 14.4 0.9 5.0 Oman 4,981.58 0.0 (2.6) (7.9) (7.9) 7.50 20,711.7 9.2 1.1 5.3 Bahrain 1,175.76 (1.7) (2.1) (3.3) (3.3) 0.93 18,484.9 7.7 0.8 5.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 8,400 8,600 8,800 9,000 9,200 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 9 Qatar Market Commentary The QSE Index rose 5.5% to close at 8,986.5. The Real Estate and Consumer Goods & Services indices led the gains. The index rose on the back of buying support from Qatari shareholders despite selling pressure from non-Qatari and GCC shareholders. Widam Food Co. and Barwa Real Estate Co. were the top gainers, rising 10.0% each. Among the top losers, Zad Holding Co. fell 8.6%, while Qatar Cinema & Film Distribution Co. declined 6.9%. Volume of shares traded on Tuesday rose by 40.1% to 14.0mn from 10.0mn on Monday. Further, as compared to the 30-day moving average of 6.1mn, volume for the day was 131.0% higher. Vodafone Qatar and Salam International Investment Co. were the most active stocks, contributing 14.1% and 13.1% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Gulf Bank Capital Intelligence Kuwait FS/FLR BBB/A- BBB+/A Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, FS –Financial Strength, FLR –Foreign Long Term) Earnings Releases Company Market Currency Revenue (mn) 4Q2015 % Change YoY Operating Profit (mn) 4Q2015 % Change YoY Net Profit (mn) 4Q2015 % Change YoY National Gas & Industrialization Co. Saudi Arabia SR – – 30.6 12.4% 40.3 10.5% Saudi Transport & Investment Co. Saudi Arabia SR – – 15.2 NA 12.6 NA Saudi Automotive Services Co. Saudi Arabia SR – – 1.6 NA 5.7 -87.9% Bupa Arabia for Cooperative Ins. Co. Saudi Arabia SR 1075.9 31.2% – – 209.3 69.0% United International Transportation Saudi Arabia SR – – 13.8 -7.9% 49.6 11.0% Al Khaleej Training & Edu. Saudi Arabia SR – – 24.7 -29.4% 21.6 -33.0% Herfy Food Services Co. Saudi Arabia SR – – 46.0 -2.1% 45.2 -7.1% National Metal Manufact. & Casting Saudi Arabia SR – – 9.4 308.3% -1.5 NA Buruj Cooperative Insurance Co. Saudi Arabia SR 115.4 123.2% – – 8.6 9.2% Saudi Real Estate Co. Saudi Arabia SR – – 42.0 -62.8% 29.4 -77.7% Alahli Takaful Co. Saudi Arabia SR 11.8 -3.9% – – 5.5 -45.9% Gulf Union Cooperative Ins. Co. Saudi Arabia SR 21.2 -14.3% – – 7.0 NA Allied Cooperative Insurance Group Saudi Arabia SR 91.3 -6.2% – – 0.2 -91.8% Basic Chemical Industries Co. Saudi Arabia SR – – 31.5 146.1% 20.2 210.8% AXA Cooperative Insurance Co. Saudi Arabia SR 111.3 -54.3% – – 5.3 -544.2% Al Rajhi Co. for Cooperative Ins. Saudi Arabia SR 326.2 61.6% – – 5.8 NA Saudi Ceramic Co. Saudi Arabia SR – – 65.1 13.6% 55.7 -6.9% National Co. for Glass Industries Saudi Arabia SR – – 5.1 -29.2% 3.5 -77.7% Al Sagr Cooperative Insurance Co. Saudi Arabia SR 248.9 444.2% – – 59.9 315.1% ACE Arabia Cooperative Insurance Saudi Arabia SR 18.6 7.5% – – 7.4 -22.4% Saudi Advanced Industries Co. Saudi Arabia SR – – -2.7 NA -15.2 NA Methanol Chemicals Co. Saudi Arabia SR – – -54.0 NA -60.2 NA Al Alamiya for Cooperative Ins. Co. Saudi Arabia SR 63.1 22.4% – – 4.2 175.7% Alinma Tokio Marine Co. Saudi Arabia SR 15.3 194.6% – – -2.0 NA Northern Region Cement Co. Saudi Arabia SR – – 51.4 -24.7% 39.6 53.5% Wataniya Insurance Co. Saudi Arabia SR 27.5 7.8% – – -14.9 NA Arabian Shield Cooperative Ins. Co. Saudi Arabia SR 46.5 -3.3% – – 27.8 186.1% United Cooperative Assurance Co. Saudi Arabia SR 222.4 8.1% – – -89.1 NA Arabia Insurance Cooperative Co. Saudi Arabia SR 57.0 -25.8% – – 6.5 -50.0% Abdullah A. M. Al-Khodari Sons Saudi Arabia SR – – -3.8 NA -1.0 NA Alandalus Property Co. Saudi Arabia SR – – 23.6 -5.2% 21.7 0.5% Oman Fiber Optic Co. Oman OMR 22.6 -3.2% – – 1.6 -79.6% Source: Company data, DFM, ADX, MSM Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 50.03% 42.71% 26,869,530.28 Qatari Institutions 10.97% 10.77% 699,306.30 Qatari 61.00% 53.48% 27,568,836.58 GCC Individuals 2.33% 1.78% 2,019,715.07 GCC Institutions 3.38% 10.53% (26,239,104.34) GCC 5.71% 12.31% (24,219,389.27) Non-Qatari Individuals 19.97% 17.43% 9,329,466.31 Non-Qatari Institutions 13.32% 16.78% (12,678,913.62) Non-Qatari 33.29% 34.21% (3,349,447.31)

- 3. Page 3 of 9 Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 01/19 US National Association of Home B NAHB Housing Market Index January 60.0 61.0 60.0 01/19 EU European Central Bank ECB Current Account SA November 26.4b – 25.6b 01/19 EU European Central Bank Current Account NSA November 29.8b – 27.5b 01/19 EU Eurostat Construction Output MoM November 0.80% – 0.60% 01/19 EU Eurostat Construction Output YoY November 2.10% – 0.80% 01/19 EU Eurostat CPI MoM December 0.00% 0.00% -0.10% 01/19 EU ZEW ZEW Survey Expectations January 22.7 – 33.9 01/19 Germany ZEW ZEW Survey Current Situation January 59.7 53.1 55.0 01/19 Germany ZEW ZEW Survey Expectations January 10.2 8.0 16.1 01/19 UK ONS CPI MoM December 0.10% 0.00% 0.00% 01/19 UK ONS CPI YoY December 0.20% 0.20% 0.10% 01/19 UK ONS CPI Core YoY December 1.40% 1.20% 1.20% 01/19 UK ONS Retail Price Index December 260.6 260.3 259.8 01/19 UK ONS RPI MoM December 0.30% 0.20% 0.10% 01/19 UK ONS RPI YoY December 1.20% 1.10% 1.10% 01/19 UK ONS RPI Ex Mort Int.Payments (YoY) December 1.30% 1.10% 1.10% 01/19 UK ONS PPI Input NSA MoM December -0.80% -1.70% -1.60% 01/19 UK ONS PPI Input NSA YoY December -10.80% -11.70% -13.10% 01/19 UK ONS PPI Output NSA MoM December -0.20% -0.20% -0.20% 01/19 UK ONS PPI Output NSA YoY December -1.20% -1.20% -1.50% 01/19 UK ONS PPI Output Core NSA MoM December 0.20% 0.00% -0.20% 01/19 UK ONS