QNBFS Daily Market Report October 2, 2018

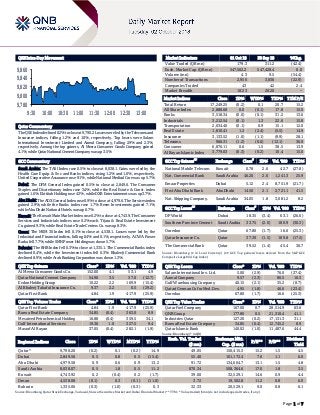

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.2% to close at 9,790.2. Losses were led by the Telecoms and Insurance indices, falling 1.2% and 1.0%, respectively. Top losers were Salam International Investment Limited and Aamal Company, falling 2.9% and 2.3%, respectively. Among the top gainers, Al Meera Consumer Goods Company gained 4.1%, while Qatar National Cement Company was up 3.5%. GCC Commentary Saudi Arabia: The TASI Index rose 0.5% to close at 8,038.1. Gains were led by the Health Care Equip. & Svc and Banks indices, rising 1.2% and 1.0%, respectively. United Cooperative Assurance rose 9.1%, while National Medical Care was up 5.7%. Dubai: The DFM General Index gained 0.5% to close at 2,849.6. The Consumer Staples and Discretionary index rose 3.4%, while the Real Estate & Const. index gained 1.6%. Ekttitab Holding rose 4.3%, while DXB Entertainments was up 3.7%. Abu Dhabi: The ADX General Index rose 0.9% to close at 4,979.6. The Services index gained 2.9%, while the Banks index rose 1.7%. Reem Investments gained 7.1%, while Abu Dhabi National Hotels was up 6.7%. Kuwait: The Kuwait Main Market Index rose 0.2% to close at 4,743.9. The Consumer Services and Industrials indices rose 0.2% each. Tijara & Real Estate Investment Co. gained 9.3%, while Real Estate Trade Centers Co. was up 8.3%. Oman: The MSM 30 Index fell 0.1% to close at 4,538.1. Losses were led by the Industrial and Financial indices, falling 0.4% and 0.1%, respectively. ACWA Power Barka fell 7.7%, while SMN Power Holding was down 5.7%. Bahrain: The BHB Index fell 0.3% to close at 1,335.1. The Commercial Banks index declined 0.4%, while the Investment index fell 0.3%. Khaleeji Commercial Bank declined 8.9%, while Arab Banking Corporation was down 1.3%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Al Meera Consumer Goods Co. 152.00 4.1 53.1 4.9 Qatar National Cement Company 54.90 3.5 37.0 (12.7) Ezdan Holding Group 10.22 2.2 169.9 (15.4) Al Khaleej Takaful Insurance Co. 9.37 2.2 0.5 (29.2) Qatar First Bank 4.84 1.9 417.9 (25.9) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar First Bank 4.84 1.9 417.9 (25.9) Barwa Real Estate Company 34.85 (0.4) 363.0 8.9 Mesaieed Petrochemical Holding 16.88 (0.4) 359.5 34.1 Gulf International Services 19.36 1.0 327.5 9.4 Masraf Al Rayan 37.05 (0.4) 282.1 (1.9) Market Indicators 01 Oct 18 30 Sep 18 %Chg. Value Traded (QR mn) 179.3 311.2 (42.4) Exch. Market Cap. (QR mn) 547,562.2 547,428.4 0.0 Volume (mn) 4.3 9.5 (54.4) Number of Transactions 2,956 3,836 (22.9) Companies Traded 43 42 2.4 Market Breadth 18:23 20:20 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,249.25 (0.2) 0.1 20.7 15.2 All Share Index 2,888.68 0.0 (0.1) 17.8 15.0 Banks 3,518.34 (0.0) (0.1) 31.2 13.6 Industrials 3,212.54 (0.1) 1.3 22.6 15.8 Transportation 2,034.40 (0.1) 0.9 15.1 12.0 Real Estate 1,810.41 1.2 (2.4) (5.5) 14.9 Insurance 3,133.52 (1.0) (1.1) (9.9) 28.1 Telecoms 966.31 (1.2) (0.6) (12.1) 36.9 Consumer 6,876.11 0.6 1.5 38.5 13.9 Al Rayan Islamic Index 3,779.03 (0.3) (0.2) 10.4 15.0 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% National Mobile Telecom. Kuwait 0.78 2.6 42.7 (27.8) Nat. Commercial Bank Saudi Arabia 46.20 2.6 1,241.3 25.9 Emaar Properties Dubai 5.12 2.4 8,751.9 (21.7) First Abu Dhabi Bank Abu Dhabi 14.50 2.1 2,721.1 41.5 Nat. Shipping Company. Saudi Arabia 34.05 1.8 3,081.2 8.2 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% DP World Dubai 18.35 (3.4) 63.1 (26.6) Southern Province Cement Saudi Arabia 33.75 (2.0) 180.9 (30.3) Ooredoo Qatar 67.80 (1.7) 16.6 (25.3) Qatar Insurance Co. Qatar 37.30 (1.5) 189.8 (17.5) The Commercial Bank Qatar 39.52 (1.4) 45.4 36.7 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Salam International Inv. Ltd. 5.00 (2.9) 76.0 (27.4) Aamal Company 9.57 (2.3) 86.5 10.3 Gulf Warehousing Company 40.15 (2.1) 35.2 (8.7) Qatari German Co for Med. Dev. 4.95 (1.8) 46.6 (23.4) Ooredoo 67.80 (1.7) 16.6 (25.3) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatar Fuel Company 167.00 0.7 28,514.9 63.6 QNB Group 177.80 0.5 21,310.4 41.1 Industries Qatar 127.20 (0.2) 17,131.3 31.1 Barwa Real Estate Company 34.85 (0.4) 12,745.2 8.9 Qatar Islamic Bank 140.02 (1.0) 11,487.6 44.4 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,790.20 (0.2) 0.1 (0.2) 14.9 49.05 150,415.3 15.2 1.5 4.5 Dubai 2,849.56 0.5 0.8 0.5 (15.4) 55.40 101,172.4 7.6 1.1 6.0 Abu Dhabi 4,979.58 0.9 0.6 0.9 13.2 91.72 134,604.7 13.1 1.5 4.8 Saudi Arabia 8,038.07 0.5 1.8 0.5 11.2 870.34 508,364.6 17.0 1.8 3.5 Kuwait 4,743.92 0.2 (0.4) 0.2 (1.7) 39.00 32,529.1 14.6 0.9 4.4 Oman 4,538.08 (0.1) 0.3 (0.1) (11.0) 3.72 19,502.8 11.2 0.8 6.0 Bahrain 1,335.06 (0.3) (1.0) (0.3) 0.3 32.33 20,529.1 9.0 0.8 6.