20 August Daily market report

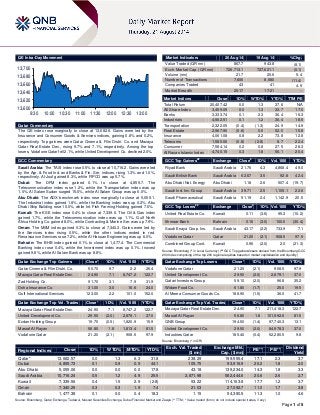

- 1. Page 1 of 5 QE Intra-Day Movement Qatar Commentary The QE index rose marginally to close at 13,682.6. Gains were led by the Insurance and Consumer Goods & Services indices, gaining 0.8% and 0.2%, respectively. Top gainers were Qatar Cinema & Film Distri. Co. and Mazaya Qatar Real Estate Dev., rising 9.7% and 7.1%, respectively. Among the top losers, Vodafone Qatar fell 2.1%, while United Development Co. declined 2.0%. GCC Commentary Saudi Arabia: The TASI index rose 0.5% to close at 10,716.2. Gains were led by the Agr. & Food Ind. and Banks & Fin. Ser. indices, rising 1.3% and 1.0%, respectively. Al-Jouf gained 8.3%, while FIPCO was up 5.7%. Dubai: The DFM index gained 0.1% to close at 4,855.7. The Telecommunication index rose 1.2%, while the Transportation index was up 1.0%. Al Salam Sudan surged 15.0%, while Al Salam Group was up 6.0%. Abu Dhabi: The ADX benchmark index rose marginally to close at 5,055.1. The Industrial index gained 1.8%, while the Banking index was up 0.2%. Abu Dhabi Ship Building rose 10.0%, while Int. Fish Farming Holding gained 7.0%. Kuwait: The KSE index rose 0.4% to close at 7,339.6. The Oil & Gas index gained 1.7%, while the Telecommunication index was up 1.1%. Gulf North Africa Holding Co. gained 8.0%, while Contracting & Marine Ser. was up 7.9%. Oman: The MSM index gained 0.3% to close at 7,340.3. Gains were led by the Services index rising 0.5%, while the other indices ended in red. Renaissance Services rose 7.2%, while Al Hassan Engineering was up 6.0%. Bahrain: The BHB index gained 0.1% to close at 1,477.4. The Commercial Banking index rose 0.4%, while the Investment index was up 0.1%. Inovest gained 9.8%, while Al Salam Bank was up 8.8%. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distri. Co. 50.70 9.7 2.2 26.4 Mazaya Qatar Real Estate Dev. 24.90 7.1 8,747.2 122.7 Zad Holding Co. 91.70 3.1 7.9 31.9 Doha Insurance Co. 31.00 3.0 16.6 24.0 Gulf International Services 123.00 2.2 101.0 152.0 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% Mazaya Qatar Real Estate Dev. 24.90 7.1 8,747.2 122.7 United Development Co. 29.50 (2.0) 2,879.1 37.0 Ezdan Holding Group 19.70 (0.5) 1,820.9 15.9 Masraf Al Rayan 56.80 1.8 1,813.4 81.5 Vodafone Qatar 21.20 (2.1) 908.5 97.9 Market Indicators 20 Aug 14 19 Aug 14 %Chg. Value Traded (QR mn) 867.7 943.8 (8.1) Exch. Market Cap. (QR mn) 726,713.1 727,621.1 (0.1) Volume (mn) 21.7 20.6 5.4 Number of Transactions 7,606 8,580 (11.4) Companies Traded 43 41 4.9 Market Breadth 20:17 17:21 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 20,407.42 0.0 1.3 37.6 N/A All Share Index 3,459.09 0.0 1.3 33.7 17.0 Banks 3,333.74 0.1 2.3 36.4 16.3 Industrials 4,562.51 0.1 1.2 30.4 18.5 Transportation 2,322.05 (0.4) (1.3) 24.9 14.9 Real Estate 2,967.90 (0.6) 0.5 52.0 15.8 Insurance 4,061.08 0.8 2.2 73.8 12.8 Telecoms 1,580.06 (0.8) (2.8) 8.7 22.4 Consumer 7,584.14 0.2 0.8 27.5 28.3 Al Rayan Islamic Index 4,740.15 0.3 1.8 56.1 20.4 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Riyad Bank Saudi Arabia 21.76 4.3 4,868.4 49.0 Saudi British Bank Saudi Arabia 62.67 3.5 92.8 42.4 Abu Dhabi Nat. Energy Abu Dhabi 1.18 2.6 507.4 (19.7) Saudi Ind. Inv. Group Saudi Arabia 39.71 2.5 1,105.1 22.6 Saudi Pharmaceutical Saudi Arabia 51.19 2.4 1,142.9 20.5 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% United Real Estate Co. Kuwait 0.11 (3.6) 95.3 (10.2) Ithmaar Bank Bahrain 0.16 (3.0) 100.0 (30.4) Saudi Enaya Coop. Ins. Saudi Arabia 43.17 (2.2) 733.9 7.1 Vodafone Qatar Qatar 21.20 (2.1) 908.5 97.9 Combined Group Cont. Kuwait 0.96 (2.0) 2.0 (21.3) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 21.20 (2.1) 908.5 97.9 United Development Co. 29.50 (2.0) 2,879.1 37.0 Qatari Investors Group 59.10 (2.0) 96.8 35.2 Widam Food Co. 61.80 (1.7) 25.0 19.5 Al Meera Consumer Goods Co. 188.90 (1.5) 36.0 41.7 Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% Mazaya Qatar Real Estate Dev. 24.90 7.1 211,418.3 122.7 Masraf Al Rayan 56.80 1.8 101,992.6 81.5 QNB Group 194.50 (1.4) 97,740.3 13.1 United Development Co. 29.50 (2.0) 84,978.3 37.0 Industries Qatar 185.40 (0.4) 52,280.5 9.8 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 13,682.57 