QE Index Rises 0.9% Led By Banking & Financial Services

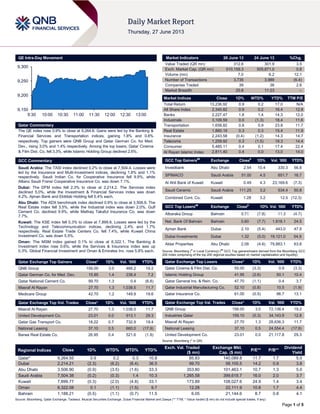

- 1. Page 1 of 5 QE Intra-Day Movement Qatar Commentary The QE index rose 0.9% to close at 9,264.6. Gains were led by the Banking & Financial Services and Transportation indices, gaining 1.8% and 0.8% respectively. Top gainers were QNB Group and Qatar German Co. for Med. Dev., rising 3.0% and 1.4% respectively. Among the top losers, Qatar Cinema & Film Dist. Co. fell 3.3%, while Islamic Holding Group declined 2.6%. GCC Commentary Saudi Arabia: The TASI index declined 0.2% to close at 7,504.4. Losses were led by the Insurance and Multi-Investment indices, declining 1.8% and 1.1% respectively. Saudi Indian Co. for Cooperative Insurance fell 9.9%, while Allianz Saudi Fransi Cooperative Insurance Co. was down 7.1%. Dubai: The DFM index fell 2.3% to close at 2,214.2. The Services index declined 5.0%, while the Investment & Financial Services index was down 4.2%. Ajman Bank and Ekttitab Holding fell 5.4% each. Abu Dhabi: The ADX benchmark index declined 0.9% to close at 3,506.9. The Real Estate index fell 3.5%, while the Industrial index was down 2.0%. Gulf Cement Co. declined 9.9%, while Methaq Takaful Insurance Co. was down 7.7%. Kuwait: The KSE index fell 0.3% to close at 7,899.8. Losses were led by the Technology and Telecommunication indices, declining 2.4% and 1.7% respectively. Real Estate Trade Centers Co. fell 7.4%, while Kuwait China Investment Co. was down 5.5%. Oman: The MSM index gained 0.1% to close at 6,322.1. The Banking & Investment index rose 0.6%, while the Services & Insurance index was up 0.3%. Global Financial Investment and Oman & Emirates Inv. rose 5.8% each. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% QNB Group 156.00 3.0 466.2 19.2 Qatar German Co. for Med. Dev. 15.85 1.4 238.4 7.2 Qatar National Cement Co. 99.70 1.3 0.4 (6.8) Masraf Al Rayan 27.70 1.3 1,038.5 11.7 Medicare Group 42.70 1.2 149.9 19.6 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% Masraf Al Rayan 27.70 1.3 1,038.5 11.7 United Development Co. 23.01 0.0 913.1 29.3 Qatar Gas Transport Co. 18.22 0.7 732.9 19.4 National Leasing 37.10 0.5 660.0 (17.9) Barwa Real Estate Co. 26.95 0.4 521.6 (1.8) Market Indicators 26 June 13 24 June 13 %Chg. Value Traded (QR mn) 312.6 301.9 3.5 Exch. Market Cap. (QR mn) 510,159.3 505,871.0 0.8 Volume (mn) 7.0 6.2 12.1 Number of Transactions 3,735 3,989 (6.4) Companies Traded 39 38 2.6 Market Breadth 25:8 11:23 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 13,236.92 0.9 0.2 17.0 N/A All Share Index 2,345.82 0.9 0.2 16.4 12.8 Banks 2,227.47 1.8 1.4 14.3 12.0 Industrials 3,109.59 0.0 (1.3) 18.4 11.6 Transportation 1,658.82 0.8 0.9 23.8 11.7 Real Estate 1,860.19 0.3 0.3 15.4 11.9 Insurance 2,243.58 (0.4) (1.2) 14.3 14.7 Telecoms 1,259.92 0.3 (1.5) 18.3 14.4 Consumer 5,485.11 0.4 0.1 17.4 22.4 Al Rayan Islamic Index 2,811.40 0.4 0.0 13.0 14.0 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Investbank Abu Dhabi 2.54 10.4 330.3 56.8 SPIMACO Saudi Arabia 51.00 4.5 651.7 16.7 Al Ahli Bank of Kuwait Kuwait 0.49 4.3 23,169.6 (7.3) Saudi Ceramic Saudi Arabia 111.25 3.2 534.4 50.8 Combined Cont. Co. Kuwait 1.28 3.2 12.5 (12.3) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Albaraka Group Bahrain 0.71 (7.8) 11.3 (4.7) Nat. Bank Of Bahrain Bahrain 0.60 (7.7) 1,818.1 24.5 Ajman Bank Dubai 2.10 (5.4) 443.0 47.9 Dubai Investments Dubai 1.32 (5.0) 19,121.0 54.9 Aldar Properties Abu Dhabi 2.08 (4.6) 79,883.1 63.8 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Dist. Co. 55.00 (3.3) 0.9 (3.3) Islamic Holding Group 41.95 (2.6) 50.1 10.4 Qatar General Ins. & Rein. Co. 47.70 (1.1) 0.4 3.7 Qatar Industrial Manufacturing Co. 52.10 (0.8) 10.5 (1.9) Qatar Insurance Co. 61.00 (0.5) 96.7 13.1 Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% QNB Group 156.00 3.0 72,136.4 19.2 Industries Qatar 159.10 (0.3) 34,143.9 12.8 Masraf Al Rayan 27.70 1.3 28,636.3 11.7 National Leasing 37.10 0.5 24,554.4 (17.9) United Development Co. 23.01 0.0 21,117.8 29.