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,780 9,800 9,820 9,840 9,860 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index declined 0.2% to close at 9,790.2. The Telecoms and Insurance indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. Salam International Investment Limited and Aamal Company were the top losers, falling 2.9% and 2.3%, respectively. Among the top gainers, Al Meera Consumer Goods Company gained 4.1%, while Qatar National Cement Company was up 3.5%. Volume of shares traded on Monday fell by 54.4% to 4.3mn from 9.5mn on Sunday. Further, as compared to the 30-day moving average of 6.1mn, volume for the day was 29.3% lower. Qatar First Bank and Barwa Real Estate Company were the most active stocks, contributing 9.6% and 8.4% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data and Earnings Calendar Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 10/01 US Markit Markit US Manufacturing PMI September 55.6 55.6 55.6 10/01 UK Bank of England Mortgage Approvals August 66.4k 64.5k 65.2k 10/01 UK Bank of England Money Supply M4 MoM August 0.2% – 0.9% 10/01 UK Bank of England M4 Money Supply YoY August 1.2% – 2.1% 10/01 UK Markit Markit UK PMI Manufacturing SA September 53.8 52.5 53 10/01 EU Markit Markit Eurozone Manufacturing PMI September 53.2 53.3 53.3 10/01 EU Eurostat Unemployment Rate August 8.1% 8.1% 8.2% 10/01 Germany Markit Markit/BME Germany Manufacturing PMI September 53.7 53.7 53.7 10/01 France Markit Markit France Manufacturing PMI September 52.5 52.5 52.5 10/01 Japan Markit Nikkei Japan PMI Mfg September 52.5 – 52.9 10/01 India Markit Nikkei India PMI Mfg September 52.2 – 51.7 10/01 India India Central Statistical Org. Eight Infrastructure Industries August 4.2% – 7.3% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 3Q2018 results No. of days remaining Status QNBK QNB Group 10-Oct-18 8 Due MARK Masraf Al Rayan 15-Oct-18 13 Due DBIS Dlala Brokerage & Investment Holding Company 15-Oct-18 13 Due MCGS Medicare Group 16-Oct-18 14 Due QNCD Qatar National Cement Company 17-Oct-18 15 Due QEWS Qatar Electricity & Water Company 17-Oct-18 15 Due QIBK Qatar Islamic Bank 17-Oct-18 15 Due DHBK Doha Bank 17-Oct-18 15 Due UDCD United Development Company 17-Oct-18 15 Due NLCS Alijarah Holding 18-Oct-18 16 Due GWCS Gulf Warehousing Company 21-Oct-18 19 Due ABQK Ahli Bank 21-Oct-18 19 Due QIGD Qatari Investors Group 21-Oct-18 19 Due KCBK Al Khalij Commercial Bank 23-Oct-18 21 Due CBQK The Commercial Bank 23-Oct-18 21 Due AKHI Al Khaleej Takaful Insurance Company 28-Oct-18 26 Due ERES Ezdan Holding Group 29-Oct-18 27 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 35.51% 43.34% (14,042,081.12) Qatari Institutions 23.26% 23.30% (64,522.38) Qatari 58.77% 66.64% (14,106,603.50) GCC Individuals 1.07% 0.70% 661,225.84 GCC Institutions 4.42% 7.08% (4,763,455.22) GCC 5.49% 7.78% (4,102,229.38) Non-Qatari Individuals 8.11% 8.71% (1,081,886.76) Non-Qatari Institutions 27.63% 16.87% 19,290,719.64 Non-Qatari 35.74% 25.58% 18,208,832.88

- 3. Page 3 of 7 News Qatar Barwa Al-Sadd signs agreement for purchasing 75% of Millennium Plaza Hotel – Barwa Real Estate Company announced the signing by its subsidiary, Barwa Al-Sadd Co. - fully owned by Barwa Group- a purchase agreement of acquiring 75% of Millennium Plaza Hotel and the Wellness Center located at Barwa Al-Sadd Development, from Katara Hospitality at a purchase price of QR501,642,516. With this transaction, Barwa Al Sadd now fully acquired the Millennium Plaza Hotel and the Wellness Center, where it has previously purchased 25% in June 2018. The company aims from this purchase transaction to support the operating real estate portfolio of Barwa Real Estate Group in a way that contributes in realizing the sustainable growth and enhances the rights of the stakeholders. Barwa also wishes to note that there is no conflict of interests between the parties related to this