PPI Output Core NSA YoY December 0.10% -0.10% -0.10% 01/19 UK ONS ONS House Price YoY November 7.70% – 7.00% 01/19 Italy Banca D'Italia Current Account Balance November 4,460m – 6,131m 01/19 China National Bureau of Statistics Industrial Production YTD YoY December 6.10% 6.10% 6.10% 01/19 China National Bureau of Statistics Industrial Production YoY December 5.90% 6.00% 6.20% 01/19 China National Bureau of Statistics Retail Sales YoY December 11.10% 11.30% 11.20% 01/19 China National Bureau of Statistics Retail Sales YTD YoY December 10.70% 10.70% 10.60% 01/19 China National Bureau of Statistics Fixed Assets Ex Rural YTD YoY December 10.00% 10.20% 10.20% 01/19 China National Bureau of Statistics GDP YTD YoY 4Q2015 6.90% 6.90% 6.90% 01/19 China National Bureau of Statistics GDP SA QoQ 4Q2015 1.60% 1.80% 1.80% 01/19 China National Bureau of Statistics GDP YoY 4Q2015 6.80% 6.90% 6.90% 01/19 China Bloomberg Bloomberg GDP Monthly Estimate YoY December 6.69% – 6.85% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2015 results No. of days remaining Status GWCS Gulf Warehousing Company 20-Jan-16 0 Due KCBK Al Khaliji 20-Jan-16 0 Due QNCD Qatar National Cement Company 20-Jan-16 0 Due NLCS National Leasing (Alijarah) 21-Jan-16 1 Due DHBK Doha Bank 24-Jan-16 4 Due QOIS Qatar & Oman Investment 24-Jan-16 4 Due QIGD Qatari Investors Group 25-Jan-16 5 Due VFQS Vodafone Qatar 26-Jan-16 6 Due MRDS Mazaya Qatar 26-Jan-16 6 Due IHGS Islamic Holding Group 27-Jan-16 7 Due QIIK Qatar International Islamic Bank 27-Jan-16 7 Due CBQK Commercial Bank 27-Jan-16 7 Due QISI Qatar Islamic Insurance 27-Jan-16 7 Due DOHI Doha Insurance 31-Jan-16 11 Due GISS Gulf International Services 2-Feb-16 13 Due QIMD Qatar Industrial Manufacturing Company 7-Feb-16 18 Due MPHC Mesaieed Petrochemical Holding Company 7-Feb-16 18 Due QGRI Qatar General Insurance & Reinsurance 10-Feb-16 21 Due ORDS Ooredoo 1-Mar-16 41 Due Source: QSE

- 4. Page 4 of 9 News Qatar QNBK to hold AGM, EGM on January 31 – QNB Group (QNBK) has announced that it will conduct its ordinary and extraordinary general assembly meeting (AGM & EGM) on January 31, 2016. Among other matters, shareholders at the AGM will consider approving the board of directors’ (BoD) proposal to distribute cash dividends at the rate of 35% of the nominal share value (QR3.5 per share) and bonus shares at the rate of 20% of the share capital. The meeting will also consider approving necessary amounts from retained profits to the legal reserve for this reserve to become 100% of the capital (excluding issue fees). It will also consider absolving the members of the BoD and fixing their fees for the financial year ended December 31, 2015. The AGM will discuss approving the QNBK’s Governance Report for 2015, as well as the election of five members to the membership of the BoD for three years from 2016-2018 from the private sector. Meanwhile, the EGM will consider modifying some of the articles of the statute of the bank according to the Commercial Companies Law No. (11) for 2015. The EGM will also consider approving the issuance of capital instruments that qualify as Tier 1 additional capital and/or Tier 2 capital instruments in accordance with the Qatar Central Bank requirements and the standards of the Basel Committee. The meeting will discuss authorizing the board to decide on the appropriate placement of these instruments in addition to approving the final size, currency and the details of the terms and conditions of the issues and obtaining necessary approvals from the regulatory authorities concerned. These capital instruments can be issued directly by the bank or through a special purpose vehicle under the guarantee of the bank. Shareholders at the EGM will also consider amending related articles of the Articles of Association to increase the capital of the bank, which amount to QR6.997bn by distributing bonus shares at a rate of 20% of the present capital. In the absence of the required quorum, the second meeting will be conducted on February 3, 2016 at the same place and time. (QSE) QIBK reports in-line earnings in 4Q2015 – Qatar Islamic Bank’s (QIBK) net profit edged up 5.6% QoQ (+15.4% YoY) to QR544.0mn, in-line with our estimate of QR554.0mn. Total assets grew 3.5% (+32.2% YoY) to QR127.0bn at the end of 2015 as compared to QR122.7bn at the end of 3Q2015, led by strong growth in the financing segment. Financing assets recorded 6.3% QoQ (+46.1% YoY) growth to QR87.2bn at the end of 2015 versus QR82.1bn at the end of 3Q2015. Customer deposits rose by a modest 5.6% to QR91.5bn at the end of 2015 compared to QR86.6bn at the end of 3Q2015 and QR66.6bn at December 2014- end. EPS came in at QR2.30 in 4Q2015 compared to QR2.18 in 3Q2015. QIBK was able to maintain the ratio of non-performing financing assets to total financing assets at less than 1%, one of the lowest in the industry. The Islamic lender continues to pursue conservative impairment policy with the coverage ratio for non- performing financing assets reaching 113% in 2015, up from 102% in 2014. The bank also raised Basel III-compliant additional Tier 1 capital by issuing perpetual sukuk for QR2bn. Total capital adequacy of the bank under Basel III guidelines is 14.1%, against the minimum limit of 12.5% prescribed by the Qatar Central Bank (QCB). QIBK has also suggested a 42.5% cash dividend to shareholders, which is equal to its 2014 dividend. (QNBFS Research, Gulf-Times.com) QATI bottom-line more than triples sequentially in 4Q2015 – Qatar Insurance