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,264.55 0.9 0.2 0.3 10.8 85.83 140,089.8 11.7 1.7 5.0 Dubai 2,214.21 (2.3) (6.2) (6.4) 36.5 99.70 58,105.5 14.2 0.9 3.8 Abu Dhabi 3,506.90 (0.9) (3.5) (1.6) 33.3 353.80 101,463.1 10.7 1.3 5.0 Saudi Arabia 7,504.38 (0.2) (0.3) 1.4 10.3 1,265.58 399,618.7 16.0 2.0 3.7 Kuwait 7,899.77 (0.3) (2.0) (4.8) 33.1 173.89 108,027.6 24.9 1.4 3.4 Oman 6,322.08 0.1 (1.1) (1.5) 9.7 12.28 22,111.9 10.8 1.7 4.4 Bahrain 1,188.21 (0.5) (1.1) (0.7) 11.5 6.05 21,144.6 8.7 0.8 4.1 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,150 9,200 9,250 9,300 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QE index rose 0.9% to close at 9,264.6. The Banking & Financial Services and Transportation indices led the gains. The index rose on the back of buying support from Qatari shareholders despite selling pressure from non-Qatari shareholders. QNB Group and Qatar German Co. for Med. Dev. were the top gainers, rising 3.0% and 1.4% respectively. Among the top losers, Qatar Cinema & Film Dist. Co. fell 3.3%, while Islamic Holding Group declined 2.6%. Volume of shares traded on Wednesday rose by 12.1% to 7.0mn from 6.2mn on Monday. However, as compared to the 30-day moving average of 12.0mn, volume for the day was 41.5% lower. Masraf Al Rayan and United Development Co. were the most active stocks, contributing 14.8% and 13.0% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Ratings, Earnings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Banque Saudi Fransi (BSF) CI Saudi Arabia FSR/ LT FCR/ ST FCR/ Support level A/A+/A1/2 A/A+/A1/2 – Stable – Ruwais Power Company (Shuweihat 2) S&P Abu Dhabi LT rating to ~$825mn bonds maturing in 2036 – A-* – – – Renaissance Services (Renaissance) CI Oman Renaissance mandatory convertible bonds omBBB- omBBB- – Stable – Bank Sohar Fitch Oman LT IDR/ ST IDR/ VR/ SR/ SR floor BBB+/F2/bb/2/ BBB+ BBB+/F2/bb/2 / BBB+ – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Credit Rating, LCR – Local Currency Rating, ICR – Issuer Credit Rating) (*Preliminary Rating Assigned) Earnings Releases Company Market Currency Revenue (mn) 1Q2013 % Change YoY Operating Profit (mn) 1Q2013 % Change YoY Net Profit (mn) 1Q2013 % Change YoY Al-Baha Investment & Development Co. (Al-Baha) Saudi Arabia SR – – (69.9) N/A (69.9) N/A Source: Company data, Tadawul Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 06/26 US MBA MBA Mortgage Applications 21-June -3.00% – -3.30% 06/26 US BEA GDP QoQ (Annualized) 1Q2013 1.80% 2.40% 2.40% 06/26 US BEA Personal Consumption 1Q2013 2.60% 3.40% 3.40% 06/26 US BEA GDP Price Index 1Q2013 1.20% 1.10% 1.10% 06/26 France INSEE Gross Domestic Product (QoQ) 1Q2013 -0.20% -0.20% -0.20% 06/26 France INSEE GDP YoY 1Q2013 -0.40% -0.40% -0.30% 06/26 France French Labor Office Jobseekers- Net Change May – 26.0 39.8 06/26 Germany GfK GfK Consumer Confidence Survey July 6.8 6.5 6.5 06/26 Spain INE Mortgages-capital loaned (YoY) April -21.60% – -34.80% 06/26 Spain INE Mortgages on Houses (YoY) April -18.10% – -34.10% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 56.60% 53.98% 8,185,278.80 Non-Qatari 43.39% 46.01% (8,185,278.80)