transaction. (QSE) ERES confirms that Moody's (reported by Moody’s on September 5, 2018) withdrew its credit ratings – Ezdan Holding Group (ERES) disclosed that credit rating agency, Moody’s withdrew the credit rating of the group and its Sukuk program, which was rated ‘B1’, due to insufficient information to support the maintenance of the ratings. ERES and its Sukuk program has another credit rating from Standard and Poor’s credit rating agency. ERES believes that withdrawal of credit rating does not have significant impact on its shareholders or its Sukuk holders, and it assures its compliance with the relevant laws and regulations, especially offering and listing of securities rulebook and governance code for companies & legal entities listed on the main market. (QSE) MERS appoints Didier Jean Castaing as CEO – Al Meera Consumer Goods Company’s (MERS) board of directors has made a resolution appointing Didier Jean Castaing, as CEO of the company, effective October 1, 2018. (QSE) GWCS to disclose 3Q2018 financial statements on October 21 – Gulf Warehousing Company (GWCS) announced its intent to disclose 3Q2018 financial statements for the period ending September 30, 2018, on October 21, 2018. (QSE) MARK to disclose 3Q2018 financial statements on October 15 – Masraf Al Rayan (MARK) announced its intent to disclose 3Q2018 financial statements for the period ending September 30, 2018, on October 15, 2018. (QSE) QIIK to disclose 3Q2018 financial statements on October 15 – Qatar International Islamic Bank (QIIK) announced its intent to disclose 3Q2018 financial statements for the period ending September 30, 2018, on October 15, 2018. (QSE) ERES to disclose 3Q2018 financial statements on October 29 – Ezdan Holding Group (ERES) announced its intent to disclose 3Q2018 financial statements for the period ending September 30, 2018, on October 29, 2018. (QSE) QNCD to disclose 3Q2018 financial statements on October 17 – Qatar National Cement Company (QNCD) announced its intent to disclose 3Q2018 financial statements for the period ending September 30, 2018, on October 17, 2018. (QSE) AKHI to disclose 3Q2018 financial statements on October 28 – Al Khaleej Takaful Insurance Company (AKHI) announced its intent to disclose 3Q2018 financial statements for the period ending September 30, 2018, on October 28, 2018. (QSE) NLCS to disclose 3Q2018 financial statements on October 18 – Alijarah Holding (NLCS) announced its intent to disclose 3Q2018 financial statements for the period ending September 30, 2018, on October 18, 2018. (QSE) ORDS to disclose 3Q2018 financial statements on October 29 – Ooredoo (ORDS) announced its intent to disclose 3Q2018 financial statements for the period ending September 30, 2018, on October 29, 2018. (QSE) Qatar to move WTO against Saudi Arabia’s violations of IPRs – The State of Qatar has started taking the necessary action to file a new lawsuit with the dispute settlement procedure of the World Trade Organization (WTO) against Saudi Arabia’s violations of Intellectual Property Rights (IPRs) belonging to Qatari nationals and Qatari institutions, confirming that these violations are a clear breach of international agreements related to intellectual property rights. The Ministry of Economy and Commerce stated that in accordance with WTO’s Article IV of the dispute resolution understanding, the Office of Qatar to the WTO in Geneva submitted a formal consultation request, which included all violations committed by Saudi Arabia against Qatar, in accordance with the WTO Agreement on Trade Related Aspects of Intellectual Property Rights (TRIPS Agreement) and the Berne Convention on the Protection of Literary and Artistic Works. In a related development, beIN Corporation (beIN), launched $1bn international investment arbitration against Saudi Arabia, having been unlawfully driven out of the Saudi Arabia’s market and subjected to what has been described as the most widespread piracy of sports broadcasting that the world has ever seen. (Peninsula Qatar) Minister of Energy and Industry highlights energy sector challenges at AEC – Minister of Energy and Industry HE Mohammed bin Saleh Al Sada addressed the opening session of the four-day Arab Energy Conference (AEC) that kick-started in Marrakech, Morocco. Participating in the opening session of the eleventh AEC on ‘The visions of the Arab