Company’s (QATI) net profit surged 202.8% QoQ (+57.8% YoY) to QR350.4mn in 4Q2015. The solid sequential performance was primarily led by a 98.4% QoQ increase in net earned premiums to QR2.38bn, coupled with around four-fold rise in investment income to QR254.7mn. The company’s net underwriting income rose 35.7% QoQ to QR288.5mn. The company’s board of directors (BoD) had recommended distribution of cash dividend (25%) of QR2.50/share and bonus shares of 10%. (QNBFS Research, QSE, Gulf-Times.com) QIGD announces several lawsuits pending against the company – Qatari Investors Group (QIGD) has announced that a lawsuit was filed by Ezdan Holding Group (ERES) and its subsidiaries against the company. Ayn Jalot Company for Trading has submitted a case bearing the number 003380 for the year 2015 in the First Instance Civil Court (FICC) against QIGD, requesting the cancellation of item number two agreed upon by the extra general assembly (EGM), which has resulted in the transfer of the ownership of the shares under the companies owned by Al Misnad Holding to Al Misnad Holding. The session will be decided at a later stage. Al–Eklim Property Brokerage Company has submitted a case bearing the number 003439 for the year 2015 against QIGD, requesting the cancellation of the attendance procedure necessary for holding the EGM. The session will be held on January 28, 2016. Manazil Company for Trading has submitted a case bearing the number 003359 for the year 2015 in FICC against QIGD, requesting the cancellation of Al-Misnad Holding possession of shares in QIGD according to the EGM of the year 2015. The session will be advised at a later stage. A case was submitted by Al-Itqan Company for Trading bearing the number 003358 for the year 2015 in FICC against QIGD, requesting the cancellation of the procedure, which led to the ownership of Al-Misnad Holding of shares within QIGD through providing material shares. The session will be held on January 26, 2016. Ethmar Company for Trading & Construction has submitted a case bearing the number 003420 for the year 2015 in FICC against QIGD, requesting the cancellation of the attendance procedure followed within the AGM & EGM of QIGD. The session will be held on February 16, 2016. Al-Taybin Company for Trading & Al-Rub Al-Khali Company for Trading & Al-kura Al- Zahabiya Company for Trading have submitted a case bearing the number 003346 for the year 2015 in FICC against QIGD, requesting the cancellation of the procedures of amalgamation of Qatari Investors Group (OPC) in QIGD. The session will be held on a date to be set later on. The case submitted by Al-Manara Company for Medical Equipment bearing the number 003440 for the year 2015 submitted in FICC against QIGC, claiming the quorum necessary to hold the AGM & EGM was not met. The session will be determined at a later stage. (QSE) Beema posts QR63mn net profit in 2015 – Damaan Islamic Insurance’s (Beema) net profit of the shareholders touched QR63mn for the full year 2015. Beema Deputy Chairman Abdullatif Abdulla Zaid Al Mahmoud said the company has achieved a gross contribution of QR314mn in the year 2015, a 23% YoY increase and a surplus of QR16.5mn from insurance operations, up 114% YoY. The shareholders’ profit increased 17% to QR46.5mn. (Peninsula Qatar) Qatar bids to host FINA World Championships – Qatar News Agency (QNA) reported that the Qatar Swimming Association (QSA) is bidding to host either the 2021 or 2023 FINA (International Swimming Federation) World Championships. FINA will choose the host cities for the 2021 and 2023 World Aquatics Championships in Budapest on January 31, 2016. (QNA) Real Estate transactions cross QR686mn during Jan 10-14 – The total value of trading in real estate sales contracts registered with the Real Estate Registration Department at the Ministry of Justice during January10-14, 2016 amounted to QR686,908,143. According to the weekly bulletin issued by the department, the list of properties that were traded included open plots of land, houses and multi-purpose buildings, which are located in the

- 5. Page 5 of 9 municipalities of Doha, Umm Salal, Al Khor, Al Dhakira, Al Rayyan, Al Daayen, Al Wakrah and Al Shamal. (Gulf-Times.com) Qatar fears no hotel glut post-2022 FIFA World Cup – Al Rayyan Tourism Investment Company (Artic) Vice Chairman Sheikh Mohamed bin Faisal al-Thani has said that the hospitality sector in Qatar will remain vibrant even after the country has hosted the 2022 FIFA World Cup. Citing statistics, Sheikh Mohamed said Qatar needs around 90,000 hotel rooms to accommodate the influx of thousands of tourists attending the 2022 FIFA World Cup. He said while there are plans to build more five-star hotels, along the West Bay area, there is robust spending for three and four-star hotels as well, providing more investment opportunities for companies in the hospitality sector. (Gulf-Times.com) S&P: Qatar has ‘significant’ strength in defending riyal-dollar peg – Global credit rating agency Standard and Poor’s (S&P) has said Qatar has “significant” strength in defending its fixed exchange parity with the dollar due to availability of reserves to cover the monetary base and current account payments over the next four years. S&P, in its report, said, “This is largely due to its implicit assumption that their liquid assets, in addition to their official foreign currency reserves, would be brought to bear to defend the currency pegs.” Qatar, expected to show a current account deficit of 