- 3. Page 3 of 5 News Qatar QCB to issue QR4bn T-bills on July 02 – Qatar Central Bank (QCB) will issue treasury bills for a period of 91 days, 184 days, 273 days on July 02, 2013. The total amount of issuance is QR4bn. (QCB) UDCD announces formation of a new executive committee – The Board of Directors of United Development Company has formed a new executive committee. The main function of the committee is to assist the Chief Executive Officer in fulfilling his duties. The powers of the Committee shall be defined via a charter approved by the Board of Directors.(QE) Qatar’s petrochemical production reaches 16.8mn tons in 2012 – Petrochemicals production in Qatar touched 16.8mn tons in 2012, making the country the second largest producer in the GCC downstream sector, after Saudi Arabia. One of the key projects that came on-stream last year was Qatar Petrochemical Company’s (Qapco) new low density polyethylene (LDPE-3) plant, which increased its polyolefin production capacity to 1.15mn tons per annum. This plant has the highest polyolefin production capacity in a single location anywhere in the world. Qapco also plans to expand the production capacity of its ethylene plant, which will enable Qapco to produce up to 1mn ton of ethylene every year. (Peninsula Qatar) QTEL gets regulatory approval for name change to Ooredoo – Qatar Telecom (QTEL) has obtained legal and regulatory approvals to change its name to Ooredoo. (Peninsula Qatar) Hassad Food to invest in Croatian farms – The Croatian Chamber of Agriculture is in talks with Hassad Food Company for seeking investments in cattle and corn farms in Croatia. (Bloomberg) QIIK to disclose its 2Q2013 results on July 15 – Qatar International Islamic Bank (QIIK) will announce its 2Q2013 financial results on July 15, 2013. (QE) IHGS to disclose its 2Q2013 results on July 15 – The Islamic Holding Group (IHGS) will announce its 2Q2013 financial results on July 15, 2013. (QE) International Draghi: ECB is ready to act but governments must reform – The European Central Bank (ECB) President Mario Draghi said the bank is ready to take fresh action if needed, but its monetary policy cannot create real economic growth, which can only happen if governments support with reforms. He said the ECB has done as much as it can to stabilize the financial markets and support the EU economy, so it is now up to governments and parliaments to do all they can to raise the growth potential. Meanwhile, the ECB also said it expects the Eurozone’s recovery to be gradual and fragile, pointing to continued downside risks to growth. (Reuters) Ifo: German economy to grow 0.6% in 2013 – Germany's Ifo Institute has trimmed its forecast for the country’s economic growth in 2013 to 0.6% since the economy had a subdued first quarter and only narrowly avoided a recession. In December, Ifo had forecast a growth of 0.7% for 2013. However, the institute remains more optimistic than the German government and the Bundesbank, which expect growth of 0.5% and 0.3% respectively. (Reuters) BoE warns of sharp global interest rate rise – The Bank of England warned banks and borrowers in the UK about the risks from a potential abrupt rise in global interest rates. The BoE said banks might need to further bolster their capital buffers to protect against this risk. The BoE said that it had ordered an investigation into the vulnerability of Britain's financial institutions and borrowers to higher interest rates. The investigation will file its report to the BoE’s new risk watchdog, the Financial Policy Committee by September. (Reuters) Fitch downgrades BRICs