countries on the energy strategy,’ Al Sada said the vision of the energy strategy in Qatar is derived from the country’s ambitious Qatar National Vision 2030, which is aimed to provide high sustainable living standards for its people and the generations to come. He said that the final result of Qatar National Vision for the energy sector is the optimal utilization of natural resources and overcome the challenges of development. Qatar aims to add renewable energy sources to its current mix for domestic use. This will include using solar energy to generate between 700 and 750 megawatts per hour to feed the main grid. The Minister, who is heading the official Qatari delegation, also Chaired the first ministerial session entitled “Changes in Oil and Natural Gas Markets and their Implications for Arab Oil Exporting Countries”. In his address, he highlighted the challenges facing the global energy sector. It is estimated that the future demand for oil will continue to rise to reach a peak of 113mn barrels per day by 2040. He pointed out that this will require a massive investment of at least $11tn in the field of oil production between 2018 and 2040. (Peninsula Qatar)

- 4. Page 4 of 7 QP’s chief holds energy talks with top South Korean executives in Seoul – Cooperation in the field of energy, particularly in the LNG industry, was at the center of the talks Qatar Petroleum’s (QP) President and CEO, Saad Sherida Al-Kaabi had with senior executives of major South Korean companies during his visit to Seoul recently. Al-Kaabi discussed with senior South Korean executives ways and means of enhancing the relationship and cooperation between QP and major South Korean companies. Al-Kaabi met the presidents and senior executives of KOGAS, Hyundai Heavy Industries, Samsung Heavy Industries, Daewoo Shipbuilding and Marine Engineering, Hanwha Chemical Corp (HTC), and SK E&S and SK Group. The visit also included a meeting with the Vice Minister of South Korea’s Ministry of Trade, Industry and Energy. (Gulf-Times.com) Qatar Airways upgrades five Airbus A350-900s to A350-1000s – Qatar Airways has upgraded five of its current order of A350- 900s to the higher-capacity A350-1000, as the national carrier upsized its original order following the strong performance of the A350-1000 and need for extra capacity on its growing global network. The airline has already taken delivery of 30 A350 aircraft (27 A350-900 and three A350-1000s) from the total order of 76 A350 XWBs. The decision to upgrade the original order comes just eight months after the national airline, which was the global launch customer for both A350 types, welcomed the first A350-1000 into its fleet. “The strong performance of this state-of-the-art aircraft and the need for extra capacity on the world’s fastest growing airline are the key factors behind this latest announcement,” Qatar Airways stated. (Gulf- Times.com) Qatar’s first overseas visa center set to open – With Qatar completing all preparations for the opening of the first Qatar Visa Centre (QVC) outside the State, it was stressed that one of the aims of the initiative is to ensure protection against health problems that may originate abroad and reduce the risk of serious diseases being brought into the country. The first phase of the new recruitment mechanism, under which work visa- related procedures are to be completed in the home countries of expatriate workers before they arrive in Qatar, will come into effect on October 12, when the first QVC opens in Sri Lanka. Overall, 20 QVCs will be opened in eight countries over the next few months, the official Qatar News Agency reported. (Gulf- Times.com) International US factory activity slows; construction spending edges up – A measure of US factory activity retreated from a more than 14- year high in September, as growth in new orders slowed, but supply bottlenecks appeared to be easing, suggesting a steady pace of expansion in manufacturing. Other data showed a small increase in construction spending in August, amid weakness in investment in private residential and non-residential projects. The report did little to change views of strong economic growth in the third quarter. The Institute for Supply Management (ISM) said its index of national factory activity dropped 1.5 points to a reading of 59.8 last month from 61.3 in August, which