0.0 1.3 6.3 31.8 238.29 199,555.4 17.1 2.3 3.7 Dubai 4,855.73 0.1 0.9 0.5 44.1 105.75 93,916.9 20.2 1.8 2.0 Abu Dhabi 5,055.06 0.0 0.0 0.0 17.8 43.18 139,234.0 14.3 1.8 3.3 Saudi Arabia 10,716.24 0.5 1.2 4.9 25.5 2,871.98 582,444.6 20.6 2.6 2.7 Kuwait 7,339.56 0.4 1.5 2.9 (2.8) 93.22 114,163.8 17.7 1.2 3.7 Oman 7,340.29 0.3 0.3 1.9 7.4 21.03 27,092.7 11.0 1.7 3.8 Bahrain 1,477.38 0.1 0.0 0.4 18.3 1.15 54,380.5 11.3 1.0 4.6 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 13,600 13,620 13,640 13,660 13,680 13,700 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QE index rose marginally to close at 13,682.6. The Insurance and Consumer Goods & Ser. indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. Qatar Cinema & Film Distrib. Co. and Mazaya Qatar Real Estate Dev. were the top gainers, rising 9.7% and 7.1%, respectively. Among the top losers, Vodafone Qatar fell 2.1%, while United Development Co. declined 2.0%. Volume of shares traded on Wednesday rose by 5.4% to 21.7mn from 20.6mn on Tuesday. However, as compared to the 30-day moving average of 17.0mn, volume for the day was 28.1% higher. Mazaya Qatar Real Estate Dev. and United Development Co. were the most active stocks, contributing 40.3% and 13.3% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Global Economic Data Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 08/20 US MBA MBA Mortgage Applications 15 August 1.40% – -2.70% 08/20 EU Eurostat Construction Output MoM June -0.70% – -1.40% 08/20 EU Eurostat Construction Output YoY June -2.30% – 4.40% 08/20 Germany Destatis PPI MoM July -0.10% 0.00% 0.00% 08/20 Germany Destatis PPI YoY July -0.80% -0.70% -0.70% 08/20 Japan Ministry of Finance Exports YoY July 3.9 3.8 -1.9 08/20 Japan Ministry of Finance Imports YoY July 2.3 -1.5 8.4 08/20 Japan METI All Industry Activity Index MoM June -0.40% -0.40% 0.60% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar The loan book fell by 1.0% MoM (up 5.0% YTD) while deposits declined by 2.7% MoM (+4.9% YTD) in the month of July 2014. After posting a growth of 1.9% MoM in June 2014 (primarily due to pick-up in credit off-take from the international and private segments), loans fell by 1.0% MoM with public sector declining by 4.4% MoM. On the other hand, deposits also declined by 2.7% with public sector deposits declining by 3.8% MoM. Thus, the LDR climbed to 106% vs. 104% in June. Going forward, post the summer lull, we expect increased activity in the sector. We expect improvement in the public sector, in addition to large corporate loan growth to be the primary drivers of the overall loan book in 2014 followed by the SMEs and consumer lending. Our view is based on the expected uptick in project mobilizations in the coming months. (QNBFS Research) HIA has handled 2.36mn passengers so far – Hamad International Airport’s (HIA) head of the passports section Nasser Abdul Karim Al Hamidi said that the airport has handled 2.365mn passengers since its opening and 34,000 passengers go through the counters every day. The airport has a new passport screening device, the best in the world, and once an immigration officer raises a query regarding a passport, it was sent to this device and verified. He said the device can check the passport for any manipulation or fraud and misrepresentation in the data or photo. (Peninsula Qatar) QRC to extend Weqaya to 5,000 more workers – Qatar Red Crescent (QRC) recently extended the field implementation of Phase One of its National Communicable Disease Prevention Campaign (Weqaya), funded and sponsored by the Supreme Council of Health (SCH). The campaign will continue for several months, serving some 5,000 more expatriate workers. In the first event after the extension, a QRC medical affairs team held a health education lecture and distributed personal hygiene kits to 200 workers of Toyo-Thai Corporation Public Company Limited- Qatar, in coordination with the Thai Embassy in Doha. (Peninsula Qatar) International Fed officials see smaller balance sheet in the long run; job gains may bring faster rate increase – The US Federal Reserve officials pledged to reduce the size of the central bank’s record balance sheet as they mapped out a strategy to exit from the most aggressive monetary