1.2% of GDP in 2016 but a surplus of 0.8% of GDP in 2017, has close to around 30 months coverage of current account payments during 2016-19 and about 125% coverage of the monetary base. Kuwait has the highest reserve adequacy among the Gulf Cooperation Council (GCC) countries at over 70 months coverage of current account payments and about 375% coverage of the monetary base. Saudi Arabia has about 25 months coverage of current account payments and about 150% coverage of the monetary base. Oman has more than five months coverage of current account payments and about 60% coverage of the monetary base and the UAE has about 15 months coverage of current account payments and about 175% coverage of the monetary base. Bahrain has the lowest reserve adequacy than its peers, which S&P estimates at three months coverage of current account payments during 2016-2019 (a more conservative measure than imports) and with coverage of 20% of the monetary base over the same period. Qatar, expected to show a real growth of 4.5% in 2016, is slated to see a net general sovereign debt of 87.4% of GDP. However, the net general government debt-to-GDP ratio is likely to fall to 79.4% with the same real economic growth. The rating agency said overall, the GCC countries are expected to maintain their fixed exchange parity with the US dollar over the medium term. The ratings agency’s view comes amidst increased speculation in the market about the GCC countries depegging their currencies from the dollar. (Gulf-Times.com) MEED: Qatar projects to compete for ‘prestigious’ quality awards – Business intelligence firm MEED has launched the 2016 edition of the MEED Quality Awards for Projects, in association with Mashreq, which it said is the region’s “only awards program” that recognizes project excellence and benchmark best practice in project delivery. Two of Qatar’s flagship projects have won the highlight coveted MEED Quality Project of the Year, the only country to have achieved the feat in the six-year history of the awards program. The Pearl GTL Project received the distinction in 2012, with Qatar Foundation’s Qatar Faculty of Islamic Studies Project replicating the achievement in 2015. (Gulf Times.com) Qatar’s oil consumption rose 190% in a decade – Oil consumption in the Middle East has risen substantially over the past decade. The region, which is the largest producer of oil in the world, increased its consumption of oil by about 47% during 2004-2014. According to the BP Statistical Review of World Energy 2015 report, Qatar witnessed the highest growth in the region in percentage terms by registering 190% growth in oil consumption during the period. Saudi Arabia saw the highest growth in terms of absolute amount by registering a growth of 1.3mn of barrel per day or 67% during the same period. Qatar’s consumption increased from 106,000 barrels per day (bpd) in 2004 to 307,000 bpd in 2014. Saudi Arabia’s oil consumption rose from 1.9mn bpd in 2004 to 3.2mn bpd in 2014, being the largest consumer of oil in the Middle East. Iran is the second largest consumer of oil in the region, with the country’s consumption of oil having increased from 1.6mn bpd to 2mn bpd in 2014. The UAE came out as the third largest consumer of oil, which saw consumption rising from 484,000 bpd in 2004 to 873,000 bpd in 2014. Total oil consumption in the Middle East region increased from 5.9mn bpd in 2004 to 8.7mn bpd. (Peninsula Qatar) International IMF cuts global growth forecast as China slows – The International Monetary Fund (IMF) cut its global growth forecasts for the third time in less than a year, as new figures from Beijing showed that the Chinese economy grew at its slowest rate in a quarter of a century in 2015. To back its forecasts, the IMF cited a sharp slowdown in China trade and weak commodity prices that are hammering Brazil and other emerging markets. The Fund forecast that the world economy would grow at 3.4% in 2016 and 3.6% in 2017, both years down 0.2 percentage point from the previous estimates made in October 2015. IMF said policy makers should consider ways to bolster short-term demand. The updated World Economic Outlook forecasts came as global financial markets have been roiled by worries over China's slowdown – confirmed by official Chinese data on Tuesday – and plummeting oil prices. The IMF maintained its previous China growth forecasts of 6.3% in 2016 and 6.0% in 2017, which represent sharp slowdowns from 2015. China reported that growth for 2015 hit 6.9% after a year in which the world's second biggest economy endured huge capital outflows, a slide in the currency and a summer stock market crash. (Reuters) CBO: US tax breaks to increase deficit for first time since 2009 – The Congressional Budget Office (CBO) said the US budget deficit will grow sharply to $544bn in 2016 after six years of declines, largely because of permanent tax breaks that Congress passed late in 2015. The new projection makes it harder for Republicans who control Congress to demonstrate election-year fiscal restraint. Meeting past goals of passing a budget that reaches a surplus in 10 years would now require deeper cuts to politically sensitive benefits programs and perhaps military spending. The non- partisan CBO said the fiscal 2016 deficit will swell by 2.9% of US economic output from $439bn in fiscal 2015. The deficit peaked at about $1.4tn in 2009 during the deepest recession since the 1930s. The projected fiscal 2016 deficit is $130bn higher than the CBO's