was the highest since May 2004. (Reuters) PMI: UK’s factories perk up, big picture still lackluster – British factories perked up unexpectedly in September, halting a three- month run of slowing growth even though the bigger picture stayed subdued six months ahead of Brexit, according to a survey. The IHS Markit/CIPS Manufacturing Purchasing Managers’ Index (PMI) rose to 53.8 from an upwardly revised 53.0 in August, topping all forecasts in a Reuters poll of economists that had pointed to a reading of 52.5. Export order books recovered slightly from the first decline in more than two years during August, while output expanded at the fastest pace in four months. Still, survey compiler IHS Markit stated the latest reading was consistent with the official measure of manufacturing output expanding only moderately. Britain’s economy has relied heavily on spending by consumers to soften the slowdown that followed the decision by voters in 2016 to leave the European Union (EU). Official data showed Britain’s manufacturing sector failed to contribute to economic growth during the first half of 2018. (Reuters) PMI: Eurozone’s manufacturing growth at two-year low – Eurozone’s manufacturing growth slowed further to a two-year low at the end of the third quarter, in another sign the escalating trade war between the US and China was hurting factories elsewhere too, according to a survey. Growth in manufacturing activity has dwindled across the Euro currency bloc this year, and the latest data suggests the momentum in the currency bloc is well past its peak. IHS Markit’s September final manufacturing Purchasing Managers’ Index dropped to a two-year low of 53.2 from August’s 54.6, a touch below a flash reading of 53.3 and still above the 50 level that separates growth from contraction. (Reuters) Weak German data points to a growth slowdown in third quarter – Germany’s retail sales fell unexpectedly for the second month in a row in August and factories shifted into a lower gear in September, data showed, suggesting that Europe’s largest economy has lost steam over the summer. Household spending has become a key growth driver in Germany, where consumers benefit from record-high employment, rising real wages, strong job security and low borrowing costs. But trade disputes abroad and political tensions at home are both leaving their mark on a still exports-dependent economy, which is now in its ninth year of expansion. Retail sales edged down by 0.1% on the month in real terms in August, the Federal Statistics Office stated. This was weaker than the Reuters consensus forecast for a 0.4% rise and followed a revised drop of 1.1% in July. On the year, retail rose by 1.6%, beating the Reuters consensus forecast for a 1.5% increase and following a revised 0.9% increase in July. (Reuters) PMI: French factory growth slowest in three months in September – French manufacturing activity grew in September at the slowest pace in three months as export demand weakened and input costs firmed, a monthly poll showed. Data compiler IHS Markit stated its final Purchasing Managers’ Index fell to 52.5 in September from 53.5 in August, unchanged from a preliminary reading. The result brought the indicator closer to the 50-point line dividing expansions in activity from contractions. Survey panelists reported the lowest factory output in two years as export orders fell slightly last month, while input costs grew much fast than selling prices. (Reuters) Regional S&P: GCC banks’ financial profiles should remain stable in 2019 – Banks in the GCC region should continue to breathe a little easier in the year ahead with lending growth to stabilize around

- 5. Page 5 of 7 5% and return on assets at about 1.5% to 1.7%, according to Standard and Poor’s (S&P). Higher oil prices and stronger public investments are resulting in higher economic growth across the GCC in 2018, it stated, forecasting that oil prices will stabilize at about $65 per barrel in 2019 and $60 in 2020. “We anticipate un- weighted average economic growth of 2.8% in 2019-2020 for the six GCC countries. This is less than a half of what they delivered in 2012, but more than five times higher than their performance in 2017,” S&P stated. Highlighting that growth in lending recovered slightly, reaching an annualized 4.7% at midyear 2018, S&P stated that it expects