stimulus in its 100-year history. According to the minutes of the Federal Open Market Committee’s July meeting, the balance sheet should be reduced in order to minimize the effect of the Fed’s portfolio holdings on credit allocation across different sectors of the economy. Over the last six years, the Fed’s bond buying program has flooded the global banking system with $2.71tn of excess reserves in order to support a recovery. Since banks no longer need to borrow reserves from each other as they did before the crisis, officials have been forced to come up with a new way to raise the federal funds rate. Meanwhile, the Fed officials said there is a possibility they might raise rates sooner than anticipated, as they neared agreement on an exit strategy. Fed Chairperson Janet Yellen has committed to use monetary policy to strengthen the labor market so long as inflation remains in check. The meeting minutes showed many participants still saw a larger gap between current labor market conditions and those consistent with their assessments of normal levels of labor utilization. (Bloomberg) Carney seen holding sway as BoE dissenters pull away from pack – The Bank of England (BoE) Governor Mark Carney Overall Activity Buy %* Sell %* Net (QR) Qatari 61.97% 65.39% (29,606,207.95) Non-Qatari 38.03% 34.61% 29,606,207.95

- 3. Page 3 of 5 has come through his first public argument on interest rates with enough scope to contain dissent for now. According to economists at Goldman Sachs Group Inc. and UniCredit SpA, while BoE policy makers Martin Weale and Ian McCafferty voted for a rate increase this month, the gulf between their thinking and that of the governor’s seven-strong majority suggests his view will hold sway. Investors share that outlook, with expectations for the first rate increase staying stuck in May even after the revelation of the first split in more than three years. Even though Carney has given some mixed signals on the potential timing of tightening, his warnings about risks to the recovery signal an entrenched position in his camp. (Bloomberg) Hollande to speed up reforms in France, ease tax on poor households – French President Francois Hollande said he would accelerate reforms, while at the same time giving tax breaks to poorer households as he tries to win back confidence from voters who have lost trust in his ability to lift the country out of stagnation. The most unpopular French president in modern history has come under growing fire from both the opposition and some ruling Socialist party lawmakers over his economic policy after his government abandoned growth and fiscal targets last week. As he prepares for tough negotiations on the 2015 budget both at home and with France's EU partners, Hollande pledged he would work on both fronts: reform France and help low-income households. (Reuters) Reuters Tankan: Japan manufacturers' mood up, outlook dims – Confidence among Japanese manufacturers inched up in August to mark the first improvement since April's sales tax rise, but the service sector's mood soured for the second straight month, a Reuters poll showed, reflecting a tame economic recovery. In the Reuters Tankan poll, the sentiment index among manufacturers stood at plus 20 in August, up 1 point from July. The service-sector gauge was at plus 19 in August, down 4 points from the prior month and marking a second straight month of declines. The Reuters Tankan poll of 400 big firms followed data last week that showed the economy had suffered its worst slump in April-June since the March 2011 disaster. Although policymakers and private-sector economists expect a rebound in the current quarter, the poll indicated that any recovery is likely to be modest. Many industry participants believed it would be hard to recover at least until the next tax rise planned in October 2015, that could encourage last-minute spending to avoid the higher tax rate. Meanwhile, a separate survey showed manufacturing activity accelerated in August as export and domestic demand increased in another sign that the economy is steadying after the sales tax hike. (Reuters) Regional Regional electronics market growth to deliver bumper Gitex Shopper 2014 – The Middle East’s considerable and