last estimate for 2016 made in August 2015, a forecast based on tax and spending laws then on the books and an expectation faster US growth would bring in more revenues. Since then, Congress passed a year-end spending bill that included making permanent and expanding several major temporary tax breaks for businesses and individuals, including credits for research and development expenses, families with children and the working poor. (Reuters) ILO: Global unemployment rate to slip lower in 2017 – The International Labor Organization (ILO) said The global unemployment rate will inch down to 5.7% in 2017 from 5.8% in 2014-16, helped by job creation in the US and Europe, although a growing population means the total of number of unemployed people will rise. The ILO's forecast for the unemployment rate to fall is more optimistic than it was a year ago, when the United Nations agency estimated it would remain at 5.9% from 2014 to 2017. Publishing its annual World Employment and Social Outlook report, the ILO also said the total number of unemployed people

- 6. Page 6 of 9 will top 200mn for the first time in 2017, up from 197.1mn in 2015 and its forecast for 199.4mn in 2016. (Reuters) Morgan Stanley sees 2016 global recession risk as high as 20% – US investment bank Morgan Stanley said the probability of a global economic recession in 2016 is as high as 20% in a worst case scenario. Its economists said soft consumer demand in the US and Japan and weakness in emerging markets due to worries over plunging oil and commodity prices and capital outflows from China were among the main risks. A global recession is loosely defined as growth below the roughly 2.5% needed for the world economy to keep up with an expanding population. The rise will come in developing and emerging countries such as Brazil, where the number of jobless will grow from 7.7mn to 8.4mn in 2016 and next, and Russia and South Africa. All three are forecast to fare much worse than the expectation a year ago. (Reuters) PBOC to inject $91bn to ease liquidity strains – The People's Bank of China (PBOC), China's central bank, said it would inject over $91.22bn to help ease a liquidity squeeze expected before the Lunar New Year in early February 2016. PBOC said it will inject the funds via the three policy tools of the standing lending facility (SLF), medium-term lending facility (MLF) and pledged supplementary lending (PSL). Liquidity conditions often tighten ahead of the week-long new year holiday and the central bank usually injects large amounts of cash into the banking system prior to the festivities to keep rates steady. The first day of the new year is February 8, 2016. Analysts say the PBOC's move could reduce the need for it to cut banks' reserve requirement ratios (RRR) in the near future, but the central bank remains under pressure to ease policy to support a slowing economy. Growth in 4Q2015 slowed to the weakest since the financial crisis, increasing pressure on a government struggling to regain the confidence of investors after perceived policy missteps jolted global markets. (Reuters) Regional S&P rates 9 of 13 MENA sovereigns in ‘BBB’ category or above – Standard & Poor’s (S&P) Ratings Services has said that overall sovereign creditworthiness in the Middle East and North African (MENA) region has deteriorated since S&P last published six months ago. The agency has rated nine of the 13 MENA sovereigns in the ‘BBB’ rating category or above. The average MENA sovereign rating is now close to ‘BBB’. When weighted by GDP, the average moves closer to ‘BBB+’. Bahrain, Lebanon, Oman and Saudi Arabia have negative outlooks. S&P sovereign analyst Trevor Cullinan said the average weighted by nominal GDP has fallen more sharply than the unweighted average over the past six months because S&P has lowered the rating on the region’s largest economy, Saudi Arabia. The average rating for the hydrocarbon-endowed sovereigns of Abu Dhabi, Bahrain , Iraq, Kuwait, Oman, Qatar and Saudi Arabia is currently close to ‘A’, having been at ‘A+’ prior to the downgrade of Saudi Arabia and the inclusion of Iraq in the average. For those with limited hydrocarbon resources (Egypt, Jordan, Lebanon, Morocco, Ras Al Khaimah and Sharjah), it is closer to ‘BB+’. Outside the GCC, the currencies of oil-exporting sovereigns have depreciated significantly, and some have devalued their currencies and introduced more flexible exchange rate regimes. Speculation in the market has increased whether the GCC countries would experience the same scenario and unpeg their currencies from the dollar. Bahrain and Saudi Arabia’s negative outlook reflects weakening fiscal profiles and uncertain policy responses. (Ameinfo.com) IRENA: MENA to witness $35bn renewable energy investment by 2020 – According to the International Renewable Energy Authority (IRENA), the MENA region is likely to witness renewable energy investment worth $35bn per year by 2020 with increasingly lower-cost solar photovoltaic modules helping countries to diversify their energy mix. (GulfBase.com) Riyad Bank reports 19.72% YoY decline in 4Q2015 net profit – Riyad Bank reported a net profit of SR851mn in 4Q2015 as compared to SR1.06bn in 4Q2014, representing a decrease of 19.72% YoY. The bank’s total assets stood at SR223.31bn at the end of December 31, 2015 as compared to SR214.59bn in the year- ago period. Loans & advances portfolio reached SR144.67bn, while customer deposits stood at SR167.09bn. (Tadawul) KSA market regulator says