a slight acceleration in the next two years barring any unexpected shock. Higher government spending, supported by strategic government initiatives, will support the lending growth. (Gulf-Times.com) OPEC oil output boost in September limited by Iran losses – OPEC delivered only a limited increase in oil production in September, a Reuters survey has found, as a cut in Iranian shipments due to US sanctions offset higher output in Libya, Saudi Arabia and Angola. The 15-members of OPEC pumped 32.85mn barrels per day in September, the survey found, up 90,000 bpd from August’s revised level and the highest this year. However, the 12 OPEC members bound by a supply- limiting agreement actually cut output by 70,000 bpd because of declines in Iran and Venezuela, boosting compliance with supply targets to 128% from a revised 122% in August, the survey found. (Reuters) IATA: Middle Eastern carriers see 5.4% traffic increase in August – Middle Eastern carriers posted a 5.4% traffic increase in August, IATA stated and noted it was a slowdown from 6.2% in July. Passenger volumes have trended upwards at 8% annualized rate since the start of the year. Capacity increased 6.3%, with load factor slipping 0.7 percentage point to 80.7%. On freight volumes, IATA stated, the Middle Eastern carriers posted 2.2% increase in August compared to the same period last year. This was a significant deceleration in demand over the 5.4% recorded the previous month. The decrease mainly reflects developments from a year ago rather than a substantive change in the near-term trend. (Gulf-Times.com) Saudi Arabia denies it shelved SoftBank solar project – An official at Saudi Arabia’s Public Investment Fund (PIF) said on October 1, that a Wall Street Journal report that it had shelved a $200bn plan with SoftBank Group Corp (SoftBank) to build the world’s biggest solar-power-generation project was incorrect. “PIF continues to work with the SoftBank Vision Fund and other institutions on a number of large-scale, multi-billion- Dollar solar projects which will be announced at the appropriate time,” as reported to the Saudi Press Agency. (Reuters) Saudi Aramco may borrow up to $50bn from banks for SABIC – Saudi Aramco could borrow as much as $50bn from international banks to fund its acquisition of a stake in Saudi Arabian Basic Industries Corp. (SABIC), according to sources. Bankers have met with Saudi Aramco to present proposals for financing the purchase of a major stake in the world’s fourth- biggest petrochemicals producer, which has a stock market value of about $100bn. The deal is expected to involve the purchase of all or nearly all of the 70% stake in SABIC held by the Public Investment Fund (PIF). The most likely outcome now is a deal that would see Saudi Aramco tap its cash holdings for part of the deal, probably around $20bn. The remaining $50bn would be raised through a combination of a large, long- term syndicated loan and short-term, bridge loans that would be replaced after about 12 to 18 months with bond issues. Many bankers expect bonds eventually to become part of the SABIC financing, as part of economic reforms; Saudi Arabia is keen to develop its bond market and expand the international investor base for its debt. (Reuters) IMF lifts UAE’s growth forecasts on oil, state spending – The International Monetary Fund (IMF) lifted its forecasts for economic growth in the UAE because of expectations that oil production and state spending will rise. The Arab world’s second biggest economy is now likely to expand 2.9% this year and 3.7% next year, Natalia Tamirisa, IMF Mission Chief to the country, said. Gross domestic product grew 0.8% in 2017, preliminary data for the UAE’s showed. In April, the IMF had predicted GDP would expand 2.0% this year and 3.0% next year. (Reuters) UAE’s cabinet approves AED180bn for 2019-2021 budget – The UAE’s cabinet approved a zero-deficit federal budget of AED180bn for the next three years (2019-2021) at a meeting on October 1 .The 2019 budget was approved at a total value of AED60.3bn, allocated to various sectors with a focus on those directly linked to citizens’ well-being, health, and education. The budget includes 42.3% for community development, 17% for education development, and 7.3% for healthcare services. During the Cabinet meeting, a new federal law was adopted to