fast- growing appetite for consumer electronics has led the organizers of GITEX Shopper 2014 – the Middle East’s largest consumer IT and electronics show – to expect another bumper sales performance at its 2014 event. The eight-day sales extravaganza bringing together the region’s power retailers and the world’s biggest electronic brands, runs from September 27 to October 4 at the Dubai World Trade Centre (DWTC), and is expected to attract more than 210,000 visitors. According to the Consumer Electronics Association, strong sales of tablets, smartphones and Digital SLR cameras – traditional GITEX Shopper favorites – have positioned the Middle East and North Africa (MENA) alongside China and South America among the territorial contenders to overtake North America as the world’s dominant consumer technology market. With the UAE’s consumer electronics market forecasted to reach AED16bn by 2015, GITEX Shopper serves as a critical platform for the region’s consumer electronics industry. (AmeInfo.com) Saudi Arabia imports 3mn tons of cement in 9 months – According to a report released by the Customs Department, Saudi Arabia imported some 3.1mn tons of cement in the past 9 months valued at SR750mn. According to a source, the rise in cement imports was attributed to the increased pace of project implementation and growing government spending on infrastructure projects. The source further added that demand for cement is annually increasing at rates ranging from 3% to 5%. The production capacity of 15 operating cement plants in the Kingdom has reached 60mn tons, but the companies are producing 55mn tons at a value of SR13bn. The volume of production varies between one company & another where daily sales are ranging between 5,000 and 25,000 tons for small and big companies, respectively. (Gulf-Base.com) Egypt picks Saudi consultancy to draft Suez plan – Egypt has selected a Saudi consultancy to draw up the plan for the government's mega project to transform the Suez Canal waterway into a hub of international investment and free trade zones. Suez Canal is the fastest shipping route between Europe & Asia and brings in around $5bn in revenues per year. (GulfBase.com) Saudi Aramco invests $30mn in US-based Siluria Technologies – Saudi Arabian Oil Company’s (Saudi Aramco) investment arm has spearheaded a $30mn investment in US- based Siluria Technologies, a company that plans to produce low-cost gasoline from natural gas. Siluria's two-step process converts natural gas into ethylene, and ethylene into liquid fuels such as gasoline, diesel and jet fuel. (Reuters) Saudi Arabia said to seek ministry responses on market opening – According to sources, Saudi Arabia, home to the biggest Arab stock exchange, is seeking feedback from government ministries on the proposed opening of its bourse to direct foreign investment. The draft rules will go for a wider consultation with banks, market participants and the public once government ministries have responded. Sources said that the proposals include restricting foreign ownership in listed companies to 10-30%. The country’s Capital Market Authority had said on July 22 that it will open the stock market to foreigners in 1H2015. (Reuters) FCA: UAE’s non-oil trade reaches AED256bn in 1H2014 – According to preliminary data from the Federal Customs Authority (FCA), UAE’s non-oil trade reached AED256bn in 1H2014, reflecting the continuous momentum of the UAE’s non- oil foreign trade in 2013, driven by stronger performance in all economic sectors and the country’s more advanced position on many global indices. The FCA’s statistics showed that imports accounted for 65%, or AED166.4bn of the non-oil trade in 1Q2014, while exports represented 11.8%, or AED30.2bn and re-exports represented 23.2%, or AED59.4bn of non-oil trade. UAE’s non-oil trade in terms of weight reached approximately 40.7mn tons in 1Q2014, of which imports accounted for 15.5mn tons, exports 22.7mn tons and re-exports 2.5mn tons. Based on the FCA figures, the value of non-oil trade between the UAE and Gulf Cooperation Council (GCC) reached AED22.9bn in 1Q2014, of which GCC imports accounted for AED7.4bn, while exports and re-exports represented AED7.7bn each. The total value of UAE-Saudi non-oil trade recorded AED8.3bn, accounting for 36.2% of total trade with the GCC countries. Oman came second with AED6bn (26.4%), followed by Kuwait and Qatar with AED3.2bn (14%) each, and finally Bahrain with AED2.2bn (9.4%). Non-oil trade with Arab countries hit AED35.9bn in 1Q2014, to which imports contributed