but forecasts a pickup in global GDP fuelled by US and Eurozone – Ratings agency Fitch has cut its growth outlook for all the four BRIC nations (Brazil, Russia, India and China), stating that 2012-13 will have the second weakest growth (after 2009). In its Global Economic Outlook Report, Fitch said it expects the global economy to strengthen gradually in 2H2013 as well as in 2014 and 2015, on the back of pickup in the US and the Eurozone economies. (Bloomberg) Regional MEED: GCC construction, transport contracts cross $39bn in 1H2013 – According to a report by MEED Projects, contracts worth over $39bn have been awarded for in the construction and transport projects in the GCC region during 1H2013. Qatar Rail topped the list of awarding clients and ABV Rock was the leading contractor in terms of contract value. (GulfBase.com) IRENA: Renewable energy investment in MENA rises 40% YoY in 2012 – According to a report released by the International Renewable Energy Agency (IRENA), renewable energy (RE) investments in the MENA region grew by 40% YoY to $2.9bn in 2012. The report said that more than 100 RE projects, including solar, wind and biomass are currently under development in the MENA region. These projects could increase non-hydro RE generating capacity by 450% over the next few years. The report also said that announcements by various MENA region governments indicate that additional capacity of 107 Giga watts could be established by 2030, representing a 60- fold growth in the installed capacity. (GulfBase.com) Saudi residential market posts robust growth in 1Q2013 – According to a report released by the Jones Lang LaSalle (JLL), the residential market witnessed a solid growth across Saudi Arabia in 1Q2013 as demand for housing rose rapidly backed by increased levels of credit, employment, assistance and consumer confidence. The report said that residential prices were on the rise in Riyadh and Jeddah. The report also said that in Riyadh, the average rents and prices of both apartments and villas witnessed a steady rise as supply continued to trail demand. JLL said that land prices in peripheral areas continue to increase, although it perceived a less speculative pressure than last year. (GulfBase.com) Saudi Fund provides finance for Tanzanian water project – The Saudi Fund for Development has agreed to provide $15mn finance for a drinking-water supply project to towns in the Mara region in Tanzania. (Bloomberg) Taiba signs SR250mn loan deal with Riyad Bank – A unit of Taiba Holding has signed a 10-year financing agreement with Riyad Bank, to build a five-star hotel in Al-Khobar. (Bloomberg) Zain Saudi extends SR9bn Murabaha facility until July 31 – The Mobile Telecommunications Company (Zain Saudi) has extended the maturity date of its SR9bn syndicated Murabaha facility till July 31, 2013. Zain Saudi said the extension will allow it to finalize a new long-term replacement agreement with its lenders, which will be for a period of five years and will incur lower costs. (Tadawul)

- 4. Page 4 of 5 Maskan Arabia completes 30% construction in BLOMINVEST – Maskan Arabia Real Estate Development Company (Maskan Arabia) announced that it has completed 30% of the construction work in the BLOMINVEST- Maskan Arabia Real Estate Development Fund project, being built north of Riyadh. Maskan Arabia said it will deliver 92 residential units to their owners by 1Q2014. (AME Info) UAE banks cash surges as deposits outpace lending – According to the data released by the UAE’s Central Bank, UAE’s banks are holding the most liquid assets in more than three years