regulate the space and advanced technology sectors in the UAE. (GulfBase.com) GEM working with Perella Weinberg Partners on debt restructuring – Gulf Energy Maritime (GEM) is working with Perella Weinberg Partners to try to restructure its roughly $350mn in debt as it seeks to stave off a default, according to sources. The Dubai-based product and chemical tanker company, which counts Emirates National Oil Company (ENOC), Mubadala Investment Co and Oman Oil Co as its three main shareholders, has been asking its creditor banks to amend and extend its debt. GEM, which has struggled with depressed demand in the tanker market, is currently in technical default as the estimated $270mn value of its assets, in the form of its fleet, has dipped below that of its debt. (Reuters) Moody's places all ratings of Commercial Bank of Dubai on review for downgrade – Moody's Investors Service (Moody's) placed the following ratings of Commercial Bank of Dubai on review for downgrade: the ‘Baa1’ long-term deposit ratings, the ‘P-2’ short-term deposit ratings, as well as the ‘ba1’ adjusted baseline credit assessment (BCA) and the ‘ba1’ BCA. Furthermore, Moody's also placed the ‘A3/P-2’ Counterparty Risk Ratings and the ‘A3(cr)’/‘P-2(cr)’ Counterparty Risk Assessments on review for downgrade. The outlook on the long-term bank deposits was changed to ‘Ratings under Review’ from ‘Stable’. The primary driver underpinning Moody's decision to initiate a review for downgrade of Commercial Bank of Dubai's ratings is the bank's deteriorating asset quality, with a material increase in problem loans formation in the corporate and mid-corporate loan portfolio this year. The increased delinquencies in these segments reflects the slower economic growth in the UAE that is affecting the

- 6. Page 6 of 7 creditworthiness of mid-sized corporates, combined with a more conservative classification approach upon adoption of IFRS9 accounting standards. The mid-sized corporate segment constitutes the core client base of Commercial Bank of Dubai. (Bloomberg) DLD: Dubai’s real estate market is consistently sustainable – Dubai Land Department (DLD) announced that Dubai’s real estate market is consistently sustainable, attracting about 9,500 new investors from 1st January – 31st August 2018 with total value of investments worth more than AED19bn. The influx of new investors is evidence of their eagerness to benefit from the opportunities and return on investments guaranteed by Dubai’s attractive real estate market. DLD’s Director General, Sultan Butti bin Mejren stressed that the economic sectors in the Emirate, especially the real estate sector, are in line with the UAE’s Strategy for the Future. (GulfBase.com) Drake and Scull International postpones shareholders meeting – Drake and Scull International, the Dubai-based contractor facing mounting losses, postponed until October a shareholder meeting that was scheduled for September 27 and could seal the fate of the cash-strapped company. (GulfBase.com) IMF expects Dubai's economy to gradually recover ahead of expo – IMF expects Dubai’s economy to gradually recover as the government accelerates spending in preparation for the Expo 2020 event. Dubai’s gross domestic product will likely expand 3.3% this year and 4.1% in 2019, Natalia Tamirisa, the IMF Mission Chief to the UAE, said. Dubai’s GDP grew 2.8% in 2017. “The gradual recovery is progressing and we see a similar pattern in Abu Dhabi,” Tamirisa said. The IMF expects Abu Dhabi’s non-oil economy to grow 2.3% in 2018 and 3.6% the following year, as the government ramps up spending. (Bloomberg) Abu Dhabi's Mubadala plans $6bn debt reorganization – Abu Dhabi’s state investor International Petroleum Investment Company (IPIC) is to reorganize about $6bn of debt following its merger with state investment fund Mubadala Development Company (Mubadala) last year. IPIC has asked bondholders to agree to Mubadala, the merged entity, becoming guarantor and Mubadala the issuer of over $6bn of IPIC’s existing debt. “The end result will be a more efficient single, rated entity within the group responsible for our capital market funding activities,” Mubadala stated. (Reuters) About 8,000 institutions trade on ADX – Abu Dhabi Securities Exchange (ADX) stated the number of institutional investors reached 7,993 by the end of August 2018 due to a