fund evaluators must be accredited – Saudi Arabia’s market regulator has said that evaluators of real estate investment funds domiciled within the Kingdom must be accredited. The Capital Market Authority (CMA) said it would only accept property appraisals by members of the Saudi Authority for Accredited Valuers (Taqeem), which is launching a licensing system for real estate valuation in the Kingdom. (Reuters) Arab National Bank reports 5.47% YoY drop in 4Q2015 net profit – Arab National Bank reported a net profit of SR594.4mn in 4Q2015 as compared to SR628.8bn in 4Q2014, representing a decrease of 5.47% YoY. The bank’s total assets stood at SR170.42bn at the end of December 31, 2015 as compared to SR164.67bn in the year-ago period. Loans & advances portfolio reached SR115.14bn, while customer deposits stood at SR135.69bn. (Tadawul) Savola Group appoints new CEO – Savola Group’s board of directors (BoD) has decided to appoint Eng. Rayan Mohammed Fayez as the Chief Executive Officer (CEO) of the group, based on the recommendation of the Compensation, Nomination and Governance Committee. In order to facilitate the handover process, Fayez will join Savola officially as the CEO effective March 1, 2016, while H.E. Eng. Abdullah M. Nour Rahemi will continue in his position as the Managing Director (MD) of the group till the end of the official term of the current board of directors, which will expire on June 31, 2016. (Tadawul) GGCIC announces reinforcement of technical reserves for 2015 – Gulf General Cooperative Insurance Company’s (GGCIC) board of directors (BoD) has approved the technical reserves in the statement of reserves received from the appointed actuary, in which it includes a material increase in the technical reserves. The net increase in the technical reserves is SR22mn as compared to the technical reserves of the previous quarter. The financial impact will be reflected negatively in the income statement of 4Q2015 under changes in the technical reserves item. The change in the reserves will enable the company to raise its efficiency and its ability to meet future obligations. (Tadawul) Increase in energy products, electricity tariffs may cost RSHSC an additional SR5mn in FY2016 – Red Sea Housing Services Company (RSHSC) has made a follow-up announcement regarding the impact of the adjustment of energy prices and electricity tariffs. The company said it expects a financial impact of around SR5mn in FY2016. RSHSC will make efforts to optimize the utilization of energy resources and implement initiatives to reduce the impact of the expected increase in costs. (Tadawul) Saudi CMA approves MetLife AIG’s SR175mn capital request – The Saudi Capital Market Authority (CMA) has approved Metlife, American International Group & Arab National Bank Cooperative Insurance Company’s (MetLife AIG ANB) capital increase request. Earlier, MetLife AIG ANB had submitted a request to the CMA to approve its capital increase by way of rights issue valued at SR175mn. The capital increase is subject to company's extraordinary general assembly meeting, which will be decided by the board of directors (BoD) at a later date and should be held within six months from the approval date. (CMA) Al Eqtisadiah: KSA-China trade rises tenfold in 12 years – According to data compiled and analyzed by Al Eqtisadiah, the trade

- 7. Page 7 of 9 exchange between Saudi Arabia and China surged tenfold in the 2003-2014 period, amounting to a total of SR1.73tn. The trade balance is heavily in favor of Saudi Arabia, whose exports to China during the 12-year period stood at SR1.2tn, while imports reached SR662tn. (GulfBase.com) IMF cuts KSA economic growth forecast to 1.2% for 2016 – According to projections released by the International Monetary Fund (IMF) and HSBC Holdings, Saudi Arabia’s economy is likely to grow in 2016 at the slowest pace since 2002 as the oil-price plunge drains the Kingdom’s finances. The IMF, in an update to its World Economic Outlook, said the Kingdom’s economic growth would slow to 1.2% in 2016, which is more optimistic than HSBC, which expects the biggest Arab economy to expand 0.8%. The prolonged oil slump saddled Saudi Arabia with a budget deficit of about $98bn in 2015, pushing officials to cut spending, consider an international sovereign bond sale and cut energy subsidies. The price of Brent crude has fallen by over 40% since October 2015, when the IMF last released forecasts for the Kingdom and said growth would be 2.2% in 2016. IMF Research Department Director Maury Obtsfeld said the fundamentals seem to point to a low-for-long scenario for oil. The fall in oil prices is also forcing other oil producers in the Gulf Cooperation Council (GCC) countries to cut subsidies and scale down public projects. The UAE scrapped fuel subsidies in August 2015 and reined in increases in public wages. HSBC trimmed its growth forecast for the seven- state federation to 2.3% from 2.4%. HSBC cut projections elsewhere in the Persian Gulf. Qatar is now seen expanding 3.6% versus an initial estimate of 5.5%. Oman’s output forecast was reduced to 0.5% from 1.4% and Kuwait’s was lowered to 1.9% from 2.1%. Bahrain remained unchanged at 1.8%. (Bloomberg) Sharjah plans five-year Sukuk – Sharjah is targeting a five-year Sukuk offering and could launch a transaction soon. The sovereign finished road shows on Monday in London, following investor meetings in the Middle East and Asia last week. The country is now in the process of receiving feedback