as government deposits surge and companies increasingly rely on the bond market for funding. The data showed that the combined loans-to-deposits ratio of all the 51 UAE banks fell to 90.4% in April, the lowest since March 2010 when it was 105.7%. The data also showed that the increased liquidity has helped reduce the three-month interest rate by 38 basis points, to go below the level of neighboring Saudi Arabia. (Bloomberg) UAE offers $1.3bn grant to Morocco for sustainable development – The Abu Dhabi Fund for Development (ADFD) has signed a MoU with Morocco to provide a grant within the framework of the UAE’s contribution to the GCC’s Gulf Development Fund initiative. The UAE’s contribution in this initiative amounts to $1.3bn, of the total grant value of $5bn to support Morocco over the next five years. (GulfBase.com) Japan-Jafza trade up 28% in last four years – According to sources, bilateral trade between Japan and Jebel Ali Free Zone (Jafza) is estimated to have reached AED9.6bn in 2012, posting a growth of around 28% in the last four years. (AME Info) DIA passenger traffic rises 18.9% YoY in May – According to a report released by the Dubai Airports, the Dubai International Airport (DIA) racked up another month of double-digit growth of 18.9% YoY, with 5.2mn passengers passing through it in May 2013. The report showed that the traffic was up 16.8% YTD to 27.1mn as compared to 23.2mn during the first five months of 2012. (AME Info) Nakheel in talks to refinance AED8bn loan – Dubai-based property firm Nakheel is in talks with banks to refinance its loans worth AED8bn that are due in 2015. (GulfBase.com) DP World launches new container terminal at Jebel Ali Port – Dubai-based port operator DP World has opened a new extension to Container Terminal 2 (T2) at its flagship, Jebel Ali Port. This extension has added 1mn twenty-foot equivalent container units (TEU), taking the capacity at Jebel Ali Port to 15mn TEU. (AME Info) Etisalat, Turkcell eye 35% stake in Tunisie Telecom – Abu Dhabi-based Emirates Telecommunications Corporation (Etisalat) and Turkey-based Turkcell have expressed interest in buying Dubai Holding's 35% stake in Tunisie Telecom. (Reuters) Air Arabia mulls fleet expansion to cater budget travel market – Air Arabia CEO Adel Abdullah Ali said the airline is studying the purchase of additional narrow-body aircraft as it seeks a larger slice in the Middle East budget travel market. He added that the airline is looking at Airbus A320neo, Boeing 737 Max as well as Bombardier’s C-Series. However, he said that a decision is unlikely to come before 2014 and the airline has no plans for an announcement in time for the Dubai Air Show in November 2013. (Bloomberg) TAQA arranges investor meet for Shuwaihat 2 bond issue – The Abu Dhabi National Energy Company (TAQA) has announced that it is leading a consortium which will conduct a series of investor meetings with fixed income investors in the Middle East, Asia, London and the US. TAQA said that these meetings could lead to a potential $825mn project bond refinancing for Shuwaihat 2 independent power & water project, subject to market conditions. (ADX) AMAF reports AED2.5mn net profit in 1Q2013 – Awqaf & Minors Affairs Foundation (AMAF) has reported a net profit of AED2.5mn in 1Q2013. (AME Info) Al-Riyada F&I exits its KD30mn investment from Al-Liwan Mall – Al-Riyada Finance & Investment Company (Al-Riyada F&I) has exited from its investment of around KD30mn (22% of invested capital) in Al-Liwan Mall located in Eqaila area of Kuwait. Al-Riyada F&I’s Chairman Muhanad Al-Sane said profits