- 4. Page 4 of 5 AED11.9bn, exports and re-exports AED11.7bn and AED12.3bn, respectively. (GulfBase.com) UAE national banks’ deposits up 80% in June 2014 – The volume of customer deposits of national banks in the UAE has increased in June 2014 by AED87bn to AED1,210.4bn, up 80% from AED1,123.6bn, registered by the end of December 2013. The Emirates NBD and Emirates Islamic Bank registered the largest volume of customer deposits at AED252.8bn, while other banks in the country also registered mentionable volume of customer deposits by the end of last month. (GulfBase.com) Damac to plant forest in Dubai desert for Akoya Oxygen development – Damac Properties is planning to plant a forest in the desert to help sell its latest Dubailand project. The company is planning a 55mn square feet Akoya Oxygen project, and is aiming to transplant 4,000 trees to create what it describes as a lush green environment on the site that will be located off the Umm Suqeim Road extension. (GulfBase.com) Straits Financial joins DME as clearing member – The Dubai Mercantile Exchange (DME) announced the approval of Straits Financial LLC as a clearing member. Straits Financial LLC is a Futures Commission Merchant (FCM) registered with the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) and is also a full Clearing Member of the Chicago Mercantile Exchange (CME), the Chicago Board of Trade (CBOT), the Commodity Exchange (Comex), the New York Mercantile Exchange (Nymex) and Clearport, the OTC (over the counter) Clearing Exchange. (GulfBase.com) ICD, KEXIM sign MoU – The Investment Corporation of Dubai (ICD) and the Export-Import Bank of Korea (KEXIM) have signed a MoU to form an alliance to explore international investment and export finance opportunities across Asia, the Middle East and Africa. This agreement enables both the entities to develop new investment opportunities in potential markets for mutual benefit, alongside a partner of global standing. (GulfBase.com) DCCI: Family tourism emerges as major growth area in Islamic economy – According to a research report by the Dubai Chamber of Commerce and Industry (DCCI), family tourism has emerged as a major segment of the Islamic economy, accounting for as much as 12.5% of the $1.07tn global tourism market in 2012. The report shows that family tourism has grown in value from $137bn in 2012 to $140bn in 2013, and is expected to surpass $181bn by 2018. The size of this market can be estimated from the fact that it is larger than the world’s largest conventional tourism market, the US, which is only 11.4% of the global market. (GulfBase.com) Nakheel to repay all AED7.9bn bank debt four years early – Dubai property developer, Nakheel is repaying all of its AED7.9bn worth of bank debt as much as four years ahead of schedule. The developer will repay 31 banks AED5.54bn on August 21, 2014. Of that amount, AED3.45bn would go to UAE- based banks, with Emirates NBD and Dubai Islamic Bank being the biggest recipients; the remaining AED2.09bn would be paid to foreign banks. In addition, Nakheel will make an interest payment of AED129mn for the six months to August 28, 2014. In February 2014, Nakheel repaid AED2.35bn of bank debt that was due to mature in September 2015. (Reuters) Jeffrey Singer resigns as CEO of DIFC Authority – Jeffrey Singer has resigned from the position of the CEO of the Dubai financial zone authority, which oversees Dubai's financial free zone, the Dubai International Financial Centre. He is stepping down with immediate effect. (Reuters) Mexican oil industry courting ADNOC, Mubadala Petroleum – Abu Dhabi National Oil Company (ADNOC) and Mubadala Petroleum have held informal discussions with the Mexican government and oil industry officials to invest in the country’s oil industry. Officials have so far briefed representatives from the two Abu Dhabi state-owned companies on the size of investment needed to revitalize Mexico’s