from the market. Sharjah has mandated Bank of Sharjah, Barclays, Commerzbank, Dubai Islamic Bank, HSBC and Sharjah Islamic Bank to arrange the meetings and the possible transaction. Earlier, Reuters reported that Sharjah was planning to raise funds through a dollar-denominated Sukuk of benchmark size, in what could be the first sovereign Islamic bond issuance from the region in 2016. (GulfBase.com) Agility: UAE ranks second on Agility Emerging Markets Logistics Index – According to the 2016 Agility Emerging Markets Logistics Index, the UAE leads the ranking for the best business conditions found in the world’s emerging markets. The UAE ranked second overall behind only China among the countries in the 2016 Index. Among the countries in the Index, the UAE, Qatar and Oman are the most business friendly, based on a combination of market access, risk, regulation, foreign investment, urbanization and wealth distribution. Saudi Arabia at 5, Kuwait at 9 and Bahrain at 11 are among the other Gulf States ranked near the top in business conditions. (GulfBase.com) SCAD: Abu Dhabi inflation up 0.4% MoM in December 2015 – According to a report by Statistics Centre Abu Dhabi (SCAD), Abu Dhabi’s inflation was up 0.4% MoM in December 2015 as compared to November 2015. This reflects the net outcome of the rises and falls in prices of the goods & services of the consumer basket and during the aforesaid period. The rise in December 2015 was mainly due to increase in prices of hotels & restaurants (up 3.8% MoM) and housing, water, electricity, gas and other fuels (up 1.6% MoM). The report analyzed the consumer price index (CPI) calculations for the period under review, with the year 2007 fixed as the base year. It details CPI results by welfare levels, household types and geographical region. Abu Dhabi region accounted for 78.5% of 0.4% increase in consumer prices during December 2015 as compared to November 2015, followed by Al Ain (18.9%) and Al Gharbia region (2.6%). Consumer prices in Abu Dhabi nudged down 0.2% in November 2015 as compared to October 2015. (GulfBase.com) Masdar to invest $300mn in Jordan solar project – Masdar CEO Ahmad Belhoul said that the company is investing around $300mn in a solar power project in Jordan, with more investments planned across the MENA region. Masdar is planning to build a 200 megawatt (MW) solar project in Jordan, its second renewable project in that country. He said the company has signed the agreement yesterday and expect financial close in 4Q2016. (Reuters) DEWA awards water network contract – Dubai Electricity and Water Authority (DEWA) has awarded a tender to supply, extend and launch a 27 kilometer water transmission network to boost water flow along the Jebel Ali-Al Hebab Road area. The project is estimated to cost AED185mn, and is expected to be completed in 28 months. (GulfBase.com) DLD witness growth in its property investment – Dubai Land Department (DLD) has said that the amount and value of money put into Dubai’s real estate market from its entire main source markets increased in 2015. The department said that the amount of real estate investment transactions in Dubai 2015 exceeded AED135bn, up 24% YoY as compared to AED109bn of transactions reported in 2014. The number of investors also grew to 55,298 from 41,475 reported in 2014, representing a 33% YoY increase. (GulfBase.com) Aldar acquires Daman House in Abu Dhabi – Aldar Properties has acquired Daman House, a commercial office building in Abu Dhabi. Daman House comprises 23,000 square meter GLA of Grade A commercial space, fully leased on a long-term contract to a single government related entity. The transaction underscores Aldar’s ambition to grow its recurring revenue portfolio through investment in new and existing revenue producing assets. The purchase of Daman House is the first to be made as part of an AED3bn investment program that Aldar is implementing to drive growth within its recurring revenue business to achieve its new target of AED2.2bn net operating income by 2020. (ADX) PIC to buy 25% stake in SK Advanced – Kuwait's Petrochemicals Industries Company (PIC) has agreed to buy a 25% stake in a venture owned by SK Gas Company Limited and Advanced Global Investment Company (AGIC), a subsidiary of Advanced Petrochemical Company (APC). PIC will invest in SK Advanced, which is building 600,000 tons per year propane dehydrogenation (PDH) project in South Korea. SK Advanced will be operated as a three-party venture with SK Gas retaining a 45% stake and AGIC and PIC holding 30% and 25% stake, respectively. Earlier, APC invested $135mn for a 35% stake; later AGIC agreed to sell a 5% stake reducing its holding to 30%. The impact of the sale will generate SR16mn for APC which will be reflected in its 1Q2016 results. PIC is a subsidiary of Kuwait Petroleum Corporation, while SK Gas South Korea-based liquefied petroleum gas (LPG) distributor. (Reuters) KIB: Kuwaiti banks’ risks grow as real estate sales drop – According to a report by Kuwait International Bank (KIB), Kuwait’s real estate sale declined 29% in 2015 amid softening prices, suggesting low sales volumes and lower real estate values in 2016. As per the report, decline in real estate sales would adversely affect banks’ new business volumes and earnings, while it would increase credit risks for Kuwaiti banks that are highly exposed to real estate through collateral. More granular data show that by November 2015 all major real estate segments suffered declines in aggregate sales after several years of strong performance and a record year