realized from this exit will be visible in the 2013 financial results. (GulfBase.com) ASAR advises on URC’s KD60mn bond issuance – Al Ruwayeh & Partners (ASAR) has advised the joint lead managers on the placement of a KD60mn bond issue by the United Real Estate Company (URC). (AME Info) Oman to sign open skies accord with US; Muscat Airport capacity to reach 12mn passengers in 2014 – The Oman Public Authority for Civil Aviation’s CEO Salim Al Aufi said the country is set to sign an open skies accord with the US in the next few weeks and has also sought similar agreements with Canada, South Africa, Japan and China. He said that the aviation market in Oman is expanding and Oman is spending $7.5bn to expand Muscat and Salalah international airports, as well as Sohar, Ras al-Hadd and Duqm domestic airports. He added that the Muscat international airport’s capacity will increase from 7.5mn passengers currently to 12mn passengers in 2014. (Bloomberg) Oman’s first corporate sukuk gets regulatory approval – According to sources, Oman’s first corporate sukuk has received regulatory approval and the five-year, OMR50mn private placement aims to close next month. Issued by Tilal Development Company, the proceeds of this sukuk will be used to repay its existing debt and expand the Muscat Grand Mall. (GulfBase.com) Moody’s reviews 4 Bahraini banks for downgrade – Moody's Investors Service has placed four Bahraini banks National Bank of Bahrain (NBB), BBK, BMI Bank (BMI) and Bahrain Islamic Bank (BIsB) on review for downgrade the deposit, issuer and senior debt ratings. As part of the same rating action, Moody's has also placed on review for downgrade the standalone bank financial strength rating of BIsB. Moody's decision to place the deposit, issuer and senior debt ratings of the four banks on review for downgrade follows the potential weakening in the sovereign's capacity to provide support to the banks, as signaled by Moody's decision to place the Baa1 Bahraini government bond rating on review for possible downgrade. (Bloomberg)

- 5. Contacts Ahmed M. Shehada Keith Whitney Saugata Sarkar Sahbi Kasraoui Head of Trading Head of Sales Head of Research Manager - HNWI Tel: (+974) 4476 6535 Tel: (+974) 4476 6533 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 ahmed.shehada@qnbfs.com.qa keith.whitney@qnbfs.com.qa saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg 80.0 90.0 100.0 110.0 120.0 130.0 140.0 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 QE Index S&P Pan Arab S&P GCC (0.2%) 0.9% (0.3%) (0.5%) 0.1% (0.9%) (2.3%)(2.9%) (1.9%) (1.0%) 0.0% 1.0% 1.9% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,226.65 (4.0) (5.4) (26.8) DJ Industrial 14,910.14 1.0 0.7 13.8 Silver/Ounce 18.54 (5.6) (7.9) (38.9) S&P 500 1,603.26 1.0 0.7 12.4 Crude Oil (Brent)/Barrel 101.92 0.7 0.5 (9.7) NASDAQ 100 3,376.22 0.8 0.6 11.8 Natural Gas (Henry Hub)/MMBtu 3.72 (1.3) (3.3) 9.6 DAX 7,940.99 1.7 1.9 4.3 LPG Propane (Arab Gulf)/Ton 794.00 0.0 0.5 (18.0) FTSE 100 6,165.48 1.0 0.8 4.5 LPG Butane (Arab Gulf)/Ton 784.00 0.0 0.5 (19.1) CAC 40 3,726.04 2.1 1.9 2.3 Euro 1.30 (0.5) (0.8) (1.4) Nikkei 12,834.01 (1.0) (3.0) 23.5 Yen 97.72 (0.1) (0.2) 12.6 SHANGHAI SE Composite 1,951.50 (0.4) (5.9) (14.0) GBP 1.53 (0.7) (0.7) (5.8) HANG SENG 20,338.55 2.4 0.4 (10.2) CHF 1.06 (0.5) (0.9) (2.9) MSCI EM 901.98 1.8 0.2 (14.5) AUD 0.93 0.2 0.6 (10.7) STOXX 600 284.54 1.7 1.5 1.7 USD Index 82.98 0.5 0.8 4.0 BSE SENSEX 18,552.12 (0.4) (1.2) (4.5) RUB 32.95 0.3 0.4 8.0 Bovespa 47,171.98 0.6 0.2 (22.6) BRL 0.46 1.2 2.6 (6.3) RTS 1,261.13 1.4 1.2 (17.4) 133.1 117.7 107.1