ailing energy sector. (GulfBase.com) KA plans to buy 10 Boeing 777 aircraft – Kuwait Airways (KA) is planning to buy 10 Boeing 777 jetliners. KA officials are expected to meet with Boeing officials soon to discuss legal and technical matters. (GulfBase.com) Omani oil & gas industry’s JSRS goes live – Oman’s oil & gas industry has implemented the Joint Supplier Registration System (JSRS), which is ‘single window’ for uniform supplier registration process connecting suppliers in Oman and abroad. JSRS is a national project supported by the Oman Ministry of Oil & Gas under the In-Country Value (ICV) Initiative and is developed by Business Gateways International. This initiative helps all suppliers (national and international) to have a uniform registration mechanism to connect to the oil & gas opportunities across Oman and the registration on this system is now mandatory for any supplier wanting to connect with the oil & gas operators in Oman. (GulfBase.com) Nawras calls an OGM to seek approval for brand license agreement with Ooredoo IP – Omani Qatari Telecommunications Company’s (Nawras) board of directors has invited all shareholders to an OGM to be held on September 9, 2014 at Capital Market Authority in Ruwi to approve the company entering into a brand license agreement with Ooredoo IP LLC, a related party. (MSM) AHEC receives LoI from Daelim Petrofac SRIP – Al Hassan Engineering Company (AHEC) announced that it has received a Letter of Intent (LoI) from Daelim-Petrofac SRIP (joint venture), for the construction and pre-commissioning of civil and underground piping works for the Sohar Refinery Improvement Project in Oman. The contract value is approximately $68mn and the work is expected to be completed by April 2016. AHEC expects to generate reasonable income from this project. (MSM) SCPE to invest $75mn for 9.8% stake in TEM – Standard Chartered Private Equity (SCPE) announced to invest $75mn for a 9.8% stake in Topaz Energy & Marine (TEM), a subsidiary of Renaissance Services. The funds will be deployed in support of Topaz’s long-term fleet expansion plan in its core operational regions and a strategic entry to key growth opportunities. The transaction is subjected to bank consents and customary conditions, and is expected to close during 4Q2014. (MSM) ASRY signs contract for $8.6mn desalination plant – Arab Shipbuilding & Repair Yard (ASRY) has agreed a build-operate- transfer contract for the completion of a reverse osmosis sea water desalination plant. The agreement has an estimated $8.6mn budget and April 2015 operational target. The desalination plant project, previously managed by Gemsil Aquatech Services, had an initial production capacity of 3,000 tons per day, which will be expanded to 7,000 tons per day. This will not only meet the future requirements of ASRY, but also contribute to serving Bahrain by contributing to daily national requirements of sweet water. (Bloomberg)

- 5. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg (* Market closed on 20 August 2014) Source: Bloomberg 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 210.0 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 QE Index S&P Pan Arab S&P GCC 0.5% 0.0% 0.4% 0.1% 0.3% 0.0% 0.1% 0.0% 0.2% 0.4% 0.6% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,291.92 (0.3) (1.0) 7.2 DJ Industrial 16,979.13 0.4 1.9 2.4 Silver/Ounce 19.48 0.2 (0.4) 0.1 S&P 500 1,986.51 0.2 1.6 7.5 Crude Oil (Brent)/Barrel (FM Future) 102.28 0.7 (1.2) (7.7) NASDAQ 100 4,526.48 (0.0) 1.4 8.4 Natural Gas (Henry Hub)/MMBtu 3.85 0.1 2.2 (11.5) STOXX 600 335.30 (0.1) 1.7 2.1 LPG Propane (Arab Gulf)/Ton* 102.25 0.0 (0.4) (19.2) DAX 9,314.57 (0.2) 2.4 (2.5) LPG Butane (Arab Gulf)/Ton 121.00 0.8 (0.6) (10.9) FTSE 100 6,755.48 (0.4) 1.0 0.1 Euro 1.33 (0.5) (1.1) (3.5) CAC 40 4,240.79 (0.3) 1.6 (1.3) Yen 103.76 0.8 1.4 (1.5) Nikkei 15,454.45 0.0 0.9 (5.1) GBP 1.66 (0.1) (0.6) 0.2 MSCI EM 1,085.08 0.1 1.0 8.2 CHF 1.09 (0.5) (1.2) (2.2) SHANGHAI SE Composite 2,240.21 (0.2) 0.6 5.9 AUD 0.93 (0.2) (0.4) 4.1 HANG SENG 25,159.76 0.1 0.8 8.0 USD Index 82.23 0.4 1.0 2.7 BSE SENSEX 26,314.29 (0.4) 0.8 24.3 RUB 36.29 0.3 0.3 10.4 Bovespa 58,878.24 0.7 3.4 14.3 BRL 0.44 (0.6) (0.1) 4.5 RTS 1,257.41 0.5 2.0 (12.8) 196.6 164.3 147.9