- 8. Page 8 of 9 in 2014, with investment property sales declining 32% YoY more than other segments. (GulfBase.com) OTTCO plans 25mn barrels of new oil storage project – Oman Tank Terminal Company (OTTCO) said that Oman is planning to open a storage project with 25mn barrels of space in 2019, helping to keep the country's oil flowing. OTTCO Project Director Said Al- Maawali said that complex will be built in Ras Markaz, and is needed as oil storage in Sohar is already full. He said the tanks will boost trading of Oman crude oil futures on the Dubai Mercantile Exchange (DME) by making more oil available that can be delivered against the futures contracts, and it would also help guard against price volatility. He further added that future phases of the project could expand its capacity to as much as 200mn barrels of storage. (GulfBase.com) Sohar Islamic to lend finance to Muscat Hills property buyers – Sohar Islamic has signed a MoU with Muscat Hills to provide preferential Shari’ah-compliant financing solutions to Omani citizens, GCC nationals and expatriates, interested in investing in freehold office or residential property developed and built by the company. (GulfBase.com) CBO: Oman witness uptrend in banking assets & deposits – According to the Central Bank of Oman (CBO), despite a steep decline in crude oil prices, the monetary aggregates in Oman witnessed an uptrend in 2015. The combined balance sheet of conventional and Islamic banks shows that the banking system in the country is on the right track. Both assets and deposits of the banks witnessed significant growth. The total assets of conventional commercial banks increased by 15.1% to OMR28.5bn in November 2015 from OMR24.7bn a year ago, while the total assets of Islamic banks and windows combined, amounted to OMR2.2bn by November 2015-end constituting about 7.1%. As per the report, Islamic banking entities provided financing to the extent of OMR1.64bn as at the end of November 2015 when compared to OMR1bn a year ago. Total deposits held with Islamic banks and windows also registered a significant increase to OMR1.5bn during the period from OMR0.5bn outstanding as at the end of November 2014. Credit to the private sector increased by 10.3% to reach OMR16.2bn. (GulfBase.com) ODC plans to further expand its range of activities – Oman Drydock Company (ODC) has unveiled its action plan for the year 2016. ODC CEO Ahmed Al Abri said that the company is planning to further expand its range of activities and plans to offer specialist services like complex painting, retrofitting, modification, restructuring and the installation of Ballast Water systems. He said ODC will also be targeting the industrial and offshore sectors for steel fabrication works. (GulfBase.com) CBRE: Retail boom powering Bahrain property market – CBRE in its 4Q2015 market review for Bahrain said that the Kingdom looks set to be cushioned from the blow by continued infrastructure investment from the GCC aid fund. Despite negative impacts of the on-going oil slump Bahrain’s real estate sector has proven resilient with solid returns still considered achievable, affording hard pressed investors the opportunity for potential growth in an otherwise unpredictable market. This was underlined by the 7% growth achieved within the construction sector during early 2015, as a raft of new development projects were launched across all real estate asset classes, but notably in the retail, hospitality and residential sectors. (GulfBase.com) Batelco receives non-binding bids for Umniah – Bahrain Telecommunications Company (Batelco) has received non-binding offers to buy its Jordanian unit Umniah. The unit made a net profit of BHD5.25mn in 9M2015, about 11% of the group's total profit for the period. Earlier, in October 2015, Batelco said it was assessing options for Umniah and subsequently launched a sales process for the subsidiary. Over the coming period, Batelco together with its advisors will evaluate the offers received and update the market in due course. (Bahrain Bourse, Zawya)

- 9. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa ` QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 9 of 9 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 QSE Index S&P Pan Arab S&P GCC 4.0% 5.5% 0.6% (1.7%) 0.0% 2.5% 3.3% (4.0%) 0.0% 4.0% 8.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,087.31 (0.1) (0.1) 2.4 MSCI World Index 1,520.49 0.4 (0.0) (8.6) Silver/Ounce 14.03 0.5 0.7 1.2 DJ Industrial 16,016.02 0.2 0.2 (8.1) Crude Oil (Brent)/Barrel (FM Future) 28.76 0.7 (0.6) (22.9) S&P 500 1,881.33 0.1 0.1 (8.0) Crude Oil (WTI)/Barrel (FM Future) 28.46 (3.3) (3.3) (23.2) NASDAQ 100 4,476.95 (0.3) (0.3) (10.6) Natural Gas (Henry Hub)/MMBtu 2.22 1.5 1.5 (4.2) STOXX 600 332.93 1.6 0.7 (8.5) LPG Propane (Arab Gulf)/Ton 30.00 (0.8) (0.8) (23.3) DAX 9,664.21 1.8 1.0 (9.9) LPG Butane (Arab Gulf)/Ton 40.25 (7.5) (7.5) (30.0) FTSE 100 5,876.80 1.1 0.6 (9.4) Euro 1.09 0.1 (0.1) 0.4 CAC 40 4,272.26 2.3 1.3 (7.3) Yen 117.64 0.3 0.6 (2.1) Nikkei 17,048.37 0.5 (1.2) (8.0) GBP 1.42 (0.6) (0.7) (3.9) MSCI EM 714.37 1.6 0.7 (10.0) CHF 1.00 0.2 (0.2) (0.1) SHANGHAI SE Composite 3,007.74 3.2 3.6 (16.2) AUD 0.69 0.6 0.7 (5.2) HANG SENG 19,635.81 1.9 0.4 (11.1) USD Index 98.99 0.0 0.0 0.4 BSE SENSEX 24,479.84 1.1 0.3 (8.4) RUB 78.73 (0.7) 1.3 8.6 Bovespa 38,057.02 0.0 (1.2) (14.1) BRL 0.25 (0.2) (0.4) (2.5) RTS 660.29 2.1 1.1 (12.8) 103.7 90.8 90.6