stable trading environment. Out of the 7,993 institutions that traded on the bourse, 5,979 were foreign institutions and 2,014 were domestic. Net institutional investment from the beginning of year up to the end of August 2018 reached AED1.4bn, the bourse stated in a statement. At the same time, the cash dividend distributed by listed companies during 2018 amounted to AED23.4bn in comparison to AED22.2bn during 2017, which is an increase of 5.5%. In addition, the top 25 asset management companies in terms of assets under management are registered on ADX and actively investing, where ADX has 350 of the largest international pension funds operating in the exchange. (GulfBase.com) OBG report analyses Oman's economic challenges – Efforts to address credit downgrades, support the growing Islamic finance segment and tackle the challenge of delayed payments were among the topics explored by Executive President of the Central Bank of Oman (CBO), Tahir Salim Al Amri, at a meeting he held recently with a team from Oxford Business Group (OBG). Al Amri was talking to the global research and consultancy firm’s representatives as research continues for ‘The Report: Oman 2019’, OBG’s forthcoming publication on the Sultanate’s investment opportunities and economic development. Oman 2019 will be a vital guide to the many facets of the country, including its macroeconomics, infrastructure, banking and other sectoral developments. (GulfBase.com) Duqm petchem worth $10bn complex to be Oman’s biggest project – Oman Oil Duqm Development Company, a key vertical of the wholly government-owned Oman Oil Company (OOC), has reported further headway in the implementation of a mega petrochemical complex downstream to Duqm Refinery currently under construction at the Special Economic Zone (SEZ) in Duqm. The petrochemicals complex, estimated to cost between $8-$10bn, is set to be the biggest industrial investment in the Sultanate, surpassing in scope and size the Liwa Plastics petrochemical scheme under development in Suhar. Oman Oil Duqm Development Company is also making headway in the financing of the debt component of the $7bn Duqm Refinery project. Oman Oil Company and Kuwait Petroleum International (KPI) are 50:50 joint venture partners in Duqm Refinery and Petrochemicals LLC, which will own the refinery as well as the downstream petrochemicals complex. (GulfBase.com) Oman Oil to raise $850mn revolving loan – State-run Oman Oil Co is set to raise an $850mn revolving credit facility, the unsecured loan will be provided by a consortium of more than 10 banks and will be finalized over the next few weeks. Oman Oil has been a regular borrower of US Dollar-denominated loans over the past few years, in line with a wider push by the Omani government to raise external funding to reduce pressure on its finances, strained by a slump in oil prices. The $850mn facility will refinance an $850mn revolving loan due in 2019. (Reuters)

- 7. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market was closed on October 1, 2018) Source: Bloomberg (*$ adjusted returns; # Market was closed on October 1, 2018) 50.0 75.0 100.0 125.0 Aug-14 Aug-15 Aug-16 Aug-17 Aug-18 QSE Index S&P Pan Arab S&P GCC 0.5% (0.2%) 0.2% (0.3%) (0.1%) 0.9% 0.5% (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,189.03 (0.3) (0.3) (8.8) MSCI World Index 2,188.18 0.2 0.2 4.0 Silver/Ounce 14.49 (1.4) (1.4) (14.5) DJ Industrial 26,651.21 0.7 0.7 7.8 Crude Oil (Brent)/Barrel (FM Future) 84.98 2.7 2.7 27.1 S&P 500 2,924.59 0.4 0.4 9.4 Crude Oil (WTI)/Barrel (FM Future) 75.30 2.8 2.8 24.6 NASDAQ 100 8,037.30 (0.1) (0.1) 16.4 Natural Gas (Henry Hub)/MMBtu 3.14 3.3 3.3 1.6 STOXX 600 383.94 (0.2) (0.2) (5.1) LPG Propane (Arab Gulf)/Ton 109.75 1.5 1.5 10.9 DAX 12,339.03 0.4 0.4 (8.1) LPG Butane (Arab Gulf)/Ton 128.75 3.6 3.6 18.7 FTSE 100 7,495.67 (0.2) (0.2) (6.0) Euro 1.16 (0.2) (0.2) (3.6) CAC 40 5,506.82 (0.1) (0.1) (0.2) Yen 113.93 0.2 0.2 1.1 Nikkei 24,245.76 0.1 0.1 5.2 GBP 1.30 0.1 0.1 (3.5) MSCI EM 1,046.40 (0.1) (0.1) (9.7) CHF 1.02 (0.2) (0.2) (0.9) SHANGHAI SE Composite# 2,821.35 0.0 0.0 (19.2) AUD# 0.72 0.0 0.0 (7.5) HANG SENG# 27,788.52 0.0 0.0 (7.3) USD Index 95.30 0.2 0.2 3.4 BSE SENSEX 36,526.14 (0.1) (0.1) (6.5) RUB 64.97 (0.9) (0.9) 12.8 Bovespa 78,623.66 (0.8) (0.8) (15.3) BRL 0.25 0.8 0.8 (17.6) RTS 1,191.28 (0.1) (0.1) 3.2 76.7 74.5 71.5